Published

- 08:00 am

CME Group, the world's leading derivatives marketplace, today announced it plans to further expand its cryptocurrency derivatives offering with the addition of Micro Bitcoin Euro and Micro Ether Euro futures on March 18, pending regulatory review.

"Global investors have sought more precise tools to manage their risk as interest for bitcoin and ether grows. As such, we have seen a four-fold increase in volume in our USD-denominated Micro Bitcoin and Micro Ether futures," said Giovanni Vicioso, Global Head of Cryptocurrency Products at CME Group. "The launch of these new Micro Euro-denominated contracts will provide clients with additional products to more efficiently hedge bitcoin and ether exposure in the second-highest traded fiat behind U.S. dollar-based contracts. Year-to-date, 24% of Bitcoin and Ether futures volume at CME Group has been transacted from the EMEA region, and we continue to develop additional tools for clients there to hedge their crypto portfolios and express or take a view on potential market moves."

Designed to match their U.S. dollar-denominated counterparts, Micro Bitcoin Euro and Micro Ether Euro futures contracts will be sized at one-tenth of their respective underlying cryptocurrencies. These new futures contracts will be listed on and subject to the rules of CME.

"TP ICAP will support this market-defining crypto derivative from CME Group by providing block facilitation services to this product. Our global Digital Assets business has been providing price discovery and execution services on CME Group's suite of crypto derivatives since the start of 2020, leveraging TP ICAP's strengths in connecting market participants as the foundation for our Digital Assets proposition," said Sam Newman, Digital Assets Head of Broking at TP ICAP. "Interest in crypto derivatives has seen huge worldwide growth in recent years and these new euro-denominated micro futures contracts will help further expand the accessibility and utility of crypto derivatives, particularly within Europe."

CME Group's Cryptocurrency product suite continues to provide consistent liquidity, volume, and open interest for clients seeking to hedge their risk or gain exposure to the asset class. January was a record month in terms of average daily volume (71K contracts) across all Cryptocurrency products. In addition, average daily open interest for Bitcoin and Ether futures reached all-time highs for the month (23.5K contracts and 6K contracts, respectively). Micro Bitcoin and Micro Ether futures also saw a trading surge, with average daily volumes growing 43% versus December 2023.

Related News

- 03:00 am

According to a recently released study by Chargebacks911, a fintech company providing payment dispute solutions, the promise of cryptocurrency's widespread acceptance as a means of payment remains far from being realized.

