Bank of Mauritius’ ADF-XBRL Reporting Mandate: What lies ahead for Mauritian Banks

- Shivani Venkatesh, Lead Consultant at Fintellix Solutions,

- 15.07.2015 01:00 am Banking , reporting , Shivani Venkatesh is a Lead Consultant at Fintellix and comes with rich experience in Consumer Banking (Channel Management, Proposition Development, Customer Portfolio Management and Segment Strategy). Shivani is currently working with Fintellix’s solutions team in building nextgen banking decision enablement products and solutions.

As the Bank of Mauritius (BOM) embarks on an ambitious journey to make reporting by banks in the region more timely, accurate and consistent, it has also opted for XBRL as the ideal reporting taxonomy.

The mission features two key milestones -

- XBRL taxonomy and development of a submission platform

- Automated Data Flow (ADF)

The first phase has 6 sub-phases during when the various report templates along with XBRL taxonomies will be released. The XBRL project is currently underway, with templates for about 21 reports already rolled out to the banks. Phase one is expected to conclude by October 2015 with about 60 report templates being released to banks.

This development is only the latest in an increasing number of international risk and regulatory guidelines that banks have to comply with.

Global wave of recent regulations.

As Mauritian banks get ready to meet BOM’s new reporting requirements, they will be faced with multiple choices on how to achieve the stated goal of XBRL-based reporting. This is where it becomes relevant to direct our attention to Phase 2; i.e. ADF. ADF essentially refers to the ‘straight through processing’ of data from source to return with zero manual intervention.

While ADF is more a direction rather than a mandate, it is evident that the stated goals of the regulator in embarking on this project, i.e. easy availability of historical data, improved data quality and timely submission will not be achieved merely by XBRL-based reporting.

To meet these requirements it is critical to establish a ‘data foundation’ that is capable of storing granular, historical data subject area wise. The foundation must also possess strong data integration, data management and content management capabilities to support straight through processing in very short timeframes.

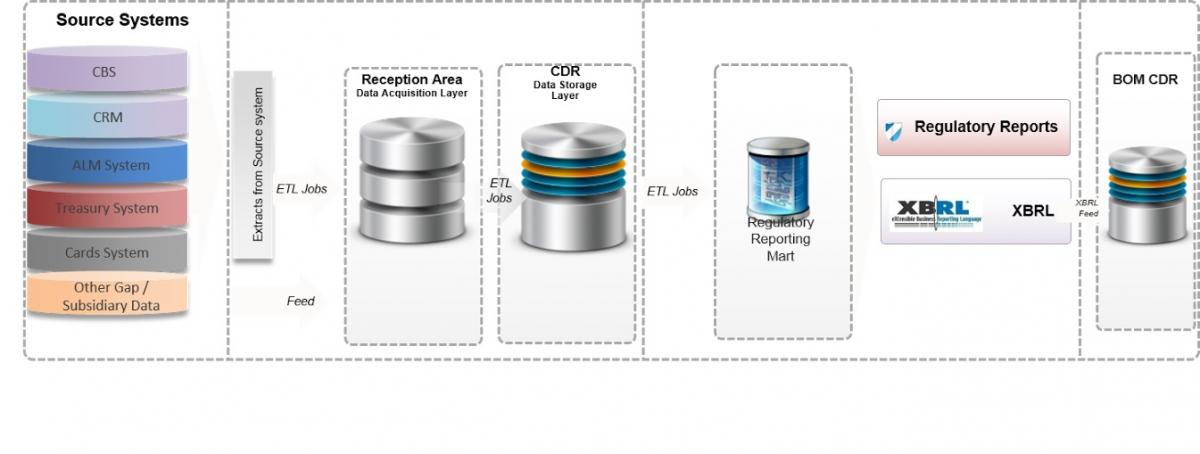

Interestingly, the primary Indian banking regulator – the Reserve Bank of India (RBI) had embarked on a similar journey during late 2010 after it published its farsighted ‘ADF Approach Paper’. Subsequently the regulator has also adopted XBRL as the medium of reporting submission. The solution architecture recommended by the regulator and subsequently adopted by banks is depicted below.

Five years later and after going through multiple regulatory audits, Indian banks that invested in a Common Data Repository (CDR) -based ‘straight through processing’ solution are the ones that have been found to be able to make accurate and timely submissions, as well as respond satisfactorily to queries during inspections.

In addition, Indian banks have also benefited from extending the data and platform infrastructure to meet other regulatory reporting mandates and internal business reporting needs. In fact, a recent study commissioned by the Indian regulator to highlight learnings from the ADF initiative and explore the way forward, talks about the need to reuse the data infrastructure created for ADF for other reporting requirements to reduce costs, minimize reconciliation overheads and increase trust in data.

Given the direction of local and global regulatory guidelines impacting Mauritian banks and lessons from an identical journey by a visionary regulator in a complex economy such as India, it is apparent that a strategic investment in a ‘future-proof’ data foundation and platform is likely to yield rich long term returns – both, from a tactical regulatory compliance as well as an ROI standpoint.