Published

- 09:00 am

Nebeus, the European cryptocurrency app has today announced a partnership with Modulr, the embedded payments platform, to augment its offering with accounts, real-time payments and Visa cards. This move makes Nebeus one of the first European companies to leverage Modulr’s one-stop card issuing solution across the UK and Europe.

Based in Barcelona, Nebeus is the leading European cryptocurrency app and desktop platform which specialises in providing a full crypto ecosystem which allows users to earn rewards on crypto by staking and renting; access exchange and personal wallet; borrow crypto, and; embed crypto for B2B clients. Nebeus, connected to Modulr accounts and embedded payment features like Direct Debit, Faster Payments and SEPA Instant, can now scale operations across Europe and the UK in its bid to become the leading financial app bridging crypto and fiat payments.

The partnership with Modulr will enable Nebeus to issue branded virtual and physical cards – with ‘out of the box’ modern issuing features like card-freezing, real-time spend notifications and spend controls – to their customers across the UK and Europe. This will provide Nebeus’ customers with a payment experience equivalent to that provided by a traditional bank account* but seamless, crypto-enabled, and instant. Modulr is one of few non-banks to hold and settle GBP funds at the Bank of England.

Combined, these payment methods mean Nebeus can offer each customer a dedicated digital account with unique IBANs (EUR) or Sort Codes and Account Numbers (GBP), together with a whole ecosystem of crypto services, and give customers a virtual and physical Visa card to spend fiat. In this way, Nebeus can offer consumers a bridge between crypto and traditional financial services.

Marca Wosoba, Managing Director of Europe at Modulr comments, “We live in an age where we expect payments to be seamless, secure and instant. We’re excited to work with Nebeus and, in particular, for them to be one of our first live customers as we launch our card issuing solution across Europe. It’s a great example of the growth and innovation we can spark when we make money flow more efficiently through European businesses and the economy.

“Establishing and running a card programme across Europe requires multiple partnerships, and the handling of such a complicated partner network requires extensive time and money. This pulls businesses away from their focus: customer experience and revenue growth. The European launch of our card issuing solution replaces these legacy inefficiencies with a proven, full-stack solution.”

Michael Stroev, COO and Head of Product at Nebeus adds, “Our mission is to bridge the gap between crypto and traditional money by providing crypto and fintech services for all needs. Harnessing Modulr’s embedded payments platform, we can build new products and services to achieve our mission and scale at pace. With Modulr’s support, we are one step closer to becoming the leading cryptocurrency app in Europe.”

Related News

- 02:00 am

Forage, a payments processor that makes it easier for grocers to accept SNAP EBT (previously known as “food stamps”) payments online, announced today that it has raised a $22M Series A funding round to accelerate online grocery access for America’s 42 million SNAP EBT recipients. The round was led by fintech specialist firm Nyca with participation from PayPal Ventures, EO Ventures, and prominent angels including Apoorva Mehta, founder of Instacart. Forage will use the funds primarily for product development and accelerate hiring to meet the high demand for the company’s solutions.

Ofek Lavian, co-founder and CEO of Forage, said, “This capital will help accelerate Forage’s mission to democratize access to government benefits. We’re proud of the technology we’ve built and are excited to expand the acceptance of SNAP EBT payments online for low-income Americans.”

One in eight Americans receives government assistance to buy groceries. While more than 250,000 brick & mortar locations accept SNAP benefits via EBT in-store, only a fraction have been approved for online EBT. Many SNAP recipients are homebound, lack transportation, or live in a food desert without easy access to grocery stores; many others want to avoid in-person shopping due to concerns about COVID. While many Americans were able to shift to online grocery shopping during the pandemic, SNAP recipients were not afforded this safety and convenience because they are effectively unable to use their benefits online.

Forage has an in-house team of EBT and payments experts, including former Instacart and Freshop employees. In addition to its stand-alone EBT solution, Forage developed and recently launched the first Shopify app that offers online EBT payment processing to Shopify’s ecosystem of merchants. The company is already working with dozens of well-known grocers to help them accelerate their path to accepting SNAP EBT online.