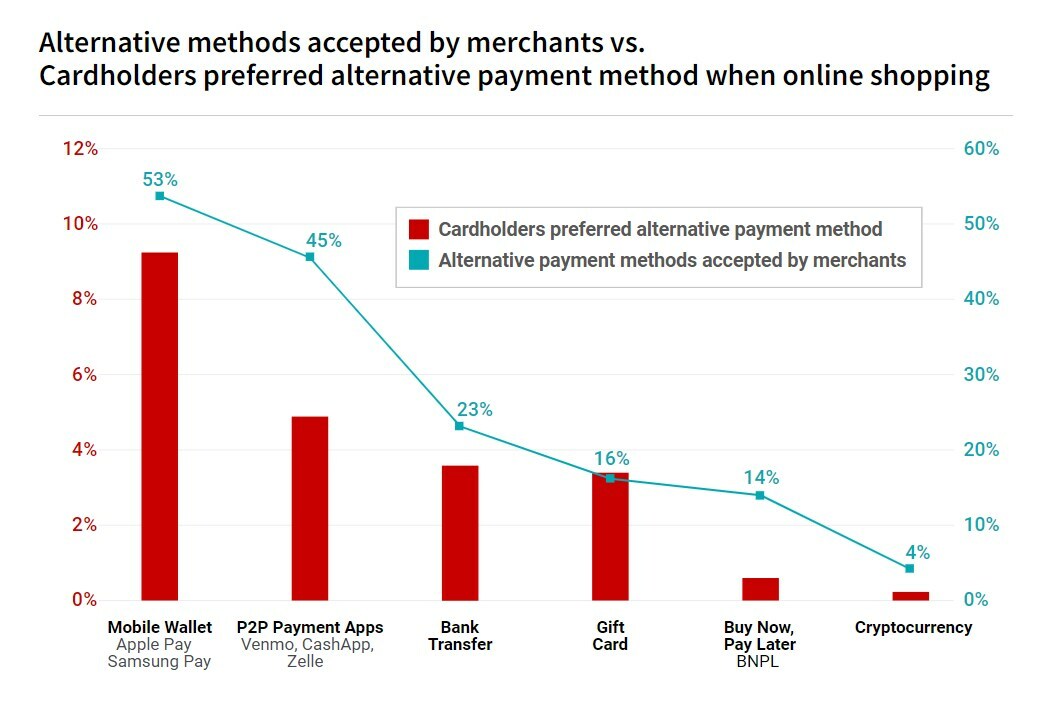

The 2024 Cardholder Dispute Index, created in partnership with analytics and consulting firm TSG (The Strawhecker Group) surveyed 4,000 online shoppers in the United States. Fewer than one percent of respondents identified cryptocurrency as their preferred way to pay online.

Cryptocurrency payments firm Triple-A estimates that 4.2 percent of global consumers own some amount of cryptocurrency. However, given the insights gained from the Cardholder Dispute Index, it seems most crypto holders continue to see digital currencies as a store of value and an investment opportunity rather than a viable currency for day-to-day transactions.

The Cardholder Dispute Index shows that the vast majority of buyers still prefer credit and debit cards over alternative payment methods. 80 percent of those surveyed identified credit or debit cards as their preferred way to buy online. Roughly 10 percent of respondents said they preferred mobile wallets, while a small number of respondents also identified P2P payment apps (Venmo, CashApp, Zelle, etc.), bank transfers, gift cards, and "buy now, pay later" services as other preferred options.

These shopping preferences were mirrored in the Chargeback Field Report, a study conducted by the firm last year that looked at online retailers. That study found that only 4% of sellers offered cryptocurrency as a payment option.

"This is not to say that cryptocurrency is dead," states Jarrod Wright, the head of marketing for Chargebacks911. "However, it's hard to deny that the promise of cryptocurrency as a decentralized, widely accepted means of exchange has failed to materialize so far. If consumers don't want to pay in crypto, merchants won't be incentivized to maintain it as an option."

Related News

- 09:00 am

Bloomberg announced today that Commercial Bank International (CBI), a leading national bank in the UAE, has adopted Bloomberg’s Multi-Asset Risk System (MARS) modules for Counterparty Risk, Market Risk, and Valuation.

CBI previously adopted MARS Front Office to aid its LIBOR transition and has now decided to adopt three additional modules of the solution, making MARS the Bank’s primary risk management system. The MARS counterparty risk (XVA) module will notably help address existing regulatory requirements such as SA-CCR for counterparty credit risk capital calculations. The same module provides robust counterparty exposure analytics for derivatives portfolios.

MARS Market Risk module integrates seamlessly to provide a comprehensive solution supporting the risk management and data workflow, providing scalability and allowing further growth of CBI’s treasury business with confidence both in terms of financial product volumes and complexity.

Finally, MARS Valuations provides credible and complete valuations for derivative portfolios, including over-the-counter derivatives and structured products, ensuring data and pricing consistency across the front-to-back trading workflow cycle.

On this occasion, Randa Kreidieh, Chief Risk Officer at CBI, commented: “Using MARS as our primary risk system enables us to streamline our risk management workflows, quickly implement new financial regulations, and improve our operational efficiencies. By adopting additional MARS modules, we benefit from a comprehensive and integrated set of tools, ensuring data consistency and transparency between the front and back office, and enabling us to automate more processes. Such advancements enable more informed decision-making and efficient operations, which contributes positively to both investment management and customer service aspects of banking.”

“We are pleased to continue to support CBI with streamlining and digitizing its risk management processes by expanding the range of MARS modules into an integrated front to back solution,” said Jose Ribas, Global Head of Risk and Pricing Products at Bloomberg. “The ability to bolt on additional risk capabilities as firms progress on their technology journey is a key feature of our MARS offering, in addition to our broad asset class coverage, our pricing library which includes a range of models and automated enterprise workflow that streamlines the entire risk management process.”

Bloomberg MARS is a suite of risk solutions, which are accessed on the Bloomberg Terminal and via APIs, that provides risk analytics for cash and derivatives securities. MARS enables traders, portfolio, and risk managers to manage front office risk, market risk, XVA counterparty risk, credit risk, hedge accounting, as well as collateral and SIMM requirements – all by using a common pricing and data library, providing consistency from front to back. To find out more about Bloomberg’s multi-asset risk solutions, please visit here.

Bloomberg MARS has been recognized across a range of risk management and risk transfer solutions at the 2023 Risk Market Technology Awards, including Market Liquidity Risk Product of the Year, Pricing and Analytics: Structured Products/Cross-Asset, and Best Support for Risk-Free Rates.

