Published

- 04:00 am

Sixfold, a groundbreaking InsurTech startup, has launched the first generative artificial intelligence (AI) specifically designed to tackle the most complex challenges faced by the insurance industry.

The company has secured a seed investment of $6.5m, generously provided by Bessemer Venture Partners and Crystal Venture Partners. This financial boost, along with Sixfold’s industry-savvy leadership, primes the company for a fast-paced transformation of AI application in the insurance sector.

Sixfold aims to make strides in the underwriting process, a notoriously inefficient facet of the insurance business. Using their generative AI, Sixfold will aid in pattern recognition, helping to untangle the myriad factors involved in assessing complex risk. This novel approach is intended to alleviate the longstanding struggles of insurers to standardise risk assessment amidst an overwhelming influx of information.

With this funding, Sixfold is initially focusing on streamlining underwriting. The company is deploying its AI assistant to help underwriters swiftly evaluate and rate submissions, improving their capacity as well as the precision and traceability of their decisions.

In contrast to previous unsuccessful attempts at incorporating AI into insurance, Sixfold’s AI doesn’t adopt a ‘black box’ approach. Instead, their generative AI models are trained to ‘understand’ the massive volumes of data and assist human professionals in manual assessment.

Sixfold’s AI assistant promises to take over much of the tedious groundwork that underwriters have to contend with daily. Working in tandem with existing technologies, Sixfold enables insurance providers to reap its benefits without the need to replace legacy systems.

Sixfold is launching with BTIS, a commercial insurance provider centred on the construction and building trades industry. Sixfold’s tools will be instrumental in enhancing the speed and precision of BTIS underwriters’ work, thus enabling BTIS to focus more on issuing policies.

The company is also launching in collaboration with BuildZoom, a leading provider of contractor profile data, property building permit data, and contractor sourcing services. Sixfold plans to extend its partner ecosystem to include consulting and advisory firms, cloud providers, risk and prior loss providers, and medical records providers.

The founding team of Sixfold includes former founders and operators, with extensive experience in heavily regulated industries. Jane Tran, former founding team member at Unqork, the $2bn enterprise no-code platform, joins as COO and co-founder. Brian Moseley, who was previously head of developer experience at American Express, has come on board as CTO and co-founder.

Related News

- 02:00 am

UK consumer lender Fluro has launched the second edition of its “Consumer Lending Newsflash”, examining current trends across the entire UK open market, encompassing major price comparison website partners.

The data shows that there was a 22% uplift in consumers making loan requests during April 2023, compared to the same period last year.

As the cost of living squeezes personal finances, growing numbers of consumers are looking to consolidate their debts or shift spending behaviours. Compared to the same period last year, Fluro’s data shows a 45% increase in loans requested for debt consolidation purposes. Additionally, holiday loan requests have seen a 69% increase in April year on year, suggesting that consumers are determined to make the most of their post-pandemic freedoms, despite the high levels of inflation in air travel and accommodation prices.

There was a 29% year-on-year rise in loans requested amongst homeowners with a mortgage last month, likely a response to the challenges posed by rising interest rates. The ONS has said that 1.4 homeowners have fixed-rate mortgage deals expiring this year; these households are facing significant hikes in their monthly repayments. There has also been an 18% year-on-year increase in renters requesting loans. The most recent figures from Zoopla show that rental inflation is currently running at over 11%.

Fluro’s data shows that demand for loans has risen fastest amongst lower-income households, but that the trend is present across the economic spectrum. There was a 195% increase in loans requested by people earning less than £1,000 per month year on year. During the same period, there was a 27% increase in loan requests from people earning between £72,000 to £84,000 annually, over double the UK average salary.

A closer look at the data reveals that people who are divorced, separated or widowed were far more likely to apply for a loan, with increases of 144%, 286% and 88% respectively. Individuals who are divorced, separated or widowed often live in single-income households, meaning that their housing costs are relatively higher when compared with people who are married or living with a partner. They are therefore generally more vulnerable to rising interest rates and rental prices.

