Published

- 05:00 am

Blackfinch Property, a rapidly growing agile lender to the UK property market, has completed its largest loan to date, a £20m refinancing for a mixed portfolio of 54 residential and commercial properties across East London.

The 24-month deal from Blackfinch Property will enable the landlord to continue to provide high-quality residential and commercial properties to London tenants, with funds also released for further improvement works. All investment opportunities at Blackfinch Property are scored against criteria that will deliver Environmental, Social and Governance (ESG) benefits. This loan is structured to incentivise the borrower to improve the Energy Performance Certificate (EPC) ratings for the 30% of the properties that were less energy-efficient should the energy-saving work be completed in time.

During a period of mortgage rate uncertainty, the fixed rates offered under the commercial term loan also provide some certainty for the borrower.

Phil Downie, Blackfinch Property investment manager, said: “We're very pleased to support this experienced landlord in providing the highest quality homes and workplaces for Londoners. This is Blackfinch’s largest loan to date and is backed by top London real estate with the interest fully serviced by the underlying income. The properties already represent some of the best homes in their markets and will be further improved over the loan term by upgrades to their energy efficiencies.”

To complete the deal, the Blackfinch in-house legal team created a bespoke approach to its due diligence process that sped up the transaction and saved the borrower fees. Reports on titles were completed for a representative sample of properties, with an insurer providing title insurance for the remaining properties. This customised approach demonstrates the flexible, entrepreneurial and practical approach taken by Blackfinch Property to meet the needs of its borrowers.

Blackfinch Property has been enjoying a period of high growth which has seen the launch of new products and the signing of new deals. Their previous largest loan was a £14.8m residential development loan in the South East completed at the end of 2022 and the loan book has increased by 61% over the last year. This is the seventh commercial term loan issued by Blackfinch Property since the new product launched in January 2023, with the first helping to secure the future of a popular restaurant just outside of Birmingham city centre.

Related News

- 06:00 am

UK organisations and consumers are ready to embrace a new era of digital identity according to a new report from Curity, an API-focussed identity and access management company.

63% of UK organisations either currently use digital identity or have plans to incorporate digital identity solutions into their operations, with 61% of those planning to do so within the next year. Additionally, 52% of UK firms have plans to incorporate new and emerging decentralised identity solutions. UK consumers are also displaying a growing familiarity with digital wallets, with 58% of consumers currently using them and half of consumers that don’t currently use digital wallets considering them in the future.

The report entitled “Plotting the Roadmap for Digital Identity” surveyed 200 IT decision makers (ITDMs) in the UK and US as well as 1000 consumers to better understand the rapidly changing digital identity landscape. This report comes as the UK government introduces a new trust framework for digital identities.

The new report reveals that 60% of organisations surveyed expect digital identity to have a transformative impact on their industry, with financial services (89%) and health (86%) seen as industries set to benefit most from latest innovation in this area according to ITDMs.

Finance (62%), retail (61%) and travel (46%), were the most popular services used by consumers with digital wallets. Financial institutions (38%) are current leaders in public trust when it comes to storing personal data in digital identity wallets, followed by medical providers. (35%), whereas the government (22%) and transport providers (17%) were the least trusted, according to the research.

Other key findings include:

- Among UK consumers that currently use digital wallets, 77% use it weekly and 30% use it daily

- 60% of consumers in the UK & US highlighted data privacy risks and fraud as reasons they would be hesitant to store personally identifiable information in a digital identity wallet.

- Top security challenges posed by digital identity for ITDMs are hacker sophistication (39%) and lack of appropriate infrastructure (37%).

Travis Spencer, Curity CEO, commented on the findings, “As consumers demand seamless digital experiences and organisations face increasing pressure to protect customers’ data, continued innovation and development in the digital identity space could not be of greater importance. While there are encouraging signs that businesses are adequately prepared for the paradigm shift that decentralised identity will cause, the winners after the move will be those that cultivate trust among consumers. The question of how digital identities are managed and by who will continue to be a key question over the coming years. To keep up with this pace of change and consumer expectations, digital identity must be on the priority list of enterprise architects and strategy makers.”

Related News

- 03:00 am

“I’m excited to join DivideBuy at such a pivotal moment in its growth journey.” Amanda states, “I know first-hand the challenges faced by merchants and their customers in accessing affordable, transparent and customisable interest-free credit.

“DivideBuy really understands the importance of providing a superior merchant onboarding experience and a best-in-class customer journey. I’m looking forward to collaborating with the incredible sales and marketing teams at DivideBuy to help merchants expand their customer bases and build stronger revenues.

