Published

- 09:00 am

Paymob, the leading financial services enabler in the Middle East, North Africa, and Pakistan (MENA-P) has announced its partnership with Tamara, the leading shopping and payments platform in the GCC region.

The strategic partnership integrates Tamara’s Buy Now Pay Later (BNPL) service with Paymob’s secure gateway to power seamless payments by enabling customers to split their payments in four without any hidden fees or interest. Paymob’s omnichannel payments infrastructure serves 250,000 merchants in the region, while Tamara has over nine million registered users and more than 30,000 partner merchants. The agreement between two of the MENA region’s fastest-growing fintech companies creates a payments ecosystem that enables merchants to offer more comprehensive solutions and seamless customer experiences.

Both companies have partnerships with some of the region’s biggest brands, however, this agreement is designed to fuel the growth of small and medium-sized enterprises (SMEs) which are the greatest contributors to GDP in MENA. For businesses of any size, comprehensive payment offerings ensure increased sales and conversions. With Tamara’s BNPL solution, merchants gain a 40% increase in average order value, a 15% increase in online conversion rates, and a 50% increase in repeat purchases.

The addition of Tamara’s BNPL solution to Paymob’s gateway is via a simple integration that reduces merchants’ barriers to entry and ensures transactions are processed seamlessly and securely. The partnership will initially serve merchants in KSA and the UAE in the first phase, with more countries planned to go live in later stages.

Islam Shawky, Co-founder and CEO of Paymob said, "Our partnership with Tamara delivers on Paymob’s mission to fuel SME growth in the digital economy. There is a massive opportunity to enable merchants in the GCC to capitalize on the power of alternative payment methods and we are thrilled to partner with Tamara to fuel this growth in MENA.”

Turki Bin Zarah, Co-founder and CCO of Tamara said, “This partnership with Paymob provides seamless access to Tamara’s services to thousands of SMEs to enable their growth across the region. As a leading commerce enabler, we are revolutionizing how people shop, pay, and bank and are thrilled to partner with Paymob as we deliver on this goal.”

Tamara and Paymob are currently experiencing rapid growth fueled by recent funding. Riyadh-based Tamara secured a $150 million debt facility earlier this year from Goldman Sachs, the first deal of its kind in the region. The company is actively expanding its product lines and

verticals. Paymob’s growth across the region is driven by its 2022 Series B funding which was led by PayPal Ventures. As a result, the company expanded to the UAE in 2022 and secured PTSP certification from Saudi Payments in Q2 2023 making it fully operational in KSA.

