Published

- 06:00 am

Aculab, a global provider of development APIs for voice, fax, speech and SMS, is pleased to announce the launch of its biometric speaker verification system.

Aculab's voice biometric system, is designed to enable its customers to add voice authentication solutions to any business application. VoiSentry will provide companies with the ability to quickly and cost-effectively add speaker verification functionality to their applications, whether on-premise or for cloud-based delivery. As a result, businesses using such solutions will be able to replace costly, time-consuming and frustrating, inquisition-like identity verification processes, simply by allowing their customers to authenticate with their voice.

"Regardless of the customer interaction channel, users want an unobtrusive and intuitive customer experience without having to compromise on security. At the same time, across all market sectors, businesses have to compete in terms of that interaction, while fulfilling an overarching obligation to provide the highest levels of security of access to user data, accounts and services. With such compelling imperatives, businesses have never been more in need of solutions that proactively enable them to tackle the issues," states David Samuel, Managing Director at Aculab.

"VoiSentry is designed as a scalable speaker verification system that is simple to install and integrate and can be deployed on the customers platform of choice," explains Ian Colville, Product Manager at Aculab. "Interaction with Aculab's system is via the VoiSentry API, which facilitates ready integration with any IVR, self-service, or contact centre solution."

VoiSentry is engaged for enrolment and verification, leaving the solution with full scope to cater for individual businesses' needs. That means they can readily enable unique services to be provided on a per client basis, with a return on investment across a range of metrics, which is the essence of cloud-based services provision," elaborates Colville.

For solutions developers or providers offering services to multiple clients, VoiSentry presents an ideal option. A multi-tenant contact centre solution, for example, can offer speaker verification as a customer interaction security feature, simply and conveniently, to individual businesses, each according to its needs. Each business has full, independent control over the creation of datasets against which its users' enrolments and verification attempts are performed.

Highly scalable, supportive of multi-factor authentication, and with innovative resilience and database features, VoiSentry is available now. To explore the system, click here or for any further information, contact Aculab.

Related News

- 02:00 am

CryptoCompare adds order book and trade data for 50 cryptocurrencies to Thomson Reuters Eikon

CryptoCompare, the global cryptocurrency market data aggregator, has entered into a strategic partnership with Thomson Reuters, the world’s leading source of news and information for professional markets. Under the agreement, CryptoCompare will integrate order book and trade data for 50 coins, sourced from a wide variety of trusted exchanges, into Thomson Reuters financial desktop platform Eikon, providing institutional investors with reliable insight into the crypto asset market as a whole.

Thomson Reuters Eikon is a powerful and intuitive next-generation solution for consuming real-time and historical data, enabling financial markets transactions and connecting with the financial markets community. Its award-winning news, analytics and data visualization tools help its users make more efficient trading and investment decisions across asset classes and instruments including commodities, derivatives, equities, fixed income and foreign exchange. Eikon is an open platform, customizable to the individual needs of a financial professional or institution.

Adding CryptoCompare’s data to the Eikon platform will allow trading professionals and investors to gain a comprehensive view of the cryptocurrencies market and of market participant behaviour, enabling them to predict price movements with a high degree of probability. Eikon users will be able to see data for actively trading coins, allowing them to identify the specific buy and sell opportunities, expand their digital asset portfolios and make profitable investment decisions.

CryptoCompare provides real-time, high-quality and reliable market and pricing data on 5,000+ coins and 200,000+ currency pairs globally, bridging the gap between the crypto asset and traditional financial markets. Acting as gatekeeper for reliable, accurate and clean data, CryptoCompare adheres to rigorous standards to safeguard data integrity, normalising global data sources to ensure consistency and confidence in the market.

By aggregating and analysing tick data from globally recognised exchanges and seamlessly integrating different datasets in the cryptocurrency price, CryptoCompare provides a comprehensive overview of the market and a fundamental value matrix. At a granular level, CryptoCompare produces cryptocurrency trade data, order book data, block explorer data and social data.

