Published

- 05:00 am

Liberis, a leading global embedded business finance platform, today announced that it has entered into a partnership with Barclaycard to offer its small business customers access to personalised revenue-based finance. The news follows Barclays’ investment of £34.5 million in Liberis agreed in Q4 2021.

The finance will in part help Liberis to further develop its API driven embedded finance platform, deliver innovative new products and solutions for small businesses, and continue its international expansion. Liberis has integrated its platform with over a dozen global strategic partners in 8 countries including the UK, USA, Ireland, Sweden, Finland, Denmark, Slovakia, and the Czech Republic, and is looking to expand further into Europe.

Alongside Barclays, Liberis is backed by investors including UK based venture builder Blenheim Chalcot and US-based growth investor FTV Capital.

Barclaycard Business Cash Advance is a brand-new solution that’s been designed to help small businesses by providing the funding needed to grow their businesses. Cash Advance is an alternative finance product where Liberis advances a sum of money to eligible merchants on the grounds that they will pay back the sum plus a pre-agreed fee. It offers fixed cost financing with flexible repayment terms – allowing business owners to access the funds they need when they’re needed.

Rob Straathof, CEO of Liberis, commented: “We are very excited to launch our finance partnership with Barclaycard to provide personalised business finance to their small business customers. This investment is a testament to our leadership position in embedded business finance and shows how banks and fintech can create vital partnerships to help even more small businesses obtain the funding they need to grow”

Rob Cameron, CEO of Barclaycard Payments, said: “Small businesses underpin the UK economy and it’s critical that they have quick and easy access to the flexible finance products they need to support their growth. Having a bit of extra breathing room with repayments through Barclaycard Business Cash Advance will give many SMEs the confidence they need to invest in growing their business. We’re looking forward to continuing to work closely with Liberis to enhance our innovative suite of products.”

Related News

- 05:00 am

In a rare acquisition of a US tech company by an African tech company, MFS Africa, Africa’s largest digital payments network, today announces that it has reached an agreement to buy Global Technology Partners (GTP).

Based in Tulsa, Oklahoma, GTP is the number one processor for prepaid cards in Africa, with over 80 banks – including UBA, Ecobank, BIA, Stanbic, Coris, NSIA and Zenith Bank – using its platform. GTP’s client base covers 34 countries and is fully connected to the Visa, Mastercard, GIM, GIMAC and Verve networks for which it provides the processing. This acquisition enables MFS Africa to further deepen its offering to Africa’s gig economy, the business travel market and the millions who eagerly want to participate in global digital commerce through card credentials linked to mobile money wallets – rather than bank accounts – for seamless and secure online purchases. It also expands MFS Africa’s bank and fintech base and provides tokenisation for the mobile money world in connecting with the traditional card scheme ecosystems such as Visa and Mastercard.

Founder and CEO of MFS Africa, Dare Okoudjou, said: “This is a momentous milestone for us and Africa's tech ecosystem – on many levels. It’s something of a first for an African tech company to acquire a US tech company of GTP’s size and stature, and we’re delighted to be welcoming the GTP team to the MFS Africa family. Their expertise enables us to extend our value proposition of last-mile connectivity to African banks and to accelerate our offering of card connectivity to mobile money users and other fintech companies operating across the continent. The combined operations have immense and exciting growth potential, and with our extended portfolio, we are now truly an omnichannel payments company.”

Robert Merrick, Founder and Chairman of Global Technology Partners, commented: “GTP’s established position as Africa’s number one prepaid card processor has been built on its unique, flexible platform that actively helps prepaid cards to succeed. We have become the leader of prepaid cards in Africa because of our people, who have genuine in-depth knowledge not only of the prepaid card business but also of the realities that African card users face. We connect the right solution to the right markets with the right products. MFS Africa is an ideal home for GTP, and we are focused on adding new features and functionalities to our platform, signing up new clients, expanding into new countries, driving growth and making a significant contribution to growing MFS Africa’s business and its network of networks.”

