Kiwi Tumbles as RBNZ Stands Pat; Dollar Flat as Fed Mulls Taper

- Michael Moran , Senior Currency Strategist at ACY Securities

- 19.08.2021 11:15 am undisclosed

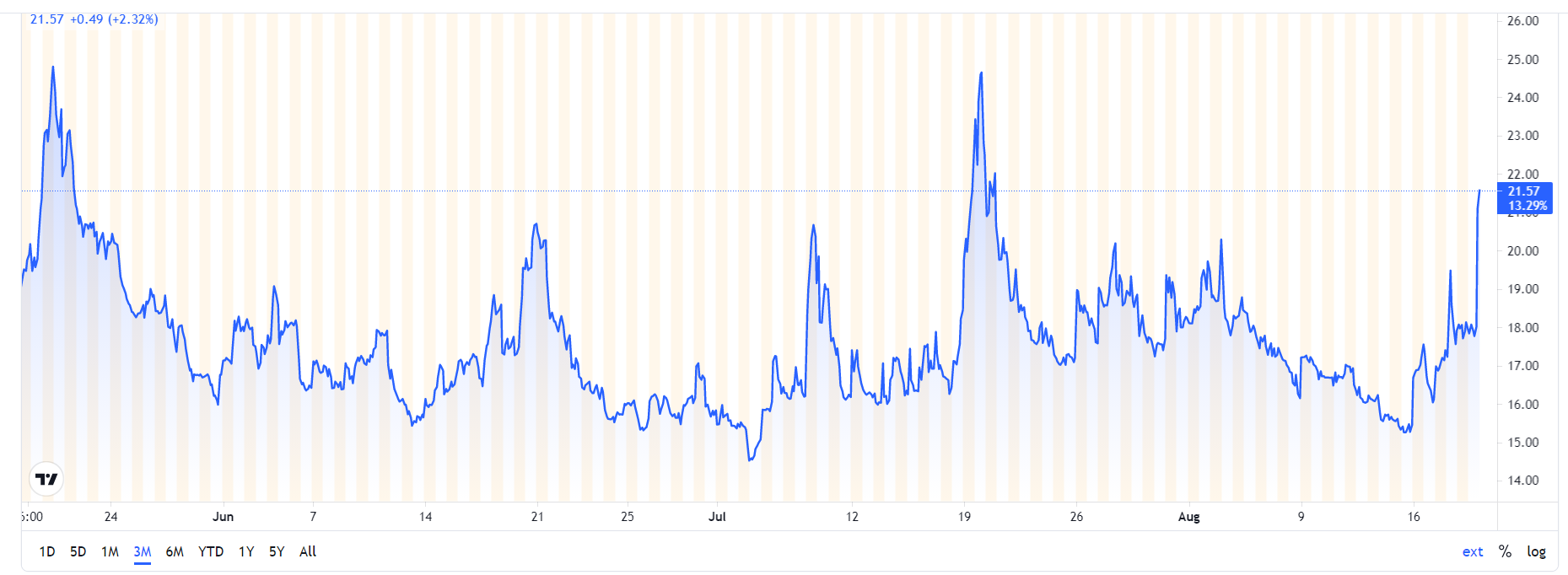

Delta, Geopolitical Fears Hit Risk FX, Stocks, VIX Index Soars

Summary: Risk appetite took another knock after the release of the minutes of the FOMC’s July 27-28 meeting. US policymakers signalled that they would reduce emergency purchases of Treasury bonds before the end of this year. The Fed also acknowledged that the rising spread of Covid-19 Delta variant cases could dampen the economic recovery. Geopolitical fears remained high following the Afghan government’s collapse. The CBOE VIX Fear Index soared 10.5% to 21.57, a one-month high.

(Source: Tradingview.com)

US Treasury bond yields dipped with the benchmark 10-year note settling at 1.26% (1.27%). The Dollar Index (USD/DXY), a popular gauge for the US currency’s value against a basket of 6 major currencies ended little changed, at 93.15 (93.12). Against a range of currencies, the Greenback had mixed fortunes. New Zealand’s Kiwi (NZD/USD) tumbled 0.7% to 0.6880 (0.6915) to finish as worst performing major after the RBNZ surprised many and left its Overnight Cash Rate unchanged at 0.25%. Analysts had expected a hike to 0.5%. The Australian Dollar (AUD/USD) extended its slide to 0.7235 from 0.7255 yesterday. Sterling edged up to finish at 1.3751 from 1.3735 yesterday despite a lower read on UK inflation data. The Euro was little changed, closing in New York at 1.1708 (1.1710). Against the Japanese Yen, the US Dollar edged higher to 109.78 from 109.60 yesterday. The Greenback rallied against the Canadian Loonie to 1.2656 (1.2624) despite higher-than-forecast Canadian CPI data. Oil prices extended their slide after several countries re-introduced travel restrictions due to the rise of Covid-19 infections. Against the Asian and Emerging Market currencies, the US Dollar was mostly flat. USD/SGD settled at 1.3610 (1.3620) while USD/CNH was last at 6.4850 (6.4900).

Wall Street stocks slid. The DOW finished 1.03% lower to 34,935 (35,290) while the S&P 500 slid 1.08% to 4,395 (4,442).

