Afghanistan Collapse, China Slowdown, Delta Upset Risk

- Michael Moran , Senior Currency Strategist at ACY Securities

- 17.08.2021 08:45 am trading

Aussie, EMFX, Asians Fall; Yen Outperforms, Kiwi Steady

Summary: Risk appetite soured as Afghanistan’s government collapsed after US President Biden hastily withdrew all troops. China’s trifecta of Industrial Production, Retail Sales and Fixed Asset Investment all fell below previous levels and widely missed estimates. New cases of Delta in the US continued to surge in low vaccination areas. The risk sensitive Aussie slipped 0.35% against the Greenback to 0.7335 from 0.7372 yesterday. Against the haven sought Japanese Yen, the US Dollar eased 0.28% to 109.25 (109.60). The Dollar Index (USD/DXY), a measure of its value against 6 major currencies was mildly 92.60 (92.55). Ahead of tomorrow’s RBNZ monetary policy meeting, the Kiwi was steady, settling at 0.7022 from 0.7037. USD/CAD soared to 1.2573 from 1.2517 yesterday after Canada’s Manufacturing Sales missed forecasts. The Euro dipped to 1.1775 (1.1795). Sterling eased to 1.3837 from 1.3867 yesterday. The Greenback advanced modestly against the Asian and Emerging Market currencies. USD/SGD edged higher to 1.3560 from 1.3545 while the USD/CNH pair (Dollar-Offshore Chinese Yuan) dipped to 6.4760 (6.4770). Against the Thai Baht the Dollar was little changed at 33.37 (33.35). The US 10-year bond yield dipped to 1.27% from 1.28%. Wall Street stocks overcame earlier slides to finish higher. The DOW settled at 35,610 (35,512), up 0.28%. The S&P 500 was last at 4,480, up 0.26% from yesterday’s 4,468.

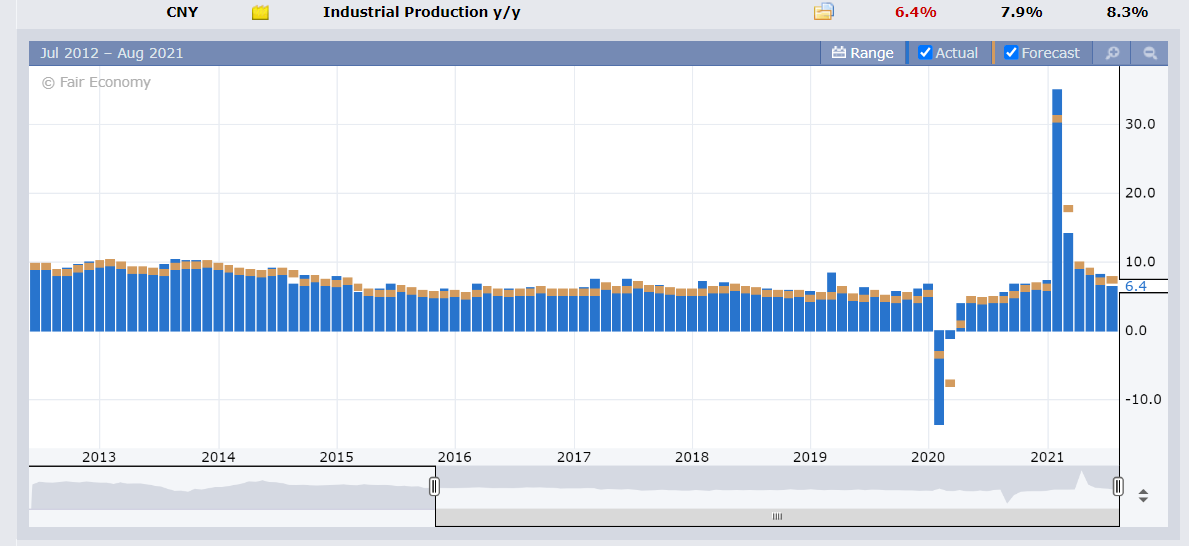

Data released yesterday saw Japan’s Preliminary Q2 GDP climb to 0.3%, beating forecasts at 0.1%. Japanese Preliminary GDP Price Deflator was at -0.7%, beating estimates at -0.9%. Japan’s Annual Industrial Production for June climbed to 6.5%, beating forecasts at 6.2%, and a previous 6.2%. China’s Annual Retail Sales for July slid to 8.5% from a previous 12.1%, and missing median forecasts at 10.9%. Chinese July Industrial Production fell to 6.4% from 8.3% in June, underwhelming estimates at 7.9%. China’s July Fixed Asset Investment was also lower than forecasts, at 10.3% from 11.3% and a previous 12.6%. Unemployment in China was up at 5.1% from a previous 5.0%. Canada’s Wholesale Sales in June eased to -0.8%, bettering forecasts at -1.8%. Canadian Manufacturing Sales printed at 2.1% against estimates of 2.5%. The US Empire State Manufacturing Index in August fell to 18.3 from 43.0, and underwhelming expectations of 29.0.