Nick Harding, Co-Founder & CEO, Fluro, said: “Consumers have been enduring incremental price rises for over a year now, but in the case of housing, one huge hike is only just coming on stream at scale. We shouldn’t underestimate the impact this will have on personal finances over the coming months. Housing is by the far the biggest monthly expense for most people.

“In response, it can be smart for consumers to use loans to consolidate debts into one simple monthly payment and to reduce their interest rate costs. However, our data also shows that many are attempting to use loans as a way of maintaining lifestyles, which have become unaffordable. We wouldn’t recommend taking out a personal loan to fund a holiday for example, but there has been a surge in demand for this type of credit.

“In this environment, lenders need to support customers who have fallen into difficulty, but they also need to adapt their underwriting criteria to ensure that they only lend to those who are able to pay it off.”

Related News

- 06:00 am

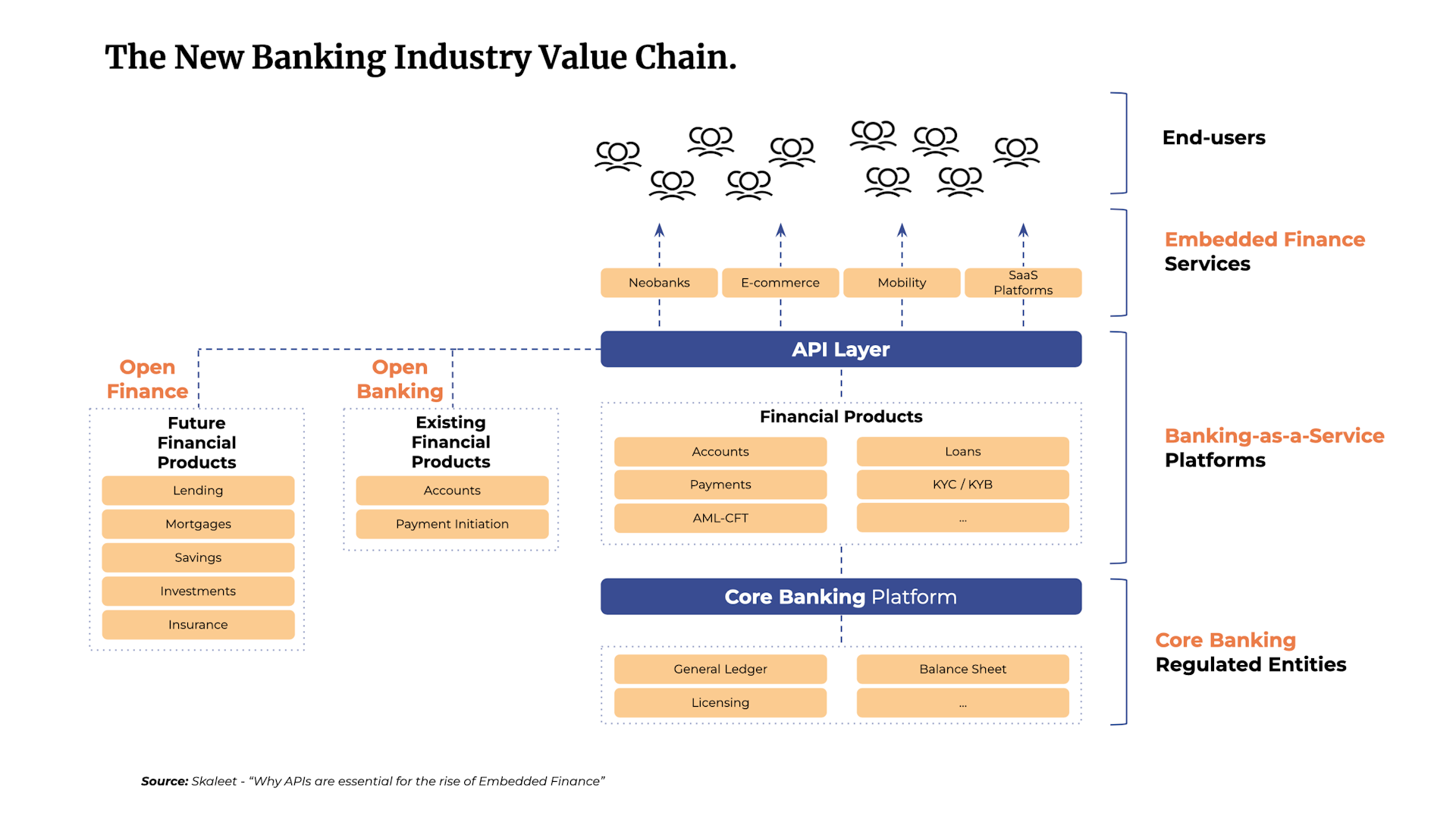

"BaaS" is an acronym increasingly used in the financial sector. But what exactly is it? What is Banking as a Service? What opportunities does it offer to banks? What technical constraints does it create? All the answers are in this article!

Banking as a Service or BaaS: how does it work?

Banking as a Service: definition

Banking as a Service, or BaaS, is a business model that allows any company to offer banking services to its customers without obtaining a banking license or developing a financial infrastructure. How? By partnering with a bank or financial institution with a Credit, Electronic Money, or Payment Institution license. This partnership allows the non-banking company to offer white-label financial services: debit cards, payment services, and loans...

With BaaS, banks and financial institutions take on a new role: B2B distributor of financial services to unregulated third parties.

Read also: Banking as a service, platform, open banking, cloud banking... The big lexicon of finance 4.0

BaaS: example

To better understand what BaaS is, let's use a concrete example.

A fintech wants to launch a neobank based on a mobile application dedicated to 15-25-year-olds. The fintech uses the services of a Bank as a Service to offer its customers an account with a debit card. It, therefore, relies on a bank to provide regulated banking services for its project and can focus on developing its mobile application.

This application communicates with the bank's IT system via APIs and Webhooks. The fintech does not directly manage its customers' accounts and money; the partner bank does. This delegation allows the fintech to save considerable time. It can be registered as a BaaS agent in a few weeks, whereas obtaining its registration would have taken 6 and 12 months.

Open Banking: at the beginning of BaaS

