Can Banks Acquire Customers with Biometric Payment Cards?

- Michel Roig, Senior Vice President, Head of Busines Line Payments & Access at Fingerprints

- 25.02.2021 07:30 am Biometrics

When it comes to banking, consumers are traditionally loyalists and often stay with their banks from early adulthood through to retirement. In fact, one 2018 study found that just 4% of U.S. consumers switched primary banks that year.

Yet increasingly, consumers want more from their bank than just a place to store their money. The era of ‘one bank for life’ is coming to a close, so banks will have to keep improving the customer experience to stay competitive. In an industry where customer retention and acquisition are critical, finding opportunities to offer consumers value-added products and services is key.

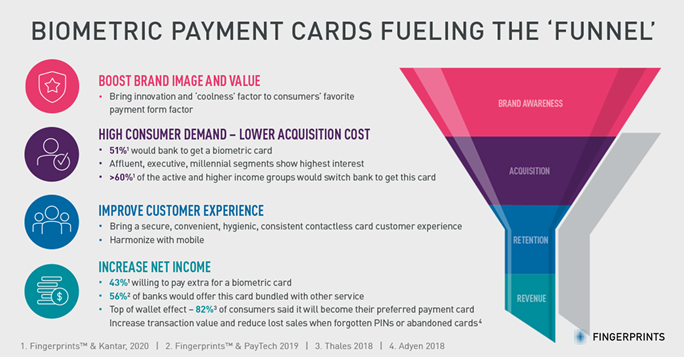

One such opportunity is the biometric payment card. With early adopters of the technology already rolling out the cards to their customers and 51% of consumers willing to switch banks to get their hands on the tech, now is the time for banks to get serious about biometric cards. From boosting brand image and adding value for customers to, ultimately, increasing revenue, let’s take a look at the business case for biometric payment cards.

Improving the payment experience

Contactless cards are the most-used payment method in store, with 77% of consumers using their card weekly or even daily. Consumers praise contactless payments for their user-friendliness and 63% of consumers would like to use the payment method even more in the future.

Despite its popularity, however, some serious pain points remain. Our recent survey found that 51% of consumers worry about the lack of security if their contactless card were to be lost or stolen. This worry has increased from 38% in 2018 – a clear sign that security is a primary concern for consumers. Beyond security, the limitations on contactless transactions are also a point of frustration for many. 1 in 4 are confused about the maximum amount they can spend without entering their PIN at PoS terminals, and that you sometimes need to enter the PIN despite being under the cap, and an equal amount consider the payment cap too low for their usual in-store payments.

Banks that introduce biometric payment cards can enable their customers to tap and pay for any amount, every time, while at the same time improving the security.

Moreover, biometric payment cards are a way to harmonize the payment experience. Consumers are already used to unlocking their smartphone with a fingerprint sensor. With mobile payments and banking apps on the rise, biometric authentication is now increasingly common in consumer finance. By offering biometric technology in payments cards, banks can offer their customers the same convenience and security they are used to from their mobile banking.

Boosting brand image

Aesthetic and innovative design is increasingly a key consideration, particularly among affluent, executive, and millennial consumers. It is no surprise, then, that over 60% of these demographics would switch banks to receive a biometric payment card. But also, a large proportion of the more mainstream segments would consider switching banks to get this card, which shows the excitement of this technology across different consumer demographics, both for functional and emotional reasons.

What exactly are consumers looking for in their payment card, then? Our 2020 research found that ‘modern’ and ‘personalized’ cards are the highest-rated design traits for consumers. Most importantly, they want a card they feel they can show off and that is intuitive to use.

This is where biometric payments cards can help banks boost their brand image. Beyond the security and convenience that biometric cards offer, the technology brings a sense of futuristic innovation to consumers’ favorite payment method. By offering consumers this latest technological advancement banks can stay ahead of the curve, thereby increasing customers’ loyalty and, crucially, attracting new customers.

Increasing revenue

Attracting new customers is of course a good way to increase revenue, particularly considering 43% of consumers are willing to pay extra for a biometric payment card. 56% of banks have also said they would bundle this technology with other value-added services, creating the competitive offerings that consumers are looking for these days.

Creating these value-added services is not only important for driving revenue from customer acquisitions, but also for reducing the cost of losing customers. To regain a lost customer takes 5 times to cost of keeping one, and with consumers increasingly ‘shopping around for banks’, retaining them with up-to-date and value-adding services is crucial.

Besides supporting customer acquisition and retention, biometric technology itself can also increase revenue by reducing fraud and increasing transaction volumes. Not to mention the savings from reduced ‘lost PIN management’ internally!

Timing is everything

Biometrics is growing across payment methods. The technology is certified by major payment networks and already has received recognition from industry bodies, such as EMVCo. Consumers are used to the technology from unlocking their banking apps and verifying mobile payments, but mobile payments won’t work for every situation or demographic. Only 2% of consumers use their mobile for everyday in-store payments and in fact, 74% of active mobile payment users are also interested in having a biometric payment card. Card and mobile go hand-in-hand and work in harmony across online and physical payments, different situations and locations.

With biometric card trials moving to commercial roll-out this year, it won’t be long before this new tech is a consumer expectation. Timing is everything in business, and for banks looking to stay ahead, now is the perfect time to level up their payment card and offer their customers the convenience and security of biometric payments.