Published

- 05:00 am

A fully automated Know Your Customer (KYC) solution for achieving superior Anti-Money Laundering (AML) and Counter Terrorism Finance (CTF) compliance has been launched by Encompass Corporation. The software platform enables banks to meet the increasingly demanding regulatory requirements of The European Union’s Fourth Anti-Money Laundering Directive, which comes into force on the 26 June 2017.

The 4th AML Directive includes fundamental changes to the existing procedures, which will impact banks. Changes to Customer Due Diligence (CDD), the requirement for a central register for beneficial owners, a focus on risk assessments, and the new rules for politically exposed persons (PEPs) within the UK, all present a challenge for banks who struggle to tailor legacy systems or keep up with manual process.

Encompass Confirm, the new KYC platform for AML/CTF compliance is fully automated and can be tailored to the banks specific regulatory and risk criteria. Fully tried and tested with Uncover, Encompass’ product for restructuring and insolvency practitioners, this new system for KYC instantly aggregates and cross-refers information from 12 data providers in real time including Companies House, Experian, Equifax, The Gazette, Dun & Bradstreet, 192.com, Bureau Van Dijk, Creditsafe, redflagalert, C6 Group, Kyckr and Land Registry.

Trials of the platform have shown that on average using Encompass Confirm is 13 times faster than current systems and can cut manual costs by as much as 80%. Being automated, it also provides a full audit trail including an instant view of beneficial ownership and control, both key parts of the anti-money laundering compliance requirements.

Wayne Johnson, CEO from Encompass said: “The fourth Anti-Money Laundering Directive adds both an extra layer of complexity, and requirement for greater clarity of process and auditing including maintaining accurate and current information on beneficial ownership. It’s something a lot of businesses are struggling to prepare for. By automating the process, [building societies] can reduce the risks of failure to comply and also vastly improve efficiency, both at the point of need and, crucially, as and when the information needs to be updated or interrogated in the future.”

Related News

Product Profile

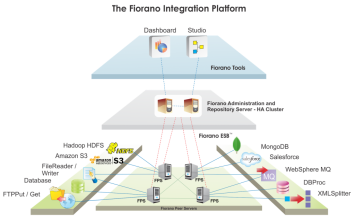

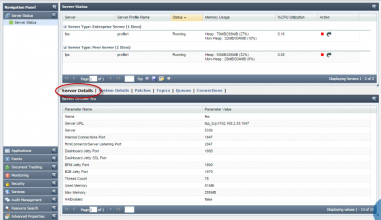

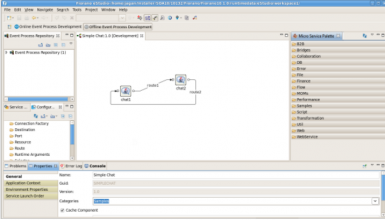

Fiorano ESB

Screenshots

Product/Service Description

An ESB acts as a high speed expressway for data flow in an enterprise, enabling seamless communication among mutually interacting software applications. Fiorano ESB obviates point-to-point integration efforts and integrates heterogeneous applications, databases, cloud and other systems streamlining the complex architecture of an enterprise.

Customer Overview

Features

- Fiorano ESB provides codeless integration between the bank's core banking system with all the channel applications. The configuration based tools enable citizen integrators to use the drag and drop interface to create integration flows without and coding

- Detailed technical product features can be found on this link: http://www.fiorano.com/products/esb-enterprise-service-bus/key-features.php

Benefits

- Secured and reliable communications Fiorano ESB is backed by an underlying standards-based messaging backbone providing scalable, enterprise class messaging with assured message delivery.

- Future proof solution Fiorano ESB's unique architecture allows parallel message flows between nodes, enabling natural and seamless integration of new applications/systems across the enterprise. This unbounded scalability makes your IT infrastructure a las

- Enhanced enterprise-wide visibility and administration Easily monitor all your information flows, manage all security authorizations and event-handling through a centralized ESB Administration Console.

- Reduced development costs Apart from obviating point-to-point integration, Fiorano pre-built adapters and Microservices allows over 80% of all integrations to be implemented out-of-the-box, with no additional programming, saving enterprises significant ti

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

- 04:00 am

Path Solutions is proud to announce that it was awarded by the universally recognized financial magazine ‘International Finance Magazine’ as ‘Best Islamic Finance Technology Service Provider - Global 2016’.