Data released yesterday saw New Zealand’s PPI Output in Q2 climb to 3.0% against 0.9% forecast while PPI Input rose to 2.6%, beating estimates at 0.4%. Japan’s Core Machinery Orders eased to -1.5%, bettering forecasts at -2.7%. Japan’s Trade Balance went into a Surplus rose of JPY 0.05 trillion, from a previous Deficit of -JPY 0.06 trillion. UK Annual CPI in July eased to 2.0% against forecasts at 2.3%. The Eurozone Final July CPI rose to 2.2% from 1.9%, matching forecasts at 2.2%. Canada’s July Headline CPI rose to 0.6% from 0.3%, beating estimates at 0.3%. US July Housing Starts fell to 1.53 million units from June’s 1.04 million, missing expectations at 1.60 million. US Building Permits for July rose to 1.64 million, beating forecasts at 1.61 million.

- NZD/USD -The Flightless Bird had its wings clipped after the RBNZ kept surprised many by keeping interest rates unchanged. The RBNZ MPC maintained its hawkish stance and a hike at its next meeting is likely. The Kiwi tumbled to an overnight low at 0.6868 before settling at 0.6880, down 0.70%.

- AUD/USD – the Aussie Battler slid after its little cousin the Kiwi got smacked. AUD/USD finished 0.28% lower to 0.7235 from 0.7255 yesterday. The Australian Dollar hit an overnight low at 0.7229.

- EUR/USD – The Euro finished little changed at 1.1708 (1.1710 yesterday). The shared currency hit an overnight low at 1.1694. The Eurozone Final CPI matched forecasts. There was little other data out of Europe yesterday.

- USD/JPY – the Dollar rallied against the Yen to settle at 109.78 from 109.60 yesterday after an initial drop to 109.48 overnight low. The US 10-year bond yield settled at 1.26% from 1.27% yesterday. Japan’s Trade balance missed expectations with a smaller Surplus.

On the Lookout: Minutes from the FOMC latest meeting saw Fed officials mulling a taper of its massive bond purchases before the end of this year. Which saw the US Dollar keep its overall bid stance against its rivals. The caveat is the ongoing rise in Covid-19 cases of the Delta variant in the US, and around the globe. Many countries have re-introduced travel restrictions amidst lockdowns, which if extended could slow the economic recovery. Economic data releases today kick off with Australia’s July Employment Change (f/c at between -42.5 k to -46.2 k from June’s +29.1k). The Participation Rate is forecast to ease to 66.0% from 66.2%. Australia’s July Jobless Rate is forecast to rise to 5.0% in July from 4.9% previously. Switzerland follows with its July Trade Balance (no forecasts, previous was +CHF 4.3 billion). Swiss Q2 Industrial Production follows (no f/c previous was 4.8%). The Eurozone follows with its July Current Account (f/c +EUR 12.3 billion from +EUR 11.7 billion). Canada releases its July Employment Change (no f/c previous was -294.2 k). The US reports its Philly Fed Manufacturing Index for July (f/c 23.0 to 23.2 from 21.9); Weekly Jobless Claims (f/c 362,000 from 375,000 – ACY Finlogix); US Conference Board July Leading Indicator (f/c 0.7% from 0.8% - ACY Finlogix).

Trading Perspective: The Fed debate within its ranks continue to debate when to taper. Although the noise from US policymakers seems louder for sooner rather than later, it is still not the majority view, according to economists cited in a Reuters report. The next set of data from the US will need to see solid gains in the Jobs area. Elsewhere, geopolitical fears remain elevated for now while the rise in coronavirus delta strains has seen some countries reimpose travel restrictions amidst lockdowns. The rise in the VIX Index to a monthly high, while unnoticed for now, will start to influence markets. FX traders would be wise to keep an eye on it.

- AUD/USD – The risk leading Aussie continues to trade heavy in the current scenario. Today sees the release of Australia’s July Employment report which is expected to see jobs fall to between -42,500 to -46,200 from June’s +29,100. The risk is for a better than forecast employment report. AUD/USD has immediate support at 0.7230 followed by 0.7200 and 0.7170. Immediate resistance can be found at 0.7270 and 0.7310. Look for a likely range in choppy trade between 0.7190-0.7290 today. Looking to trade this range, be nimble.

(Source: Finlogix.com)

- NZD/USD – The Kiwi had its wings clipped by the RBNZ after New Zealand’s central bank kept interest rates unchanged with the OCR at 0.25%. RBNZ Governor Adrian Orr cited the Delta Covid-19 variant as the key hurdle to a rate hike even as he reiterated his view that the next move is to reduce stimulus. NZD/USD has immediate support at 0.6865 followed by 0.6835. Immediate resistance can be found at 0.6900 and 0.6940. Look for a likely range today between 0.6870-0.6970. Prefer to buy dips, the market is short of Kiwi.

- GBP/USD – Unlike its global peers, Sterling edged higher against the Greenback to finish at 1.3752 (1.3735) despite a lower than forecast UK CPI report. GBP/USD hit an overnight low at 1.3730 which is where immediate support lies. The next support level is at 1.3700. Immediate resistance can be found at 1.3780 followed by 1.3820. The UK Covid-19 situation seems to have stabilized, and this should be Sterling supportive. Britain has vaccinated around 61% of its population. Look to buy dips in a likely trade today between 1.3730-1.3830.

- EUR/USD – The Euro edged lower to finish at 1.1707 from 1.1712 yesterday. Overnight low traded was 1.1694. Immediate support lies at 1.1690 followed by 1.1660. Immediate resistance can be found at 1.1730, 1.1760 and 1.1800. Look for consolidation in a likely trading range today of 1.1690-1.1790. Yesterday Eurozone CPI beat forecasts with a higher read. Look for consolidation in a likely range today between 1.1690-1.1790. Prefer to buy dips.