Published

- 09:00 am

Pyypl – pronounced “People” – the Middle East and Africa (MEA) focused financial services platform and Hub71 company has closed its target Series B raise of $20 million from a diverse group of international investors and ten existing investors. Pyypl is considering opening a second tranche for further investment due to interest from investors.

Since its inception in 2017, Pyypl has raised almost $40 million and the Series B raise will enable the Company to further expand its reach across the MEA region. Product development will also be a key focus, with Pyypl 2.0 building out new features of the company’s proprietary technology platform to enhance user experience and facilitate scaling in current and new markets.

Led by an experienced management team with a proven track record in the region, Pyypl is one of the fastest-growing FinTechs in MEA. It has already seen great traction since its Series A just a year ago, growing over four times in terms of user numbers, transaction volumes and revenues. Pyypl operates at a healthy gross margin showing that FinTechs can grow sustainably.

Pyypl has established key partnerships that have taken years to develop in order to be part of a financial ecosystem required to meet demand across. These include Visa, a number of payment gateway partners, Ripple and Binance to name a few. Based in Hub71, Abu Dhabi’s global tech ecosystem, Pyypl is gaining access to its network of partners, and benefiting from its business-friendly environment and strong talent base.

With its proprietary technology, experienced management team and unique multi-product, pan-regional approach Pyypl is in the right sector, in the right geography at the right time.

Antti Arponen, co-founder and CEO of Pyypl, commented:

“We welcome our new investors and appreciate the further investment from our existing shareholders in support of our financial inclusion journey. We have grown significantly since our Series A round and are excited to enter the next phase of growth and capability. This is just the beginning.”

Pyypl’s purpose-driven approach offers key financial services in one app for the 800m financially underserved smartphone users across Africa and the Middle East, via internationally accepted virtual and physical prepaid cards, instant domestic and international user-to-user transfers as well as remittances to 38 currency destinations. Pyypl has a strong pipeline of additional products.

Related News

- 08:00 am

One of the most well-known names in the BFSI industry NK Purohit, has joined SBI Securities as Chief Business Officer With N K Purohit at the helm of affairs, SBI Securities aims to achieve a leadership position in its chosen market segment, leveraging technology, lineage and reach of State Bank of India’s 22,000+ branches across India reaching 124 crore people.

He will be responsible for SBI Securities business with its largest physical presence having 800 crores+ revenues, a customer base of around 3 million and an employee base of 10,000+ to deliver scale and growth by leveraging technology to transform SBI Securities into a Financial Supermarket.

N K Purohit has a rich experience of more than 23 years with cutting-edge digital practices to connect business and technology, where he has contributed immensely in the field of Sales, Revenue, Asset Product Distribution, Strategy, Analytics, Product development, Technology, Customer Experience and Digital Transformation.

NK Purohit has the distinction of being amongst the select few end-to-end business leaders who have experience across physical, digital and phygical companies. He has managed physical channel business at HDFC bank and spearheaded digital transformation and distribution business at Angel broking and HDFC securities and managed technology with IIFL.

The phrase “digital transformation” has been part of NK Purohit’s business lexicon for many years and he has been instrumental in heading some critical digital transformation projects in his previous stints, contributing significantly to the overall business and revenue growth for organisations. He is an expert in transforming physical businesses into phygital/digital native businesses thus delivering exponential growth for organisations.

NK Purohit is a futurist, digital transformist, multiple award winner and a keynote speaker where he shares his vision to help organizations understand the business dynamics and adopt digital transformation for rapid scale-up.

His expertise on the future of technology, business trends and digital transformation to uncover and capture the full value of technology and innovation to radically transform business for scaling up has made him a go-to resource among top companies, media and market experts.

N K Purohit has done his B. Tech. (Electrical) and MBA in Marketing and Finance from IIT, Delhi, and also has certifications in “Digital Transformation for Financial Services” from Copenhagen Business School, Denmark. He was recently awarded as “Chief Digital Officer, Chief Technology Officer of the Year 2022”, besides a couple more awards for Best use of AI and ML in BFSI and Most Admired Professional in BFSI by World Leadership Council.

