Published

Steve Flynn

Sales and Marketing Director at ESET Southern Africa

Despite the significant risks, SMEs seem reluctant to take the same digital preventative measures to secure their IT infrastructure as they would to protect their offic see more

- 07:00 am

AxeTrading, the award-winning global fixed income trading software company, has extended its Fixed Income products’ offering to support non-standard Interest Rate Swaps. This allows Raiffeisen Bank International (RBI) to respond quickly to complex inquiries in a competitive market environment and gain electronic market share.

The actively traded instrument in the Fixed Income space, Interest Rate Swaps, add significant value to investors and dealers alike. The flexible ticket types provide all the information required by dealers to seamlessly handle customer inquiries. RBI developed its own pricing library for the calculation of non-standard swaps, which effortlessly connects to AxeTrader and boosts quoting confidence for their traders.

Crucially, this feature can also be fully integrated into AxeTrading’s existing products across the globe, no matter the region or currency. Its introduction will therefore reduce administrative workload and drain by enabling all Fixed Income workflows to be handled from one application. Traders can connect to Tradeweb and Bloomberg from one market-making platform.

Coming only two months after AxeTrading announced the appointment of a new CEO, Greville Lucking, this introduction of non-standard Interest Rate Swaps signals the company’s new direction and desire to cater and respond to client feedback and industry demands.

Greville Lucking, CEO, AxeTrading: “We worked closely with several customers to implement this product feature and are delighted with the result – an expanded product suite that is already proving its worth within a highly competitive market. Working with an institution with the reputation of RBI has brought real credibility to AxeTrading’s offering and we look forward to working with them to continue to deliver the efficiencies and solutions that AxeTrading provides”.”

Harald Müller, Head of Group Capital Markets Trading & Institutional Sales at RBI:

“We are running a client-centric trading and sales business and are striving to always improve our product offering as well as our competitiveness from a pricing and response time perspective.

Therefore, we are glad that by integrating our in-house developed pricing library into our existing Quoting and Execution Management System (QEMS) from AxeTrading, we can now offer broken date interest swaps on electronic platforms.

Through this approach, we have (i) reached the highest level of flexibility and efficiency for our pricing methodologies and (ii) reduced manual workflows for traders drastically"

Related News

- 06:00 am

Deutsche Bank and Traydstream have been working together since July 2021 with a detailed pilot of the Traydstream automated trade document checking platform. Both parties have now announced a further commitment for a deep dive into the bank’s trade operations as well as integration of Traydstream’s AI tools. The parties have agreed to integrate the Traydstream platform into the Deutsche Bank environment and intend to subsequently roll out the platform globally.

Claudia Hussy, Trade Finance Product & Process Management at Deutsche Bank, says: “Traydstream’s extensive trade expertise and technical knowledge will enhance our Trade Finance offering to improve the processes for our global documentary trade business. It brings our client service to the next level and is a further endorsement for automated document checks as a key enabler for the digitisation of documentary trade products.”

Traydstream has recently launched the 2.0 version of its platform, with enhanced speed and accuracy of its data extraction and classification models, and integrated third-party providers for compliance checks. The 2.0 platform further augments all workability checks, across all available documents, including underlying letters of credit, in accordance with global trade rules (Uniform Customs & Practice for Documentary Credits and International Standard Banking Practice).

Another update to the 2.0 platform includes a cloud-native architecture as well as a new user interface that utilises all the learnings from documents the system has processed over the past twelve months.

“The entire team at Deutsche Bank, from Business to Operations and Technology, have been clear on the value add that they are looking for. Traydstream is excited to work with Deutsche Bank - the leading Trade Finance bank in Europe – on the transformation of their global documentary trade business” said Moshe Wolfson, Traydstream Global Sales & Implementations Head for Europe & the Americas.

