Published

Alex Reddish

Managing Director at Tribe Payments

Crypto acceptance see more

- 01:00 am

iDenfy, AI-powered ID verification, fraud prevention and compliance startup, announced partnering with UpStack, premium staffing solution for fast-growing companies. iDenfy’s AI-driven biometric ID verification will enhance the safety of UpStack while helping onboard applicants more efficiently.

The risk of hiring fraudulent candidates got more prominent over the global pandemic when remote hiring reached its peak. Now, the new default for many companies remains digital talent acquisition due to its many beneficial factors, including removing geographic barriers and saving time or costs for traveling. According to iDenfy, the recruitment market must be protected by robust solutions to stop the use of deepfakes, altered documents, and stolen identities of fraudsters trying to score remote work positions.

UpStack centers on helping other businesses find skilled developers. The company understands the importance of having a multi-layer security system in place. By fast-tracking the tech hiring process with personalized matching, the staffing solution provider ensures a seamless onboarding for the talent while businesses can concentrate on their other business goals. Being in the HR space, UpStack started to search for more efficient ways to prevent fraudsters from trying to access its tech talent hiring hub.

UpStack prioritized secure, end-to-end identity verification and AML service providers when searching for new fraud prevention solutions. Hence, the HR enterprise joined forces with iDenfy to mitigate fraud risks and automate pre-employment screening. iDenfy is now responsible for ensuring that all UpStack’s applicants are protected and their sensitive data is stored in a compliant manner.

By partnering with iDenfy, UpStack managed to speed up the onboarding process, guaranteeing that only legitimate applicants are allowed into their talent network. With the new verification, UpStack’s users go through a simple, four-step process where iDenfy’s software, powered by biometric technology, instantly detects the use of deepfake videos, 3D masks, and any type of fraudulent imagery.

Additionally, iDenfy runs AML checks using its Screening tool to automatically check if the applicant isn’t included in global watchlists, sanctions lists, and PEPs. It’s worth mentioning that the compliance service provider has an in-house team of experts who additionally review each candidate application to ensure complete accuracy for UpStack.

As specified by iDenfy’s CEO, Domantas Ciulde, flexible and user-friendly ID verification is vital in the digital sphere to maximize security for a platform like UpStack. Despite that, it’s critical to maintain efficiency without compromising on security:

“Increased volumes in remote hiring means more opportunities for fraudsters. We’re helping our partners at UpStack improve the experience for the candidates and secure the best talent in tech,” — added Ciulde.

“We’re excited to join forces with true professionals in the KYC/AML field, iDenfy. Our top priority as a growing company is to stay compliant with security policies and provide top-notch services in the most reliable and trusted manner,” — commented Roxanna Duta, Head of Talent at UpStack.

Related News

- 03:00 am

Eventus, a leading global provider of multi-asset class trade surveillance and market risk solutions, and Fennel Financials LLC, which just launched an Environmental, Social and Governance (ESG)-focused platform offering retail investors access to tools to better engage with companies, today announced that Fennel has chosen to deploy the Eventus Validus platform for all of its trade surveillance activities. Fennel will also be using the platform’s anti-money laundering (AML) capabilities.

Fennel launched its mobile investing app for equities in mid-November, providing in-app ESG data and rankings to educate retail investors on public companies’ ESG practices. Through the app, users can invest in publicly listed stocks and exchange-traded funds (ETFs) as they analyze the data.

Jenn Gatherer, Chief Compliance Officer of Fennel Financials LLC, said: “We want our customers and regulators to know that Fennel has a true culture of compliance and that we have employed best-in-class systems and compliance practices at every level of the business, aligning ourselves with companies that do the same. We will evolve as the landscape evolves, and Validus enables us to do that. I believe having a customizable, automated trade surveillance platform is imperative for a real compliance program.”

Eventus CEO Travis Schwab said: “We are delighted to provide the backbone for Fennel’s trade surveillance program as the firm grows its business through a truly innovative investing app. It’s exciting to continually expand into new and creative use cases in equity and other asset classes as our clients chart new territory and financial markets evolve.”

Gatherer has been in compliance for decades and has deployed a number of trade surveillance platforms, including Validus when in a previous role. She said: “The customer service at Eventus is second to none. The firm’s commitment to innovating, as well as hearing what’s important to clients and making that a reality are extremely important to me as a partner in compliance. We can tweak reports to our liking, and that ability to act independently or with Validus support is really powerful. Knowing what I need to find and then refining the requirements as we learn how our customers trade makes my job easier and significantly more effective.”

