CECL Forum: Impact of Prepayments on Life of Loan

- Manish Kumar Nirala, Senior Consultant, Product Management & Strategy at Fintellix Solutions

- 03.11.2015 12:00 am payments

The CECL (Current Expected Credit Loss) regime requires banks to consider expected prepayments for determining the Life of Loan. Prepayments are expected to play a critical role in ‘rightsizing’ Allowance for Loan and Lease Losses (ALLL) under the CECL regime. The cascading effect could be the need for new internal controls over the ALM systems, necessitating integration of timing of charge-off expectations with prepayments.

As the charge-offs expectations are built using historical loss experience as the guiding input for supportable and reasonable forecast, prepayment model could be built using the historical prepayment experience as the guiding input for supportable and reasonable forecast, rather than depending on the ALM systems.

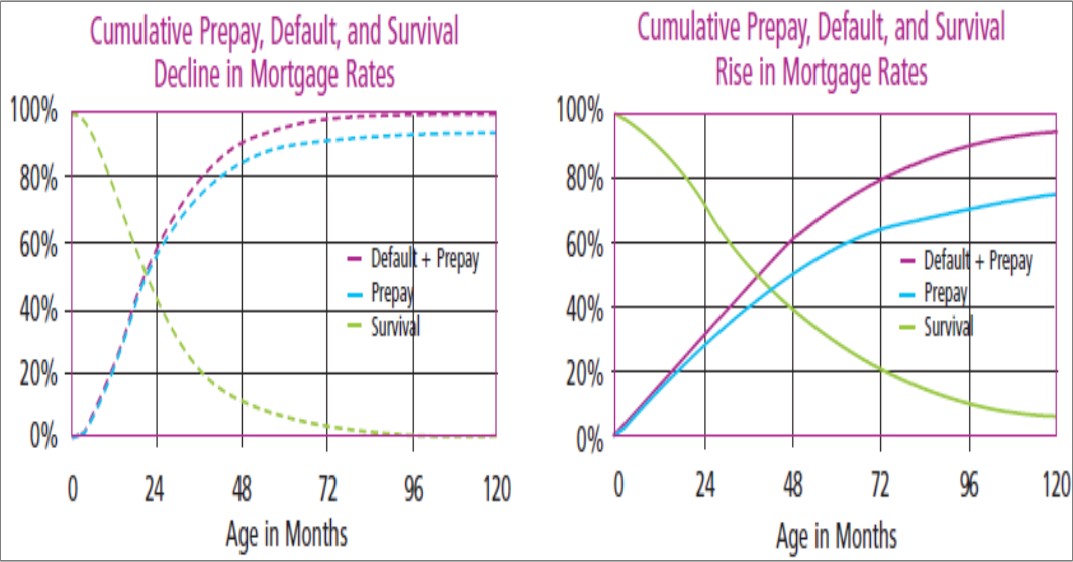

Intuitively, as well as from past experience, it can be demonstrated that interest rates play a vital role in upward or downward movement of prepayment speed.

A higher prepayment speed would decrease the life of loan and probability of default whereas a lower prepayment speed would increase the life of loan and the probability of default.

A historical decrease in interest rates would result in higher prepayment speed. As a result the weighted average life of loan would decrease, resulting in a decrease in the projected life of loan.

Also, higher prepayment speed would mean lesser number of loans are available for default and it can be inferred that survival rate would be higher and default rates lower.

On the other hand, a historical increase in interest rates would result in lower prepayment speed and therefore an increase in the weighted average Life of Loan as well as the projected Life of Loan.

As the Life of Loan increases, more loans would be available for default and it can be inferred that the survival rate would be lower and default rates higher.

Lundstedt, Arden Hall and Kyle G., 2005

The approach for calculating Life of Loan by considering prepayment speed may vary for different calculation methodologies as the pooling criteria would vary. In case of Cohort Analysis where the pools are based on risk characteristics such as risk grades, the approach will vary from that in Vintage Analysis, where the loan origination period defines the vintage.

However, the fundamental philosophy of the impact of prepayment speed on Life of Loan remains the same for each.

The complexity will increase further with the PD/LGD method, as banks may have to use the hazard models for establishing relationships between prepayment rates and defaults.

Given that Life of Loan is the core concept behind the CECL model and prepayment speed being a significant parameter for determining Life of Loan, modelling prepayments for Life of Loan calculation is expected to be a mandatory requirement.

As the prepayment model requires a significant amount of transactional data, the data landscape would concurrently expand.

With the complexities involved in prepayment modelling for Life of Loan determination being significantly high, a thorough analysis of not just integration of prepayment speeds with ALLL calculation, but also the analysis of the existing data landscape will become essential.

References:

Lundstedt, Arden Hall and Kyle G. (2005). The Competing Risks Framework for Mortgages: Modeling the Interaction of Prepayment and Default. The RMA Journal, 54-59.