Published

- 06:00 am

Signalling that it has entered the next phase in its rapid growth, Brite Payments today announced the appointment of Alexander Kassai as Chief Operating Officer and Fredrik Strömqvist as Chief Financial Officer. The appointment of two new senior leaders follows a period of strong growth for the Stockholm-based fintech, which leverages the capabilities of open banking to give merchants and businesses a complete, out-of-the-box instant payments and payouts solution.

Alexander Kassai joins Brite to lead the company’s operational functions in his role as COO, bringing more than a decade of fintech experience, including at Klarna, where he led global merchant support during the company’s hyper-growth phase. Most recently, he served as CIO at Aleris, a leading Scandinavian healthcare provider. At Brite, Kassai will focus on scaling operational teams that deliver a first-class consumer and merchant experience.

“What attracted me to Brite was the opportunity to join an experienced and highly capable team that has built a top-class product that solves major pain points for businesses,” said Alexander Kassai, COO, Brite Payments. “In light of Brite’s rapid growth, I will be focused on how technology, including process automation, can support our further expansion; this will be all important as we scale up and serve customers in more markets. I believe my background in technical as well as operational roles will also help greatly as we continue to innovate with open banking-based instant payments.”

Fredrik Strömqvist has taken on the role of Chief Financial Officer following a stint as interim CFO at FOREX, a leader in the Nordic travel money market. His career spans more than 15 years in the financial sector, including roles at Oliver Wyman, Skandia, SBAB and DLL. Strömqvist is also responsible for developing and maintaining relationships with a growing network of banks.

“I’m excited to lead the finance function at Brite, which is crucial to supporting our local operations and is a key driver of our growth. I am also looking forward to helping shape the strategic direction of the company,” said Fredrik Strömqvist, CFO, Brite Payments. “Brite has already demonstrated that it has a very attractive offering in the instant account-to-account (A2A) payments space, and I believe it has the people as well as the technology to be a true instant payments leader.”

“Alexander and Fredrik are joining at an exciting time for Brite, bringing extensive experience to the business that will be invaluable as we continue to grow,” commented Lena Hackelöer, Founder & CEO, Brite Payments. “Our management team will benefit from their functional expertise, as well as their proven leadership capabilities. The finance and operations teams they lead are absolutely integral to our future success.”

The appointment of new senior leaders at Brite follows strong headcount growth in 2022, with the company nearly doubling in size. It also caps off a busy period during which the open banking payments specialist announced its Brite Instant Payments Network (Brite IPN) – a proprietary network that enables instant payments and payouts through open banking and helps close the gaps in Europe’s fragmented real-time payments landscape.

Related News

- 09:00 am

Temenos today announced that it has successfully completed certification for the FedNowSM Service, the Federal Reserve’s new instant payment offering launching in July 2023. Through Temenos’ flexible, cloud-native Payments Hub, banks can support the FedNow service and offer faster payments services to their customers.

FedNow is an instant payments network that moves funds directly and immediately between financial institution accounts in the United States. Participation in the program will enable banks’ customers to receive value into their accounts in near real time, thus outperforming traditional US payment clearing services with faster completions. Temenos will continue to enrich its FedNow capabilities, enabling its US clients to better serve customers with innovative payments solutions such as Request to Pay, accelerated payouts, and embedded finance offerings.

Christine Barry, Head of Banking & Payments, Datos Insights, commented: “For banks wanting to stay at the forefront of technology, participating in the FedNow Service will pave the way to creating additional differentiation for their customers. Offerings like Temenos’ core banking and payments cloud-native technology enables banks to innovate more quickly, giving customers access to faster payment methods which improve their cashflows and increase satisfaction, not just for Temenos’ banking clients but for their clients’ customers too.”

Ken Montgomery, Federal Reserve Bank of Boston first vice president and FedNow Service program executive, said: “We are excited that early adopters of all sizes across the country are making strides in their operational readiness for live transactions through the system. Completing certification is a key milestone for participating organizations to validate their ability to deliver instant payment services.”

