Published

- 06:00 am

Copenhagen has a strong fintech ecosystem and a leading position among fintech hubs globally. The hub connects both start-ups, established companies and organizations focusing on innovation and new opportunities. Mastercard is committed to empowering the growing fintech community through collaboration with Copenhagen Fintech, a fintech start-up based in Copenhagen, Denmark.

Over the past few years, Mastercard has strengthened its presence in Denmark. This includes the acquisition of Nets´ Corporate Services business and the leading open banking platform Aiia. In less than two years, Mastercard has grown from just a handful of employees to hundreds in Copenhagen. The ambition is to create a strong base and develop existing and new solutions for Denmark, the Nordics, and the whole world.

Mastercard and Copenhagen Fintech are now establishing a strengthened collaboration that brings together existing and new activities with a joint focus on growth, knowledge sharing and innovation opportunities through multiple programs and services ranging from open banking to start-up programs.

"Copenhagen Fintech is a vibrant innovation hub that not only creates successful startups but has become a centre for technology and innovation that activates and inspires everyone in the fintech ecosystem. We are proud of being an active part of that - not least because we have been involved in the fintech landscape for more than a decade with Spiir and Aiia. In the new capacity as Mastercard, we now have the opportunity to help new fintechs take Nordic financial services innovation even further in close collaboration," says Rune Mai, Senior Vice President, Mastercard & Co-Founder of Aiia, founded in Denmark and now one of Europe's leading open banking platforms.

Lars Asger Petersen, Senior Vice President, Mastercard and CEO of Mastercard Payment Services Denmark, providing solutions for digital payment of bills, account-to-account transfers such as Betalingsservice and real-time payments adds:

"We support Copenhagen Fintech's ambition to develop Copenhagen as one of the leading fintech hubs, not only in the Nordics but also globally. We look forward to strengthening and expanding the existing collaboration with a focus on development and growth with international perspectives.”

Fintech as a strong Danish industry

Since Copenhagen Fintech was established in 2016, the number of startups, new jobs, partnerships, and investments in fintech has increased year after year. The interaction between innovative startups and the established industry is a part of the recipe for success, according to Copenhagen Fintech.

"The strength of the fintech environment in Denmark lies in partnerships, collaboration and knowledge sharing. We are proud that we can now expand the collaboration with Mastercard, which not only has a significant position within digital payment solutions and technology globally, but also sees the potential in Denmark and the Nordics as a global, digital frontrunner," says Thomas Krogh Jensen, CEO Copenhagen Fintech, and continues:

"We want to make the fintech environment in Denmark the best in the world, and therefore we must have partnered with a local presence and a strong international reach. The collaboration opens new innovative opportunities for all parties in the ecosystem.”

The cooperation with Mastercard includes, among other things, consulting and development for startups in the Copenhagen Fintech Lab and Mastercard Lighthouse, a Nordic and Baltic FinTech initiative that is an innovation project and accelerator program for startups. Mastercard supports new fintechs through its Start Path Opening Banking programme and also participates as a sponsor and presenter at Nordic Fintech Week, which will be held on 27-28 September in Copenhagen.

Related News

Nick Horne

Sales and Commercial Director at Suresite Group

Whatever the causes of the current cost-of-living crisis in the UK – variously attributed to Brexit, Covid-19, and the war in Ukraine – the upshot for SMEs wa see more

- 06:00 am

We’re proud to announce our largest fundraise to date: €1bn to invest in the next generation of changemakers. Between the global climate crisis and social, macroeconomic, and political uncertainty, we believe technological innovation will continue to be the silver lining that delivers real societal growth. Now more than ever, we look to entrepreneurs who are building a mindful, innovative future; and founders have proven many times that they thrive in turbulent times.

At the outset of our tenth fund cycle, we have reached yet another defining moment for our society: tech entrepreneurs today are able to shape behaviour for generations to come, redefining our world, from hybrid work to travel, transportation to healthcare, retail to entertainment, and more.

We’re grateful to our entrepreneurs and LPs from around the globe for doubling down on this journey with us. Reflecting on the scale of the opportunity ahead, we will continue to be long-term partners to founders, focusing on opportunities across Europe and the US, from Seed through to IPO. We will continue to invest in existing verticals such as fintech, healthtech, SaaS, and consumer. Many of the entrepreneurs we have yet to meet will build their own business category through this fund cycle.

