Published

Chris Skinner

Chief Executive Officer at The Finanser Ltd

I guess I’m an optimist and, in a world of pessimism, it’s an interesting place to be. I say a world of pessimism as all I’ve seen since the Brexit vote and Donald Trump being President-elect is n see more

- 02:00 am

With "#openspace" in Berlin-Schöneberg, Commerzbank has developed the first digitalisation platform for small- and medium-sized enterprises (SMEs). As the first of its kind, "#openspace" is a corporate transformation platform for German SMEs and constitutes a long-term cooperation between SMEs, innovation partners, and start-ups with the objective of successfully tackling the challenges posed by the digital future together. At the same time, "#openspace" is available as a home base for national and international start-ups providing advisory and logistical support.

"Digitalisation dominates the media, sciences, and corporate world like no other topic. But how can companies master the challenges posed by digitalisation? As an answer to this, we have created "#openspace", a networked platform comprising SMEs, innovation partners, and start-ups. Here, the digital transformation is expedited and accompanied in the long term thanks to customised programmes," says Holger Werner, CEO and founder of #openspace.

"With '#openspace' we would like to empower SMEs so that they can fundamentally change their business models in line with new digital standards and help to overcome uncertainty with regards to digitalisation. Priority is given to the principle of 'helping people to help themselves'," says Joachim Köhler, COO and co-founder of "#openspace".

In addition to a six week basic module named "#SenseOfUrgency", "#openspace" offers various advanced programmes to provide a company with long-term support. The "#DigitalLab" module, for example, is geared towards supplementing an existing business model with digital products and processes. By contrast, in the "#DisruptiveLab", an existing business model is fundamentally adapted over three phases.

In addition to the offering for Germany's SME sector, with the "#StartUpFactory" "#openspace" also provides premises and support for international start-ups wishing to establish a foothold on the German and European markets or to expand in the region.

Related News

- 02:00 am

Identity confirmation provider HooYu today released its Digital Banking Benchmark Report. The report analyses the online account opening performance of five of the UK’s top retail banks to investigate where banks can improve their online account opening processes.

On average, only 53% of online account openings are completed, meaning that 47% of online account opening attempts are left abandoned.

One of the key drivers of abandonment is that the traditional process of name and address checking against credit reference agency databases fails just under a third of online account applications in the UK.

When name and address data checks fail and customers are asked to email or bring their ID documents to a branch it causes a huge hole in the onboarding funnel. Banks are investing heavily in marketing to attract customers to the bank’s site or app, however abandonment in online account opening is causing cost per acquisition to rise.

The report also reveals how online account opening volumes are growing and how long it takes on average to open an account online. The report can be downloaded at https://business.hooyu.com/digital-banking-report

David Pope, Director of Marketing at HooYu said, “UK retail banks still have a clunky customer journey that kills the momentum of the application when a customer fails the traditional name and address data check. Sometimes the customer is asked to come in-branch or sometimes the bank emails the customer to ask them to return to their site to upload an identity document. Banks should integrate ID document checking and digital footprint analysis into the heart of their online application process so more customers complete and less customers abandon.”

Randolph McFarlane, Head of Partnerships at Intelligent Environments said, “UK retail banks are still too slow to add new KYC technology to cater for the 30% or so of customers that fail the name and address check. Banks need to look for new technology partners so the customer’s identity document and digital footprint can instantly be analysed and verified to support a quicker, smoother account opening process.”

HooYu was established as a global identity verification platform to help financial services firms to authenticate customer identity at point of online application.

The HooYu service is integrated into financial services merchants’ online application processes. HooYu cross-references and analyses data from a person’s digital footprint to confirm their real-world identity. HooYu also extracts and verifies data from ID documents at the same time as authenticating the ID document and conducting a biometric facial check comparing a selfie of the customer with the facial image on their ID document.