Philip Barnett, President Americas, Temenos, said: “Temenos’ highly scalable platform with proven localization and ongoing investment in the US, enables banks to modernize their payments giving them the business agility required to benefit from new market initiatives such as instant payments. Temenos has a wealth of experience in supporting global financial institutions with their payments transformation across multiple payment schemes, clearing infrastructures and evolving regulations. In addition, many banks’ existing core technology can limit the benefits they provide to their customers from instant payments services like FedNow. Temenos can address these limitations by enabling banks to progressively modernize their core capabilities and accelerate the time to value. We see tremendous growth opportunities and are excited to have recently been selected by Convera, the global payments leader to modernize their payments infrastructure. We continue to invest in our single code base across core banking and payments making our offering the most compelling in the market.”

The benefits of this flexible, secure, and cost-efficient setup for instant payments are already well known to Temenos clients across the world, using instant payment rails including both ISO20022 and non-ISO20022 schemes such as UK Faster Payments and SEPA Instant in the European Union. FedNow certification further enhances Temenos’ capabilities in this area and reputation as a leader in the market. Temenos Payments is ranked #1 best-selling payments system in the global IBS Sales League Table 2023.

Temenos Payments Hub standardizes and simplifies payments operations within a centralized cloud-native platform and helps banks gain greater efficiency and lower costs. Temenos Payments Hub running in the cloud can scale massively handling all payment types and schemes.

Temenos offers a single platform across all banking verticals and business segments including payments and core banking. With Temenos, banks can progressively replace legacy systems, starting with payments. This way they can process payments at scale and pass on the benefits of the FedNow instant payments to their customers by using a modern, cloud-native core, unincumbered by legacy core systems. Therefore, the FedNow rollout process can become a key step towards the bank’s full modernization.

Related News

- 01:00 am

Mark brings his 20+ years of industry experience to accelerate Weavr’s growth from a product perspective, while expanding into international markets and building upon strategic partnerships, such as the recently announced Visa collaboration.

Before joining Weavr, Mark held the position of Executive Director for the New Ventures Group at Visa, overseeing venture, strategic partnerships, fintech and product growth opportunities in Europe. In this role Mark grew Visa’s network with market moving businesses such as Apple and Google and disruptors such as Klarna and Solaris.

Mark joined Visa Europe as it became an independent entity and Visa Inc. listed on the NYSE. He was instrumental in building out the European payment platforms and went on to drive their push into eCommerce and API-based product offerings. Mark was a key member of the team that reunited Visa when Visa Inc. acquired the European business.

Being at the intersection of digital businesses, financial services disruption, and one of the most successful payment network businesses in the world has offered Mark a unique vantage point. Coupled with his extensive commercial, operating and product leadership experience, he is well placed to drive Weavr’s product agenda to deliver the easiest way for businesses, and the safest way for banks, to embed relevant financial services at the point of need.

In addition to supporting partnerships with banks and financial institutions, Mark will spearhead Weavr’s expansion into new sectors, including lending, ERP, HR management, B2B commerce, and travel and logistics. To penetrate these untapped markets, he will focus on increasing the existing market size to underscore the significance of new payment flows.

When asked what first attracted him to Weavr, Mark Pettit said: “For me, it is the opportunity to unlock the next distribution channel for financial services, we’ve gone from branch, to phone, then to the internet, on to mobile and the next evolution will be embedded: seamlessly integrating financial services into our digital experiences when we need them.

Another appeal of Weavr is that it allows me to work in a close-knit and talented team. This might be the most exciting part about joining a growing start-up like Weavr. We can focus on a single objective and all of our actions will have a material impact, both on the business and the industry as a whole.”

Speaking on the appointment, Co-founder and CEO at Weavr, Alex Mifsud, said: “I’m delighted to welcome Mark to Weavr as our Chief Product Officer. His work at Visa focused at the intersection between the world’s largest payment network, big tech and the fintech ecosystem that Visa invested in across Europe. This makes for an invaluable contribution to our team as we continue to build the infrastructure for the widespread and rapid adoption of embedded finance. Mark’s passion for innovation, his experience in top-tier financial infrastructure and his broad industry perspectives all directly support Weavr’s ambition to be the category leader in the emerging embedded finance industry.”

The announcement comes shortly after the launch of Weavr’s new ‘Embedded Finance Cloud’ solution, which enables banks and other financial institutions to create and distribute embeddable financial products. Additionally, Weavr has recently collaborated with Visa to speed up the adoption of embedded finance solutions among enterprises and B2B Software-as-a-Service companies.