Related News

- 03:00 am

Amidst demand from consumers for greater flexibility on monthly payments, there is an opportunity for utility providers to unlock greater customer loyalty by investing in payment methods that offer more control and transparency.

That’s according to new research of more than 2,000 UK consumers by Tink, a market-leading payment services and data enrichment platform. Findings reveal that amidst the ongoing cost of living crisis, an estimated two-thirds (66%) of UK consumers believe that utility providers must support customers struggling to pay their bills.

Consumers need greater control and support with monthly payments

With uncertainty around further energy price cap increases, one in five (18%) surveyed UK consumers are currently struggling to keep on top of changes in their regular payments, including increases in monthly utility bills.

Nearly one in five (18%) respondents have defaulted on their regular bills and gone into a debt collection process. While one in five (21%) surveyed have also forgotten about a bill and been charged for going into their overdraft.

The research reveals that consumers want greater control when dealing with their monthly payments, as over half of Brits (51%) say they would welcome more control over how and when they pay their utility bills.

A business opportunity for utility providers

As competition starts to heat up again in the energy market and people search for the best deal, there’s an opportunity for providers to improve the payment experience – to serve their customers in a way that better fits the flow of incomings and outgoings from their accounts.

An estimated one in five (21%) consumers would switch utility providers if offered the flexibility to change the amount they pay each month, while 17% would consider switching providers if offered the opportunity to change the date of their bill payments.

Utility providers who invest in payment methods that offer more control and transparency have the potential to reduce churn and enjoy greater customer acquisition and retention.

Andrew Boyajian, VP of Product for Payments & CX at Tink comments: “During the colder months, when energy and utility bills typically rise, consumers are under increasing financial strain - meaning growing demand for utilities providers to offer more support with managing their bills. With payment flexibility a particular sticking point, investing in data-driven financial services enables utility providers to give customers greater control over their payments – which is especially important during difficult economic times.

“Open banking solutions like VRP (Variable Recurring Payments) can help utilities providers offer support to customers struggling to stay on top of monthly outgoings, with features such as agreed maximum payment amounts and automated retries meaning both parties can have more peace of mind and the ability to adapt to changing circumstances. More flexible payment methods can also be powered by VRP, for example, an agreement with the utility provider to split bills into multiple payments.”

Related News

Andrew Hawkins

CEO, UK & Europe at Shieldpay

To complete a successful merger and acquisition (M&A) deal, see more

- 04:00 am

iDenfy, a Lithuania-based RegTech firm specializing in identity verification and fraud prevention solutions, announced a new collaboration with bestshopping.com, a leading Italian e-commerce brand operating in the online retail space. This partnership aims to take security measures to the next level, protecting bestshopping.com from potential fraudulent activities and ensuring a safer online shopping experience for its users.

The global landscape has witnessed a surge in online payment fraud over the past few years. In 2022, the estimated global losses to e-commerce fraud reached a staggering 41 billion U.S. dollars. By 2023, Statista has reported that this figure escalated to an alarming 48 billion U.S. dollars. According to iDenfy, such growth is expected to be fueled by the increasing use of alternative payment methods, such as digital wallets and the Buy-Now-Pay-Later model, which introduced new avenues for fraud risks in the e-commerce industry.

Bestshopping.com, with platforms targeting Italy and Germany, has become a trusted provider of reliable cashback experiences for over 600,000 users. The e-commerce site, known for its innovative approach, relies on in-house technologies, seamless integration into partner platforms, and growth strategies involving apps and browser extensions. Despite its successful growth, the rise in e-commerce fraud prompted the company to seek professional verification services.

According to the e-commerce platform officials, before the partnership, the goal was to find a new solution to identify and mitigate potential fraud risks proactively. The decision to partner with iDenfy was driven by the necessity to enhance security measures and protect users from evolving internet attacks by unknown entities. iDenfy's reputation for robust identity verification solutions, particularly in the Know Your Customer (KYC) process, made it the ideal choice for Bestshopping.

The e-commerce professionals now use iDenfy's KYC verification to strengthen the platform’s anti-fraud measures and improve the efficiency of user verification processes. This partnership empowers bestshopping.com to identify potentially illegitimate customers, reducing the risk of financial fraud and creating a secure online environment for its users. Additionally, the robust ID verification solution accepts more global documents, helping the platform scale and onboard more users in less time. According to bestshopping.com, with iDenfy’s biometric verification solution, the users benefit from a simple, user-friendly KYC process, which is crucial for minimizing cart abandonment rates.

