Published

- 04:00 am

Finastra has successfully completed connectivity testing with SIA, the European leader in payment infrastructure and services, to provide connectivity to the European instant payments infrastructure systems via SIAnet.

As of November, the RT1 infrastructure is live to process SEPA instant credit transfers, supporting euro payment transfers between accounts in less than 10 seconds and immediate availability of funds to the payment beneficiary. SIA provides access to this infrastructure with SIAnet, which is specifically designed to meet the requirements of instant payment and instant clearing systems. Finastra’s real-time payments gateway solution will allow financial institutions to access payments platforms such as RT1 via SIAnet in order to execute pan-European instant payments.

“After rigorous testing, Finastra is now able to successfully support RT1 users in executing payments through SIAnet,” said Andrea Galeazzi, Network Services Director, SIA. “Customers of Finastra that seek to execute real-time payments throughout Europe can be confident in SIA’s network infrastructure and Finastra’s ability to facilitate these payments via leading edge technology.”

Robin Crewe, CTO, Lending & Transaction Banking at Finastra, said, "By connecting to the infrastructure and network solutions laid out by EBA CLEARING in partnership with SIA, we are enabling our customers easier access to real-time payments capabilities. This move demonstrates our commitment to supporting banks as real-time payments continue to gather pace in an open banking environment.”

Related News

- 03:00 am

Velocimetrics, the leading provider of real-time business flow tracking and performance analytics and CloudShark, the world’s first web-based packet capture management and analysis system have today announced a tie-up, which will enable traders, network operatives and financial IT specialists to have greater visibility into network packets of data.

With this added CloudShark functionality, Velocimetrics’ clients are now able to look at a particular trade or market data in the system and query the individual packets of data that make up that detail through a simple click through. Previously, large files of data would have to be downloaded, without the seamless link to the market data or trade detail. It’s much better to capture data in real-time, with all the associated analytics. This approach negates the possible security risks that are associated with moving sensitive data. The new functionality means the process is now automated, transparent and more secure.

Jason Walls, Director of Technical Marketing at CloudShark commented: “The trading environment is a new and exciting market for CloudShark’s technology to be deployed in. Our packet capture management and analysis expertise fits with the Velocimetrics trade monitoring and performance analysis to build the perfect solution for the trading community seeking to get granular, deep insight into data anomalies within their networks.”

Steve Colwill, CEO of Velocimetrics concurred: “The trading community is facing the mammoth task of staying compliant in a MiFID II environment. Giving financial institutions the ability to drill down into their trading data to extract the required level of detail, whilst causing minimal disruption to the trade flow and reducing security risk is an extremely compelling proposition for them. The integration of the CloudShark module within the Velocimetrics solution has taken our proposition to the next level by supporting our highly modular, best in breed,

approach to monitoring and tracking. We are delighted to announce our partnership.”

Key benefits of the joint proposition include:

• Cost benefit

• Complete visibility of data

• Reduced time to incident root cause determination

• Real time alerting of network level issues

• Increased security, due to network data staying protected in the system rather than being downloaded into higher risk locations.

Related News

- 02:00 am

Piraeus Bank - the leading Bank in Greece - in conjunction with UnionPay International - the Chinese financial services organization with more than 6,1 billion credit, debit and prepaid cards worldwide - introduces QuickPass to Southern Europe for the first time.

Piraeus Bank is at the forefront of digitalization in retail banking. Subsequent to the introduction of direct flights from Beijing to Athens, Piraeus Bank recognized the need for Chinese visitors to Greece to be able to access quick and easy ways to pay at popular spots across the capital and the islands. According to the Greek-Chinese Economic Council, the gradual increase in the number of flights from China will allow up to 1.5 million Chinese to visit Greece annually, within the next five years.

Commenting on the joint-venture with UnionPay, Ioannis Grammatikos, Assistant General Manager at Piraeus Bank said: “We take pride in leading the contactless experience in Greece and we are delighted to be working with UnionPay to bring QuickPass and contactless payments for QuickPass customers to Southern Europe for the first time.”

Related News

- 03:00 am

The Maltese Government is receiving recommendations for an effective legal framework regulating blockchain technology and digital assets.

Parliamentary Secretary for Financial Services, Digital Economy and Innovation Silvio Schembri is encouraging all those interested in investing in this new sector of the digital economy to come forward and make their recommendations.

