Will PSD2 Affect You?

- Saurabha Sahu, Senior Consultant at Mindtree

- 28.07.2017 12:15 pm PSD2

The Second Payment Services Directive or PSD2 will come into effect January 13, 2018. PSD2 must be transposed into national law by Member States by 13 January 2018, which means that the majority of the legal provisions will apply from that date.

What Is PSD2 Anyway?

PSD2 laid out the rules and guidelines for modern payment services in the European Union which simplified payment processing throughout the member states.

The goal of PSD1 and PSD2 is to make payment policies more equal across EU borders and all levels of financial institutions. The benefit is that the landscape becomes more competitive and smaller entities like fintech start-ups have a chance against established institutions. And that competition means that as consumers should have better options and better user experiences, particularly in our online banking.

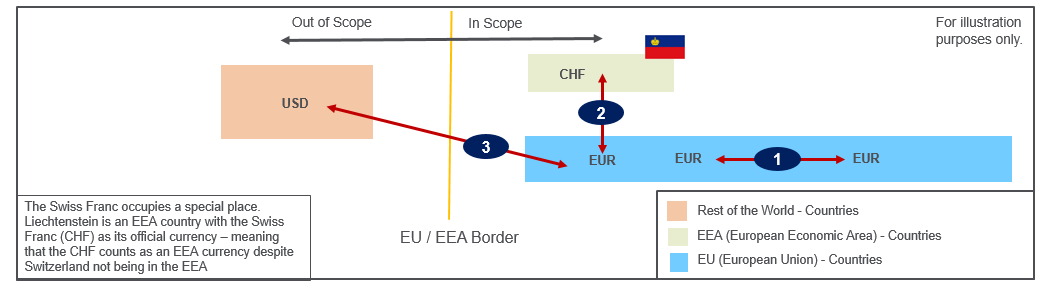

PSD2: Scope Vs Out Of Scope

- The “Two-Leg-Principle” (reflecting the scope of PSD1): The Directive applies to all payment transactions in all EU/EEA-currencies carried out in the EU/EEA.

- Foreign currency transactions (new). This extends the “Two-Leg-Principle”: payment transactions in every currency, where all participant PSPs are located within the EU/EEA.

- The “One-Leg-Principle” (new): payment transactions in every currency, where only one of the PSPs is located within the EU/EEA, in respect of those parts of the payment transaction that are carried out in the EU/EEA.

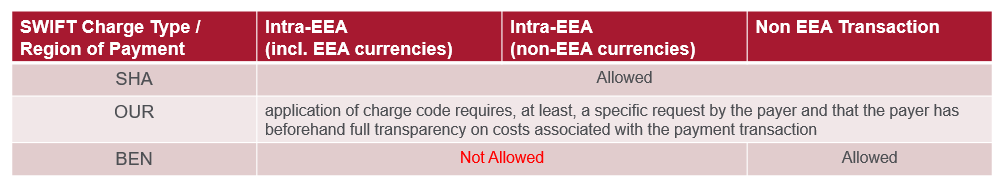

PSD2: Business Applicability on Charge Types

It also shows that the basic principle for intra-EEA transactions in EEA currencies is to share charges, using the “SHA” code. The charge code “OUR” is still used by way of existing market practice in light of PSD1. The respective provisions have not fundamentally changed from PSD1 to PSD2.

The application of such a charge code – however – requires, at least, a specific request by the payer and that the payer has full transparency on the costs associated with the payment transaction before entering into it.

PSD2 for a Consumer

The main goal of PSD2 is for banks to better serve consumers and to give consumers more insight into their financial lives.

PSD2 Objective 1: A Single View of Financial Status.

Most consumers have numerous bank accounts. Consumers may have a loan in a different one than our salary goes into. They may probably have retirement savings in another bank. They may even have financial accounts in different countries and different currencies.

Now those consumers with European bank accounts, instead of having to log in and out of different websites, with PSD2 they should be able to get a consolidated, data-rich view of our financial situation, often on a third-party site.

PSD2 Objective 2: Faster and may be cheaper Payments

Today, there are multiple intermediaries (middle man) comes in to action for any payment processing. Like in a case of Card Payment, there may be the credit card issuing company or bank. With a purchase through a credit card usually it goes with a series of intermediaries then at last the money reaches to the merchant. This is a time-consuming it is costly to the merchant who then in turn raises prices on the consumer.

With PSD2, the retailers/ merchants will be able to ask consumers if they would like them to directly withdraw from the consumer’s bank. At the same instance consumer can revoke that permission at any time. This will not change too much of the process for a consumer except that it’ll lessen delays on payments showing up in the account statements and, without the intermediaries, there will be fewer entities involved, presumably, meaning a lesser chance of fraud.

PSD2: API-driven Interoperability

The main goal for banking and backend services is to play better together — interoperability. As you may have guessed by the outcomes listed above that means it’s all driven by the application programming interface or API.

Specifically this is based on open APIs which are public interfaces based on an open standard to be agreed upon. An API-backed platform allows banks to learn more about their clients and then to rapidly prototype and deliver more innovative products and services to their clients. Plus a well-designed API enables banks to do all this on any device and to more quickly comply with regulations.

Authentication and Identification with PSD2

Authentication is going to be essential with PSD2 since the directive aims not only to make the financial markets more accessible but also more secure. The problem is financial institutions haven’t actually decided on a common way of doing it yet.

One of the so-far un-outlined objectives of PSD2 is two-factor authentication, which means not only something simple like a passport, but something that “cannot be easily guessed or left in a cab or chopped off,” like a fingerprint.

PSD2 Isn’t the Only Standard to Comply with

Each country and currency (there are 11 currencies within the current EU) will have different regulations. Add to that the regulations of external countries they are working with. Most importantly, all actions of PSD2 must comply with current EU regulations (and those regulations must be adapted for PSD2 compliance.)

Some other standards and regulations to keep in mind:

- elDAS — cross-border acceptance of electronic signatures and allowing these signatures to happen via a mobile device.

- General Data Protection Regulation (GDPR) — This is still under debate by the European Council and Parliament and subject to change, but deals with these five concepts:

- How data protection is a part of system design

- Banks required to report quickly and publicly if they have a data breach

- Institutions must prove a “legitimate interest” in the data they are collecting

- It will protect both EU citizens and small businesses

- Third-party entities outside the EU won’t be able to access this data if there isn’t a bilateral treaty.

PSD2 brings a major update of payment market regulation in the EU/EEA. PSD2 should be welcomed as a clear indication that the EU wishes to be at the heart of a digital payments era already well underway across the globe. Consumers as well as merchants will be benefited through the direct processing of payment transactions.