Published

- 04:00 am

Exchanges are required to obtain licensing as a payment institution in Japan to operate their business (see previous article covered by Bitlegal for background information). This is a short note that Japanese FSA has a Fintech Support Desk to assist with any enquiries for licensing. In addition, the FSA has signed fintech cooperation agreements with Singapore MAS and UK FCA. This should make the process easier for market entry. A UK firm or Singapore firm will through their regulator seek a referral to the JFSA.

Japan unveiled proposed guidelines for the legalization of a controversial means of raising money in the cryptocurrency space.

A government-backed research group has put forward rules that would see initial coin offerings (ICOs) given regulatory definition and approval. An ICO is a means of raising capital by issuing and selling new crypto tokens in exchange for cryptocurrencies like bitcoin and ethereum. Proposed guidelines include identifying investors to prevent money laundering, protecting existing shareholders and debt holders, restricting unfair trade practices like insider trading and ramping up cybersecurity efforts.

The proposals come as China and South Korea toughen up on cryptocurrencies with their own regulations to rein in speculation in the nascent market. Last year, both countries banned ICOs due to concerns of illegal activity and speculative investing in the space.

For More Confirmed Speakers, Please check our official website: www.szwgroup.com/ibdac-tokyo-en/

Related News

- 09:00 am

Adyen, the payments platform of choice for the world’s leading companies, has partnered with Retail Pro International to help retailers provide the ultimate in-store experience for customers. The partnership will be rolled out across markets in Europe, Singapore and Australia, to deliver a unified retail experience for customers across all channels.

Retail Pro software is designed to help retailers optimise business operations within the store and better engage with customers at Point of Sale. The partnership with Adyen will deliver a more secure and streamlined Point of Sale (POS) experience, tapping into Adyen’s extensive global payment capability. The partnership will strengthen both businesses’ international capabilities and allows retailers to opt-in to using Adyen’s services with Retail Pro instore technology.

“With Retail Pro’s suite of industry leading retail software solutions and Adyen’s global payment platform, this partnership enables retailers to deliver a truly exceptional and unified shopping experience, regardless of the customer’s preferred channel, or geographical location” says Roelant Prins, Chief Commercial Officer at Adyen. “Adyen is committed to helping retailers improve the shopping experience for their customers and our ability to enable a range of global payment options is now available to Retail Pro customers.”

The partnership will connect Retail Pro International’s existing POS software solutions to Adyen’s payments platform, ensuring a quick and smooth payments experience for both customers and merchants. It also enables merchants to access a range of global currencies and payment options – for example Chinese customers can use their WeChat and Alipay accounts at the PoS.

“With our new partnership, we are able to deliver a more comprehensive payment solution to our international customers which in turn helps them to create a better in-store shopping experience for their shoppers,” says Kerry Lemos, Chief Executive Officer at Retail Pro International. “Our customers now have the option to have Adyen as their payment solutions provider directly through our POS systems, delivering a wider scope of payments providers for truly international business and customers.”

Related News

- 06:00 am

Trade finance software firm Traydstream has announced the executive appointment of Shishir Vyas as the firm's Chief Client Experience & Digitisation Officer.

As the fintech continues to expand its core offering to banks and corporates of automating the critical processes that underpin trade finance, the appointment signals the next stage in the company’s progress from pilots to commercial mandates.

In his role as Chief Client Experience & Digitisation Officer, Shishir will focus on leveraging the latest technology to enhance customer engagement (spanning across digitally enabled touch-points and assisted channels), and leading the creation of innovative solutions at Traydstream to improve the value derived by end users.

Shishir brings hands-on expertise in the implementation of internet and mobile banking, portal technology and architecture, and customer relationship management (CRM) or customer-centric solutions, gained from over 20 years at banks and other financial services institutions. He has led award-winning technology solutions for leading global banks, enhancing business capability across multiple markets. Previous to Traydstream, Shishir has worked at leading multinationals such as Citi, Mphasis, ANZ Grindlays, and TATA Motors, and most recently ran his own digital strategy consultancy business, focussed on financial services. He holds an MBA from Indian Institute of Management (IIM), Calcutta, and a Bachelor of Technology. from Indian Institute of Technology (IIT), Kanpur.

