Published

- 03:00 am

Minima, the first cooperative, ultra-lean, blockchain network that enables anyone to run a complete node on a mobile or IoT device, today launched The Minima Innovation Challenge in partnership with EdenBase, UK’s first fund with a supergrowth hub and an ecosystem, investing in the next generation of game-changing companies, powered by frontier technologies.

Minima aims to become the most decentralized, immutable and scalable blockchain protocol on the market. In contrast to current Proof-of-Work blockchains, users collaborate to build and secure the chain by running ultra-lightweight complete nodes on their devices, minimising energy requirements, which in turn support the ESG (Environmental, Sustainability and Governance) goals of applications. During the seven-week challenge, innovators will be encouraged to explore the potential of Minima’s decentralized blockchain. Entries are open all, around the globe. Teams that show more long-term thinking, including ideas around how to productize their idea, will have a higher chance of winning.

Challenge teams will have access to educational resources and time with the Minima and EdenBase teams to brainstorm and ask questions to develop their ideas in Phase 1 (Ideation), after which the top ten projects will receive $1,000 in Minima tokens and be invited to the Coding Phase (Phase Two) to build their solutions and provide at least a Proof of Concept (PoC). Two runners-up will win $5,000 in Minima tokens and the winner of the challenge will receive $20,000 in Minima tokens.

The top five will be invited to feedback and mentorship sessions that will provide them with further technical and business support in developing the dApp use case and code. Token prizes will also be awarded to outstanding submissions.

Minima CEO and Co-Founder, Hugo Feiler, said: “We already have the largest network of complete nodes ever assembled. Running a full node on Minima is as effortless as running a messaging app on your mobile. Using Minima, developers can build decentralized apps on a mobile, with an addressable market of 2.5Bn users and no middlemen, miners, stakers or block producers.”

EdenBase Co-Founder, Eric Van der Kleij, said: “Most crypto projects talk about moving to a decentralized system but Minima was created as an ultra-lean, fully decentralized blockchain protocol that is community-owned and operated, which is why we are keen to support their mission to find some awesome use cases.”

Related News

- 02:00 am

Founded in 2016 as the investment arm of Natwest Group, NatWest Markets helps its corporate and institutional customers manage their financial risks and achieve financial goals while navigating changing markets and regulations. Today, beyond providing products and solutions centred across currencies, rates, and financing, the company's mission is to actively support customers in their transition to achieving broader environmental and societal goals.

"We measure our success by the results we deliver for our customers," says Jeremy Arnold, Chief Risk Officer, NatWest Markets. "But to provide excellent customer service and fast execution, we need to anticipate their needs with the right people and the right technology in place."

Originally, the bank's Risk applications were set up on a high-performance computing grid managed by a central technology team at NatWest Group. But in 2019, faced with the need to process larger volumes of data at speed and on ageing servers, NatWest Markets decided to migrate Risk platforms to the cloud.

"As the volume of data we need to process continues to increase, the regulators become more demanding and customers expect faster services, it became clear that it wasn't enough for us to speed up processes and carry on as usual. We instead needed to transform the way we do things," explains Chris Conway, Head of Risk and Finance Technology, NatWest Markets. Deciding to migrate to the cloud instead of refreshing and buying new servers, Conway and his team used the momentum to research tools that could be integrated with a serverless infrastructure to help the bank to adopt long-term, selecting Google Cloud Platform to power this digital transformation.

"Google Cloud is the ideal solution for us because it provides on-demand scalability, analytics capabilities that broaden the possibilities of what we can do for our customers, and automated services that free up our team from managing infrastructure to focus on our customers instead," Conway explains. "We had clear, but challenging objectives, and with our partnership with Google Cloud we were able to achieve them."

Helping colleagues and customers realize their potential quickly

Speed is key in financial markets, especially at a time when global systems are being impacted by market volatility. News about price fluctuations and interest rates, for example, can all affect the risk appetite of a company within seconds. NatWest Markets knows the importance of being able to support its customers by collecting signals from a diverse set of data points and interpreting them to enable timely business decisions. So, when laying out its cloud migration plan, moving data processing workloads to BigQuery to turn data into insights quickly and cost-effectively was a priority.

