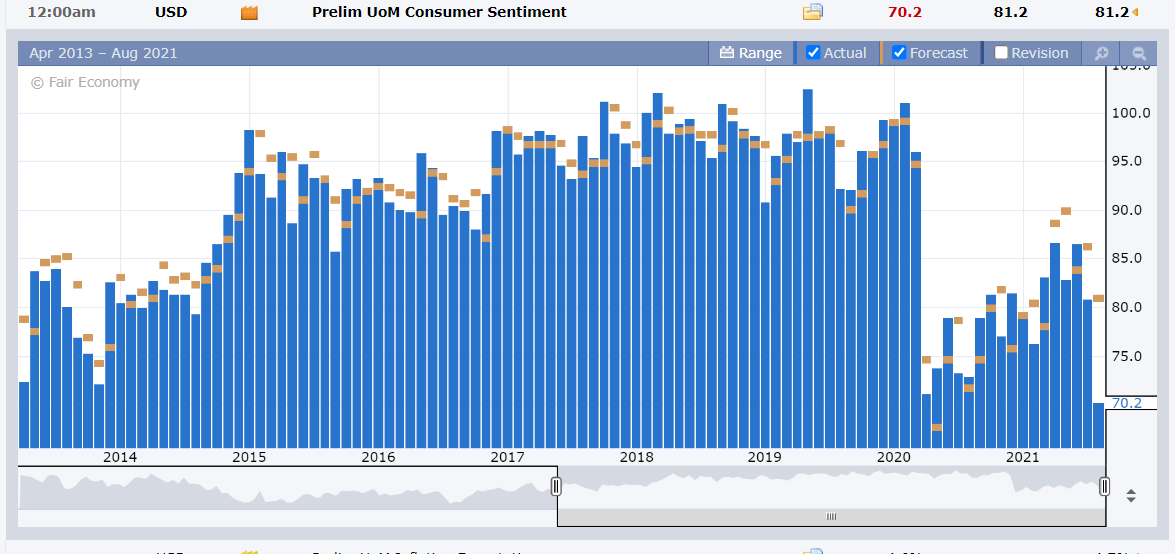

Dollar, Bond Yields Retreat After US Consumer Confidence Plunges

- Michael Moran , Senior Currency Strategist at ACY Securities

- 16.08.2021 06:45 am trading

Yen Jumps; Kiwi Soars, RBNZ Seen Raising Rates; USD Longs Bail

Summary: A surprisingly soft read of a US consumer confidence measure saw bond yields and the Dollar retreat as long bets bailed on Friday. The Preliminary University of Michigan Consumer Sentiment Index plunged to 70.2 in August from 81.2 in July, underwhelming forecasts at 81.2. This was the lowest level since 2011. After climbing for 2 days in a row to 93.00, the Dollar Index (USD/DXY), a favoured measure of the Greenback’s value against a basket of 6 major currencies, slid to 92.52. A report on market positioning from Reuters and the US CFTC (Commodity Futures and Trading Commission) released on Friday, saw net US Dollar longs rise to their highest since March last year. The yield on the benchmark US 10-year Government Bond slid 8 basis points to 1.28%. Other global bond rates were little changed. Germany’s10-Year Bund rate settled at -0.47% from -0.46%. Japan’s 10-year JGB yield was flat at 0.02%. Against the Japanese Yen, most sensitive FX to US yield movements, the Greenback tumbled to 109.60 from 110.43. The Kiwi (NZD/USD) rallied 0.46% to close at 0.7038 from 0.7000 ahead of this week’s Reserve Bank of New Zealand monetary policy meeting (Wednesday). Broad-based US Dollar weakness enabled the Australian Dollar to hold key support above 0.73 cents and close 0.28% higher at 0.7370 (0.7337 Friday opening). New South Wales, Australia’s largest state announced tighter lockdown restrictions today to slow the spread of the Delta variant. The Euro rebounded 0.41% from its 1.1735 opening on Friday to 1.1795 at the New York close. Sterling rose 0.29% to 1.3868 (1.3806). The Greenback fell against the Singapore Dollar (USD/SGD) to 1.3545 from 1.3575. USD/CAD dipped to 1.2510 from 1.2517. Wall Street stocks dipped. The DOW finished at 35,512 (35,522) while the S&P 500 was little changed at 4,465.

(Source: Forexfactory.com)

Data released on Friday saw New Zealand’s BusinessNZ Manufacturing Index climb to 62.6 from a previous 60.9. New Zealand’s Visitor Arrivals in July dropped to -10.4% from June’s 80.4%. Germany’s Wholesale Price Index beat forecasts at 0.9%, rising to 1.1%. Switzerland’s Producer Price Index rose to 0.5% from 0.3%. French Final CPI in July matched forecasts at 0.1%. The Eurozone Trade Surplus rose to +EUR 12.4 billion, beating expectations of +EUR 10.9 billion. US Import Prices eased to 0.3% from 1.1% and median forecasts at 0.6%.

- NZD/USD – Ahead of Wednesday’s RBNZ Monetary Policy meeting, the Kiwi Dollar outperformed the majors, climbing to 0.7038 from 0.7000. New Zealand is widely seen to be the first advanced economy to begin normalizing policy. NZD/USD high traded was 0.7048.