We have embraced multiple geographies with a joint local and global mindset. Our team of 36 operates across 6 countries and represents 16 nationalities. Many of the most successful companies we’ve invested in — such as Spotify, iZettle, Klarna, Trustpilot, Kahoot!, Tier, Personio, Zopa, Forto, TrueLayer, and Spring Health — can attribute their success to their experience scaling internationally and building global teams.

Founders are expecting more from their capital partners than ever before. We have invested in a fully integrated platform team, with expertise across marketing, talent, finance and legal. We have also built a global network of more than 300 seasoned operators who have successfully scaled teams and who are at hand to support our founders at every step of their journey.

Diversity and inclusion continue to be core to Northzone’s foundation. In addition to championing people with diverse backgrounds both at Northzone and in our portfolio, we’re proud to say that we’ve had gender equality in our investment team for several years.

In spite of the headwinds and challenges of today, entrepreneurs have many reasons to be optimistic. Our ecosystem has scaled to become more international, professional and ambitious – all of which give founders more choice in selecting their venture capital partner. We’ve had people on the ground in several cities for many years, including New York, London, Stockholm, Amsterdam and Berlin, and have witnessed these colossal changes in the local ecosystems firsthand.

Tech innovation will continue to drive some of the biggest changes in the coming generations. We’ve seen it create new jobs and industries, as well as remove barriers to opportunities around the world. Startups today can tap into a bigger pool of talent than ever before and decide whether to build teams locally or entirely remotely.

Our investment strategy has always prioritised finding and backing the most ambitious entrepreneurs at the right stage. From Seed to Growth, we are excited to be able to offer more to our founders across multiple stages of their company-building journey. That’s why with this fund, we decided to earmark a significant part of our capital for growth stage investments so that we can offer our entrepreneurs a “full-stack” partner, from Seed to pre-IPO.

Tech innovation used to be a vague promise of positive but uncertain progress. Today, the pace of innovation is rapid, changing our behaviours faster and more profoundly than ever before. We’re excited and prepared for this paradigm shift — join us!