"Traditional data warehouses aren't designed to handle today's financial data growth, run advanced analytics, or scale quickly and cost-effectively. As a result, many financial institutions are burdened by operational complexity and are unable to innovate," says Conway. "As a modern and truly serverless data warehouse, BigQuery addresses our current analytics demands with blazingly-fast, real-time, predictive insights while scaling as our data needs grow."

To build cloud capabilities within the company, NatWest Markets invested in training 1,100 employees on the Google Cloud Platform throughout 2021, with almost 100 of them becoming Google Cloud certified. "We speak with the Google Cloud team continuously as the efforts in our progression have to come from both sides. It means a lot for us to be able to get the support and training to empower our engineers to think differently, use tools they enjoy and play an active role in driving our cloud migration forward."

High-performance computing for risk simulation and regulatory reporting

With its migration journey well underway, NatWest Markets has already seen a significant reduction in the overall time to complete business-critical pricing and risk management activities. "By simply migrating from on-premise to BigQuery, we've already noticed a 60% improvement in compute time for overnight batch processing of risk simulations and calculations," Conway explains. NatWest Markets is using multiple Google Cloud products to achieve these outcomes including Compute Engine, Google Kubernetes Engine, Cloud SQL, Cloud Storage, BigQuery and Dataproc.

Meanwhile, compliance with regulatory requirements and effectively managing regulatory relationships remains critical to the ongoing success of NatWest Markets, so the company is also leveraging the ability to streamline regulatory reporting with unified data on BigQuery.

Next, NatWest Markets aims to build artificial intelligence and machine learning capabilities to detect financial risks for customers before they arise. "Our goal is to have all risk modelling, surveillance, and supervision powered by machine learning on Google Cloud from 2022 onwards, where we can better connect the dots from different data sources," says Conway.

NatWest Markets is also looking at how Google Kubernetes Engine can help improve its performance by containerizing application components as it transitions from a monolithic to a microservices architecture. "We aim to speed up our release cycles from 12 months to 2 weeks for the XVA (valuation adjustments) desks, and we're just touching the surface of what we're able to do with Google Cloud," says Conway.

Helping address the climate crisis

Besides its focus on customer services and the optimal use of technology, NatWest Markets is also considering how to make its own operations 'Climate Positive' by 2025. Aligned with the purpose goals of the broader NatWest Group, the Group aims to use 100% renewable electricity in its direct global operations by 2025 and to see a 40% improvement in energy productivity by 2025 from a 2015 baseline.

The company is working to help others accelerate the speed of transition to a low-carbon economy, too. "We're talking to all our clients about their transition plans towards a low-carbon way of conducting business, and we have been clear as a group that we have no interest in partnering with companies that do not aim to take responsibility for their own carbon footprint," says Arnold. "With that in mind, the fact that Google Cloud is carbon-neutral and committed to running on carbon-free energy by 2030 is part of the reason why we've strengthened our bonds in the past 18 months, and we look forward to a long and prosperous partnership."

Related News

- 09:00 am

Two-thirds of UK retailers (69%) report improvements in at least one area of their business sales and performance metrics as a direct result of offering Buy Now Pay Later (BNPL) payments to customers. This was the finding of analysis by RFI Global, the only global data and insights company focusing exclusively on financial services.

Among the UK retailers offering BNPL payment, the most common benefit delivered was sales conversion, with 61% of BNPL-accepting retailers indicating that it had improved their access to new-to-business customers. This drove growth in revenue for more than half (52%) of- and profits for more than a third (37%) of BNPL-accepting retailers.

With more than 17 million UK consumers having used BNPL services, new customer acquisition improved for 59% of retailers and just under half (43%) said customers were making more frequent purchases.

Despite the clear benefits that BNPL delivers for retailers, more than half (63%) claim they are not interested in offering it as a payment method. The most common reason given is a lack of relevance.

Some retailers may be wary about the criticism of this soon-to-be-regulated market with concerns that consumers can run into trouble if they miss their payment instalments, leading them into a dangerous spiral of debt. The UK government announced last month that it will require BNPL providers to conduct credit checks on users of its services and register with the Financial Conduct Authority, but this may not take effect until 2024.

RFI’s research also shows that one in five UK retailers are concerned about exposing their business to credit risk; highlighting a lack of understanding about how BNPL works since the BNPL provider takes that risk, not the retailer.

According to Mark Schultz, Global Head of Business Payments at RFI Global, “Even though there’s a fee for retailers to offer BNPL as a payment option, most retailers report a clear improvement in sales and other performance metrics.