Charles Hayter, CEO and Founder of CryptoCompare, said: “As the digital asset markets mature, we see a fast-growing demand from the institutional investor community for comprehensive, real-time and global market data, which can be trusted as the basis for investment decisions. We are excited to enter into this partnership with Thomson Reuters; we have always sought to provide transparency to this market and this partnership provides a great opportunity for the institutional investor community to access not only our data, but also to benefit from our experience and insight.”

Sam Chadwick, Director of Strategy in Innovation and Blockchain at Thomson Reuters, said: “Despite the decline in the price of many of the leading cryptocurrencies during 2018, we continue to see increasing demand from our customers for pricing coverage of the major names. We have been engaged with CryptoCompare since their involvement in our blockchain hackathon in September 2016, and continue to be very impressed by their approach to coverage of these challenging markets. This partnership puts pricing data for this emerging market alongside other asset classes, giving our customers a more comprehensive trading view in Eikon.”

Related News

- 08:00 am

As high business rates continue to sink many floundering High Street shops, Chancellor Hammond is pressing ahead with plans to find a ‘better way of taxing the digital economy’ to reduce online stores’ tax advantage. But a new Study by ParcelHero questions whether a new tax on the one growing area of retail is the best solution?

A new Study, published today by the parcel delivery comparison site ParcelHero, challenges Chancellor Philip Hammond’s belief that the Government can counteract the impact of prohibitive business rates on High Street retailers by introducing a new tax on e-commerce businesses to lessen their tax advantage.

High business rates are being condemned by large retailers and the Federation of Small Businesses alike; but the Chancellor is standing firm, saying they help stabilise local Government funding. Instead he told the Treasury Select Committee in July that: ‘We need to find a better way of taxing the digital economy…before considering the implications for the wider tax system.’

But ParcelHero’s new Study, The Digital Tax: To Save A Sinking Ship, Would You Torpedo Another? questions whether the real cure for plummeting High Street sales is to introduce a new digital sales tax on the one remaining successful retail sector: e-commerce. And it reveals multiplatform ‘brick and click’ stores may well end up paying excessive business rates and the new digital tax as well.

ParcelHero’s Head of Consumer Research, David Jinks MILT says: ‘Retailer’s business rates were recalculated in 2017 for the first time in seven years. Of course, some areas had shot up in rateable value. Our Study reveals that, since the change, 200,000 businesses have faced magistrates because they have been unable to pay; one in six of every commercial properties.’

Says David: ‘Commercial property taxes in the UK are now the highest in Europe. In a statement akin to Captain Smith saying the iceberg might delay the Titanic’s voyage slightly, Mr Hammond acknowledges: “The Government recognises that business rates can represent a high fixed cost of some businesses.” But his solution is not to lower or scrap business rates but instead to find a better way of taxing the digital economy, to level the playing field.’

Explains David: ‘His original, widely welcomed, idea was for a ‘Google Tax’ to ensure overseas tech giants such as Google, Facebook and Amazon pay taxes in the countries where they are earned. But the digital tax plans Chancellor Hammond outlined to the Treasury Committee in July seem to firmly have UK-based e-commerce stores in their sights as well.’

David observes: ‘Some retail organisations, such as the New West End company, suggest that a 1% sales tax on online businesses’ revenues could provide more than £5bn relief for High Street retailers’ rate bills. And the former Downing Street adviser MP Neil O’Brien proposes an even-steeper 3% online sales tax. But the High Street’s concerns are far from being a one-way street: online limited companies already pay corporation tax at 19% and VAT at 20%; they may also be paying their own business rates on warehousing and offices. And there are costs e-commerce businesses face that established High Street stores don’t: online retailers generally have significantly larger technology investment and delivery and returns charges, for example.’

And David reveals the new Study finds the digital tax may well hit many businesses already paying the highest Business Rates, such as John Lewis. ‘The most successful retail businesses today have a mix of physical stores and e-commerce sales. Multiplatform sales are the key to a successful modern retail business. It seems likely a new digital sales tax would apply to online sales for businesses with High Street stores, as well as pureplay online retailers. In which case large stores weathering the Business Rates storm could be hit by even more taxes.’