“Most importantly, I wouldn't have joined DivideBuy unless I knew they were treating customers fairly. DivideBuy is a really down-to-earth organisation where everybody at every level, from the CEO down, is prepared to get stuck in. The company’s ethical stance, the collaborative culture, and its ability to provide tailored solutions to both merchants and their end customers are perfectly aligned with my own values.”

Rob Flowers, Founder and CEO at DivideBuy, comments: “Amanda has unrivalled industry expertise, and her knowledge of the merchant acquiring processes is exactly what we’re looking for as we begin the next stage of our growth journey with Zopa.Her success in managing high-performing sales teams and multi-million-pound contracts, and her network of industry contacts spanning small, mid-size and large merchants across several sectors, are a perfect fit for our growth ambitions.”

Related News

- 02:00 am

BNP Paribas and NatWest are now going live with ‘Dynamic Credit’ from CobaltFX, part of United Fintech, in efforts to simplify and streamline the allocation of credit for FX transactions between banks and improve access to liquidity. According to CobaltFX, the moves are indicative of an increasing trend of financial institutions wanting to optimise the disbursement of credit for FX trades and simultaneously improve market access and control.

They’ve both been key partners of CobaltFX, part of United Fintech, throughout the years, yet now BNP Paribas and NatWest are increasing their engagements, going live with CobaltFX’s latest product innovation, Dynamic Credit, in a move to manage credit exposures for their respective financial institutions, addressing overly manual processes as well as market access and control.

“Industry-wide, we see that banks are adopting innovative techniques to manage credit exposures for FX trades and maintain market stability through digitalisation. CobaltFX's solution offers a much needed improvement to the manual process of updating credit limits with interbank trading venues. By providing a standardised and digitised approach, and aggregating IT infrastructure across multiple venues, ‘Dynamic Credit’ gives banks unprecedented control to navigate fast-moving FX markets and proactively manage credit exposure. This is a very important step in delivering a solution for credit providers, taking full advantage of new technical advancements”, says Joe Nash, Digital COO for Foreign Exchange, Rates and Commodities, BNP Paribas.

Leveraging tech to “enhance market stability”

After only three months of ownership by United Fintech, a relaunch from Cobalt to CobaltFX was announced along with an impending Digital Asset spin off, signalling a “return to roots” for the FX business. Thus, according to the British fintech, reducing risks through simplification and streamlining of credit disbursement will be paramount, as CobaltFX under United Fintech hones in on solving a list of “very current and real problems” for the FX industry, says CobaltFX’s Founder Andrew Coyne:

“The problem CobaltFX is solving is essentially simplifying and streamlining many of the manual processes tied to allocation of credit which creates challenges for financial institutions. I.e. leveraging tech to enhance market stability. Thus, correcting the supply of credit and at the same time deepening the availability of liquidity, CobaltFX’s Dynamic Credit technology ensures that for less credit deployed, there is more liquidity, administrative simplification and, essentially, superior market access control - the latter being a key factor for financial institutions around the world”, says Andrew Coyne.

Challenging legacy as part of something bigger

Ever-since its acquisition by United Fintech in late 2022 and subsequent relaunch in early 2023, CobaltFX has experienced “tremendous traction” according to CobaltFX CEO Marc Levin, calling it a “prime example of United Fintech and partner companies showcasing their best case practises, collaborating to drive innovation in big banks’ digital transition - and become lead industry vendor for fintech solutions”, pointing to another prevailing trend. Like never before, banks and financial institutions are seeking-out engagements with broader covering technology vendors over single-purpose product firms due to growing compliance and security concerns. On this, United Fintech’s founder & CEO Christian Frahm elaborates:

“What we see is that leading financial institutions are seeking to decrease the number of third-party vendors which used to mean bigger contracts with so-called legacy providers, yet this is where United Fintech differentiates with a fresh approach to cater to the trend: We offer a selection of best of breed technology products under one umbrella to financial institutions wanting to challenge legacy providers and solutions, thus giving both sides the benefits of becoming part of something bigger. And our prediction is that we will see many more banks and fintechs follow suit and join each other's journeys on our digital platform”, ends Christian Frahm.

Related News

- 06:00 am

BidX Markets, the global multi-asset liquidity and B2B trading technology provider has today announced they have welcomed a new addition to their team as Elizabeth Leskauskaite joins as the firms new Liquidity Manager. With a wealth of experience in the financial services industry, Leskauskaite brings strategic vision and wide-ranging expertise to further strengthen the company's position in the market.