Our research shows that the lack of awareness among retailers of the benefits of BNPL is acting as a clear barrier to growth. Rectifying these misperceptions and educating non-accepting retailers will be key to accelerating the uptake of BNPL in the UK and globally.”

From reduced fees to streamlined onboarding and contract flexibility, retailers are receptive to a range of incentives to begin accepting BNPL. Yet among those retailers that are yet to accept BNPL, one-third (37%) said that nothing would encourage them to begin accepting a BNPL service.

Retailers are increasingly moving towards offering multiple BNPL options to their customers. “This is good news for consumers who use BNPL to budget and manage their cash flow to avoid debt,” added Schultz. “Staying with a single provider helps them keep better track of their credit record.

Further, not being able to access their preferred payment service is one of the key reasons consumers cite as something that can drive them to an alternative retailer. With inflation creating the biggest cost of the living crisis to hit UK consumers in decades, it is in the interest of retailers to provide payment choices. Those that do are more likely to increase repeat purchasing and their bottom line.”

RFI Global’s report ‘The Global State of BNPL: How banks and providers can champion customer interest’ released earlier this year also highlighted consumer attitudes towards and use of BNPL including:

No interest, No Fee is the main driver - What appeals to British consumers most about BNPL is: no interest charges (41% compared to 33% globally), convenience (31% compared to 33% globally), improved cash flow management so that they can pay other expenses (22% compared to 28% globally) and helping them to budget (28% compared to 31% globally).

Repeat use BNPL for bigger ticket items - although online retail dominates BNPL purchases, consumers are interested in using it for higher value items such as electrical goods, household appliances and furniture.

Covering everyday expenses - Against a backdrop of soaring inflation, around a third of consumers in the UK have indicated they would use BNPL to pay for everyday expenses such as household bills (34%), groceries (29%) and petrol (27%).

Frequent users willing to pay a fee for excellent experience - frequent users of BNPL are finding so much value in using it as a payment option that 47% of BNPL users in the UK say they would still use the provider if fees were attached to it.

Consumers averse to debt - Consumers surveyed by RFI Global display a level of aversion to debt and do not want to buy things they cannot afford, even ranking this as one of the key reasons why they do not use BNPL. Rather than leading people towards a dangerous spiral of debt, BNPL is helping them to better manage cash flow by offering short-term interest-and fee-free products, thereby avoiding revolving credit card debt and bank charges.

Related News

- 06:00 am

TrueLayer, Europe’s leading open banking platform, today announced that the innovative credit firm Tymit is delivering an enhanced experience through instant bank payments for its Credit and Booster customers.

Tymit was founded as a flexible approach to financing purchases and managing a monthly budget, creating a viable alternative to credit cards or loans. The Tymit Card allows customers to plan their spending, see the true total cost of any transaction, and avoid unnecessary interest by controlling their monthly repayments through instalments, while Tymit Booster offers a way for consumers to build a better credit score through timely repayments on purchases.

Determined to deliver the best possible digital experience, the firm has integrated TrueLayer into its app. As a result, Tymit Card customers can make repayments whenever they like, through secure, seamless and instant account-to-account payments. Tymit Booster customers also benefit from a more streamlined and straightforward process by using open banking to make their initial refundable deposits.

Martin Magnone, CEO at Tymit, comments: “Customer experience always comes first at Tymit, and that’s why we’re so excited about our partnership with TrueLayer. Together, we’re taking the pain out of payments for our customers, creating the kind of experience that sets our offerings apart. “

Payments powered by TrueLayer offer a higher conversion and fewer failed transactions, creating a more convenient approach and providing Tymit customers additional peace of mind that their repayments have been made on time.

Nick Tucker, Head of Financial Services at TrueLayer, comments: “Millions of people in the UK have faced a user experience that makes it difficult to anticipate the total cost of purchases. Millions more have been left behind due to thin credit files. Working with a firm like Tymit that is delivering a more transparent, fee-free and customer-friendly approach to credit, is exciting. It has recognised that offering instant payments creates an opportunity to develop a deeper and more positive relationship with its customers.”

Related News

- 06:00 am

Consumers want far more personalized mobile banking experiences that make it easy for them to get real-time 1:1 support anywhere, says a survey of almost 3,000 consumers, commissioned by Sinch (Sinch AB (publ) – XSTO: SINCH). With 93% calling out for personalized financial assessments from their bank, but fewer than 30% receiving them, the survey across 15 countries shows customers would benefit from a greater level of interactive personalized communication with their banks and financial partners.