And the Study reveals efforts to tax overseas e-commerce giants have not yet solved the problem, which means the new plans will directly hit UK-based web stores but not overseas multinationals. Says David: ‘By trying to balance the playing field between High Street and web stores, the Chancellor is in danger of introducing a new unfair advantage for overseas e-commerce giants over UK-based web stores.’

David concludes: ‘Whatever the shape of a new digital duty, whether it’s a sales tax or an attempt to tax the value of user-created content - another idea the Chancellor has thrown into the mix - ParcelHero is asking is now the right time to launch significant changes? Just as Brexit plans seem likely to impose new costs on digital businesses. The answer shouldn’t overtax the Chancellor unduly: it’s simply to reduce excessive High Street Business Rates.'

Related News

- 03:00 am

Online Blockchain plc, a leading UK blockchain company, launches ManilaCoin, a cryptocurrency for financial inclusion in the Philippines.

The launch of ManilaCoin comes as the local government spurs growth of crypto and blockchain bodies. Announced in late April, the Philippines is on the verge of becoming a crypto hub as governmental initiatives have opened up the market for blockchain companies. The Cagayan Special Economic Zone will be welcoming ten crypto businesses from across Asia to be start their activities and operating in the island.

Like most of the developing world, the Philippines also has a high proportion of its population without access to banking services - estimates from the Central Bank point to 86% of households being unbanked - highlighting the opportunity for blockchain and fintech companies to establish themselves and create a steady crypto market.

The Philippines is considered to have a high rate of cryptocurrency acceptance among its Southeast Asian neighbours making it a promising territory for crypto tokens. This unique combination of openness to crypto and the lag between the banking services and financial exclusion puts Online Blockchain and its ManilaCoin in a favourable position.

ADVFN, the global stocks, shares and crypto information website and sister company of OBC, has a website in the Philippines, Finance Manila. The site represents a solid platform for OBC and the Board saw the opportunity to leverage its relationship with ADVFN's financial communities.

The CEO of Online Blockchain, Clem Chambers, commented: “OBC is applying the tried and true strategy of thinking globally but acting locally. We are looking at different opportunities for crypto projects locally where we see a need and a community to serve. The Philippines is one of those.”

Related News

- 02:00 am

Fiserv, Inc. (NASDAQ: FISV), a leading global provider of financial services technology solutions, and BlueVoyant, a next-generation cybersecurity company, today announced a strategic alliance to deliver a comprehensive managed security platform that specifically addresses the unique needs of financial institutions – from threat detection, response and remediation to regulatory compliance and reporting.

These are among a range of intelligent security capabilities offered by Fiserv to enable financial institutions to understand emerging threats and establish multilayered defenses to minimize risk, prevent fraud, help ensure compliance, and enable consumers and businesses to transact with confidence. These capabilities embody a clear and consistent approach that emphasizes fact-based security decisions and measurable outcomes, facilitating intelligent financial experiences.

This new solution complements other leading-edge cybersecurity solutions offered by Fiserv, including SentrySM Cyber Security and SecureNowTM, which are designed to mitigate risks within the financial institution as well as risks associated with customer-facing services such as digital banking platforms.

“Fiserv and BlueVoyant are delivering a leading-edge cybersecurity solution that is both broader and deeper in its protection than any other solution we evaluated,” said Elizabeth Macias, Chief Information Officer, Ponce Bank, a $950 million asset bank based in the Bronx, N.Y., that recently implemented the solution. “Cyberattacks are a very real threat to financial institutions today, and we are pleased to have implemented this robust tool to protect our customers’ money and their data.”

Disparate cybersecurity components, an inability to customize solutions to their needs, and a shortage of qualified cybersecurity talent can make it difficult for financial institutions to defend internal systems against attacks. Fiserv and BlueVoyant help overcome these challenges with a cybersecurity platform that orchestrates an organization’s internal cybersecurity modules and provides a clear and customizable portal with actionable, plain-English alerts, along with skilled cybersecurity experts who work to remediate threats to the institution. Financial institutions receive consolidated reports to greatly simplify regulatory compliance, and professional threat remediation that allows IT staff to focus attention on building business value.