In a meeting with the Parliamentary Secretary, Stasis.Net stated that they will be sending their recommendations for an effective legal framework that regulates the use of blockchain technology and cryptocurrencies to both the national blockchain taskforce and the MFSA.

Parliamentary Secretary Schembri stated that “we are developing appropriate legislation to become an international hub for blockchain operators.”

CEO and founder of Stasis.Net Gregory Klumov reiterated his satisfaction with Malta endorsing and supporting new regulatory approaches to blockchain and cryptocurrencies in the reshaping of the future of digital assets.

Gregory Klumov stated that “soon, we will be able to bridge the existing gap between on-demand blockchain economy and finance, which people can benefit from.”

Gregory Klumov adds:

Malta has a track record of creating stable and attractive regulatory environment for complex industries like financial intermediaries and gaming. More than 10 years ago Malta became the first EU country to enact comprehensive legislation on remote gaming, and industry leaders consider Malta as one of the foremost tried and tested jurisdictions in the world. We believe decentralized finance is exactly the industry that perfectly fits into Maltese strategy of digital innovation and happy to contribute to respected authorities our recommendations to regulate digital assets, particularly asset-backed tokens.

Related News

- 06:00 am

Christmas gift giving pressure is causing Brits to drop their guard and increasing their chance of being targeted by seasonal online scams, according to new data from Barclays.

A new study has found that two thirds (65 per cent) of parents would use an unfamiliar site to find the must have toys of the year, with 16 per cent saying that the Lego Star Wars BB8 is the most in-demand present for children this Christmas. The Paw Patrol Sea Patroller (13 per cent) and LOL BIG Surprise Doll (12 per cent) follow close behind on their children’s wish lists.

Across the UK, almost seven in ten (69 per cent) Brits say they feel under pressure when buying gifts for their loved ones at Christmas, with one in five (22 per cent) of these shoppers admitting to ‘panic buying’ presents as a result. A similar proportion (20 per cent) visit websites they wouldn’t normally buy from in order to find the right gift.

This stress and panic creates the ideal opportunity for fraudsters to strike; one in five (19 per cent) gift givers would be willing to register and save their personal details on an unfamiliar website, while one in 10 (10 per cent) would pay via bank transfer to someone they didn’t know in pursuit of the perfect present.

Don’t let the fraudsters win

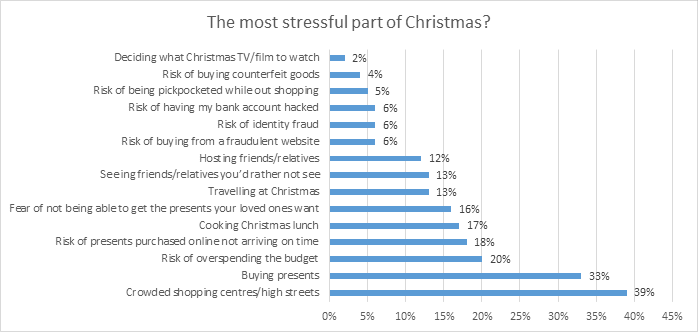

With one in three (33 per cent) Brits considering present buying to be one of the most stressful aspects of the festive season, second only to battling crowded shopping centres and busy high streets (39 per cent), it’s important that online safety is not overlooked.

Worryingly, just six per cent identified the possibility of buying from a fraudulent website as a festive stress trigger, despite the fact that the average victim loses £893. Instead, people are more than three times as likely to worry about seasonal overspending (20 per cent), with one in four (26 per cent) resorting to buying their loved one’s gift from whichever website offers the cheapest price to save on cost.

‘Tis the season to be wary

With more than a quarter (26 per cent) of scam victims having been scammed over the Christmas period, Barclays is warning everyone to stay vigilant when shopping online this December. Almost half (48 per cent) of former victims of online scams were buying for someone else when they were targeted, with one in seven (14 per cent) admitting to being more preoccupied with finding the right gift than checking the legitimacy of the website.