- USD/JPY – the Greenback tumbled against the Japanese Yen weighed by the fall in US bond yields. USD/JPY closed at 109.60 from 110.43 Friday. Overnight low was at 109.54. The 10-year US treasury slid 8 basis points to 1.28% from 1.36%.

- EUR/USD – overall US Dollar weakness enabled the Euro to rally against the Greenback to 1.1795 in late New York from 1.1735. The shared currency hit an overnight peak at 1.1805.

- AUD/USD – the Aussie Battler finished higher against the broadly based weaker Greenback to 0.7372 from its Friday opening at 0.7337. Australia continues to struggle in its battle against rising Delta variant cases in New South Wales, its largest State.

On the Lookout: Today’s data releases kick off with New Zealand’s Services PSI for July (f/c at 57.9 from 58.4 – ACY Finlogix). Japan follows with its Preliminary Q2 GDP Growth Rate (forecast at 0.2% from a previous -1.0% - ACY Finlogix). Japan will also report on its Q2 Preliminary Growth (y/y forecast 0.7% from -3.9%). China follows next with its July Retail Sales (f/c 11.5% from 12.1%; Chinese July Industrial Production (f/c 7.8% from 8.3%), July Fixed Asset Investment (YTD f/c at 11.3% from 12.6%) and July Unemployment Rate (f/c 5.0% from 5.0%). Japan follows with its Final June Industrial Production (m/m f/c 6.2% from a previous -6.5%) and June Capacity Utilisation (no forecasts given, previous was -6.8%). Canada kicks off North American data with its June Final Wholesale Sales report (m/m no forecasts, previous was 0.5%) and Canadian Manufacturing Sales for June (no forecasts, previous was -0.6%). The US releases its Empire State Manufacturing Index for August (f/c 30 from a previous 43). Early tomorrow morning (6 am Sydney time) the US releases its June TIC Net-Long Flows which is the difference in the value between foreign long-term securities purchased by US citizens and those purchased by foreigners during the reported period (no forecasts given, previous was -USD 30.2 billion).

The week ahead sees the release of Australia’s RBA monetary policy meeting minutes, US Headline and Core Retail Sales for August, US Industrial Production and a speech by US Fed President Jerome Powell in an online event (Tuesday, August 17). On Wednesday (Aug 18) the RBNZ holds its monetary policy meeting, rate announcement and press conference. The UK reports on its inflation data (CPI, Core CPI, RPI, PPI Input, PPI Output) and the Eurozone releases its Final Headline and Core CPI report. Canada releases its Inflation reports (Headline and Core CPI, Trimmed CPI). The US Fed’s latest FOMC Meeting minutes are released early Thursday (4 am, August 19). Australia also releases its July Employment Report. Finally on Friday (August 20) the UK releases its GFK Consumer Confidence report for August as well as Japan’s Inflation data. China will also announce any changes to its Annual Loan Prime Rate. Big week ahead.

Trading Perspective: The Dollar did a U-turn and retreated against most of its Rivals following the release of a surprisingly soft read in the US Michigan Consumer Sentiment Index. It was the lowest level in almost 10 years. US bond yields tumbled with the 10-year treasury bond rate down to 1.28% from 1.36%. Bond yields matter and drive currencies. Without yield support, the Dollar will drop. And as the Northern Hemisphere summer season draws to a close FX volatility should pick up.

- NZD/USD – The Kiwi takes centre stage in the early part of the week with the RBNZ’s monetary policy meeting and rate announcement on Wednesday. Markets are widely anticipating the New Zealand central bank to raise its Official Cash Rate to 0.50% from 0.25%. The Kiwi soared to an overnight high at 0.7048 from 0.7000 Friday. Immediate resistance lies at 0.7050 followed by 0.7080. NZD/USD closed at 0.7039. Overnight low was at 0.6995. Immediate support can be found at 0.7010 followed by 0.6980. Look for a likely trading range today between 0.7010-0.7060.

(Source: Finlogix.com)

- USD/JPY – The US Dollar tumbled 0.78% against the Japanese Yen to 109.60 at the New York close from 110.43 on Friday morning. Immediate support on the day lies at 109.50 (overnight low 109.54). The next support level is found at 109.20. Immediate resistance can be found at 109.85 and 110.20. Look for USD/JPY to grind higher initially to 110.10 as it fills in the gap from its steep fall from 110.20 to 109.54. Likely range 109.50-110.10.

- AUD/USD – The Aussie Batter managed to hold above its critical support level around 0.73 cents. Broad-based US Dollar weakness against all currencies, favoured the Aussie. AUD/USD closed at 0.7372 (0.7337 opening Friday). Immediate resistance lies at 0.7385 (overnight high at 0.7381). The next resistance level can be found at 0.7405. Immediate support can be found at 0.7350 and 0.7320 (overnight low at 0.7333). Look for the Aussie to trade within a 0.7340-0.7390 range today. Preference is to buy AUD/USD on dips.

- EUR/USD – The Euro rallied 0.41% to finish at 1.1795 (1.1735 Friday). Overnight high traded was at 1.1805. Immediate resistance on the day can be found at 1.1805 followed by 1.1820 and 1.1850. Immediate support lies at 1.1760 followed by 1.1730. Look for the Euro to drift lower to 1.1760 initially to fill in the gap from 1.1760 to 1.10800. There are no major Euro area economic reports scheduled for release today. The shared currency will be driven by the moves in the Greenback.

Have a safe and good week ahead all. Happy Monday, happy trading.