Published

- 09:00 am

Hashdex, a leading global crypto-focused asset manager, today announced the launch of its Staking Program for all non-bitcoin funds and ETFs in The Cayman Islands, Brazil and Chile. Investors in eligible funds will benefit from staking awards to achieve higher returns, either through partial or full compensation of the management fee.

“Hashdex is committed to continually providing cutting-edge products that meet the high standards of global professional investors, and our new Staking Program further reinforces our unmatched ability to evolve in-line with the growing crypto ecosystem,” said Marcelo Sampaio, Co-Founder & CEO of Hashdex. “Staking is a key benefit of select cryptocurrencies, serving as passive income and enabling institutional and retail investors to benefit from valuable staking rewards while supporting the security of the underlying blockchains. Through our program, investors will enjoy the benefits of staking through Hashdex’s professional, trusted and regulated products, all without the need for specialized expertise or the use of complicated platforms.”

Hashdex’s industry-leading products and services, including the firm’s latest staking program, allow investors pathways to fully participate in the crypto ecosystem. In addition to benefiting from the potential price appreciation of crypto assets, Hashdex’s Staking Program provides investors with the ability to earn additional yield on their tokens as staking rewards and mitigates the impact of token dilution, all while contributing to network security. The Program will automatically be incorporated in the firm’s funds and ETFs in the Cayman Islands, Brazil and Chile, with the exception of bitcoin-only products. This in turn enables Hashdex to offer higher net returns on its products, as the staking rewards will offset the impact of costs and, depending on the product, either lower the management fee, reduce the tracking error or generate outperformance.

“The ever-growing interest and adoption across crypto assets, especially as a result of challenges within the banking sector, reiterates investors’ enthusiasm for this important sector,” said Bruno Caratori, Co-Founder & COO of Hashdex. “Staking provides numerous benefits to the blockchain ecosystem that span from helping to secure the blockchain network, to facilitating governance, to improving efficiencies, and to regulating the supply and demand of tokens. As pioneers of this new approach to transparently allow investors to benefit from staking rewards, we are thrilled to set a new standard that any ETF issuer with proof of stake crypto assets should return the staking rewards value to clients, even when the ETF is not a staked ETF.”

To carry out the Staking Program, Hashdex has carefully selected providers with an excellent track record and risk controls that minimize the possibility of any losses during the staking process. All selected providers offer insurance against loss for operational errors or misbehaviour. Moreover, to ensure sufficient liquidity for redemption or other needs, Hashdex always keeps a portion of each crypto asset unstaked. Staked crypto assets are held by the same qualified custodians that hold the firm’s unstaked assets, including Coinbase Custody and Bitgo. As part of Hashdex’s ongoing mission to provide investors around the world with the opportunity to participate in the crypto ecosystem through innovative products and services, the firm is reviewing additional regions in which to expand its Staking Program.

With offices in Brazil, the United States, and Europe, Hashdex is a renowned leader in the development of industry-first crypto offerings that enable global investors to participate in the crypto ecosystem. Nasdaq developed, in partnership with Hashdex, the Nasdaq Crypto Index™ (NCI™), which benchmarks the institutionally investable crypto market, and listed the world’s first crypto ETF, the Hashdex Nasdaq Crypto Index ETF, on the Bermuda Stock Exchange. Hashdex currently has more than 225,000 investors globally in its products.

Related News

- 09:00 am

Clearwater Analytics, a leading provider of SaaS-based investment management, accounting, reporting, and analytics solutions, today announced that Scott Erickson has been appointed as the Company’s first Chief Revenue Officer. He will now oversee Clearwater’s sales efforts in Europe, Asia, and the Americas. With an 18-year track record of driving Clearwater’s growth including roles in services, product strategy, and sales, Erickson will continue to lead the Company’s market share expansion, now across all regions.

“I can think of no one more deserving of the title Chief Revenue Officer than Scott, given his expertise and exceptional track record of growing the Clearwater platform,” said Sandeep Sahai, CEO at Clearwater Analytics. “On the heels of a number of large wins in North America, Europe, and Asia Pacific, Clearwater’s strategy of bringing global asset managers, insurers and corporations of all sizes on to a single SaaS platform has proven very transformative and effective. While each geography and industry presents unique accounting and regulatory reporting needs, our platform addresses all our clients’ needs, whether it’s managing yield, risk or complying with local and global regulations. Given the similarities we’ve seen across our target clients and the global nature of their portfolios, we believe a global approach best serves our clients and allows us to capture even more market share throughout 2023 and beyond.”

