Over the next decade, over $2.5 trillion will be generated by blockchain trade

- Chris Skinner, Founder and Chairman at Financial Services Club

- 21.09.2018 11:45 am Blockchain , Chris Skinner is known as an independent commentator on the financial markets and fintech through his blog, the Finanser.com, as author of the bestselling bookDigital Bank and its new sequel ValueWeb. In his day job, he is Chair of the European networking forum: the Financial Services Club. He is on the Advisory Boards of many companies including Innovate Finance, Moven and Meniga, and has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), one of the Top 5 most influential people on BankInfoSecurity’s list of information security leaders, as well as one of the Top 40 most influential people in financial technology by theWall Street Journal’s Financial News.

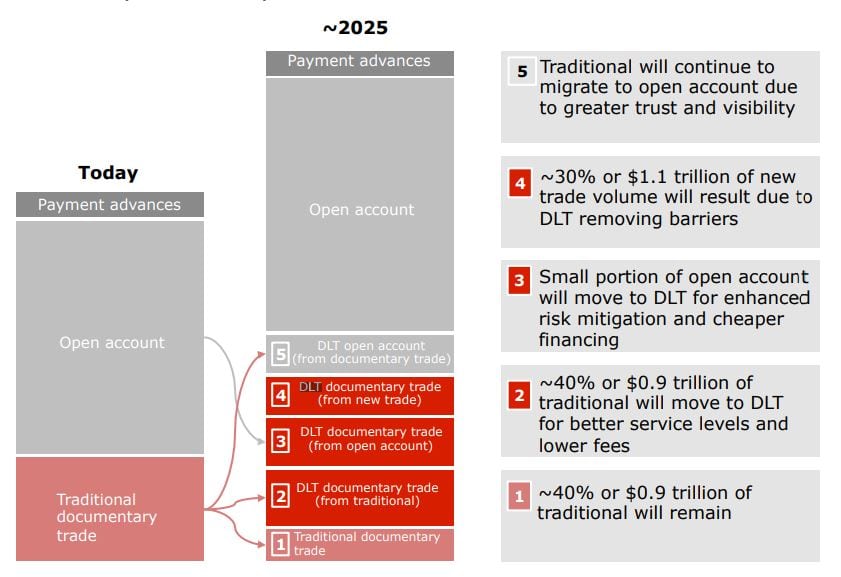

I just saw a report from the World Economic Forum, who estimate that over $1 trillion in new trade will be created through blockchain-based distributed ledger technologies (DLT) over the next decade. They also estimate it will reduce the global trading gap by $1.5 trillion.

Bold claims.

Here’s the key paragraph from their report (for me):

The Asian Development Bank estimates there was a $1.5 trillion trade financing gap in 2017, representing roughly 10% of global merchandise trade volumes. This is particularly important for Asian countries since almost three-quarters of total documentary import and export trade transactions originate or arrive in Asia. South Korea is the largest issuer of import letters of credit, followed by Bangladesh and China and Hong Kong the largest markets for advising export letters of credit. SMEs and midcap companies represent 75% of the total trade gap.

Left unsolved, the trade finance gap will rise to more than $2.4 trillion by 2025, according to Bain & Company estimates. However, a viable solution has emerged. Bain’s modeling estimates that new digital technologies, especially distributed ledger technology, can reduce a large part of this gap, facilitating about $1.1 trillion of new trade volumes globally.

It’s interesting as I’ve talked for a while about how DLT could bring efficiency to supply chains by getting rid of the old paper Letters of Credit and Bills of Lading, moving to Open Account structures, and where other efficiencies will come from.

Equally, I’ve quoted the REL Working Capital surveys for years, that show European corporations alone have over €1 trillion tied up in wasted processing. Hackett Group have a similar figure for US corporations, with over $1.135 trillion locked up in wasted processing. Globally, that figure is more than $3 trillion locked in working capital that could be tapped into through better processes, and DLT will be a key one here.

Why DLT?