Sometimes confused, Open Banking and Banking as a Service refers to two different models.

Having become mandatory in January 2018, Open Banking consists of opening banks' information systems. Customer data can thus be shared with third parties and financial service providers.

This model promotes collaboration between banks and new partners. This is how the fintech in our example can connect to the bank's feeds to offer banking services to its customers.

In short, Open Banking has paved the way for BaaS: the bank now can offer third parties the possibility of integrating banking products on their platform or application.

Banking as a Service: what opportunities for banks?

1. The opening to new markets

With Banking-as-a-Service, banks can multiply distribution channels and increase the market reach of their products. BaaS also allows them to address new customers, sometimes even new customer segments, from their partners' markets. In particular, the fintech in our example enables the bank to reach 15-25-year-olds with an innovative mobile experience, albeit in a white-label mode. This model then accelerates opportunities, giving the bank access to new customers.

2. Response to competition from fintech

BaaS also allows banks to face the emergence of fintech by positioning themselves as their partners rather than their competitors. Indeed, the neobank, in our example, could have undertaken an accreditation process with the ACPR to become a regulated financial institution. In this case, the fintech would have competed with the bank for offers for 15-25-year-olds. With BaaS, on the other hand, the neobank is leaning on the bank to save time and benefit from its expertise: it is not stealing market share.

3. A direct source of revenue

Finally, the Bank-as-a-Service model allows financial institutions to multiply their direct revenue sources. Non-banking companies that rely on banks to provide financial services become customers of their partner banks. They pay the bank for the use of its APIs.

Read also: New business models for a new banking environment

BaaS: a necessary overhaul of banks' IT strategies

Technologically, BaaS is based on the cloud and APIs (Application Programming Interfaces). This is how the non-banking company can connect to the bank and offer financial services to its customers. This requires the bank to adapt its IT strategy to enable this connectivity. Several business areas need to be studied to determine the technical implications of BaaS:

- Customer relations;

- Innovation;

- Collaboration;

- Time to market.

For more details on these 4 axes, please read our article: Open Banking: the technological challenges (Traditional IT vs. Open IT)

Because it is multi-dimensional, integrating APIs in a Bank-as-a-Service context can be complex. Fortunately, Core Banking Platforms offer open and modular solutions to make this easier.

