Published

- 02:00 am

- Introducing Dell EMC PowerMax, the world's fastest storage array built for mission-critical applications of today and tomorrow

- PowerMax engineered with end-to-end NVMe, ready for Storage Class Memory (SCM) and NVMe over Fabrics

- Dell EMC VxBlock System 1000 will support end-to-end NVMe with PowerMax for extreme performance without compromise for mission-critical applications

- Dell EMC XtremIO adds native replication, new entry point X-Brick system at up to 55% lower cost than previous generation and support for VxBlock 1000

- Sneak peek of new Dell EMC PowerEdge MX infrastructure coming soon

Full story

Dell Technologies is launching several new breakthrough Dell EMC storage and server products backed by a comprehensive services portfolio. Raising the bar yet again to power up the Modern Data Center, these new products are designed to address a wide range of traditional and emerging data center workloads to help customers drive better business outcomes.

As organizations race to capitalize on the benefits of emerging technologies ahead of their competitors, they are faced with new demands that require IT modernization to achieve higher levels of performance and automation in the data center. According to a recent ESG global survey commissioned by Dell EMC and Intel of 4,000 IT decision-makers, 81% agree if they do not embrace IT Transformation, their organizations no longer will be competitive in their markets.

"The Modern Data Center is the proving ground for our customers to gain a digital advantage over their competition and achieve better business outcomes," said Jeff Clarke, vice chairman, Products & Operations, Dell. "Dell EMC is delivering the Modern Data Center innovations that our customers require, with new solutions that are engineered using future-proof technology to take on the data center challenges of today and to support the next big thing that our customers are imagining for tomorrow."

From consulting to deployment and support, from managed services to education, Dell EMC Services are available to help drive the rapid adoption and optimization of the Modern Data Center, making it easy for customers to integrate new technology and make it a productive component of their business.

Dell EMC PowerMax

Dell EMC's PowerMax, the future of enterprise-class storage, is architected with end-to-end NVMe and a built-in, real-time machine learning engine. Building on the legendary architecture and capabilities of Dell EMC's flagship storage system, PowerMax is the world's fastest storage array1, delivering up to 10M IOPS2 and 50% better response times3 – 2x faster than the nearest competitor4.

Architected with end-to-end NVMe to support NVMe-over-Fabrics and high-speed, low-latency Storage Class Memory (SCM)5, PowerMax is not only fast, smart and efficient, but also engineered to handle the world's most demanding application workloads.

In addition, the PowerMax OS includes a built-in machine learning engine, which makes autonomous storage a reality, leveraging predictive analytics and pattern recognition to maximize performance with no management overhead. Built-in machine learning is the only cost-effective way to leverage SCM. Dell EMC is also the only company that can provide this level of storage software intelligence – currently analyzing 425 billion data sets in real time6 across its high-end All-Flash customer base.

PowerMax also includes inline deduplication and enhanced compression providing up to 5:1 data reduction7, while delivering industry-leading security, protection and resiliency. It achieves greater than "six nines" availability8 to help ensure zero downtime of business-critical applications.

Storage solutions are increasingly being consumed within converged infrastructure, namely the Dell EMC VxBlock System 1000. As the industry's leading provider of converged infrastructure systems9, Dell EMC offers expanded options for VxBlock 1000 customers who can benefit from fast, smart and efficient storage with new support for PowerMax with end-to-end NVMe and XtremIO X2 All-Flash arrays. This means that the VxBlock system breaks the physical boundaries of traditional CI and offers enterprises even greater simplicity and flexibility to help accelerate their IT and digital transformation efforts.

To speed implementation of PowerMax or VxBlock in their environment, customers can take advantage of Dell EMC ProDeploy Plus services for up to 66% faster deployment10 and up to 49% fewer technical support calls.11 Customers can also choose ProSupport Plus for consistent best-in-class support delivered across their environment and up to 75% faster service request response time.12

Dell EMC XtremIO Replication and new entry price point

XtremIO X2 All-Flash arrays gain major updates with the new XIOS 6.1 operating system, including delivering the industry's most efficient replication across a wide area network (WAN)13. X2 metadata-aware native replication is highly efficient and provides an added level of data protection for application workloads. XtremIO replication sends only unique data to the remote site to minimize bandwidth requirements by 75% or more14, enabling potential network cost savings. XtremIO replication requires up to 38% less storage space15 at disaster recovery sites and operates with predictable performance to achieve recovery point objectives of 30 seconds16.

