Published

- 06:00 am

iDenfy, a global RegTech startup offering AI-based ID verification and fraud prevention tools, announced partnering with SI Tickets, a fan-first ticketing marketplace by Sports Illustrated. iDenfy will help SI Tickets enhance security through a user-friendly and compliant identity verification process.

Ticketing companies must implement a range of security measures to ensure that online ticket transactions are secure and compliant with relevant regulations. According to iDenfy, a robust fraud prevention system helps protect both customers and businesses from financial crime and data breaches. Consequently, iDenfy claims that online marketplaces must meet Know Your Customer (KYC) demands and turn them into a competitive advantage through automated measures.

As iDenfy explains further, to experience the benefits of KYC, it’s essential to keep up-to-date with the most recent regulations, prepare for compliance deadlines, and use technology to streamline the process. SI Tickets agrees with this approach, stating that the ticketing platform aimed to optimize its onboarding process and reduce costs by building a fully automated KYC process. For this reason, the company partnered with iDenfy.

Currently, SI Tickets is best known for being part of Sports Illustrated, one of the most trusted brand names in sports. With the largest audience of any ticketing platform in the industry, SI Tickets connects more buyers and sellers globally. The platform offers access to over 175,000 concerts, theater performances, and sporting events. With such volumes, ticketing professionals promote transparency and access to major events by guaranteeing a full refund if an event is canceled.

Through its partnership with iDenfy, SI Tickets will implement iDenfy's biometric identity verification technology to simplify the identification process for event organizers and attendees. By using iDenfy's built-in image capture SDK, users can complete the verification process more quickly, leading to higher conversion rates. As a result, with iDenfy’s four-step verification solution, SI Tickets customers will easily verify their identity using their government-issued ID, reducing the risk of fraud and ensuring a safe and secure event environment.

To stay current on ever-changing compliance regulations, SI Tickets also implemented iDenfy’s Screening and Ongoing Monitoring solution to help the business keep in line with Anti-Money Laundering (AML) regulations. The service will automatically scan through OFAC sanctions and high-risk jurisdictions while checking customers' legal status, ensuring that only legitimate users can access the ticketing marketplace.

iDenfy's digital anti-fraud tooling suite will assist SI Tickets in cross-referencing and monitoring their customers' data effortlessly. This will allow them to manage larger volumes of data, improving the accuracy of the automated compliance workflow. iDenfy says the partnership will enable SI Tickets to concentrate on other tasks as its team will take on KYC/AML-related operations.

“SI Tickets users receive their tickets instantly, avoiding waiting in long lines. As their KYC service provider, we aim to make the onboarding experience even smoother and faster with just a few clicks,” noted Domantas Ciulde, iDenfy’s CEO. “Our identity verification solution will ensure a secure and fraud-free environment for our new partners at SI Tickets, providing users with a seamless and hassle-free experience."

Related News

Chaitanya (Chai) Rajebahadur

Executive Vice President and Head of Europe at Zensar

Consumers are facing something of a perfect financial storm. see more

Fraser Stewart

co-founder and CCO at Lyfeguard

In today's world, financial literacy is more important than ever before. see more

- 05:00 am

PaymentComponents, a leading provider of payment software solutions, today announced the launch of FINaplo.AI, an innovative platform that uses Artificial Intelligence to assist bankers in managing their everyday activities in a completely new way! You don't need to be an AI expert to access advanced AI capabilities. This solution is made for bankers.

We are proud to say that FINaplo.AI is a unique platform that offers conversational AI capabilities based on the bank's payment transaction data, providing bankers with valuable insights into account and transaction behaviour. The platform uses advanced AI and Large Language Models to enable bankers to discover new opportunities and hidden value in their data, making it a very powerful tool for all financial institutions. We have made it simple and easy to use, specifically for bankers. With FINaplo.AI you don't have to be an AI expert to add AI capabilities to your day-to-day tasks.

In particular, FINaplo.AI provides bankers with valuable insights on account and transaction behaviour, including trends, patterns, forecasts, and anomalies. All these are accessible through a chat-assisted dashboard. What sets FINaplo.AI apart is its innovative ChatGPT-like tool that makes navigating and analyzing data easier than ever before. With just a few questions, you can access valuable insights and information on account and transaction behaviours, providing you with a new way of working that is truly revolutionary.

