Do You Have a Virtual Card?

- Fabio Carvalho , Digital Marketing Specialist at Nets Switzerland AG

- 15.07.2021 12:15 pm #payment #ecommerce #virtualcard

Using plastic money in grocery stores, restaurants, the hospitality industry, and in the e-commerce sphere has become second nature for consumers. But who has used or accepted virtual cards so far? This debit card or credit card that only exits on the smartphone or smart watch could be the future means of payment for many.

Unheard of. Virtual cards (VCs). They are used for payment purposes and fund transfers already and can be conveniently settle the bill for eating out, shopping or to book flight tickets. but they have not won the hearts of minds of the main street as yet. While virtual reality (VR), on the other hand, is known to many and into only used by designers, engineers, and pilots in training, but also by students and gamers, especially in the wake of a global pandemic that functioned like a digital accelerator, VCs still face some headwinds due to security concerns. We will get back later to the safety aspect.

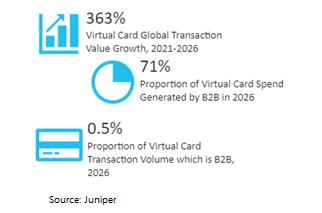

According to Juniper Research, payment transactions by card have reached 6.8 trillion U. S. dollars (whereby two thirds of these transactions are executed in North America, and a mere 15 percent in Western Europe). Virtual card spend alone is projected to grow to $355 billion by 2022, up from $136 billion in 2017, according to Paystand. According to Internet Innovation Alliance, The United States is a leader in the world with respect to the adoption of smartphone technology.

Source: Juniper Research

What is it all about?

Heard of. Virtual debit and credit cards do everything that a standard material card is able to do. Virtual cards (VCs) just are part of your digital wallet instead of your physical one. VCs are secured by encryption codes, hence they are safe and easy to use, making e-payments swift and hassle-free at cashless counters or mobile pay terminals, albeit it is primarily designed for online purchases. It is like the client jumps to the “checkout” step directly while purchasing online, with the difference that he or she does not take a physical card on his hand anymore.

VCs are used in the B2B world as well in the retail segment. Juniper Research stresses the huge potential in both segments, as economies of scales remain untapped in many countries and regions. Banks and card issuers praise VCs as practical because it is part of your apps on the smartphone, environmentally friendly because no plastic and mini-chips have to be used for conventional card, and secure because it can’t get lost like the conventional version and used immediately by the finder. According to Industrystatsreport.com, quoting Internet Innovation Alliance, the USA is a leader in the world with respect to the adoption of smartphone technology.

Who offers VCs?

Juniper Research’s latest “Virtual Cards research report” is based on tests of 17 different vendors, from “A” like Airplus to “W” like Wex, but there are many more providers.

Earlier in July, SAP Concur has joint forces with Cardlay, a Danish FinTech firm which recently launched “a payment cloud solution that integrates issuers, processors and technology providers to enable end-to-end virtual card creation and reconciliation,” IBS Intelligence has reported.

Some providers have designed two different solutions for single payments and regular payments. ePaySercvice for example offers in a joint venture with Mastercard “Single use non-reloadable ePayService Mastercard® Virtual Single can be a right payment instrument when it comes to one-time payments. Reloadable card ePayService Mastercard Virtual Multi will help you out where you need to regularly pay for subscriptions or services.”

iCard offers new customers two free VCs: а Visa card and a Mastercard card. If someone needs more than two VCs, the client can order up to 20 cards in total from the iCard app.

Who uses VCs?

In countries with an ample shadow and cash-heavy economy such as in India, virtual cards are getting increasingly popular. Tech-savvy and cash-tired millennials in particular have a love affair with the imaginary card on the surface of their smartphone, because they can upload their virtual cards (similar to the real one) with funds, simply by loading cash into an ATM machine via their account number and password or secret PIN. On the subcontinent, Axis bank has made its name in the VC world.

Main features of a VC are:

- Hygiene: No one can touch or ask for a VC because it is on the phone and payment can be done (similar to Apple Pay) contactless. Who would give his smartphone to a vendor, not to talk about the smart watch that is fixed at the wrist.

- Flexibility: by carrying the smartphone or smartwatch, the consumer combines telecommunication with digital payment capacity.

- Convenience: can be linked to apps and secured by PINs and passwords to place online orders without having a real card in hand.

- Speed: the search for the credit card or debit card out pf plastic is over. The phone becomes once again the e-wallet.

- International acceptance: a growing number of markets abroad are familiar with the usage of VCs and accept them at shops, eateries, and elsewhere.

What about security?

“The card you can’t lose”, is the ad slogan for the VC offered by Switzerland’s biggest lender UBS AG. Because the card is not physical, you can’t lose it indeed. An if a consumer loses her or his phone, the entry data to call the VC are protected by passwords or by biometric encryption. Certainly, UBS clients can collect the inevitable loyalty points (KeyClub points, in the case) and benefit from the card’s insurance policy. A holiday package booked with a VC is insured by the card’s underlying travel insurance.

The virtual card protects client information online. While it does not exist in any material form and is designed for online purchases. While there is no plastic money in VC’s world, the 16-digit card number along with the CVV code and date of 6-digit expiry date like on an issued card of Mastercard, VISA, or American Express, still exists and the card is depicted on the smart phone as if you took a photo shot of while it lies on your (home) office desk. Like any user ID or password, these features should not be written down on a post-it or piece of paper in the wallet.

What are the tailwinds supporting VCs?

Clearly, the tech-savvy generation Z and the millennials do not have to be much enticed to VCs. For the youngsters, the smartphone is a more important daily tool than the wrist watch. Other boost for VCs are the rise of crypto currencies like Bitcoin or Ethereum which can be used as an additional underlying for a debit card, aside from the usual bank account credit with fiat money.

The ever intensive competition among smartphone developers like Apple, Huawei, Xiaomi, Samsung, & Co. leads to more users to swap their plastic card for a virtual card. Like the use of ATM machines has been on the decline since the outbreak of Covid-19, plastic money is not here to stay amid the rise of the contactless and virtual alternative.

As the delta variant shows that the global pandemic is not over yet, the tendency to avoid physical contact with coins, banknotes, and cards gives further reason to opt for VCs.

And which are the headwinds?

As mentioned above, security concerns remain the predominant reason for the hesitation about VCs by some consumers to adapt to future trends.

Data leaks and hacker attacks can always trigger a setback for digital innovation, but the long-term trend towards more digital money, and less physical money has been unabated (as yet).

Tech it easy!

The pandemic has mercilessly exposed the weak points of the analogue economy, while giving an unprecedented boost to digital solutions. Consumers and institutions alike can no longer ignore the latest products for cashless and contactless payments.

It might sound unheard of to pay with a credit card that someone cannot hold in the hand like a business card. But who wants to appear to be out of touch with reality when business trips and leisure trips pick up and all guests at the hotel reception pay with their VC by showing their smartphones, rather than showing off with outdated environmentally unfriendly plastic money?