Given the strategic importance of Europe, the Company has continued to build out the leadership team in the region. Brian Slattery, who led the effort to make Clearwater the leading platform in the North American insurance market has relocated to London. He will lead our efforts in the Northern European market. The Company recently appointed Josef Sommeregger, a former leader at SimCorp, to lead the DACH region. These proven leaders are paired with Thomas van Cauwelaert, regional head for France and Sai Perry, Head of Solutions across Europe. In their drive to modernize the investment accounting and reporting infrastructure across the region, this team will report directly to Erickson.

“I look forward to working with our team to demonstrate that only our innovative, single-instance SaaS technology platform has the power to drive real, long-term improvements,” said Erickson. “I’m immensely proud of our customer-first approach – I truly believe we are better together, am humbled by the team’s trust, and honoured to take on this new challenge.”

Since joining Clearwater in 2005, Erickson has successfully led multiple Clearwater departments, first as Director of Client Services, then as Director of Product Management, and as Director of Sales. In 2022, he served as President, Americas and New Markets, ensuring the success of partnerships with some of Clearwater’s largest clients including J.P. Morgan, Aegon Asset Management, Avallis Investments, and Asia Capital Insurance, all while leading the charge to create new products like Clearwater LPx, Clearwater Prism, and more. In December 2022, he added the Asia Pacific regions to his portfolio and with this change today, he will have global responsibility for sales.

Following three years of dedicated service to Clearwater, Gayatri Raman has decided to resign from her position as President of Europe to focus on her family. “Gayatri’s work was instrumental in positioning the Company for continued growth. On behalf of the Board and the management team, I want to thank Gayatri for her contributions and service and wish her all the best,” added Sahai.

Related News

- 04:00 am

Rego Payment Architectures, Inc. (“REGO”), the only COPPA-certified and GDPR-compliant provider of a white-label family digital wallet platform for financial institutions, announced today that it has secured a critical banking partnership as well as raised approximately $100M funding to continue delivering its integrated banking solutions.

“Customers have demanded from their banks and credit unions the ability to provide their children with financial literacy tools that allow them to spend, save and donate with parental controls,” said Peter S. Pellulo, CEO and co-founder of REGO. “However, the IT and regulatory requirements can be overwhelming for many financial institutions. REGO is uniquely positioned to offer a secure and fully integrated solution.”

Though the demand for banking products for children under 17 is high, state and federal lawmakers are increasing protections over children’s data and privacy. Companies risk paying severe fines for not complying with federal laws such as Children's Online Privacy Protection Act (COPPA) and similar laws passed by a growing list of states such as California, Utah, Colorado, Iowa and others.

“Getting data privacy wrong - especially with COPPA AND GDPR protected information of a child - can be troublesome for a financial institution, not just from a regulatory or monetary standpoint, but also the erosion of trust from customers,” said Donald Codling, retired FBI Cyber Division Unit Chief and CISO/CPO advisor for REGO. “Having worked with REGO for years, I’m pleased to say they have invested time and money into the necessary foundational cyber security and data privacy technologies to build a solution that is fully compliant.”

REGO has been recognized by PRIVO, one of the leading global industry experts in children’s online privacy and delegated consent management, to be certified COPPA and GDPR-compliant, making it the only digital family wallet solution to meet its rigorous standards. REGO has also been awarded multiple patents related to the safety of parent and child data, including the age verification of the internet user.

Recently, REGO announced its partnership with Q2, a leading provider of digital transformation solutions for banking and lending. This partnership enables all of Q2's banking and credit union customers to offer a secure family digital wallet with children’s online safety in mind to their customers.

"REGO was built from the ground up to be a flexible, white-label solution for financial institutions,” explained Stuart C. Harvey Jr., chairman of REGO’s board of advisors and former CEO of Elavon Global Merchant Acquiring and Comdata. “Now, banks and credit unions of all sizes can offer REGO’s secure family wallet under their own brand at all levels of integration - from a co-branded standalone app or fully integrated in their own app.”

Furthermore, REGO has secured funding to continue building its secure platform. The company has raised approximately $100M in funding to date, so that it can continue to invest in its technology, team, and growth in the market.