Related News

- 04:00 am

Analytics software firm FICO today announced that Southwest Airlines has been awarded the 2016 FICO Decisions Award in the Decision Management Innovation category for its Baker Airline Operations Recovery Optimizer tool. The Baker, as it is referred to by Southwest Airlines, is the airline industry’s first real-time, integrated recovery solver that generates solutions to operational disruptions such as maintenance problems and weather events, while minimising the impact to passengers and flight and ground crews.

Since its implementation in November 2015, Baker has yielded significant cost savings by demonstrating significant improvement in key metrics such as on-time performance (OTP), customers delayed more than two hours, and mishandled luggage. On days with irregular operations in which more than 2 percent of flights were cancelled, OTP was 10-15 percent higher than similar events in the past – equating to more than 2 percent increase in OTP since the tool was launched in November 2015. During a blizzard in Denver last year, for instance, OTP was seven percent higher than a comparable airline that did not take proactive action.

“Prior to the Baker implementation, superintendents of dispatch would address airline problems with a manual, labour-intensive process that could take hours to work out a single solution,” said Phil Beck, manager, optimisation solutions at Southwest. “Not only does this tool enable them to quickly react to problems within minutes, but they can also get ahead of potential disruptions hours in advance and have time to evaluate multiple scenarios. This project has supported the company’s goals and philosophies related to passenger hospitality, cost avoidance and operational performance.”

Using FICO® Xpress Optimization Suite, the Baker utilises several algorithms, advanced in-memory cache technology, and hundreds of carefully calibrated parameters to achieve real-time performance and high-quality, integrated decision-making. The Baker team worked closely with Southwest’s Superintendents of Dispatch for years prior to launch, incorporating business knowledge and best practices gained from their decades of first-hand experience.

“Southwest achieved an industry-first solution to a well-studied problem,” said Jim Bander, national manager, Decision Science, Toyota Financial Services, a judge for this year’s FICO Decision Awards. “The Baker project has several obvious benefits for its back-end operations and profitability, but at the end of the day, the real winners are the passengers who can get to their destinations without delay, and the crewmembers who can complete their assigned shifts as planned. Southwest is solving real problems for real people.”

Related News

- 05:00 am

Linedata the global solutions provider dedicated to the investment management and credit industries, has launched a new version of its award winning fund accounting solution, Linedata Mfact.

Based upon client feedback and our continuous evaluation of market trends, Linedata Mfact offers a range of improvements designed to deliver increased operational efficiency and compliance with stringent regulatory requirements.The new release offers greater integration with Linedata’s business process management tool, Linedata Optima, which offers a rich set of customisable tools that sit across Linedata’s suite of Fund Services products. This increased integration is designed to automatically bring areas of potential concern and improvement directly to the users’ attention, without the need for detailed examination of reports, as well as providing an operational overview at a glance.Driven by a rapidly evolving regulatory environment, which has increased operating demands and costs, the latest version of Linedata Mfact delivers automated options processing, expanded STP integration with transfer agency systems, process consolidation, enhanced corrections handling and full scheduling of processing tasks. Reacting to recent regulatory changes for SEC registered money market funds, Linedata Mfact addresses amended reporting and data storage requirements.

Michael Galvin, Product Manager at Linedata, says: “Our clients find that regulatory and operational pressures can be relentless: our mission is to ease the pressure and react to their greatest concerns. Increased automation and seamless integration have been a major focus in this latest update to Linedata Mfact, allowing financial institutions manage more complex asset types and comply with their increased reporting and compliance burdens without incurring additional costs. This is built upon an architecture which continues to offer clear reporting and audit trail capabilities.”

Related News

- 04:00 am

Traxpay, pioneer in the automation and optimization of B2B financial transactions, and NORD/LB, one of Germany’s largest wholesale banks with extended expertise in the corporate and structured finance businesses and its subsidiary NORD/LB Luxembourg S.A. Covered Bond Bank, today announced a planned cooperation to support the bank’s digitalization strategy. With Traxpay’s Financing Platform NORD/LB will be able to streamline Supply Chain Financing (SCF) services through a direct plug-in to customers’ ERP systems. They will benefit directly through accelerated response times, transparency, flexibility, and administrative efficiency.