On his appointment, Shishir commented: “Having worked with some of the best and brightest technology folks in banking and technology, I was seriously impressed by how this highly talented team, comprised of banking experts and technology ninjas, was working together in close concert to create a solution for a challenge that no-one had attempted to address previously. I am thrilled to be a part of this superpowered team, and very excited to be leading the Client Experience & Digitisation efforts for transforming how banks, corporates and even SMEs engage in international trade.”

Traydstream is marked by its holistic approach to the digitalisation of trade finance, with a focus on the automation of key processes like document discrepancy-checks, due-diligence, and regulatory and compliance screening, as well as the initial stages of converting data to digital format (a process achieved by their proprietary Optical Character Recognition (OCR) technology). Designed and built by leading individuals from the banking and technology communities, Traydstream is making headway in an industry increasingly aware of its need for reform.

Related News

- 04:00 am

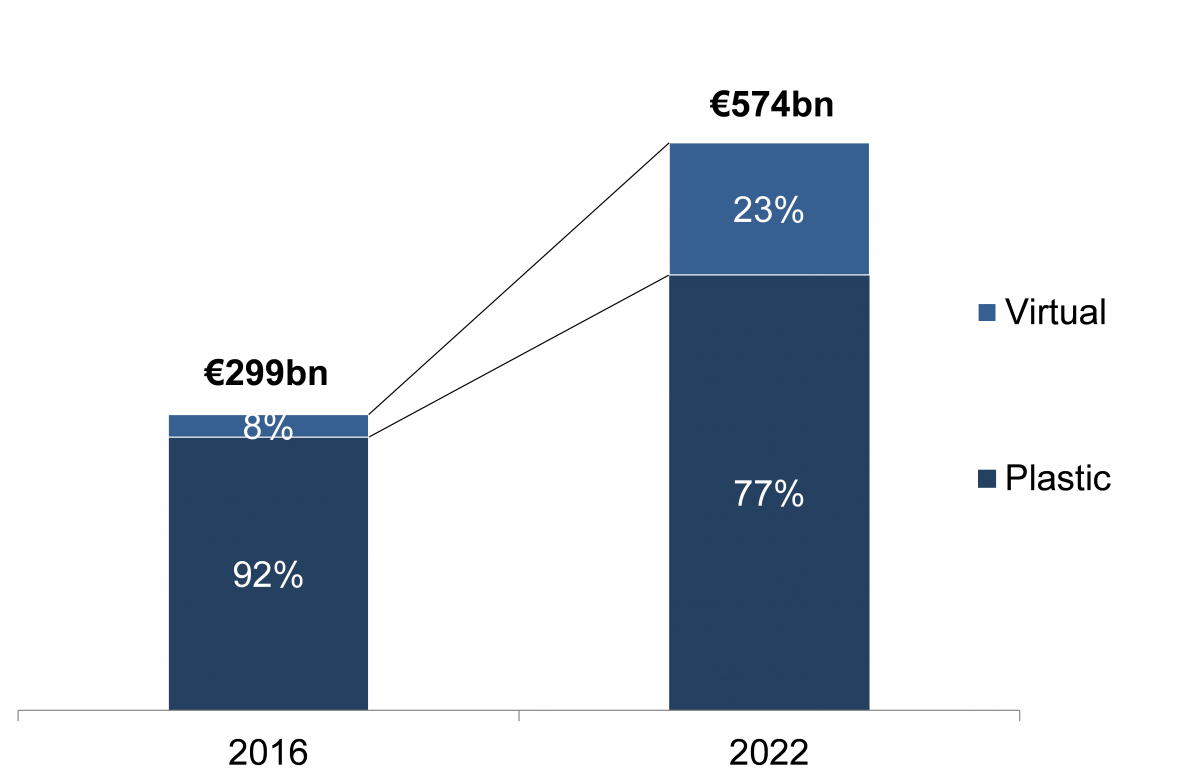

RBR observes strong growth in spending on European commercial cards as a result of increasing use of virtual cards for travel-related and B2B payments

According to RBR’s Commercial Cards in Europe 2018, there were 58 million commercial cards in Europe in 2016, up 6% on the previous year. Commercial cards represent just 4% of all cards and with many businesses not yet offering commercial cards, there is much opportunity for expansion.