Related News

- 07:00 am

Crypto derivatives market participants are set to increase their use of third-party trading technology as the quality and sophistication of the products on offer continues to increase, a newly published study by Acuiti has found.

The whitepaper Changing Approaches to Crypto Trading Technology is based on a survey conducted in Q4 2022 of Acuiti’s Crypto Derivatives Expert Network and is published today in partnership with Trading Technologies, a global capital markets technology platform provider.

Historically, proprietary trading firms, hedge funds and asset managers entering the crypto derivatives markets have tended towards inhouse builds owing to a relative lack of third-party offerings in the market.

However, the Acuiti study found that firms experienced challenges in building technology inhouse, in particular when it came to trading execution, risk management and market data tools.

As the quality and sophistication of third-party offerings in the crypto derivatives market increases, firms are likely to increasingly look to third parties, the study predicts. This trend is likely to accelerate as crypto-native firms expand into traditional asset classes.

Other key findings include:

● Crypto derivatives market participants would welcome increased involvement from traditional sell-side firms with balance sheet and reputation the key benefits they would bring

● A significant majority of firms execute most of their trading on exchange via a central limit order book, but over-the-counter (OTC) volumes are expected to increase

● Over a third of crypto-native firms are set to expand into traditional asset classes

“The crypto market grew from nothing to a multi-trillion dollar market in a short space of time,” says Will Mitting, founder of Acuiti. “One result of this was that the quality and sophistication of third-party technologies often lagged the inhouse builds of the early pioneers.

“Today there are many institutional-quality third-party offerings in the market and more being launched. This is lowering the barrier to entry for firms coming into the market and tilting the calculus in favour of third-party development for both incumbents and new entrants.”

"The survey respondents made it clear that third-party support of their crypto trading expansion plans can both ease their burden and help them achieve their goals at the pace that's comfortable for them," said Jason Shaffer, Trading Technologies EVP Product Development and Head of Americas. "These findings are aligned with what we're hearing from customers who are working with us on the expansion of our crypto offering. They view our advanced toolset for professional and institutional trading – combined with expanded market access – as a superior alternative to creating and maintaining inhouse systems."

Download full report here: https://www.acuiti.io/changing-approaches-to-crypto-trading-technology.

Related News

- 02:00 am

iDenfy, a global RegTech startup offering ID verification, compliance, and fraud prevention tools, announced partnering with Dialics, a PPC tracking and real-time marketing analytics software. iDenfy’s full-stack identity verification solution will help speed up the sign-up and verification process for Dialics customers.

Dialics partnered with iDenfy to simplify registering new customers, all while complying with strict regulations and maintaining top-notch security measures to protect its customers. To ensure compliance with these standards, Dialics searched for an ID verification provider to handle its Know Your Customer (KYC) process without compromising security or user experience.

Dialics carefully evaluated various vendors and ultimately chose iDenfy as its identity verification partner because of our user-friendly integration and advanced fraud detection capabilities. One key factor that set iDenfy apart was its hybrid approach, which combines AI-powered software with an in-house team of experts to thoroughly review ID documents for complete accuracy.

Since its establishment in 2019, Dialics has been driven by a team of passionate experts who are committed to improving the effectiveness of online marketing through call-tracking functionality. The platform offers a user-friendly experience that allows for easy management of online Pay-Per-Сall (PPC) marketing campaigns while providing instant access to analytical data and the ability to process international inbound calls.

As Dialics and its customer base continued to expand, the company recognized the need for a more efficient onboarding process that could help accelerate growth and reduce the workload for its internal KYC specialists. The entire Dialics platform was built on a user-friendly interface, so the company wanted to ensure the same ease and convenience would be available for the ID verification process.

Consequently, Dialics prioritized delivering a digital experience that could compete with the best available options while maintaining a robust fraud prevention program. After careful evaluation, Dialics determined that iDenfy offered both of these essential factors, providing a convenient solution for its customers while ensuring the security of their data.

iDenfy utilizes AI-powered algorithms to verify the authenticity of uploaded IDs and matches them with the customer's onboarding selfie. This process, which consists of four steps, enables Dialics to onboard its customers within a few minutes. By preventing fraudulent attempts to pass the verification process, iDenfy effectively eliminates any possibility of fraud. To maintain high accuracy rates, iDenfy's KYC experts conduct real-time manual checks of each verification.

