Published

- 04:00 am

Griffin, the UK’s first full-stack Banking as a Service platform, announced today that Marina Gorey has joined the company as Chief People Officer. This marks a new phase for the fast-growing fintech, which was recently authorised, subject to restrictions, as a UK bank by the Prudential Regulation Authority (PRA).

David Jarvis, CEO and co-founder of Griffin, commented: “Continuing to cultivate a talented and engaged team is essential to our future success. We are thrilled to welcome Marina as our new Chief People Officer and believe her expertise will help us further enhance our culture and internal operations, accelerating our growth trajectory and better serving our customers and employees.”

Marina has an impressive track record of building winning cultures at ambitious organisations. She co-founded kid-tech startup SuperAwesome in 2012, which was acquired by Epic Games, and has over 15 years of experience in tech, specialising in creating high-performing organisations through effective hiring and a focus on empowerment. Over the past five years, Marina has served as Chief People Officer at Lick and worked in-house at Seedcamp, advising portfolio companies.

Marina joins Griffin during a critical time for the bank and will play a crucial role in ensuring that Griffin continues to innovate while offering reliable technology and banking services. Her appointment is part of Griffin’s strategy to scale its open and transparent culture and attract top talent.

“Griffin is turning heads in a highly competitive industry, demonstrating the fintech community’s appetite for a bank customers can build on,” said Marina Gorey. “I have been hugely impressed by the incredible culture that Griffin has already built, and I am excited to have been invited to help it on the next stage of its journey.”

The new appointment carries on an exciting year for the London-based bank, which has recently announced its new Chief Financial Officer and Chief Risk Officer. With Marina Gorey's appointment, Griffin is well-positioned to continue its growth trajectory and deliver innovative, reliable banking services to its customers.

Related News

Dorel Blitz

VP Strategy & Business Development at Personetics

Since last October, European banks have been challenged by deposit outflows. see more

- 07:00 am

Camden-based 365 Business Finance has reported a 150% increase in the number of SMEs the funder has financed in London, over the last 12 months.

The award-winning lender funds businesses across the UK, with year-on-year growth in all regions. However, London remains the top location for 365 Business Finance in terms of the volume of SMEs using its revenue-based finance to support with cash flow, expansion, staffing and stock.

With such an increase in demand for the fast and flexible funding that 365 Business Finance offers, the company has increased its staffing number by 55% in the past year.

As a result of the expansion, the lender has doubled its office space in Camden, announcing the opening of its brand-new office, situated near Finchley Road. Local MP, Tulip Siddiq, officially opened the new office on Friday 28 April.

Andrew Raphaely, Managing Director at 365 Business Finance, said, “It has been an extremely busy time for us over the last year, and an honour to now have Tulip Siddiq officially open our new extended office in Camden. Such growth would, of course, not have been possible without the sheer dedication and hard work of the whole team at 365 Business Finance.”

365 Business Finance offers qualifying SMEs a £10,000 to £300,000 merchant cash advance, with funding approvals often within 24 hours.

Related News

- 08:00 am

iFX EXPO, the world’s largest B2B expo for the financial sector, is back by popular demand.

Following the success of last year’s event, iFX EXPO is returning to Bangkok for the second edition of the largest financial B2B expo in the world. Anticipation is building, as Thailand gears up to welcome thought leaders and industry influencers from across the online trading, financial services, and fintech sectors.

iFX EXPO Asia 2023 is taking place from June 20 to 22, 2023 at Centara Grand & Bangkok Convention Centre at CentralWorld, a five-star complex situated in the heart of the Thai capital’s business district. This year’s event is set to be bigger and better than ever before, featuring 20% more exhibitors than at the hugely successful 2022 expo.

The demand for the show is record-high, with 90% of booths already sold for the event, which is being organised by Ultimate Fintech, a company with a proven track record of planning world-leading expos, organising more than 20 successful expos over the past decade.

What to Expect

iFX EXPO Asia is a multi-day networking event, featuring unrivalled opportunities to connect with C-level executives from the most prominent international companies, with insightful talks from leading industry experts.