Related News

- 05:00 am

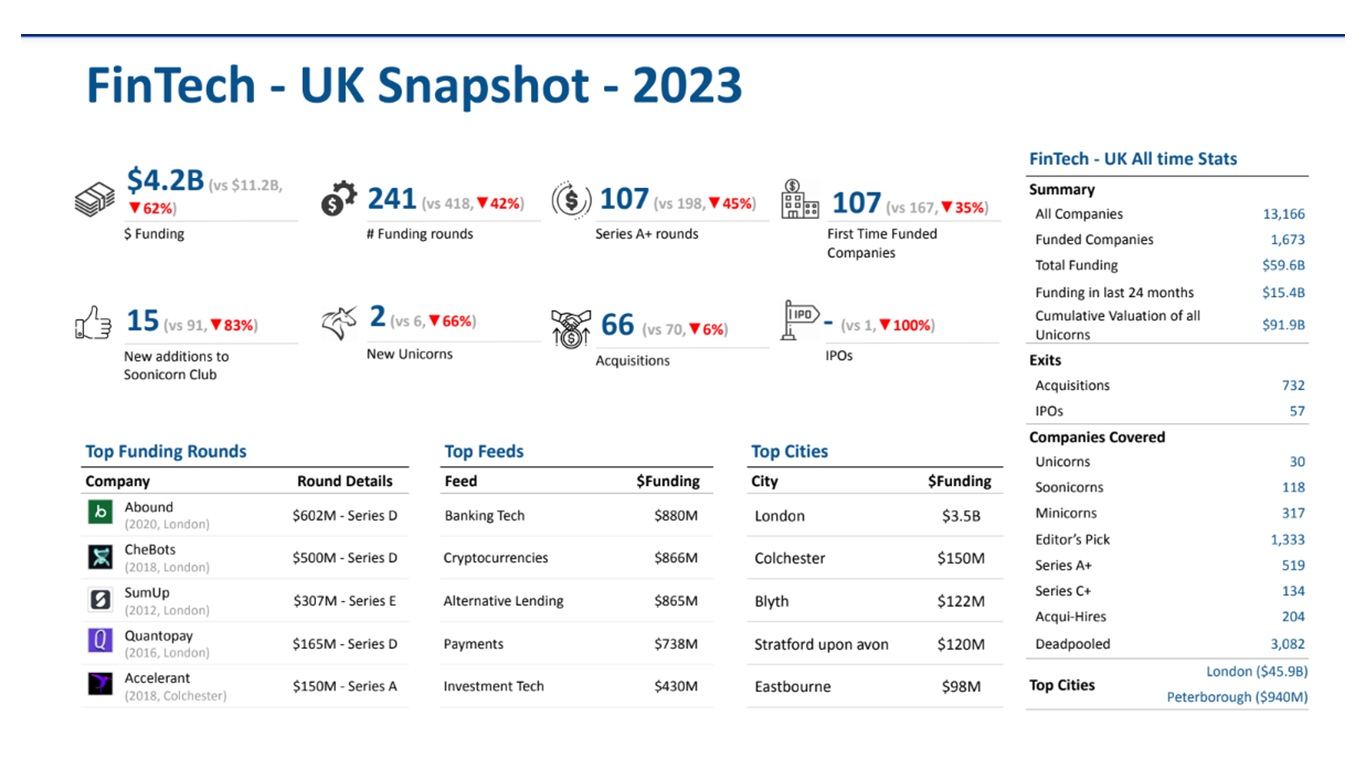

The Tracxn Geo Annual Report: UK FinTech 2023, based on our extensive database, provides a round-up of funding and other major developments in the UK FinTech space in 2023.

In terms of funding, the UK FinTech startup ecosystem ranks second after the US, in 2023. The country has more than 13,000 companies in the FinTech space, accounting for nearly 10% of all FinTech companies worldwide.

With its leading talent pool, stronger FinTech adoption rate, a larger concentration of financial and professional services organizations, and forward-thinking legislation, the UK has been a major focus for FinTech companies. Despite these advantages, the space has witnessed a downward trend in funding in 2023. This decline can be attributed to the prevailing macroeconomic conditions characterized by escalating interest rates, inflationary pressures, and a notable surge in gas prices within the region.

The UK FinTech startup ecosystem secured a total funding of $4.2 billion in 2023, a 63% decline from the $11.2 billion raised in 2022 and a 70% plunge from the funds raised in 2021. The overall number of funding rounds, too, decreased by 42%, from 418 rounds in 2022 to 241 rounds in 2023.

The drop in funding is primarily due to a downward move in late-stage and early-stage funding. The sector attracted late-stage investments worth $2.7 billion in 2023, 60% lower than the $6.8 billion raised in 2022. Early-stage funding fell 68% to $1.2 billion in 2023, compared with $3.7 billion raised in 2022. Seed-stage funding, too, saw a 50% decrease to $321 million in 2023, from $647 million in the previous year.

In 2023, quarterly funding for the UK FinTech startup ecosystem experienced a steady decline from Q1 to Q3, reaching its lowest point in Q3 at $410 million, marking the least funded quarter since 2019. However, there was a notable turnaround in Q4, with funding increasing by 193% to $1.2 billion, compared with the previous quarter.

2023 has witnessed only nine 100M+ funding rounds, a drop of 64% from 25 such rounds in 2022. Abound, a FinTech company that aims to increase access to affordable loans, raised $602 million in Series D funding, making it the highest funding round amount in the UK FinTech startup ecosystem in 2023. Quantexa and Enable became the two new Unicorns in this space in 2023, after reporting $100M+ rounds.

Other major funding rounds in this space include the $307 million Series E round from SumUp, which offers business solutions, card readers, and a business account to help merchants manage their money. The round valued the company at $1.6 billion.

A downward trend has been observed in acquisitions as well. A total of 66 acquisitions were recorded in the FinTech UK sector in 2023, lower than 70 in 2022 and 95 in 2021.

Worldpay, a leading global provider of payment processing solutions, was acquired by GTCR Digital for $18.5B. This was the highest-valued acquisition in 2023, followed by Adenza, which was acquired by Nasdaq for $10.5 billion.