“Our new partners at Dialics offer convenient conditions for users of all types, including companies of all sizes, solo affiliates, and marketing agencies. With this partnership, our goal is to provide a flexible identity verification solution that enables Dialics to onboard all its customers safely and securely.” — commented Domantas Ciulde, the CEO of iDenfy.

Related News

- 04:00 am

Gatehouse Bank has been named the ‘Best Islamic Bank in the United Kingdom’ and the ‘Most Innovative Bank in the United Kingdom’.

The Shariah-compliant challenger Bank was given the accolades by the international media group, Islamic Finance News (IFN), following a record number of votes in its most recent Best Banks Poll – Country, which honours outstanding Islamic banks in key financial markets.

IFN noted that the UK is widely recognised as a Western hub for Islamic finance, commending Gatehouse Bank for continuing to play a vital role in this landscape despite the country’s tricky economic and political climate over the last year. Gatehouse Bank was further praised for its expertise and digital-first ethos.

The accolades reflect the Bank’s strong position in the UK market and digital advancements across product areas over the last year. In 2022, the Bank launched a savings app to provide customers with round-the-clock access to their personal savings accounts, as well as an online decision in principle tool to allow home finance customers to independently gain a decision in principle at a time convenient to them.

Andrew Tebbutt, Managing Director, REDmoney, said: “Gatehouse Bank continues to innovate in the provision and distribution of financial solutions for ethically minded consumers in the highly competitive UK market.

“The Bank’s position is reflected by its strong showing in the 2022 IFN Best Banks Poll, and IFN congratulates Gatehouse Bank and its leadership for their continued success.”

Charles Haresnape, CEO of Gatehouse Bank, commented: “We are thrilled to have been named the Best Islamic Bank in the UK and Most Innovative Bank in the UK by Islamic Finance News and extend our gratitude to everyone who voted for us.

“At Gatehouse Bank, we pride ourselves on our customer-first ethos and digital product offering and are pleased that our efforts have been noted by such a prestigious, international organisation.”

Related News

- 03:00 am

Wolters Kluwer, the Dutch technology company, has launched a new financial tech solution that it says will help multinational companies collect, align, calculate and report integrated finance and tax data in accordance with Organisation for Economic Co-operation and Development (OECD) Pillar Two tax requirements. The CCH Tagetik solution will also help CFOs better understand how Pillar Two regulations will impact their business model and operations.

“Today, many large companies use disparate, disconnected technology to manage tax and financial data, making it difficult to efficiently address the new tax requirements,” Wolters Kluwer notes in a statement. And with this in mind “Wolters Kluwer is extending its unparalleled corporate tax expertise to its market-leading CCH Tagetik Corporate Performance Management (CPM) platform.”

As part of a continuous effort to reform the international tax system, and in adherence to OECD Pillar Two tax requirements, more than 140 countries have agreed to implement a global minimum corporate tax rate of 15% in 2024, for certain multinational companies. To meet the new obligations of Pillar Two, multinational companies need to quickly gain visibility into, connect, and analyze massive amounts of enterprise-wide data. They must also process complex tax calculations to understand the impact Pillar Two will have on corporate profitability and operations.

The company says that the CCH Tagetik Global Minimum Tax expert solution empowers multinational companies to rapidly meet Pillar Two regulation requirements by collecting, aggregating, harmonizing, and securely storing the new data sets required to perform complex calculations across local, group, finance, and tax consolidation.

The solution also helps manage the tax process end-to-end, “reducing the burden that tax and finance teams face when reporting in accordance with the Pillar Two framework.”

“CFOs need to gain visibility into, connect and analyze enterprise-wide data in a way that helps them better manage complex global requirements related to OECD Pillar Two,” said Ralf Gärtner, Senior Vice President and General Manager of Corporate Performance Solutions, Wolters Kluwer. “Our new CCH Tagetik Global Minimum Tax solution delivers on that need – and it’s the latest example of our commitment to creating user-friendly, advanced technologies that address the constantly evolving challenges faced by the Office of Finance.”

Wolters Kluwer adds that the solution takes a top-down approach by connecting tax to consolidation, centralizing enterprise data, and automating processes and calculations to facilitate compliance process.

The solutions will also help companies guide their tax strategy, and understand the current and future impact that Pillar Two reporting requirements will have on their business model and operations. “Users can perform what-if analyses of how various business decisions will be impacted by the new tax model. Armed with this information, CFOs can create more informed 3-to-5-year strategic plans that guide and optimize their corporate tax strategy to drive profitable growth,” Wolters Kluwer adds.