The Core Banking Platform to the rescue of banks

The Core Banking Platforms allow for advanced management and monitoring of all the APIs integrated into the bank's IS via a single interface. Thus, the bank can:

- Strengthen security by imposing a strict level of authentication and advanced access management;

- Manage the catalog and versions of active APIs;

- Monitor APIs consumption in a detailed manner: usage metrics, requests, incident tracking, etc.;

- Have a central interface to consolidate and manage multiple APIs on different platforms.

This new management mode will allow more detailed management of the bank's APIs, with a clear view of each API. With this in mind, La Banque Postale called on Skaleet's Core Banking Platform.

Related News

- 03:00 am

Skorlife, the Indonesia-based FinTech start-up focused on improving credit score transparency, has successfully raised $4m in a seed funding round.

The funding round was spearheaded by Hummingbird Ventures, attracting further investment from QED Investors as well as repeat investors AC Ventures and Saison Capital, according to a report from TechCrunch.

Skorlife, co-founded by Ongki Kurniawan and Karan Khetan, is a pioneering platform that allows Indonesians to view their credit scores and reports from Indonesia’s credit bureaus. The platform additionally offers personalised advice to help users improve their credit scores, thereby providing a safeguard against identity theft.

With this fresh injection of funds, Skorlife aims to enhance product development, amplify marketing efforts and expand its team. The start-up is uniquely positioned in the market, catering to a demographic that has typically found it challenging to access affordable credit products.

Skorlife has accomplished several milestones since its launch, including achieving 100,000 downloads and gaining admittance into a regulatory sandbox overseen by the Financial Services Authority (OJK) of Indonesia. It is also the proud recipient of ISO 27001 and ISO 27701 certifications, further establishing its credibility in the market.

Kurniawan, sharing his vision for Skorlife, explained that many Indonesians have limited access to fair credit because banks and financial institutions tend to be very conservative about approvals due to lack of a robust credit scoring infrastructure and data. He highlighted that Skorlife’s solution caters to those individuals with prime or near-prime credit who have strong repayment histories but still don’t qualify for affordable credit products.

Before this round, Skorlife raised $2.2m in pre-seed funding announced in September, showing a consistent upward trajectory in its growth journey.

Related News

- 06:00 am

Niyo, a leading fintech company, recently expanded its multi-bank partnership proposition, by onboarding Equitas Small Finance Bank as a new banking partner for its Niyo Global programme (debit or credit card issued by partner bank).

With zero forex markup, the Niyo Global Card has set a benchmark for financial convenience and value for customers’ spending money abroad, making it among the most popular products in this category. Moreover, following the recent decision by the government to exclude all debit and credit cards up to Rs. 7 lakhs under the LRS (Liberalised Remittance Scheme) limit, though further clarity is awaited, the Niyo Global Card becomes a go-to choice for travellers seeking a cost-effective and hassle-free way to manage their finances abroad.

With the new banking partnerships, Niyo's consumer-first approach is demonstrated, which will give its customers more bank options to choose from along with a comprehensive and secure travel banking experience. Niyo plans to acquire over 1 million customers in this financial year under the Niyo Global programme, which is open to all Indian passport holders.

Vinay Bagri, co-founder and CEO of Niyo, said, "We are thrilled to onboard our new partner bank in Niyo Global to democratise financial products for Indians' travel experiences. We are confident that our multiple bank partnerships will help us offer best-in-class banking experiences with zero mark-up forex charges for our customers. With the huge tailwind of international travel, we expect exponential growth for Niyo Global this year."

As Niyo continues to evolve and expand its network of banking partners, it is committed to transforming the way travellers manage their finances, empowering them to explore the world without financial constraints. Moreover, customers using the Niyo Global Card gain complimentary lounge access, adding an element of luxury and comfort to their journeys.

