Fed Taper Timeline Nears; US Yields, Dollar Extends Gains

- Michael Moran , Michael Moran - Senior Currency Strategist at The Dollar Index

- 20.09.2021 01:30 pm #stock

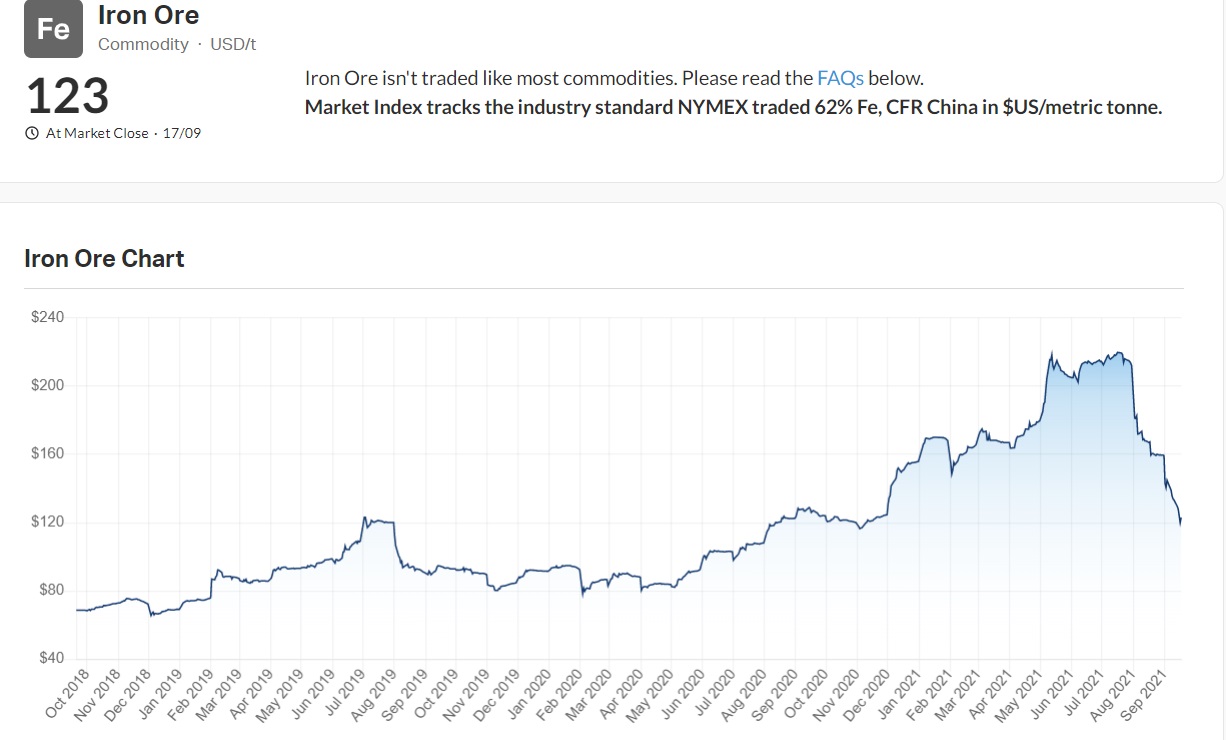

Risk-Off in Asia on China Evergrande, Weak Resources

Summary: The Dollar Index (USD/DXY), a popular gauge of the Greenback’s value against a basket of 6 major currencies, extended its gains, climbing 0.39% to close at 93.20 (92.85). US Treasury bond yields rose on Friday ahead of this week’s Federal Reserve policy meeting. Speculation that the Fed will move policy sooner than later grew following the strong US Retail Sales results last Thursday. The benchmark US 10-year treasury bond yield climbed 2 basis points to 1.36%. The Euro retreated 0.38% to 1.1725 after it broke through strong support at 1.1750 (1.1770 Friday). Sterling slid to 1.3730 (1.3795) on lower a UK Retail Sales report and an overall stronger Greenback. The Aussie tumbled to 0.7265 (0.7295) as iron-ore prices extended their decline.

Against the Yen, the Dollar lifted to 110.00 (109.75), buoyed by higher US yields. The Dollar finished stronger against all the Asian and Emerging Market currencies. The USD/CNH pair closed at 6.4700 (6.4600 Friday). Against the Thai Baht, the Greenback climbed to 33.30 from 33.10. In early Asia it was risk-off at the outset as speculation grew that China’s embattled property developer Evergrande was on the brink of default. Elsewhere, the latest results from Canada’s Federal Election saw the contest too close to call. Regardless of the outcome, no Canadian candidate is expected to alter current policy. On Friday, the USD/CAD pair settled 0.37% higher to 1.2770 (1.2685).

Wall Street stocks closed lower. The DOW slid to 34,480 (34,730). The S&P 500 finished at 4,417 from 4,470 on Friday. Other global bond yields rose following the lead of their US counterparts. Germany’s 10-year Bund rate closed at -0.28% (-0.30%). The UK 10-year treasury yield was at 0.84% (0.82%). Japanese 10-year JGB bond rates were unchanged at 0.00%.

