Dollar Spikes on Upbeat ADP, Will Payrolls Follow Suit?

- Michael Moran , Senior Currency Strategist at ACY Securities

- 04.06.2021 07:00 am trading

AUD, NZD Slump, EMS Drop, USD/JPY Soars Above 110.

Summary: A robust increase in US private payrolls by 978,000 jobs in May boosted the Dollar against its Rivals. The ADP National Employment report showed its biggest increase since June 2020 and overwhelmed median forecasts of a 650,000 gain. This followed a fall in US Weekly Jobless Claims to 385,000 from 405,000 and forecasts of 400,000. The Dollar Index (USD/DXY), a measure of the value of the Greenback against a basket of 6 major currencies, rose 0.63% to 90.47 (89.92 yesterday). Against the Japanese Yen, the Dollar soared above 110, closing at 110.28, its highest finish since early April. The risk leading Australian Dollar slumped to an overnight and April low at 0.7446, settling at 0.7660 (0.7750 yesterday). The NZD/USD pair lost 1.2% to 0.7140 from 0.7235 yesterday and 0.7315 a week ago. Sterling slid to 1.4105 from 1.4168 while the Euro fell 0.66% to 1.2128 (1.2208). The Greenback’s rally was broad-based, advancing against the Asian and Emerging Market currencies. USD/CNH extended its advance yesterday to a 6.3985 finish from 6.3850 yesterday and 6.3517 earlier in the week. The benchmark US 10-year bond yield rose 4 basis points to 1.62%. Other global bond yields were also up but to a lesser degree. Germany’s 10-year Bund rate was last at -0.19% (-0.20% yesterday). Wall Street stocks were lower. The DOW closed at 34,587 (34,600) while the S&P 500 was last at 4,191 (4,207).

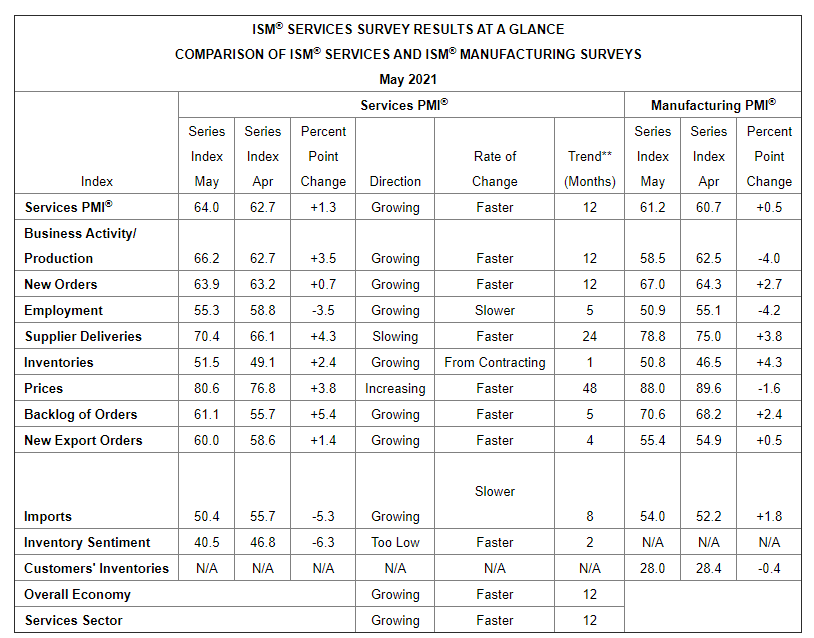

Other data released yesterday saw Australia’s May Trade Surplus increase to +AUD 8.03 billion from +AUD 5.57 billion in April, but lower than forecasts of +AUD 8.35 billion. China’s May Caixin Services PMI fell to 55.1 from 56.3 in April, and lower than median forecasts at 56.3. European (French, German, Italian, Spanish) and Eurozone Services PMI’s mostly matched or were better than forecasts. UK Final Services PMI printed at 62.9, bettering expectations of 61.8. US ISM Services PMI climbed to 64.0 in May from 62.7 in April and beating median estimates at 63.0.

- AUD/USD – The risk leading Aussie was smacked lower as positive sentiment eased amidst broad-based USD strength. AUD/USD slumped to 0.7446 from yesterday’s 0.7750 open, settling at 0.7660.

- USD/JPY – The Dollar soared against the Yen after trading in a relatively tight range between 109.30 and 110.00 for most of this week. USD/JPY traded to an overnight and 2-month peak at 110.313 before easing to settle at 110.28. A rebound in the US 10-year bond yield by 3 basis points to 1.62% propelled USD/JPY higher. Japanese 10-year JGB rates were flat at 0.07%.

- GBP/USD – slip-sliding away. The British Pound slid 0.46% against the broadly based stronger US Dollar to 1.4105 from 1.4168 yesterday. A better-than-forecast climb in UK Final Services PMI report (see above) failed to lift Sterling. It was all about the Greenback overnight.