Customers want two-way, real-time interactions that can solve banking problems as they happen, no matter where they are. Fifty-three per cent are frustrated when they cannot reply to a mobile message and one in three under 40 have even switched banks to get a better mobile experience. This desire for personalized banking and being able to communicate easily is more pronounced in younger customers, as over 80% of Gen Z surveyed want to solve even more complex tasks using digital channels including completing a loan application or sharing personal information to get tailored financial product recommendations.

Getting answers instantly

In addition, 98% say they want their questions answered quickly, but just 58% experience this. While most banks offer support via email or in-app communication channels, they have yet to capitalize on the opportunity to connect 1:1 with customers and build stronger relationships through text messaging.

It's about securing trust

The research shows a positive technology experience is highly correlated with securing consumer trust. Banks that do not deliver on good experiences are significantly less likely to have customers that say they trust their banks. Trust is also gained by knowing when human interaction with a customer is needed. Even with widespread usage of automated chat options, in moments of frustration customers still want to hear a human voice; 95% of those surveyed want an option to switch seamlessly from automated messaging to a human conversation from inside the messaging stream.

“Our survey shows that omnichannel engagement is fast becoming the answer for banks to improve customer experience,” said Jonathan Bean, CMO of Sinch. “It is all about interactive, personalized communications that are relevant to customers’ financial goals, and how easy it is to get a response from a person when needed. Though many are still building their trust in digital banking, technology can also help customers feel more secure too. Banks that partner with a reliable CPaaS vendor gain a unique advantage for securing both customer engagement and trust through a wide range of real time communications and verification solutions, like multi-factor authentication and two step verification, using channels customers prefer and are familiar with.”

Related News

- 08:00 am

Personetics, the leading global provider of financial data-driven personalisation and customer engagement solutions for financial institutions, today announced a new partnership with iBank Marketing Co., Ltd., a subsidiary of Fukuoka Financial Group and widely recognised as Neobank in Japan. By adding Personetics’ capabilities to its offerings for regional banks, iBank with the support of TIS, a leading systems integrator in Japan, intends to help more of Japan’s regional banks move to the digital space and bring a digitalised banking experience to more Japanese bank customers.

iBank is one of Japan’s most innovative Neobank, with a mission to enhance customers’ daily lives with digital banking services. As a subsidiary of Fukuoka Financial Group (FFG), one of Japan’s largest regional banks, iBank will work with Personetics is a B2B2C (Business-to-Business-to-Consumer) business model to partner with other regional banks in Japan. By partnering with Personetics and TIS, iBank intends to help its Japan regional bank partners offer advanced hyper-personalisation capabilities, but without requiring individual deployments from the other banks.

Personetics provides financial data-driven personalisation for banks and financial institutions through its real-time artificial intelligence (AI) solutions. By cleansing, enriching, and analysing customer financial transaction data, Personetics helps banks get a clearer view of how their customers manage money. By working with Personetics, banks can create personalised insights, relevant recommendations, and product-based advice to help improve their customers’ money management and financial wellness – for example, by setting smart budgets, creating financial goals, and saving more money automatically.

“We are excited to partner with FFG and iBank, who have always been at the forefront of digital innovation in Japan,” said Mr. David Sosna, CEO & Co-founder of Personetics. “By bringing Personetics data enrichment and personalised engagement capabilities to iBank’s regional bank partners, we can open new opportunities for Japan’s regional banks to support their customers. We can help Japan’s regional banks offer personalised engagement, based on their own customers’ financial transaction data. We can work together to create the future of digital banking with better money management, relevant financial advice, helpful product recommendations, and other solutions such as smart budgets and savings recommendations to make people’s financial lives better.”

Financial institutions also drive business impact from Personetics solutions by delivering an enhanced customer experience for higher customer engagement, better customer satisfaction, and more effective cross-sell targeting to help the institutions issue loans and open new accounts.

Related News

- 07:00 am

Today, Jaid, formerly, Opsmatix, an established, innovative fintech firm providing AI-powered human communications solutions, unveils a new company name and corporate identity which underpins the firm’s ambitious business development strategy. The new corporate identity launch follows the appointment of Dan Kramer as CEO in April 2022. It is the first of several important new announcements to come. The company will trade as Jaid with the official company records remaining as Opsmatix Systems Limited.

