Banks and financial services are racing to innovate in order to enhance the customer experience. Mastercard recently launched Selfiepay whilst HSBC has said they’ll allow their customers to use selfies to open bank accounts. Samsung has also announced that they’re planning to launch voice and facial recognition biometrics for mobile banking.

All content with RSS

Further to its announcement this morning, Temenos, the software specialist for banking and finance, confirms that Bank of Ireland Group has selected UniversalSuite, its front-to-back solution for retail, commercial and corporate banking, to be implemented as Bank of Ireland’s new core banking and channels platform.

Abu Dhabi Islamic Bank (ADIB), a top-tier financial services institution, has partnered with Fidor Bank to launch the region’s first ‘community based digital bank’. The new platform is designed to fit the lifestyle of millennial consumers also known as Generation Y, as well as those looking for a digital offering that matches their banking needs.

Coupa Software, a leader in cloud-based spend management, today announced that Paul Watts will lead the company’s Asia Pacific (APAC) region as Vice President of Sales. Watts combines more than 20 years of experience based in the APAC region with his extensive knowledge of the enterprise software space.

In his new role, Watts will be responsible for advancing the company’s go-to-market strategy, business development, overseeing Coupa’s sales team, and supporting enterprise customers in APAC.

Bink – the new loyalty app that, for the first time, links consumer card payments to loyalty schemes - has today announced the appointments of Bob Wigley (former Chair of Merrill Lynch EMEA) as Chairman to its board and Dr Steve Perry (former Head of Visa Europe) as a Non-Executive Board Director.

In announcing the formal appointment of the board members, Bink adds deep financial services expertise to its team, ahead of its launch to consumers in the Autumn.

HDFC Bank Ltd., one of India’s premier banks, providing innovative products and smart banking solutions to over 37 million customers across India, has selected Backbase, the omni-channel digital banking market leader, to deliver its new digital omni-channel banking platform, running both its online and mobile banking apps. Backbase will play a key role in delivering HDFC Bank’s next generation of banking architecture. Thus platforms like the mobile banking app, digital banking portal, and web site will run on the Backbase platform.

Lexmark International, a global technology leader, announces Kofax Kapow™ 10 for robotic process automation (RPA) projects aimed at automating the labour intensive processing of digital information.

ESMA today published its first Q&A on MiFIR transparency topics which focuses on the double volume caps (DVCs) in equity markets and clarifies how markets can transition to the new DVC regime. The document outlines how to calculate the market share of non-transparent trading for instruments only coming in scope under MiFID II (think ETFs, for example).

December 8, 2016 in Abu Dhabi will be held Blockchain Conference (B Conference) - the first major event in the Middle East, which is dedicated to the development of Blockchain technology The conference program will feature 20+ speakers from major financial institutions from all over the world and blockchain startups. The agenda explores a unique combination between fintech entrepreneurs, bankers and governments across Europe, Middle East and the rest of the world.

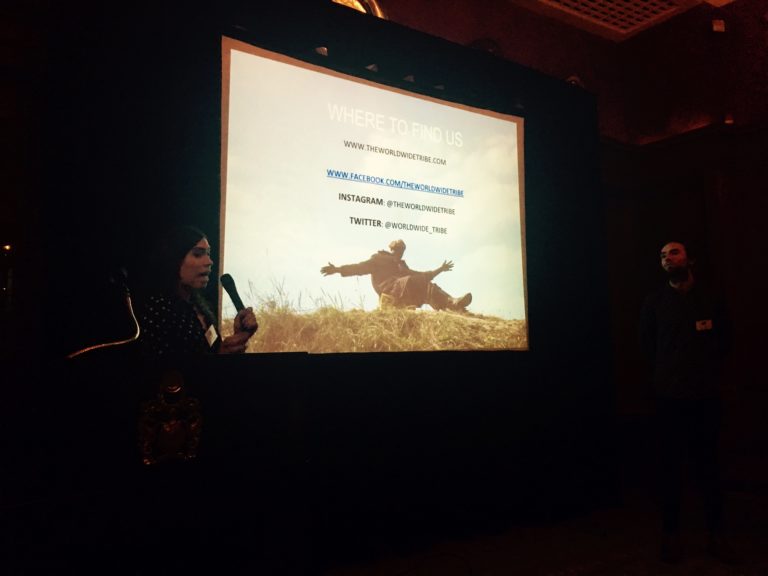

We had a really interesting meeting about digital identity, blockchain and the Calais Jungle at The Financial Services Club recently from Jaz and Nils O’Hara of the Worldwide Tribe.

One member of the Club, Nick Swanson of ObjectTech, was so taken with it that he blogged about it. Thanks Nick and he’s kindly allowed me to publish his blog here …