- USD/CNH – The Dollar extended its gains versus China’s Offshore Yuan to a 6.3980 finish from 6.3850 yesterday and Monday’s 6.3517 lows. USD/CNH hit an overnight high at 6.4009 before settling. The lower than forecast Chinese Caixin Services PMI also weighed on the Chinese currency.

On the Lookout: Welcome to Payrolls Friday! And it’s all about tonight’s US NFP report. The robust increase in US private payrolls set the stage for tonight’s much-awaited employment data. Economists are forecasting May’s Payrolls to climb to a median range from 645,000 to 664,000 from April’s disappointing 266,000. ACY’s Finlogix is expecting NFP up by 650,000 jobs. The Unemployment rate is expected to fall to 5.9% from a previous 6.1% (April). Wages (Average Hourly Earnings) are widely forecast to slow to 0.2% from 0.7% (ACY Finlogix)

Other data released today sees Japan’s Household Spending report (annual) for April. Our ACY Finlogix is forecasting a rise to 9.3% from 6.2% annually. Europe sees the Eurozone’s April Retail Sales (f/c -1.2% from 2.7%). Canada also releases its Employment report, which unlike that of its US neighbour is expected by most analysts to see a loss of jobs. Canada’s renewed lockdown has contributed to a recent slowdown in jobs growth. Employment Change for May in Canada is forecast to -20,000 jobs from April’s -207,100. Canada’s Unemployment Rate is forecast to climb to 8.2% from 8.1% (ACY Finlogix).

One factor which should not be overlooked is the employment component of last night’s US ISM PMI report. According to the US ISM the Employment Index fell to 55.3% from April’s 58.8%, down 3.5%. While all the other components rose, the crucial Employment component fell. The stage is set for some dramas tonight. We would have to see a very good Payrolls report, say a Jobs gain of 1 million or higher to really set the Greenback on fire. If the NFP rise is at or lower than medians forecasts, the Dollar will fall back again. Watch the bond market’s reactions too. Tin helmets on folks, we may be in for one of those nights. Happy days !

- EUR/USD – Expect the Euro to consolidate at these lower levels ahead of tonight’s US Payrolls report. EUR/USD hit an overnight low at 1.21181 before rallying to close at 1.2130. Immediate support can be found at 1.2110 and 1.2070. Immediate resistance lies at 1.2150 and 1.2180. Look for consolidation in a likely trade between 1.2110-1.2180 first up today.

- AUD/USD – The Australian Dollar slumped on the back of broad-based USD strength and lower Asian and Emerging Market currencies. Risk appetite eased and the specs, long of Aussie bets headed for the exits. AUD/USD closed at 0.7660 after dropping to an overnight low at 0.76466. Immediate support lies at 0.7640 followed by 0.7620 and 0.7580 (strong). Immediate resistance can be found at 0.7700 and 0.7740 (overnight high 0.7754). Look for the Aussie to consolidate within a 0.7640-0.7740 range pre-US NFP.

- USD/JPY – Against the Japanese Yen, the Greenback found its legs and came to life as it soared through the 110 level, closing at 110.28, up 0.63%. Japanese data of late has mostly underwhelmed while the country struggles to cope with the rise in recent Covid cases ahead of next month’s Olympic Games which the country is hosting. USD/JPY has immediate resistance at 110.35 (this morning’s high traded 110.335) and 110.85. Immediate support lies at 110.00 and 109.70. Expect consolidation in this pair between 109.70-110.40 pre-NFP.

- GBP/USD – Sterling slid 0.46% to 1.4105 under the weight of the overall stronger US Dollar. It was all about the US Dollar and US data as the improvement in UK Final Services PMI was overlooked. In the latest Commitment of Traders report (week ended 25 May) speculators increased their long GBP bets, which have been pared a tad since then. Overnight low in the British currency was 1.40867. Today GBP/USD has immediate support at 1.4085 followed by 1.4055. Immediate resistance can be found at 1.4135, 1.4165 and 1.4205. Look for Cable to consolidate within a likely range of 1.4085-1.4185 first up today.

- USD/CAD – closed at 1.2105 from 1.2035 yesterday. The Loonie wilted under the pressure of a strong US Dollar. Tonight’s a big night for this currency pair as we have the release of Payrolls data from both North American countries. A weaker than expected results in Canada’s Employment report coupled with a stronger US number will see USD/CAD spike. And we may have well established a low for the Greenback. Immediate resistance lies at 1.2120 (overnight high 1.21198) and 1.2150. Immediate support can be found at 1.2080 and 1.2050. Look to trade a likely range of 1.2070-1.2170. My preference is to buy USD dips but will wait for the numbers.

Its Friday so take it easy, save your bullets for tonight. And hopefully we may just be singing the lyrics of that classic 1963 hit song by Frankie Valli and the Four Seasons. “Oh What a Night”.

Happy Friday and trading all.