Related News

- 02:00 am

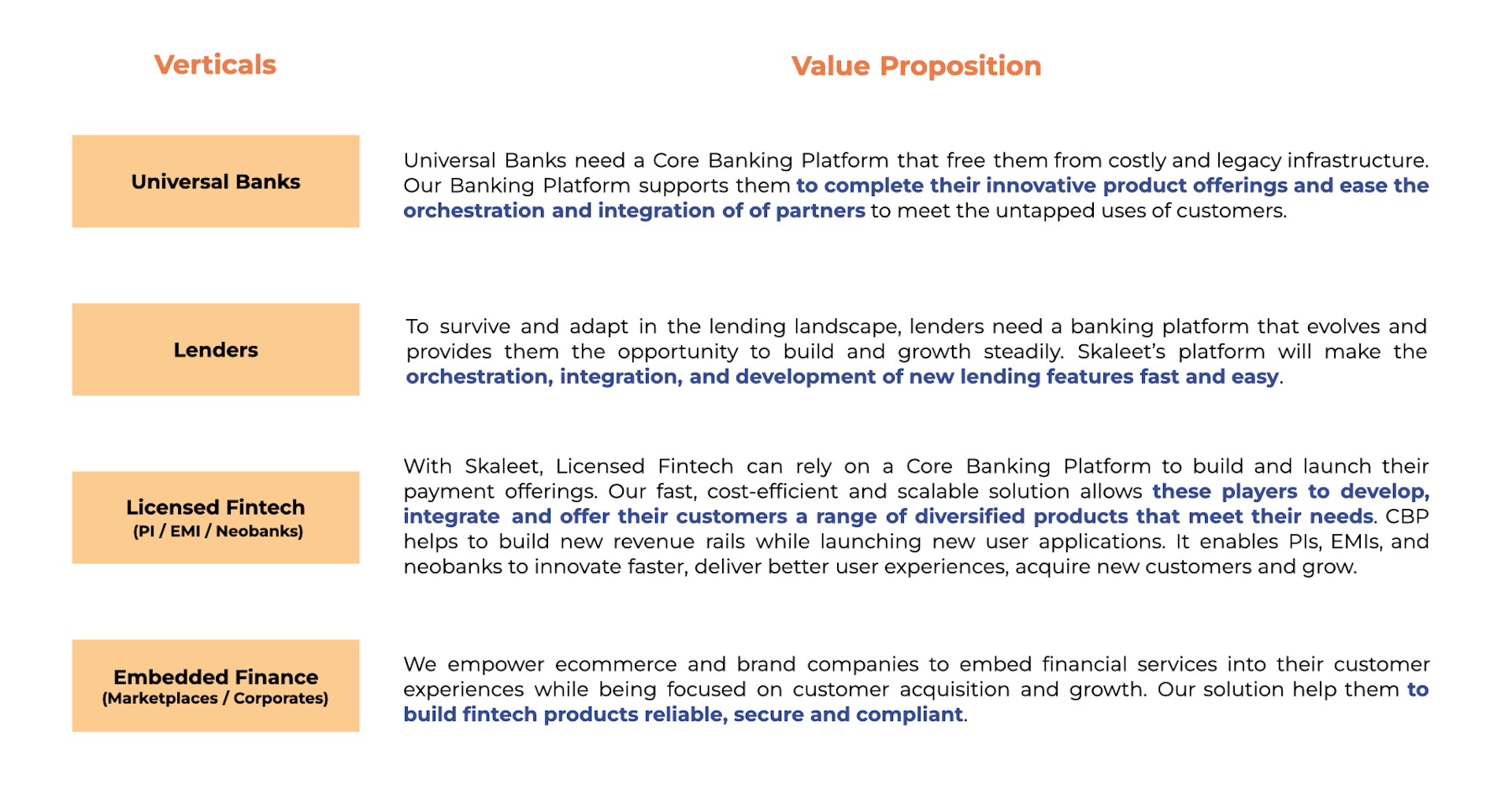

Process Oriented Core Banking (POBC), or Core Banking Platforms, represents the latest generation of core banking solutions. Developed over the last few years, they offer financial institutions the opportunity to take full advantage of the digital revolution by meeting the scalability needs of the industry.

