Published

- 08:00 am

ATRAM Trust Corporation (ATRAM), the largest independent asset and wealth manager in the Philippines, today announced that it has signed a strategic partnership with additiv, a leading global wealthtech platform provider.

The strategic partnership will enable ATRAM to modernize and digitize its wealth management solutions to meet the growing need for intelligent and intuitive investment services. ATRAM’s new digital wealth management platform will utilize additiv’s award-winning orchestration engine, DFS®, which enables financial service providers like ATRAM to launch smart, engaging, and highly personalized wealth and investment services.

Scheduled to be launched in the 2nd half of this year, the fully digitized solution will offer ATRAM’s high net worth (HNW) customers easy and efficient access to innovative advisory services supported by ATRAM relationship managers, facilitating a seamless client-advisor collaboration. Additionally, it offers access to a range of tools including the ability to set up personal wealth goals and to determine bespoke scenarios to ensure optimum investment decisions, all while minimizing investment risk. Furthermore, the digital platform allows ATRAM institutional and corporate customers to digitally access and transact on ATRAM’s suite of investment products, all while having an instant 360 view of the investments. ATRAM also plans to make a sandbox available to its partners that will allow the development and integration of innovative products. The sandbox will utilise ATRAM’s market-leading infrastructure based on additiv’s DFS® platform.

Deanno Basas, President & Managing Director at ATRAM Trust Corporation said “To maintain our position as the leading independent asset manager, it is essential to be ready for the digital economy. By partnering with additiv, with its highly intuitive and engaging wealth platform, we can truly fulfil the needs of our relationship managers, customers as well as distribution partners, enhancing growth through focused digital financial solutions, and achieving wealth inclusion in the Philippines market.”

Pieter Zylstra, General Manager APAC at additiv said ''Our platform enables ATRAM to exceed the Philippines’ need for a fully digital wealth management service and to become the market leader in the emerging Wealth-Management-as-a-Service (WmaaS) industry. Delivered in the Microsoft Azure cloud, through a SaaS model, these end-to-end financial services can now be offered in the most cost-efficient way.”

Michael Stemmle, CEO and Founder of additiv added “Partnering with ATRAM to support their Wealth-Management-as-a-Service (WmaaS) strategy allows the true benefit of additiv’s DFS® platform to be realized at scale. Additionally, with our fast-growing Asian operational team, we are ideally suited to deliver according to regional needs.”

Over the last years, the Philippines wealth management market has seen a growth of more than 10% per year. The country is heading toward a very large middle class, and the mass affluent segment is rising. The next-generation clients are embracing technology, and this is hastened by the pandemic. In short, a holistic and digitized structured approach to wealth planning and investments will help to further boost the market.

Related News

- 06:00 am

European branded payments company Recharge.com today announced the appointment of Martine Tiemersma as Chief of Staff. Reporting directly to the CEO, Martine will be an instrumental member of the senior team, driving organisational effectiveness and company-wide alignment as the firm enters the next phase of growth.

Martine has worked at Recharge for five years in various positions. She started when the company had only 25 people and helped to transform the company into a global fintech brand with millions of users.

As Chief of Staff, Martine will be in charge of leading critical company-sponsored cross-functional initiatives like setting up and opening regional outposts, including Recharge’s office in Lisbon, Portugal, which is home to the company’s new tech development hub. In addition, she will drive organisational effectiveness and company-wide alignment by managing and scaling the tools and mechanisms to support strategy execution and innovation.

Commenting on the strategic hire, Günther Vogelpoel, CEO of Recharge said: “Our high growth strategy is driven by complex product, technology and commercial development challenges. This requires clarity of objectives and a structured approach to effective execution. This becomes even more complex in a continuous growing and changing organisation. In this environment, Martine’s position as Chief of Staff will be vitally important, as she will be making sure that the whole organisation can execute as best as possible on achieving the company’s strategic objectives.”

Recharge.com is the European leader in online consumer-branded payments. Operating in over 150 markets around the world the company processes millions of online transactions annually connecting customers with leading global brands.

Martine said: “I am delighted to take on this role and to play a part in helping to transform Recharge into a global player. With the support of my fantastic colleagues I am looking forward to working with them on the next phase of Recharge’s scaling journey during this exciting phase of the company.”