Following GTP's acquisition, MFS Africa plans to further invest in GTP's current card programmes with banks and bring to these all the innovations and possibilities offered by the MFS Africa HUB – including seamless interoperability with Mobile Money. The company will also leverage GTP's stack to fast-track card programmes for MNOs and FinTechs across Africa. Lastly, MFS Africa intends to leverage GTP's presence in the USA to expand its commercial activities in North America.

Related News

Chris Bell

Contracts Product Management Manager at Factor

The Schrems II ruling given by the Court of Justice of the European Union (CJEU) on 16 July 2020 upset the apple cart for organizations across the globe, and the latest see more

- 06:00 am

VikingCloud, a leading provider of cyber security and compliance solutions, has announced the appointment of Tracey Luehring as its new Chief Financial Officer.

Tracey brings her considerable expertise in enterprise-wide financial and transformation management to drive VikingCloud’s ambitious growth strategy. Her impressive track record of achievements in driving business strategy, mergers and acquisitions, and financial planning and analysis, was garnered through hugely successful stints at two Fortune 500 companies, where she oversaw double-digit rises in stock prices and consistently outperformed the Dow Jones Industrial and S&P 500 benchmarks under her tenures.

Commenting on the appointments, Robert McCullen, Chief Executive Officer of VikingCloud, said: “We are thrilled to welcome Tracey to the VikingCloud executive team. Her dynamic and incisive leadership style is reflected in the strong financial results she’s delivered, and I am delighted that she brings her extensive experience in business transformation to our growing company. VikingCloud is at a pivotal moment in its growth journey, and we have ambitious plans for our future. With Tracey’s strategic foresight, I am confident that we have the best team in place to accelerate VikingCloud’s momentum as the go-to name for securing millions of businesses around the world.”

Tracey joins VikingCloud from conglomerate Jones Lang Lasalle (JLL), where she served as Global CFO of its Work Dynamics unit. At JLL, Tracey successfully managed a global team of 1,600 colleagues and executed against organic and inorganic growth models that consistently delivered EBITDA growth of 20%+, Tracey also served as the CFO of the JJL Technologies division, which included setting up the growth infrastructure for driving rapid expansion through mergers & acquisitions and internal development of their SaaS revenue business. Prior to JLL, Tracey spent 10 years at Aon in a succession of business partnering, FP&A and strategic senior financial roles. During her tenure at Aon, Tracey delivered a financial turnaround of $510 million in revenues and managed and restructured a global finance team following a series of acquisitions. She obtained a core finance foundation in investment banking and commercial lending prior to shifting over to corporate finance.

Tracey holds an MBA from Northwestern – Kellogg School of Management and a BBA from the University of Wisconsin - Madison.

Tracey’s appointment is the latest strategic senior hire for VikingCloud in recent weeks, following the additions of Gregory Leos as Chief Revenue Officer, and Paul Arceneaux as Vice President Product Management in April this year.

News of Tracey’s appointment comes at a time of rapid change for the global cyber security market. In 2021, the total number of cyberattacks increased by 50% year-on-year, with education, research and healthcare hit hardest. As cyber threat actors refine their techniques and leverage machine learning and automation, the number and impacts of attacks is only likely to grow. VikingCloud aims to meet these challenges head-on, building on its recent momentum as it delivers enhanced solutions to clients of all sizes throughout 2022 and beyond.

Related News

- 03:00 am

Triterras Inc., a leading fintech company focused on trade and trade finance, and Unqork, the leading no-code enterprise application platform, today announced they have entered a partnership to further digitize global trade finance. Unqork will be used to enhance the end-to-end trading lifecycle of Triterras’ Kratos platform, one of the largest trading and trade finance platforms in the world. By incorporating Unqork’s simple ‘drag and drop interface, Triterras will be able to offer better efficiency and improve outcomes for both lenders and traders.