Dell Technologies also introduced a new Dell EMC X2 entry model for customers, at up to 55% lower cost than the previous generation17. Designed with XtremIO's unique metadata-centric architecture with full data services including inline data reduction (in-memory space-efficient copies, deduplication and compression), XtremIO can also achieve over "five nines" availability,18 offering customers enterprise-grade capabilities that start at midrange prices.

Dell EMC PowerEdge MX

Dell EMC will preview PowerEdge MX, a new modular infrastructure solution for the modern data center. Designed with Dell EMC's kinetic infrastructure, PowerEdge MX will enable customers to flexibly configure and optimize their IT infrastructure for new and emerging workloads.

Available in the second half of 2018, PowerEdge MX will bring new levels of flexibility to IT, ideal for dense virtualization, software-defined storage and networking, network functions virtualization (NFV) and big data analytic environments.

Availability

Dell EMC's Modern Data Center solutions PowerMax and XtremIO X2 with native replication, as well as VxBlock System 1000 with XtremIO X2, are available now. VxBlock System 1000 with PowerMax support will launch this summer. Dell EMC PowerEdge MX has planned global availability for the second half of 2018.

Related News

- 01:00 am

Two-thirds of federal IT executives in a new survey say their agencies are moderately-to-highly prepared to withstand a cyberattack and continue to function. But a number of gaps in cybersecurity resilience remain.

Nearly 7 in 10 federal civilian agency IT leaders — and more than half (55 percent) of their defense and intelligence agency counterparts — say their agencies aren't keeping pace with evolving threats, according to the study.

The study found about roughly two-thirds of IT officials surveyed say their agency can detect — and more than half say they can respond to — cybersecurity incidents within 12 hours. But tracking "incidents" may belie deeper threats lurking in networks, observed Wayne Lloyd, federal chief technology officer at RedSeal.

The study explored how resilient federal agencies are at withstanding cyberattacks, what tools and activities they rely on most to respond to identify and respond to attacks, and the top investment priorities and concerns of agency officials.

Executives are investing most heavily now in data and network protection tools and threat intelligence, but "they still need help overcoming a talent shortage of cybersecurity professionals," said Wyatt Kash, SVP of Content Strategy at Scoop News Group, which publishes CyberScoop and FedScoop.

The findings are based on responses from more than 100 prequalified federal agency government IT, cybersecurity and mission, business or program executives. All respondents are involved either in identifying IT and network security requirements, evaluating or deciding on solutions and contractors, allocating budgets, or implementing or maintaining cybersecurity solutions. The study was completed in the first quarter of 2018.

Download the report, "Closing the gaps in cybersecurity resilience at U.S. Government agencies," for detailed findings and guidance on how prepared agencies are to continue operating during an attack.

CyberScoop is the leading media brand in the cybersecurity market with more than 350,000 unique monthly visitors and 240,000 daily newsletter subscribers, reporting on news and events impacting technology and top cybersecurity leaders across the U.S.

FedScoop is the leading tech media brand in the federal government market with more than 210,000 unique monthly visitors and 120,000 daily newsletter subscribers, reporting on how top leaders from the White House, federal agencies and the tech industry are using technology to improve government.

Related News

- 09:00 am

Leading cloud-based graphics rendering firm OTOY has introduced RNDR, a blockchain-based rendering platform that leverages a distributed network of idle GPUs to render graphics more quickly and efficiently. Based on a patent taken out by OTOY in 2009 for a token-based billing model for server-side rendering, RNDR is built on the mission of accelerating an immersive, virtual future, allowing content creators to crowdsource the power of graphics cards across its peer-to-peer network. RNDR's technology makes it possible to scale rendering speed and simplify the transactional process of rendering and streaming 3D environments, models, and objects. Recently closing the completion of their Phase I release, RNDR's team and advisory board is comprised of notable players such as Hollywood director and producer J.J. Abrams, founder of Brave and Basic Attention Token Brendan Eich, and famed talent agent Ari Emanuel.

Jules Urbach, CEO of OTOY said, "The concept for RNDR has been in the works for some time and the reaction we've seen so far is highly encouraging. We're now in an excellent position to deliver on our mission of democratizing the process of complex rendering."