As BidX Markets’ newly appointed Liquidity Manager, Leskauskaite will oversee and optimise liquidity management strategies, ensuring seamless execution, enhanced market access, and superior trading conditions for the firm's valued clients. With a focus on maximising profitability and minimising risk, Elizabeth will play a pivotal role in driving BidX Markets and its client’s financial growth to ensure they maintain their competitive edge.

"BidX Markets is dedicated to providing exceptional trading experiences and innovative solutions to financial institutions," said Simon Blackledge, CEO of BidX Markets. "We are delighted to welcome Elizabeth to our team. With her proven track record in liquidity management and a deep understanding of the Forex, CFD and crypto markets, we are confident that Elizabeth will play a pivotal role in expanding our market presence and deliver exceptional results for our international and quickly expanding client base."

Elizabeth Leskauskaite, Liquidity Manager at BidX Markets expressed enthusiasm for joining the rapidly expanding liquidity and trading solutions provider: "I am honoured to join BidX Markets and be a part of a dynamic team dedicated to providing outstanding trading and FinTech solutions. I look forward to leveraging my expertise in liquidity management to enhance our market position, optimise trading conditions, and drive sustainable growth. Together, we will continue to deliver unparalleled value and service to our clients."

BidX Markets remains committed to its core values of integrity, transparency, and client-centricity. With the addition of Elizabeth Leskauskaite to its leadership team, the company reaffirms its dedication to excellence and its commitment to empowering brokers, and financial institutions in general, to achieve their financial goals in the world of online trading and investments.

Related News

- 01:00 am

Eduardo Castro, Managing Director ID&F, Experian UK&I, commented: “Experian is committed to helping eliminate fraud and financial crime, ensuring safe financial access for all.“As part of this journey, we are delighted to be working with IDVerse. Its generative AI capabilities are a natural addition to our existing CrossCore solution, offering our customers more flexibility and the ability to adapt to changing circumstances.”

John Myers, CEO at IDVerse, commented, “IDVerse is a new generation of AI that is more intuitive and adaptive at making real-time risk decisions throughout the customer lifecycle. Our new name reflects the expansive potential of our generative AI technology and a continuing commitment to partner with innovators like Experian, who are fusing risk-based authentication, identity validation, and fraud detection into a single, state-of-the-art cloud platform.”

Related News

- 09:00 am

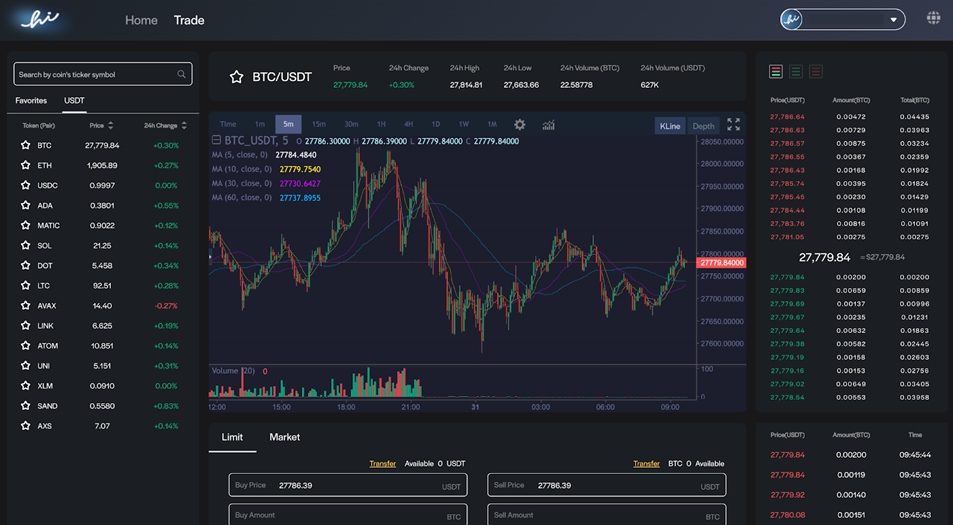

hi - the Web3 Neo-Banking platform - announces the launch of an independent trading platform - hkx.hi.com - for Hong Kong users, following the submission of its application notice to be registered as a licensed Virtual Asset Trading Platform, under the supervision of the Hong Kong Securities and Futures Commission (SFC).