“Forage is tackling a critical problem for consumers and merchants as more groceries are bought online,” said Tom Brown, Partner at Nyca Partners. “Nyca is excited to back the incredible team on their mission of making it as easy for eligible merchants to accept EBT as any other form of payment.”

Forage provides merchants with support through every step of the USDA approval process, from preparing the required documentation, through system engineering and testing, to deployment, making it as easy as possible for new merchants to accept EBT online, with the goal of opening the online EBT space to more merchants and ultimately more SNAP recipients.

Related News

- 06:00 am

viafintech GmbH, part of the leading specialised payments platform, Paysafe, announces a partnership with Pecunpay to launch a new cash deposit and withdrawal network in Spain. Pecunpay, a brand from e-money institution Pecunia Cards EDE, specialises in innovative e-payment and e-money processing systems. The collaboration enables fintechs who partner with Pecunpay to leverage its core banking system and licences to offer consumers easier access to cash deposit and withdrawal services at numerous supermarket checkouts across Spain.

The new cash-in/cash-out service is now available through Pecunpay’s integration of viacash, powered by Paysafe. Pecunpay’s fintech partners can access viacash as a white-labelled solution and customise the cash deposit and withdrawal service with their own brand, resulting in a consistent customer journey and experience for the end user.

Antonio García Cruz, CEO of Pecunpay, commented on the significance of the new partnership: “Through the launch of this new network, consumers will have much easier access to cash, by being able to use cash withdrawal and deposit services at partnering supermarkets and stores across Spain. This is a vital step in providing services that are focused on the needs of consumers.”

Sergio Kvaternik, General Manager Spain at viafintech, added: “Our partnership with Pecunpay allows us to leverage our joint strengths and align our complementary services. Together we can provide improved access to cash to many more companies and their customers, thanks to our extensive POS network in Spain.”

Related News

- 06:00 am

Shieldpay, the market leader in secure digital payments, has announced the appointment of Chris Andrews as Head of Sales.

Chris will be driving the business forward into the next era of commercial success. In his leadership position, he will be developing the Shieldpay sales strategy and guiding the team to achieve significant growth over the second half of 2022 and into 2023, and beyond.

While there remains a focus on building share in existing markets, Chris will be looking to broaden the scope of Shieldpay’s current client base. The sales team will pursue emerging opportunities to service the complex payments needs of new markets and sectors to make Shieldpay the trusted partner of organisations of all sizes that need safe, reliable and easy-to-use digital payment solutions across their businesses.

Chris has a well-established career as a senior leader at renowned payments companies, such as CyberSource, Mastercard and ACI Worldwide, and now joins Shieldpay from his former role with Payoneer as Regional Enterprise Sales Director, EMEA. With his depth of business development experience in the payments space, Chris will play an integral role in the growth of Shieldpay over the coming months and years.

Chris Andrews, Head of Sales at Shieldpay, commented:

“I’m really excited to join Shieldpay at a pivotal time in our growth trajectory. We’ll be expanding our position in existing markets and accelerating growth into new verticals, whilst building on our direct and indirect channels. I’m looking forward to being part of the next stage of our development.”

Claire Van Der Zant, Revenue Director at Shieldpay, added:

“Chris has a wealth of experience in the payments industry and targeting enterprise customers to drive stellar business growth against revenue targets. I can’t wait to learn more from Chris as we charge forth together and build on what Shieldpay has achieved so far.”

Related News

- 03:00 am

Assetz Capital are delighted to announce a partnership with LexisNexis Risk Solutions to adopt the LexisNexis® RiskNarrative™ platform across its business.

The platform leverages automation, AI and machine learning to provide a market-leading, sophisticated, configurable and accessible financial crime lifecycle management solution. This will allow Assetz Capital to further enhance its KYC and AML detection capabilities, as well as deliver productivity benefits to both customers and businesses.

The RiskNarrative™ platform will improve their onboarding process, allowing their colleagues to run multiple KYC and AML checks from aggregated data sources simultaneously, strengthening checks alongside enhanced fraud detection and document verification capabilities.