Today, RNDR also is announcing partnerships with blockchain innovators ZeppelinOS and Decentraland. Zeppelin will be working with RNDR to provide an on-chain smart contract library that developers can call to provide standard and common functions in their applications. In addition to this, the Zeppelin OS SDK will assist in the development, testing, and deployment of RNDR's decentralized apps. This partnership is a crucial element in the scaling of the RNDR network and its potential to perform an ever-growing number of transactions.

Demian Brener, Zeppelin CEO, said, "We are proud to partner with RNDR to achieve our mission of creating the next generation of smart contract infrastructure. We look forward to collaborating with them to usher in a new era for smart contract security with ZeppelinOS."

Through RNDR's partnership with VR blockchain, Decentraland, RNDR will make the process of rendering and streaming intricate virtual works easier for all users by allowing complex GPU-based render jobs to be distributed and processed on a peer-to-peer network. RNDR's partnership with Decentraland will see RNDR working directly with the public VR blockchain's user base to provide them with access to RNDR's network of GPUs that can power the creation of assets on the Decentraland platform. Decentraland co-founder Ari Meilich also serves on RNDR's advisory board.

Urbach added "Working with these two renowned blockchain companies is valuable in our move towards creating an extensive, distributed network of idle GPU computing power. Both Zeppelin and Decentraland are experienced players in the blockchain space and we are confident that these partnerships will provide us with access to even more users as our network scales."

Decentraland co-founder Ari Meilich said, "I chose to join RNDR's advisory board because they share my mission of creating an open, decentralized Metaverse. We hope that, with the launch of their platform, Decentraland content creators will be able to rent GPU power in a P2P network. RNDR has the potential to increase the pool of GPUs available by 3 to 4 orders of magnitude, compared to the public cloud."

The RNDR platform is currently in alpha testing with a full release slated to go live later this year. For more information, visit www.rendertoken.com, read the whitepaper here, and join RNDR's Telegram channel here.

Related News

- 04:00 am

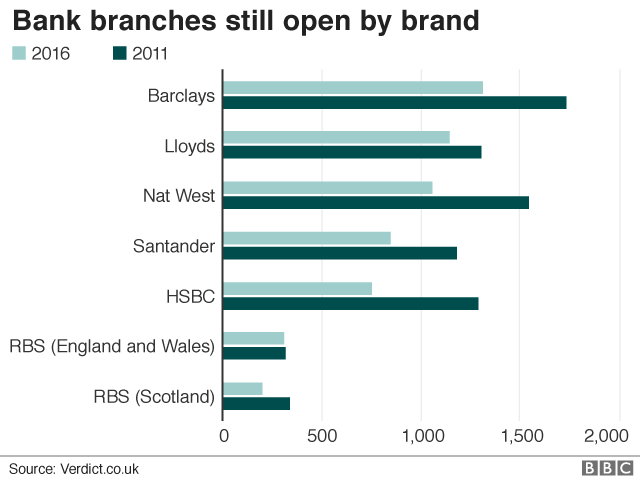

Royal Bank of Scotland has announced it is closing 162 branches across England and Wales.

The bank said that 792 jobs would go as a result and staff would be offered voluntary redundancy.

RBS branches in England and Wales, and the NatWest business in Scotland, had been earmarked for a new "challenger bank" under the name Williams & Glyn.

However, that project is now not going ahead and the bank has reviewed its branch network.

Some 109 branches will close in late July and August 2018, while a further 53 branches will close in November 2018.

You can see a full list of the branches that will be closing here.

An RBS spokesman said: "We are no longer launching Williams & Glyn as a challenger bank, and we now have two branch networks operating in close proximity to each other; NatWest and Royal Bank of Scotland, in England and Wales.

"As a result, we have had to review our overall branch footprint in England and Wales and we've made the difficult decision to close a number of Royal Bank of Scotland branches.

"Customers of Royal Bank of Scotland in England & Wales will be able to use NatWest branches instead for their everyday banking needs."

'Dark futures'

The latest branch closures follow existing plans to close 52 bank branches in Scotland that serve rural communities, and 197 NatWest branches.

The Unite union has calculated that in the case of 71 of the 162 branches closing, customers will be forced to make return journeys of about 25 miles to reach another one.