Related News

- 07:00 am

BCB Group has appointed Noah Sharp as Deputy CEO, who will share responsibility with the CEO for the corporate scaling strategy across geographies, client segments, products and licensing. Sharp, a pioneering, international Fintech banker and specialist in banking-as-a-service and embedded payment solutions for crypto exchanges, PSPs and marketplaces, is based in London and reports to Oliver von Landsberg-Sadie, Founder and CEO.

Sharp joins BCB Group’s executive leadership team from Paysafe, where he was Chief Banking Officer, leading the global banking and payments division he created to run the rails on which Paysafe's $100bn+ annual payment volume was processed. His teams were responsible for global financial partnerships and operations across international and digital banking, alternative payments, crypto, embedded finance, FX and credit/lending, as well as clearing schemes and card networks. This included the management of relationships and strategy involving over a hundred banks and dozens of payment, acquiring and processing partners across the Americas, EMEA and APAC regions.

Before Paysafe he hailed from Standard Chartered Bank as Director of Fintech Banking & Advisory, where he was responsible for building and advising the bank’s Fintech client franchise in Europe and North America in order to market its emerging market footprint whilst also improving the governance framework for the sector.

Prior to this, Sharp spent 11 years at Deutsche Bank, where he was a corporate banker covering global relationships for European and US-headquartered Fintechs, card schemes, insurance companies and other non-bank financial institutions. He also spent time in Deutsche’s transaction banking and COO divisions with several roles in international locations, including India and the US.

Oliver von Landsberg-Sadie commented: “Our scaling journey on home turf has been fuelled in part by an outstanding product-market fit, where the platform we’ve built has been met with incredible demand from the high-growth crypto industry. We have appointed Noah at a time where the international scaling of the business needs a seasoned expert with an extensive track record in banking and payments, and I’m honoured to have Noah support my vision in such a powerful way.”

Noah Sharp added: “BCB Group has established itself as the leading crypto banking and payments company, and I’m enthused about applying my experience to drive the company’s growth as we expand upon and execute our vision. Joining a high-growth, mission-driven company is exciting, and I look forward to working with BCB’s talented founders and teams to ensure the achievement of our operational and strategic goals.”

Related News

- 05:00 am

Ugam, a Merkle company and a global leader in analytics and technology, today announced its brand migration to Merkle. This brand migration is part of the integration plan following Ugam’s acquisition by Merkle in July 2019.

Part of dentsu’s $10 bn global network, Merkle is a leading customer experience management (CXM) company. The company’s heritage in data, technology, and analytics forms the foundation for its unmatched skills in understanding consumer insights that drive hyper-personalized marketing strategies. Its combined strengths in consulting, creative, media, analytics, data, identity, CX/commerce, technology, and loyalty & promotions drive improved marketing results and competitive advantage.

Ugam is a leading analytics and technology services company which consistently delivers superior, impactful results for large corporations through its customer-centric approach. With 22 years of analytics and technology experience, Ugam will help Merkle grow and build a globally scaled, highly skilled talent pool from India. Over the next months, the brand migration will reflect across Ugam’s website and social media handles and will be communicated to all stakeholders.

Sunil Mirani, the CEO and Co-Founder of Ugam said. “I’m proud of Ugam’s achievements in the past 22 years. We’ve experienced year-on-year growth, driven impact for our long-tenured clients and strategic partners, grown into a family of 4,000+, and been recognized as a Great Place to Work. We’ve pushed boundaries to drive meaningful impact in the society too. I’m excited about this brand migration as we will be part of a global leading company with similar values and culture.”

The integration with Merkle will provide Ugam access to leadership opportunities, global mobility, and best-in-class learning and development programs. Ugam’s existing talent will also enjoy an enhanced employee experience and get to contribute to and shape a great work culture. Even as the Ugam brand retires, the significant opportunities presented by Merkle will continue to provide talent a platform for accelerated career growth.