CBP is based on an open, flexible, and modular architecture and enables the creation of efficient ecosystems capable of fluidizing interactions between financial services and Tech players while offering increasingly personalized customer experiences with an accelerated Time to Market.

Thanks to their lean code, Core Banking Platforms can manage complex products and processes directly in the cloud. They can be deployed continuously, without interruption, with meager maintenance costs and perfect scalability. CBPs are particularly well suited to the challenges of Open Banking and "Best-of-Breed" approaches.

Companies like Skaleet deliver these new Core Banking solutions by leveraging new technology precepts to manage digital experiences, operations, and ecosystems agilely. This is a great way to accelerate innovation, whether you are a bank, a neobank, a credit institution, or even an Embedded Finance player!

Read also: Core Banking —a fourth-generation based on platformisation

You are a Universal Bank

Despite significant technology growth, banks still rely on Core Banking Systems, and legacy technologies not designed to meet new customer needs. The main problem for banks is the lack of scalability of their IT systems, which prevents them from providing personalized experiences due to the complexity and rigidity of technical architectures, exacerbated by new regulatory requirements.

Also read: Components and microservices give banks flexibility

For example, according to an Accenture survey on banking operations, 80% of top bank executives fear their organization will be at risk if their technology is not upgraded to be more flexible and able to support rapid innovation.

The Boston Consulting Group estimates that banks risk putting 15 to 25 percent of their revenue at risk if they don't improve their daily banking offerings by incorporating new features, providing an innovative customer experience, and using data better.

Core Banking Platforms enable banks to compete with the tech giants by providing cutting-edge technology, innovative services at lower cost, and rapid and continuous customer experience improvement through an open and flexible architecture.

You are a Neobank

Neo-bank users are inactive partly because of the limited product catalog. Indeed, since most neo-banks are not licensed as credit institutions, the services are more limited: no checkbook, no authorized overdraft, and no credit or savings offer...

In a study of French neobanks, the ACPR found that almost all of their banking revenues come from only 20% of their customers. This reality weighs on their profitability. Also, in 2019, each customer generated a median loss of 20 euros for neobanks. This situation is not unique to France since the firm Business Insider Intelligence estimated that this amount was 11 dollars per user worldwide. An untenable position in the long run...

Also read: Why do neobanks have to reinvent themselves?

To remain profitable in this environment, neobanks have two main options:

For credit institution license to address a market that has not been covered up to now with a complete offer;

Relying on a new generation Core Banking Platform to offer innovative and differentiating products, possibly continuously reinventing itself to attract new clients.

The Core Banking Platform thus allows neobanks to accelerate their innovation and gain profitability without undertaking certification procedures, which are particularly long and administratively restrictive.

You are a Credit Institution

The lending industry faces many challenges, including changing regulations, increased demand, and disruptions in the financial markets. As a result, lenders seek to respond quickly to loan requests and provide the best possible service to their customers while minimizing risk. However, for traditional lenders, creating new products or adapting existing offerings can take months due to a monolithic IT system that is not very agile and not easily scalable.

To design agile and innovative financial products, implementing new solutions is becoming a priority for many lenders. Credit players are thus forced to consider maintaining their agility to remain competitive. They must be able to embrace a new modular approach. Core Banking Platforms technology allows them to integrate innovative products and technology partners to gain agility, responsiveness, and differentiation.

The Core Banking Platform collects all regulatory information and reporting to support audits of existing transactions or established credit agreements. It also centralizes all information required by the regulator. As a result, lenders can make decisions much faster and more compliantly and deliver a customer experience that meets the highest standards. Lenders can then leverage data to design real-world offerings and technology for rapid innovation.

You are an e-commerce or corporate actor

Financial players are not the only ones who need to innovate regarding the banking experience. E-commerce and corporate players are now looking to integrate comprehensive payment services to smooth the customer experience and meet new consumer demands.

The challenge here is to gain commercial agility while remaining compliant and profitable. These players need to be able to rely on a stable and available solution to avoid any disruption of service to their customers, which would result in a loss of revenue.

Here again, Core Banking Platforms are particularly relevant. They enable e-commerce players to integrate financial services into their payment experiences to create reliable, innovative, compliant, and secure banking products.