Commercial cards tend to be used for high-value purchases

RBR’s research shows that commercial cards were used for 2.4 billion payments worth €299 billion. The number of commercial card payments accounts for a mere 3% of European card payments, but the proportion of expenditure is much higher, at 10%, as such cards tend to be used for high-value purchases.

Historically expenditure for travel and entertainment purposes has accounted for the majority of commercial card payments and employee convenience when on business travel is considered a major driver of commercial cards as such cards remove the need for employees to submit expenses claims to the business. RBR also expects use of commercial cards for B2B spending to become more significant, as acceptance among smaller businesses increases and as companies recognise cards’ potential to improve the procurement process by reducing administrative costs.

Emergence of specialised issuers has led to growth in virtual card expenditure

The issuance of virtual cards – a card account number allowing authorised employees to make payments to nominated suppliers – is still at a relatively early stage in most European countries. By 2022, RBR predicts that virtual cards will account for almost a quarter of commercial card spending in the region as they become more widely used for high-value B2B and travel-related expenditure.

A number of specialised commercial card issuers, such as WEX and Optal Financial, have entered the sector in recent years. Banks in most countries continue to focus on traditional plastic cards, but the increased competition from specialists may cause them to diversify their product range.

Growth in the value of commercial card payments in Europe

Source: Commercial Cards in Europe 2018 (RBR)

Commercial card expenditure to almost double by 2022

RBR forecasts that commercial card numbers will rise by 17% in Europe between 2016 and 2022, and that the number of payments will increase by 50% over the same period as companies use cards to a greater extent and increasingly mandate this form of payment for business expenses. Use of commercial cards is favoured by many companies as they value the ability to monitor employee expenses, block certain merchant categories and reduce misuse.

Meanwhile expenditure will almost double by 2022. The increasing use of virtual cards, typically for high-value transactions, will drive up the average value of each payment.

RBR’s Chris Herbert commented: “Commercial cards have the potential to reduce administrative costs and enhance control and convenience and this will support their use as the payment instrument of choice by more businesses and for a greater range of purposes. Virtual cards have already made a significant impact and have the potential to transform the sector.”

Related News

Aoife Harney

Regulatory Consultant at Fenergo

GDPR introduces ten new rights to data subjects. see more

- 05:00 am

Wealth management fintech firm, JHC Systems (JHC) has announced today that it has partnered with US fintech firm Vertical Management Systems (VMS) to provide customers with high quality and efficient market data.

VMS will provide a full range of financial information through Figaro and Neon allowing clients to fully integrate their market data needs. The partnership is a significant step for the US based market data provider which is looking to increase its European and MENA client base. In turn JHC will increase its access to the US and deliver significant advantages for clients with global interests, as well as an alternative to existing providers.

Bob Ward, Chief Revenue Officer at VMS says: “JHC’s global and well-established position in the market has made them a clear partner of choice for us. We already have a strong presence in the US, particularly in the retirement (pensions) and asset management sector, and now this partnership will allow us to extend our global wealth management customer base. We believe that this new capability will offer real advantages to clients, integrating our market data through JHC’s technology will help firms to streamline their operations and give a much greater level of oversight.”

Ed Lopez, Chief Revenue Officer at JHC added: “As our clients become more global, we need to follow suit and ensure that we are offering as diverse a range of services as possible. Our partnership with VMS will give our customers access to comprehensive market data through our trusted platforms, eliminating the need for clients to outsource this service separately. Hot on the heels of our agreement with Thomson Reuters, this latest partnership sees JHC continue our global push and will further our reach in the American market.”