At the same time, iDenfy acknowledges the critical importance of applying advanced biometric identification technology and consistently enhancing and expanding its RegTech solutions. As part of the collaboration with bestshopping.com, iDenfy is committed to further monitoring and analyzing emerging trends and threats in the evolving regulatory landscape.

“Our collaboration with Pointer Srl aligns with our mission to empower e-commerce businesses with innovative identity verification solutions. Together, we look forward to driving efficiency for a simpler and better online shopping experience,” — commented Domantas Ciulde, the CEO of iDenfy.

"We’re excited about the value that iDenfy brings to our e-commerce platform. Their identity verification enhances our security strategy, enabling us to offer more robust and efficient services to our clients," — added Edoardo Rodolfi, Content Manager at bestshopping.com.

Related News

- 01:00 am

“The identity landscape is facing a seismic upheaval, and Igor joining our team of innovators is just another step we’re taking to ensure Jumio remains the clear leader in this space,” said Jumio CEO Robert Prigge.“I’m thrilled to join Jumio at such an integral moment in the company’s evolution and look forward to helping make 2024 the company’s best year yet,” Beckerman said.

Related News

- 03:00 am

Sovos, the always-on compliance company, today announced the launch of the Sovos Compliance Cloud, the industry’s first and only solution that unifies compliance, tax, and regulatory reporting software in one platform and provides a holistic data system of record for global compliance. The Sovos Compliance Cloud represents the culmination of more than eight years and hundreds of millions of dollars of investments in native engineering. That investment is combined with integrations into most ERP, P2P, and eCommerce technology ecosystems and incorporates several billions of dollars of acquired, best-of-breed products from around the globe.

“It’s time to transform tax compliance from a business requirement to a force for growth,” said Sovos CEO Kevin Akeroyd. “Sovos recognized this need almost a decade ago and invested in building the industry’s only truly integrated, complete compliance solution. Just as enterprise resource planning (ERP), customer relationship management (CRM), and human capital management (HCM) all shifted from disparate point solutions to holistic system of record platforms that unlocked tremendous business value, the Sovos Compliance Cloud does the same for tax and compliance.”

The launch of the Sovos Compliance Cloud comes amid a period of increased risk and inefficiencies for businesses trying to address compliance with individual point solutions. In fact, 82% of companies believe they’re more exposed to tax-related compliance risk than they were five years ago (source: Bloomberg), and 90% expect their compliance-related costs to keep climbing (source: Accenture). The move to a unified cloud empowers companies with greater visibility and more economies of scale in their technology infrastructure across the enterprise – saving time, and money, and reducing risk.

The Sovos Compliance Cloud also helps CFOs and CIOs maximize their existing investments by embedding itself into a rich ecosystem of partners and technology providers. To date, the company features more than 75 embedded integrations into key enterprise resource planning (ERP), accounts payable (AP), and accounts receivable (AR) systems, as well as over 425 Connectors in the Sovos App Marketplace. This means that companies do not need to replace or modify costly infrastructure to deliver more accurate tax compliance and reporting.

Sovos’ Compliance Cloud will facilitate more than six billion tax and e-invoicing transactions across 80-plus countries this year; whereas the next largest provider will facilitate less than 100 million. The Sovos Compliance Cloud represents the most scalable and secure global compliance solution ever introduced for the modern enterprise.

“Compliance is now inside the transaction, elevating its importance and driving businesses to look beyond just meeting a minimum threshold. Now, the goal is a global view of compliance with a single source of data that allows them to generate actionable business intelligence,” says Kevin Permenter, Research Director, Financial Applications, IDC.

A New Platform for Modern Compliance

The Sovos Compliance Cloud is the only platform solution to address the five fundamentals for modern compliance, enabling companies to:

- Connect to pertinent internal and external data and systems, including every government tax authority via the Sovos Compliance Network.

- Identify each party to a transaction or obligation and verify they are who they purport to be via the Sovos Identity solution.

- Determine every transaction is accurate and compliant via the Sovos Tax Determination for VAT & SUT, Sovos Tax Withholding, Sovos eInvoice and Sovos Shipping.

- Report every transaction or tax obligation and file it correctly while ensuring fidelity between business records and the tax agencies via the Sovos Tax Information Reporting and Sovos Filing.