Related News

- 01:00 am

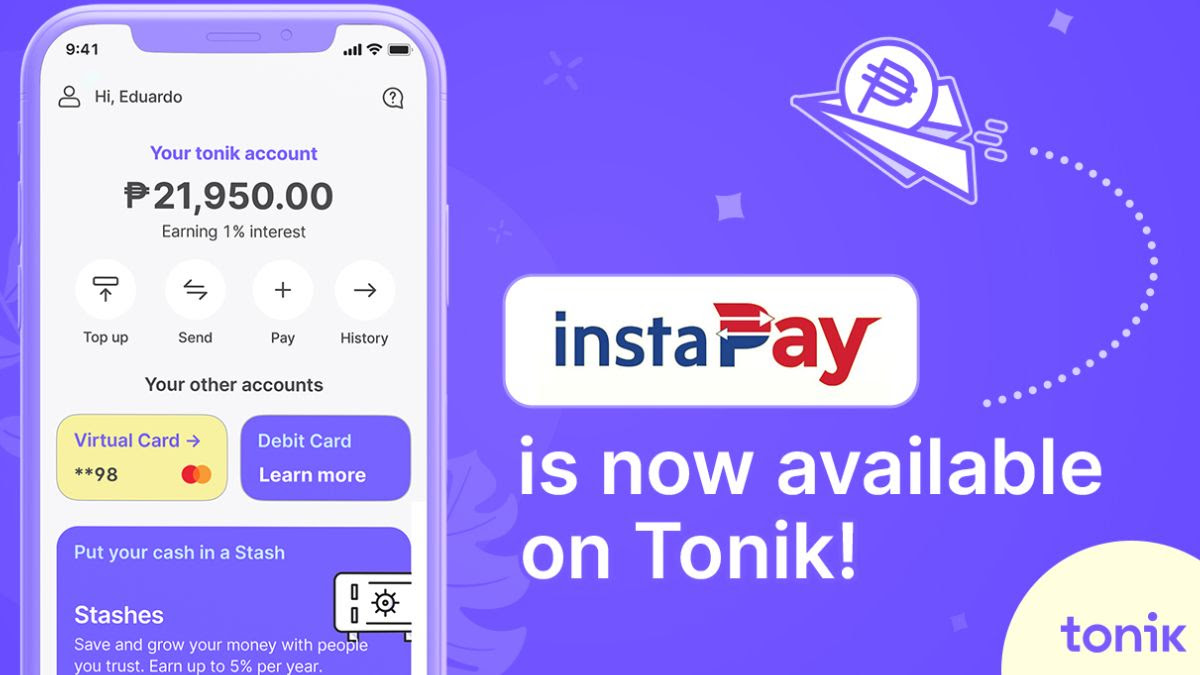

Tonik, the Philippines’ first neobank, continues to make digital banking easy and convenient for Filipinos through the integration of InstaPay services on its mobile app. This makes the neobank the first officially BSP-recognized and licensed digital bank in the country to fully implement InstaPay services.

Customers can now send and receive real-time transactions for up to Php 50,000 to and from participating banks and electronic money issuers with no added transfer fees from Tonik.

To top up a Tonik account, simply go to the “Top Up” options in the app dashboard, choose InstaPay and copy the 14-digit Tonik account number. Once copied, launch the source bank’s mobile app or online banking website, paste the 14-digit Tonik account number and enter the desired amount and other required transaction details. Lastly, perform the required authorization to finalize the transaction.

To transfer funds to another bank, just click on the “Send Money Options'' on the app dashboard and select “To another bank.” Change the channel to InstaPay and input the desired cash-out amount, transfer purpose, beneficiary account details, and perform the required authorization.

This is applicable to all financial institutions with InstaPay in their payments rail and the best part is, that all Tonik InstaPay transfers are free of charge! Other banks, however, may have varied transaction fees for InstaPay top-ups so make sure to check with the source bank to make the most out of the transfers.

“It has always been our mission to make digital banking work for the convenience and ease of Filipinos—and with InstaPay now in our service roster, it’s even easier to transact using our proprietary mobile app. Filipinos work hard for their finances and they deserve to have a bank that works as hard in ensuring they get access to better ways of managing their hard-earned money,” says Tonik Founder and CEO Greg Krasnov.

“This milestone of Tonik provides more opportunities for us to serve the underserved, and together with other financial institutions, the opportunity to serve the unbanked Filipinos who deserve a better banking experience,” adds Krasnov.

To know more about Tonik and how to transfer funds via InstaPay, download the app now via the Apple App Store or Google Play Store.

Tonik is supervised by the Bangko Sentral ng Pilipinas (BSP) and deposits are insured by the Philippine Deposit Insurance Corporation (PDIC) for up to Php 500,000 per depositor. Its unique cloud-based solution is powered by global financial technology leaders such as Mastercard, Amazon Web Services, and Finastra.

Related News

- Product Reviews

- 03.08.2022 10:00 am

What does the product do?

Trust Payments specialise in frictionless payments and value-added services by providing on-demand Payments and Banking-as-a-Service to help businesses grow and scale online, in-store, and mobile. Services and tools such as loyalty management and instant eCommerce combine to create engaging, new and innovative payment methods.

Who needs the product?

Small and medium-sized businesses across the UK, EU, and the US - an industry frequently struggling to deploy digital strategies due to a lack of funding, time and resources.