There has hardly been any activity on the IPO front in the past two years, with only one IPO in 2022 and no IPO in 2023.

Banking Tech, Cryptocurrencies, and Alternative Lending are the top-performing segments in terms of funding in the UK FinTech ecosystem in 2023. Despite being the top funded segments, funding across sectors has dropped compared to the previous year. The Banking Tech segment secured total funding of $880 million in 2023, a drop of 53% from the $1.9 billion funding raised in 2022.

The cryptocurrency sector in this region has raised a total funding of $866 million in 2023, a drop of 54% compared with the $1.9 billion funds raised in the previous year. Funding in the Alternative Lending sector fell by more than 42% to $865 million in 2023 from $1.5 billion raised in 2022. While funding across the industries has seen a decline, RegTech and Insurance IT are the only sectors that were least affected in 2023 with an overall funding drop of less than 25% compared to the funding received in 2022.

In terms of city-wise funding, London takes the lead in the UK FinTech space, accounting for 81% of the funds raised in this space in 2023. FinTech companies headquartered in London raised $3.5 billion in 2023, followed by those based in Colchester ($150 million) and Blyth ($122 million).

Over the past five years, London has consistently secured the highest amount of funding in the UK’s FinTech sector. Remarkably, it is now the second-largest globally funded city in this industry after San Francisco.

Seedcamp, Techstars, and Anthemis Group are the overall most active investors in the UK FinTech sector. Speedinvest, Y Combinator, and Techstars were the most active investors in terms of seed-stage

investments in 2023, while Octopus Ventures, Motive Partners, and Augmentum were the most active early-stage investors. SoftBank Vision Fund was the leading late-stage investor in 2023 in this space.

The UK government has been actively involved in initiatives to support and boost the FinTech sector. The government has launched the "FinTech for Gov" initiative, which aims to transition the government from being not just a supporter, but also an active user of FinTech. This initiative seeks to tap into the potential for the UK government to adopt FinTech into its financial processes, given its status as the largest payer and payee in the country.

The government is also working on creating a FinTech for Gov Centre of Excellence to raise awareness of FinTech among public entities, facilitate the execution of identified FinTech opportunities, and establish strategic relationships with startups as well as established firms in the sector. Such initiatives could help the FinTech sector grow.

Related News

- 09:00 am

Chetwood Financial has announced Julian Hynd as its new Chief Operating Officer.

Founded in 2016, Wrexham-based Chetwood Financial is a digital bank. As well as its existing consumer savings products, Chetwood Financial is soon to launch ModaMortgages, a new specialist, broker-only buy-to-let (BTL) mortgage lender.

Hynd has more than 30 years’ of experience in financial services, with a strong record of building, growing, and transforming businesses.

Throughout his career, he has worked for several recognized brands, including First Rand, Siemens Southern Africa, National Savings & Investments, and Ford Credit Europe, where he led the development of Ford Money, a UK online savings bank. Hynd also worked for Volkswagen Financial Services, where he led the development of their UK online savings bank.

Most recently, Hynd led the operational and digital transformation at Shawbrook Bank and the commercial transformation at Redwood Bank.

As Chief Operating Officer, Hynd will have executive responsibility for bringing Chetwood Financial’s strategy to life through the company’s technology, operations, and people. He will also help bring the ModaMortgages proposition to market later this year.

Hynd said: “I’m delighted to have joined the Chetwood team. The company’s goal is to deliver exceptional products and services to help people financially – and it’s one I wholeheartedly believe in. I’m excited to play my part in ensuring we achieve that goal from an operations perspective.”

Chetwood’s founder and CEO, Andy Mielczarek, added: “It’s great to welcome Julian to the team. He joins at a dynamic time for Chetwood, with exciting projects in the pipeline for the coming year, not least the launch of ModaMortgages. Julian’s experience and expertise when it comes to operations in the financial spaces will no doubt prove extremely valuable in helping Chetwood achieve its ambitious plans for 2024 and beyond.”

Related News

- 08:00 am

Hitachi Payment Services, India’s leading end-to-end payments and commerce solutions provider, today announced that it has completed its acquisition of Writer Corporation’s Cash Management Business and unveiled its new name – Hitachi Cash Management Services, in line with Hitachi’s single brand identity. Hitachi Cash Management Services Pvt. Ltd. would be a wholly owned subsidiary of Hitachi Payment Services Pvt. Ltd.