- Analyze and derive data from all transactions and taxes to gain a single source of truth, mitigate risk, and find key patterns that show business changes via Sovos Intelligence solutions.

The Sovos Compliance Cloud provides comprehensive capabilities that address the full breadth of a global business’s needs, ensuring companies file accurately on employee, vendor and partner income. Its Tax Determination, Filing, and Reporting for Value Added Tax (VAT), Continuous Tax Control (CTC), and Sales Use Tax (SUT) produce accurate calculations across more than 19,000 tax jurisdictions globally. Sovos Tax Information Reporting already handles more 1099s than any company in the world.

Related News

- 04:00 am

Tandem, the UK’s greener, digital bank has announced it has become a signatory of the Women in Finance Charter, becoming one of the latest banks to back the Government and industry’s push for gender balance in financial services.

The Charter, launched by HM Treasury, commits signatories to support the progression of women into senior roles across financial services.

Tandem’s signature marks its latest move in its transformation to become one bank, with a single established culture since significant acquisitions, including Oplo in 2022.

While Tandem is finalizing its specific plans to underpin its commitment, the charter makes four pledges: 1. Having a member of the senior executive team who is responsible and accountable for gender diversity and inclusion 2. The setting of internal targets for gender diversity across senior management

3. Publishing of progress annually

4. An intention for the pay of the senior executive team to be linked to these targets

Commenting on the charter, Tandem Chief People Officer, Steve McNicholas, said: “Culture is such an important thing across any business, but Tandem’s transformation has meant it is even more so. Diversity and inclusion are at the heart of that. And I couldn’t be prouder of the steps we’re taking to ensure we are leading the way in creating female role models that lead and inspire the next generation of female leaders.

“Signing of the charter marks our commitment to see gender balance across financial services and our work to build a fair, balanced, and best place to work in the sector.”

Benefiting customers’ pockets and the planet, Tandem offers greener ways to save, borrow, spend, and share. From low-emission motor loans to lending for greener home improvements, to EPC discount mortgages and green savings, its products make it easier for more people to choose a greener lifestyle – helping save money, whilst reducing carbon footprints.

Related News

- 06:00 am

Encompass Corporation, the global provider of real-time digital Know Your Customer (KYC) profiles, has appointed Job den Hamer, former CEO of CoorpID, as Head of Business Development to bolster its mission to revolutionise KYC with Corporate Digital Identity (CDI).

With more than 20 years of experience within mid-corporate and corporate financial services markets, den Hamer has held senior roles across sales, business development and change management. Most recently, he conceptualised and grew CoorpID within ING’s innovation network, with it helping banks to transform KYC outreach before being acquired by Encompass last month.

As Head of Business Development, based in the Netherlands, den Hamer will be a key member of Encompass’ sales leadership team, under the direction of Chief Revenue Officer (CRO) Steve Hadaway. He will be responsible for maximising the value the CoorpID platform brings to Encompass’ global banking customers, with the acquisition furthering Encompass’ efforts to solve the challenge of identification and verification of corporate and institutional clients with its game-changing CDI platform.

CoorpID was founded by ING Labs in 2018 to allow global banks to automate outreach and gather private KYC data directly from corporate banking customers, providing a repository that allows the corporate to manage all their banking relationships.

Its functionality enables Encompass to build a complete KYC profile that combines authoritative public information with private information directly from customers. This makes CDI possible for the first time, providing a unified source of truth and unrivalled visibility into risk. As a result of this complete customer profile, the need for unnecessary outreach is eliminated, improving customer experience without compromising on robust regulatory compliance.

Job den Hamer, Head of Business Development, Encompass Corporation, comments: “Joining Encompass at such a pivotal time for the organisation is a fantastic next step, which allows me to continue my efforts to contribute genuinely exciting innovation to the financial services industry, which improves the KYC journey for banks and corporates.

“CDI offers real value, solving critical challenges banks face today, and to be involved in this journey, and able to carry on the story of CoorpID as part of Encompass, is a huge privilege.

“The bringing together of Encompass and CoorpID will facilitate change and impact like we have never seen before, and I am thrilled to play my part in bringing the possibilities to life.”

Steve Hadaway, Chief Revenue Officer, Encompass Corporation, adds: “There is so much to be excited about on the road ahead for Encompass, and I am delighted to build on the acquisition of CoorpID by welcoming Job to my leadership team.

“Not only does he possess decades of experience and enviable knowledge, but being the driving force behind CoorpID means he will add tremendously to what we bring to our customers as we lead the way in transforming KYC with CDI.”