This accolade underpins the market’s need and recognition for long overdue innovations in Islamic financial technologies. With 25 years of solid experience, Path Solutions - a Kuwaiti IT company specialized in the development and implementation of cutting-edge Sharia-compliant software solutions and services plays a pioneering role in the global Islamic software industry.

The UK-based ‘International Finance Magazine’ (IFM) Awards recognize and honour individuals and organisations who make significant contributions to raising the bar in the global financial industry through activities of note. These include path-breaking innovations and other notable achievements that impact the international finance community. The IFM Awards also shine the spotlight on organisations in niche segments and those that exhibit brilliance in the unsung corners of the financial services industry.

“We are honored to have been chosen by the esteemed editors and readers of IFM for this award which acknowledges not only our leading-edge technology, but also our vision and determination to pioneer the Islamic financial services sector”, said Mohammed Kateeb, Path Solutions’ Group Chairman & CEO. “Winning this prestigious award for the fourth consecutive year is a notable recognition to our concerted efforts and long-term commitment, being the benchmark for Sharia-compliant technologies globally”.

Using a combination of reader nominations and expert analysis to ensure a fair and unbiased selection process and following a meticulous research and analysis by an internal team, the process is transitioned to an external research agency to provide its input. The nominees are then evaluated by a jury of prestigious international experts to whittle them into a final shortlist. The finalists undergo extensive scrutiny on the basis of innovation, growth, sustainability and in how companies lead the way in driving their industries forward among other key factors before the final award winners are announced.

According to the organizers of IFM Awards, Path Solutions was adjudged winner based on a proven track record, as well as the accelerated speed in growing its market share by expanding lately into Tunisia, Morocco and Suriname, thus registering 25 per cent increase within a short time span.

The winners of IFM Awards (Middle East & Africa) were honoured during IFM Award Ceremony held on 26th January 2017 at JW Marriott Marquis Hotel in Dubai, UAE.

The Award Ceremony brought together under one roof the who’s who of the international financial community, people holding C-Level positions within financial organizations, making it a highly-selective private gathering.

To view the official announcement on IFM website and the Award Winners for the year 2016, follow the link:http://www.internationalfinancemagazine.com/awards/winners#G and then click on 2016.

Read in over 185 countries worldwide, IFM is published by International Finance Publications Ltd, UK: www.internationalfinancemagazine.com

Related News

- 01:00 am

Chargebacks911™, a Global Risk Technologies company and an internationally-renowned leader for risk mitigation, announces the appointment of Tracy Cray as Director of Card Scheme Compliance at Chargebacks911’s new Essex location.

Tracy Cray, former Chargebacks & Disputes Manager for The Royal Bank of Scotland, has led Europe’s most successful chargeback processing division for the majority of her 34-year tenure in the payments industry. She also chaired a number of chargeback and scheme forums including the European Experts Chargebacks Group.

As an unrivalled expert in the field of chargeback management and risk mitigation, Tracy’s in-depth understanding of card schemes and influential relationships within the industry will serve as the cornerstone of Chargebacks911’s latest venture—services tailored to assist issuers, acquirers, and enterprise-level merchants. The service will launch in Q1 in Europe and will be offered to qualified clients, backed by a performance and ROI guarantee.

Tracy Cray, Director of Card Scheme Compliance, commented: “When it comes to chargeback management, financial institutions are burdened in many ways—it’s impossible to stay current on constantly-evolving regulations, there is little transparency regarding the processes of other entities, and an inability to maintain compliance becomes a major liability. These hidden issues have continued to accumulate without reprieve.”

According to recent reports published by ITS, internal chargeback-related expenses have climbed by 21% since 2015 and are expected to double in 2017.

“For this reason,” Tracy continues, “the services Chargebacks911 is offering will be a godsend to many, taking the guesswork out of the equation completely with effective results that last. I couldn’t be more pleased to lead this unprecedented industry initiative.”

Monica Eaton-Cardone, Co-Founder of Chargebacks911, stated: "Tracy is undoubtedly the most astute chargeback expert I have met, with an undeniable and persistent approach to positively address the core source of any problem she takes on. Her in-depth understanding of the inner-workings of chargeback management is unmatched, and we’re thrilled to have her join our growing leadership team in the U.K.”

Chargebacks911’s new services will include, among other things, personalised consulting and results-oriented strategies to assess current policies and procedures. By identifying oversight, errors, and unrealised opportunities, clients will experience an immediate improvement to their bottom line.