Related News

- 04:00 am

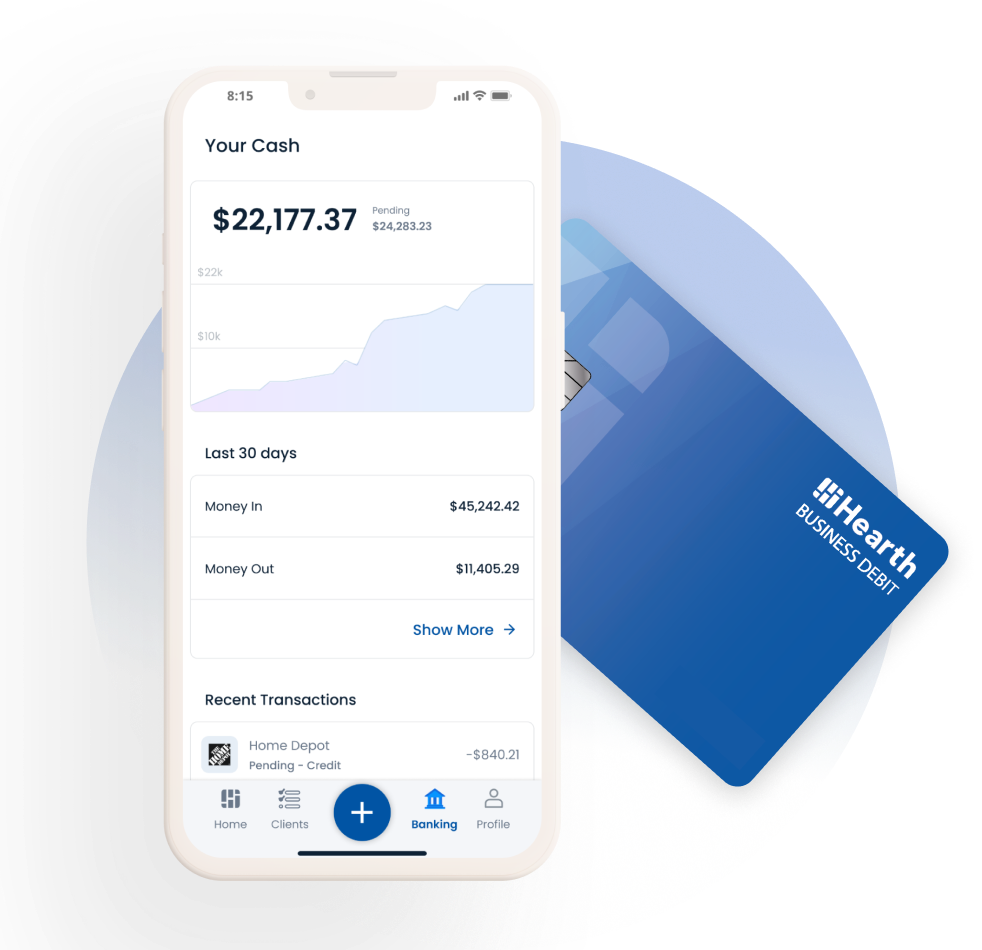

Hearth, a software platform for home improvement professionals, announced today that it has launched a new financial services product, Hearth Banking. Hearth Banking is the first cash-back banking account designed specifically to help home improvement businesses get paid faster.

Used in combination with Hearth's digital invoicing and payments tools, Hearth Banking helps businesses access and spend money from ACH transactions in just one business day and credit and debit card transactions in just two business days—compared to four to seven days with other banking accounts. This means that home improvement business owners can access cash flow, purchase supplies, and pay their employees faster. Qualified purchases with the Hearth VISA Debit Card also earn cardholders 1% cash back.

Says Hearth CEO Misha Tsidulko, "Contractors are often put in positions to have to chase down payments, then wait to get paid as balances settle. Cashflow is everything to small business contractors, who are underserved by big banks and traditional financial institutions. Pros work hard to serve their customers and grow their businesses, and their banking should meet their needs.

"Hearth Banking is the first and only cash-back banking account specifically designed to help home improvement pros get paid faster and keep more money in their pockets. That means purchasing materials faster, sending paychecks sooner, and speeding up cash flow."

Founded in 2016, Hearth is a financial technology company that provides integrated software to tens of thousands of home improvement professionals. The Hearth platform helps customers accelerate their sales process, get paid faster, and win more business. Hearth's platform includes digital quotes, contracts, invoices, payments, and customer financing. These tools work hand in hand to help businesses grow by winning more jobs, automating administrative work, and giving their customers flexible payment options. Hearth also offers customized insurance solutions to secure and protect home improvement businesses.

Says Tsidulko, "Home improvement pros are in many ways the embodiment of the American Dream—skilled, hard-working individuals who go out to earn security and freedom by serving their communities. Our aim is to tip the scales in their favour. Hearth Banking is the first of many additions specifically designed to make it easy for pros to grow and run their businesses, and we're just getting started."

Related News

- 08:00 am

Future FinTech Group Inc., a blockchain application technology developer and fintech service provider, announced that Future FinTech Labs ("FTFT Labs"), a wholly subsidiary of the Company, has teamed up with CurrencyCloud, a subsidiary of Visa and a global payment platform that is registered with FinCen and is licensed for money transmission in various states in the US, to launch the remittance app Tempo to offer US-based immigrants and others a streamlined, secure and cost-effective way to send money from the US to North America(Canada and Mexico), Europe (Austria, Belgium, Czech Republic, France, Germany, Hungary, Italy, Poland, Portugal, Spain, Sweden and the United Kingdom), Australia, India and the Philippines.

By working with Currencycloud and other service providers, FTFT Labs can provide its customers with a multicurrency digital wallet that makes sending money to the aforementioned countries easier and more cost-effective than many other remittance services that charge high fees per transfer. Most importantly for FTFT Labs, the Tempo app is a remittance service that its users can trust, with features that make moving money seamless and with in-app customer support at their fingertips. Tempo's conversion tool means users can remit payments to foreign accounts following currency conversion and hold foreign currencies for users' convenience; Tempo's Funds Feature allows users to easily add funds to the digital wallet.