Oliver Ward, Group Head of Change & Lending Operations at Assetz Capital, said “Since deploying the platform, we have seen fantastic operational and productivity improvements with reductions in the time taken to complete KYC and AML checks, thereby reducing the time from application to funding, for our customers.”

Edward Vaughan, Banking Expert at LexisNexis Risk Solutions, said “It’s brilliant to see the RiskNarrative platform help organisations of all sizes protect their customers from the effects of financial crime. I am delighted Assetz Capital are one of our customers, and that we can support their onboarding processes, especially when the cost of compliance is at an all-time high. We look forward to future initiatives with them as they deliver an exceptional and frictionless customer experience.”

Related News

- 02:00 am

The Sage Group plc, the leader in accounting, financial, HR and payroll technology for small and mid-sized businesses (SMBs), today announces that it has agreed to acquire Lockstep, a provider of cloud-native technology that automates accounting workflows between companies. The acquisition of Lockstep accelerates Sage’s strategy for growth by broadening its value proposition for SMBs and by expanding Sage’s digital network.

Headquartered in Seattle, Washington (US) and employing over 130 colleagues, Lockstep develops products and services that streamline accounting processes, allowing customers to save time, eliminate human error and improve cash flows. Its solutions include applications to automate accounts receivable and accounts payable workflows, deepening Sage’s capabilities in the office of the CFO, while its API platform expands the ecosystem by enabling third parties to develop connected services. Today the Lockstep platform enables network connections to more than 40 different accounting solutions, and over 26,000 businesses are already part of its ecosystem.

The acquisition is aligned with Sage’s ambition to be the trusted network for SMBs. It accelerates the expansion of Sage’s digital network by enabling and enhancing connections between businesses and their customers and suppliers. As part of the transaction, Lockstep’s highly experienced management team will join Sage to help drive the development of Sage’s digital network.

The acquisition does not affect Sage’s previously communicated financial guidance and is expected to close by the end of September.

Aaron Harris, Chief Technology Officer of Sage, commented:

“The acquisition of Lockstep represents an important milestone in our growth strategy. Its complementary portfolio of products, resources, and know-how accelerates our ambition to be the trusted network for SMBs. Working together we will continue to knock down the barriers that limit CFOs and accounting teams by streamlining their workflows, improving productivity and efficiency, and enabling them to focus on more valuable, human work.”

Peter Horadan, Chief Executive Officer of Lockstep, commented:

“Over the years it has become abundantly clear that Lockstep and Sage have the same vision for the future of the industry. Since its inception, our mission has been to improve and transform the way companies do business with one another. Together with Sage, we look forward to accelerating the development of connected accounting which is imperative for accountants, finance teams and the companies they serve.”

Related News

- 03:00 am

Zimpler, a leading fintech company born in Sweden, has teamed up with fintech startup Gigapay to provide content creators with a hassle-free payout management system. Gigapay was the first to accommodate freelancers without a registered company, and now thanks to their partnership with Zimpler, Gigapay is also the first to provide instant payouts to those with a registered company in Sweden. The instant payout function is now available in Finland as well, with plans to expand internationally this year.

Influencer marketing is hitting an all-time high. In 2022 the industry is projecting a growth of approximately 16.4 billion USD. With several million influencers worldwide, the number is likely to increase. The industry growth creates an opportunity for fintech companies to innovate and create solutions, allowing them to get paid instantly, making self-billing or self-invoicing hassle-free.

While instant payouts are possible, sole traders have to wait 15 days for the money to reach their accounts. Zimpler’s partnership with Gigapay gives all creators and sole traders access to instant payments on equal terms. The companies within the space currently using Zimpler’s and Gigapay’s services include Society Icon, Gigital and INCA.

Raiha Buchanan, CEO and co-founder of Gigapay, said: “Our collaboration with Zimpler will provide Gigapay users with the best service and functions possible, allowing self-employed creators to receive instant payouts, without having to rely on a traditional long billing cycle. As many creatives who are self-employed value instant payouts, we know that removing this element can be life-changing.

