Open Banking - Growth Opportunities in Retail Banking

- Alistair Muir, CEO at Vanteum

- 23.10.2019 07:45 am #OpenBanking

Access to customer data has been a topic of conversation for many governments around the world in recent years, with many regimes around the world slowly moving towards legislation requiring data to be “opened up” to facilitate data sharing and portability.

Here in Australia, there have been several waves of this with a Productivity Commission report into Data Availability and use across the economy and the establishment of the Consumer Data Right (CDR) which enables greater empowerment for consumers to get access to the data that organisations have on them so that may provide this to third parties for better products and services. In Australia, the first implementation of this economy-wide Consumer Data Right is in Banking with “Open Banking”.

Whilst Australia is not the first jurisdiction in the world to mandate Open Banking through regulation, it is the first to regulate this as part of a broader framework that is to be economy wide.

Given we’ve been on our Open Banking journey for quite a while now, it still surprises me just how many Banks, Financial Services companies and indeed players in other adjacent markets are not clear on the Growth use cases presented by Open Banking. One explanation for this is that in Australia, there is still a large focus on the activities to comply with Open Banking rather than to compete in this environment.

As the Consumer Data Right in Australia extends beyond banking into Utilities (Energy and Telecoms), General Insurance (P&C), Superannuation (pensions), etc. the myriad of possible use cases for the data being provided through such a regime is mind boggling.

Instead of going into all of these possibilities here, I wanted to offer some concrete use cases for Open Banking in Retail Banking, specifically as I’ve seen in Australia, UK, Europe and elsewhere around the world.

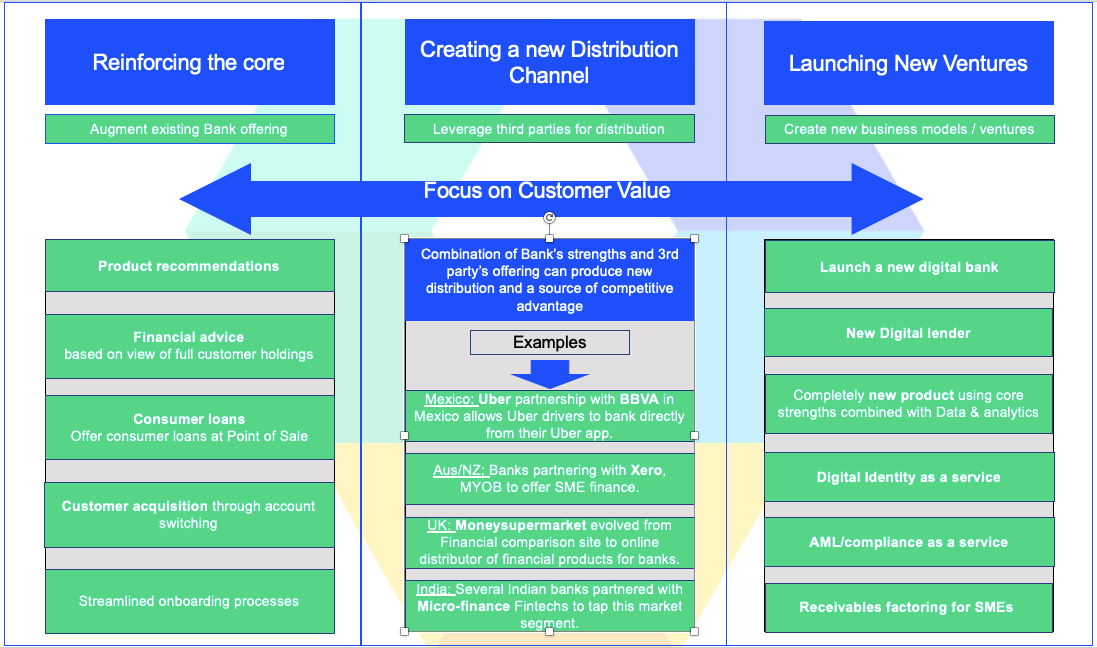

With the right mindset, the right strategy, customer focus and ecosystem collaborations, Open Banking can provide the means to increase market share, grow revenues and develop new digital propositions in adjacent markets.

Retail Banking use cases

These examples are from what we have seen working with Banks, Insurers and Fintech companies both in Australia and in Europe and is intended to give a sense of what is possible in Retail Banking, specifically.

When considering which Open Banking strategies and use cases to execute upon, it is important to note that embarking upon an Open Banking transformation is certainly not a one size fits all proposition and is largely dependent on:

- The Bank’s Digital maturity

- The Bank’s Data maturity

- The ambition and overall strategy of the Bank

The use cases above are high level and intended to give a flavour of the opportunities that Open Banking presents in the near term and with some international examples of where these use cases have already been implemented to significant benefit.

Data Collaborations

In addition to Open Banking opportunities that leverage Application Programming Interfaces (APIs), there are also a tremendous number of potential growth opportunities that can be realised through secure data collaborations with trusted third parties. Such collaborations can support and compliment an overall Open Banking strategy.

Whilst I haven’t gone into any detail here, some examples that could be executed through third party collaborations include:

- Leveraging bank data in combination with 3rd party data to enhance credit scores across personal, business and home loan customers

- Fraud detection and Anti-Money Laundering compliance

- Customer Marketing: Better segmentation, enhanced recommendations and personalisation, etc.

- Provide entirely new data products to market and add new revenue lines

In my next post, I’ll write about the growing use of a field of technologies called Privacy Preserving Protocols (PPP) which are being used by banks and, indeed, regulators to build distributed artificial intelligence (AI) models for pattern identification across data residing with multiple participants without the need to “see” or exchange the underlying data. We very much see this as the next wave of “data sharing” and it will have a profound effect on Financial Services.