We understand that the financial industry is becoming increasingly complex, and the need for AI-powered tools is growing day by day. With FINaplo.AI, we are committed to helping financial institutions stay competitive and navigate this complex landscape. The platform's AI capabilities can help identify new opportunities and discover hidden value in data while protecting customers and the financial system's integrity by detecting and preventing fraudulent activities.

In short, FINaplo.AI is a cloud-based service that reads payment transactions of a financial institution and analyzes them using AI technology. Different teams within the bank use its interactive and conversational way of navigating and analyzing data in order to identify new opportunities, discover hidden value, and make informed decisions about quality leads, potential fraudulent behaviour, liquidity management, run-away clients, and more.

Related News

- 08:00 am

Women’s World Banking, Findexable and Money20/20 are today launching the first Global Fintech Diversity Scorecard that enables fintech and financial services companies to track themselves for diversity, benchmark against peers and monitor progress over time.

The scorecard, based on Women’s World Banking’s proprietary Gender Assessment Methodology developed with the support of Convergence takes the form of an anonymised six-minute online survey that measures a firm’s current position on internal gender diversity and outreach to women clients. The scorecard culminates in a free, high-level report that includes an overall gender diversity result and initial recommendations for improvement.

The initiative launches today and our target is to share the first results later in 2023. Each individual company's results are anonymous but collectively they will give an unrivalled view into how the Fintech and financial services industry is progressing.

It is well known that diverse businesses with diverse management teams perform more strongly than those that are not. The original 2015 McKinsey report on this topic and updated in 2020 outlines that diverse businesses perform more strongly and there is a direct link between diverse management teams and an organization creating products that serve everyone in society.

Mary Ellen Iskenderian, President and CEO of Women’s World Banking, explains: “Investing in women both as customers and talent builds competitive advantage. We developed the Gender Assessment Methodology to help institutions build strong, gender-diverse teams and position themselves to serve and benefit from the multi-trillion dollar women’s economy.”

“Fintech firms are ideally placed to design and offer financial products and services best suited for excluded and underserved customer segments, which is why we are working with Findexable and Money/2020 to share our methodology and experience to accelerate diversity, and ultimately, financial inclusion.”

Denise Gee, founder and managing director of Findexable, points out that customers and employees expect diversity and that boards are under pressure to deliver.

“Diversity is also good for business,” adds Gee. “To achieve true diversity in financial services and fintech requires collective action. This is why we are building a global consortium to accelerate diversity in fintech and highlight the missed value-creating opportunities of building products for women and customers from diverse backgrounds.”

“Measurement of the current position of a company's diversity position is critical” added Tracey Davies, President of Money20/20. “We all know progress is being made but we need to be clear of where we are now so we can accelerate that progress. If we don’t measure and understand where we are we simply will not move forward fast enough. This data will provide an annual stocktake on progress and we are delighted to be partnering with Women’s World Banking and Findexable to support this initiative.”

The consortium currently includes Women’s World Banking, Money20/20 and Findexable.

Take the survey!

Click on the link to receive a score for your company, an indication of how you rank against your peers and a free report with recommendations.

Related News

- 03:00 am

Transaction Banking Services enablement platform 'TransBnk' has announced a partnership with Mufin Group, a leading NBFC, to empower the latter with enhanced transactional banking experience. Leveraging Machine Learning (ML), TransBnk will help in curating customized workflows for Transaction banking services and to create seamless experience for the end customers at Mufin Group.

Mufin group has been working in the financial domain since 1985 through its parent company Hindon Mercantile Limited. The Group offers easy credit to the retail segments through their products like E-rickshaw loan (EV), Two-wheeler loan, gold loan among others.

Remarking on the tie-up, Kapil Garg, Founder and Managing Director, Mufin Group, Hindon Mercantile Ltd, said, "At HML, we have been consistently working to ensure our customers get the best experience of their journey with us along with benefits derived from digital processing. This partnership with TransBnk shall bring in quality delivery and we’re focused on scaling up. We look forward to building an organization with consistent innovation in every aspect of our business. Always keeping our customer needs ahead of everything, TransBnk will continue to keep developing more interesting features in the future.”