To conclude...

Financial and non-financial players must now take up the challenge of moving from "finance for all," which has been successful over the last fifty years, to "finance for everyone." This means developing specific financial services for each group and sub-group of the population to cover increasingly individual and personalized market needs. Faced with this demand, only the innovation of Core Banking Platforms seems relevant.

With Skaleet, you can orchestrate best-of-breed products and services through a documented API catalog. With a plug-and-play configuration, you can integrate the modules of your choice to customize your solution to meet new customer expectations and requirements. This approach radically overturns the rigid and historical paradigm of Core Banking Systems: by boosting the level of performance, scalability and launch new products to address markets, customers, and uses more quickly.

With its modular and flexible technology, Skaleet's Core Banking Platform helps every financial player meet the challenge of financial innovation:

So, become an architect of your business by building your innovation ecosystem with Skaleet.

Related News

- 03:00 am

B2BinPay is thrilled to announce the newest partnership with Ledger, The global platform for digital assets. This groundbreaking collaboration offers customers an exclusive branded Ledger Nano X bearing the B2BinPay logo.

Two different types of B2BinPay’s clients will be eligible to receive their branded Ledgers. Newly onboarded merchants and enterprise clients can look forward to the Ledger as part of their onboarding package. At the same time, existing loyal customers will be rewarded with a Ledger for their continued support.

B2BinPay will provide customers with unique promo codes to claim their exclusive hardware wallets. Those who enter their code on Ledger's official collaboration page can secure one of the 1000 limited units available. This emphasizes these custom devices' unique value and exclusivity, making them even more desirable for crypto enthusiasts.

Why Ledger?

Ledger is a trusted provider of high-end multi currency devices for securely storing private keys for cryptocurrencies offline. Their unparalleled security against hacks, simplicity in asset management, and transaction transparency make them an ideal partner.

This partnership will give clients access to some of the best crypto storage solutions, allowing them to quickly diversify their portfolios and manage their assets.

About B2BinPay

B2BinPay is an integrated crypto payment platform that enables businesses to securely and cost-effectively accept cryptocurrencies, supporting all major coins.

B2BinPay’s innovative platform allows users to consolidate their holdings into fiat, coin, or stablecoin, staying ahead in the ever-evolving industry.

With the collaboration of Ledger, B2BinPay can now provide robust solutions for client's asset management needs as they transition into the world of FinTech.

Related News

- 04:00 am

Today, some of London’s biggest fintech companies and interest groups have come together to demand an urgent review of legislation regarding hidden fees for international payments. Thirteen companies including Wise, Revolut and Monzo have joined forces to urge The Chancellor to eradicate this problem. [Letter in full here]

Research from Wise shows that consumers and SMEs in the UK lost a total of £5.6 billion* in mostly hidden foreign exchange fees in 2022, and current ambiguous legislation allows major providers to keep earning profits through these hidden fees.

Demands for the Chancellor include:

The total cost of currency conversions needs to be shown upfront to consumers and SMEs before they make a payment.

The legal definition of a ‘currency conversion charge’ should include any mark-up over the mid-market rate.

Firms must use an aggregated mid-market rate issued by a neutral provider (e.g. Bloomberg, Refinitiv, New Change FX), which is approved by the Financial Conduct Authority (FCA) as an official mid-market rate provider.

These rules need to apply to global currency conversions to support Global Britain, and not just to EU currencies.

The letter also instructs how the Treasury can support the FCA in removing vague wording, and ensuring all companies are clear on the rules they should abide by.

Magali Van Bulck, Head of EMEA Policy at Wise, said: “Hidden fees in foreign transactions simply shouldn’t exist in 2023. Burying additional costs in inflated exchange rates and labelling these as ‘zero fee’ is having a detrimental effect on the finances of people and businesses across the UK. In light of the Consumer Duty coming into force at the end of the month, this is completely unacceptable and a textbook example of how firms are not “providing fair value to customers”.

“Not just that, it’s also limiting the UK’s role as a global exporting superpower, by making the movement of money across currencies more expensive than it needs to be. Transparency is absolutely critical to ending these hidden fees, giving everyone who relies on international money the chance to understand just how much they are being charged. More shopping around means more competition means lower costs.