“With the fintech industry continually growing and expanding, many have started to see the value in collaborations. Having a strong fintech ecosystem is key to continued growth and success, and it is done by continuously improving the quality of products and services offered, allowing sharing of knowledge and expertise.”

Catrine Rhenberg, Head of Partnership at Zimpler, said: “For us, simplicity is everything. We want people, no matter their form of employment, to have a seamless and simple experience when it comes to their workers compensation and payout.

“Fintech as we know it is evolving and changing every day. Our main goal is to provide our clients and users with the best solutions and experiences possible. To do this, we need partners who understand us, our brand and who also challenge us to be the best Zimpler in every way – today and tomorrow. We are very pleased to be working closely with Gigapay, as we believe that strong collaborations are key to staying relevant in fintech.”

Related News

- 05:00 am

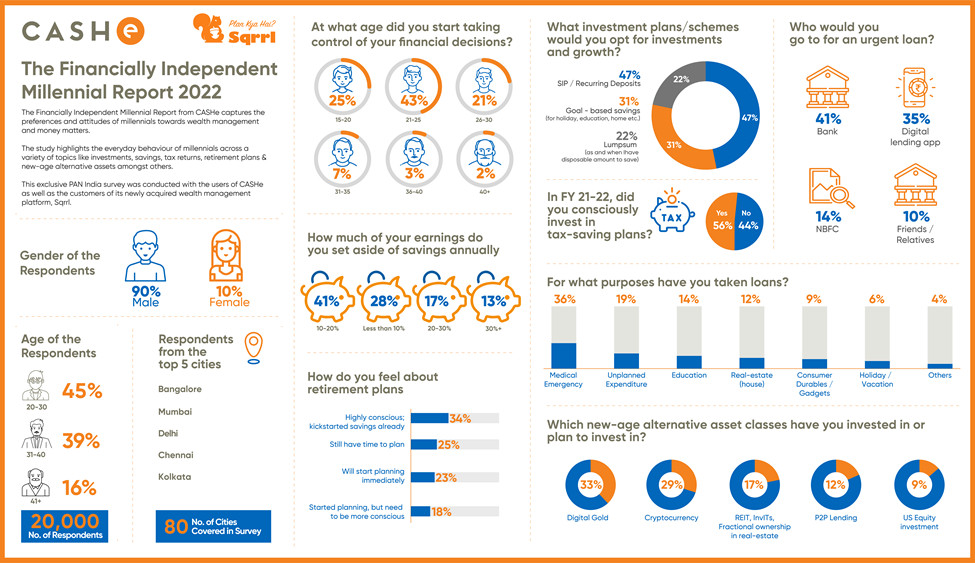

CASHe, India’s leading AI-driven financial wellness platform with a mission to make financial inclusion possible for all, today released the ‘The Financially Independent Millennial’ report 2022. According to the survey, more than 43% of the respondents across the country stated they started making financial decisions independently between the ages of 21-25 years. The pan-India survey was conducted among more than 20,000 customers on the CASHe platform as well as on its newly acquired wealth management platform, Sqrrl. The survey witnessed the participation of millennials from more than 80 cities and captures their preferences and attitudes towards finance & investment matters.

As millennials are evolving and growing to take on additional financial commitments, there is a growing realisation among the cohort for responsible investing. As part of their preference for ongoing investment and growth, millennials are eyeing to ace financial discipline and regularity with over 47% of respondents expressing their penchant for SIP/recurring deposits as their preferred investment pattern followed by 31% of respondents who favoured goal-based savings. Although young millennials may not have much to put aside, the study indicates that they are aiming to adopt smart savings habits. Also, the cohort’s inclination towards SIP and goal-based investment plans implies their commitment to regular savings.

With millennials growing increasingly wary about money matters post-pandemic, the study indicated that a vast majority of the respondents (41%) set aside a budget of anywhere between 10-20% of their annual income as savings. The data showcased the growing trend of millennials adopting responsible financial behaviour at an early age. However in contrast it also stated that a considerable chunk of millennials (around 30%) set aside less than 10% of their annual income as savings which raises concern in regard to the cohort committing to regular savings.