What is special about the product?

Trust Payments holds the licensing to carry out payments, which means their innovative technology drives value through personalised services, secure and frictionless payments, and creative products. The level of investment Trust Payment has in data, a key area of competitive advantage, means SMEs can deploy digitalisation quickly and easily. Providing SMEs with the ability to combine payments with another experience, for example, a shopping cart or alternative payments for contactless, offers brands a personalised entry into the US, EU and UK markets.

What features are relevant?

SMEs can easily integrate Trust Payments’ systems into existing tech stacks. Trust Payments gives businesses a choice of entry with an advanced stack of APIs and other technology integration points. They have an extensive network of partners giving SMEs access to millions of tools and features.

An example of the key features includes payments-as-a-service (streamlining sales channels with smart payments, crypto and tokenisation online and offline), hassle-free finance and an e-commerce platform to go direct to consumers with AI and SEO channels to amplify reach. Trust Payments provide everything SMEs need to accept payments from customers globally with omnichannel payments and 24/7customer support and a dedicated local account manager.

Who is the competition?

The fintech industry is a saturated marketplace and there are many established and challenger brands offering payment solutions. For our recently launched e-commerce platform Stor, Shopify would be the obvious answer, however, Trust Payments offers a unique selling proposition that maximises the use of partner services, features and tools to layer tech infrastructure in a tailored way that has never been done before.

What are some real case examples?

Trust Payments partnered with Guestline to offer a payment solution to hoteliers for all their payment needs, including payment platform services. In almost 3,000 hoteliers in 25 countries, Trust Payments delivers a unified payments solution to enable global pay-in, pay-out, and customer journey technologies, linking merchant acquiring, e-commerce, and POS devices.

The initiative reduces fraud, chargebacks, manual processes, costs and reporting in a transparent interface. Another benefit is securing revenue for hoteliers by enabling guests to settle their invoices or deposit payments before check-in.

The partnership is revolutionising the customer experience in the hospitality industry by providing an end-to-end solution embedded into Guestline’s systems. Trust Payments are deeply integrated into Guestline connection points, so when customers book online and check into a hotel, all their information is in one simple to access quick and secure place.

Other Product Reviews

- 01:00 am

Federated Innovation @MIND, a public-private collaborative model to foster innovation and Fabrick, a business that promotes Open Finance at an international level, are two businesses that share a common desire to encourage the development of innovative concepts into concrete new products, processes and services that can contribute to economic growth in Italy and Europe while enabling collaboration and synergies between different sectors through the open

platform model.

Federated Innovation @MIND, thanks to a multidisciplinary and cross-sectoral approach, intends to go beyond traditional business innovation by encouraging cooperation between different market players and sectors with a view to fostering Open Innovation. The public-private innovation model created inside @MIND (Milan Innovation District) has identified Fabrick as a leader in fintech and financial services. As a result, Federated Innovation @Mind and Fabrick have partnered to launch “B2B FINTECH FOR FUTURE”. The “B2B Fintech for Future” initiative is a call for standout European startups that are creating disruptive fintech solutions in one of the following B2B areas:

- Billing

- Payments

- Credit

- Prospect and customer data analysis

- Digitisation of the buying/selling process

- SaaS solutions for specific industry verticals (e.g. wellness, hospitality, catering, etc.)

By applying to the “B2B Fintech for Future” challenge via the initiative’s portal, the most promising startups and projects will have the chance to become part of Fabrick's open financial ecosystem. The “B2B Fintech for Future” initiative will enable Fabrick to welcome the best European startups to its Open Finance ecosystem from the pool of successful applicants. This will support Fabrick’s efforts to continue expanding its network with innovative new fintechs in accordance with its founding values of collaboration, openness, and innovation.

Paolo Zaccardi, CEO of Fabrick: "The decision to promote the MIND project stems from our open approach, which sees openness and collaboration as engines of growth and development for the entire financial sector and a great resource for end consumers who have an increasing appetite for innovative and customised products and services. MIND also applies this model to other sectors, making the district an all-around innovation hub. Fabrick is fully convinced of the great value of MIND and we are proud to be in charge of the fintech vertical and to provide know-how and leverage the network of interdisciplinary relationships developed over the years. Milan once again proves to be a place where it is possible to experiment, work and build together. Against this backdrop, we have launched B2B FINTECH FOR FUTURE, the first of many initiatives that will be organised to help the most promising startups to develop and grow rapidly”.