This acquisition will enhance Hitachi Payment Services’ market position as a holistic provider of payments and commerce solutions, further strengthening its value proposition to financial institutions and merchants.

Hitachi Cash Management Services would offer ATM Cash Replenishment services for Financial Institutions and Retail Cash Management Services (RCM) for retail outlets. With a strong network of close to 40,000 touchpoints including ATMs and Retail spanning 25 states across 1,500 locations, Hitachi Cash Management Services’ end-to-end offerings are tailored to meet the needs of financial institutions and retailers, helping them manage their day-to-day cash-related requirements seamlessly and efficiently.

Sumil Vikamsey, Managing Director & Chief Executive Officer – Cash Business, Hitachi Payment Services, said, "We are committed to providing solutions that effectively meet the varied needs of our customers. Through Hitachi Cash Management Services, we will be able to deliver comprehensive services to financial institutions and retail merchants, furthering our vision of becoming an end-to-end payments and commerce solutions provider."

"We are also happy to introduce Anup Neogi as the Managing Director and CEO of Hitachi Cash Management Services. Anup's exceptional career trajectory and extensive experience in the Cash Management space makes him an exemplary leader, poised to steer the company towards new heights of success."

"I am delighted to lead Hitachi Cash Management Services during this dynamic phase of growth and innovation in the payments space. We aim to provide best-in-class services to our customers, through a customer-focused approach that is high on transparency, cost-effectiveness, and value creation. With our deep understanding of customer needs and technology-led approach, our offerings will enable customers to gain a competitive edge”, said Anup Neogi, Managing Director & Chief Executive Officer, Hitachi Cash Management Services.

Hitachi Payment Services is a pioneer in the payment industry in India, offering a comprehensive range of payment solutions including ATM Services, Cash Recycling Machines, White Label ATMs, POS Solutions, Payment Gateway Solutions, Toll & Transit Solutions as well as innovative offerings such as HPY UPI Universe, SoftPOS, Value Added Services, AI & ML based solutions, HPY Sigma - next-gen mobile based merchant platform and HPY Neo - UPI ATM. The company is committed to delivering exceptional customer experiences and driving financial inclusion across India.

Related News

- 09:00 am

Montonio, the online payment solutions provider, is thrilled to announce its strategic partnership with Totalizator Sportowy, the Polish national lottery provider with a legacy spanning over 67 years. This collaboration signifies Montonio's continuous commitment to offering top-tier payment solutions, catering to a diverse range of industries and sectors.

Montonio will initially provide its online payment services to Totalizator Sportowy’s online casino. Users will be able to deposit funds by using Montonio’s dedicated payment system.

Andrzej Bagiński, Montonio's Poland Country Manager, commented on the partnership, saying, "Collaborating with Totalizator Sportowy is a testament to Montonio's versatility and adaptability in the fintech realm. We're enthusiastic about bringing our innovative solutions to a broader audience and enhancing the payment experience for online casino enthusiasts across Poland."

"Montonio is a portfolio company of our CVC fund, ffVC Tech & Gaming powered by Totalizator Sportowy. Being able to integrate a startup we have been supporting before into our own business ecosystem is the most desirable outcome. Montonio will now handle a part of our payments on our online casino platform. Their fast and reliable services have been tailored to our needs, which will give our players a seamless payment experience,” says Piotr Bindas, Corporate Governance Department Director, Totalizator Sportowy.

This partnership comes on the heels of Montonio's pronounced growth in Poland, further solidifying its position as a leader in the fintech space. With its extensive suite of services and user-centric approach, Montonio aims to streamline and elevate the payment journey for Totalizator Sportowy's vast user base.

As Montonio continues its ascent in the fintech sector, the company remains committed to forging meaningful partnerships and delivering unparalleled value to businesses and consumers alike.

Related News

- 04:00 am

Maalexi, the UAE-based dynamic risk management platform for SME agri-businesses, announces its completion of a $3 million pre-Series A fund raise.

The funding round was led exclusively by Global Ventures - MENA’s leading venture capital firm - which joins existing venture capital investors Rockstart (Amsterdam) and Ankurit Capital (New Delhi).

The proceeds will be deployed by Maalexi for: (i) tech development - to enhance its full-stack platform to help SME agri-buyers procure faster, cheaper, and safer from globally placed SME sellers; and (ii) drive customer acquisition - specifically more buyers in the UAE and Saudi Arabia and to add sellers from 50+ origin countries.