Related News

- 09:00 am

Metamako, the acknowledged leader in the low-latency, FPGA-enabled network solutions space, has now entered the security space with the announcement of its MetaProtect™ Firewall solution.

Metamako’s approach to innovation has established the company as unique in bringing fast, intelligent switching technology to market; the launch of MetaProtect™ Firewall is set to make similar changes offering security for exchanges, banks and other trading institutions as well as outside of the financial services sector.

Dr Dave Snowdon, founder and CTO of Metamako, said: “We have put significant development into our new firewall technology, using our extensive efforts in low-latency switching to improve the performance of these firewall products. As with all things Metamako, it is engineered to do the job required better and faster than anything else out there. Surprisingly, packet filtering technology has suffered from an ‘if it ain’t broke, don’t fix it’ attitude, which has prevented progress: it is now time for change. Clients have seen the benefits of using our low-latency devices and have asked if we can improve their firewall architecture. We were able to draw on our flexible FPGA platforms and app infrastructure to very quickly build the right product for those customers, and the result is MetaProtect - a low latency firewall.”

He adds: “Some exchanges in Asia, for example the Korean Stock Exchange (KRX), stipulate that a broker must ‘own and manage’ a firewall between a client’s trading servers and the exchange. The latency penalty that this introduces was a major concern for trading participants. Now that there’s an ultra-low latency, high-density firewall solution available, the exchange-facing architecture is far better.”

MetaProtect performs packet filtering in 130 nanoseconds, some of the fastest in the industry, as well as providing comprehensive logging capabilities for those filters. It also has flexibility in how it can be configured, including the ability to specify ports which don’t need to be filtered, in which case packets are passed through in a staggering 5 nanoseconds.

Key functionality:

• Ultra-low latency filtering with average latency of 130 nanoseconds (1 rule) to 155 nanoseconds (510 rules) - some of the fastest in the industry

• Extreme determinism - a tightly bound maximum latency for each configuration.

• High port density with 48x 10GbE ports and 32x firewall filters

• Up to 510 rules per port

• Extensive packet statistics for all ports for advanced network monitoring

• Comprehensive logging, including logged statistics of permitted and denied packets.

Metamako has accelerated its growth over the past 12 months with its first acquisition, buying the xCelor hardware business, which was announced last month. Being the network solution of choice for financial firms such as electronic traders and exchanges, it is now expanding into new verticals, notably network monitoring and telecommunications, along with data centre and security spaces, with the MetaProtect™ Firewall clearly marking another step into new markets.

Related News

- 06:00 am

Cinkciarz.pl wins against MasterCard. The company refuted MasterCard's objections against the registration of the Cinkciarz.pl company trademarks. In Europe alone Cinkciarz.pl has won every one of the 12 proceedings in which a decision has been made.

MasterCard objected to the registration of overlapping circles in the word-graphic trademarks consisting of logo of Cinkciarz.pl. The objections alleged that the graphic design was similar to a series of former MasterCard trademarks registered for identical or similar products and services.

“In Europe alone, MasterCard filed objections to 13 trademark applications for registration of Cinkciarz.pl’s word-graphic trademarks. So far, the Office of the European Union for Intellectual Property (EUIPO) in Alicante, Spain, which conducts these proceedings, has rejected 12 of MasterCard’s oppositions and issued favourable verdicts to Cinkciarz.pl,” says Professor Ewa Skrzydlo-Tefelska from Soltysinski Kawecki & Szlezak's law firm in Warsaw, Cinkciarz.pl's attorney.

One case has been temporarily suspended. The other decisions are not yet binding. MasterCard has the option of lodging an appeal within two months of issuance.

Moreover, cases are also ongoing outside Europe. MasterCard filed objections to the international protection of Conotoxia’s word-graphic trademarks in Australia and the United States. Additionally, it objected to the protection of the CINKCIARZ trademarks in the United States. Further proceedings are also pending in Hong Kong, Brazil, Saudi Arabia and the United Arab Emirates.