Equipping customers in Hong Kong with sophisticated trading tools in order to be able to trade crypto assets, the new independent and segregated platform is in accordance with the SFC’s requirements for safety and cybersecurity standards.

These efforts follow the registration as a Virtual Assets Service Provider (VASP) in Lithuania in October 2022 and registration as a Virtual Currency Operator with Italy’s payments services regulator, the Organismo Agenti E Mediatori (OAM) in February of this year. This prepares hi to comply with the Markets in Crypto Assets (MiCA) legislation coming into force in July across Europe.

hi’s Co-Founder Sean Rach said, “This represents another step forward for hi as we expand, delivering our much in-demand crypto & fiat services to our valued members. We remain committed to work closely with regulatory agencies to uphold global standards.”

The hi platform has 3.5 million members who use the App for Trading, Savings & Payments. Recently, hi launched its Debit Card in the UK and select markets in the EEA, enabling members to spend digital and fiat assets at over 90 million Mastercard merchants worldwide. Additionally, cardholders can earn up to 10% in Spend Rewards as well as 100% rebates on 1-15 digital subscriptions such as Netflix, Disney+ and Amazon Prime. Coming shortly will be the world’s first NFT Customizable Card with Mastercard.

With its platform launch in Hong Kong, hi is proud to be a part of @web3harbour - a membership network of stakeholders from across industry sectors in Hong Kong who are committed long-term to the sustainable and equitable development of a decentralised internet and virtual asset economy.

Related News

- 02:00 am

Today, Mastercard and Open Finance sector pioneer Fabrick announced an expanded new partnership to develop Embedded Finance solutions that will improve the digitalization of businesses, financial institutions and fintechs across Europe.

Today’s announcement builds on the ongoing relationship between the two companies who have been working together since 2019 to promote innovation on the development of digital financial services for the commercial ecosystem.

Embedded Finance enables companies from any sector to integrate financial services directly into their products via API implementation, giving every business the opportunity to provide payment, banking and insurance services without the need to build a proprietary financial infrastructure themselves.

Fabrick's Open Finance platform enables embedded payments solutions worldwide. This innovative service empowers companies and banks to enhance their relationship with customers by providing a comprehensive and value-added offering in digital payments and embedded finance.

As part of the agreement, Mastercard has made a minority investment in Fabrick. To date, over 400 counterparties are connected to the Fabrick platform, generating over 330 mln API calls per month.

Paolo Zaccardi, CEO and Co-founder of Fabrick: “Being able to count on the collaboration of a partner of the caliber of Mastercard with a new level of commitment will allow us to strengthen our international presence and open a new phase of growth and evolution. We have already made payments a core asset of our platform, but today with even greater intensity we will be able to define a new and even more complete offer deriving from the coming together of our respective strengths, to grow faster thanks to new resources and know-how, with the aim of establishing ourselves in other European countries as a benchmark in Open and Embedded Finance, which is already registering an extraordinary response from corporates, but which we are certain is only the tip of the iceberg of the infinite possibilities it enables”.

Michele Centemero, Country Manager Italy Mastercard: “We are glad to reinforce our collaboration with Fabrick, and value their great vision and model to face, govern and design the evolution of embedded finance, we think will be a big driver for development of digitization in the next years. Our work with Fabrick and the digital financial services we will develop together, will support our collective goal to offer digital payment solutions to businesses and to deliver a seamless experience for their customers in a time of need.”

Related News

- 02:00 am

NomuPay, a modern end-to-end payment platform purpose-built for expansion into regions of high cross-border and e-commerce growth, has raised $53.6m. The round was co-led by Finch Capital and Outpost Ventures, an investment platform of Neuberger Berman, with participation from individuals.

Peter Burridge, CEO of NomuPay, says “Every growing international enterprise knows the problem of ‘multiples’ when it comes to payments. There are multiple countries, multiple payment types, different payment use cases in each nation, a variety of channels, and an endless list of changing regulations. As a result, expansion slows down. Companies have to maintain countless technical integrations and vendor relationships while reconciling global payments. At NomuPay, we remove the burden of ‘multiples’, by unifying fragmented payment networks. In the face of continued technological, market, method and data fragmentation, we provide companies with an ‘all access pass’ to global payments’, enabling enterprises to continue to expand globally, and to future-proof payment strategies.”

