What Blockchain Isn’t

- Stephen Harrison, Consultant at Capco

- 11.05.2016 08:30 am Blockchain

Let’s cut to the chase. Blockchain is a combination of four existing technologies put together to create something new. These technologies are well-known:

- Distributed, open ledgers: A shared, public record

- Public-key encryption: A secure method of transferring digital data

- Merkle tree hashing: An elegant solution to retaining an audit trail

- Consensus protocols: Validating new records to prevent corruption

Simply put, when Satoshi Nakamoto combined these elements in his seminal bitcoin paper, he created something more powerful than the sum of its parts.

However, there are countless other interpretations that often obscure the original concept. Blockchain as we know it could be destined to join big data and cloud computing, hyped to such an extent that their meaning is almost irrelevant. Yet everyone seems to think they need them. Now.

One way to cut through the noise is to look at what blockchain isn’t.

It’s NOT another term for bitcoin

Blockchain is the underlying technology used in bitcoin. However, it has many other applications. Blockchain’s defining characteristics lie in its distributed, immutable nature. It’s better to think of bitcoin as the first fully-fledged working use-case of blockchain technology.

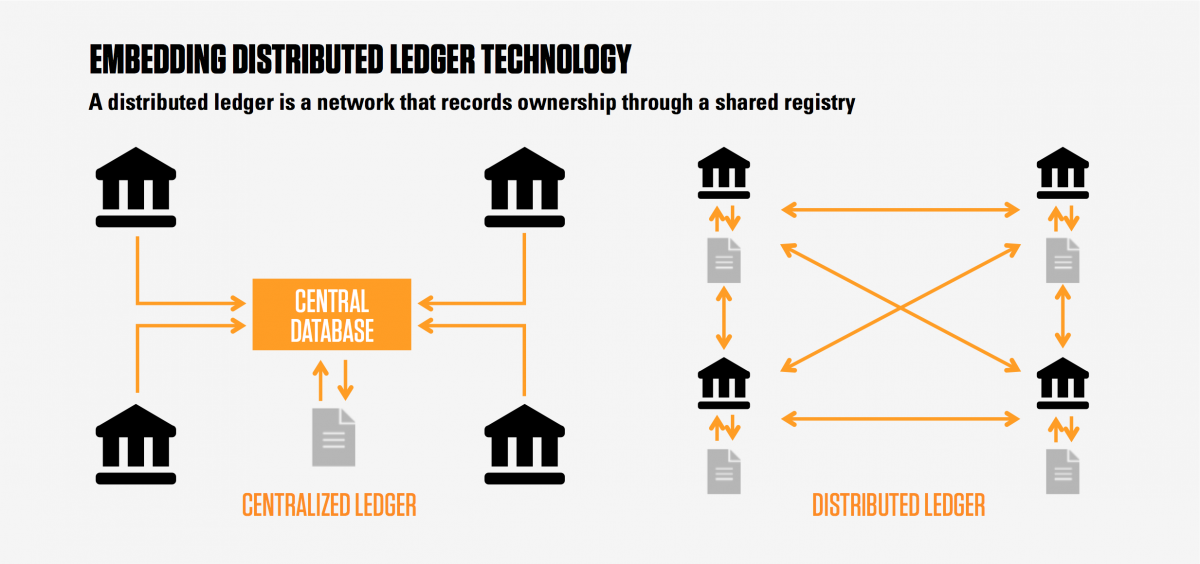

It is NOT a centralised database

Centralised databases hold the master copy of data in a single location. They are owned and updated by a central body, for the benefit of a users’ network.

A decentralised database has multiple copies of the same data, owned by each of the members. There is no master source. Changes to the database are broadcast by the node across the network and all copies of the database are updated accordingly.

In blockchain, the process of broadcasting changes involves an intermediary step, which ensures the change is valid (e.g. a new transaction).

Distributed ledgers share data across the networks, unlike central golden-source based systems

It is NOT just a network of trusted parties

The beauty of ‘pure’ blockchain is in circumventing trust barriers between the parties involved. There is no membership validation onto the network, no gatekeepers or overseers - true democratisation!

However, if trust is of the essence in a given network and it is imperative that contributors know each other (e.g. market infrastructure for interbank payments), then it becomes a distributed database.

A distributed database will most likely still use Merkle hashing and encryption akin to blockchain. If it also uses a different consensus protocol to proof-of-work to validate new records, it could arguably be considered blockchain, too.

It is NOT going to revolutionise the financial services industry overnight - or maybe not at all

Projects such as the R3 consortium and Hyperledger have started gaining traction and accumulating partners. These partners are investing substantial amounts of money to become early use-cases. However, blockchain is still in its infancy and will take some time (and a lot more investment) to turn the existing proof-of-concept into the real thing.

Let’s look at a practical example – the most established case of working public blockchain today – bitcoin. Currently it only processes 3-7 transactions per second. This low speed will cause massive issues as the network starts to reach capacity. The developer base working on a solution to this is already becoming fragmented as they struggle to agree a way forward. If we consider that Visa, for example, needs to process tens of thousands of transactions per second then payment blockchains have to overcome this huge technological hurdle to compete. This will not be easy. It may not even be possible.

Adi Shamir, a co-inventor of the RSA algorithm, sums it up with the tweet: "Yet to see a use-case for blockchain that can't be solved with an existing simpler technology."

So, what’s the point?

Blockchain is not easy to define as opinions on its core components vary dramatically. It will take a number of years, perhaps, decades, before blockchain establishes itself on a large scale in finance, with masses of technological obstacles along the way.

Never-the-less, the momentum is growing for blockchain; use-cases are being identified and proof-of-concepts are becoming more solid. The good news is that these developments don’t just focus on blockchain for its own sake, but can be used as real solutions to real financial problems.