Dan Kramer, CEO at Jaid, commented: “While the existing brand had served us well, it was clear from client feedback that it was no longer representative of what the company does or stands for. To this end, our goal was to create a simple, modern brand identity that truly reflects the capabilities and values we hold dear. I believe the new Jaid name, logo, website, and messaging speak directly to the needs and aspirations of our clients, investors, employees, partners, and the wider influencer community. Leading the new brand identity project team has been an incredible experience, and I am excited to be sharing it with everyone today. Please take a moment to visit, www.jaid.io, for more information.”

Dan concluded: “We are passionate about what we do, and I am very confident about our shared future success which is being made possible by the enthusiastic support of a committed team, underpinned by a fabulous, new brand and corporate mantra which we love. ‘Focus on what matters’ works on so many levels. It’s how we operate as a team and it’s what the Jaid solution enables our clients to do. Client adoption and global interest in our offerings are snowballing, and I look forward to sharing more exciting updates over the next weeks and months.”

Related News

- 01:00 am

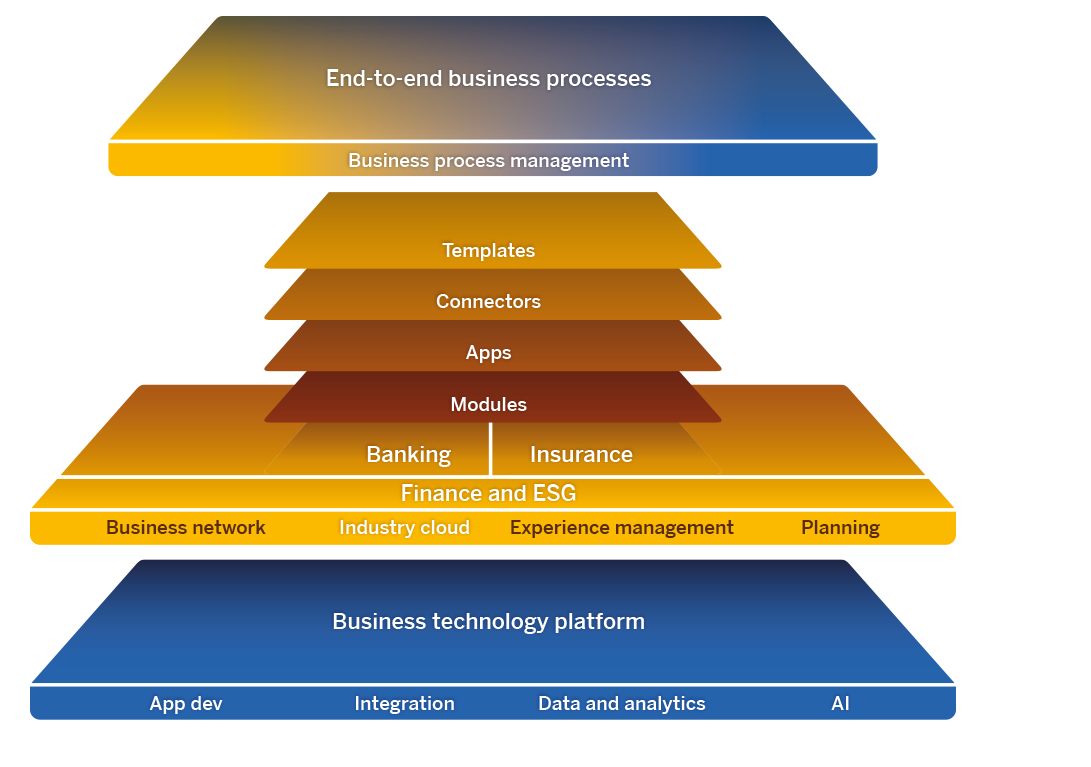

SAP Fioneer, a leading global provider of financial services software solutions and platforms, has announced the launch of a new vertical product strategy which significantly reshapes its offering to customers. Adopting a vertical approach, three platforms will provide IT solutions tailored to a specific market and customer needs enabling them to navigate an increasingly complex financial landscape.