Tommaso Boralevi, President of Federated Innovation @MIND: "The entire Federated Innovation @MIND ecosystem is progressing at a rapid pace and has launched many projects that will make a fundamental contribution to the Italian and European innovation landscape in the coming years. It is in this context that we created B2B FINTECH FOR FUTURE and launched it alongside Fabrick. It is now well known that fintech played a primary role in overcoming the crisis triggered by the pandemic two years ago by enabling many small and medium-sized enterprises to obtain financing in a very short time. Now we need to go a step further and try to bring those same companies’ other tools to simplify internal processes and services: from invoicing to payments, from analysing prospect and customer data to digitising the buying and selling process, and much more. Our call for startups to join B2B FINTECH FOR FUTURE will make it possible to identify many innovative startups that can support SMEs in the transition towards increased digitalisation, and we are proud that it is happening within Federated Innovation @MIND."

Related News

- 04:00 am

The SWIFT Hackathon 2022 continues our innovation mission to work together with experts in the industry to solve the biggest technological puzzles as the digital economy evolves.

We’re looking to harness the brightest minds in the tech world, and those at the forefront of finance, to take part.

Spotlight on digital assets

Following on from our hugely successful hackathon last year, we’re now drilling into the theme of digital assets.

Are you thinking about how new networks of value will be connected to the existing infrastructure of today? Are you concerned about the traceability of ownership of digital assets? Are you currently exploring interoperability between the platforms that process these assets? We’re bringing together experts at the cutting-edge of the latest developments around these questions and giving them a unique platform to share their knowledge.

We expect ideas to fly, thoughts to be challenged, and more than a little disruption…

And we invite you to join. Entry is only open until Friday 12 August, so sign up now to be sure to reserve your team’s place.

About the SWIFT Hackathon theme

Digital assets are a key topic on the innovation agenda, as many leading forces in the industry know.

At SWIFT, we’ve already been experimenting around this topic with major industry players and fintechs, as well as using our expertise to help others.

So it made sense to take it one step further – and collaborate and innovate as an industry. That’s why we’ve made the theme for this year’s SWIFT Hackathon “Digital assets: exploring interoperability and ownership.”

The challenges

These are the challenges we’ll be giving to hackathon teams this year:

Challenge one

Interoperability: how might we achieve interoperability between multiple digital asset platforms to have a scalable, secure, irrevocable exchange of assets against payment?

Challenge two

Ownership: how might we achieve traceability of ownership of digital assets across multiple ledgers on multiple technologies?

Neither of these questions has a simple answer. But by sharing our knowledge and expertise, together we can create solutions. We want you to challenge each other’s views, think beyond the obvious, and expand established industry thinking.

Areas to consider

Challenge one: financial firms want faster transactions and reduced costs. Meanwhile, the introduction of new technologies may well help resolve longstanding interoperability issues.

From a legal responsibility perspective, finality and irrevocability of asset purchase is a key question in traditional asset management.

Participants should address one or more of the following use cases: coin-to-coin, tokenised asset to a single currency, tokenised asset purchase with multi-linking.

Challenge two: for traditional assets, traceability of ownership is an aspect that the industry has been actively trying to improve and gain better control over. Could accelerated creation of digitally-native assets and conversion of existing ones bring new solutions?

Another factor is that digital assets will be expected to be transferred from one ledger to another, and these ledgers use different technologies. Will this lead to even more complexity, or will it force issuers and intermediaries to adopt relevant solutions?

If you’re ready to get going and create solutions to these issues, grab a team and let’s go.

Sharing industry expertise

When you join the hackathon, you’re guaranteed to be in good company. Last year’s participating teams came from leading global financial firms as well as cutting-edge fintech challengers.

The hackathon is an opportunity to delve into key issues affecting your organisation, focus minds, and benefit from the support and expertise of SWIFT.

The solution you develop could not only help your organisation but also future-proof key elements of our industry.

Individually, this is an opportunity to deepen your expertise, and to give yourself time to innovate and explore key issues. It’s also a chance to show the rest of your firm what you can do.

How does the hackathon work?

Each company can submit one team per challenge, with a maximum of 10 participants per team.

One solution per team can be submitted.

The winners will be announced at Sibos and have the chance to show off their solutions.

On top of that, the joy is in taking part, and knowing that your skills have added to some of the biggest challenges the industry is facing right now. Share your insight, and in return, you’ll get ah-ha moments, industry connections and the chance to innovate.

We want to foster this spirit of innovation across the whole industry. Because learning benefits the industry as a whole. And connections are our driving force.

Registrations are open until Friday 12 August with the hackathon commencing on 6 September until 23 September.