The long-term strategic alliance between Fiserv and BlueVoyant is fortified by an investment from Fiserv in BlueVoyant, a company led by cybersecurity experts formerly with the National Security Agency, FBI, and British and Israeli intelligence services.

“Adversaries are targeting banks and credit unions of all sizes with sophisticated attacks,” said Byron Vielehr, Chief Administrative Officer, Fiserv. “By working with partners like Fiserv and BlueVoyant, financial institutions can access capabilities and insights to make their cybersecurity strategies exponentially more effective than if they went it alone.”

“It’s time to end the hacker advantage,” said Jim Rosenthal, CEO, BlueVoyant. “The solution we’ve developed jointly with Fiserv closes the information and organization gap and offers financial institutions the advanced defenses previously only available to the largest banks and government agencies. These defenses are essential to protect financial institutions, our industry and our economy.”

Related News

- 07:00 am

Euronext today announces that the Supervisory Board has approved unanimously the appointment of Chris Topple as CEO of Euronext London, Head of Global Sales and a member of the Managing Board of Euronext N.V., subject to all relevant shareholder and regulatory approval.

Stéphane Boujnah, Euronext CEO and Chairman of the Managing Board, said: “We are pleased to welcome Chris Topple to Euronext. His deep knowledge of the industry and experience in managing sales and generating revenues both within established and start-up environments will be a great addition to the team as we continue the transformation of Euronext into an agile, ambitious and successful market operator. I would also like to thank Paul Humphrey for his contribution during this interim period and for his continued service as Global Head of FICC.”

Chris Topple said: “I am delighted to join Euronext’s leadership team. There are many opportunities for a European exchange as successful and innovative as Euronext, and for that reason I am thrilled to be part of a team that is making a real difference in shaping the market structure going forward. I am also looking forward to contributing to the growth and the strong ambitions of Euronext, while continuing to focus on clients as a central tenet of our strategy.”

Chris Topple has been co-head of Société Générale Prime Services, a global multi-asset, multi-instrument prime brokerage proposition, including financing, custody and execution since May 2015. Previously, he was responsible for leading the Prime Brokerage and Clearing Services (PCS) sales teams globally within Société Générale’s Newedge Group. Chris joined Newedge from Lehman Brothers / Nomura in 2012, where he spent five years as Co-Head of Prime Brokerage Sales. Prior to Lehman Brothers, Chris worked for JP Morgan from 1993 to 2005 in a variety of senior roles, including Global Head of Electronic Trading Sales across Fixed Income, European Head of Fixed Income Prime Brokerage Sales and Head of European Clearing Sales. Chris holds a BSc in European Business with Technology Politecnico di Torino from Italy and Brighton Polytechnic.

Related News

- 07:00 am

Gemalto, the leader in digital security, and Entrust Datacard, a leading provider of trusted identity and secure transaction technology solutions, today announced the expansion of their longstanding partnership to include a secure framework for Internet-connected devices. This expanded collaboration and integration will allow customers to leverage Entrust Datacard IoTrust™ Security Solutions with Gemalto's SafeNet Data Protection On Demand to establish and secure trusted identities across their Internet of Things (IoT) infrastructures and further enable their digital business initiatives.

A recent Gemalto IoT security study found that 90 percent of consumers lack confidence in the security of IoT devices and only half of companies have adopted a "security by design" approach when building IoT devices. In addition, more than half of consumers are most concerned with a hacker controlling their IoT device or having their data stolen due to the connected object, according to the study. Based on the security risks and growing need for "security by design," companies like Gemalto and Entrust Datacard are working together to make securing the IoT as easy and efficient as possible.

The partnership addresses the industry need to simplify the process of building and maintaining security in IoT products and services with an integrated cloud-based solution for identity management and data protection. Customers adopting Entrust Datacard's IoTrust Security Solution are able to identify IOT devices from the earliest stages of manufacturing throughout the operational lifecycle and secure data within IoT infrastructures. Gemalto's SafeNet Data Protection On Demand enables enterprises to protect IoT device identities and data with cloud-based Hardware Security Modules and broad range of cloud-based encryption, key brokering and key vaulting services. Organizations can also choose to deploy on-premise versions of both the SafeNet Hardware Security Modules, Key Management and Data Encryption products and Entrust Datacard's IoTrust Security Solution.