Related News

- 04:00 am

Top performing Islamic bank signs for new FusionBanking Essence Islamic solution

Misys today announced that QIIB has chosen Misys FusionBanking Essence Islamic. The bank is implementing the new solution in conjunction with Misys FusionBanking Party Management, to accelerate modern Sharia-compliant banking and build client loyalty through an enriched customer experience.

“The Islamic finance sector is highly challenging as a result of multiple players and strict regulations. In order for us to differentiate ourselves and grow, we must put the clients’ needs front and centre, providing them with superior customer service,” said Nasser Hasan Mahmoud, Head of IT at QIIB.

“We are confident that choosing the new Misys Islamic banking solution will enable us to streamline processes, improve operational efficiency, and deliver Sharia compliant products and services to our clients quicker. As a result we expect to be in the best position to fully capture and meet the needs of this growing market and obtain tangible cost reduction.”

The Islamic banking sector is fiercely competitive. Increasingly, technology is acting as a powerful enabler to help institutions automate, drive efficiencies and identify new areas of profitability.

FusionBanking Essence Islamic is a new component of the broader Essence suite. It enables banks to rapidly transform architecture without the need to rip and replace. This agile building-block concept offers rapid construction of new finance processes at a granular level, driving down the high cost-to-income ratio of Islamic banks.

Mohammed AlMawlawi, General Manager of Business Development and Marketing at QIIB said, “Our vision is to go beyond expectations. Our close collaboration with Misys enables us to achieve that goal. We are able to further apply our own innovation on top of the new solution which will support us in driving advanced banking automation and a more intelligent banking future.”

“We are committed to helping banks excel in the increasingly in-demand area of Islamic finance,” said Nadeem Syed, CEO, Misys. “QIIB will benefit from our cutting edge technology, optimising Islamic banking processes so that it can drive growth, performance and compliance. Having worked with the bank for many years, we are keen to continue supporting its transformation journey.”

QIIB has been a Misys customer since 1990, with the bank already using Misys FusionBanking Equation for core banking, alongside other Misys payment management and trade finance solutions. Combining the Islamic offering with these componentised tools delivers a comprehensive, integrated system.

With three decades of experience in Islamic markets, Misys works with hundreds of banks around the world.

Related News

- 01:00 am

Join business leaders at a two-day event in London aimed at highlighting how wealth and asset managers can implement and get the best out of digital technology through agile working and innovative leadership.

Experts from some of Europe’s top investment management companies will gather to share their experiences of digital transformation and how they use data in new ways to make more intelligent decisions and expand marketing reach.

The event is split into two days (7th and 8th February) with day one comprising a series of workshops followed by a day of keynote presentations, roundtable debates and facilitated panel discussions. Expert speakers include Peter Sayburn, founder and CEO of Market Gravity, who will host an interactive workshop on how to use digital technology to create a highly compelling client offering, putting customers and principles over products. He will share insights on how to build platforms and processes to ensure customers of all age groups love interacting with your organisation, and design products and services that are meaningful and relevant to your audience’s needs.

Peter is an entrepreneur, investor and author who has worked with some of the world’s foremost wealth and asset management businesses. He is passionate in the belief that if large companies are to live and grow in the digital age they must create a culture of innovation and embrace new digital technologies to stay ahead in the competitive marketplace.

Peter says: "Digital technology is bringing new and exciting opportunities to the wealth and asset management sector and now is the time for businesses to embrace the technology and implement new ways of working to engage with customers.

“This event brings together experts to share knowledge, experience and predictions on what’s coming up and highlights how new business models and cultures can improve operations and increase profitability, while meeting customer needs. I’m delighted to be presenting alongside leading innovators and trailblazers within digital transformation and look forward to some lively discussions.”

Jodie Paula Cohen, head of content at Event Creation Network, organised the event and says: “It’s important for the wealth and asset management sector to recognise the potential of digital transformation, technology and agile working to ensure customers are engaged, serviced well and enjoy their experience. A Fidelity report showed that managers who deploy digital technology have 40 per cent more assets under management than those who don’t, so to stay relevant, digital has to be an integral part of their offering. This event aims to inform attendees of the opportunities and offer techniques to put into practice within their organisations to make the most of digital technology.”

The event will run over two days. Workshops take place on Tuesday 7th February at 45 Moorfields, and the second day of presentations on Wednesday 8th are held at 200 Aldersgate, St Paul’s.