Related News

- 03:00 am

Europe financial intermediary and FinTech platform YouHodler bolstered its European occupation by obtaining registration and regulatory approval in Italy. Currently, the company has offices in Switzerland and Cyprus and services various countries in Europe and around the world. Now, it will expand its physical presence once again in Italy.

As of 29th July 2022, YouHodler has been officially registered and approved by the Organismo Agenti e Mediatori (OAM) in Italy as a cryptocurrency service provider. This registration allows YouHodler to offer its wide range of crypto services to Italian clients in compliance with local regulations.

In a statement, YouHodler legal counsel Julian Grech said “we are extremely happy with this registration. It is yet another step in YouHodler’s strategy to extend its presence within Europe. More local licenses and registrations are expected shortly.”

Following the announcement, YouHodler states it will initiate steps towards setting up a physical office space in Milan and recruiting local teammates. This new structure will align with all local operations in accordance with Italian regulations.

Grech added that “we’re pleased to continue servicing our long-time, loyal Italian clients in new and exciting ways. This latest announcement means we can take them to an even higher level, opening new gateways to creative and innovative financial possibilities.”

Related News

- 08:00 am

Relativity, a global legal and compliance technology company, today announced that Breaking Wave, a Deutsche Bank company building a digital future for the bank and its customers, has implemented Relativity's AI-powered communication surveillance product Relativity Trace to advance their compliance and regulatory efforts. Relativity Trace proactively detects regulatory misconduct like insider trading, collusion and other non-compliant behaviour.

With the implementation of Relativity Trace, Breaking Wave will be able to leverage AI capabilities to improve its automated risk detection with a focus on risks such as change of venue, hate and discrimination, and collaborative behaviour. The product’s award-winning, AI-powered data cleansing capabilities will dramatically decrease false positives and improve reviewer accuracy and speed for Breaking Wave. The current AI capabilities coupled with Relativity’s plans to continue to up-level AI solutions for compliance teams were fundamental in Breaking Wave’s decision to adopt Relativity Trace.

Through deploying Relativity Trace, Breaking Wave has access to 50 pre-built policies allowing them to save time and resources by not having to build their own. Each policy leverages advanced lexicons, metadata, and machine learning to pinpoint risk and reduce false-positive alerts. The policies were built by industry experts and honed through testing across real financial service industry corporate communications. The pre-built policies were key to an efficient and easy implementation within two months.

“We are excited that Breaking Wave, an organization focused on innovation in financial services, has implemented Relativity Trace to manage their compliance process and detect potential misconduct before it happens,” said Jordan Domash, General Manager of Relativity Trace. “The solution’s out-of-the-box workflows and policies empowered their teams to save time on manual setup and complete the implementation in just two months. We look forward to seeing how Breaking Wave will continue to take advantage of Relativity’s advanced AI capabilities and apply them to their everyday workflows.”

Designed to receive the latest and greatest technology available, Breaking Wave is a cloud-only data sources customer. Relativity Trace delivered Cloud Connectors that enabled Breaking Wave to deploy the software quickly and without any on-premises infrastructure.

“As an engineering-led company, we are always looking for ways to use technology to automate our processes and implement our controls; Relativity Trace helps us to be compliant with minimal effort,” said Gillian Benge, Chief Operating Officer at Breaking Wave. “We were looking for cutting-edge technology that could use its AI capabilities to remove the noise and provide the relevant information via an intuitive UI – and Relativity Trace delivered against this.”

Related News

- 09:00 am

Global Payments is to acquire smaller rival EVO Payments for nearly $4 billion in an all-cash deal that will extend its reach in the B2B sector.

Headquartered in Atlanta, EVO currently offers merchant acquiring and payments processing services to more than 550,000 merchants in over 50 markets and 150 currencies.

Global Payments is paying a significant premium for the acquisition, which will expand its geographic footprint and also add accounts receivable automation software capabilities that complement its existing B2B and accounts payable offerings.

“The acquisition of EVO is highly complementary to our technology-enabled strategy and provides meaningful opportunities to increase scale in our business globally,” says Cameron Bready, president and chief operating officer, Global Payments. “Together with EVO, we are positioned to deliver an unparalleled suite of distinctive software and payment solutions to our combined 4.5 million merchant locations and more than 1,500 financial institutions worldwide.”

The deal coincides with the offloading of Global Payments' Netspend consumer payments business to Rev Worldwide for $1 billion.

The transaction, which is expected to close no later than the first quarter of 2023, is expected to deliver $125 million of run-rate synergies.