FinTech Will Shift Advertising's Status Quo

- Maik Lutze, Experience Design Lead FinTech APAC EMEA at Citibank

- 21.10.2016 12:00 pm Fintech , Maik personifies two worlds colliding in one person – a creative director working as an SVP in the finance industry.

A friend of mine, CCO at a large advertising network, recently asked me: What will impact digital creation in the next years?

He was looking for cultural insights from Asia, but my answer wasn’t what he had expected: FinTech and the digital transformation of the banking industry.

Huh?

Winter is coming

Let's see – The role of creation and advertising in the 20th century was clearly defined as fruitful partner for marketing with the juicy target of awareness.

The Dotcom era led to changes. At first it just looked like digital was just the addition of a new channel for display ads, but brands and their ad partners soon discovered the potential of tracking, analytics, CRM and the ubiquitousness of mobile to get closer to customers.

Today, digital creation is key to customer loyalty. Advertising and creation has made its way deep into the sales funnel, shy only of the actual sale, which is still disconnected from their work. Whether customers need to step into a store of brick and mortar or into that of pixels, they don’t do so in the remit of the creative collateral that got them interested in the product.

Most ad people are rather happy with this, for the mere thought of retail's number-driven tactile intricacies makes them cringe. Big ideas and sales logistics just don’t seem to mingle well.

Well, folks, brace yourself. The white walkers are on top of the wall already. And they're not just after the type of effectiveness we see hailed by the large advertising award shows today.

Hello from the future

Let’s turn our attention to China for a minute. In October 2010, a small team in a tiny temporary Guangzhou office is working on the idea of a chat app. The team belongs to Tencent, the company behind QQ messenger and the Qzone social network. Unknown to the west, they already have 780 million active users and some R&D money at hand. Tencent is inspired by Jan Koum’s WhatsApp and wants to develop their on mobile-only chat solution.

What the small task force launches just 3 months later is called Weixin. In a country of strong censorship, the privacy of a chat in the palm of your hand is a liberation; user numbers explode over night. Soon it becomes the world’s most frequented social app and changes its name to WeChat (a timeline).

Tencent has understood the power of intimacy and privacy early on and took the app far beyond social messaging to inline commerce and digital wallets. After all, what's more private than your money?

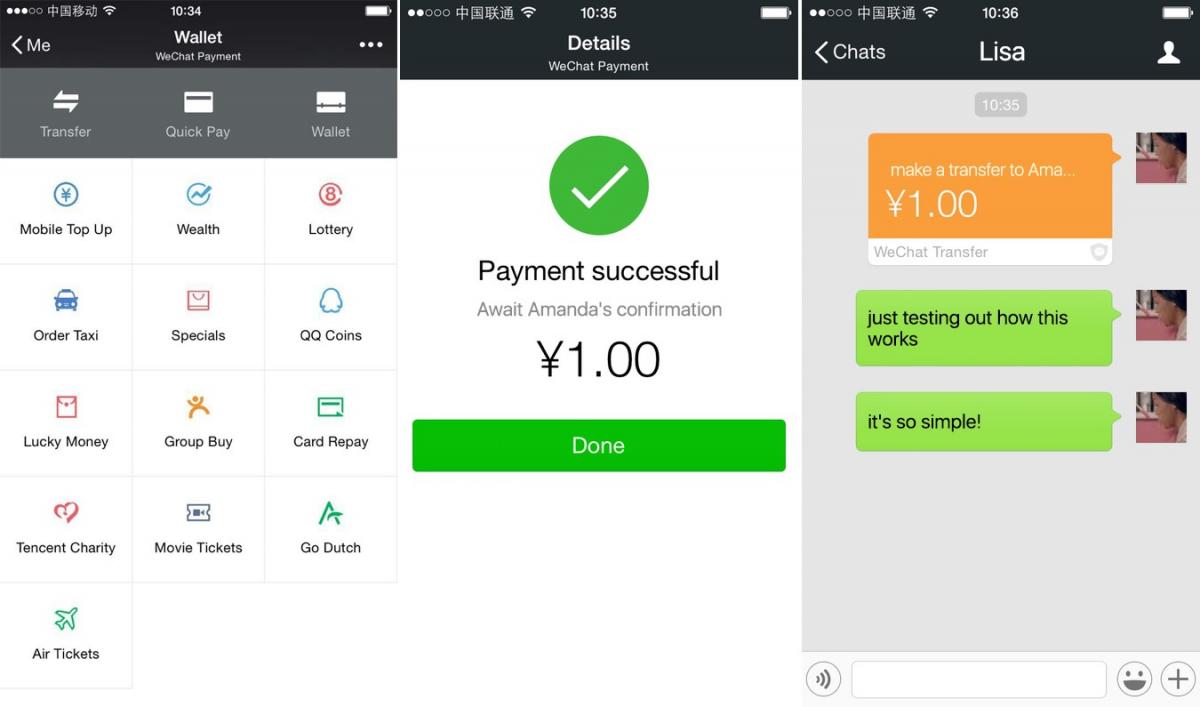

Transferring money with WeChat wallet

Buy. Now.

One reason WeChat is ahead is the unique regulatory situation of the Chinese market. In a nutshell and very simplified, Tencent was able to establish a bank inside an app, something that the West simply can’t pull off the same way. But today, Chinese WeChat users not only talk to friends, post moments, follow and converse with companies, but they also buy products and services and manage their money in a digital wallet, which allows them to pay anyone instantly and even take loans. It’s the app of apps. The one app to pay them all.