Related News

- 01:00 am

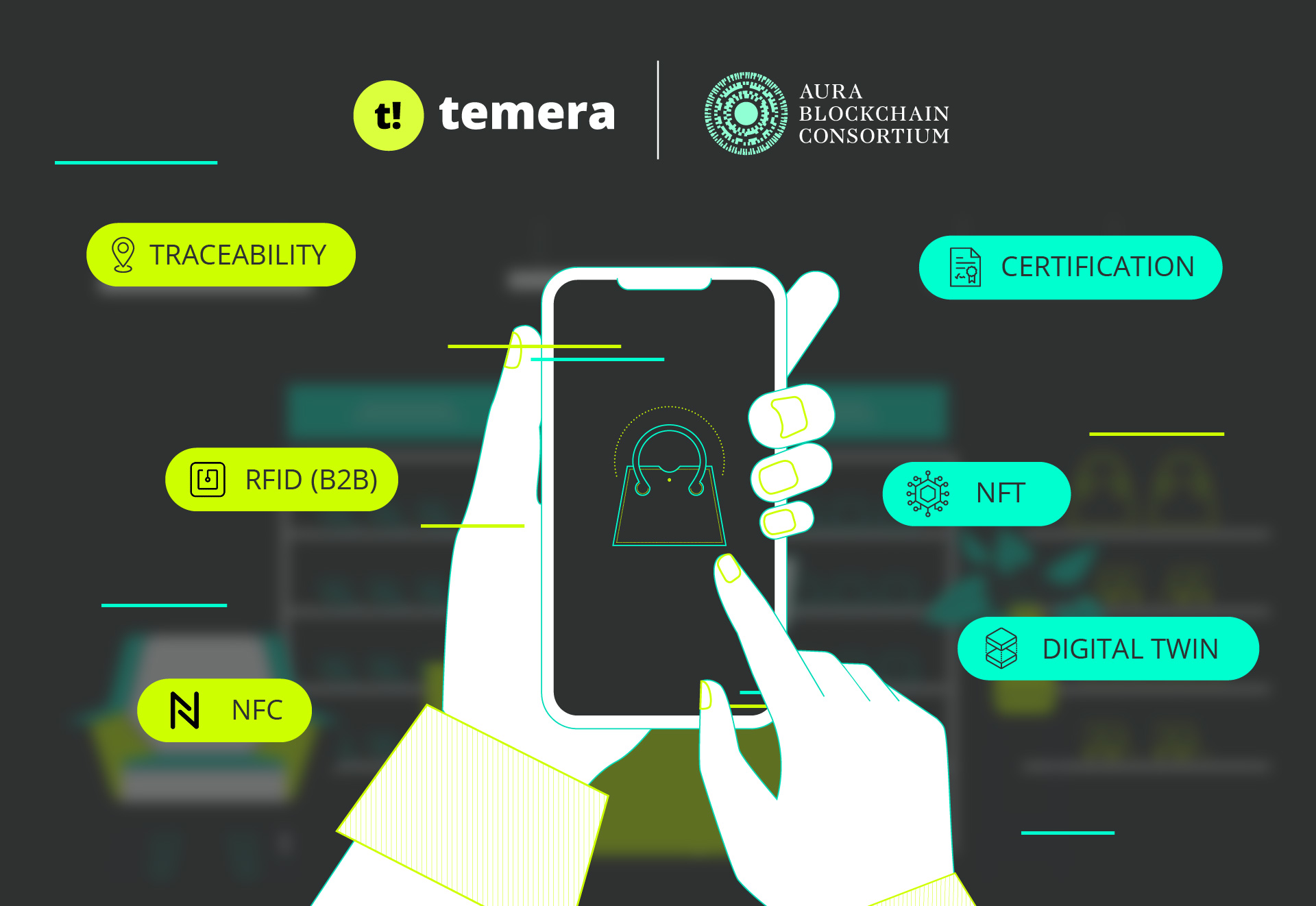

Aura Blockchain Consortium and Temera are once again at the forefront of tech solution development for the luxury market, to support greater transparency and traceability for customers.

Temera brings its solid expertise in product traceability and acts as a business integrator and solution provider – by using its proprietary platform Stylewhere and the RFID and NFC technology - in the development of innovative projects to drive change in the industry.

Aura Blockchain Consortium enables and supports participating members to tag their products with secure, unique blockchain-based identities that can track a product’s manufacture and supply from raw materials through to end consumers. With their Aura SaaS offering, member brands can quickly and easily onboard, maximizing value, and focusing on the customer journey and digital innovation. This allows for both upstream and downstream traceability in the supply chain for consumers – making it one of the best direct-to-consumer offerings in the market and giving full transparency to the customers.