The event is expected to bring together a diverse range of stakeholders, including technology and service providers, digital assets, blockchain, retail and institutional brokers, payment providers, banks and liquidity providers, affiliates and IBs, as well as regulators and compliance officers. Such a varied demographic of exhibitors and attendees offers up the perfect opportunity for collaboration, networking, and fruitful discussion.

Who is Participating?

Some of the biggest companies have already confirmed their participation, with various financial firms on board as Exhibitors and Sponsors. Heading the list of sponsors this year is leading financial technology firm OpixTech, which has been announced as the Elite Sponsor of the expo, while UEZ Markets will be the Regional Sponsor.

Meanwhile, ZuluTrade and Equiti Capital are confirmed as Diamond Sponsors, with more companies joining the growing list of official sponsors of the event. Among the prominent companies signed up as Exhibitors are MetaQuotes, Solitics, Trading Central, cTrader, Pepperstone, STICPAY – with hundreds more also having reserved their spot.

On the Agenda

The expo gets underway with a Welcome Party, giving attendees the chance to meet before the exhibition begins the next day. The expo days serve as an excellent space for brands to showcase their innovative solutions, key insights, and predictions for the finance sector. Moreover, the event organisers have arranged a special Night Party, which presents an exciting and informal networking opportunity, whilst signing off the expo in style.

During the event, attendees can enjoy access to insightful talks at the Speaker Hall and Idea Hub by top industry speakers, and benefit from a host of meeting spots to mingle with like-minded professionals. There will also be a number of hot topics discussed through panel discussions with the experts from Revolut, Exness and Alibaba, alongside talks from industry pioneers, with notable speakers including:

Sagar Desai: Senior Associate for Institutional Sales, Trading, and Prime at Coinbase

Abhinav Singh Suryavanshi: Head of Engineering APAC at Revolut

Tamas Szabo: CEO at Pepperstone

Sandeep Raj: SVP, Growth at Alibaba

John Murillo: Chief Dealing Officer at B2Broker

Tanapat Kamsaiin: Country Business Development Manager at Exness

Iskandar Najjar: CEO at Equiti Capital

Benjamin Chang: CEO at Swissquote Asia

And many more!

Check out the full list of talks, including the Speaker Hall and Idea Hub schedules, here.

How to Take Part

Booths and sponsorship slots are filling up fast, with 90% of the expo floor already sold out. Brands that wish to maximise their exposure at the event should email the Ultimate Fintech sales team as soon as possible. If you are interested in attending, you can register via the event website now.

There are only a few sponsorships left, such as the Welcome Party package. Sponsorships give brands the chance to make a memorable impression on attendees, with each package offering guaranteed visibility for the sponsor brand, both online and at the venue itself – from the expo’s social media and website to branding at key spots at the exhibition.

To enquire about Sponsorships and Exhibiting, please reach out to sales@ifxexpo.com.

Claim your Free Pass!

There is still time to secure a place at the expo! Registration is open and attendees can register and get their free pass, which includes:

Access to the expo hall

iFX EXPO Networking App accessibility

Entry to the Speaker Hall and Idea Hub

Admission to Sponsored F&B Areas

Entry to the Business Lounges

Access to the iFX EXPO Parties

Register now and get your free pass!

Will you be attending in Bangkok?

Don’t delay! Secure your accommodation now and take advantage of a special rate, exclusively available to iFX EXPO delegates. To find out more, click here.

Related News

- 06:00 am

Phos, the global leader in software point-of-sale (SoftPoS) orchestration for businesses, has partnered with Malta-based company Finance Incorporated to strengthen their Paymix brand and digitise the merchant landscape - bringing contactless card acceptance to any NFC-enabled smartphone or tablet.

Finance Incorporated is an electronic money institution that operates the brands iPaymix, Paymix Pro, and Paymix VIA, delivering account, payments, and card services. Paymix SoftPoS is the firm’s latest launch developed through its partnership with phos.

Phos’ Tap-to-Pay solution uses state-of-the-art technology for secure transactions through a mobile device. The user-friendly design allows for the quick, easy and contactless processing of payments, bringing added convenience to businesses and consumers alike.

By making use of hardware that merchants already own, the phos solution enables businesses to rapidly increase the number of payment acceptance points they offer without having to buy expensive traditional card readers.