Triterras will kick off its work with Unqork by building new client onboarding processes on its Kratos platform. Client onboarding is an integral undertaking for all financial service institutions, yet rigid, fluctuating protocols have often hindered digital adoption. Through Unqork, Triterras will be able to quickly develop client onboarding applications with more flexibility as industry regulations change for a seamless customer experience.

Customer onboarding will be just the first step in Triterras’ larger digital transformation initiative for the Kratos Platform. Down the line, Triterras plans to migrate risk and fraud mitigation, trade digitization, transaction tracking and more—using Unqork.

“By leveraging Unqork’s no-code platform, Triterras plans to accelerate the way SME clients and lenders are able to transact online,” said Sri Vasireddy, Chief Technology Officer, Triterras. “Our business model is to bring new trade finance lending to underserved or underbanked market segments. Our partnership with Unqork will allow us to further our mission to provide tech-forward lending solutions that are accessible to the world of micro-lending.”

“Unqork has proven experience accelerating our customers’ time-to-market with our Codeless Architecture approach, enabling the delivery of premium, future-proof applications in record time,” said Matt Singleton, Head of Financial Services, Unqork. “We’re proud to partner with Triterras to deliver market-leading offerings on the Kratos platform that will enable Triterras to bring their expertise and solutions to their customers in an innovative and rapid way.”

Related News

- 01:00 am

EarnUp, a San Francisco-based Fintech company offering intelligent payment and data solutions for the mortgage industry, announced the strategic expansion of its executive team to help accelerate EarnUp’s growth and support its mission to create a financial system that works for everyone by transforming the loan payment ecosystem into a key driver for achieving financial wellness.

The four new executive appointments are Michelle Scanlon as Chief People Officer, Aileen Casanave as General Counsel, Brad Woodcox as Vice President of Strategy and Operations, and Johnathan Flowers as Head of Marketing. The creation of C-level People and Legal roles will help retain and attract talent and oversee regulatory compliance, respectively, as the Company grows. While the addition of a Strategy and Operations role, and a strong Marketing leader with demand generation experience, will help attract, adapt, and retain enterprise customers.

“Michelle, Aileen, Brad, and Johnathan bring with them decades of experience and their expertise will bolster our executive team as we drive the Company’s next round of growth together,” said Nadim Homsany, EarnUp co-founder and CEO. “Along with our trailblazing customers, EarnUp has already helped over one hundred thousand borrowers to simplify the mortgage payment experience. With our expanded executive team, we are well-positioned to grow the number of lenders and servicers on our platform to reach and serve even more people.”

EarnUp’s four new leaders bring a wealth of experience with them:

- Michelle Scanlon has been promoted to the newly created role of Chief People Officer. She will continue to drive people strategy and enhance the Company’s culture.

Michelle joined EarnUp in 2020, with more than 15 years of experience successfully leading global people and culture programs for high growth technology companies including Broadcom, Accela, Jiff, and HelloSign (a Dropbox Company). Over the last two years, Michelle has partnered with EarnUp’s leadership to achieve corporate objectives and drive the people strategy including recruiting top talent, driving engagement and retention, fostering diversity, equity and inclusion and building a people-first culture.

- Aileen Casanave has been appointed as General Counsel. She will oversee and manage EarnUp’s legal and regulatory compliance matters.

Aileen has been General Counsel or has held senior legal positions at many Silicon Valley companies including Jiff, TIBCO, Sun Microsystems, and Lockheed Martin. She has 30+ years of legal and business experience in technology commercial transactions, regulatory compliance, intellectual property, and corporate governance. Aileen serves on the Board of Governors of the University of San Francisco School of Law, is President of the California Association of Black Lawyers, and will receive the Leader of the Year award, presented by California Assemblymember Ash Kalra, at the 2022 Silicon Valley Juneteenth Festival in San Jose, California.