(Source: Forexfactory.com)

US TIC Long-Term Purchases matched forecasts at USD 110.9 billion, against a previous -USD 30.0 billion.

- AUD/USD – a souring of risk sentiment, a slowing of Chinese growth and a continued rise in Delta cases which have triggered lockdowns in 4 out of 6 Australian States weighed on the Aussie Battler. AUD/USD slid 0.35% to finish at 0.7335 (0.7370).

- USD/JPY – slid to finish at 109.25 from 109.60 yesterday. The traditional haven sought Yen rallied against the US Dollar and other currencies. Better-than-expected Japanese economic data also buoyed the Yen.

- NZD/USD – settled modestly lower against the Greenback ahead of tomorrow’s RBNZ monetary policy meeting. NZD/USD was last at 0.7023, down 0.22% from 0.7039 yesterday. The RBNZ is expected to be the first of the major central banks to raise rates at the conclusion of its meeting tomorrow.

- USD/CAD – the Greenback soared against the Canadian Loonie following a miss in Canada’s Manufacturing Sales report. The market’s risk off tone also weighed on the Loonie. USD/CAD rose to finish at 1.2575 from 1.2515 yesterday.

On the Lookout: Economic data today will continue to drive risk and FX. The key report is the US Retail Sales for July. Headline US Retail Sales are expected to fall between -0.2% and -0.3% from June’s +0.6%. US Core Retail Sales in July are forecast to slow to 0.2% from 1.3%. Today’s main event is the release of the minutes of Australia’s latest RBA monetary policy meeting. Japan kicks off with its June Tertiary Industry Index (m/m – no forecasts, previous was -2.7%). The UK kicks off Europe with its June Average Earnings Index (Wages – mm f/c 8.7% from 7.3% - ACY Finlogix); UK July Claimant Count Change (f/c -84.1k from previous -114.8 k); UK June Unemployment Rate (f/c 4.8% from 5.8% - Finlogix). European data start off with Eurozone Flash Q2 GDP (f/c 2.0% from -0.3% Finlogix); Eurozone June Construction Output (no forecasts, previous was 1.36%); Eurozone Q2 Employment Change (no f/c, previous was -0.3%). Canada kicks off North America with its July Housing Starts for July (f/c 282k from 281.2k). The US rounds up the day’s reports with its US July Industrial Production (m/m f/c 0.5% from -0.1% - Finlogix); US July Manufacturing Production (m/m f/c 0.5% from -0.1% - Finlogix); US July Capacity Utilisation (m/m f/c 75.7 from 75.4% - Finlogix); and finally, US NAHB Housing Market Index for August (f/c 80 from previous 80 – Finlogix).

Trading Perspective: The Dollar finished mixed despite maintaining its haven status against the risk and Asian and EM currencies. Tonight’s US Retail Sales are key for the Greenback. Any number lower than expected in the Headline Sales and Core Sales report will see selling accelerate in the Dollar against all its rivals. The Dollar Index (USD/DXY) will soar to resistance at 92.80/93.00 from its current 92.60 level. Risk, Asian and EM currencies could well accelerate their slide against the Greenback. Only a better-than-expected result in the Sales report will see the Greenback stabilise. It’s a big risk event tonight.

- AUD/USD – the Aussie slid to an overnight low at 0.7319 before rallying to settle at 0.7335 in late New York. The pressure is still on the downside of the Aussie Battler with immediate support at 0.7315 coming into play. The next support lies at the 0.7300 level. The RBA meeting minutes release, if less hawkish than expected will see the Aussie test 0.73 cents next support. Immediate resistance is found at 0.7350 and 0.7375 (overnight high 0.7373). Look for the Aussie to trade a likely 0.7310-0.7360 range today.

- USD/JPY – the Dollar slid against the traditional haven sought Japanese Yen to 109.25 from 109.72 yesterday. Overnight low traded was 109.11. Immediate support lies at 109.10. The next support level is found at 108.90. Immediate resistance can be found at 109.50 followed by 109.80. Look for an initial drift lower to 109.10, where its ideal to buy this dip. Likely range today 109.10-109.70.

- EUR/USD – The Euro continues to grind lower but has yet to break lower. The Euro closed modestly lower against the Greenback at 1.1775 from 1.1795 yesterday. Immediate support lies at 1.1765 (overnight low 1.1767) followed by 1.1735. The next support level is at 1.1700. Immediate resistance can be found at 1.1800 (overnight high 1.18007) and 1.1830. Likely range today 1.1740-1.1790. Prefer to sell rallies.

- USD/CAD – The Greenback soared against the Canadian Loonie to finish at 1.2575, up 0.57% from its 1.2515 close yesterday. USD/CAD has immediate resistance at 1.2585 (overnight high 1.2584) followed by 1.2605. The next resistance can be found at 1.2625. Immediate support lies at 1.2555 followed by 1.2525. Look to buy USD dips in a likely 1.2525-1.2625 range today. This currency pair is likely headed higher.

(Source: Finlogix.com)

Happy Tuesday and trading all.