“We’re glad to have the support of the signatories in this letter today, and hope this marks the beginning of the end of hidden fees.”

Related News

- 07:00 am

CoinFund, a leading cryptonative investment firm and registered investment adviser, today announces the close of $158 million (M) CoinFund Seed IV Fund LP (“Seed IV” or “The Fund”), backed by a combination of sophisticated institutional investors, family offices, and high net worth individuals. CoinFund Seed IV LP exceeded its initial target fundraising goal of $125M. The Fund will support pre-seed and seed-stage investments in new and ambitious founding teams across the web3 ecosystem. The CoinFund team is proud to head into its ninth investment year after raising over $550M in the last 18 months across venture and liquid investment strategies.

Founded in 2015 at a Brooklyn kitchen table by Highbridge Capital Management and Amazon alum Jake Brukhman, and later joined by co-founder and American Capital alum Alex Felix, CoinFund is now supported by a world-class interdisciplinary global team of nearly 30 people with more than 100 investments across six investment vehicles. In the face of reported industry headwinds, the most recent Fund is emblematic of CoinFund’s commitment to steward thoughtful, long-term investment in blockchain technology with a clear, yet non-consensus view of how next-generation applications will be built on web3 rails.

“As CoinFund enters its ninth year, we continue to raise the bar for ourselves, our investors, and our portfolio companies,” said CEO and Co-Founder, Jake Brukhman. “Our investors have shown deep confidence in our people and strategy by continuing to allocate capital to our products in a bear market. Over the last two years, we’ve built a truly institutional-grade firm, the model of a large professional manager in web3. On the portfolio side, we are more bullish on the industry than ever and continue to invest in platform resources and personnel to help navigate a nascent and sometimes opaque category and support the growth of each portfolio company. CoinFund is proud to identify and back emergent teams and technologies before they trend.”

In addition to the close of Seed IV, CoinFund is proud to announce a new mission and vision for the firm: CoinFund champions the leaders of the new internet - powered by foresight as active investors to achieve extraordinary results. The mission statement will anchor operations and developing brand work as the firm amplifies its story among leading entrepreneurs and crypto talent and builds out post-investment services for its portfolio companies.

Speaking to CoinFund’s mission, CIO and Co-Founder Alex Felix said, “Being a champion is more than writing a check. It's being present, celebrating and promoting the smaller, everyday efforts that ultimately lead to significant achievements and large outcomes. And we do this for more than just our entrepreneurs. We are in service to the crypto ecosystem, the leaders of the new internet, pursuing ideal conditions for founders to flourish and their technologies to thrive by unlocking our networks and fostering education.”

In the last month alone, CoinFund has announced investments in Cloudburst Technologies’ cyberthreat intelligence for digital currency fraud; ML compute protocol Gensyn; Giza, an AI platform for smart contracts and web3 protocols; Cosmos layer 1 blockchain Neutron; and Robert Leshner’s Superstate, building blockchain-based financial products.

The formidable CoinFund investment team focused on deploying this capital into seed-stage deals is led by Managing Partners Jake Brukhman (focus areas currently include decentralization technologies and infrastructure, AI x web3); Alex Felix (marketplaces, infrastructure, financial services); Seth Ginns (cross-vertical liquid investing); David Pakman (NFTs, consumer, infrastructure) and Chris Perkins (financial convergence, tokenization, CeFi.) The Investment team includes Vangelis Andrikopolous, Austin Barack, Einar Braathen, Evan Feng, Christian Murray, Rishin Sharma and Isaiah Washington. Areas of expertise include ZK/ML/AI; DeFi; Layer 2s; consumer services, gaming, NFTs and DAOs; infrastructure including nodes, security, analytics, middleware, interoperability and scalability, and emerging markets.

2023 has also been a year of exciting organizational developments and growth for CoinFund, further evidenced by its recent appointments of Dilveer Vahali as Head of Venture Legal, Jules Mossler as Head of Marketing & Communications and Jenna Pilgrim as Head of Platform. The firm continues to seek talented investors; applicants may visit the CoinFund job board for more information on CoinFund and portfolio company roles.