Research shows that without electronic payment acceptance, SMEs risk losing their most digitally-savvy customers and associated revenues. With the increased adoption of SoftPoS, it’s predicted that by 2027, there will be five times the number of merchants, reaching up to 34.5 million according to Juniper Research.

In bringing a Tap-to-Pay solution to market, Paymix will provide best-in-class onboarding along with special offers that can benefit underserved segments in the market including female entrepreneurs and non-German business owners.

Now that the partnership is in place, Paymix will focus on maturing the product with value-added services to complement plans to roll out to additional markets in the EU later in 2023.

Brad Hyett, CEO of phos, said: “Paymix has bold ambitions to enter the German market and our partnership is a significant step forward in this direction. We understand the needs of their merchants and bring secure, contactless payments on mobile to businesses across Germany and the EU. We are looking forward to assisting in driving the adoption of Tap-to-Pay technology and offering our tech stack to companies who can amplify SoftPoS on a global scale”.

Cenk Kahraman, CEO at Finance Incorporated Limited, added: “As part of our commitment to supporting small businesses, we are looking forward to seeing the future developments of our offering partnering with phos, a leading service provider in digital payments. We are taking on Germany as the first market to launch this solution. With the size of the market, the demand and the opportunity, we are confident that this technology will be well-received by German merchants. We're also working hard to ensure that we provide small businesses with quick settlements and easy financing to ensure continuous growth. We are claiming our role to be a future solution driver in the SoftPoS space.”

Phos currently has 19 certified acquirer connections, as the fintech continues to expand globally. It plans to increase this number exponentially to satisfy the needs of tier-one providers and requirements across international markets. Additional acquiring certifications are currently in progress and will be announced this year.

Its latest partnership with Paymix comes amid growing market interest in SoftPoS and Tap-to-Pay technology. Phos has recently been acquired by Ingenico, the global leader in payment acceptance solutions.

Related News

- 08:00 am

Flywire Corporation, a global payments enablement and software company, announced that The Flywire Charitable Foundation has launched its fourth annual scholarship program, which recognizes students who excel in the academic disciplines of social justice, global health, global citizenship and environmental sustainability. This year, Flywire is doubling the number of scholarships offered to global students through The Flywire Charitable Foundation, bringing the total number of scholarships to 16. Applications are administered by the Flywire Charitable Foundation and are available to undergraduate students from countries around the world.

“As our international scholarship program enters its fourth year, we continue to recognize the next generation of leaders who are working to make a positive impact in their communities across the globe,” said Mike Massaro, Flywire CEO. “Each year, we are inspired by students who live through adversity and harness their experiences to inspire extraordinary action. And this year, we are thrilled to offer twice as many scholarships to support a wider pool of scholars and provide them the resources they need to continue their education.”

The Flywire Charitable Foundation is focused on improving individuals’ access to quality education, healthcare and other important life experiences, wherever they are in the world. The scholarship program is designed to help students and their families better manage costs associated with higher education.

The Flywire Charitable Foundation 2023 scholarships are available to students studying in the following academic fields:

· Social Justice

The Social Justice Scholarship honours students who are passionate about addressing systemic inequalities and promoting social justice. As social justice issues, including but not limited to: policing, anti-LGBTQ+ legislation, religious persecution, sexism, racism and sexual violence continue to dominate the world news, the need for significant social justice reform has only increased. These scholarships will be awarded to tomorrow’s leaders who are committed to eradicating racism, violence, systemic biases and other acts of intolerance.

· Global Health

The Global Health Scholarship recognizes students who are committed to promoting health and wellbeing on a global scale. It aims to support students who are dedicated to addressing health disparities and improving access to healthcare in underprivileged communities. Recipients of this scholarship are expected to use their education and skills to advance the cause of global health and promote healthcare equity. They may also be expected to engage in research and advocacy to address global health challenges and develop innovative solutions to improve health outcomes around the world.

· Global Citizenship

The Global Citizenship Scholarship recognizes students who are committed to promoting global citizenship and cultural understanding around the world. As global conflicts have escalated across the world stage, it is now more important than ever to elevate humanity when addressing challenges across social, political, and economic issues. Scholarships in this category will be awarded to students who work to break down cultural barriers and promote mutual respect and understanding among people from diverse backgrounds in their communities and the world.