Rob MacGregor, Unite's national officer, said: "The Williams & Glyn saga rolls on as Royal Bank of Scotland continues with its shambolically poor management of this business.

"How does a taxpayer-funded institution spend £1.8bn on a failed IT project and in the next breath demolish the much-needed local bank branches?

"Today nearly 1,000 employees have finally been told of their dark futures because the bank has been calamitously managed for too long."

In February, following a campaign by local communities, RBS decided to keep 10 branches threatened with closure open till the end of the year.

Nicky Morgan, who chairs Parliament's Treasury Committee, said there was "a risk of increased levels of financial exclusion" as a result of the branch closures, since bank branches were still vital for many people.

"It's important for the government to monitor this trend. If financial exclusion is increasing, the government may be required to intervene," she said.

Analysis: Simon Gompertz, personal finance correspondent

Staff were braced for something like this, though the scale of the closures and job losses is a shock.

Last year the European Commission said RBS could forget about trying to hive off part of its business and, instead, set up a fund to support new rivals.

Ever since then the writing was on the wall for most of the people and branches which RBS had shoved into Williams & Glyn, a Frankenstein bank which no one seemed to want.

That was the trigger, but it's also a fact that big banks have been looking for excuses to close as many branches as they can.

And they would have you believe it is partly your fault, if you've joined the legions who bank on computers and mobile phones.

For customers wondering where it will all end, it seems inevitable that we will end up with even fewer branches.

Those that survive may be dedicated to selling complicated products like investments and pensions, and sorting out tricky complaints.

Mobile banks

Unite is calling on RBS "not to abandon their responsibilities" to the communities that depend on the affected bank branches.

RBS chief executive Ross McEwan recently defended the bank's closure of its Scottish branches, saying that mobile banks are serving 440 communities.

However, the bank has faced criticism from customers that the mobile banks do not stop in each location for long enough.

RBS has also tried to persuade customers to start using online banking and its companion smartphone mobile banking app.

But the bank has had to recognise that not everyone wants to handle their banking digitally.

To this end, it announced that it had created a special taskforce to help customers learn digital skills so they could use online banking in future.

Tim Dimond-Brown, VP Sales and Operations at Quadient, said the following:

“RBS’ branch closure announcement follows hot off the heels of similar news from Halifax and Lloyds. With customer behaviour changing, and more transactions moving online, these closures mirror the current evolution of high-street banking. After all, in a TNS survey of more than 2,000 UK adults, more than a third (38 percent) hadn’t visited their local bank for six months or longer. However, banks need to be make sure that the shift to online banking doesn’t leave customers behind: in the same survey, 79 percent of consumers were concerned that customer service would fall as remote banking continues to grow – while 62 percent were only comfortable using banking applications for the most basic tasks, or not at all.

“These findings reflect the fact that the banking industry is facing an uphill battle when it comes to customer satisfaction. So how can they come out on top? Put simply, the banks that can reassure and communicate with customers in the right way will have a significant advantage over those that don’t, emerging with happier, more loyal customers.”

The news originally posted on bbc.co.uk

Related News

- 07:00 am

Vonage, a business cloud communications leader, has announced the launch of its newest chatbot, Vee for Workplace by Facebook. An exciting development within the cloud communications industry, Vonage has partnered with Facebook to provide Workplace users with virtual assistant capabilities to create and manage AI-enabled conferencing.

Vee for Workplace uses simple bot commands to leverage cloud-based APIs via Nexmo, the Vonage API Platform, and Vonage's Unified Communications APIs, to integrate cloud communications features directly into the Workplace collaboration platform, including the ability to initiate and manage conferencing and calling. In addition, Vonage Business Cloud customers receive real-time interactive call alerts, can respond to calls with SMS quick replies, and redial callers at their convenience, all from within Workplace.

"Business communications should focus on improving internal collaboration and connection for employees beyond phone system capabilities," said Omar Javaid, Chief Product Officer for Vonage. "Partnering with Workplace to deliver innovative, advanced communications capabilities to enhance productivity and the user experience within the collaboration platform is a natural extension of Vonage's communications offering. By providing the tools businesses need to empower their workforce to more easily and efficiently connect with each other, we are helping them to drive better business outcomes."