"Organizations are still struggling to incorporate security into IOT initiatives and keep pace with the broader IoT objectives of delivering innovative services and more efficient operations. While we continue to work with the industry to mature best practices and standards, we've also incorporated these learnings into our solutions," said Josh Jabs, vice president, office of the CTO and GM of IoT solutions for Entrust Datacard. "Extending our long-standing relationship with Gemalto to include IoT made sense as together we make critical elements of IoT security easier to adopt."

"We are pleased that many security providers are now coming together to integrate solutions and employ security across the entire IoT ecosystem," said Todd Moore, senior vice president of Encryption Products at Gemalto. "We're moving our strong partnership with Entrust Datacard into a new era – securing the IoT, where encryption, cryptography, identity issuance and access management are a full-stack solution and not individual components. This way, security is built-in and no longer an after-thought or a challenge. It becomes invisible and just happens."

Related News

- Reports

- 31.07.2018 07:28 am

Australian Securities and Frankfurt Stock Exchange cross listed iSignthis Ltd (ASX:ISX|FRA_DE:TA8), the global leader in RegTech for identity verification and transactional banking/payments, is pleased to provide the following business update and Appendix 4C for the quarter ended 30th June 2018.

Please fill up these fields in order to read the publication.

Other Reports

- 09:00 am

Australian Securities and Frankfurt Stock Exchange cross listed iSignthis Ltd (ASX:ISX|FRA_DE:TA8), the global leader in RegTech for identity verification and transactional banking/payments, is pleased to provide the following business update and Appendix 4C for the quarter ended 30th June 2018.

iSignthis Ltd is able to provide the following details based on our unaudited management accounts.

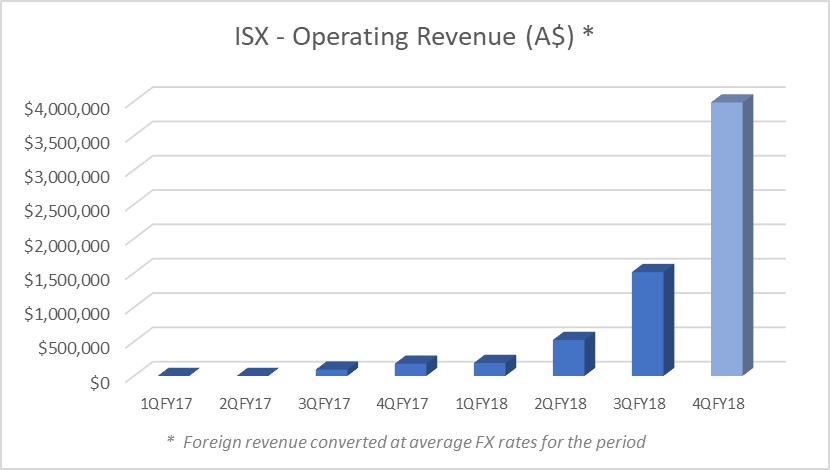

Total Operating Revenue (A$) *

Highlights:

• Unaudited management accounts reflect the following revenue performance for the period ending 30 June 2018;

o Revenue in FY18 compared to FY17 is 363% greater.

o Revenue in Q4FY18 compared to Q3FY18 is 167% greater.

o Revenue in Q4FY18 was in excess of $3.95m.

o Unaudited revenue for the 6 months from 1st January 2018 to 30th June 2018 was in excess of A$5.5m.

• Cash Receipts increased to A$2.633m, representing a 67.4% increase versus the March quarter of A$1.571m

• The Company continues to increase the value of its contracted GPTV, which is now in excess of AU$600m

• The uptake of the Company’s expanded suite of emoney services and products based around the unique patented Paydentity® KYC technology solution, continue to build momentum.