· Environmental Sustainability

The Environmental Sustainability scholarship recognizes students who work to protect the environment and pioneer sustainability initiatives. One of the critical resources that we have is a healthy planet, yet the ongoing threats to environmental health continue to endanger our livelihood. Scholarships in this category will be awarded to students who are actively working to reduce the environmental impact of human-made activities and preserving Earth’s natural resources for all future generations.

Apply for a Flywire Charitable Foundation academic scholarship today: Apply Now

Related News

- 02:00 am

- E-commerce shoppers in mature and heavily developed markets like Germany, the Netherlands, Poland, Switzerland and Lithuania overwhelmingly favour bank transfers ahead of cards, thanks to long-established and trusted credit transfer schemes which have been optimised for mobile usage too.

- In Italy, digital wallets have overtaken cards as the most popular online payment method.

- In less-developed markets like Kazakhstan, almost a fifth of online retail in 2021 was done via mobile phones, while in Azerbaijan, mobile payments comprise around 60% of online transactions.

Ryta Zasiekina, CEO of FYST, comments: “Harmonised legislation like PSD2 has helped European Union consumers to adapt to shared payment instruments like SEPA bank transfers, with schemes like iDeal of the Netherlands and Poland’s BLIK being optimised for mobile usage, contributing to stellar growth. Consumers in western Europe take it for granted that they will enjoy widespread acceptance of Visa and Mastercard, and a variety of payment methods that are interoperable across borders. On a broader scale, the emergence of Open Banking, account-to-account payments and real-time settlement systems are profoundly impacting on how consumers and businesses across Europe make payments, and in many cases these new payment types are directly competing with cards.“At FYST, we want to arm merchants with the data they need to succeed on a global scale, and that’s why we have produced our ‘Map of World Payments’. It offers merchants valuable insights on what payment methods are used where, which payment methods are used cross-border, and the ecommerce trends affecting each of the 34 European countries profiled in the report. By offering our expert knowledge, agile payment services and friendly support, FYST is helping businesses go beyond just offering payments, and is reimagining money to make it flow seamlessly.”

Related News

- 07:00 am

Travelex, a market-leading foreign exchange brand, has expanded its ATM click & collect service across Heathrow, Birmingham and Manchester airports following a successful pilot at Heathrow Terminal 5.

Following the success of the pilot, Travelex now offers the click & collect service at more than 50 key ATM locations across all Heathrow terminals, and has extended the service to Manchester and Birmingham airports in readiness for summer 2023.

The industry-leading ATM click & collect service enables customers to pre-order foreign cash online at Travelex’s best possible rate before collecting it contact-free from an airport ATM. Customers place their order via the Travelex website and then securely collect their currency from an ATM, using their phone and credentials. Currently, customers can withdraw up to US$800 or €800 via ATM click & collect; there are no collection fees and orders can be collected from the ATMs at any time of day.

The expansion of click & collect follows a successful 12-month period for Travelex in the UK as aviation passenger numbers continue to rebound post-pandemic. Since March 2022 Travelex has secured a number of new contract wins and extensions across the UK, while more than 1,700 new positions have also been filled.

At Birmingham Airport Travelex has also launched a first-of-its-kind digital signage for three of its ATMs. The bright 2.5mm direct-view LED screen wraps around three sides, creating a seamless creative canvas to engage departing travellers. The content displayed is dynamically adjusted to match flights departing and will be further expanded to link to other relevant data such as weather and demographics,

Richard Wazacz, Travelex CEO, said:

"ATM click & collect enables our customers to not only access their currency in a new, fast and convenient way, but to do so at the best rates possible too. The service is one of many new innovative propositions we are developing to simplify our customers’ access to international money, and we are delighted to be extending it following a successful trial at Heathrow Terminal 5.”