Vaibhav Tambe, Co-Founder and CEO at TransBnk, stated, "We are thrilled to associate with Mufin Group to provide solutions around Transaction banking services and especially around escrow. This new partnership will bring exciting opportunities for growth and innovation to both the organizations. We will be able to leverage our strengths and resources to deliver even greater value to the end customers and our shared commitment to innovation and customer satisfaction makes this partnership a natural fit.”

Related News

- 07:00 am

BharatPe Group, one of India’s leading names in the fintech industry, today announced that it will be rebranding PAYBACK India, the country’s largest multi-brand loyalty program to Zillion. This new brand identity is in line with the company’s vision to make Zillion ubiquitous to loyalty and rewards across the country. The new brand identity aims to target customers across age groups and add a new dimension to their overall shopping experience, across categories and brands.

Zillion will offer a wide range of options for customers to earn and redeem at a wide range of partners across the country. The customers will be able to earn ‘Zillion coins’ for their routine spends, that will in turn add a moment of delight in their life. The Zillion logo incorporates this, signifying experiencing joy of spark and finding ‘aha’ moments everywhere. Customers will be able to earn Zillion coins across the network of offline and online partners, including groceries, fuel, entertainment, travel, apparel and more. The new web address for Zillion is https://zillionrewards.in/.

Speaking on the rebranding, Mr. Rijish Raghavan, Chief Executive Officer - Zillion said, “It has been a long and satisfying journey for us, building PAYBACK over the years as India’s largest loyalty program with over 130 million customers. Today marks a landmark day as we begin a new era in our journey - as Zillion. The new brand identity marks a transformational shift in our strategy from being a niche loyalty program to one with an extensive range of partners, across categories. The new name and identity will also help us connect better with a wider range of customers - including Gen Z and Millennials. Our objective is to make Zillion a de facto customer delight tool for retailers across the country. I am confident that Zillion will emerge as the preferred loyalty program for millions of customers in the coming months.”

Added Parth Joshi, Chief Marketing Officer, BharatPe, “Zillion has been created keeping in mind the customers of today - it is young, bold and energetic and aims to add a spark of joy in the customers’ lives, every day. We are confident that this new version of the brand will appeal to a wider customer base and will be able to deliver more aha moments and make every day special for the customers. We will be launching marketing campaigns in the coming months to build awareness about Zillion and drive consumer engagement.”

Download the Zillion app,

1- Android: https://play.google.com/store/apps/details?id=com.loyalty.android

2- iOS: https://apps.apple.com/in/app/zillion/id6447864577

Zillion (erstwhile PAYBACK India) is a unique multi-brand loyalty program, designed to engage with customers and reward them for their purchases with loyalty coins that can be redeemed later. Currently, its members can earn coins at 50+ brands – instore & online and redeem them at select partners or for products and vouchers from leading brands. The partners of Zillion include renowned brands from multiple industries including retail, fuel, banking, payments, entertainment, hospitality and travel. Some of its key partners include HPCL, BookMyShow, American Express, Amazon, Flipkart and many more.