Murali Vaidyanathan, Senior President and Country Head, Equitas Small Finance Bank, said, "Equitas believes in customer first as a core value, and we are delighted to offer the best range of services with the best rates for deposits and savings accounts across the industry. We offer our savings accounts with zero non-maintenance charges to promote savings as a culture across India. We are thrilled to embark on this exciting journey with Niyo for Niyo Global after the success of NiyoX. This partnership aligns with our vision of providing Indian travellers and aspirants across demography and geography with best-in-class financial services that are tailored to meet their specific requirements. Our international debit card offers zero forex mark-up charges, giving you comfort for overseas transactions, and card limit management using the mobile app, helps one control the transaction limits seamlessly. This expands the customer base from savers to saver plus spenders segment. By combining our strengths, we are confident that we can create a truly remarkable and seamless experience for our customers."

Niyo raised $130 million in a Series-C funding round from renowned investors such as Accel India, Lightrock India, and Multiples Alternate Asset Management. The company's notable investors also include Prime Venture Partners, JS Capital, Social Capital, and Beams Fintech Fund.

Niyo's mission to redefine the banking experience for Indian travellers is set to make waves worldwide. By seamlessly blending cutting-edge financial technology with a customer-centric approach, Niyo Global aims to become the go-to platform for Indian travellers, revolutionising and democratising travel experiences on a global scale.

Related News

- 07:00 am

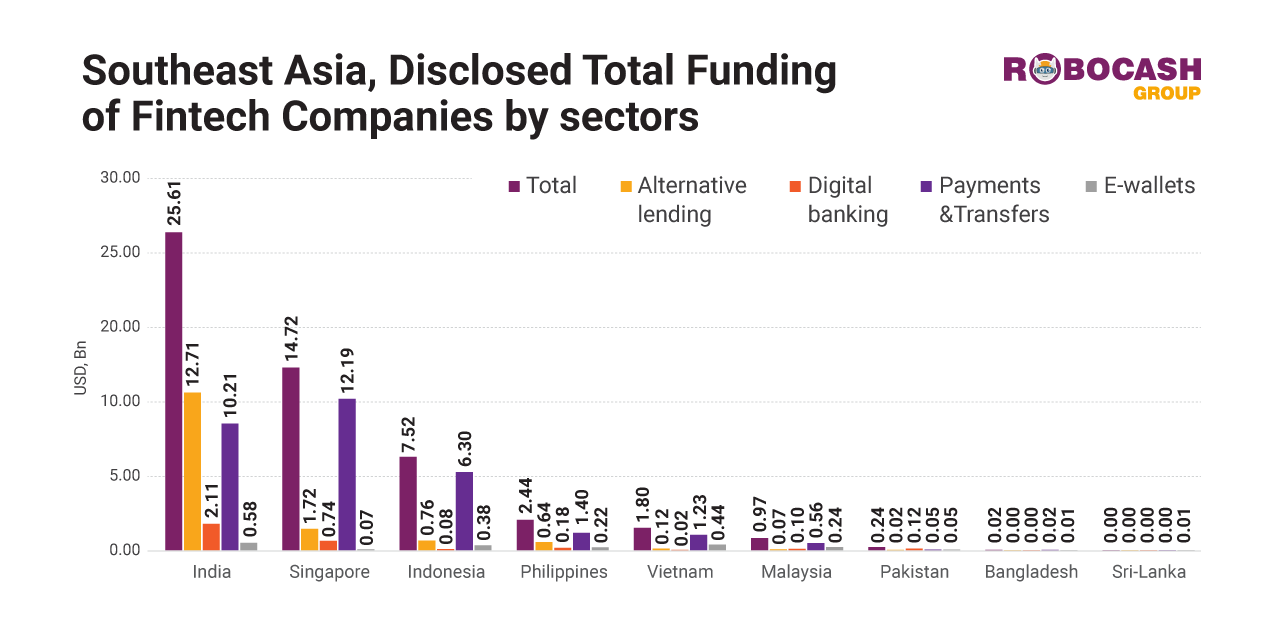

Over the entire history, fintechs in alternative lending, digital banking, payments & transfers, e-wallet sectors have raised a grand total of USD 53.3 Bn and earned USD 17.8 Bn. The total rate of return (Total Revenue / Total Funding) is approximately 33.4%, which means that for every dollar attracted, fintechs earn an average of 33.4 cents per year on transactions related to their activities.