An ambitious objective that best exemplifies the potential of the collaboration between Aura Blockchain Consortium and Temera in contributing to raising the standards in the luxury industry. Once again, an innovative process puts the customer at the centre and aims to increase trust between consumer and brand.

"As Temera's Chief Marketing Officer, I am really pleased to be working with Aura Blockchain Consortium to offer brands a first-rate traceability and certification solution, orchestrated by two key companies for the Fashion Luxury sector. The expertise and professionalism of Aura Blockchain Consortium Founding Members, some of whom we have been collaborating for years, combined with our desire to increasingly innovate and enrich all stages of traceability along the supply chain, find in this partnership a service that will become fundamental for consumers and therefore for brands in the coming years: full transparency of the product life cycle. Let's rock together!” Guido Mengoni, CMO Temera.

“We are thrilled to be working with Temera to make a vital contribution to raising the standards in the luxury industry. Our respective solutions such as Aura SaaS and Temera’s NFC and RFID solutions tackle the important issues such as product traceability, authentication and providing full transparency throughout the entire supply chain. We are enthusiastic about this collaboration as our customers will benefit from it through an enhanced customer journey.” says Daniela Ott, General Secretary of Aura Blockchain Consortium.

Related News

- 05:00 am

British Business Investments, a wholly-owned commercial subsidiary of the British Business Bank, today announces a commitment of up to €25 million to Wilshire’s European Venture Capital Fund II through its Managed Funds Programme. This will be Wilshire’s second European venture capital fund of funds and will target venture capital managers that are based primarily in the UK and Germany and that invest in technology companies.

British Business Investments’ Managed Funds Programme seeks to draw more institutional capital into the UK’s venture and growth capital markets and increase access to longer-term patient capital for ambitious and innovative companies with high growth potential. The programme expects to generate a commercial rate of return and will build a diversified portfolio of underlying fund and company investments, which will be selected and managed by experienced alternative asset managers.

Alongside the commitment to Wilshire’s Fund II, British Business Investments has also committed to a co-investment mandate of up to an additional £21m (€25m). The co-investment strategy will make additional capital available for high-growth, UK-headquartered Stage B+ companies. This co-investment mandate will help fill gaps in the market and further support promising UK businesses, unlocking the capital they need to grow and compete globally.

Judith Hartley, CEO, British Business Investments, said: “Wilshire’s second fund of funds brings additional expertise to the UK venture capital ecosystem. It will also increase access to patient capital for innovative UK businesses seeking to scale-up and compete on the global stage. By committing to Wilshire and the co-investment mandate, we are supporting fast-growing technology companies, while doubling down our support for the most successful UK headquartered businesses.”

Björn Waltmans, Managing Director, Wilshire, said: “We are honoured to work together with British Business Investments to support the UK venture capital ecosystem. With our longstanding track record investing in the UK, we are well equipped to support the thriving UK technology sector with capital and advice across all venture capital stages.”

British Business Investments aims to increase the supply and diversity of finance for smaller businesses across the UK by boosting the investment capacity of a range of finance providers. Since it was established in 2014, British Business Investments has committed more than £3.0bn to providers of finance to UK smaller businesses.

Related News

- 06:00 am

GoCardless, the global leader in direct bank payments has today announced at Xerocon London it has partnered with Xero, the global small business platform, to provide its Instant Bank Pay feature to Xero’s customers in the UK.

Instant Bank Pay is a new open banking feature directly integrated into the GoCardless global payment platform. With Instant Bank Pay, Xero users can receive one-off bank-to-bank payments from new and existing customers while still reaping the benefits of Direct Debit for their recurring payments.

Instant Bank Pay supports all businesses, including those with recurring revenue models. According to GoCardless research, 85 per cent of recurring revenue businesses have a need for collecting one-off payments, such as a supplementary fee during tax season.

Using Instant Bank Pay, Xero customers can accept one-off account-to-account payments and benefit from instant confirmation with payment authorisation completed in seconds. They will also enjoy fast, one-day settlement and access to recurring and instant one-off payments through one provider.