By continuously adding new features to the app, FTFT Labs aims to bring the most innovative, easy-to-use remittance services to the fingertips of an often overlooked market: US immigrants.

Mr. Sean Liu, CEO of FTFT Labs, said of the launch, "Tempo represents an easy, fast and secure way to transfer money cross-border. Working with Currencycloud and using the breadth of its services, it allows us to offer our customers a seamless production from start to finish. We are confident we are making remittance a seamless process for our end users."

Lewis Nurcombe, Vice President Sales, Currencycloud commented, "Migrants in the US should be able to send money cross-border without friction and without prohibitive costs. A fintech company like Future FinTech Labs understands the needs of working people wanting to send money to family and friends, and as such is successfully re-imagining how money flows for this huge market."

Related News

- 03:00 am

UK-based InsurTech Stubben Edge Group (the Company) has secured a further £5.6m in investment following an over-subscribed £10 million round in September last year. Cornerstone investors include a number of Lloyd’s Names, Nigel Wray, Dowgate Wealth, family offices, institutional investors and other HNW investors.

Since the last round, the Company has delivered on its ambitious growth strategy including the acquisition of Lloyd’s broker Genesis Special Risks, the establishment of Guernsey entity 1Edge and, in August, the purchase of SME-focused media titles from Bonhill PLC.

Further announcements are planned, including additional M&A activity, as the Company continues to target the funds to continue providing the best selection of services to brokers and IFAs who want to start, run, and grow their businesses.

Chris Kenning, CEO of Stubben Edge, says: "In the context of declining confidence in the FinTech market and the wider economic climate, this is a huge deal and testament to the strength of the business. Our ambition continues to be to support the entrepreneurs and owners of brokers and IFAs. Helping them build their businesses by providing the technology, data and products that will enable them to service their SME clients more efficiently, cost-effectively, wherever, and whenever their clients want to engage.

“Our ambition is to change the Financial Services industry, which is currently antiquated, arbitrary and unbalanced, empowering brokers and IFAs to provide better value-for-money, security and confidence for customers and their families, while building long-term business success."

David Poutney, Chief Executive of Dowgate Capital, commented: “We were delighted to extend this opportunity to some of our institutional, family offices and other HNW investors, many of whom are experts in financial services, Lloyd’s and the insurance industry generally. It is a testament to the strength of the business that we were able to raise additional funds at a higher valuation, especially in the current difficult economic climate.

“We believe that Lloyd’s and the insurance industry generally are ripe for disruption and reform and that Chris Kenning and the team at Stubben Edge are well-positioned with their strategy and products to take full advantage of the opportunity. We’re excited to see them execute on their ambitious plans and look forward to continuing to work with them on their journey.”

Related News

Ieva Janarauskaite

Communications Specialist at Mistertango

Financial services, like many other aspects of the global economy, have been profoundly influenced by the pandemic and the war happening in Ukraine. see more

- 07:00 am

Kroll, the leading independent provider of global risk and financial advisory solutions, today announced its report Cyber Risk and CFOs: Over-Confidence is Costly which found chief financial officers (CFOs) to be woefully in the dark regarding cyber security, despite confidence in their company’s ability to respond to an incident.

The report, commissioned by Kroll and conducted by StudioID of Industry Dive, exposed three key themes among the 180 senior finance executives surveyed worldwide:

- Ignorance is bliss. Eighty-seven per cent of CFOs are either very or extremely confident in their organization’s cyberattack response. This is at odds with the level of visibility CFOs have into cyber risk issues, given only four out of 10 surveyed have regular briefings with their cyber teams.

- Wide-ranging damages. Nearly three-quarters (71%) of the represented organizations suffered more than $5 million (mn) in financial losses stemming from cyber incidents in the previous 18 months, and 61% had suffered at least three significant cyber incidents in that time. Eighty-two per cent of the executives in the survey said their companies suffered a loss of 5% or more in their valuations following their largest cyber security incident in the previous 18 months.

- Increasing investment in cyber security. Forty-five per cent of respondents plan to increase the percentage of their overall IT budget dedicated to information security by at least 10%.