Related News

- 06:00 am

Chatbots are the future of customer service

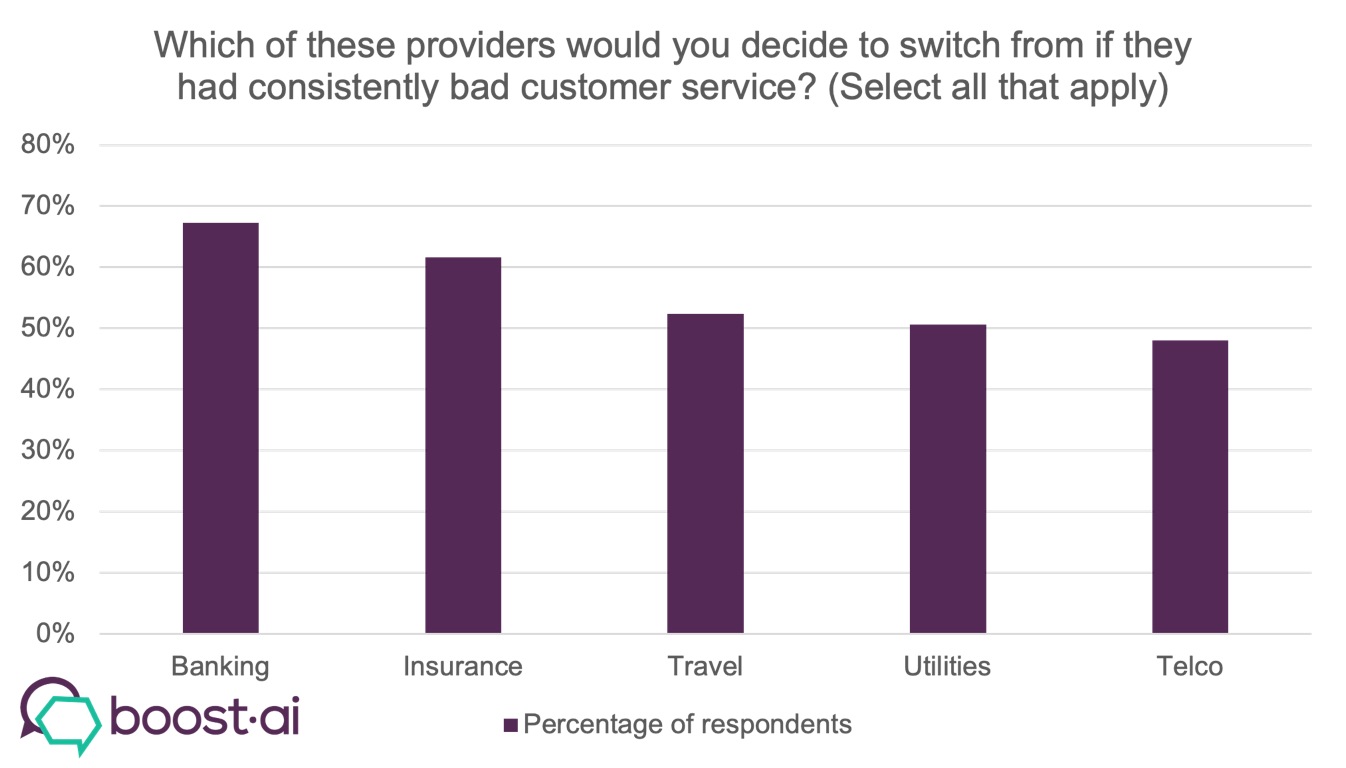

Modern consumer expectations dictate that businesses need to deliver high-quality digital experiences and customer service, according to a recent survey commissioned by leading conversational AI platform Boost.ai. The findings show that some industries need to adapt faster than others, as consistently bad customer service would cause almost two-thirds of banking (67%) and insurance (62%) customers, and almost half (48%) of telecommunications customers, to leave their existing provider for another one.

More broadly, 2 in 5 people (42%) do not have the patience to wait more than 10 minutes on the phone to speak with a customer services operator, and doing so would prompt them to switch service provider, highlighting a need for improved, streamlined and efficient customer service across all industries. This figure rises to 69% of respondents who are unwilling to wait longer than 20 minutes, while 81% of respondents said they would switch providers if they consistently had to wait 30+ minutes to speak to a customer service operator.

While long waiting times are a serious barrier to customer satisfaction – there is a solution. The survey revealed that 61% of people would talk to a chatbot if it meant spending less time waiting for their enquiry to be dealt with. Many businesses see chatbots as a luxury rather than a necessity for customer service. However, with some chatbots consistently hitting resolution rates over 90%, it is clear that conversational AI technology can breathe new life into tired customer service processes and give customer service operators more time to deal with complex requests. 59% of people said they wait up to 20 minutes a month waiting on customer service, a waiting time that can be reduced with conversational AI.

Conversational AI helps industries like banking, insurance and telecoms to provide an immersive experience to their customers. By automating customer service, banks and insurers can process enquiries quickly and accurately with the same level of detail as a human agent.