- Brad Woodcox has been promoted to the role of Vice President of Strategy and Operations. He will continue to drive EarnUp’s internal operations as well as lead company strategy.

Brad joined EarnUp in 2017 to create and lead the partnerships and business development teams. In his role, he helped grow the Company from first enterprise sale to double-digit enterprise contracts and over $10B in loans managed on the EarnUp platform. Brad has more than 20 years of experience creating business value and impact for startups and large corporations via roles in product, engineering, operations, strategy, and business development for companies in highly regulated industries, including fintech, medical devices, and legal.

- Johnathan Flowers has been appointed as Head of Marketing. He will lead all marketing initiatives to attract and retain enterprise customers.

Johnathan brings over 25 years of marketing, design, and creative experience to EarnUp, having held senior positions at companies such as Google, PayPal, Amazon, PubNub, eBay, Agilent, and HP. Competition is in his DNA. He is a U.S. Army Combat Veteran, last serving with 160 SOAR, an NFL veteran with the Los Angeles Raiders football organization, and the Scottish Claymores football team, formerly part of NFL Europe.

Related News

- 04:00 am

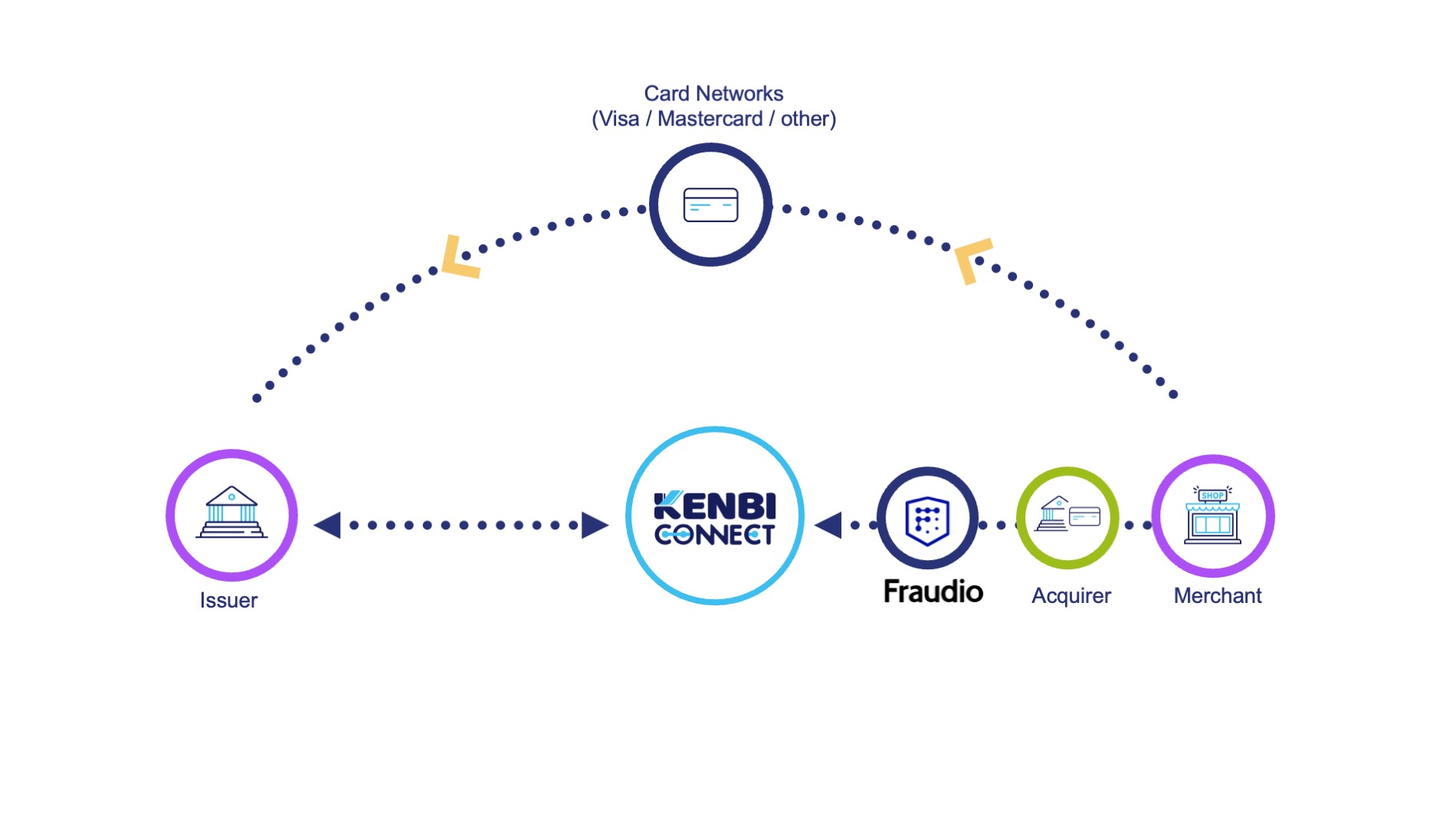

Fraudio, a payment fraud detection and anti-money laundering (AML) solution provider is partnering with Kenbi Authorize More, the developer of an AI platform that helps global merchants and card issuers approve more transactions. The partnership will help solve transaction declines caused by the lack of data available in real-time to issuers when approving or declining e-commerce transactions based on fraud risk. The partnership will enable issuer banks and merchants to reduce false positives and maximize conversion rates, all in real-time.

A significant percentage of online purchasing is declined by issuer banks due to the risk of fraud. Although many merchants use advanced anti-fraud monitoring systems utilizing a large data set to eliminate fraud at an earlier stage, those supplementary analytics are not shared with the issuer as part of the transaction details. By accessing AI-enriched merchant data in real-time, issuers can make smarter decisions and avoid false declines.