• The Company continues to strategically invest in establishing the infrastructure and network connections to process and settle funds at the highest possible margins and reducing the reliance on third party providers. The initial increase in costs and operating at lower margins is seen as a necessary short term issue with expected margin growth to occur in the coming quarters.

• Tier 1 or direct connect capabilities to Credit Card Association, Central Banks, and Payment Schemes (e.g. SEPA, RITs, BECS, SWIFT) will be the Company’s focus for the coming three quarters, in order to eliminate third parties in our supply chain, and reduce our dependency on third party networks, and the associated costs. These facilities will progressively be going live in our EU and Australian operations, with each Credit Card Association, payment scheme and central bank connection being a discrete milestone.

• Implementation of Tier 1 infrastructure will be by the inhouse iSignthis software development team, with marginal increase in staff costs.

• The Company has requested a certification slot with Mastercard for Australia, which is likely to be in circa 10-11 months based upon information received from Mastercard. AMEX is likely to be sooner, as preparations have already commenced.

• The Company commenced execution of its Australian strategy to reduce reliance on incumbent banks and legacy networks.

The Company advises that its accounts are currently being audited by the Company’s auditors, Grant Thornton, and detailed commentary on revenue performance will be provided with the release of the full-year results in August 2018.

Online Briefing An online analyst briefing will be held Friday 3rd August 2018 at 1pm. Analysts may request details and send advance questions1 by emailing investors@isignthis.com by 5pm Thursday.

Related News

- 05:00 am

MarkitSERV powers first wave of SOFR swaps trades

IHS Markit (Nasdaq: INFO), a world leader in critical information, analytics and solutions, today announced that MarkitSERV, its trade processing service for OTC derivatives, is at the forefront of the use of new reference rates replacing LIBOR in derivatives markets.

The first wave of OTC derivatives trades using the new Secured Overnight Financing Rate (SOFR) used MarkitSERV to match, confirm and straight through process them for clearing and regulatory reporting. To date, seven major derivatives dealers have completed SOFR trades using MarkitSERV. These included both cleared and non-cleared, as well as party-to-party direct and SEF-executed trades.

“Helping our clients adopt new reference rates is a classic example of how we provide a highly reliable and efficient mechanism for the derivatives market to both innovate and respond to industry driven change,” said Claire Lobo, managing director at MarkitSERV. “As we have done for clearing, reporting and electronic trading, when we bring a new standard like SOFR onto MarkitSERV, we automatically update the market and create the bridge between new and old types of swaps, regulatory regimes and multiple forms of trade execution.”

“Goldman Sachs fully supports the advent of new reference rates and the important changes they will bring to our markets,” said Richard Chambers, global head short macro trading at Goldman Sachs. “MarkitSERV helps us and our clients operate efficiently and keep pace with rapid evolution in derivatives markets.”

Shawn Bernardo, CEO of tpSEF, which was the first SEF to complete a SOFR trade, said, “I am very excited that TPIcap were part of the first SEF executed SOFR swap transaction and that we were able to rely on the network and post trade services provided by MarkitSERV in completing the trade.”

Currently, MarkitSERV supports SOFR, SARON (Swiss Francs), SONIA (British Pounds) and TONA (Japanese Yen). For each new reference rate, MarkitSERV consults extensively with market participants to provide the standards and functionality required to reliably and efficiently confirm, clear, report and manage other trade lifecycle events using the MarkitSERV network.

“It is no surprise that the first SOFR swaps happened the week after the CFTC’s Market Risk Advisory Committee meeting addressed the transition from LIBOR on July 12,” said Salman Banaei, executive director at IHS Markit and a member of the Committee. “Cooperation among regulators, market participants and infrastructure providers like MarkitSERV was critical to the successful start for this transition.”

MarkitSERV will add other reference rates intended as successors to LIBOR, based on industry demand.

MarkitSERV is an integrated, multi asset class service for the management of trade confirmation, clearing, allocation of block trades and regulatory reporting. More than 2,500 firms use MarkitSERV to process OTC derivatives trades, connect with 18 clearinghouses worldwide and report trades in multiple jurisdictions.