BIOMETRIC PAYMENT CARDS - WHERE ARE WE NOW?

- Lina Andolf-Orup, Global Product Marketing Manager at Fingerprints

- 30.01.2018 09:30 am undisclosed

Biometric smart cards are emerging as the next innovation in payment cards.

According to ABI Research the payment card is here to stay and fingerprint authentication within the card is the next natural evolution to retain convenience while increasing security.

So, let’s take a look at the potential and status of the technology to understand why 2018 is set to be the turning point for on-card biometrics.

Solving real-life problems with a touch

Every year, around 4 billion smartcards are sold globally. They are mostly payment cards and around half of them are contactless. And, all of these numbers are increasing year on year as we move closer towards cashless societies, but convenience needs to be balanced with security to drive consumer trust.

Our consumer research revealed that people around the world want to use their contactless cards more frequently, but security concerns and transaction caps are holding them back. Indeed, 38% of consumers see security as the main barrier to use. On top of this, a market study from Visa shows that one in five (20%) Europeans use the same PIN on more than one payment card, and one in six (16%) share their card details with family and friends. They know that this is a risky behavior, but still do it because convenience always wins.

Source: Fingerprints market research in collaboration with Kantar TNS, 4,000 online consumers in USA, UK, China, India

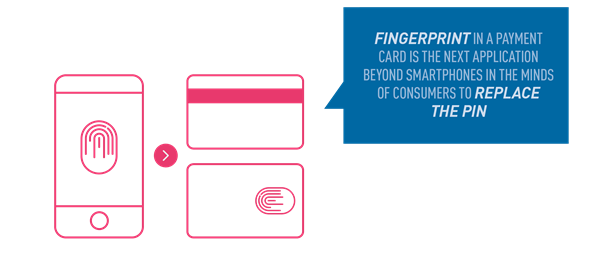

On-card biometrics is the final piece of the puzzle to bring trust and security to contactless payments without compromising convenience. Consumers are familiar with biometric authentication from the mobile world and therefore recognize the value it can bring to their cards.

Benefits for banks, retailers and consumers

Importantly, the benefits are many and wide ranging for all stakeholders:

Banks can open up many opportunities to increase the use of payment cards, while reducing fraud and customer frustration. New technology can also enable them to bundle with other innovative services. Being at the cutting edge brings increased status and trust, which in turn can result in new customers.

Retailers will see more through-put in store as more consumers use contactless and spend less time in line. And this often leads to higher spend as there is less time to second-guess purchases. This will be even more noticeable if the contactless payment cap is removed. Overall, swifter and more secure shopping experience, all using the existing dual-interface payment terminals.

Consumers are the real winners here. They were given contactless to make their lives easier and quicker, which it has. A recent infographic from Barclaycardvisualizes how much time is actually saved using contactless instead of chip and PIN and cash, and it truly adds up over a lifetime. However, the lack of authentication has left many uneasy. Now, with on-card biometrics, they can retain the speed and convenience of contactless, just with added confidence.

Collaboration is the key

It is exciting that consumers are driving demand for new features and the industry is working hard to answer the call. To make it happen, though, players from the entire eco-system need to work together.

Biometrics leaders like Fingerprints are leading the charge. We have carried our expertise from the high-volume smartphone sensor market and are now at the forefront of innovation in making biometric payment cards a reality.

Solution providers like NXP, Zwipe, Linxens, CardLab are adapting and developing components and solutions like secure elements, prelams and inlays to fit the new requirements.

Card Manufacturers like IDEMIA, Kona and Gemalto are developing and manufacturing the smart cards and working with the card issuers.

Payment schemes like Visa, and Mastercard and standardization bodies like EMVCo and Eurosmart are working to ensure that technologies are interoperable, secure and stable to ensure a standardized and sustainable industry.

Issuing banks and large retailers are sharing their requirements to ensure the right product for their customers.

So, where are we now? Trials have recently been announced with AirPlus, Visa in the U.S. and Cyprus, and there are others are underway. The technology is ready to scale with low power consumption and the required biometric performance, and it can be integrated into cards with current manufacturing techniques, working with existing contactless point of sales terminals. Finally, the all-important pull from the market is there.