Data released on Friday saw UK August Retail Sales slump to -0.9%, underwhelming median forecasts at 0.5%. The Eurozone July Current Account Surplus eased to +EUR 21.6 billion against median forecasts at +EUR 25.9 billion. Eurozone Annual Headline and Core CPI in August matched forecasts, at 3.0% and 1.6% respectively. US Preliminary University of Michigan Preliminary Consumer Sentiment rose to 71.0 from 70.3 previously, but lower than expectations at 71.9.

- EUR/USD – the shared currency extended its decline to 1.1725 from 1.1768. The EUR/USD pair broke through the late August support level at 1.1750 in New York trade. Overnight high traded for the Euro was at 1.1789.

- AUD/USD – slip-sliding away. Following last week’s dismal Australian Employment report, the Aussie Battler extended its decline. Iron ore prices continued to fall, weighing on the Australian currency. AUD/USD closed at 0.7262, down 0.52%. Overnight low traded was 0.7253.

- USD/CAD – against the Canadian Loonie, the Greenback climbed 0.37% to 1.2770 (1.2685). A close contest in the Canadian general elections did not impact the Loonie. A win by either party is not seen as a risk as economic and monetary policy will not change. Risk-off sentiment and broad-based USD strength were the dominant factors for the Loonie.

- GBP/USD – Sterling slid to 1.3730 from 1.3792 following a slump in UK August Retail Sales which was more than most analysts had expected. GBP/USD hit an overnight low at 1.3674 before settling a touch higher in late New York.

On the Lookout: Asian trade will be slow today due to holidays in Japan and China. Today’s economic data calendar is light. New Zealand’s August Services PSI fall to 35.6 from a previous 55.9 (ACY Finogix). There were no forecasts given. Europe kicks off with UK monthly Rightmove House Price Index for September (no f/c given, previous was -0.3%). Germany’s August PPI follows (m/m f/c 0.8% from 0.9%, y/y f/c 11.4% from 10.4% - ACY Finlogix). There are no major economic data releases from North America.

Markets are focussing on the outcome of the Fed meeting and its Press Conference (early Thursday, Sept 23 in Sydney). Speculation is growing on whether the Federal Reserve will (or will not) announce a formal reduction of its bond purchases. Other central banks with monetary policy meetings this week are the Bank of Japan (Wednesday), Swiss National Bank and Bank of England (Thursday). None of these central banks are expected to alter policy.

Trading Perspective: The Dollar maintained its overall bid against its rivals on the speculation of a Fed announcement of taper plans and a general risk-off tone. Developments on China’s property developer Evergrande will be closely monitored. In the current environment, expect the Greenback to stay bid. The potential damage to risk currencies are high, and the Australian Dollar, currency of China’s biggest trading partner risks further falls. We can expect China Inc to intervene to slow any damage to Evergrande. At the end of the day, the effects on China’s economy will be felt, and seen.

Iron ore prices have tumbled nearly 12% this month.

- AUD/USD – The Battler remains under pressure but is holding its own so far this morning. The Aussie closed in New York at 0.7265. In Asian trade, the Aussie traded to 0.7257 lows. Immediate support for the Aussie lies at 0.7250 followed by 0.7220. Immediate resistance can be found at 0.7290 followed by 0.7320. Look for the Aussie to drift lower initially. Likely range today 0.7220-0.7290. Looking to trade the range. The Aussie trades heavy but the specs are short…

- EUR/USD – extended its drop to 1.1725 from 1.1768 on Friday. The shared currency fell under the weight of the overall stronger Greenback. There were no major data releases on Friday. This week the Euro will take its cue from the US Dollar with the FOMC meeting mid-week to set the tone. The Euro has immediate support at 1.1720 (overnight low). The next support level is found at 1.1695 and 1.1665. Immediate resistance lies at 1.1740 and 1.1780 (strong). Look for the Euro to consolidate in a likely range of 1.1700-60.

- GBP/USD – Sterling slumped to 1.3730 at the New York close, down 0.9% from 1.3792 on Friday. The British Pound was under pressure in Europe after the disappointing UK Retail Sales report was released. Overnight, the GBP/USD traded to a low of 1.3720 which is where immediate support lies. The next support level is found at 1.3690. Immediate resistance on the day is at 1.3755 followed by 1.3775 and 1.3800. Look for consolidation in a likely trading range today of 1.3710-1.3780.

- USD/CAD – Against the Canadian Loonie, the US Dollar finished near its overnight highs at 1.2770. Immediate resistance lies at 1.2770 followed by 1.2810. The overnight low traded for USD/CAD was at 1.2725. Immediate support on the day can be found at 1.2740 followed by 1.2720. The USD/CAD remains bid on the possibility of a Fed taper tantrum and weaker oil and commodity prices. Look to trade a likely range today of 1.2740-1.2820.

Have a good week ahead all. Happy Monday.

Analysis written by Michael Moran, Senior Currency Strategist.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplied by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.