Related News

- 05:00 am

Wise, the company building the best way to move and manage money around the world, has announced a collaboration with Interactive Brokers (IBKR), an automated global electronic broker. Interactive Brokers has integrated Wise to allow clients a simple and seamless experience when making deposits in their trading accounts.

This integration is made possible by Wise Platform, which allows banks and businesses to leverage Wise’s global payments infrastructure and makes global investing easier than ever by allowing clients to save money on transfer fees when investing in their choice of 150 international markets worldwide through a quick and easy service.

Interactive Brokers offers clients from over 200 countries and territories the ability to trade stocks, options, futures, currencies, bonds, funds, and more on 150 global markets from a single unified platform. With IBKR, clients can fund accounts and trade assets in up to 26 currencies. This offers clients a simple way to trade products worldwide without opening multiple accounts in different currencies.

With today’s launch, clients of Interactive Brokers can now also elect to ‘Pay with Wise’, which enables them to convert their local currency to an Interactive Brokers-supported currency at the true mid-market exchange rate, free from hidden fees and markups 一 all without leaving their IBKR platform.

Additionally, clients can transfer directly from balances in their linked Wise accounts. Customers may receive their money in the chosen currency in a matter of seconds — over 50% of all transfers globally sent on Wise are instant (arriving in less than 20 seconds).

Together, these features help reduce transfer fees and shorten the time clients of Interactive Brokers need to move funds between their bank accounts and their trading accounts.

Steve Naudé, Head of Wise Platform, said:

“Our integration with Interactive Brokers will make investing in global stocks through IBKR’s platform affordable and fast for users all over the world. Customers will be able to see exactly how much they are paying to move their money into different currencies, which means greater peace of mind and a better return on investment. We look forward to continuing to work alongside IBKR to make global investing easier for clients all over the world.”

Steve Sanders, EVP of Marketing and Product Development at Interactive Brokers, said:

“Interactive Brokers serves over two million self-directed investors and active traders in 200+ countries and territories. With the Wise integration, we can offer account funding in more local currencies, enabling greater participation in global markets, diversification of investments, and added protection against local economic uncertainty - all on Interactive Brokers’ single unified platform.”