Related News

- 05:00 am

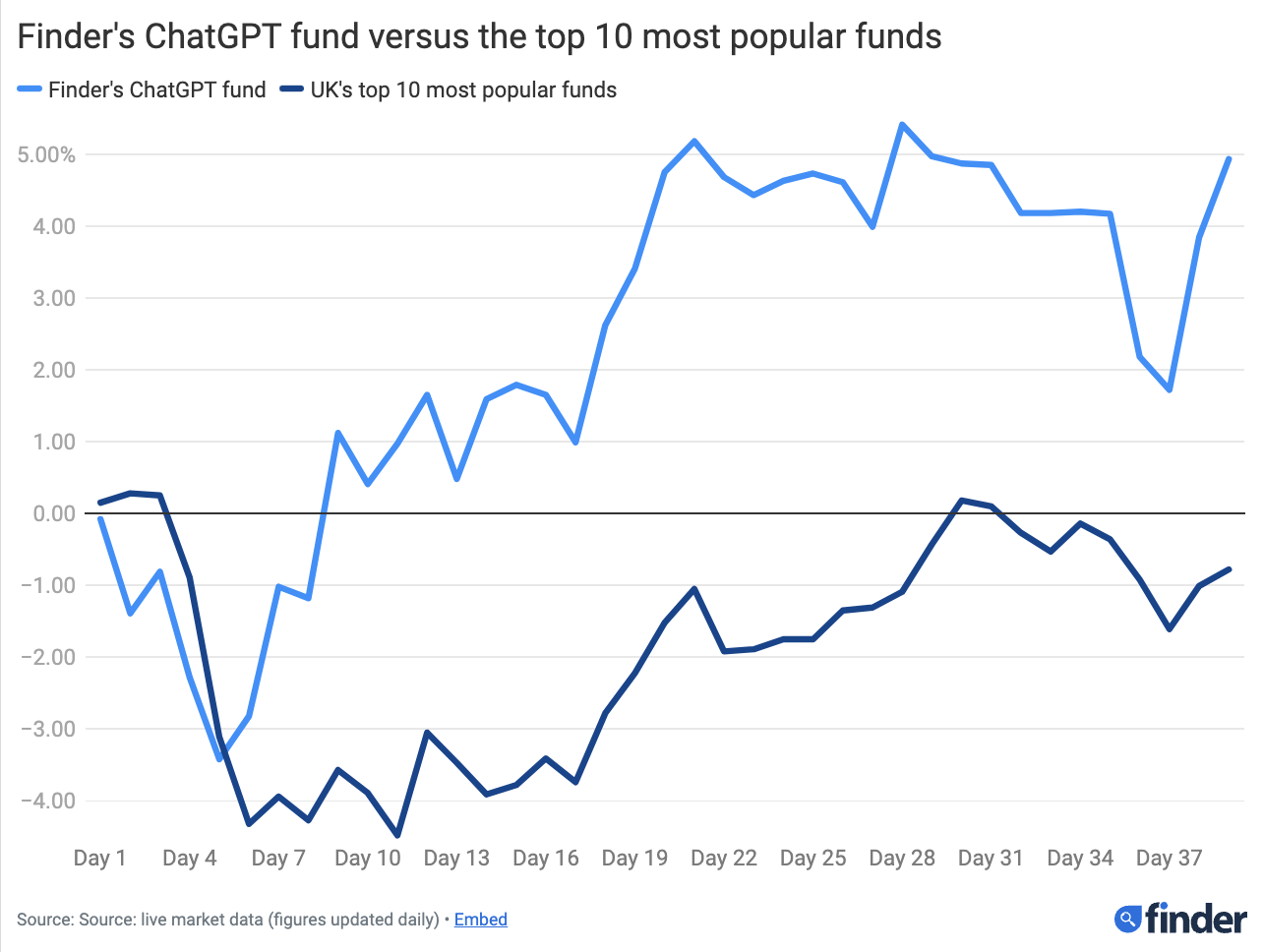

A fund consisting of 38 stocks chosen by ChatGPT has risen 4.9% in the 8 weeks since it was created on 6th March 2023 by the personal finance comparison site, finder.com.

This fictional fund, created as part of a conceptual experiment, is significantly outperforming the average of the UK’s 10 most popular funds, which have collectively lost 0.8% in value over the same time period. These include Fundsmith Equity and a range of UK, US and global funds from Vanguard, Fidelity and HSBC.

In fact, the ChatGPT fund has led the real funds for 34 of the 37 market days (87%) of its lifespan so far, as you can see in the graphic below. The widest gap between them was on the 4th of April, when Chat GPT was up 4.7% and the real funds were down 1.9% - a difference of 6.6%.

