Arguing With a Banker …

- Chris Skinner , Chairman at Financial Services Club

- 18.04.2017 12:30 pm undisclosed , Chris Skinner is known as an independent commentator on the financial markets and fintech through his blog, the Finanser.com, as author of the bestselling bookDigital Bank and its new sequel ValueWeb. In his day job, he is Chair of the European networking forum: the Financial Services Club. He is on the Advisory Boards of many companies including Innovate Finance, Moven and Meniga, and has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), one of the Top 5 most influential people on BankInfoSecurity’s list of information security leaders, as well as one of the Top 40 most influential people in financial technology by theWall Street Journal’s Financial News.

A banker and I were talking about the function of a bank. He gave me the classic view:“A bank is there to take people’s money and lend it out at a profit, whilst ensuring the risk of non-payment is minimised”

No it isn’t, I said. I pushed the view that the bank is there as a trusted store of value. The lending part is now no longer important, as that can be done through alternative media such as peer-to-peer lenders.

The banker took exception to purely being a store of value, and felt that the risk management aspect of banking was a critical part of their function.

I argued that the bank’s risk management function is being eaten by software. This means that credit analytics, transparency and management of risk, and the democratisation of finance is becoming a key change factor, as people connect directly through marketplaces and platforms.

The banker kind of lost it at this point, claiming that I didn’t understand the complexity of the markets and there is far more to creating financial markets than just deploying a server.

I argued back that anything that can be automated will be automated, and we can see that most clearly in the trading rooms and investment markets as hedge funds and asset managers are replaced by ETFs and index-linked funds. High value jobs are disappearing fast as are low value transactional jobs from branch-based customer services to compliance to reconciliations to even programming.

He scoffed, and said that my discussion was too far out.

I argued that it wasn’t too far at all. A lot of these changes have already happened, and marketplaces for finance are developing quickly. It’s all based upon apps, APIs and analytics.

The end of the debate was a stalemate, with him believing that the bank needs to balance risk and leverage with human insight; whilst I continued to push the idea that a lot of that balance can be achieved through algorithms.

As I reflected on the argument, I realised that the key thing he had missed is that banking is not the end, but the means to the end. The end is what we are buying and selling. A bank provides a method to enable that to happen but software, platforms and marketplaces can just as easily provide that method in a far cheaper, faster and lower risk form. That was the point I was really trying to make: that banking is necessary, but banks are not.

Now you may recognise that line – it’s an old one from Bill Gates – so how come banks are just as strong today, if not stronger, than when that comment was made 23 years ago? The answer is that the technology had not reached primetime until now, and the regulator had enforced barriers to entry that would not allow new players to enter the markets … until now.

We are on the cusp of radical change. Some banks are leading the change. Some banks are watching and waiting. Some have no idea what change is coming. This is because they are led by a C-suite filled with people who either make things happen, watch things happen and wonder what happened. What’s your C-suite like?

You may say we’re ok, and look at other financial institutions with scorn. However, I can tell you exactly how many of your institutions are fit for change: half. Where do I get this number from? The MIT/Deloitte annual survey of banks digital readiness. In last year’s survey, 9 out of 10 participants felt that digital transformation is ripping through the industry, but only 46% felt their organisation was ready to respond.

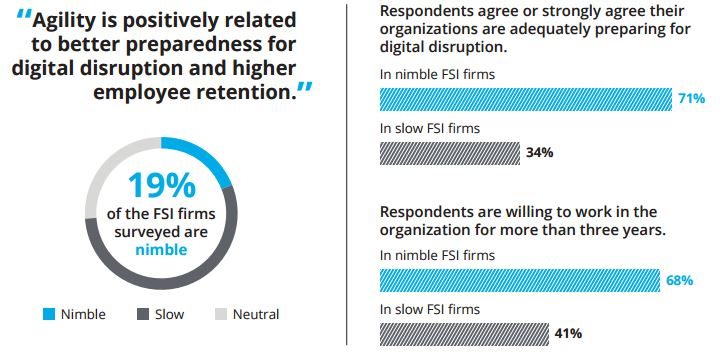

In other words, 54% think they’re not ready, even though this is fundamental. Even more telling is that only 1 in 5 institutions are felt to be nimble enough to change, whilst most feel their bank is slow to change. A problem? Maybe. 3 out of 5 employees in slow to change banks expect to leave within the next three years.

So, for my banking friend who I had the argument with and for all the other C-suite complacent bankers out there, wake up.

This article originally appeared at: Chris Skinner's Blog