Maalexi’s platform helps the millions of small agri-businesses active in the $3 trillion global, cross-border food trading market. Despite the market growing at 6% CAGR in the last five years - such businesses often suffer from an inability to manage trade risks and get access to finance.

Maalexi’s proprietary technology has embedded risk management tools such as digital contracts, AI-enhanced inspections, and blockchain-authenticated documentation - all on a user-friendly web platform. Maalexi’s solution increases participation and automates trade - leading to higher customer revenues, more bankability, and more sustainable enterprises.

Maalexi has grown significantly in 2023 recording a Cumulative Monthly Growth Rate of 60%, adding hundreds of users, and helping SME buyers procure millions of kilograms of food supplies - across 70 products, from 27 countries. The Company’s overall focus and strategy is to build resilience in the food supply chain - strengthening food security in the UAE and then replicate the same model across the GCC.

Dr. Azam Pasha, co-founder and CEO of Maalexi, said:

"We are delighted to complete our $3 million pre-Series A round - with the exclusive participation of MENA’s leading VC firm - Global Ventures. It is a fascinating time for Maalexi; we have a huge market opportunity that we know needs our solution - a proprietary automated process that makes life easier and more lucrative for SME agri-buyers and sellers. The per-transaction costs of our platform are very low, and we enable safer, faster cross-border trades.“Simultaneously, we are strengthening food security in our home country and region. We look forward to 2024, and our regional expansion, with great confidence.”

Maalexi’s management team includes two co-founders with stellar backgrounds in supply chain management, technologies, and finance. Dr. Azam Pasha (CEO) has over two decades as a head and senior advisor on food and agricultural supply-chain management and trade finance and has worked with world-renowned conglomerates in this space. Rohit Majhi (CTO) has a background in Management Consulting at Deloitte and led the technology function at US-based supply chain startups during his career.

Noor Sweid, Founder and Managing Partner of Global Ventures, commented:

"We are delighted to lead Maalexi’s funding round. Focused on empowering small to medium agri-businesses, the company is streamlining the transborder exchange of agriculture products, using AI-driven risk management tools to address payment and performance risks in regional and global supply chains.“The $3 trillion global, cross-border food trading market is still weighted against SME agri-businesses. Even though they constitute 90% of global agribusinesses, they only control 30% of the cross-border trade market. Maalexi's business model aligns with our thesis on the role of technology in disintermediating supply chains to make them more efficient and productive, as well as reducing the GCC's 85% dependency on food imports. We are excited to partner with Azam and Rohit as they enhance the engagement of small agri-businesses in trade, and improve food security in the Gulf, and beyond."

Related News

Alex Axelrod

Founder and CEO at Uluky

The efficiency and innovation witnessed in Consumer-to-Business ( see more

- 09:00 am

Origence, the leading credit union lending technology company in the U.S., and Tesla, the largest EV manufacturer in the world, announced a partnership to offer credit union financing to EV buyers through the Tesla website. This partnership will provide Tesla buyers seeking affordable monthly payments with more options through credit union financing.

By making credit union financing available at the point of purchase, EV buyers will have easy access to competitive rates and extended financing terms—both important factors in providing consumers with options to lower their monthly payments.

Consumers shopping for Tesla vehicles are provided financing options when reserving or purchasing a Model Y, Model 3, Model X, Model S, or Cybertruck vehicle through Tesla’s website or mobile app. The addition of credit union financing makes convenient point-of-sale financing available to millions of credit union members and consumers seeking low-rate financing options.

Origence will leverage its new licensed subsidiary, FI Connect, to purchase and place retail contracts with partner credit unions nationwide. When a consumer finances their vehicle through FI Connect on the Tesla website, the contract will be purchased and serviced by a credit union.

“Tesla is making their cars more affordable for credit union members with price adjustments,” said Tony Boutelle, president and CEO of Origence. “With FI Connect and Tesla coming together, EV buyers can receive affordable financing through credit unions.”

Related News

- 08:00 am

Solva, a FinTech providing working capital solutions, has announced that it has raised a $20 million investment backed by the Sawiris family and ZCP.

The capital injection will allow Solva to further scale our digital financial products for millions of micro, small, and medium enterprises and boost job creation in Central Asia.