NomuPay’s Unified Payments (uP) Platform provides omnichannel payments acceptance and payout disbursements through a single API integration. Engineered to simplify fragmented payment infrastructure throughout Southeast Asia, Europe and Turkey; the uP Platform provides scalable payment solutions and robust data management and reporting capabilities. An ‘all-access pass’ to payments, NomuPay’s uP Platform is gateway agnostic and capable of augmenting existing payment infrastructure with ease.

Radboud Vlaar, Managing Partner of Finch Capital, says “Under the Leadership of Peter Burridge, NomuPay has made a series of licence acquisitions, and top-level hires that has helped to take the company to the next level. On top of this, the company has built a Unified Payments Platform that unlocks local payment acceptance and payout disbursements in geographies that have long lacked a unified system, through a simple and single integration. We are very excited to see how NomuPay addresses the burning need of clients in these core markets."

David Dubick, Partner of Outpost Ventures says, “We’re thrilled to partner with the deeply experienced team at NomuPay and be a partner with them in this next phase of growth. Throughout our conversations with NomuPay we’ve been continually impressed by the technological implementation of the uP Platform, its ability to solve a wide range of issues faced by enterprises and marketplaces in global payments, as well as their approach to distribution and the initial partners who are using the platform at scale.”

NomuPay has successfully started to onboard new clients as of Q4 2022, and are now actively scaling the business in their core markets. The team continues to add new markets to the uP Platform, as well as continuing to invest in product development.