“Traxpay’s technology will help us support our corporate customers to optimize processes, and increase efficiencies in their supply chains by making use of the data and intelligence they already have within their systems. Digitalization in our sophisticated SCF transactions will allow for reduced administrative complexity and spending, faster response times, and a high level of flexibility in transacting with us and their trade partners.” said Olaf Hugenberg, Head of Corporate Finance at NORD/LB.

Having a broad track record and extensive experience in corporate finance products, NORD/LB is keen to provide its clients with contemporary technical means to enable efficient and easy-to-install solutions for working capital financing. The envisaged cooperation with Traxpay is an important strategic landmark for the bank, reflecting customer demand and securing future opportunities in a competitive market. The cooperation emphasizes NORD/LBs business approach to keeping processes as simple as possible and minimizing manual administration on the part of the client.

Traxpay’s Financing Platform provides banks, corporations, and B2B networks with a turnkey solution for digitizing supply chain financing transactions. Trading partners can connect their ERP systems easily not only to one another but also to banks backend systems, essentially automating communications between all parties. As such, complete invoice data is instantly available to accelerate all processes required for efficient SCF transactions. These services offer corporates a great deal of flexibility and advantages due to optimized working capital and cash flows, better liquidity, and minimized risk. Banks benefit from enhanced customer relations and minimal administration associated with managing their SCF product portfolios.

Markus Rupprecht, Traxpay’s Founder and CEO: “In a global business climate that is extremely competitive, corporations are continually seeking technologies to increase efficiencies and transparency into their complex value chains. Our cooperation with Nord/LB is a perfect example of how banks and FinTechs can work together to improve existing processes, create new revenue streams, provide superior customer service, all of which represent a differential advantage in today’s financial services landscape.”

Related News

- 03:00 am

ING has partnered with Whydonate, a Dutch startup for managing charity donations, to launch first contactless charity donation boxes. The pilot project will be started in 2017 in the Netherlands.

The idea of creating the contactless charity boxes was borne out of the global tendency that today fewer people have cash on hands or keep notes at their homes. In most cases, consumers prefer using plastic cards or NFC-equipped mobile wallets. The new product allows nonprofit and charity organisations to collect funds going door-to-door, the method that has suffered a downturn in recent years.