Duncan Barrigan, Chief Product Officer and Chief Growth Officer at GoCardless, said: “It’s been a pleasure to work hand-in-hand with Xero over the past six years, and we’re strongly aligned in our mission to help small businesses take the pain out of getting paid. This integration is the first step to offering Xero’s customers in the UK access to the next era of bank payments through Instant Bank Pay, making their payments faster, cheaper and easier.”

Leigh O’Neill, EGM, Global Financial Services at Xero said: “One of the biggest challenges for small businesses is the time it takes to generate and issue invoices and then chase payments using multiple systems. We recognise that integrated online payments are not only making a huge difference when it comes to saving time but also in helping businesses look professional and credible by providing multiple payment options for different types of customer needs. The GoCardless Instant Bank Pay feature is another way Xero is making it easier for businesses to seamlessly collect payments from their customers.”

Merchants can add the Instant Bank Pay option straight into their checkout flow or simply send a payment request with a link to pay. Similar to a mobile wallet payment, customers are seamlessly connected to their bank and can authorise payment directly from their bank account in just a few clicks.

The Xero Instant Bank Pay integration is the latest milestone in GoCardless’ journey to accelerate its open banking strategy. Since April 2021, the company has introduced two open banking-powered features, Instant Bank Pay and Verified Mandates, which combine open banking account information services with a direct debit to prevent fraud, across the US, UK and Germany.

The GoCardless Instant Bank Pay feature will soon be available to Xero UK customers.

Related News

- 04:00 am

Ondato, a technology company that streamlines KYC (Know Your Customer) and AML (Anti-Money Laundering) processes, today announces the launch of Ondato Risk Scoring, an automated tool for companies to identify and manage customer-associated risk better and faster during onboarding. The new tool reduces high acceptance and rejection error rates associated with manual AML customer risk assessment processes.

Ondato Risk Scoring delivers an advisory risk assessment that gives financial institutions a significantly better understanding of their AML risk exposure across their customer portfolio. It shows each customer's risk score, enabling companies to make informed decisions about how to manage that risk and what additional actions to take to minimise the risk. The solution is fully integrated into the Ondato OS platform, which covers the entire customer onboarding cycle, creating risk-based management of new and existing customers.

When onboarding new customers, banks and non-bank financial institutions currently face a significant challenge in knowing when to accept applications and when to reject them. Accepting customers who later turn out to be fraudulent or infringe AML regulations — false positives — risks compliance failure and reputational damage. Eliminating false positives with stringent monitoring of customer accounts runs the opposite risk of false negatives and can lead to unnecessary account closures and a backlog of appeals.

Institutions are struggling to achieve a satisfactory balance in AML risk management processes. One major cause of these difficulties is that current AML decision-making is often inaccurate and even irrelevant. It tends to rely heavily on human input and defensive box-ticking approaches to risk and is frequently not integrated into wider business processes.

As a result, customer complaints about inaccurate and heavy-handed onboarding are widespread. In 2020, Resolver, a UK-based online complaints resolution service, said it had received more than 8,100 customer complaints over the previous three years against the four main digital banks: Monzo, Revolut, Starling and Pockit.

Liudas Kanapienis, CEO and co-founder of Ondato, says: “Part of the challenge preventing better AML compliance is that the majority of current risk assessment and risk management tools are still based on spreadsheets, such as Excel, or static reporting platforms. As a result, they do not allow data to be analysed in one place and at a scale large enough to cope with the demands of growing companies or established institutions. Ondato Risk Scoring eliminates the need for spreadsheets, automates the risk assessment process, and generates a more fine-grained picture of risks.”

Before Ondato OS, institutions tended to have separate tools for each client onboarding step, making it complicated to manage and integrate a holistic KYC cycle and risk assessment. The platform provides enhanced process automation for greater efficiency and lower operating costs, minimising the risk of interventions and fines from regulatory authorities.

Related News

- 09:00 am

Fraud prevention expert, SEON has helped B2B buy now, pay later (BNPL) business, Biller, reduce fraudulent transactions by 87% across its platform, while decreasing the company’s manual review times by 93% with its powerful fraud-fighting solution.

Few sectors have experienced the same growth rates as BNPL in recent years. Between 2020 to 2021, the user base for BNPL services grew by 85%, with regions such as Australia, Europe and North America leading the way in terms of adoption. However, until recently, the same form of the system was not available for businesses in the B2B space. Thankfully, B2B BNPL pioneer, Biller, now offers a solution to fix this challenge.