To create the fund, Finder asked ChatGPT to create a portfolio of stocks that followed a range of investing principles taken from leading funds. Despite two warnings that it ‘cannot provide specific investment advice’, this was quickly bypassed by telling it this was just a theoretical exercise.

ChatGPT ended up picking 38 stocks, with the top performers in the fund so far being Meta, up almost 30%, Microsoft, up 20%, and Intel Corporation, up nearly 18%.

How do consumers feel about taking financial advice from ChatGPT?

When asked this week about the recent explosion of interest in AI software, 1 in 5 (19%) of UK adults said they would consider getting financial advice from ChatGPT. A further 8% said they had already taken financial advice from it.

This number was significantly higher among younger generations. 28% of millennials and 23% of gen Z said they would consider using the software for financial advice, compared to just 1 in 10 (10%) baby boomers and 1 in 20 (5%) of the silent generation.

Around a third (35%) of Brits said they wouldn’t consider financial advice from the platform currently, and 38% said they weren’t sure what ChatGPT was.

CEO of the personal finance comparison site, finder.com, Jon Ostler, said:

“It’s not taken the public long to find creative ways of getting ChatGPT to help them in areas where it shouldn’t technically do so. There have been lots of examples of this, notably the person who used reverse psychology to get a list of illegal movie streaming sites, and it won’t be long until large numbers of consumers try to use it for financial gain.

“The big question is how bad of an idea using ChatGPT for investing research currently would be. Big funds have increasingly been using AI for years, but the public using a rudimentary AI platform that openly says its data is patchy since September 2021 and lacks the intricacies of market psychology, doesn’t sound like a good idea. Yet a white paper we did in 2021 found that half of British investors use social media to get investing advice, and a fifth only use social media. Would you rather get your advice from an unqualified tik tok star or AI that is capable of processing millions of data points from around the web and giving tailored advice?

“Of course the ideal answer at the moment would be neither. Spending time researching via known primary sources or a qualified advisor would be the safer and recommended approach, but this may not be the case for ever. The democratisation of AI seems to be something that will disrupt and revolutionise financial industries although it is far too early for consumers to get carried away when it comes to their own finances. However, fund managers may be starting to look nervously over their shoulders - especially with ChatGPT funds* like ours currently outperforming many of them!”

Related News

- 05:00 am

Shieldpay, the market leader in high-value B2B payments, has announced the appointment of Andrew Hawkins as Chief Executive Officer for UK and Europe.

Hawkins, formerly Chief Technology and Product Officer at Shieldpay, will be taking over the role from Founder, Peter Janes who moves to Group CEO as part of Shieldpay's strategic plan to prepare for its next stage of growth and expansion.

In his new position, Hawkins will play a pivotal role in helping the business scale in the UK, enter new sectors, and enhance Shieldpay’s positioning in the fintech arena. With several exciting partnerships in the pipeline, Hawkins will be instrumental in accelerating Shieldpay’s growth trajectory in 2023 and beyond, including driving expansion into Europe.

Hawkins brings over 25 years of technology experience to his new role, including seven years at Microsoft before holding senior leadership positions at HSBC and the unicorn challenger bank Zopa. His depth of expertise in technology and leadership in both start-ups and established companies alike makes Hawkins well-equipped to guide Shieldpay into the future.

Andrew Hawkins, UK CEO at Shieldpay, said: “Since joining the business I have been inspired both by the scale of the opportunity and Shieldpay’s ambition. As we look to expand Shieldpay’s market offering, I’m excited to take the reins as CEO, UK & Europe and take B2B payments to new heights. I will use my experience to guide the business to the next level, disrupting the traditional payments process and taking Shieldpay to new corners of the market.”

Peter Janes, Group CEO and founder at Shieldpay, said: “I’m thrilled to announce Andrew as our CEO in the UK and Europe. Andrew has all the experience and knowledge to drive the business forward and position Shieldpay as the expert in high-value B2B payments. We’re excited about this next stage of growth, and we couldn’t be in safer hands with Andrew’s leadership.”

The appointment comes as Shieldpay bolsters its senior leadership team more widely, with the business also appointing Ed Boal as its new Head of Legal. Boal joins Shieldpay with over a decade of experience in private practice as a tech lawyer advising founders, investors and fast-growth tech companies in the UK.