According to the WEF:

Distributed Ledger Technology is well suited to eliminating some inefficiencies in trade and supply chains through the following features:

- Faster credit risk assessment from the transaction history

- Minimized human error in document checks

- Instant verification and reconciliation of records

- Automatic execution of workflow steps through smart contracts

- Instant, secure and low-cost exchange of data

Source: World Economic Forum

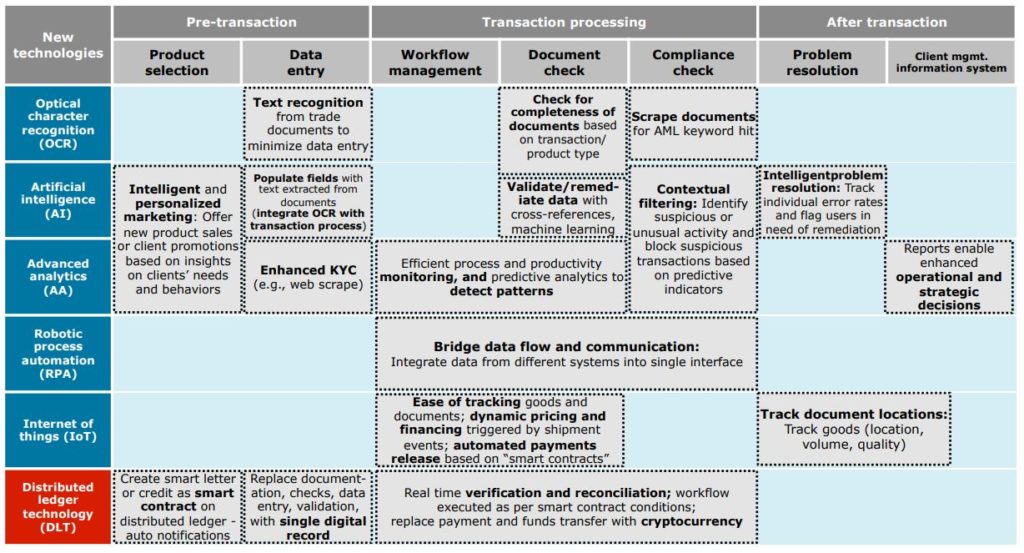

It’s not just DLT however. It’s digitalising the whole supply chain using DLT, AI, Open APIs and more.

Tokenization

The replacement of sensitive data with a non-sensitive equivalent symbol to ensure security enables the creation of a digital identity for goods in transactions, such as labelling goods for supply chain transparency and traceability.

Smart contracts

These verify and execute contracts automatically, which synchronizes delivery and payment

of goods or services.

IoT devices

Communications between a network of these devices can be built on distributed ledger technology to reduce the need for central control and the risk of data tampering.

AI tools

Distributed ledgers’ ability to maintain privacy and integrity of data promotes data exchange, which will help encourage development of AI tools that could, for instance, predict a company’s working capital requirements.

Application programming interfaces (APIs)

By governing how one application can communicate and interact with another, these sets of requirements allow communication between applications and distributed ledgers.

Source: World Economic Forum

All in all, this will deliver real change and benefits.

The digitalization of trade processes offers potentially huge benefits to support the massive flow of goods worldwide. For example, the United Nations Economic and Social Commission for Asia and the Pacific adopted the Framework Agreement on Facilitation of Cross-Border Paperless Trade in Asia and the Pacific in 2016 to advance regional coherence. The agreement is designed to encourage adoption of digital tools that will facilitate trade. Some estimates suggest full implementation could boost Asia-Pacific exports by as much as $257 billion annually, while the time required to export could fall by 44%, according to the United Nations Economic Commission for Europe (UNECE).

Meantime, if you’re interested in this area, here are some interesting reports on working capital issues:

- PwC’s 2017/18 Working Capital Study

- EY’s 2018 Working Capital Report

- KPMG’s Cost of Capital Study 2017

This article originally was published on the thefinanser.com