Merchants can sign up to the Kenbi AI platform easily and configure their collaboration policy. Fraudio then shares – in real-time – the AI enriched transaction data with the issuer through Kenbi connect platform. The merchant policy can be updated at any time using the Kenbi AI platform.

Chanan Lavi, Kenbi CEO and Co-Founder explains; “We believe in collaboration, in sharing data and connectivity, and in saying ‘yes’ to legitimate transactions. Partnering with Fraudio, who shares our goals, will enable us to provide intelligent data, collected and analyzed by their AI through Kenbi's platform, directly to issuer banks.”

Gadi Erel, Fraudio VP Global Sales, adds: “This partnership unlocks the ability to increase both the merchant and the issuer acceptance rates using enriched data to make decisions that benefit each business's bottom line. And of course, this results in providing the consumer a better, more frictionless experience.”

Related News

- 07:00 am

Taskize, the leading provider of inter-company workflow to the financial services industry, today announced a significant milestone with 500 financial institutions now live on the company’s network, almost double the 289 companies in January 2021.

Operating across 85 countries, the recent growth of the network has been driven by the wave of new regulations along with industry initiatives, such as the T+1 settlement. The Settlement Discipline Regime of the Central Securities Depository Regulation (CSDR) and the Uncleared Margin Rules (UMR) have created an increased need for solutions that facilitate faster and more efficient resolution of settlement breaks and margin disputes.

The global, web-based platform, used by Tier-1 investment banks, brokers, asset managers, hedge funds, CSDs, custodians and CCPs, allows firms to more efficiently manage operational issues across counterparties as well as internally within their organisation.

The Taskize Smart Directory™ and Taskize Bubble™ allow users to manage all work in one place making workflow more efficiently across all their post-trade operational areas, including settlements, corporate actions, income and collateral.