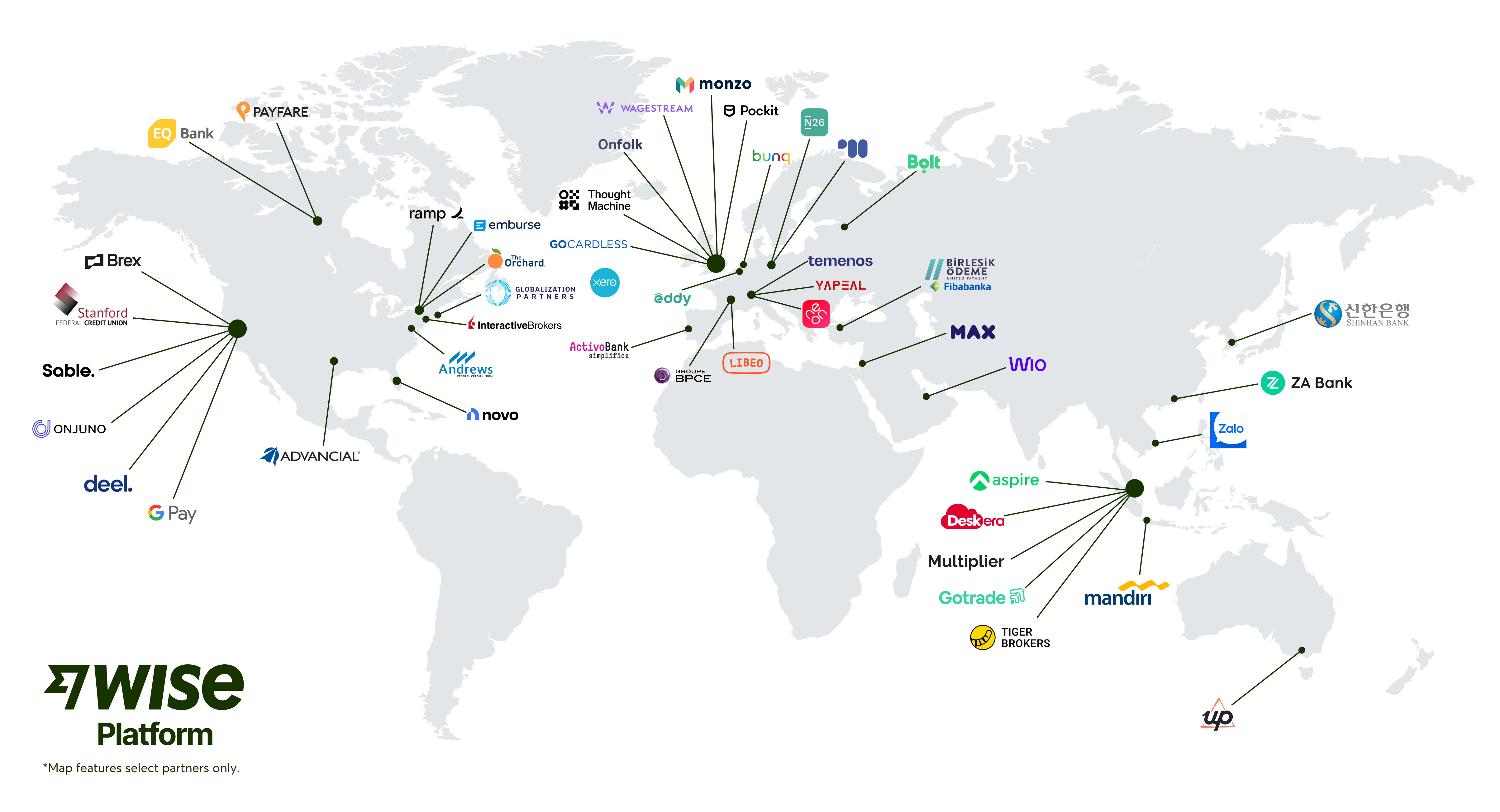

Wise Platform partners with over 60 banks and businesses worldwide, allowing them to leverage Wise’s technology and embed the best way to send, receive and manage money internationally. Wise’s collaboration with Interactive Brokers is one of its largest to date.

Related News

- 07:00 am

“We have been a Global Partner of Kickstart since its founding in 2016. Together with our in-house experts, Kickstart defines relevant topics and looks for promising startups. We are able to promote open innovation, connect with startups, and enable new trends in the marketplace and contribute to Deeptech Nation as well as sustainability-driven solutions." explains Roger Wüthrich-Hasenböhler, Chief Strategy and Growth Officer at Swisscom. Also participating in Kickstart's 8th innovation program with the aim of developing sustainable and innovative solutions within society are AXA, Canton de Vaud, City of Zurich, Coop, la Mobilière, PostFinance, Sanitas, CSEM and MSD. Over the past years, Kickstart has been able to attract some of the world's best startups, including well-known names such as Planted, Neustark, Unsupervised and AAAcell. Since 2016, Kickstart has supported over 400 startups from more than 80 countries, facilitating over 270 deals in the form of collaborations. To date, investments of more than CHF 2 billion have been raised in the process.

"The program continues to grow in importance not only from an innovation perspective, but also in sustainability and circular economy," explains Katka Letzing, Co-Founder and CEO of Kickstart Innovation, one of the largest open innovation platforms in Europe. "The challenges for companies and organizations are becoming more complex and the competitive pressure is increasing. With us not working in silos and resulting in proofs-of-concept, both sides have the opportunity to progress significantly faster in their respective fields." The goal of the Kickstart program is to enable pilot projects or commercial collaborations between later-stage startups and established institutions. The aim is to bring new products and services to market on a larger scale, develop new revenue streams and invest in pioneering models and processes. Last year, over 50 deals were announced to collaborate on cutting-edge solutions for Switzerland and beyond. The ideas were diverse and ranged from a software platform for decarbonizing supply chains, to sustainable insulation packaging made from recycled waste paper, to solar thermal and photovoltaic collectors that achieve one of the world's highest energy densities.

Five focus areas are being explored to identify the topics of the future: New Work & Learning, Health & Wellbeing, Finance & Insurance, Food & Retail and Smart Cities. Each vertical focuses on specific innovative trends and the needs of individual partners with acceleration in technology, sustainability and investments.

Related News

Mashum Mollah

CEO at Blogmanagement.io

Short-term loans, also known as payday loans, have become increasingly popular in recent years due to their accessibility and quick processi see more