Australia Recession/Depression? The Lofty and Jagged Peaks of Jackson Hole

- Clifford Bennett, Chief Economist at ACY Securities

- 30.08.2021 10:30 am undisclosed

The lofty and jagged peaks of Jackson Hole, could be the most valuable warning of all.

Gold is the ultimate market solution, as Delta continues to wreak havoc in the USA and around the world.

Sell Australia remains our other central mantra. We were the first to call that a recession was already underway in Australia. Only over the weekend have a few competitors and the government begun to acknowledge this as a 'risk'. It is already a reality. We are in it.

The absurdity of buying stocks in this economic reality will become increasingly apparent to all market participants.

US stocks rallied on the combination of Powell and data. Our highlights last week were two fold. The market could very well have a knee-jerk upward response, but was already losing momentum. I stand by both statements. I feel that loss of momentum encourages the view that the knee-jerk rally after Powell, will be short lived. Monday momentum follow through likely, but after that, we could be pitching over yet again.

Powell: Tapering will happen this year.

The Fed has continued to move closer to our early forecast of tapering this year, and interest rate hikes next year.

What the market liked, was that interest rates will not be occurring at the same time as tapering, and are therefore, some time off. It always amuses me, when the stock market gets excited over something not happening, that was never going to happen in the first place. Tapering comes first. Then rate hikes.

Interest rate hikes when they finally arrive, will be so far behind the inflation curve, that the economic situation will be dire.

An aggressive rate hike cycle, larger than it needed to be, awaits the United States, and likely Australia as well.

Inflation will continue to gather momentum far beyond the Federal Reserve's current expectations. The spread of Delta will only further the inflation process, while at the same time again degrading the economy.

Exactly what is being seen in Australia at the moment. In a profound way.

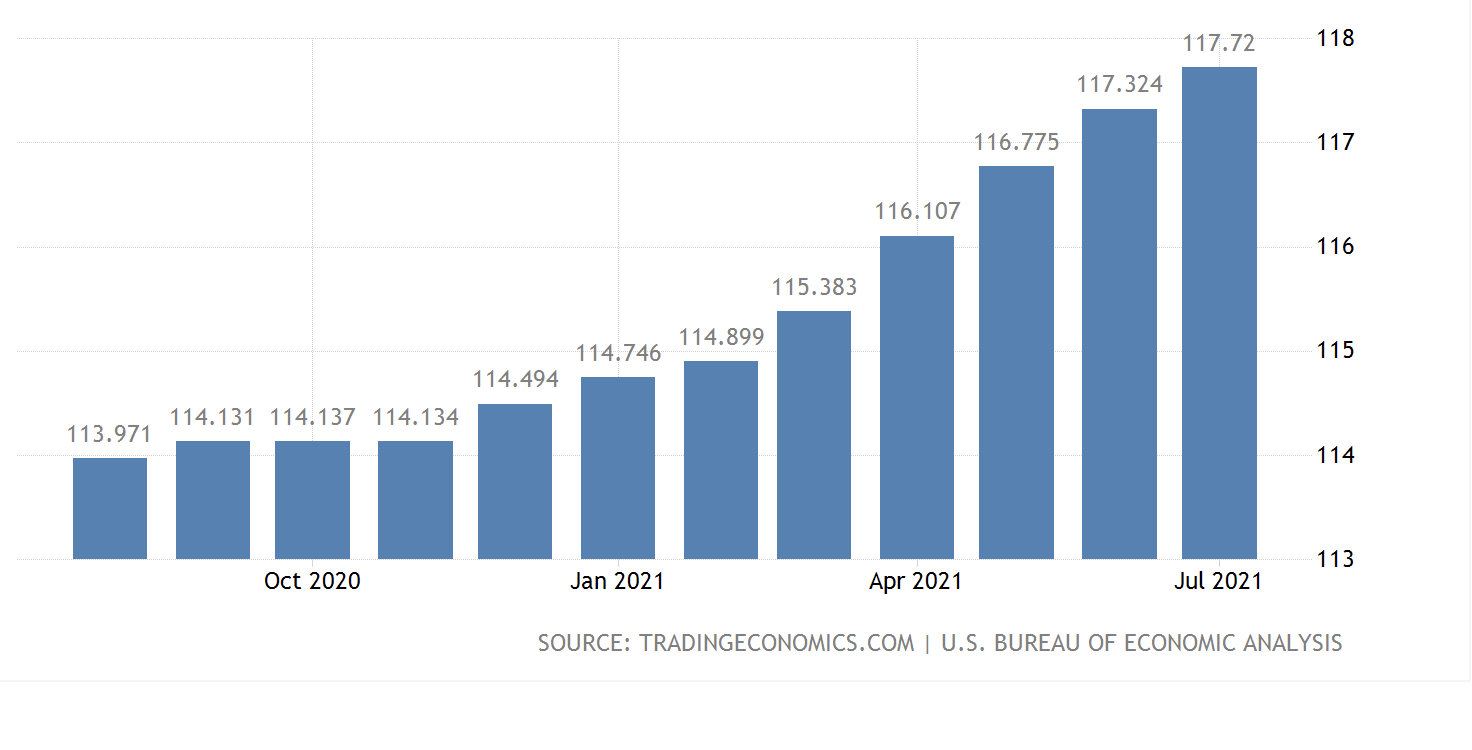

US Consumer Spending.