“We are confident about our rights and we will defend them," says Marcin Pióro, CEO of Cinkciarz.pl, which is a part of the Conotoxia Holding Group. “Interestingly, a few years ago MasterCard withdrew its objections related to word-graphic trademark of Cinkciarz.pl comprising two overlapping circles, thus giving up the endeavor of blocking this trademark registration. “However, recently I have been called to testify in New York in similar proceedings pending before USPTO” adds Marcin Pióro.

Responding to MasterCard's actions, Cinkciarz.pl has filed two applications for the invalidation of MasterCard's trademarks on the grounds that they lacked distinctive character. These signs consist of simple black and white graphic geometrical elements, i.e. two overlapping circles. The proceedings remain unresolved.

Related News

- 05:00 am

Nucleus Software, a leading lending and transaction banking solutions provider, today announced that HDB Financial Services Limited(HDBFS), one of the leading Non-Banking Financial company (NBFC) in India, has selected their lending analytics solution to help them leverage the insights provided by their data and make faster and more informed lending decisions.

HDBFS chose Nucleus Lending Analytics due to its unique combination of product capabilities and system flexibility. With cutting edge statistical and data analysis capabilities, Nucleus Lending Analytics is a powerful and user-friendly solution that enables informed decision making through data visualization and business insight generation. The solution uses sophisticated predictive scoring models to allow financial institutions to create scorecards that span the entire loan management life cycle—from lead generation to collection. Nucleus Lending Analytics will help HDBFS to target the right customers with the right loan products at the right time, increasing acquisition rates, lowering costs and improving customer satisfaction.

Mr. Rohit Patwardhan’, Head - Credit and Risk, HDB Financial Services Ltd. stated, "We realize the importance of business insights gained from the huge amount of data that we are gathering. At HDBFS we needed a dynamic predictive analytics solution to help us leverage these insights in processing loan applications in real-time and provide a better customer experience. We look forward to benefitting from the solution to make our credit decision making processes across the origination and collections stages of our retail loan products faster, simpler and better."

Mr. Sudeep Verma, Global Head - FinnOne NEO, said, “Unlike traditional analytical tools, which cater to a wider set of industries, Nucleus Lending Analytics is designed specifically to address the analytical needs of lending business. We are already witnessing a lot of interest from financial institutions across the globe. Along with HDBFS, the solution is helping banks in Africa and the Middle East by enabling more effective decision making, offering comprehensive portfolio management, increasing collection effectiveness and streamlining operations.”

Related News

- 02:00 am

Visa and PayPal today announced an extension of their strategic partnership to Canada that will see them work collaboratively to accelerate the adoption of secure, reliable and convenient digital and mobile payments for consumers and merchants in Canada.

The partnership creates a seamless experience for consumers who choose to pay with their Visa card at places that accept PayPal. Through collaboration between bank partners and PayPal, consumers will be able to add Visa cards into the PayPal digital wallet easily from other banking apps.

It also enables PayPal to leverage Visa Direct (Visa's real-time payments solution), which allows Visa cardholders to more easily move funds from their PayPal account to an eligible Visa debit card in real-time.

In addition, Visa and PayPal have agreed to extend participation in the Visa Digital Enablement Program (VDEP). VDEP provides Visa's partners with access to tokenisation technology, which enables simple and secure payment on mobile phones or any connected device. This will help expand the use of PayPal to businesses that accept Visa in physical locations.

"This partnership will open new avenues for Visa and PayPal to collaborate to honour consumer choice and provide greater benefits to merchants and issuers," said Stacey Madge, Country Manager and President, Visa Canada. "By working together, we will be able to bring more innovative products and enhance payment experiences online, in-app and in store for our joint customers."

"PayPal and Visa are leaders in building incredible digital and mobile payment experiences. We are delighted to collaborate and drive greater value for our 6.5 million customers in Canada by offering them more choice in how and where they pay," shared Paul Parisi, President, PayPal Canada.