SAP Fioneer’s Banking, Insurance and Finance & ESG Platforms are built on SAP’s world-class technology to deliver end-to-end solutions for the financial industry that are pre-integrated, ready to run and seamlessly integrated with existing applications. Packaged solutions, known as ‘editions’, will form an integral part of the platform offering and feature flexible and scalable ‘out-of-the-box’ solutions tailor-made for specific verticals and customer needs. At the same time, customers can ‘co-innovate’ by being able to customize and design solutions in partnership with SAP Fioneer.

The announcement was made today at the SAP & SAP Fioneer Financial Services Forum in Amsterdam by SAP Fioneer CEO Dirk Kruse. The debut flagship event takes place just over ten months after the launch of SAP Fioneer, a financial services carve-out from global tech leader SAP. The conference features a host of organizations across the banking and insurance sectors including The Bank of London, Munich Re and Standard Chartered, with experts from both SAP and SAP Fioneer joined by bestselling author, start-up founder and radio host Brett King for the day’s keynote.

Dirk Kruse, CEO at SAP Fioneer, said: “Many financial services organizations across banking and insurance are navigating significant challenges – from regulatory change to rapid digitalization – and it has never been more important for them to keep pace. The launch of our platform strategy reinforces our capability to offer stability and resilience through rock-solid, world-class financial technology, and at the same time be agile to developments with a host of scalable, configurable and open core solutions. By putting the customer experience first, our vertical approach enables them to stay ahead of the curve. Our unrivalled product portfolio, coupled with SAP Fioneer’s expertise, offers customers the breadth and depth they need to achieve their ambitions.”

SAP Fioneer products such as ‘Cloud for Banking’ (C4B), used by leading banking and paytech organizations including The Bank of London and COMO are part of the verticalized product portfolio and are available as part of the platform editions.

Both SAP and SAP Fioneer have made a united, long-term commitment to the development of their entire product range, strengthening the technology that forms the building blocks of the platform editions.

Related News

- 05:00 am

Europe’s leading open banking platform, Tink, has announced a significant upgrade to its payment stack with the launch of settlement accounts, a new feature that aggregates PIS settlement. Starting in the UK with a wider European roll-out to follow in the coming months, this launch enables real-time payment confirmation, instant refunds and payouts, integrated reporting, and more.

This means that in addition to being able to benefit from Tink’s Payment Initiation Service (PIS) technology – which already delivers secure, cost-effective and frictionless instant bank payments – merchants can now also benefit from full-stack payments offering that enables fully automated refunds, payouts, and reconciliation*.

For merchants, settlement times can be slow, taking up to four days in some cases. Fraud rates are an ongoing concern, high fees and operational costs are associated with many payment methods, alongside friction at the checkout. Tink’s new payments stack addresses these pain points directly. Merchants can now accept low-cost bank payments with integrated, real-time settlement and reporting – meaning you can send and receive money online faster while simplifying payment operations. Tink’s platform can accelerate merchants’ time-to-market since there’s no need for merchants to build and operate their own settlement or reconciliation systems, and manual processes for issuing refunds and payouts can be fully automated.

The first customer to use Tink’s settlement accounts feature in the UK is instant purchase crypto exchange, Solidi. Solidi already lets users start investing in crypto in less than two minutes, and by partnering with Tink, Solidi can take advantage of the core benefits of open banking payments – low transaction fees and reduced operational overheads – while continuing to offer instant account top-ups. Solidi can also cut out the manual work of reconciliation and troubleshooting user errors since payment details are pre-populated.

Tom Pope, Head of Payments and Platforms at Tink said: “The arrival of settlement accounts in the UK means that our partners can now enjoy the full-time and cost-saving benefits of real-time bank payments more easily. We already enabled instant, seamless pay-ins that reduce friction for the end-user, and now we’re removing friction for merchants with the ability to receive a real-time payment confirmation and automate manual processes like issuing refunds and payouts or reconciling payments. This has the potential to be a game-changer for merchants by unlocking the full value of open banking payments for key use cases like e-commerce and crypto. We are proud to partner with Solidi as our first settlement account customer in the UK.”

Jamie McNaught, CEO and co-founder of Solidi added: “Providing Solidi customers with a completely seamless experience when investing in crypto is key. Tink's open banking payments technology is the obvious choice for our customers – it takes our already instant onboarding experience and adds easy, frictionless payments – enabling anyone to invest in their first crypto in less than two minutes. For Solidi, Tink’s new settlement features reduce integration and operational costs, as well as the time to market. Unlike other open banking platforms, Tink enables us to perform payment initiation and settlement using a single API – rather than multiple APIs from different providers."