Sanjeev Kumar, VP of EMEA at Boost.ai, said, “Given the rise of more digitally focussed challengers in recent years, it is clear that customer expectations have changed and adopting innovative technology solutions has never been more critical, particularly for industries such as banking and insurance.

“This survey reveals the problem at the heart of many customer service offerings – long waiting times. Customers are crying out for more efficient service and to have their enquiries handled swiftly and easily. There is clearly an appetite for change, and it is up to businesses to look at how technology can help them deliver such change.

“Awareness of chatbots is at an all-time high thanks to recent advances in generative AI, and now is the time for businesses – particularly those identified as having bad customer service – to seize the initiative and invest in AI tools to deliver a modern and future-proofed customer service offering.”

Related News

- 01:00 am

Adyen, the global financial technology platform of choice for leading businesses, today announced its partnership with FitFlop, the ergonomic and wellness footwear company. The strategic partnership will enable FitFlop to improve its consumer experience by adopting a streamlined approach to global payments.

With FitFlop’s ambitious global expansion plans, the retailer required a single financial technology partner that could streamline its offering across web, mobile, and in-store activities. Adding to this vision of frictionless checkout experiences, FitFlop also required global reach and the ability to accept key local payment methods as the brand grows internationally.

With its global acquiring capabilities and unified platform, Adyen’s technology supports FitFlop’s digital transformation journey by connecting the dots between sales channels and eliminating friction for shoppers at checkout. Within Adyen’s single platform, FitFlop also receives simplified reconciliation, the highest level of data security, and a reduced risk of payment fraud.

“We’re very excited to partner with FitFlop to provide seamless online and in-person transactions,” says Colin Neil, Managing Director, Adyen UK. “With our unified commerce solution, the FitFlop team can access consolidated online and in-store data in real time. These valuable insights empower them to continuously improve the shopper experience and accelerate their international growth.”

“As the physical and digital world of retail continues to evolve, we want to ensure an exceptional experience for our customers wherever they are purchasing. Through Adyen’s technology, we are able to harness data which is fundamental as we scale our operations and streamline our channels to deliver on our digital ambitions,” says Gordon Knox, Chief Operating Officer, FitFlop

Related News

- 01:00 am

SCRYPT, the leading Swiss-licensed crypto trading firm offering digital asset solutions for institutions, announced today a strategic partnership with London-based Fiat-as-a-Service platform Fiat Republic to supercharge SCRYPT’s fiat on/off ramp capabilities, as well as improve automation of customer settlements to its institutional trading platform.

This strategic partnership, bringing together two of the most promising and well-equipped companies in the industry, will improve SCRYPT’s trading services across borders and enable quicker settlement, as well as open up Fiat Republic‘s customers to SCRYPT’s leading trading solution, through SCRYPT’s membership in Fiat Republic’s Eaglenet instant fiat settlement network as a liquidity partner.

This announcement comes on the cusp of industry turmoil, including amongst others the collapse of Silvergate as well as the FED intervention into Silicon Valley Bank ‘SVB’ and Signature Bank NY.

Once again demonstrating SCRYPT’s agile approach to safeguard against market conditions, this partnership will ensure even more stringent internal controls through Fiat Republic’s laser focus on regulatory compliance.

Adam Bialy, CEO of Fiat Republic commented: "At Fiat Republic, we are proud to partner with like-minded organizations that share our mission to help crypto gain mainstream adoption and grow sustainably through increased data transparency and strict adherence to regulatory standards. We are thrilled to welcome SCRYPT to our network."

Norman Wooding, CEO and Founder of SCRYPT commented:"Crypto-fiat solutions are crucial in moving the industry forward, especially at this time, and we are proud to be taking this step to safer and more seamless services. By enhancing our technology, we will provide our clients with an even more secure and reliable way to access digital currencies."

SCRYPT’s record growth in the first quarter of 2023 was a testament to the impact of reliable and trustworthy counterparties in the industry. Driven by the company's commitment to client servicing, SCRYPT continues to combine its expertise and deep understanding of market structures to continue building strategic partnerships.