How payment regulations are driving innovation in the UK

- Tino Kam, Managing Principal at Capco

- 25.01.2016 02:45 pm undisclosed

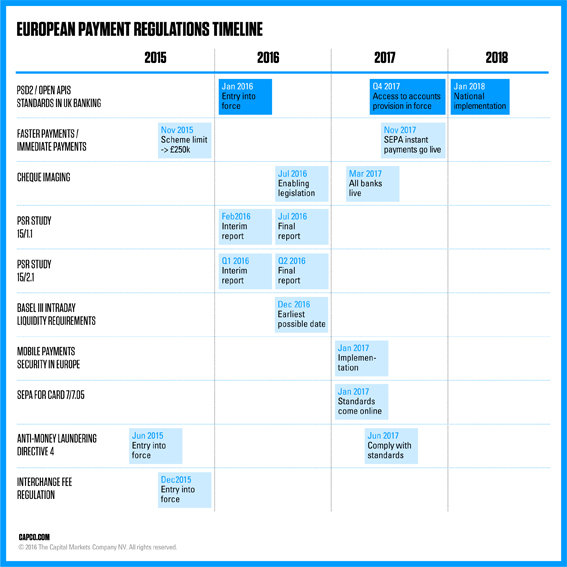

The PSD2 (Payments Services Directive 2) and Open API (application programming interface) standards in banking will come into force in the UK (and the wider EU) within two years. The UK Government is backing these initiatives with the aim to provide consumers with more secure, less expensive and easy-to-use financial services. These developments will affect both retail and corporate banking. But how will this drive innovation and competition in financial services, and where are banks in the race to take advantage of the new approaches?

Making banking APIs even more public

Open APIs have existed for decades. They are a means of accessing data based on an open standard. In other words they are they are public interfaces and like most open standards they are developed and maintained collaboratively and transparently. They can be accessed and used by anyone.

PSD2 and Open API Standards will standardise banking APIs, making them mandatory for all banks, free of charge to the consumer.

Let’s take look at two specific Open API banking services:

- Providing account information (such as balance and transaction details) to external service providers

- Making payments from a current account through external service providers

The above services are already used by aggregators such as Money Dashboard, PSPs (payment services providers) such as PayPal, and credit/debit card providers.

Aggregators use so-called screen-scraping functionality, which means you have to trust them with your e-banking credentials (user ID and password). This makes the transaction less secure and maintenance can be cumbersome. For example, a password needs to be updated every time you change it with your bank. In addition, these services are not regulated.

Using PayPal or debit/credit cards adds more parties between consumer, retailer and the bank, therefore increasing transaction costs (although PSD2 caps interchange fees)At the same time they deliver value-added services - ease of use, refunds of unauthorised payment and credit when funds are not available at the time of payment. PSD2 and Open API standards aim to have comparable facilities – standard across all retails banks in the UK (and the EU). This would be would be cheaper, securer and more advanced while also easy-to-use than current banks’ and non-banks’ offerings.

Disintermediation has already begun

- Digital only banks have taken the next steps with their Open API business models, for example providing whitelabelled FX services for SMEs and monetising big data in their consumer offerings.

- Online retail portals provide financial services such as consumer lending embedded in a one-click customer experience.

- E-commerce service providers are developing new services, for example access to big data for SMEs, omnichannel support and loyalty propositions.

- Retail banks are fostering innovation and have started their ‘beyond PSD2’ roadmaps by working with fintech partners and implementing an Open API service layer ready to absorb ‘Plug & Play’ strategies without impacting core banking services. This API Service layer allows new technologies to be integrated into the existing infrastructure.

Driving innovation and competition

Standard APIs will dramatically improve client experience, from onboarding and tailored advice to using a single bank account and authentication process to check out all purchases in retail stores or online. (This will also build up loyalty points in a (single) personal e-vault).

In addition, tech giants such as WhatsApp, Facebook, LinkedIn, Apple and Google are likely to capitalise on standard APIs by adding financial services to their ecosystems, which will revolutionise the way consumers pay and consume financial services.

Two years to evolve

The UK is a vastly over-served and over-banked country with more than 20 retail banks and a pipeline of more than 10 new ones. It also has the world largest e-commerce share of total retail sales, forecast to increase from 14.5% in 2015 to 19.3% in 2019. E-commerce accounts for over 30% of sales for large UK retailers such as John Lewis and Selfridges and a large number of consumer financial services providers.

The UK payments market is ripe for innovative products that PSD2 and Open API standards will trigger and there’s no time to lose. It is likely that we will even see traditional credit and debit cards disappearing along with today’s novelties such as e-wallets.

For banks to provide standard Open APIs to third parties while at the same time continuing to add value and remaining relevant, they need to assess the full impact of the new payments rules and define their strategy and roadmaps, starting now. In current banking terms, two years is the day after tomorrow.