By offering a modern take on finance for B2B businesses, Biller enables companies to get paid sooner, accelerates the supply chain, and optimizes cashflows. However, until recently, the company’s solution was somewhat vulnerable to synthetic identity fraud and account takeover attacks, two forms of fraud that plague the broader BNPL sector. Fortunately, the company is now leveraging SEON’s powerful fraud-fighting tool to overcome the challenges.

Following the deployment of SEON’s powerful solution, Biller was able to dramatically reduce fraudulent transactions across its platform by 87%. Additionally, the provider also cut its manual review times by 93%. In practice, SEON’s fraud-fighting solution has helped the B2B BPNL company to cut lending decisions from 4 days to 10 seconds. What’s more, the solution was onboarded by Biller 70% quicker than previous fraud prevention systems.

In addition to these dramatic fraud reduction rates, and the decrease in manual review times, SEON’s powerful solution provides Biller with invaluable extra data points, which are helping the company to make more accurate decisions at the billing stage. What’s more, SEON’s data enrichment solution, which leverages alternative data based on email, phone, IP, or device information has helped Biller to further refine its credit scoring system.

Thanks to SEON’s innovative solution, Biller is now able to instantly filter out potential fraudsters from its platform. In addition, SEON’s data enrichment solution is helping the company to ensure that users using the platform are financially viable prior to a credit decision being finalized. Because of the new partnership, Biller is now able to offer a truly frictionless credit check process, which in turn, greatly improves the company’s user journey.

Speaking on the new partnership, Coert Snyman, Senior Analyst at Biller commented: “Soon, 85% of all e-commerce B2B transactions will be online. There’s a huge shift in how payments are made - but until Biller was started, it seemed like nobody had managed to bring B2B payments into the 21st century. As a BNPL company, we’re the ones eating up the risk, so we must be smart about how we mitigate fraud and manage credit lending.

In the past, that meant a lengthy assessment process, which could take up to four days. We were looking at another provider, but they came back to us with a four-to-six-month integration process. With SEON, it was literally a phone call, followed by sandbox tests on the following Monday. Then, by the end of the week, it was done. They’re clearly an organization that approaches work and customers in a different way than most.

That modern approach extends to the company’s pricing model, which is perfect for companies who want to scale together. In fact, the SEON model, it’s now one we actively look for with our other partners.”

Speaking on the new agreement, Jimmy Fong, Chief Commercial Officer at SEON commented: “We’re delighted to be working with Biller, a true innovator in the B2B BNPL space. Primarily, the company connected with us to help reduce fraudulent activity on its platform, but our solution has quickly demonstrated the added value it can deliver for businesses in this nascent, but emerging field.”

Related News

- 09:00 am

OPEN, the world’s fastest-growing digital banking enterprise on Tuesday received a go-ahead from the Reserve Bank of India (RBI) for its new cross-border payments product. This comes after OPEN completed the test phase of the second cohort under the RBI’s regulatory sandbox structure themed ‘Cross Border Payments’.

RBI in its statement described OPEN’s product as a blockchain-based cross-border payment system, leveraging the current infrastructure and ensuring frictionless and tamperproof monitoring capabilities.

Commenting on this achievement, Anish Achuthan, Co-founder & CEO, Open Financial Technologies, said, “We were grateful to be selected for the second cohort of the RBI regulatory sandbox and the team at RBI has been really supportive in helping us successfully complete the trial. We now look forward to scaling the solution by working closely with banks to offer a suite of products for cross-border payments and trade finance which will benefit millions of SMEs in India. We also plan to offer this solution to Financial Institutions globally through our enterprise banking offering- BankingStack”

In September 2021, 8 entities were shortlisted for the second round of testing. As of today, OPEN is one of the 4 entities that have completed the testing phase of RBI’s regulatory sandbox.

Founded in 2017, OPEN offers a neo-banking platform that brings together all the tools used by small businesses and integrates them with the business's current account. OPEN also launched Zwitch which is Asia’s first end-to-end embedded finance platform that enables fintechs and non-fintechs to launch their own digital banking services and BankingStack which is a cloud-native financial OS that enables banks and financial institutions to launch fintech-like digital banking solutions in a matter of weeks.