It was positive. Though only an average kind of performance despite the recent escalation in consumer debt. This is not a good sign. It suggests many Americans are borrowing, just to keep the household going. Layoffs remain high, and the increasing human and economic toll of Delta is steadily rising.

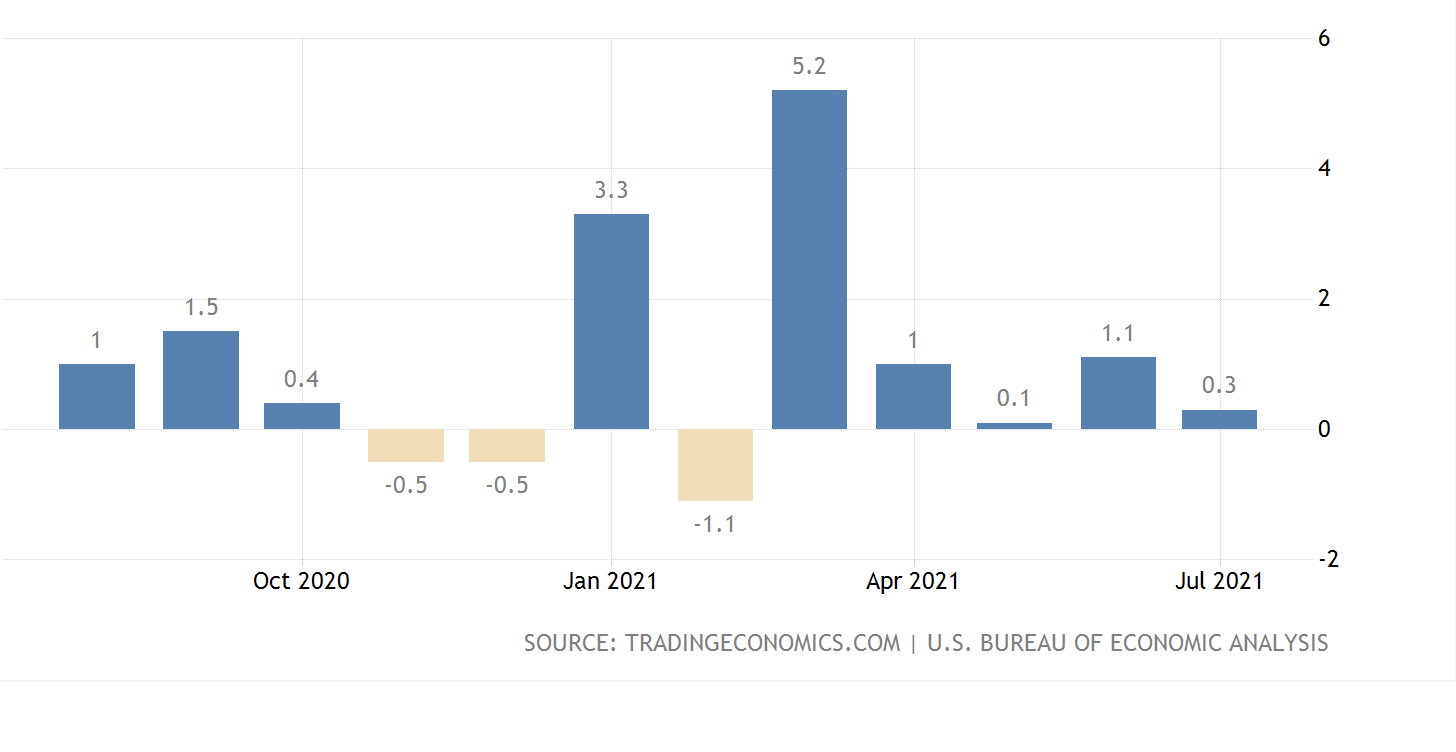

US Core PCE Inflation.

Up 0.3% in July, is of concern. That the previous number was revised higher, allowed people to suggest this is a slowing from June's 0.5%. Really, though, as this number could be revised higher as well, all we actually know is that we currently have a two month average of 0.4%. In the real world, right now, we can be sure there are gathering further inflationary pressures.