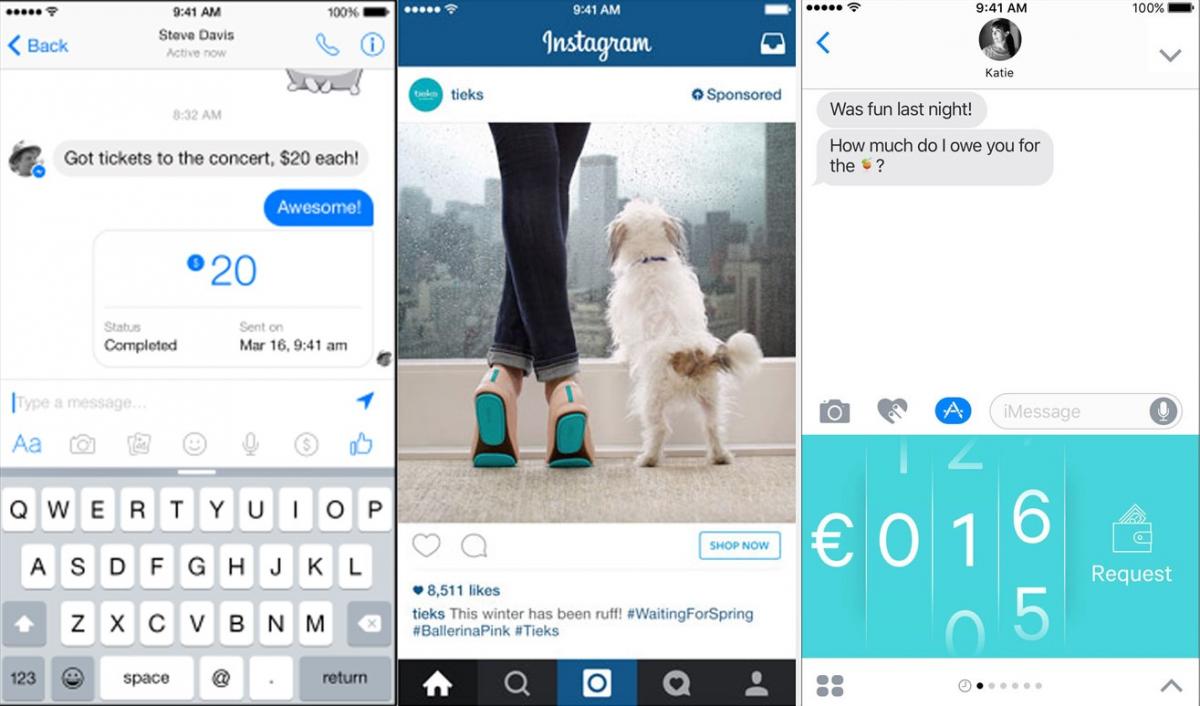

Sure, well, that’s China you say. But China is leading the world on. We can already see tests ofpayment integrations in Facebook messenger and iMessage and buy buttons in Facebook and Instagram. FinTechs and banks are supporting the push, intending to make payments and financial services increasingly frictionless and mobile. There are many more players and regulations involved in the West, so the process is much slower and years behind Tencent.

However, they are moving in the same direction and this gives us the liberty of simply looking East to see what the West will experience several years from now and why that will impact digital creation.

Venmo in Facebook messenger, BUY button in Instagram, N26 in iMessage

It’s all play from here

The real game changer to payment integrations in chat and social platforms are digital wallets. Wallets not only facilitate payments, but they act as storage, similar to a checking account. The wallets of the likes of WeChat or Alipay completely detach money from their physical form factor, transferring credit virtually between payer and payee without ever touching credit card or a bank account.

This is the change driver.

Being intangible and available 24/7, money transforms into an abstract unit like chips in a casino or a made-up currency in a game. And this changes our relationship to it. Zero tangibility means people spend it faster, more playful and with less consideration. An insight that much of the digital gaming industry is built upon.

For advertising this means one thing: The first mile becomes the last mile and this last mile is downhill with a tailwind. A ready-to-spend consumer now needs to be led through the complete sales funnel in seconds: from awareness all the way to purchase. Converting the audience on the spot will become the most important, and measurable, aspect of creation.

Since purchase decisions are made in the limbic system and not the neo-cortex of our brains, advertising must continue to invoke big emotions: Love, fear, enthusiasm. But it can’t stop at a Big Idea. For the first time it now needs to make the act of purchase part of the story telling, so it must feature outstanding UX/UI that inevitably leads to tapping the BUY button. And since everyone will do it, ads need to be highly personalized to convince, which means new ways of making content dynamic.

What advertisers should think about now is how to tell these stories in the near future. And how to do this in a news feed, a tweet or a chat message. Location based services and big data are now powerful companions to make it personal, exciting and timely for customers to hold their thumb onto the fingerprint sensor. It will be a whole new way of applying Fogg’s Behavior Model and only those agencies who dare to embrace the white walkers of retail will lead the Nights Watch into victory.

Maik Lutze is experience design lead at Citibank. While working at a bank, he has always been and will always be simply an obnoxiously nagging German, fighting for better UX and UI and his thoughts and opinions are his own, not those of his current or former employers.