The biggest bulk of the funds is flowing to India - USD 25.6 Bn (48%), Singapore - USD 14.7 Bn (27.6%). Following next are Indonesia - $7.5 Bn (14.1%), the Philippines - USD 2.4 Bn (3.4%), Vietnam - USD 1.8 Bn (3.4%), and Malaysia - USD 966 M (1.8%). The smallest part of funds is flowing to Pakistan - USD 240 M (0.5%), Bangladesh - USD 24 M (0.05%), Sri Lanka - USD 307 k (0.001%).

In 2021, India, Indonesia, and Singapore were the top-earning countries. India earned USD 10 Bn (57.2%) in revenue, Indonesia earned USD 2.4 Bn (13.7%), and Singapore earned USD 1.9 Bn (10.6%). Vietnam stands out with a revenue of USD 1.7 Bn (9.4%), followed by the Philippines generating USD 875 M (4.9%). Bangladesh, Malaysia and Pakistan contribute with USD 287 M (1.6%), 283 M (1.6%) and 167 M (0.9%) respectively, while Sri Lanka has the least at 24 M (0.1%).

It is worth noting that India is seeing the highest concentration of investment stages - 53.8% of the total number of companies, followed by Singapore - 14.3% and Indonesia - 8%. The highest investment activity is observed in the Alternative Lending sector — 45.8% of fintech companies, then in Payments & Transfers — 38.8%, Digital-banking — 8.5%, E-Wallets - 6.9%.

Related News

- 08:00 am

UniCredit and Mastercard today announced a global expansion of their payment partnership.

The agreement sets the stage for the start of a strong partnership consistent with the UniCredit Unlocked strategy. This is the first time any large commercial bank has put in place a single-card multi-market strategy of this scale in Europe. It brings together in one agreement UniCredit’s ability to harness the collective weight of 13 banks as one institution with Mastercard’s expertise in the card payment space. The significant broadening of the parties’ relationship will deliver payment innovation and enhanced digital experiences to customers.

This enhanced multi-year partnership provides the necessary resources to achieve a shared ambition to increase the speed of innovation in the payments space and put customers at the centre. It enables UniCredit to provide a best-in-class offering for all its cardholders, delivering a simplified core product proposition, optimized digital experience with a full suite of in-app solutions and the development of a dedicated approach for innovation, increasing payment choice to customers, across multiple payments rails.

Both parties’ commitment to increase their tangible actions across environmental and social sustainability will also be enhanced through this partnership. Insight and resources will be combined with a particular focus on the implementation of new projects on common ESG goals, developing solutions to support empowering communities to progress, fighting climate change with mindful spending choices and the ability to contribute tangibly to environmental goals, integrating donations in the everyday spend.

This agreement is a clear example of the execution of the UniCredit Unlocked plan, uniting 13 banks to deliver value for UniCredit stakeholders in a capital-light manner, taking opportunities from European DNA but working as a unified group. It is the most immediate manifestation of the potential within payments, which UniCredit is focused on to further extract value in terms of product simplification, cost synergies and digital transformation.

The partnership will focus on supporting the delivery of UniCredit’s strategic priorities. This includes the digitalization of payments solutions, offering multi-functioning solutions with a fully equipped card. It aligns with UniCredit’s brand attributes to build increased preference and loyalty across the consumer lifecycle, enriching bank-wide opportunities thanks to Mastercard’s strong award-winning Priceless brand platform and sponsorship marketing assets.

“This partnership epitomizes the essence of UniCredit Unlocked and our commitment to leverage the full impact of our multi-market footprint as one complete offering for the benefit of our clients said Andrea Orcel, CEO, UniCredit. Our geographical reach and Mastercard’s expertise in this space enables us to not only streamline our partnerships and contracts but enhance our digital, security and product offering for all our current and future cardholders. This is a perfect example of the new way of managing projects in UniCredit, bringing benefits to all legal entities in a disciplined way and acting as a single company.”

“UniCredit has been an important partner for many years. Together we have created real solutions that help people and businesses across Europe. This expanded relationship will build on that experience to bring new innovations to UniCredit cardholders”, said Michael Miebach, CEO, Mastercard.