As well as Peter Sayburn, speakers include Stephen Ingledew (formerly with Standard Life) and Mary Harper from Standard Life, Billy Burnside from Aviva Investors and Sasha Dabliz from Rothschild Private Wealth.

Market Gravity was founded in 2009 by Peter Sayburn and Gideon Hyde. They founded the company to help big businesses transform ideas into breakthrough propositions and inject an entrepreneurial spirit into corporate environments.

Related News

- 06:00 am

Fenergo, the leading provider of Client Lifecycle Management solutions for investment, corporate and private banks, has today announced significant enhancements to its module for Margin Requirements for Non-Centrally Cleared OTC Derivatives.

Fenergo Margin Requirements is an advanced, rules-based compliance solution designed to help financial institutions meet the varying degrees of regulatory demands of Margin Requirements across the world. The solution combines rules, workflow processes and data requirements designed in partnership with the banking community.

Margin Requirements for Non-Centrally Cleared OTC Derivatives regulation aims to reduce systemic risk in the non-centrally cleared OTC derivatives markets by ensuring appropriate collateral is available to offset any losses caused by a counterparty default. However, it is anticipated that this latest compliance requirement will pose significant regulatory and operational challenges for financial institutions striving to implement solutions against tight regulatory deadlines.

According to Laura Glynn, Fenergo’s Global Regulatory Affairs Manager, “From a client management compliance perspective, there are three core operational challenges facing financial institutions in meeting the Margin Requirement obligation. The first one comes down to identifying and classifying the client population in-scope for this regulation. The second involves determining the data and documentation required to evidence the compliance demand. Given the fact that the regulation necessitates changes to existing trade documentation, the third challenge involves orchestrating a regulatory client outreach process to collect new or outstanding data and documentation from clients. On top of this, global banks need to ensure compliance with all the different and staggered deadlines across the world, as well as understanding the equivalence determination (yet to be decided)”.

The regulatory obligation, which has been implemented in the USA, Canada and Japan for initial margin obligations since September 2016, will introduce a requirement for variation margin for these countries in March 2017. The final European RTS entered into force on the 4thJanuary. Phase 1 requirements will apply variation margin and initial margin from February 4th, 2017, with variation margin applicable for all other entities from the March 1st, 2017. Meanwhile, Hong Kong, Singapore and Australia are forging ahead with a March 1st, 2017, regulatory commencement date for Margin Requirements, with Switzerland likely to commence at some point during the first quarter of 2017.

Fenergo has been working closely with its community of banking clients to put in place a solution that meets the demands of Margin Requirements rules from the outset. The firm’s team of regulatory analysts have been actively tracking the regulations on a global basis and translating them into an automated solution that will ease the operational and regulatory burden it may pose.

By automating this process, Fenergo Margin Requirements is designed to make complying with Derivative Margin obligations (in addition to a wide range of regulatory requirements), as efficient and effective as possible, speeding up the time it takes to achieve compliance, onboard clients / new products and improve client satisfaction and overall time to revenue.

Related News

- 09:00 am

Xignite, Inc., the leading provider of cloud-based financial data application programming interface (APIs), has expanded its leadership team adding two senior financial services executives, Ryan Burdick, Senior Vice President and Global Head of Sales and Marla Sofer, Senior Director, Strategic Business Development. The company also announced that it has opened an office in the New York financial district to serve Xignite's East Coast activities and hired market data industry veteran Dina Xu as its first New York-based sales director.

Xignite is leveraging capital raised in a Series C funding to further scale its sales and marketing efforts in order to fuel the company's continued global growth in financial services technology. The company is looking to add upward of 20 employees globally in 2017.

"Ryan, Marla and Dina bring incredible financial services technology experience that will help us tremendously in educating the capital markets industry about the challenges and opportunities they face as they prepare to migrate their market data infrastructure to the public cloud," said Stephane Dubois, Xignite CEO and Founder."

Ryan Burdick joins the company as Senior Vice President, Sales and will be based in New York. Burdick brings over fifteen years of expertise in financial information technology and has led several companies through rapid growth and profitability. At Xignite, he will be responsible for the worldwide sales team and partners, as well as continue to build on Xignite's record 2016 results and rapid expansion in Asia. Prior to Xignite Burdick served as Head of Client Management North America for Markit, leading a team responsible for managing the company's enterprise software clients. Prior to Markit he was Vice President at S&P Capital IQ responsible for building partnerships and alliances to grow sales for the company's large portfolio of complex enterprise data and analytics solutions. Burdick also has held senior sales positions at Standard and Poor's. He graduated from St. Lawrence University Canton, NY.