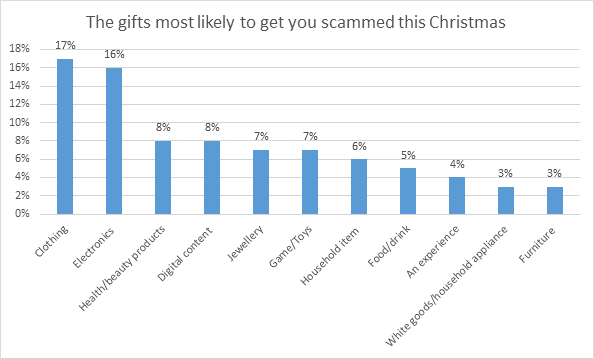

Clothing topped the list of gifts most likely to get you scammed, affecting 17 per cent of former fraud victims. Electronics (16 per cent) took second place, with health and beauty products (8 per cent) and digital content such as movies, music and computer games (8 per cent) sharing joint third place.

This coincides with some of the most popular gifts on Christmas shoppers’ lists. Clothing, beauty products and jewellery topped the list of items to buy a spouse or partner, games and electronics took the top spot for sons, clothing and electronics for daughters, and food and drink was the most popular choice for dads.

Samantha White, who leads Barclays’ work to keep customers safe from fraudsters, said:

“Scouring the internet for the perfect Christmas gift can be stressful, but if you lose sight of digital safety and just focus on the price, you could fall prey to festive fraudsters. Look out for ‘too-good-to-be-true’ deals, and always take the time to check that the website you’re buying from is legitimat

Related News

- 04:00 am

Anna Flach, previously Commerzbank and BNP Paribas, hired to scale the Marketing function at EquiChain

EquiChain, the London-based FinTech specialising in blockchain technology for capital markets, has appointed Anna Flach as Head of Marketing & Communications, effective from 27 November 2017.

Flach will be responsible for the development and implementation of the overall marketing and communications strategy, working alongside the executive team to drive the FinTech’s growth. With expanding services and the recent admittance into the Abu Dhabi Global Market (ADGM) Regulatory Laboratory (RegLab) programme, she will be joining a growing team. Flach will support the launch of EQX (“EquiChain Exchange”), a fully regulated exchange for cryptographic IPOs and secondary market trading in ADGM.

Flach will report to Nicholas Bone, founder and CEO of EquiChain, and will be based in London.

Nicholas Bone said, “This is a very exciting time for EquiChain as we strive towards our

ambitious strategic plan to become the leading blockchain FinTech in Emerging Markets.

Anna brings a wealth of expertise in financial services marketing to support this ambition, drive the communications strategy and further build the EquiChain brand. We are another step closer to bringing our vision of a totally reimagined capital market ecosystem to reality.”

Anna Flach joins from the Corporate Communications team at Commerzbank where she was responsible for Fixed Income & Currencies marketing globally. Prior to that, she held roles at BNP Paribas in Paris and London. Anna graduated from Oxford Brookes University with a BSc in Business and Psychology and holds a MSc in Management from EM Lyon Business School.

Related News

- 04:00 am

In eight countries, the iPhone X already accounts for over 2 percent of the iPhone active installed base just three weeks after its first availability on November 3. The leading countries for iPhone X adoption are markets with high gross domestic product (GDP) per head such as Singapore, Denmark, Switzerland and Japan.

IHS Markit is able to use its unique measurement of active installed base data to provide very early insights into how the iPhone X is performing, well in advance of the availability of shipment data.

iPhone X does best in markets where iPhone Plus is popular

Countries where “Plus” model iPhones have been successful in the past have a strong correlation with initial levels of iPhone X adoption. Consumers in those markets have a greater interest in larger displays and high-quality dual cameras, as well as the willingness to pay the higher price a Plus model or iPhone X costs over regular-size iPhones.

Despite production constraints, in the markets where iPhone X has launched, initial uptake is very similar to adoption of previous iPhone flagship launches in the same launch period. This indicates good demand for iPhone X and is better than the rumored supply.

In the US, iPhone X adoption after three weeks matched the adoption of iPhone 8 Plus and beat early adoption levels for both the iPhone 8 and 7 Plus. Only the iPhone 7 model had greater initial success. In Japan, initial iPhone X adoption was as good as or better than any recent iPhone launch, and matched the level of the iPhone 7.

Apple will enjoy record-breaking iPhone performance in 2018

We expect Apple will enjoy its best ever year for iPhone. IHS Markit forecasts each of the next four quarters will see increases year-on-year in iPhone shipment volumes, compared to the same quarter a year earlier.

In the fourth quarter of 2017, IHS Markit forecasts Apple will ship 88.8 million iPhones — this will be the greatest number of iPhones ever shipped in one quarter.