The report also highlighted that millennials are rapidly evolving as ‘forward thinkers’. While boomers are either into retirement or nearing it, millennials have plenty of time to plan and save, however, there is a growing consciousness among millennials to start saving early for their post-retirement life. More than 34% of the respondents stated that they were highly conscious of the matter and have started saving already. Whereas close to 48% of the respondents said they have not yet factored in retirement planning but a considerable chunk (23%) aim to kick-start retirement planning soon.

Millennials are increasingly turning to digital alternatives and prefer to do their investments themselves. In terms of preference for new-age alternative asset classes, Digital Gold topped the charts with more than 33% of the respondents voting for it. It clearly showcased millennial inclination towards gold as a stable asset class and a profitable instrument offering long-term gains. Digital gold offers the digital native cohort the best of both worlds - owning physical gold with the benefits of new-age technology that eliminates the hassles of physical inspection and onus. This was followed by cryptocurrency (29%), fractional ownership (17%), P2P lending (12%), and US equity investment (9%).

With increasing awareness about tax saving modes and avenues, millennials are joining the clique of savvy investors who look at both future returns and present tax savings. According to the survey, more than 56% invested in tax saving plans, while the rest were found supposedly unaware.

Millennials have faced the most uncertain economic future of the generation since the onset of the pandemic. The majority of millennials have grown to become more cautious about finances amid the pandemic. According to the report, medical emergency, accounting for 36% was the top reason for millennials availing of loans in 2022. This was followed by unplanned expenditure and education accounting for 19% and 14% respectively.

The report also highlighted that banks continue to lead the stride as the most preferred go-to lending avenue among millennials. The survey highlighted that 41% of millennials secured loans from a bank whereas 35% of the borrowers opted for a digital lending platform. Owing to the relaxed eligibility criteria, bias-free processes, and attractive interest rates, lending platforms are rapidly gaining popularity among millennials.

V Raman Kumar, Founder Chairman, CASHe said, “Millennials – the first generation to be known as digital natives have made technology an integral part of their everyday life and therefore money management too is no exception. As the country’s largest workforce, millennials are driving a paradigm shift in the wealth-management industry. The cohort is seeking new-age offerings at the intersection of technology and innovation that help them pursue a custom-fit journey that suits their investment appetite and goals. The survey clearly showcases how millennials today are rapidly evolving as investors, borrowers, and wealth creators. CASHe has engaged with the Indian millennial cohort extensively and has been an integral part of their aspirational journey. With the acquisition of Sqrrl, we aim to leverage our deep understanding and expertise with the cohort to offer customized financial planning and investment strategies tailored to suit this unique cohort while empowering them to embrace a responsible wealth management journey.”

CASHe is an AI-based, credit-led, non-bank, mobile-first financial wellness platform focussed on making financial inclusion possible by serving the underserved digital cohort in India. The company is driven by its laser focus to unlock opportunities for everyday people by making financial inclusion and accessibility possible using its cutting-edge algorithms and cloud-based credit decision systems. CASHe is a first-of-its-kind origination, lending, distribution, and investing platform democratizing access to credit for millennials & Gen Z in India.

Related News

- 04:00 am

OKEO, a digital payment service provider for European entrepreneurs and businesses, announced their successful go-live on the leading cloud banking platform, Mambu. OKEO helps customers save time and money by providing access to modern and professional banking services. Mambu's composable platform enables OKEO to offer multi-currency foreign exchange payments, at rates up to five times better than traditional banks, and delivery times ranging from minutes to a maximum of one business day, irrespective of the currency chosen.

Founded in 2019 in Vilnius, Lithuania, OKEO is an all-in-one payments platform designed to maximise cost efficiency and empower businesses with greater control over their finances. The fintech provides fully-fledged business IBAN accounts and online banking with an intuitive interface that allows teams to manage their profiles, set permissions and limits, and carry out payment transactions.