Also important to Fennel, Gatherer said, was that Eventus does not rest on its laurels and is constantly evolving to meet the needs of clients. “Many companies create a good system for the time, and they keep moving along with that system and really don’t adjust it or engage with clients. If they do, it’s often very slow to make those changes happen. The speed with which Eventus can make the changes is really impressive. If something needs addressing, the firm has demonstrated it can get that done instantaneously.”

Related News

Mike Hoy

Technology Director at Pulsant

The internet of things (IoT) is set to change the working lives of huge numbers of finance professionals. see more

Rajashekara Visweswara Maiya

VP, Global Head – Business Consulting at Infosys Finacle

From pandemics to politics, we live in extraordinary times. see more

Chris Harmse

VP of Revenue at BVNK

2022 has been a tough year for some in the crypto sector and we’ve seen a series of high-profile business in the space collapse. see more

- 04:00 am

Leading global cryptocurrency exchange Bitget announces that it has registered in Seychelles to aid global expansion. The exchange operates in a decentralised manner with no specific headquarters, with regional hubs in strategic markets, and plans to set up more regional hubs in the future. The exchange has also updated its recruitment plan with a new target of 1200 headcount by the first quarter of 2023, increasing its workforce by another 50% from its existing size, to better meet user demand and support business growth.

This new registration in Seychelles is under the 2016 International Business Companies Act. Together with the registration in Seychelles, Bitget has also established regional hubs in Asia and LATAM markets and plans to strengthen its global presence with more regional hubs such as ones in Europe and Africa regions. In the past few weeks, Bitget has taken a series of initiatives to build up trust and confidence with users and the crypto industry, including launching the USD 5 million Builders' Fund and increasing the Protection Fund size to USD 300 million. The exchange is also accelerating its hiring plans, not showing any signs of being affected by the recent turmoil.

Bitget, earlier in June this year, originally announced that the company would double its workforce to 1000 employees by the end of 2022. To better meet the growing user demand and business development, Bitget has further raised its target to grow its workforce to 1200 by the first quarter of 2023. So far the company has gone from a team of 450 in June 2022 to over 800 currently, a 78% growth within 4 months, and will continue to increase another 50% of its headcount till reaching the new target. The team is currently looking for talented engineers and product, marketing and branding team members to provide the best social trading experience for its users.

Gracy Chen, Managing Director of Bitget, says, "We see Seychelles as a friendly region for the crypto community. We have been working for several months on this registration and are happy to announce the development now. The registration in Seychelles offers a constructive environment for Bitget, enabling us to unlock collaborations with partners and strengthen banking relationships, along with our expansion with different partnerships, such as the Argentine football legend Lionel Messi and the Italian football club Juventus. With a global footprint, Bitget fully embraces the concept of Web3, allowing the team to work in a decentralized way without a specific headquarters. We believe doing this can help us attract talent across borders as we are hyper-focused on growth and scaling up. It is crucial for us to recruit high-calibre candidates globally and set up regional hubs to aid local communication and coordination in strategic markets simultaneously."

Gracy adds, "Our recruitment always aligns with our global expansion and long-term strategy, and we will continue to hire despite current market sentiment. Capable and suitable talent will help Bitget build a safe and reliable platform, which will gain stronger traction among users in the fiercely competitive industry and eventually lead to a more trustworthy and robust platform that better serves the community."

Related News

- 07:00 am

The TAINA Team is thrilled to have successfully raised another round of funding with the participation from HSBC Asset Management, Deutsche Bank CVC, SIX FinTech Ventures and Anthemis.

In Q1 of 2023, TAINA is looking forward to welcoming other Top Tier Global Financial Institutions as investors and clients, details will be disclosed in due course.

Maria Scott, TAINA CEO and Founder said "With this new injection of very supportive capital, TAINA is looking forward to achieving a number of objectives on its mission to grow as the Best-in-Class Platform for the industry, for an expanding range of Regulations, Geographies and Market Segments”

TAINA’s 2022 Achievements include:

• Being voted as the Best Regulatory Solution for FATCA / CRS - A-Team RegTech Insight USA Awards 2022

• Recognition as the Best Regtech Solution - 2022 Digital Finance Innovation Awards APAC

• Best Regulatory Compliance Solution - Canadian RegTech Awards

• One of the World’s Most Innovative RegTech for 6 years running

• UK’s RegTech50 (second year in a row)

• TAINA continues to add the world’s most sophisticated and largest financial institutions, funds, and fund administrators as clients, achieving Its highest growth in customer count year-on-year in 2022.