Joining the network is a quick and simple process. Seamless integrations with email, Microsoft Teams and Symphony enable workflow across both traditional and emerging communication channels. The easy-to-use API integrates with existing applications allowing internal workflows to be extended across the entire business network for even greater efficiency. This, along with a flexible sponsored subscription model, has facilitated a rapid increase in members to 500 companies in under 18-months.

Philip Slavin, CEO and co-founder of Taskize, commented on the achievement: “We are excited to have passed this significant milestone after experiencing strong demand from the market. The growth of our network is testament to the value Taskize brings, with those using our platform realising the benefits of inter-company workflow. In the face of mounting regulatory pressures, we expect the network of Taskize users to continue to grow, which will bring cumulative benefits as the industry reaps the rewards of radically reducing emails between global financial operations teams by up to 90%.”

Related News

- 06:00 am

One in three UK-based small and medium-sized enterprises (SMEs) who sought access to finance were denied in the last year, according to new research from Yolt, Europe’s rapidly accelerating smart payments and data enrichment platform. This resulted in an estimated £3.7bn lost in potential funding for UK SMEs.

Small businesses seek funding to fuel growth

The research found that in the last year, the average SME sought to borrow £331,275 in financing to help grow their business. However, on average, small businesses managed to borrow approximately £50k less than this. Business leaders are seeking similar amounts in the coming year (£332,289) with a specific focus on investing to help grow their business including new equipment (36%), product development (21%) and improved technology (17%).

Business leaders want a better financing solution

For small businesses denied funding, leaders cited the age of their business (31%), the levels of existing business debt (22%) and the lack of sufficient collateral (20%) as factors in the decision. Medium-sized businesses (50-250 employees) were the most likely to be refused funding (56%).

Even for successful candidates, the process of borrowing money via traditional means was rarely seamless. Only one in five SMEs (20%) described the process of borrowing as easy and less than 10% felt the process was low effort or utilised technology to integrate with their systems to give the most reliable result.

Small business leaders are extremely open to using technology to refine the borrowing process. Two out of three SMEs (66%) are willing to securely share their bank account data to improve their chances of borrowing money. This follows previous Yolt research which found that sharing of data via open banking technology could significantly increase approvals and reduce the processing time of SME borrowing by 85%, significantly benefitting both the lender and recipient3.

Nicolas Weng Kan, Chief Executive Officer at Yolt, said: “SMEs represent the foundation for a thriving economy, in the UK they represent 99% of all private sector businesses; as such, it’s important we nurture SME growth. Traditional borrowing, limited as it is, can make access to finance difficult. This can impede growth and make it hard for small businesses to achieve their true potential.

“We can see a clear desire from small business leaders in our research to use the power of their data and insight to allow for more accurate decisioning when it comes to borrowing money; open banking is the solution to this. By employing open banking technology, lenders can get a clearer picture of a business’ behaviours and can then provide financing with far more confidence: it’s not about taking on extra risk but accessing a great level of insight. This technology also makes the application process quicker and automated, allowing for efficiencies on both sides.”

Related News

- 07:00 am

The private sector institutions affiliated with the Islamic Development Bank (IsDB) Group organized:“The Private Sector Forum” in its tenth edition, during the period from 2-4 June 2022, at the main conference hall in Sharm El-Sheikh, Egypt. The Forum occurred on the sidelines of the Annual Meetings of the Bank’s Board of Governors, under the theme: "Beyond Recovery: Resilience and Sustainability".

It is worth noting that the Forum highlighted the activities of the Bank Group, in addition to its services and initiatives in the member countries, including the Arab Republic of Egypt. It also explored the investment and business opportunities and challenges facing the business sector in the member countries, as well as the available financing tools, such as Lines of finance, trade financing and development, and investment insurance, and finally export credit.

Moreover, this event, with its list of activities, presented various economic topics and development projects. The Forum’s program included holding bilateral meetings (B2B and B2G) with the aim of networking, forming partnerships, establishing business relations, exchanging experiences, and presenting success stories.