The close of Seed IV comes after the recent announcement of CESR, the composite ether staking rate, announced by CoinFund in collaboration with CoinDesk Indices. CESR is a global floating rate benchmark derived from the daily transaction fees and staking rewards emitted from the Ethereum Proof of Stake (PoS) blockchain, enabling the proliferation of loans, bonds, futures, swaps, other derivative products and financial instruments that reference the index. By playing a fundamental role in the building of the web3 economy, CESR is a key example of CoinFund’s continued investment in and support for the growth and maturity of web3 and its mainstream convergence.

Related News

- 06:00 am

Gala Technology, in partnership with SOTpay, unveils Pay by QR, an innovative payment solution designed to simplify transactions for businesses and elevate the payment experience for customers. This groundbreaking platform harnesses the power of QR code technology, delivering fast, secure, and seamless payment processes. Pay by QR disrupts the payment industry, offering businesses a comprehensive tool to streamline financial transactions, boost efficiency, and drive unprecedented growth.

Pay by QR, the dynamic payment solution developed by Gala Technology and powered by SOTpay, is set to transform the way businesses transact. By leveraging QR code technology, Pay by QR simplifies payment processes, introduces heightened security measures, and enhances the overall customer experience.

"Our technology was initially developed for charities collecting funds. We later expanded its capabilities to cater to the taxi and parking industries. Pay by QR also serves as a great contingency plan for the hospitality sector, including restaurants, hotels, and events," shares CTO Steve Biggs.

The beauty of Pay by QR lies in its hardware-free nature, eliminating monthly card machine fees for businesses. Moreover, businesses can effortlessly deploy hundreds of QR codes across multiple locations at no additional cost, saving them thousands of pounds in rental fees. Seamlessly integrating with the latest open banking systems, Pay by QR has already been successfully implemented by numerous automotive dealerships," adds CEO Jason Mace.

The mission is to simplify and enhance the payment experience for businesses and customers alike. Empowering businesses with a secure, fast, and seamless payment solution that streamlines financial transactions and boosts overall efficiency. By eliminating the need for traditional payment hardware, Pay by QR offers a cost-effective and flexible alternative.

Developed by Gala Technology, a leading innovator in payment solutions, and powered by SOTpay, an industry leader in Pay by Link, leveraging AI, and machine-learning technology, Pay by QR combines the strengths of both to create an exceptional payment platform. This cutting-edge solution meets the evolving needs of businesses in today's digital landscape.

Key Features of Pay by QR:

1. Fast and Secure Transactions: Pay by QR enables customers to make payments conveniently with their smartphones, ensuring a seamless transaction experience.

2. Real-Time Payment Tracking: Businesses can enjoy real-time payment tracking, providing transparency and effective financial management.

3. Comprehensive Reporting: Pay by QR offers comprehensive reporting features, allowing businesses to gain valuable insights into their payment processes and trends.

4. State-of-the-Art Security: Advanced security measures to protect sensitive customer data, providing businesses and their customers with peace of mind.

By staying at the forefront of technological advancements in the payment industry, Pay by QR ensures that businesses can adapt to the ever-changing landscape. With its focus on innovation, security, and efficiency, Pay by QR streamlines payment processes, reduces manual errors, and saves businesses valuable time and resources.

Businesses that implement Pay by QR can enhance customer satisfaction and loyalty by offering a seamless and user-friendly payment experience. Whether you are a small business, a large enterprise, or an e-commerce platform, Pay by QR has the potential to revolutionise your payment processes and drive exponential growth.

Join the payment revolution today and discover the power of Pay by QR.

Related News

- 07:00 am

Qumulo, the simple way to manage exabyte-scale data anywhere, today announced the general availability of Azure Native Qumulo Scalable File Service (ANQ) in 11 new regions: France Central, Germany West Central, North Europe, Norway East, Sweden Central, Switzerland North, UK South, UK West, West Europe, Canada Central, and Canada East. Azure Native Qumulo is a scalable, feature-rich, unstructured data storage service that powers a wide range of workloads that leverage Azure cloud.

The expanded footprint of Azure Native Qumulo is a significant milestone in Qumulo’s drive to help its customers Scale Anywhere™. In the past, customers with large-scale file workloads were deterred from leveraging cloud services by limitations in scale, feature set, and performance demands. Previous file-based cloud storage solutions were also price-prohibitive and made it difficult for companies to estimate their cloud spend.