TAINA’s 2023 Objectives include:

● Delivering more innovative cutting-edge solutions that add value and address our clients' and prospects' most pressing needs in this ever-evolving Regulatory Landscape with the continuing intensification of enforcement by Tax Authorities around the world.

● Continuing to grow and build our priority jurisdictions, including United Kingdom and Continental Europe, North Americas, The DACH region, Asia Pacific and Middle East and North Africa.

● Continue growing the propositions for Digital Assets and other key market segments that are coming into the scope of the expanding regulations.

Investor Feedback speaks for itself:

“We are delighted to participate in TAINA’s latest funding round as follow-on investment and continued commitment to support the company in strengthening regulatory client lifecycle management in the industry. Investing in selected FinTech solutions enables Deutsche Bank for example to improve the client experience and increase productivity by further digitalizing our front-to-bank processes”, said Joerg Landsch, Head of Central Corporate Venture Capital, Deutsche Bank

“HSBC Asset Management is a firm believer in the principle of adhering to the highest standards of regulatory compliance. TAINA is well on its way to establishing a standard for experience in this space. Tax reporting and compliance is unavoidably complex, but TAINA’s digital design makes the process seamless. This investment round will help boost TAINA’s international footprint and support TAINA’s mission to provide pre-eminent tax-compliance solutions to more users.” said Kara Byun, Head of Fintech, Venture & Growth Investments, HSBC Asset Management.

“Since our initial investment, we have been impressed by the resilience and grit of the TAINA team. Despite tough market conditions, the business has successfully grown its top line four-fold in the last 12 months. With this recent round of funding, we continue to support the business on its journey of becoming the category leader in tax compliance.” said Yin Yan, Principal, F10 (advisor to SIX FinTech Ventures)

“TAINA's latest funding round reinforces our investment conviction in TAINA and its exceptional team. Financial institutions of all sizes and stages of growth desperately need the technologies TAINA have developed to increase their operational and compliance efficiencies. TAINA has succeeded amid tremendous macroeconomic and geopolitical challenges and is entering a whole new growth chapter. We are honoured and excited to support Maria and the Tania team as they strive to hit their next milestones.” said Marin Cauvas, Principal at Anthemis.