NK Purohit is particularly well known for his thought leadership in a digital workplace, enterprise IT, customer experience, agile methods, and digital transformation.

Related News

- 09:00 am

deltaDAO, a data economy solutions company, today launches its Gaia-X Web3 Ecosystem network upgrade based on Polygon Supernet.

Albert Peci, Co-Founder and Web3 Lead of deltaDAO: "We've designed the Web3 Gaia-X Ecosystem with Ocean Protocol and our partners to enable businesses and public institutions to safely store, exchange and process their data in a decentralized and resilient way using Web3 technology to remove single points of failure and control. By teaming up with Polygon, deltaDAO reinforces its vision of a privacy-preserving, sustainable and decentralized data economy.”

“We’re thrilled to become deltaDAO’s infrastructure partner in its mission to provide an open and federated data economy for the European digital ecosystem,” a Polygon said Antoni Martin, Co-Founder Polygon. “By leveraging Polygon Supernets and Polygon ID, Gaia-X will reap all the benefits offered by Web3 in a modular and seamless manner, allowing them to deploy projects that fully adhere to the core principles of decentralization while preserving privacy and championing sustainability.”

Related News

- 04:00 am

Facctum™, a risktech company specialising in cloud-delivered enterprise risk decisioning technology, today announces the launch of FacctSet™, a new solution designed to streamline watchlist management for improved compliance outcomes. FacctSet is the first purpose-built product designed to address the growing data management challenges created by the rapid growth of sanctions and AML compliance obligations.

Modern screening processes require a shift in technology to address the rising pressures from evolving sanctions and anti-money laundering compliance obligations. Under this current environment, Watchlist Management (WLM) systems are not only struggling to ensure data is of the necessary standard required for screening processes, but they are also creating more customer friction and growing alert remediation costs. As financial institutions shift to a risk-based approach to screening, traditional approaches are also not capable of delivering sufficient levels of customisation, especially at the scale and complexity required to support diverse watchlist services for multiple screening scenarios.

In response to these growing challenges, Facctum has developed FacctSet as a WLM system that provides the operational capacity to manage complex, rapidly changing and large-scale watchlist data. With FacctSet, institutions can create and maintain internal block or pass lists, as well as customise commercial watchlist data to create multiple services for risk-based approach screening. Analytics dashboards provide critical operational insights and reporting features offer clear and explainable information for regulatory reporting.

KK Gupta, founder and CEO of Facctum notes, “The growth in watchlist data sources, complexity and volume, together with a high velocity of regulatory change, is pushing watchlist management systems to the limits of operational capacity and capability. With FacctSet, we are bringing watchlist management into a new era that not only addresses the current challenges, but looks ahead to provide faster speed to compliance and more efficient operations for an improved customer experience.

“After conversations with clients and those in the financial space, we saw there was an urgent need for effective sanctions and anti-money laundering compliance screening, with businesses finding it increasingly difficult to keep pace with regulatory expectations. Companies need the right technology that allows for a higher level of customisation, scale, capacity and capability, all of which FacctSet can provide in a unified platform with consistent governance and reporting. FacctSet is an example of how a new approach to implementing data technology can lead to faster, more effective compliance and customer experience.”

FacctSet is the second product launched by Facctum this year, following FacctView which provides a cloud-first screening capability for financial crime risk screening. FacctSet is designed for SaaS or as an on-premises solution.

Related News

Esther Groen

Head of Payments Consulting at Icon Solutions

Payments modernisation is a hot topic right now—and for good reason. see more

- 05:00 am

Navian has been selected as one of the three PropTech companies representing Sweden at Propel by MIPIM this week in New York.