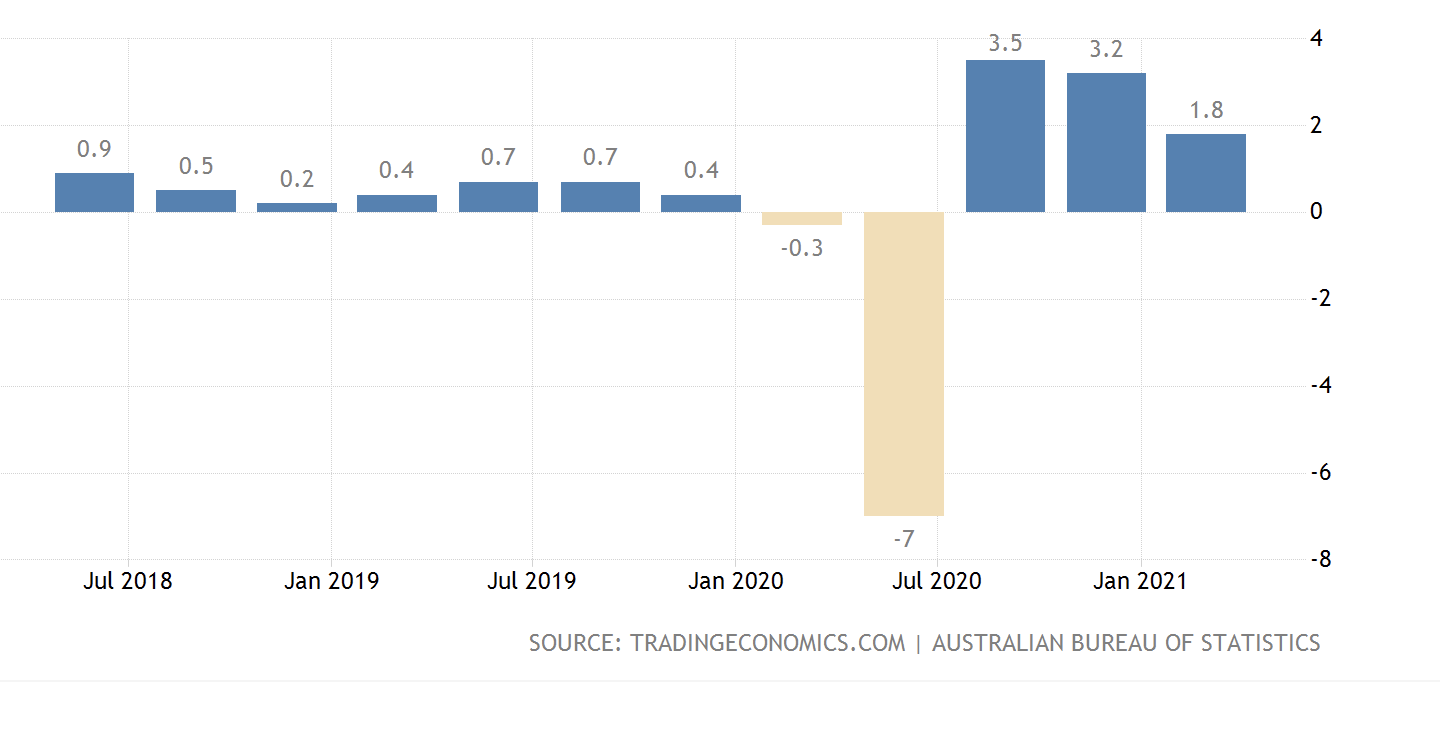

Australian GDP Q2.

Revised Australian GDP data for the second quarter will be released this week. It could well be lower than the previous estimate. What is certain, is that it is pretty much immaterial. The AFR today calls it the risk of a 'surprise' recession. There is nothing surprising about it at all.

Australia is in Recession, Q3, Q4, and possibly into Q1 next year as well.

The rolling over of the Australian economy was already in place, as forecast, before the resumption of lockdowns.

The damage to the economy is already permanent.

There is no super spend. No further need for renovations No broad Jobkeeper. That so helped those in need, while creating a profit windfall for some. The targeted measures now in place are more appropriate, but some are slipping through the cracks.

The ultimate damage however, is being done by the psychological impact on small and medium sized businesses and families. The main employers of the nations workforce. Many will not be coming back, regardless of eventual re-openings.

Back to school in October for NSW? How will that be possible, if children become very ill and are even hospitalised? If this trend were to develop further. We already see early signs. In which case, there will be no early return to school.

This is not an argument for or against lockdowns as a strategy. It is merely an assessment of the likely force of Delta and potential re-thinking of government policies on the matter.

The Australian Recession can turn into a Depression.

Not the most probable scenario, and not my forecast, but while others see risk of recession, I can see we are already there, and the risk is far greater still, than people can accept or acknowledge.

There has been a complete failure at the Federal and State level to understand just how damaging the current situation is to the long term outlook.

We will come through this, and things will get better. The pace of that recovery will however be slower than any of us would like. The recovery will not be a rebound of the likes previously experienced. It will be a long haul, and at times a struggle.

Especially, as this situation is not in isolation. The rest of the world has renewed problems too. As a trading nation, with harsh domestic lock-downs, our economy is already on its knees.