Vonage is uniquely positioned to integrate artificial intelligence (AI) capabilities into specific real-time conversational use cases for employees to connect within collaboration platforms like Workplace, enabling enhanced productivity. Nexmo's Voice API and proprietary websocket technology opens up these capabilities and audio streams to control the conversation and analyze it in real-time.

For Workplace, through a partnership with voice-centric AI pioneer Voicera, Vonage allows users to mention Vee in a post, which enables them to start an AI-powered conference bridge. Vee then offers quick reply buttons to highlight or add comments to the meeting transcription and recording. At the conclusion of the call, users will receive highlights, actions, meeting analytics, and the ability to share with the Workplace group.

To further enhance the Workplace experience, Vonage has partnered with BOT providers, such as Converse.AI (acquired by SmartSheet), that have embedded Vonage building blocks into their framework. This allows further customization of the collaboration ecosystem to suit a business' unique needs for real-time communications, such as SMS, voice, number insight and personalized workflows.

"This integration is a great example of ingenuity in technology driving direct benefits for customers and in turn, supporting better business operations," said Anand Dass, Partnerships at Workplace by Facebook.

In addition to the integration of chatbots within Workplace by Facebook, Vonage is embracing chatbot technology for its own customer experience via the Vonage Business Cloud platform. Vonage's Vee virtual assistantbot augments the customer experience, helping businesses to streamline management and monitoring of their account in real-time, as well as access support, all via simple, natural language text commands.

Check out a demo of Vee for Workplace at the F8 2018 Facebook Developer Conference in the Workplace Stand in Festival Hall, or download Vee directly from the Workplace integration directory.

Related News

- 06:00 am

ForgePoint Capital is the new name for Trident Capital Cybersecurity, the early stage venture firm investing in cybersecurity announced today.

Since 1998, the firm's principals have been the pioneers investing in security. To date, the firm has made 36 investments and has 18 cybersecurity exits.

Trident Capital Cybersecurity was formed in the summer of 2015. At that time, it raised its first fund of $300M and has invested in eleven companies. Its new name reflects the values of the Fund since its inception as the industry's largest sector-focused fund.

"ForgePoint Capital is dedicated to forging success, relationships, change, and the outcomes of our portfolio companies," added Yepez. "As successful long-term investors, we understand the point at which these multiple relationships converge to forge innovation."

Related News

- 01:00 am

Equus Software, a leader in global mobility software, today announced the launch of EquityPro, a cloud-based tool that manages tax and social security liabilities on equity awards for an organization's international workforce. Leveraging PwC's tax logic, EquityPro offers companies a unique solution that leverages data from one of the industry's leading tax firms, combined with Equus' powerful and intuitive user interface, to manage the complete incentive lifecycle – from sign-on, through payments, and receipt of award.

"Working with PwC underscores our strategic focus to further drive growth and innovation in the global mobility market," stated Mark Thomas, CEO and Founder of Equus Software. "PwC's deep tax knowledge and expertise along with their commitment to work closely with us on the further development of our solution, will directly benefit our clients around the world."

Companies can leverage EquityPro's powerful platform to manage share plans for their global employees, while benefiting from the peace of mind that a globally, up-to-date tax logic brings.

"We're extremely excited at the prospect of working with Equus Software to bring our leading-edge tax capabilities to a broader market," says Peter Clarke, Global Head of Mobility Services at PwC.

EquityPro offers complete visibility into withholding results for global mobility teams, payroll systems, employees and other internal stakeholders, all while automating real-time employee communication. Click here to learn more.

Related News

- 06:00 am

The New Payment Systems Operator (NPSO) has announced that it has taken over responsibility for the operation of Bacs and Faster Payments. The completion of this transaction represents a significant milestone for the payments industry and is the latest step in a series of developments bringing wholesale change to UK payments.

The NPSO set up the Payments Strategy Forum back in 2015 to deliver collaborative innovation and tackle long-standing problems in the payments industry. The completion of this transaction is a significant occasion for several reasons:

- It marks the delivery of one of the Forum’s key proposals in the national payments strategy and closely aligns with our work to drive innovation and competition in the payments market

- It puts the NPSO in a good position to progress the competitive procurement of the central infrastructure on the new payments architecture (NPA), which has been kicked off by the Faster Payments Scheme, as well as the next phase of the NPA’s development and delivery

- It reforms the governance structure of these payment system operators based on the Payment Systems Operator Delivery Group’s recommendations for a more independent Board. There will be no Member-appointed Directors on the Board and the end-user and stakeholder community will be appropriately represented in the NPSO’s governance structure.

