Product Profile

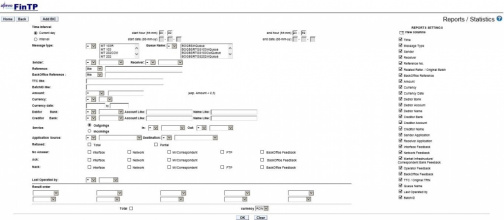

Screenshots

Product/Service Description

FinTP is a versatile open source solution for flow automation and seamless integration between various internal systems/applications and external market infrastructures or networks, providing operators with relevant information in a one-window approach (acting like a financial middleware), which allows banks to focus less on their internal processes, and more on designing attractive client-oriented services and products.

On top of its core function, FinTP provides support for the most used funds transfer instruments (credit transfer, direct debit, debit instruments) and includes features for operational risk containment (transaction filtering, duplicate detection, accounting reconciliation), liquidity reporting, treasury operations management, end-to-end management of remittances, competitive reporting and SEPA & TARGET2 compliance.

FinTP use cases are in solutions for transaction broker, payment factories, corporation financial consolidation, management of microfinance operations, optimization of payment flows for public administrations, public debt management etc.

Customer Overview

Features

- Financial instruments:

- Funds transfer (MT, MX message types)

- Direct debit

- Debit instruments

- Remittances

- Treasury operations

- SEPA (credit transfer – SCT ; direct debit – SDD) compliance

- SEPA for corporates

- Statements (MT940/MT950, MT900/MT910)

- Corporate to bank connectivity

- Operational features:

- Duplicate detection

- Accounts reconciliation

- Transactions filtering

- Competitive reports & alerts

- Liquidity reporting and forecasting

- Business continuity

- Loan disbursements and repayment matching

Benefits

FinTP lowers the total cost of ownership (ensuring nil capital expenses and optimized operational expenses – via shared development and maintenance), while eliminating the common vendor lock-in dependence and aiming to achieve a better level of interoperability - by encouraging a wide adoption, due to financial attractively and short time-to market.

The innovation factor consists in its open source distribution model, allowing banks/corporations/public institutions who use it to contribute updates and improvements to benefit all users. This enables an unprecedented level of transparency and collaboration between clients, being possible because middleware is not a competitive differentiator for them. It is in the best interest of all involved parties that this collaboration happens, so that everyone can focus on primary client oriented attractive services.

Last, but not least, FinTP is highly flexible and configurable and can be adjusted to fit the exact needs of the customer.

Platform & Workflow

Custom reporting capabilities: users can tailor their own reports. A set of standard reports already is available in the application, as most frequently asked by bank or treasury operators

Competitive reports: offers several analyses and reports of the market trends, along with early alerts

Liquidity reporting: ensures real-time cash reports and forecasts using several reporting criteria, in a consolidated view

Auditing: detailed logs of user activity, payment status updates with full information on timestamps, originating application, end application, device information, etc.