A portion of the funding will be used to support our ongoing transformation from a microfinance organization into a fully licensed SME-focused bank, which is expected in 2024. The transformation will significantly increase the company’s capacity and financing outreach, bring new funding sources from current accounts and deposits, and add transactional products to the offering.

Boris Batine, Solva Co-founder, shared, “We are delighted to announce this new strategic partnership and excited about the prospects. We believe that Solva will greatly benefit from having a well-known and respected international investor, and additional funding will accelerate the execution of our regional strategy and expansion plans. Having stepped into the active phase of transforming our company from an NBFI into a fully licensed bank, it is essential to have a knowledgeable and reliable international partner along our journey who also shares our development vision and sustainability principles.”

The latest funding round led by the Sawiris family and ZCP will fulfill Solva’s mission to make financial products more accessible and inclusive and promote sustainable growth in the region.

Solva is a FinTech in Kazakhstan and a neobank for MSMEs and consumers in Central Asia. It has achieved the fastest credit approval level across all client segments and gained extensive credit risk expertise by assessing the credit eligibility of 50% of Kazakhstan residents.

It believes that small and medium-sized businesses are the bloodstream of the country’s economy and aims to build a strong entrepreneurial community across Kazakhstan and Central Asia.

Related News

- 03:00 am

Thirdstream, the Canadian account onboarding fintech leader, today announced an extension of its collaboration with Thales, a global leader in advanced technologies in digital identity and security.

Together, they are reshaping the landscape of identity verification solutions for financial institutions, introducing state-of-the-art in-person document scanner and reader technology to support identity verification (IDV) solutions for bank branches.

Focused on addressing in-person fraud attempts in financial services, Thales’ Intelligent document reader solutions authenticate or capture data from electronic travel and government-issued identity documents quickly and reliably

A TransUnion analysis of vulnerable sectors found that financial services had the most significant increase, with a fraud attempt rate of over 200%. With in-person and digital fraud attempts against financial institutions growing steeply, the steps Thales and Thirdstream are taking are timely.

Since 2020, Thirdstream has used the Thales’ IdCloud platform to offer remote know-your-customer (KYC) and anti-money laundering (AML) services for digital banking benefiting from mobile devices to capture images from government-issued photo-ID and selfies. The document is checked for authenticity and the ID photo is matched against the selfie, with liveness detection to guarantee a live person is performing the request.

By leveraging Thales' expertise in secure digital identity and Thirdstream's continually deepening relationships with Canadian banks, credit unions, and trust companies, this collaboration will bring even more advanced identity verification options to the market.

Key highlights of the collaboration include:

Proven technology: Thales, a pioneer in digital identity and security, will provide its latest advancements in biometrics, secure document scanning, and authentication solutions to enhance the in-person identity verification process, making it faster and more secure. The technology is proven and deployed with global border security and an array of financial services companies today.

Streamlined compliance: Thirdstream's configurable onboarding platform, combined with Thales' security solutions, will provide a seamless and fully compliant identity verification process, meeting the requirements of regulators and ensuring a frictionless experience for customers. Thirdstream and Thales are delivering a proven ‘out-of-the-box’ and off-the-shelf solution.

Enhanced customer experience: The collaboration aims to create an unparalleled customer experience by incorporating innovative technology, reducing wait times, and increasing the efficiency of in-person identity verification. The solution provides a user-guided experience designed to quickly and efficiently display the results that then deliver rapid results to support the in-person experience.

Commenting on the collaboration, Haider Iqbal, Director of Product Marketing, IAM at Thales, stated, "Thales is looking forward to providing a seamless and secure in-branch ID proofing experience for both financial institutions and their customers in a time of increased risk from fraud and growing regulatory requirements."

This collaboration promises to set a new benchmark for secure, convenient, and efficient in-person identity verification solutions in the Canadian market. Further announcements are expected before the end of the year.

"The expansion of our partnership reflects on both companies’ commitment to remain at the forefront of innovation for the financial services industry,” added Keith Ginter, thirdstream’s CEO. “This advancement elevates the standards for identity verification in Canada. We are creating what some refer to as a ‘friction-right’ experience for consumers, which, research shows, is the single greatest contributor to defeating identity theft."

Thales and Thirdstream are positioned to reshape the landscape of identity verification in Canada, providing critical tools to meet regulatory requirements while enhancing the customer experience.