Greg Michaels, Global Head of Cyber Governance and Risk in the Cyber Risk practice at Kroll, said: “We often see that CFOs are not aware enough of the financial risk presented by cyber threats until they face an incident. At that point, it’s clear that they need to be involved not only in the recovery—including permitting access to emergency funds and procuring third-party suppliers—but also in the strategy and investment around cyber both pre- and post-incident. Ultimately, cyberattacks represent a financial risk to the business, and incidents can have a significant impact on value. It is, therefore, critical that this is included in wider business risk considerations. A CFO and CISO should work side-by-side, helping the business navigate the operational and financial risk of cyber.”

David Ball, Managing Director in the Valuation Advisory Services practice at Kroll, said: “Cyber incidents have the potential to cause material damage or impairment to the assets of a company, particularly intangible assets, including intellectual property, customer relationships and brand. It is important for CFOs to understand the impact of cyber incidents on these assets and be in a position to assess and quantify the financial impact and potential risks to the company.”

Related News

- 01:00 am

Strong Customer Authentication for all online transactions exceeding £25 was introduced in the UK in March. And it’s about more than just mitigating fraud.

73% of UK retailers have a solution in place to comply with Strong Customer Authentication (SCA) rules, which came into effect in March 2022.

The research, conducted by Censuswide for Adyen, shows a marked improvement from a similar study shortly before the March deadline when only 56% of businesses said they were prepared for the new rules. But those that don’t comply, risk damaging their customer experience at a time when every transaction counts.

The cost of living crisis means competition for the share of diminishing wallets will be fierce in the coming months. That, coupled with the ‘make-or-break’ peak sales period, means retailers need to do all they can to remove friction from the purchase process.

The new SCA mandates were brought in to help prevent the unauthorised use of consumers’ payment cards. But, critically, they will also help improve the customer experience. Firstly, it will increase the chance of a transaction being approved as more and more issuing banks adopt the new rules. Secondly, the share of retail transactions made via mobile and digital wallets is now 32%, so a large proportion will be processed using streamlined authentication flows such as biometrics, which makes identifying yourself as simple as a tap or a smile.

On top of that, with the right payment provider, many SCA checks can be completed in the background while the customer completes the transaction without them even noticing. Ultimately, the mandate should be removing friction from the customer experience, not adding to it.

“With costs rising and supply chain challenges making it harder for the sector, customer conversion rates are crucial,” said Colin Neil, UK Managing Director at Adyen. “Getting SCA right at this stage will not just keep you on the right side of the Financial Conduct Authority; it will help you close more sales and build trust with your customers.”

Related News

- 08:00 am

Adyen, the global financial technology platform of choice for leading businesses, today announced the expansion of Real-Time Visa Account Updater (VAU) to Europe.

As the first platform to offer Real Time VAU coverage in Europe with Visa, Adyen will help its customers increase revenue and authorization rates from card-on-file payments by automatically updating Visa accounts in real-time. This in turn prevents involuntary churn and since Adyen automatically connects to the schemes account updater services, there is no integration.

“It can be a point of frustration for consumers to have to update their new card information with multiple merchants, and this can create a poor experience for those customers,” said Neil Caldwell, SVP, Merchant Sales & Acquiring, Europe at Visa. “With Real-Time VAU, Adyen’s customers can bypass that friction and make the checkout smooth. Adyen has been a wonderful partner over the years and we’re excited that they are launching with us in Europe.”

“We are thrilled to be the first financial technology platform to provide Real-Time VAU with Visa in Europe,” said Kamran Zaki, COO at Adyen. “Businesses who have customers in Europe will be able to use Real Time Account Updater to ensure they are getting the highest authorization rates while also creating a seamless experience for their customers.”

The feature, which was previously only available in North America, allows businesses to update customers’ stored card details in real-time. When a merchant submits a payment, Real-Time VAU instantly checks for the latest card details. If there’s an update, Real-Time VAU will immediately replace the payment request with the updated card details. This all happens as the payment is being processed, and appears as a single transaction.

Real-Time VAU is a part of Adyen’s RevenueAccelerate product suite. By using data and machine learning, businesses are able to unlock more revenue by increasing authorization rates, creating better customer experiences, reducing involuntary churn, and lowering payment costs. Adyen has been offering Real Time Account Updater with a number of global card networks since 2017.