This Forum witnessed the presence and participation of senior government officials, presidents and CEOs of local, regional, and international private sector companies, along with investors, businessmen, chambers of commerce and industry, trade, and investment promotion agencies, as well as regional and international development financial institutions.

The Forum’s sessions included discussions on the activities, roles, and support provided to member countries. The Forum also addressed issues related to private sector development and trade finance, and the challenges of investment insurance and export credit, with the aim of further encouraging economic and social development among member countries.

During the sessions, the main challenges that hinder the business community and the concerned trade and investment bodies in the Arab region and other member countries were discussed by fostering an environment that allows the parties to take advantage of the available opportunities.

His Excellency Dr. Muhammad Al Jasser, President of the IsDB Group, said: “The Private Sector Forum of the Islamic Development Bank Group in its tenth edition, was held this year in a new form over three consecutive days instead of one day, like what used to happen in the past. The Forum has achieved its objectives and desired outcome during its economic, investment, and business activities and seminars, with the aim of integrating the public and private sectors, which both constitute a basic pillar for economic and social development in our member countries. The public sector is responsible for developing the infrastructure and legislation to create an attractive business climate for the private sector, to be able to develop the production and create job opportunities.”

His Excellency thanked the attendees for participating in the Forum, which included 20 activities, more than 100 speakers, 55 exhibitors, and 2000 participants representing 70 countries. It also witnessed the signing of more than 50 agreements.

During her speech, Dr. Hala El Saeed, Minister of Planning and Economic Development of the Arab Republic of Egypt, expressed her pride in hosting the IsDB’s Annual Meetings by her country for the first time in 30 years, stressing that the goal of the "Private Sector Forum" is to support all development efforts of the private sector in member countries.

El Saeed pointed to the challenges that the world faces, resulting from various global turbulences, pointing to COVID-19’s crisis, then the repercussions of the geopolitical crisis and the Russian-Ukrainian war that occurred before the full recovery from the aforementioned pandemic, stressing that all of these repercussions greatly affect all countries of the world, which is the matter that requires cooperation to make more room for the private sector to participate in the development efforts.

In his opening speech, Mr. Ousama Kaissi, CEO of the Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC), stated: “The Private Sector Forum is an important platform for the Islamic Development Bank Group to engage with various stakeholders in different aspects. The pandemic and the Ukraine war have exposed dangerous fault lines, including supply chain disruptions, failed healthcare systems, resource scarcity, and the rising cost of living that has disproportionately affected millions, especially in low-income countries.”

He added: “We cannot overemphasize the importance of political risk insurance and credit enhancement, which have a proven track record of effectively reducing risk, thereby stimulating private investment in emerging markets through capital efficient bonds. The pressure on national budgets has severely limited the ability of governments to mobilize funds, and the need for the private sector’s capital is greater than ever, as our engagement with this sector must be realigned to include ever-changing development priorities so that we can deliver on our mandates to the citizens of our member countries.”

Commenting on the success of the Forum, Eng. Hani Salem Sonbol, CEO of the International Islamic Trade Finance Corporation (ITFC), said: “Supporting the private sector has become more important than ever and is moving towards a more flexible and sustainable economic development. In this context, ITFC truly appreciates this active participation of the private sector in the Private Sector Forum, during which an excellent platform to enhance the trade and investment opportunities was provided, which was offered by the OIC member countries. Therefore, it is very important that these new business opportunities be financed so that the private sector can operate as an economic catalyst to make a tangible and meaningful impact."

Mr. Ayman Sejini, CEO of the Islamic Corporation for the Development of the Private Sector, mentioned: “Creating an enabling environment and putting in place appropriate safeguards that need to accompany increased private sector engagement in often sensitive sectors is crucial. A set of guiding principles can help overcome policy dilemmas associated with increased private sector engagement in SDG sectors. A number of tools, including public-private partnerships, investment insurance, blended financing and advance market commitments, can help improve the risk-return profile of SDG investment projects.”