Apple will need to ship just 31 million iPhone X units for iPhone average selling price (ASP) to exceed $700 for the first time in the iPhone’s 10-year history, assuming total shipments amount to 88.8 million.

iPhone X represents a shrewd strategy from Apple. In a maturing smartphone market, consumers may choose to buy replacement smartphones less often. If so, the higher price of the iPhone X means Apple could gain similar revenue levels and profits at lower shipment volumes. If Apple can increase unit shipments instead, then iPhone X will drive significantly higher iPhone profits.

Related News

- 05:00 am

Turnkey open banking platform provider, Token, has pledged to connect banks, merchants and other third-party providers (TPPs) to any bank in the EU for PSD2 payment orders and account information requests.

Marten Nelson, Co-Founder and VP of Marketing, Token comments: “The goal of PSD2 is to boost competition by letting customers choose who can access their data – this can not be achieved while everyone must contend with multiple bank-specific APIs. Developers can not write to more than one or two APIs, and TPPs can not resource the technical heavy lifting needed to integrate with them all. Token solves this problem by providing direct access to any bank in the EU. Right now, we’re connecting banks-to-banks, merchants-to-banks and TPPs-to-banks faster and with less friction than anyone else on the market, via our single, secure interface. Token is the only provider that can do this.”

“PSD2’s frontrunners are establishing how they can capitalise on the future abundance of bank-data, either to create new services, or support those developed by TPPs,” adds Nelson. “This whole approach relies on them being able to connect to their customers’ banks in the first place. In 2018, the market will develop fast, so the ability to connect to any EU bank quickly and securely has to be a priority for everyone in the industry.”

Token’s developer-centric approach has already attracted hundreds of developers and TPPs, who are now creating apps and services that run on TokenOS. Some examples are e-commerce checkout, in-purchase lending, PFM apps, multi-bank account aggregation and sweeping of funds and many more.

Camilla Sunner, Managing Director at payments solutions provider, Valitor, added: “The payments landscape is moving quicker than ever before. Token is an invaluable partner to help others take advantage of that change. As a result of Valitor’s partnership with Token, Valitor can now focus on delivering the next generation of payments. We focus on building value added services, and after a simple integration they enable back-end bank-to-bank access. Together we help drive the market into the world of open banking.”

Related News

Remi Puissant

Banking & Payment Digital Strategy Manager at Gemalto

After months of discussions and debates, Regulatory Technical Standards for PSD2 have been finally approved by the European Commission. see more

- 06:00 am

Profile Software, an international financial solutions vendor, announced today that CNP Cyprus Insurance Holdings (CNP Cyprus) has selected the IMSplus solution to deploy, so as to effectively manage its assets and fund management requirements and achieve operational efficiency.

CNP Cyprus is one of the largest and strongest Insurance Groups in Cyprus and its subsidiaries, CNP Cyprialife Ltd offering Life, Health and Accident insurance business and CNP Asfalistiki Ltd offering General insurance business, are both leaders in their respective sectors. Key important factors for this success have been the constant use of modern technology, the wide network of Insurance Intermediaries and Agents all over Cyprus and the provision of integrated and innovative insurance products, which fully cover the insurance needs of every individual and business.

CNP Cyprus selected IMSplus due to its flexible, customisable and functionality-rich environment. The insurance investment management functionality inherent in the IMSplus platform has been widely recognised by the industry, based on the number and diversity of implementations. Following an international evaluation process, CNP Cyprus chose IMSplus to automate and streamline its investment management tasks from transactions to accounting entries and achieve risk efficient operations.

IMSplus for Insurance Investment Management provides comprehensive portfolio structure definitions and multi-level analysis features that will enable CNP Cyprus to easily monitor the invested financial assets, while complying with the policies set by the Group.

The system’s customisable reporting will support the respective demanding requirements and along with the specialised asset management tools and the wide support of financial metrics, will allow investment officers to perform comprehensive gain/loss and risk exposure analysis on the company’s investment products (including cash & term deposits, equities, bonds and mutual funds), while being able to provide instant cash flow projections. IMSplus, by automating reporting and data exports of the investment’s accounting entries, will reduce the manual tasks of internal accounting requirements.

CNP Cyprus’ selection emphasises the expertise Profile Software has in the insurance market, for delivering advanced and easy to use platforms in the demanding investment management domain.