“Enterprise infrastructure owners are increasingly interested in driving efficiency and lowering operational cost through more inclusion of public cloud storage. They need to move workloads from on-prem to the cloud, without having to worry about scalability limitations or functional gaps,” said Brandon Whitelaw, Vice President of Strategic Partnerships, Qumulo. “With Azure Native Qumulo, we’ve made it simple for customers to scale their unstructured data in any major region across the EU. In fact, within 24 hours of its availability in Germany we had a customer who was able to use the service in production.”

Companies can provision ANQ on-demand for use cases that require high performance and low latency such as video editing for media and entertainment, subsurface modelling for oil and gas, vendor-neutral archives for healthcare imaging, genomic sequencing for life sciences, and many others. A five-time leader in the Gartner Magic Quadrant for Distributed File Systems and Object Storage, Qumulo helps customers maximize the benefits of cloud-based storage by allowing them to scale their data simply and cost-effectively.

As a fully managed service, Azure Native Qumulo combines the simplicity of the cloud with the rich feature-set, scalability, and performance of Qumulo on-prem to power any workload, at any scale. It allows customers to provision an enterprise-grade, cloud-native file system in minutes with just a few clicks — right from the Azure portal. Customers can migrate their on-premises workloads to Azure without re-architecting applications, dramatically simplifying unstructured data management at scale across on-prem and cloud deployments.

Related News

- 07:00 am

AccessPay, the leading corporate-to-bank integration provider, is pleased to announce the release of its new fraud and error identification tool, Detect. The launch of Detect marks the first in a series of anti-fraud and error prevention tools that AccessPay will be releasing over the coming months to support the UK’s corporates in proactively managing fraud and building operational resilience, as required by the new “UK SOx” corporate governance reforms.

Fraud is an increasingly serious issue for UK corporates. Data from KPMG shows the total value of fraud cases over £100k reaching the UK’s courts stood at £1.12bn in 2022, an uplift of 151% on 2021. In light of this, there is a growing regulatory focus on corporations to proactively manage fraud. Under new corporate governance reforms, unofficially dubbed UK SOx, large corporates will be required to produce fraud statements in their annual reports, which set out how they are detecting and preventing fraud. The same reforms also have a strong focus on operational risk and large corporates will need to demonstrate they have robust controls in place to mitigate the risk of errors in their finance and payment processes.

“Standards and expectations in relation to how corporates manage operational resilience and fraud risk are increasing,” states Anish Kapoor, CEO, AccessPay. “We have already experienced this in the financial services sector, where regulated firms are subject to new operational resilience rules and now there is UK SOx for large corporates. Yet, regardless of size, the risk of fraud and error is a very real concern for all businesses and can have a significant financial impact. The new additions to AccessPay’s product roadmap will help businesses of all sizes to take a multifaceted approach to managing fraud and preventing errors, as well as helping them to be audit-ready and able to demonstrate the impact of controls to regulators.”

The first tool to be launched as part of this roadmap is fraud and error identification tool, Detect. Detect adds an extra layer of control into corporate payment workflows, whereby the payment file is scanned and checked against several customisable rules, flagging any potential errors and issues, such as duplicate payments or potentially fraudulent transactions. This allows finance teams to promptly investigate any potential issues before payment runs are executed. While other detection technologies exist for UK BACs payments, Detect is noteworthy as it can handle all payment types, both domestic and cross-border. It is also fully integrated into the payments platform, making the detection of erroneous transactions a core step of the payment submission process and enabling faster responses by finance teams, if something does go awry.

Upcoming additions to AccessPay’s Fraud & Error Prevention Suite will focus on helping corporates take a more proactive approach to fraud and risk management, enabling them to catch potential issues before they become a problem.

“For corporates managing multiple banking partners and several bank accounts, it is astonishingly easy for potential issues with transactions to slip through the cracks. One of the biggest challenges for customers is that they only become aware of payment issues after the event,” says Kapoor. “AccessPay has long helped corporates in consolidating their payments data and automating processes, which helps reduce manual errors. Now we are taking this to another level, thanks to our new fraud and error prevention suite, which has been designed to alert finance teams to payment issues before making a transaction. Foresight is always better than hindsight.”