Marla Sofer has been appointed Senior Director, Strategic Business Development. She will be responsible for managing key partners, redistribution clients and special marketing initiatives, including the #FinTech API Ecosystem. Sofer joins Xignite from Lending Club where she was Head of Third-Party Monitoring and Oversight. Prior to Lending Club, she was a founding member of the team that launched the Global Provider Strategy function at BlackRock responsible for developing and executing BlackRock's operating strategy for selecting, managing, and partnering with global banks, index licensors, and market data providers. Previously she was at J.P. Morgan responsible for servicing asset management and institutional clients. She holds an MBA in Business Strategy and International Business from Rutgers University and a BA in Sociology and Hebrew from the University of Texas at Austin.

Dina Xu joins Xignite as Director of Global Sales Director. Based in New York, Xu brings 14 years' experience from S&P Capital IQ where she helped to build the company's business in Asia and North America, opening Capital IQ's first office in China.

Related News

- 01:00 am

Since the announcement of Donald Trump’s election and the firestorm created by his impromptu tweets, major city banks and trading houses have rushed to install sophisticated banking-compliant Twitter monitoring services to gain an advantage over their competitors.

Unpredictable tweets by a world leader mean major companies, banks and traders require an early warning system to prevent the destruction of share prices - that’s where products and services such as those offered by Market EarlyBird are taking off.

“Trump is cavalier and unpredictable. He might tweet something that raises the prospects of a US company with UK suppliers; he might tweet something that is viewed positively for international trade or he might tweet something that will have a negative effect on global security. Any of these actions could have a significant impact on global markets including the UK,” says Danny Watkins, CEO at Market EarlyBird.

“Although we launched back in 2014, the last six months has seen an exponential growth as banks and traders grapple to pre-empt the market uncertainty that accompanies Trump’s move into Office. Events such as Brexit and the US election each saw a surge in demand, and Trump’s continuing determination to “speak direct to the people” has highlighted the need for traders to get tweets first hand.”

Critical to banks’ use of Twitter is the prevention of secret messages (think LIBOR fixing) or outgoing tweets, but also the guarantee of confidentiality. The challenge then becomes the sheer volume of tweets to be monitored.

EarlyBird’s software analyses the form, style, and content of tweets as well as sender reputation to identify financially-relevant tweets. Key stories are curated as they emerge, ensuring breaking financial news is relayed to those trading or covering equities instantly, whilst retweet velocity is also monitored to quickly notify users if a tweet is about to go viral, even if they are not actively looking at EarlyBird.

Market traders and financial bodies must now be on their toes to react to whatever the new US President throws at the economy and globally trading companies. With the upcoming French elections showing an early lead for Marine Le Pen and continuing uncertainty about Brexit, financial institutions must be prepared as best they can to take on the ever-evolving face of global markets.

Related News

- 07:00 am

The Wall Street Blockchain Alliance (WSBA), a non-profit trade association, has announced that OTC Exchange Network (OTCXN) has joined the organization as a corporate member. OTCXN is utilizing blockchain technologies and smart contracts for its peer-to-peer trading network, which will launch initially for the global foreign exchange market.

OTCXN’s trading platform leverages proprietary blockchain and smart contracts technology to provide transparency and operational controls to enable safe and secure trading directly between counterparties, even if they are not known to one another. No longer will counterparties be required to establish credit arrangements with Prime Brokers – a process that can take as long as eighteen months to complete – in order to participate in the FX marketplace.

Ron Quaranta, Chairman and Founder, WSBA states: “We are delighted to have OTC Exchange Network join the Alliance. OTCXN’s innovative use of blockchain technology throughout the entire lifecycle of a transaction helps facilitate discussions outside of post trade settlement and clearing, and showcases its utility for a number of markets currently evaluating the technology. We are looking forward to OTCXN’s contributions to a number of WSBA member activities and involvement in our focused working groups.”

Rosario M. Ingargiola, CEO and Founder, OTC Exchange Network adds: “With WSBA serving as a neutral, unbiased steward of education and cooperation between Wall Street firms, we look forward to meeting like-minded individuals from investors to practitioners to regulators, and playing a part in broadening their horizons regarding the utility of blockchain technology.”