The Swedish association PropTech Sweden, sponsoring Propel by MIPIM in New York between 9-11th November, has chosen Navian as one of the PropTech companies to watch out for in the Swedish PropTech ecosystem. Moreover, they have also selected Navian to represent Sweden in the event.

Navian's ambition and efforts in this sector had not gone unnoticed. Navian was selected from a vast pool of PropTech companies and was mentioned as one of the hottest PropTech in Sweden. A recognition presented by Proptech Sweden, a juggernaut in their industry.

While awards and recognition always feel good, their most pressing objective is their determination to bring the digitalisation of real estate development to the forefront.

"We are overwhelmed to have been chosen to represent Sweden at NYC flagship real estate industry event Propel by MIPIM. We look forward to the experience and see the event as a platform to further facilitate our efforts in the PropTech industry", says Sergey Kazachenko, co-founder and CEO at Navian.

If you plan to attend Propel by MIPIM NYC, the Navian team will be available to meet and discuss how Navian is digitalising the real estate industry.

Related News

- 09:00 am

Freedom Finance, one of the UK’s leading digital lending marketplaces and embedded finance providers, is adding nine credit cards offered by American Express to its panel.

American Express is one of the leading providers of credit cards in the UK and its inclusion in Freedom Finance’s marketplace further strengthens the platform’s growing card offering.

It joins lenders like Santander, Zopa, and many more, who already offer credit cards on Freedom Finance’s digital matching platform, built on Freedom’s proprietary technology that helps consumers find the best deal they are eligible for.

As well as providing a direct-to-consumer platform that searches for credit cards, loans and other lending products, Freedom Finance’s technology powers embedded lending for some of the UK’s best-loved brands like ASDA, Very and Creation.

American Express will be offering the following credit cards on Freedom Finance’s marketplace:

British Airways American Express Credit Card

British Airways American Express Premium Plus

American Express Preferred Rewards Gold Credit Card

American Express Nectar Rewards Card

American Express: The Platinum Card

Marriot Bonvoy American Express Reward Card

Platinum Cashback Everyday Credit Card

Platinum Cashback Credit Card

American Express Rewards Credit Card

David Hendry, Chief Marketing Officer at Freedom Finance, commented: “We are delighted to continue the expansion of our growing credit card panel with the addition of American Express – a global brand with a huge and loyal customer base in the UK.

“It further improves the range of credit cards we offer consumers both directly and with partner brands via our embedded finance offering. This variety combines with our innovative use of soft-search technology and open banking to offer borrowers more deals they are sure to be eligible for and makes sure they are getting the most appropriate financial products for their circumstances.”

Related News

- 05:00 am

Rimes, the industry leader in transformative data management and investment intelligence solutions, is delighted to announce that they have been awarded 'Best buy-side managed data service' by Waters Technology.

The award recognizes Rimes' unique ability to provide a fully integrated solution that helps clients navigate tough enterprise data management challenges, such as sourcing accurate ESG data, creating a security master or maintaining a robust IBOR. Rimes’ Managed Data Service seamlessly supports the requirements of buy-side organizations and provides the analytical tools required to gain the insights needed for better performance and exposure management.

Brad Hunt, CEO at Rimes, commented. "We are honoured to have won this important award, which follows an intense period of global business growth and change at Rimes. Over the last 12 months, we have transformed our operations, hired exceptional new talent, established meaningful strategic partnerships, and extended asset classes and data management domains. I am delighted to accept this award on behalf of the entire team, whose unwavering commitment to our clients made this possible."

“The addition of ETF, ESG data, as well as specialist support services to our MDS solution are proven differentiators in our approach to enterprise data management,” stated Stuart Plane, Head of Investment Intelligence and Managed Data Services. “This facilitates our ability to respond to real-world client problems such as validating and enriching vast volumes of complex data to deliver timeliness, accuracy, and completeness across their mission-critical operational systems and workflows. Our team is very proud of this recognition.”