Related News

- 06:00 am

The British Business Bank today announced a Call for Proposals as part of the launch of the government’s Long-term Investment for Technology and Science (LIFTS) initiative. It seeks proposals from industry for the establishment of new funds or investment structures to crowd in UK institutional investment, particularly Defined Contribution (DC) pension schemes, to support the growth and ambitions of the UK’s most innovative science and technology companies.

An initial government-funded commitment of up to £250m is expected to be available to support one or more successful proposals in mobilising institutional investment into the UK’s science and technology companies. The Bank now invites managed fund proposals from DC pension schemes (or consortia) and from authorised asset managers which have at least one UK DC pension scheme willing to support the proposal by investing.

Louis Taylor, CEO, British Business Bank, said: “LIFTS is an important initiative, with the potential to unlock billions of pounds of additional investment for the UK’s fastest growing science and technology companies, while also enabling the UK’s pension savers to benefit from the value created by UK innovation. The Bank looks forward to receiving a range of proposals, and to supporting government with its wider package of ambitious measures to unlock DC pension investment into innovative firms.’’

The opportunity

UK DC pension schemes currently hold more than £500bn of assets, a figure that is set to double to £1 trillion by 2030. Currently, UK schemes are under-invested in venture capital and growth equity in comparison to overseas schemes such as in Canada and Australia, despite the potential to enhance returns for their members and diversify their portfolios.

Objectives

The LIFTS initiative aims to achieve three objectives that will support the long-term and sustainable growth of the UK economy:

- Unlock UK institutional investment – catalyse more investments from UK DC pension funds into venture and growth equity in a sustainable manner so as to increase the supply of domestic sources of capital for productive investment and increase access to potentially higher returning assets for UK savers. Institutions that are both able to invest at scale and take a long-term view to investment, such as the numerous DC pension schemes that are accruing assets due to automatic enrolment, are uniquely positioned to provide stable, patient capital to parts of the economy that require intensive or long-term capital provision. The outcome will be to support the UK’s innovative businesses to accelerate their growth while delivering potentially higher returns for pension scheme members.

- Catalyse private investment into UK science and technology – increase the supply of capital to UK science and technology scale-ups at the later stages. The UK has a wealth of science and technology businesses, which could offer valuable investment opportunities for UK savers. In addition, the Bank and others have identified a funding gap for R&D-intensive businesses seeking significant rounds of capital to scale up and accelerate their growth. We want to enable DC pension funds to participate in these investments, providing potential benefits to their members and enabling these businesses to access the scale-up capital they need.

- Stimulate the UK VC ecosystem – sustainably increase deal flow, develop the domestic venture landscape, nurture investment and entrepreneurial talent, and attract the best international players to the UK to enable high-potential UK businesses to scale and stay here.

Proposals

The British Business Bank welcomes proposals from applicants that are able to meet the objectives and satisfy the assessment criteria set out in the Call for Proposals. Respondents are encouraged to propose collaborative approaches through consortia of institutions where this is appropriate. All proposals must be managed proposals.

Full details of the call for proposals and the submission process are published on the British Business Bank website: https://www.british-business-bank.co.uk/ourpartners/long-term-investment-technology-science/

The deadline for applications is 15:00 Friday 28 July 2023.

Dates and timelines for the LIFTS assessment process are subject to change, and applicants will be informed about any amendments. In particular British Business Bank may extend the closing date if it considers that there has been an insufficient number of viable proposals.

Related News

- 08:00 am

Today, the Reserve Bank in collaboration with the Digital Finance Cooperative Research Centre (DFCRC) demonstrated the selected organisations exploring potential use cases and economic benefits of a central bank digital currency (CBDC) in Australia with a live demonstration.

The CANVAS use case demonstrated foreign exchange trade of Australian dollar CBDC for USDC, a US dollar stablecoin on the Canvas’ CBDC exchange, and instant international remittances, on its ZK Layer 2 privacy blockchain – Canvas Connect.

Last week, Aussie fintech CANVAS made financial history by facilitating the first Foreign Exchange transaction using an Australian CBDC. The historic trade was conducted as part of the Reserve Bank of Australia’s (RBA) and Digital Finance Cooperative Research Centre (DFCRC) CBDC pilot. The first FX transaction was successfully completed between ASX-listed DigitalX, and Fund Manager TAF Capital, to trade eAUD to USDC stable coin on Wednesday 17th May.