“We’ve worked closely with the Bank of England to oversee a smooth transition to the NPSO based on the Payment Systems Operator Delivery Group’s recommendations. From this point our powers will apply to NPSO Ltd as the operator of Bacs and Faster Payments,” said a PSR statement.

We now await the NPSO’s acquisition of the cheque and image clearing systems over the next few months.

Related News

- 03:00 am

This month, Fortress Security Store released their newest product line, the S6 Titan Home Security System. A competitor with other large names such as SimpliSafe and ADT, Fortress Security Store specializes in low-cost, self-monitored security systems for homes and small businesses.

The S6 Titan Home Security System represents the next generation of research and development coming from the 2005 startup. The S6 Titan main panel integrates with the existing accessories of current Fortress systems, and Fortress Security Store will be providing incentives and deals to encourage adoption of the new system.

Consumers who seize the opportunity to be among the first to try this favorably-priced system will enjoy the updated look and feel, as well as the many improvements in performance over previous Fortress Security Store lines. The S6 Titan touts a new "Over-The-Air (OTA) Update" feature, which allows Fortress to more quickly and easily resolve any potential issues reported by customers. It also adds a "Call Filtering" feature, so that customers can limit which phone numbers are able to contact the system. (The S6 Titan panel includes support for a landline phone connection or a GSM SIM card, in addition to the ability to connect to WiFi.) Other new features of the S6 Titan system include an improved mobile app, improved accessories that can now be scanned and added to the system directly from a smartphone, custom zones and names, email notifications over WiFi, and more.

Current customers of Fortress Security Store who are familiar with the Total Security and Total Security WiFi systems will notice that the S6 Titan is a natural evolution of these systems. However, Fortress Security Store is also branding this new system separately, as it represents a significant departure from the previous generations of Fortress systems.

When asked what customers should know about the S6 Titan, Program Coordinator Kip Coleman said, "The S6 Titan Security System has been a project over a year and a half in the making. I'm proud to announce this new system because it represents a lot of hard work under the surface in many areas. You'll find that we've gone above and beyond just updating the hardware, and instead focused on improving the entire customer experience. We've received a healthy amount of feedback from our customers, and we've truly been listening! We've developed a completely new mobile app, redesigned our user manuals and documentation, improved our server and backend infrastructure, and more. Keep an eye on our website for a new look and feel coming up there, too. As always, I like to recommend our newsletter as a great way for people to learn more about us, as well."

"In the near future," Coleman adds, "we'll be launching our own centralized monitoring service, all with our classically low pricing and excellent customer service. This is going to make our new S6 Titan system even more enticing to a number of our customers, whom I know have been waiting for just such a service! When you take a look at the peace of mind and value that Fortress Security Store can provide, you won't want to look anywhere else!"

Fortress Security Store currently offers security systems for sale on their own website https://www.fortresssecuritystore.com, as well as through many other channels such as Amazon, eBay, Walmart.com, and more.

Related News

- 09:00 am

Web Daytona, a leading marketing agency accepts cryptocurrency payments as of Monday, April 30. This marks the first time a digital marketing agency has done this in Florida's history, and the agency is excited to be making waves.

"It's more convenient for businesses to work with companies that accept cryptocurrency," Web Daytona CEO Gary Vela said. "Really, it's a technology that opens you up to new markets, and especially for customer acquisition. Cryptocurrency puts you right in touch with past, existing and potential clients in ways you'd never expect. Owing to this knowledge, we are fully integrating this technology into our company."

Joining the ranks of agencies in the U.K., New York and elsewhere, Daytona Beach's digital marketing leader is now officially offering cryptocurrency payment to thousands of businesses and individuals around the world. As the first agency in the state to provide this option, Web Daytona has worked in transaction options for:

- Bitcoin

- Bitcoin Cash

- Ethereum

- Litecoin

With 28.5 million Bitcoin wallets currently in use, this is an ideal market for cutting-edge industries like digital marketing. Clients from across the world use these services to improve their brand visibility, distribute their corporate message and bring in new leads. When a leading marketing agency accepts cryptocurrency, like Web Daytona now does, they crack the market wide open. The results are electrifying, to say the least.