Related News

- 05:00 am

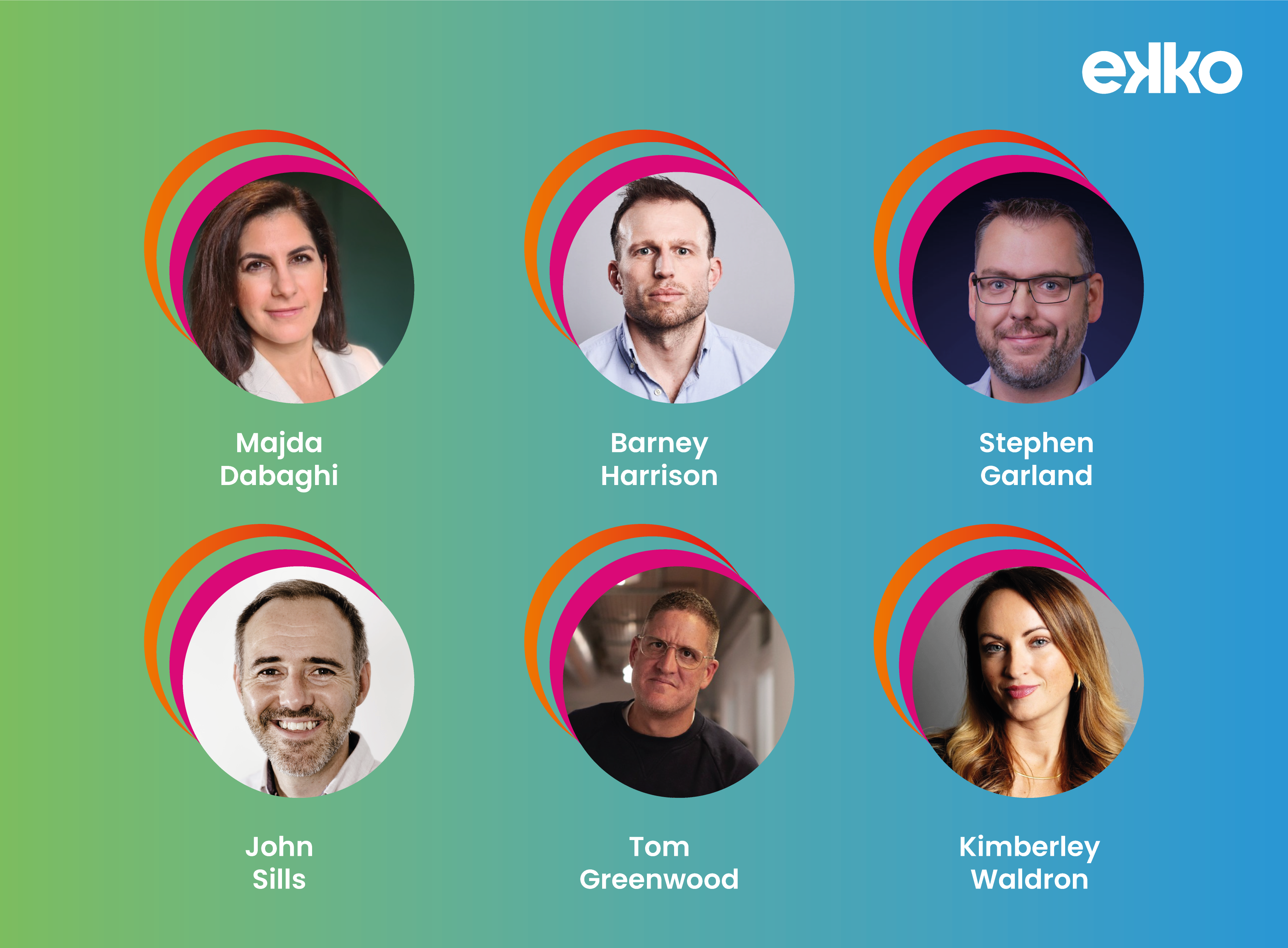

Multi-award-winning ekko has announced the formation of its board of advisors. The board comprises a wide range of experts, including Majda Dabaghi, Barney Harrison, Stephen Garland, John Sills, Kimberley Waldron, and Tom Greenwood.

As a business, ekko empowers banks, employers, consumers and payment service providers globally to seamlessly deliver embedded sustainability to their customers. Now, by enlisting such a diverse and experienced board of advisors, the company has put itself in the strongest position possible to accelerate sustainable growth and empower climate action for businesses across a myriad of sectors, driving positive impact across the world.

Together, ekko’s new board of advisors add a wealth of knowledge and expert insights in areas crucial to the company’s sustained business development, spurring increased overall impact and growth. With these advisors, ekko’s customers and partners will benefit from a comprehensive and well-rounded approach to sustainability, whilst businesses will continue to receive further guidance on how to drive commercial success while reducing their carbon footprint.

The company’s new advisory board will meet regularly in person throughout the year and aims to provide strategic input to the wider ekko team. Additionally, each advisor will contribute to dedicated working groups related to their area of expertise, allowing for more focused and actionable insights. In doing so, the company seeks to generate as much value as possible from this talented roster of business leaders.

Above anything else, ekko seeks to foster a collaborative environment among its advisory board, leveraging diverse perspectives and experiences to ensure its solutions are perfectly suited to the demands of modern business. By gaining inputs from industry leaders from a variety of fields ahead of time, ekko will continue to launch solutions that provide the greatest scalable impact.

Crucial to this effort will be Majda Dabaghi, who also sits as a Standards Advisory Board Member of B Lab Europe, the European arm of the global nonprofit network that includes over 6,000 certified companies and that’s positively impacting more than 500,000 workers across 86 countries and 159 industries. Majda’s addition to the advisory board further emphasises the authenticity and credibility underpinning ekko’s mission to create a more sustainable world, and will help the company to maximise its impact with SMEs and multinationals.

Ultimately, by bringing together this expert board of advisors, ekko has put itself in a great position to stay ahead of emerging trends in the ever-evolving field of sustainability. The forward-thinking company is now uniquely placed to navigate this rapidly expanding market and can go further in its efforts to unleash the power of purchasing, empowering every transaction and interaction with a positive impact.

Speaking on the company’s new board of advisors, Oli Cook, CEO and co-founder of ekko said: “ekko was founded with a vision to create a world where every transaction and interaction can be a force for good. We’re here to help banks, businesses and consumers around the world to make more sustainable choices.”

“It’s our belief that to have the greatest impact at the greatest scale, we need to collaborate together. Now, with the guidance of our handpicked and massively talented board of advisors, we’re bringing some of the smartest minds in their fields to the table to work with us on creating impact across our business.”

Majda Dabaghi said: "I am delighted to be a part of ekko's esteemed board of advisors and contribute to their mission of creating a more sustainable world. I believe that every business has a responsibility to tackle climate change, and ekko's award-winning solutions will help businesses take positive steps in this regard. As an advisor, I will draw on my experience in supporting businesses to take climate action and driving international initiatives that support the Sustainable Development Goals to help ekko maximise their positive impact in collaboration with SMEs, multinationals and climate leaders around the world.”

Discussing his role on the board, serial entrepreneur, Stephen Garland, said: “Being an advisor to ekko, a startup with a strong focus on the environment, fills me with great excitement. Witnessing the transformative power of their product on our climate is truly inspiring. Investing my time in such impactful climate initiatives holds immense importance, as it is clear that our present choices are moulding the world of tomorrow. ekko’s unwavering commitment to protecting our planet, driving sustainable progress, and creating a better future makes me wholeheartedly dedicated to supporting their journey and amplifying their influence.”