Related News

- 05:00 am

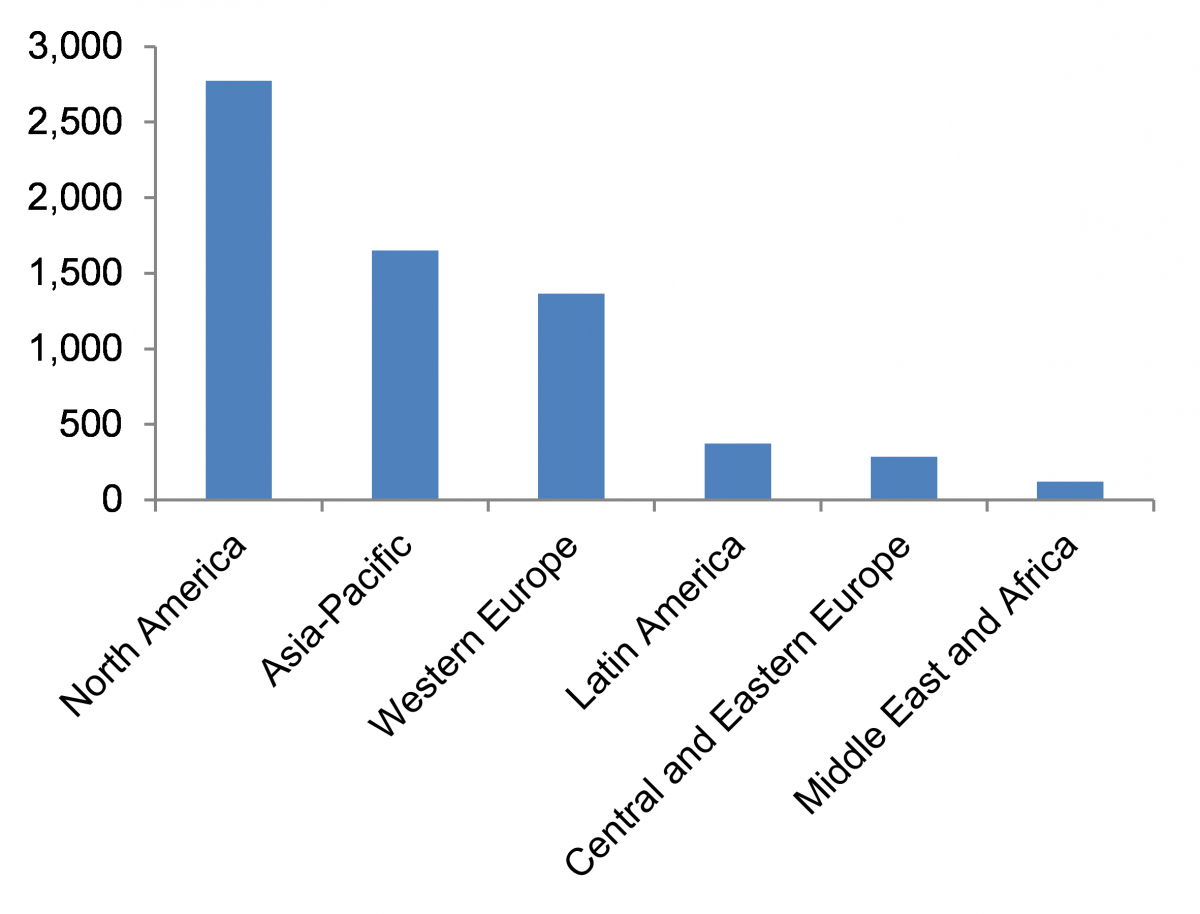

Highly-developed general merchandise and hospitality sectors make North America the largest region

Global POS Software 2016, a new study by strategic research and consulting firm RBR, reveals that North America accounts for 42% of the world’s point-of-sale (POS) software installations. The report, the first in‑depth international study of this dynamic market, shows that Asia-Pacific is the second largest region, followed by western Europe.

General merchandise, comprising both speciality chains and mixed retailers such as Walmart, makes up half of the North American market, driven by high consumer spending. The region is also home to many of the world’s largest hospitality firms, including Yum! Brands, Starbucks and Marriott International.

China and Japan are the main POS software markets in Asia-Pacific and together account for 67% of the region’s deployments. Small format stores, such as 7-Eleven, represent a significant part of the grocery sector across the region, particularly in Japan.

Grocery retail sector plays a central role in Europe

RBR’s research also highlights the importance of grocery retail in Europe; the heavily concentrated sector, which includes supermarkets, convenience stores and pharmacies, accounts for 70% of the European POS software market. There are a limited number of large grocery players in each country, including Edeka in Germany, Système U in France, and Magnit in Russia.

POS Software Installations by Region, June 2016

Source: Global POS Software 2016 (RBR)