Related News

- 05:00 am

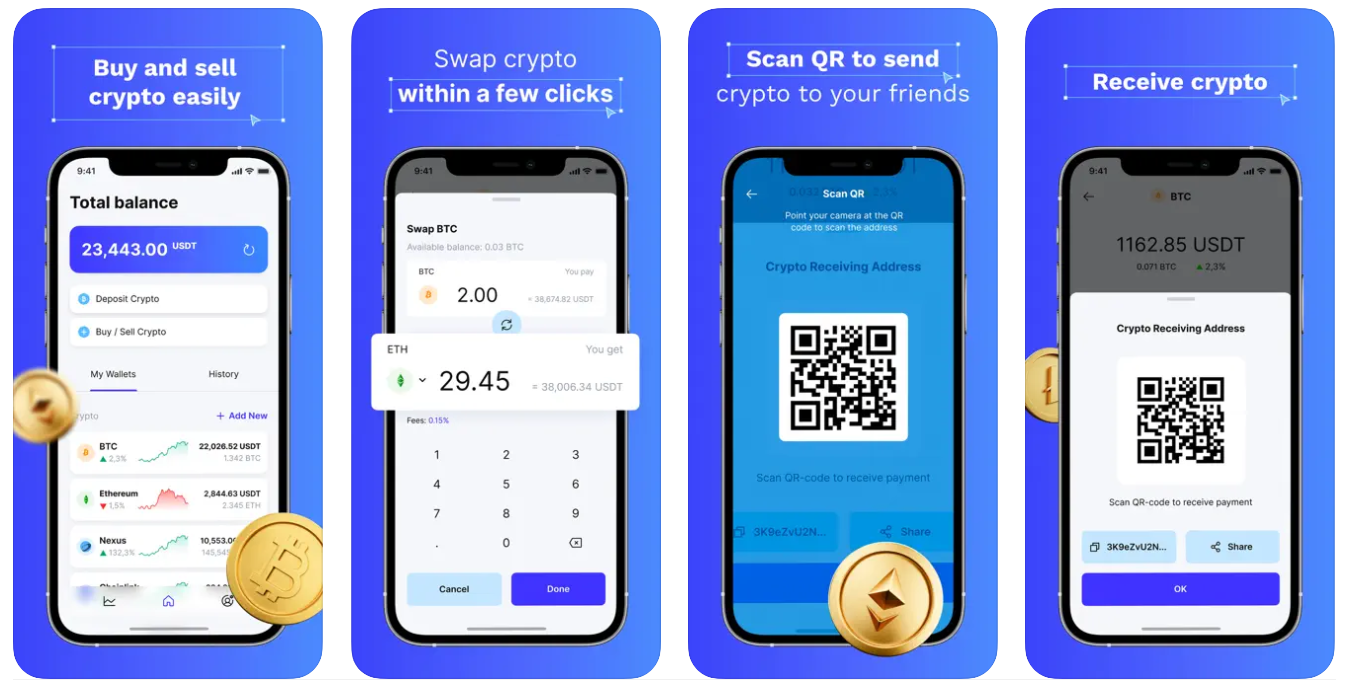

KoinKoin, the African-focused digital assets exchange, has launched a new app for retail traders to buy and sell digital currencies ultimately using local payment methods. The app intends to connect an even wider audience across the world with access to cryptocurrencies, to empower efficient cross-border remittance, trading and payments.

KoinKoin Exchange offers instant liquidity in BTC, ETH, BCH, LTC and a few others. The aim of the service is to connect users with direct access to a deep liquidity in assets of their choice and make super-fast fiat settlements as necessary.

KoinKoin partnered with BitHolla, to provide deep liquidity from 40 major exchanges to ensure market orders are filled in fractions of a second. No other local exchange currently has this capability to make and take markets across the globe.

The app includes built-in security technology to ensure data is kept safe, and all digital assets are stored in a blockchain wallet offering high-grade security. The app maintains safety standards with multi-stage verification and two-factor authentication security.

KoinKoin also allows each user to earn USDT-based digital tokens using its referrals program.

Ola Atose, CEO and Founder of KoinKoin, comments:

“The KoinKoin Exchange app marks a major push into the retail trading space for KoinKoin. We are pleased to have created an advanced smartphone application which is highly functional and super simplistic for one of the most straightforward user experiences in the digital assets trading app markets.

“This will make digital assets accessible to an even wider audience across the globe, such as in Emerging Markets, where cryptocurrency will not just be used as a store of value, but also as a means to empower fast and cost-effective cross border payments.”

Related News

- 06:00 am

Zurich-based digital financial services provider, bob Finance, has successfully migrated its full lending portfolio to Mambu’s cloud-native banking platform. This migration included a move to a locally-based Google Cloud.

bob Finance is a branch of Valora Schweiz AG, the leading provider of Foodvenience in Switzerland. They provide simple and secure digital financing solutions for both individual and business customers. The fintech originally leveraged Mambu to launch its ‘buy now, pay later’ offering for retailers called ‘bob Zero’ in 2020. As bob Finance further establishes itself in the lending market, it needed a platform hosted in Switzerland that meets internal and external partner standards.

Hilmar Scheel, CEO at bob Finance: “We teamed up with Mambu two years ago because we were looking for a flexible, cloud-native platform with core product capabilities that would support our mission to become a reliable and versatile partner for financial services. Since then, we’ve reduced maintenance effort and information security risks through an up-to-date platform and technology stack compared to one that is individually hosted.”

As bob Finance assessed the consumer finance market, it saw the need to deepen its technical integration with enterprise partners to provide fast and easy onboarding journeys and increase efficiency. This required a platform hosted in Switzerland to comply with data residency requirements, which kicked off the current migration project. With its offerings on Mambu’s platform, bob Finance is poised to continue building products and developing new opportunities in the region, while achieving its end goal of simplifying consumer finance for Swiss customers.

Zac Maufe, Managing Director, Financial Services Industry Solutions at Google Cloud: “Today’s financial organisations require solutions that help drive innovation with customer security and business scalability. By partnering with Mambu as a part of its business digital transformation goals, financial services institutions like bob Finance can benefit from in-country, technology-enabled approaches to banking at cloud scale.”

Scott Wilson, Regional VP EMEA at Mambu: “bob Finance is developing innovative, customer-first lending experiences for the Swiss market. Building on the success of our original partnership, they saw the opportunity to both migrate its offerings onto Mambu and a locally-based cloud. The versatility and power of the Mambu platform combined with our multi-cloud approach meant bob Finance could change cloud providers easily and with zero down time, all in a matter of six months. We’re looking forward to supporting the digital lender as it leverages our cloud-native banking platform to build scalable lending experiences in the region.”