Australia a Risk Market

- Clifford Bennett, Chief Economist at ACY Securities

- 10.08.2021 07:45 am trading

'No matter how correct our fundamental insights are,

we must get the price movement right in order to achieve material,

rather than purely intellectual, reward.'

- Warrior Trading.

That stalling equity look.

No get out of gaol card for Aussie dollar.

Good morning,

The Dow Jones is struggling to hold on to Friday's gains from the US jobs data. As are most equity markets.

The Australian market has continued this bizarre rally on intensifying lockdown news. How long can this market behaviour last? While the world may be awash with money, that money does not have to favour, or stay, in Australia. The long ignored factors of over-stimulus previously masking real structural flaws, zero immigration, no foreign students or travellers, will increasingly weigh in reality and also begin to become alarmingly prevalent in various economic data series moving forward.

This is a heady mix that can accelerate any downturn in the Australian dollar. Already falling due to commodities topping out and a strengthening US dollar trend. Our target of 70 cents, set when everyone else was still bullish at .7745, remains in place. Our further risk scenario to .6850 is still valid.

The Australian stock market has defied all fundamental accuracy in terms of the risk of recession, and as per the quote above, we have to be mindful that it is the markets price that determines our true success. Nevertheless, this is a rally built on a false belief of a fast economic rebound from current lockdowns. While there will certainly be a recovery phase, it is going to be very different in character and far more subdued.

You can only fit so many sofas and TVs in any lounge room.

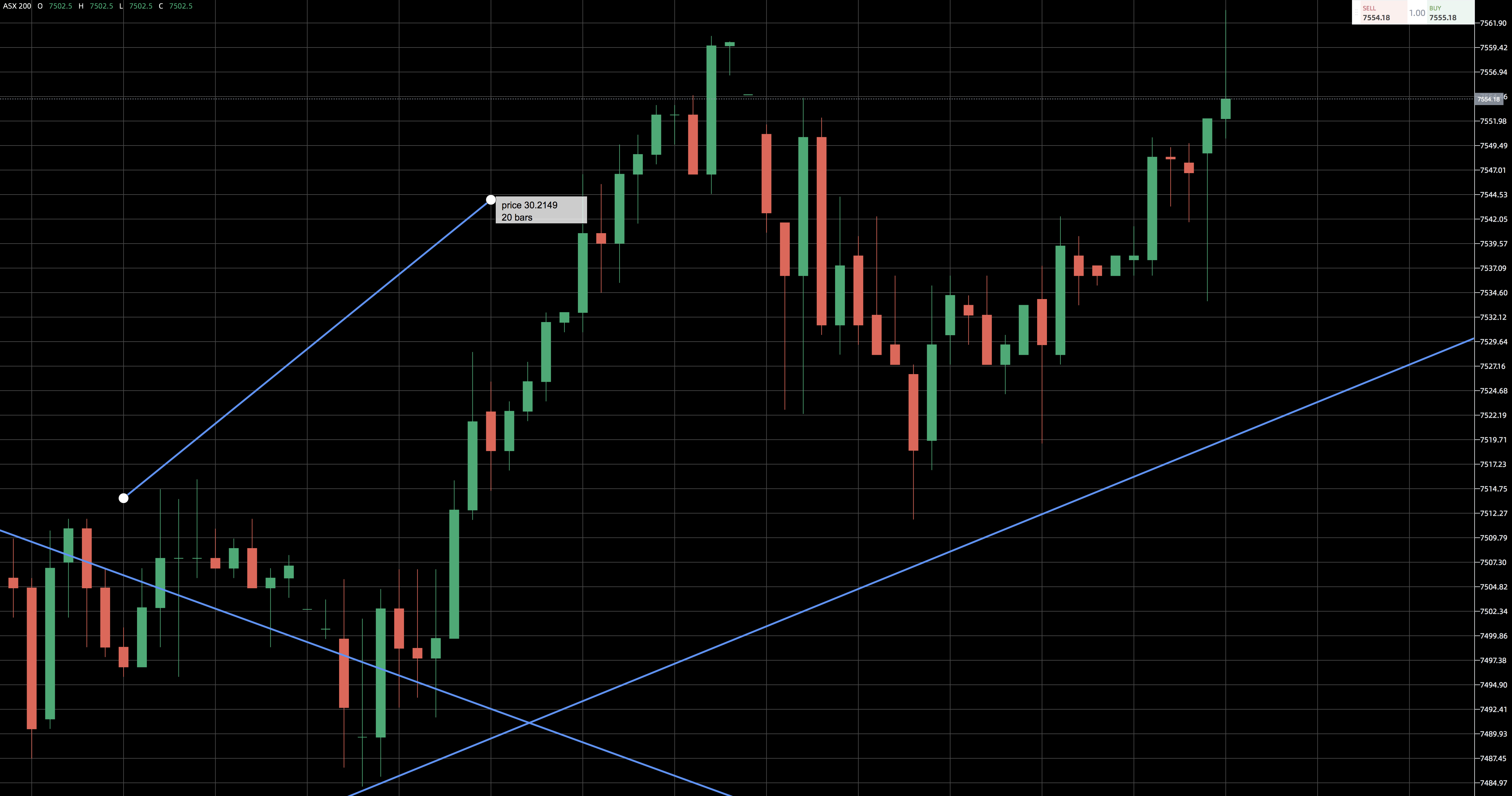

Price action today for the Australian market is that it remains an immediate bull market while support at 7512 holds. A move below 7535 would be an early warning signal. Immediately, a micro-trade might be that it looks heavy while 7573 contains?

Latest Video report: https://youtu.be/W2Bk3L7IEFE

Have focussed on the Australian situation today, because this is where I see the greatest risk in global markets at the moment.

Our big picture themes remain, US tapering by year end, US rate hikes in 2022, strengthening US dollar, Oil has already seen a long term high, commodities to weaken, Gold to break free for a rally.

All the best for your day,