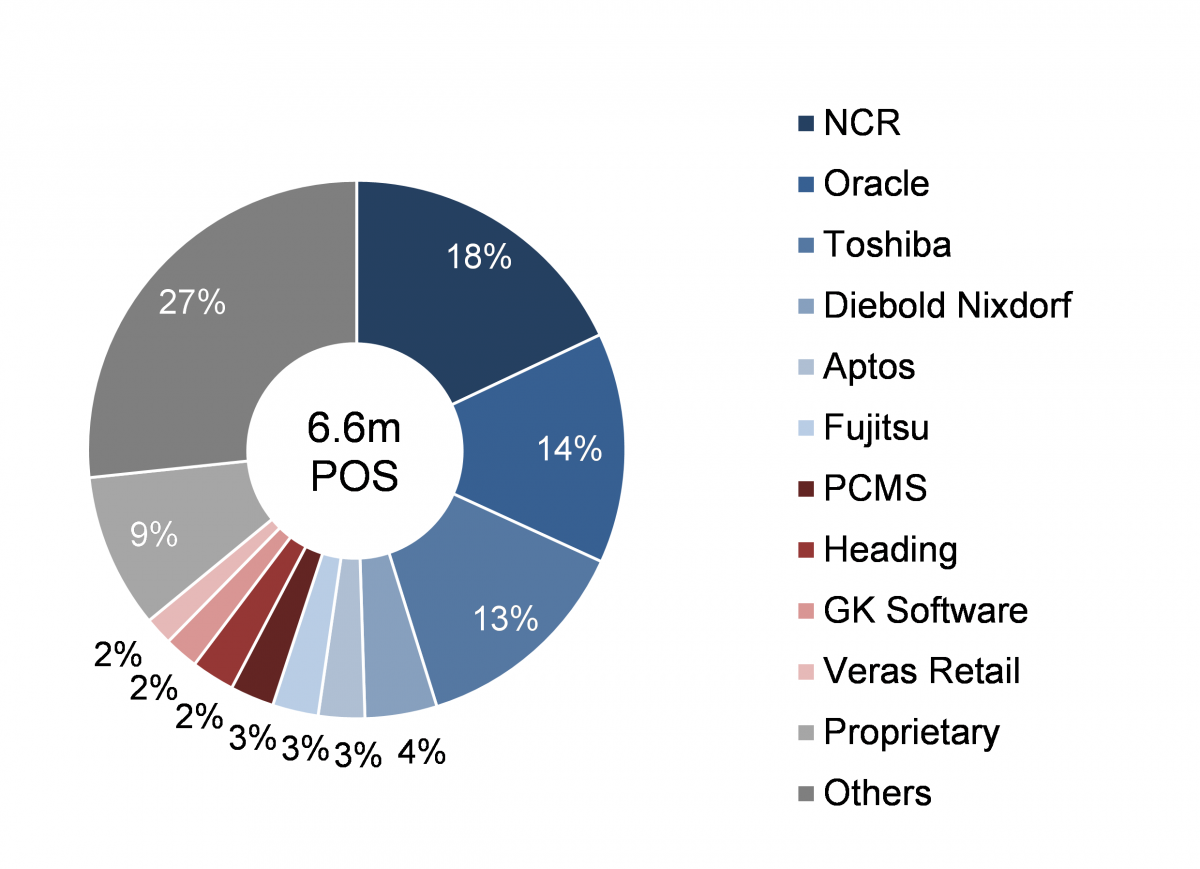

NCR is the world’s largest POS software provider, followed by Oracle and Toshiba

RBR has found that NCR has the largest number of POS software installations of any vendor worldwide, with Oracle and Toshiba close behind. NCR leads the global grocery segment, and is the largest vendor overall in both western Europe and the Middle East and Africa.

Oracle is the second largest POS software supplier worldwide, and ranks first in North America. It also leads the global hospitality and general merchandise segments.

Toshiba is the largest supplier to both Asia‑Pacific and Latin America. The vendor has a strong focus on grocery retailers and mass merchandisers.

Other leading international vendors include Diebold Nixdorf, which ranks second in EMEA, and Aptos, which has the majority of its installations in the North American general merchandise segment.

Japan’s Fujitsu and PCMS of the UK both have major customers in the US as well as strong positions in their home markets.

GK Software has the largest share in Central and Eastern Europe, while most users of software from Veras Retail, which acquired JDA’s POS software business in 2016, are in North America.