To build their new multi-currency product, OKEO examined the wider core banking market to find the most flexible, scalable and secure solution. In particular, they prioritised a configurable cloud-native platform that is designed for easy implementation and fast deployment and can facilitate regulatory processes and integrations to the European payment schemes. OKEO selected Mambu and following a nine-month implementation, successfully launched its new offering.

Katarzyna Kwiatkowska, Chief Executive Officer at OKEO, said: “Customer success is not only the goal of our service. It is also an inevitable element of its delivery process. This is why we continue expanding our services while being in constant communication with the clients. We partnered with Mambu because their composable approach is a perfect response to the quickly evolving needs of our customers, and they share our customer-centric philosophy. While Mambu keeps the lights on in the back-end, our team can focus on the customer-facing front-end, new features and enriched financial services. We believe that our partnership will enable us to take our offering to the next level.”

Scott Wilson, Regional Vice President of Mambu EMEA, added: “Our partnership is an opportunity for us to collaboratively push the envelope in the multi-currency space. The successful go-live of OKEO services on Mambu is a result of aligned goals and excellent engagement between the teams. We look forward to supporting OKEO's growth and product expansion goals.”

Currently, OKEO is building a Single European Payments Area (SEPA) instant payments service on Mambu, and will be adding it to the storefront within the next few months, enabling customers to process their Euro payments across the European Economic Area in seconds.

Related News

- 02:00 am

OpenFin, the operating system of enterprise productivity, has announced it is strengthening its executive leadership team by appointing Vicky Sanders as Chief Digital Officer.

Sanders, a highly successful entrepreneur and experienced industry operative, will drive digital transformation across the company’s ecosystem of buy-side and sell-side institutions, along with the global vendor community.

The appointment is a strategic decision for OpenFin, aligning with its vision to unlock opportunities for its community of users, accelerate collaboration and further enable interoperability for the benefit of all industry participants. The appointment follows the recent announcement that ING Ventures invested $ 10 million into OpenFin to accelerate the expansion of OpenFin OS throughout the financial industry.

Adam Toms, Chief Operating Officer at OpenFin, said: “OpenFin has a strong history of building with the industry and for the industry. This ranges from the creation of the FDC3 application interoperability standards to the launch of Workspace in 2021, which was designed and built in collaboration with several global banks and asset managers to solve their common workflow challenges. Today, Workspace accelerates standardisation and openness across the industry while solving desktop and employee productivity issues at an enterprise level.”

As the roll-out of Workspace moves forward at pace and the company continues to grow its global customer base, Sanders will be key in driving forward digital optimisation efforts for end-users across the company’s ecosystem.

Commenting on her appointment, Vicky Sanders said: “OpenFin is a well-regarded fintech, underpinned by strong and trusted client relationships, innovative technology and an experienced team. With a track record of solving complex workflow challenges, OpenFin's ecosystem has grown to include 23 of the 25 global banks, leading asset managers and large and innovative software vendors. I'm excited to join at a time of strong momentum and look forward to working with such a talented team to unlock the power of OpenFin's network while shaping digital transformation across the industry and beyond.”

Toms added: “We are delighted to have hired Vicky who has such a proven track record of driving change. Vicky will work closely with financial institutions to improve employee empowerment, productivity, and interconnected experiences. This is more important than ever as organisations need to ensure that their teams work smarter, faster, and collaborate more effectively.”

Vicky Sanders most recently served as Chief Commercial Officer for TP ICAP Group’s Agency Execution division where she was responsible for overseeing the commercial strategy of the Liquidnet and Coex Partners businesses.

Prior to that, she co-founded RSRCHXchange in 2014, a disruptive fintech operating as an aggregator and marketplace for institutional research, leading the business through the acquisition by Liquidnet.

During her time at Liquidnet she served as Head of Investment Analytics, and has developed a new division and product delivering insights to buy-side traders and portfolio managers, before Liquidnet’s acquisition by TP ICAP.

In her early career, Vicky was an Executive Director at Goldman Sachs, having started her career at Merrill Lynch after graduating with honours from Harvard University.