Related News

- 03:00 am

Policy Expert, the UK’s leading personal lines insurtech, today announces the expansion plans of its technology division, including building out the team to 100 people by the end of this year as it adds to its data, pricing and development expertise.

The addition of more than 20 new, highly skilled technology roles will take the business to over 640 employees in total, almost doubling the tech team size over the last two years as it builds on its position among the UK’s fastest-growing home insurance providers.

Policy Expert continues to focus on broadening its use of artificial intelligence and machine learning to shape its pricing strategy, which combines data science with actuarial techniques. The newly created roles will support the business in building practical applications and cloud-based tech infrastructure, improving Policy Expert’s established vertically integrated business model.

Policy Expert offers home and motor insurance to over a 1.2million policyholders, using proprietary technology and advanced data analytics to optimize the customer experience. Its model is built on a highly scalable cloud platform, powered by Amazon Web Services, which has helped Policy Expert to more than double its customer base in the last three years. Customers have been benefitting from Policy Expert’s unique data-led pricing model, with over 92% of customers saving an average of £93 per year when switching to Policy Expert.

Using technology has enabled the business to optimize its workflow and deliver efficient growth while maintaining high performance and best-in-class customer service. Nine in ten (90%) of customers’ email enquiries are handled through one-touch resolution, helping Policy Expert to maintain its position as the UK’s number one rated home insurance provider via ReviewCentre since 2013, based on over 50,000 reviews, with a 4.8 Trust Pilot rating.

Market data also suggests the business recorded the strongest customer growth of any UK home insurance brand in the six months to March 2022, according to Consumer Intelligence’s Insurance Behaviour Tracker: more than doubling its gains from the previous six months. The business has since recorded its busiest-ever month for policy sales to new and renewing customers in August 2022.

Consumer Intelligence’s analysis shows Policy Expert is the youngest brand in the UK’s top six home insurers, alongside established providers such as Aviva, LV, Direct Line, Admiral and Saga. Its current market share makes Policy Expert a bigger player than household names such as Halifax and Sainsburys.

Earlier this year, it announced a six-year agreement with Accredited Insurance (Europe) Limited to support its further expansion, with a target capacity of £2bn in gross written premium.

Adam Powell, Chief Operating Officer of Policy Expert, commented:

“The potential to deliver better insurance experiences through smarter use of technology and data has been core to Policy Expert’s vision since day one.

“Since then, we’ve grown rapidly from start-up to scale-up and achieved sustained, efficient and profitable growth by building an insurtech company that customers want to stay with for life. These new tech roles will support our ambitions to make a positive difference to millions more households who want affordable and fairly priced insurance they can rely on in times of need.

“We’re proud to have built a tech team that is operating at the cutting edge of automation, artificial intelligence and machine learning to transform what people can expect from insurance, from a pricing strategy that rewards loyalty through to a claims experience which puts customers firmly in control.”