Related News

- 04:00 am

Axerve, Payment Partner to Grow, specialising in creating accessible and frictionless payment solutions for E-commerce and physical sales, today announces that it will expand its existing proprietary Ecommerce tokenization offering to include the Network Tokens recently provided by circuits such as Visa and Mastercard and welcomes Chili, an international tech media and video on demand (VoD) firm, as one of the first companies to be activated on Network tokenization.

The enhanced solution will subsequently be rolled out with Axerve customers Aruba and Twinset in the near future.

Tokenization has a positive impact on the security and shopping experience offered to customers in E-commerce transactions. Tokenization allows merchants to retain payment credentials without having to obtain a full Payment Card Industry Data Security Standard (PCI DSS) certification. This means that by leveraging tokenization, merchants and retailers can store tokens in order to complete future payment transactions. This is particularly relevant for one-click payments and MIT payments (Merchant Initiated Transactions), where payment is initiated by the merchant without the real-time presence of the buyer, such as automatic billing.

While PCI DSS security standards, established in 2004 by circuits such as Visa and Mastercard, have helped secure credit and debit card transactions against data theft and fraud, merchants have to safely store sensitive card data during transactions and for recurring payments. Tokenization can be the solution to this problem by maintaining security benefits via the numeric or alphanumeric tokenization of card data, streamlining the process for the merchant.

There are two categories of tokens: those offered directly by the payment service provider (PSP) and ‘Network Tokens’ introduced more recently by circuits such as Visa and Mastercard. As a PSP, Axerve has offered a private solution for tokenization since 2012. This solution shifts the compliance obligations coming from card privacy rules away from the merchant and onto Axerve, which stores card PAN (Primary Account Number) data and gives the merchant a token. This token is then stored by the merchant for each new transaction performed on that card, allowing the end customer to experience a seamless payment process without privacy compliance costs unduly falling on the merchant.

The newer Network Tokens confer additional benefits to PSP tokenization as they can contribute to a further increase in successful authentication and authorisation rates. The ability to recognise more legitimate repeat customers is proven to lift conversion rates by 2.2% on average(Source: Visa). Moreover, Network Tokens can combat payment friction that emerges over the lifecycle of a card, such as at the point of card expiry or card loss and replacement. Network Tokens automatically update tokens in line with the data of the underlying card, without the need to involve the buyer.

Tokens are becoming increasingly important tools in an increasingly complex, global and competitive E-commerce context. MarketsandMarkets estimates that the global tokenization market will grow from USD 2.3 billion as of 2021 to USD 5.6 billion by 2026, at a CAGR of 19.0% during the forecast period (Source: MarketsandMarkets). Axerve’s inclusion of tokens and Network Tokens increases authentication and authorisation rates for its customers’ E-commerce transactions. For instance, Visa transaction data shows that tokens can reduce fraud by 26% compared to traditional online card transactions (Source: TechCrunch). According to leading circuit networks’ data, the increase of the transactions approval rate was between +2.5% and +6% in February 2022.

Axerve is a part of the European fintech Fabrick’s open finance ecosystem, and, beyond this, the Company supports a diverse mix of institutions, international corporations, and retail chains by offering innovative technology and data security across global payment methods.

Alessandro Bocca, CEO of Axerve, commented: “Tokens are now more important than ever in the E-commerce environment. They have the twin benefits of improved user experience and safety, the latter in turn supports increased authorisation rates. Axerve’s inclusion of tokens and Network Tokens can contribute to a further increase in authentication and payment approval rates, as they have been developed according to international standard principles.

Network Tokens are well placed to withstand card lifecycle events such as expired or defrauded cards, which to date have interfered with straightforward payments and caused friction.

We are delighted to provide our customers with tokenization tools to create seamless experiences for end-consumers, who are freed from the need to enter the card details again from the second purchase onwards, while also effectively protecting their customer data from being compromised.”

Giorgio Tacchia, founder and CEO of CHILI, said: “Payments with fewer barriers result in higher conversion rates for our billing and also create happier customers who don’t have to face undue hassle at checkout.

Tokens remove a layer of complexity from our day-to-day operations and make our customer payments friction-free, meaning we at Chili can focus on our core business.”