Shares of Global POS Software Installations, June 2016

Source: Global POS Software 2016 (RBR)

POS software fulfils an important role in omnichannel retailing

In this competitive and fragmented market, retailers are looking to POS software vendors to help them provide customers with a seamless shopping experience. Alan Burt, who led the research for RBR remarked: “In an omnichannel world, retailers increasingly understand that the in-store experience needs to echo and enhance their online capabilities; the POS application plays a key role in enabling unified commerce.”

Related News

- 09:00 am

Gemalto, the world leader in digital security, is supplying BNP Paribas, a leading European bank, with Mobile Protector, a highly secure solution to protect Wa!, an innovative multi-brand, omni-channel mobile wallet that combines payments, shopping coupons and loyalty programs. Gemalto's Mobile Protector encompasses an SDK (Software Development Kit), and both a customer enrollment and an authentication server. The solution delivers comprehensive security for all mobile payments made using Wa!. The bank is currently piloting Wa! in France with Carrefour, the world's second biggest retailer with 12,300 stores across 35 countries.

Wa! enables consumers to enjoy the convenience of swift and secure payments using nothing more than their smartphone. Once the app has been downloaded, Gemalto's solution facilitates a simple enrollment process that is activated by a PIN code sent via SMS. Customers validate payments with their PIN code or their fingerprint. In addition, coupons and loyalty rewards can be claimed and redeemed using the same wallet, creating a comprehensive shopping experience that redefines the relationship between retailers and customers.

Gemalto's proven security expertise played a key role in helping BNP Paribas achieve the first ever approval of a mobile wallet by GIE-Cartes Bancaires, France's interbank organization.

Mobile Protector offers outstanding user protection, reflected in its recent certification to the industry-recognized ANSSI CSPN software security standard. Building on the success of the Carrefour pilot, BNP Paribas expects to deploy Wa! in partnership with many more retailers looking to enhance their customers' experience.

"Gemalto provided a perfect fit for our mobile security needs, combined with ease of use," said Jacek Szpakiewicz, CEO of RMW1. "The strong involvement of Gemalto teams throughout the project has enabled us to optimize the integration of the solution and the development of the application."

"Wa! is a multi-brand, multi-bank, omni-channel and fully secure payment solution that represents the future of the mobile wallet for banks and retailers alike," said Philippe Cambriel, President for Europe, Mediterranean and CIS at Gemalto. "BNP Paribas has successfully turned this bold concept into reality, demonstrating how stringent standards of mobile security can be married to the smoothest possible customer journey."

1 RMW is the company that develops the Wa! mobile wallet

Related News

- 06:00 am

In November, Beta Systems Software AG entered into a sales partnership with SoftPlex, Inc. based in Tokyo. The IBM Premier Business Partner, who specializes in the configuration and maintenance of z/OS systems, will now implement IBM-based data center intelligence projects using products from Beta Systems.

SoftPlex, the latest addition to the Beta Systems network of sales partners, helps to set the perfect stage for an increased engagement on the Japanese market. The company, which has grown a loyal customer base in Japan over the years, sells software products and services for the IBM mainframe platform, specializing in RACF/security, output management and workload automation.

SoftPlex is already a partner of Beta Systems subsidiary HORIZONT Software, a workload automation and scheduling expert who provides products that facilitate the automation, documentation and analysis of mainframe-based IT processes in the data center.

Yasuhiro Kasai, Representative Director at SoftPlex: “The solutions from Beta System ideally complement this portfolio, allowing us to offer our z/OS customers a broader range of products. Japan has an evolved mainframe landscape, so there is ample need for output and log management, archiving, job control and other solutions that help companies optimize their data center operations.”

Walter Teichert, Director Partner Development at Beta Systems, adds: “Japan is a key target market for mainframe products, and system integrator SoftPlex has built a strong network there over the years – making them the perfect choice to help us grow our local presence over the coming months.” The cooperation with SoftPlex will serve as a gateway for Beta Systems’ greatly increased engagement in the Asia-Pacific region.