Related News

- 09:00 am

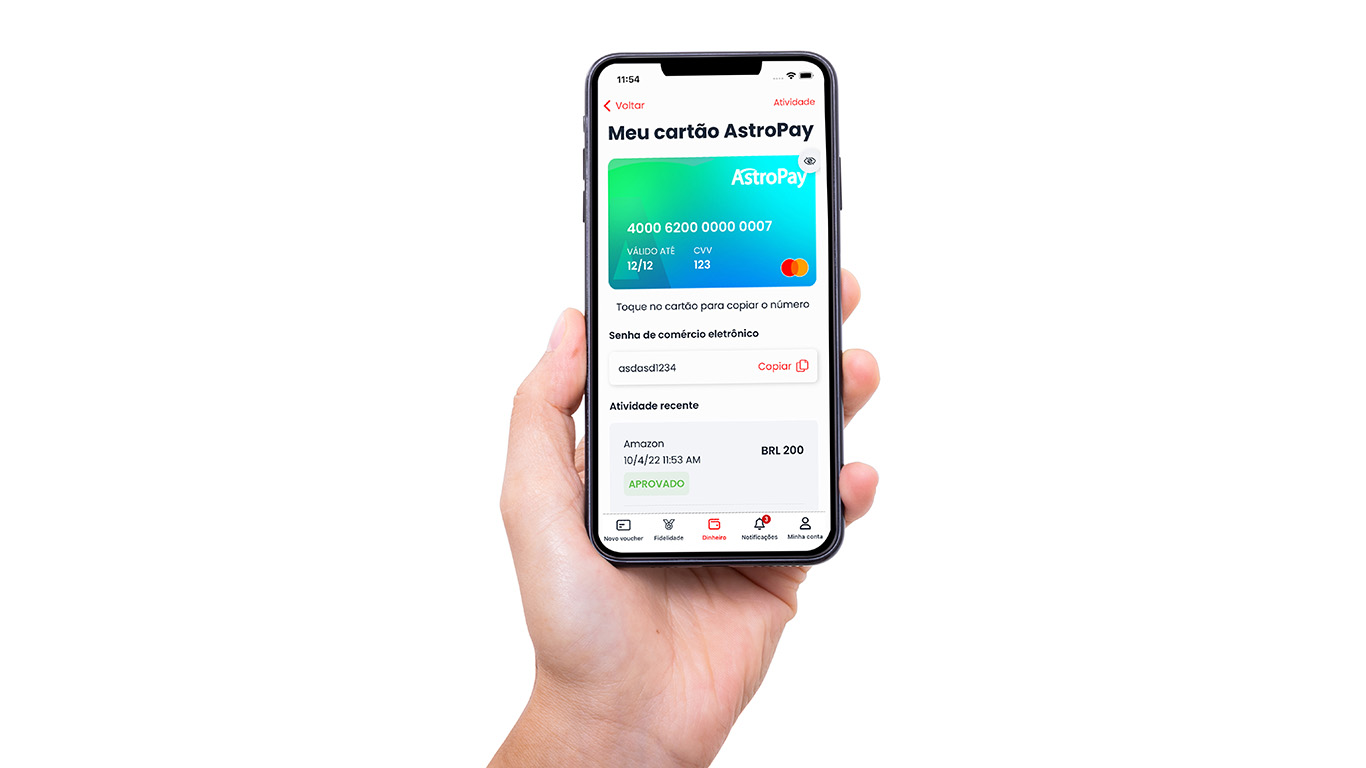

AstroPay, the online payment solution of choice for millions of users worldwide, is delighted to launch its new product in Brazil, a Mastercard prepaid card. This move will provide both new and existing AstroPay customers with the ability to pay in any store that accepts Mastercard.

The introduction of this new card in Brazil signifies a strategic relationship between Mastercard, a leader in global payments and AstroPay, a fintech with the mission to ease users’ life with the simplest, most convenient and secure way of handling their money and getting the most value out of it.

Users will be able to activate and use the prepaid card instantly without any charge and pay in any merchants that accept Mastercard. The card also comes with attractive benefits including cashback and other perks available in the AstroPay platform. Users can use the physical card to pay in stores and withdraw money from an ATM as well as make online payments with the virtual card.

The global brand adds to the growing network of solutions offered by AstroPay to its customers.

Guillermo Dotta, CTO & Chief Product Officer of AstroPay, said: “When it comes to digital money and fintechs, Brazil is one of the most advanced countries in the world, and the partnership with Mastercard honours our long-standing commitment to Brazilians to deliver the simplest solutions to handle money in the most secure and simple way. As we keep on building a strong community of consumers, our focus remains to continue innovating to adapt and streamline payment solutions such as cards into our overall product offering to ensure that the needs of our users are not only met but exceeded.”

Thiago Dias, Fintech and Enablers Vice President, Mastercard Latin America and Caribbean, said: “As the partner of choice for fintech companies, Mastercard is pleased to work with AstroPay to provide innovative solutions that help advance financial inclusion while offering consumers with a seamless and secure experience”.