CANVAS, is a global financial technology company with a mission to digitize finance and was selected to test FX transactions and International remittances with the RBA’s CBDC - the eAUD.

Connect provides privacy, confidentiality, low cost, and instant transactions, on the public Ethereum blockchain which are the essential ingredients for digital finance. Canvas’ technologies demonstrate how blockchain eliminates FX market inefficiencies and settlement risks whilst ensuring confidentiality on a public blockchain.

“We believe our solution has the potential to dramatically increase speed and reduce the risks and costs compared to traditional Foreign Exchange (FX) Trading & International Remittance networks, and will radically transform finance and markets over the next decade,” said David Lavecky, Canvas Co-Founder & CEO.

“The opportunity for CBDCs in Foreign exchange trading and international remittances is significant and we’ve successfully shown through real transactions the possibilities and efficiencies of the Canvas Connect network,” he said.

“Our Layer 2 ZK network, along with a suite of critical Financial Markets Applications enables the Transfer, Trade & Investment of digital assets which assures privacy, confidentiality, low cost and high speed. Our solution utilizes privacy-focused ZK Layer 2 technology to demonstrate that the use of CBDC and Digital currencies like USDC in FX trading and Remittances can potentially enable frictionless, 24x7x365 trading and global movement of foreign currencies,” he said.

“Today CBDC pilot live demonstration is a critical development for digital finance in Australia, and we're honoured to be a part of it alongside other major industry financial institutions and showcase its capabilities,” Said Mr Lavecky.

The CBDC pilot project selected industry participants demonstrating potential use cases; the project received a large number of use case submissions from a range of industry participants. Canvas, an Australian Fintech

CoFounded by Daniel Lavecky and David Lavecky, is one of 14 use cases chosen to participate in the pilot, including the potential to provide insights into the possible benefits of a CBDC.

Related News

- 03:00 am

Saxo Bank announces a significant milestone as it surpasses USD 100 billion in client assets. This remarkable achievement underscores Saxo Bank's growth in the number of both clients and deposits, and solidifies its position as a leading financial provider amidst a challenging macro-economic environment.

Passing USD 100 billion in client assets is yet another record-breaking milestone in the three decades since Saxo Bank was founded. It took 25 years to reach the USD 20 billion milestone, and less than five years after that to increase the key metric five-fold and surpass the USD 100 billion mark.

Saxo Bank’s commitment to transparency and client-centricity sets it apart from its peers and has been a key driver in growing client assets over the past year, as central banks have hiked interest rates across major markets. Unlike many other banks and brokers, Saxo Bank promptly passes on rate hikes to its clients, ensuring that they benefit from the increased interest rates automatically, and immediately. This proactive approach empowers clients to optimise their investment strategies while earning an attractive interest on uninvested cash, without any lock-ins or minimum holding periods. In turn, this enables Saxo Bank’s growing client base to respond to emerging opportunities in the markets with agility and confidence.

Kim Fournais, Founder and CEO, commented:

"We are humbled and honoured by our clients' trust, which has propelled us to reach this historic milestone of surpassing USD 100 billion in client assets. This showcases our ability to support our growing number of clients and partners, navigate challenging markets, and deliver a robust investment experience and platforms tailored to our clients’ needs.

When we look behind the trend, we can see that clients continuously trust us with a larger share of their wealth whether it’s benefiting from our attractive interest rates on deposits, asset management solutions, or leveraging our trading platforms to seize opportunities across global markets and asset classes.

We remain fully dedicated to further investing in improving the client experience to empower our clients with the knowledge, resources, and guidance needed to thrive in today's challenging economic environment and work towards reaching their financial goals.”

Saxo Bank recently announced it had received a BBB rating with a positive outlook from S&P Global Ratings, according to the bank’s first-ever rating report.

In addition, Saxo Bank is currently in the process of being appointed a Systemically Important Financial Institution (SIFI) later this year by the Danish Financial Supervisory Authority (FSA). The SIFI designation is given to financial institutions that are considered critical to the functioning of the financial system.