Published

- 07:00 am

Praxent, a fintech product agency with more than two decades of experience, has helped NEWITY modernize and enhance its platform, including pre-qualification, loan application, borrower portal, and ERC application powered by the successful execution of over 15 fintech integrations, with new product releases every 12 weeks.

Working with Praxent to design and build an intuitive SBA 7(a) pre-qualification experience has resulted in notable efficiency gains. In the first week of going live with the updated portal, NEWITY achieved an impressive 85% loan application completion rate. Further, the number of ineligible applications that were declined upfront represented up to 27 human hours saved per week or 67% of an underwriter’s time. The reimagined borrower portal’s self-service capabilities simplified loan servicing, leading to a 42% decrease in borrower emails and 32% decrease in overall customer support tickets.

“We had a vision for an automated SMB loan and product marketplace but needed the development expertise to launch it,” said Bryan Hallene, COO for NEWITY. “Praxent has been a true strategic partner, and their team has never failed to impress us with their depth of knowledge in the fintech space. Praxent’s direct focus on business results backed by the value engineering and fintech expertise needed to successfully implement and launch compelling digital experiences for our small business clients has driven ROI and growth.”

Praxent also supported NEWITY in launching its new ERC products, allowing small businesses to receive cash for their tax claims in as little as five days from approval. The product was launched in just 13 weeks from conception and has resulted in over 9,500 applications, yielding an average ERC refund over $70,000. This work contributed to NEWITY receiving the 2023 LendVer Award for the Best ERC Company.

“NEWITY has helped hundreds of thousands of businesses access the funding they need to grow, and it’s rewarding to be part of the platform’s evolution,” said Tim Hamilton, CEO and founder of Praxent. “To enable rapid innovation, we built an orchestration layer, delivering a foundation that allows the company to be incredibly agile and facilitate a SMB borrower experience with unrivaled flexibility. We’re proud to support NEWITY as they continue to solve common challenges for small businesses across the country.”

Related News

- 05:00 am

Money20/20, the world’s leading fintech show, regarded as the place where money does business, is launching Money20/20 Asia set to take place April 23-25 of 2024 in Bangkok at the Queen Sirikit National Convention Center.

Money20/20 has long been recognized as a premier destination for leaders across the digital money ecosystem to connect, share insights, and drive transformative change in the industry. Bangkok becomes Money20/20’s third host city, joining Amsterdam and Las Vegas which welcome over 20,000 fintech and financial services professionals globally each year. With Asia emerging at the forefront of global fintech innovation, the introduction of Money20/20 Asia is set to accelerate the momentum, connecting fintech communities to drive progress, growth, and success across the region’s financial ecosystem.

Money20/20 Asia will gather an exceptional lineup of influential speakers, industry experts, and decision-makers to explore the latest trends, technologies, and strategies shaping the future of fintech and financial services. The show will feature a dynamic agenda comprising keynote presentations, fireside chats, panel discussions, and interactive workshops, offering attendees unparalleled opportunities for learning, collaboration, and networking.

In addition to its content-rich program, Money20/20 Asia offers an immersive exhibition space where leading fintech companies, startups, and service providers can showcase their products and solutions to a highly influential audience. Attendees will have the opportunity to explore the latest innovations, engage in product demonstrations, and forge strategic partnerships that will drive growth and shape the future of fintech in Asia.

Rizal Commercial Banking Corporation from the Philippines, WeLab from Hong Kong, LXME from India, Alex.bank from Australia, Wing Bank from Cambodia, Bank of Israel, Vietnam Prosperity Bank, World Bank, Bank of International Settlements, etc. are just a few of the banks on the speaker roster.

Asia, with its diverse economies and IT literate population, has become a hotbed for fintech innovation. Money20/20 Asia aims to serve as a catalyst, fostering collaboration between incumbents and disruptors, bridging the gap between traditional financial services and cutting-edge technologies such as blockchain, artificial intelligence, and digital currencies. Money20/20 Asia will be a destination for forging strategic partnerships, uncovering investment opportunities, and gaining valuable insights into the challenges and opportunities that lie ahead in the rapidly evolving fintech landscape.

“Money20/20 was founded to help the world of digital money do business together. So I’m delighted that we are now officially welcoming Bangkok and the whole of Asia into our global community. Our view is that given the economic challenges faced by the rest of the world today, Asia has a real opportunity to drive the global narrative in fintech and financial services over the coming years and we’re humbled by the incredibly warm welcome that Thailand, the Asia fintech community and our many regional partners have given us already. We can’t wait for next April”, said Tracey Davies, President of Money20/20.

Money20/20 Asia will showcase the latest advancements in fintech across a wide range of sectors, including payments, banking, regtech, insurtech, lending, and more. The show will also address key industry themes such as financial inclusion, sustainability, cybersecurity, and regulatory frameworks.

“The digital adoption has been largely accelerated particularly over the last few years. The provision of instant, 100% digital and convenient financial services is already a given for customers. To stay ahead of the game, it’s crucial for fintech players to be smart and intelligent by integrating advisory elements into their services,” said Jessica Lam, Group Chief Strategy Officer of WeLab. “This is the future of fintech and I’m excited to talk more about the insights of empowering customers with personalized solutions at Money 20/20 Asia.”

Related News

- 02:00 am

Applifting has announced a strategic collaboration with FactSet a leading provider of flexible, open data and software solutions for over 185,000 investment professionals worldwide.

FactSet helps the financial community to see more, think bigger, and work better. The companiy’s digital platform and enterprise solutions deliver financial data, analytics, and open technology to over 7,500 global clients, that is then used to make informed investment decisions.

The collaboration enables Applifting to assist FactSet clients with their software and app development needs. By easing the software development and integration process for future FactSet clients, Applifting will continue to cement its position as “one to watch” in the fintech development field.

Jan Hauser, CEO of Applifting said: “ Applifting is a well-respected entity in London and across central Europe for helping startups, scale-ups, and companies to grow their business, but wanted to further strengthen our presence in the UK, so we actively sought out the right partner for us. We have found such a partner in FactSet.“

“FactSet is an established and recognised brand in the financial services sector, so this is a win-win situation as we can learn from their success and best-in-class practices. At the same time, we can provide our expertise to FactSet’s clients. By collaborating with FactSet we aim to provide not only exceptional tech resources, but also to enable businesses to transform their ideas into investment-ready projects,” concluded Hauser.

“Our collaboration with Applifting ensures that FactSet clients have access to strong professional services organizations intimately familiar with our solutions,” said Josh Gaddy, Director, Developer Advocacy, FactSet. “We look forward to working with Applifting’s team of talented engineers to help our clients maximize our solutions so they can do their best work.”

Related News

- 06:00 am

Delta Capita, a leading global Capital Markets consulting, managed services and technology provider, today announces the appointment of Alan Philpot to Chief Product Officer.

Bringing more than 30 years’ experience in operations and strategy across financial markets, Alan joins from SETL where he was Head of Custody and Market Infrastructure. He has also held senior roles in post-trade and securities at Barclays and Capco.

In his new role, Alan will be responsible for bolstering Delta Capita’s DLT offering and leading the strategy and execution of future product offerings. Based in London, he will be working closely with the product management and strategic partnerships team.

Delta Capita’s DLT business currently includes settlement optimisation, asset and collateral tokenisation, multi-asset books and records, digital issuance and digital custody, digital identity and passports, and interoperability.

Alan’s appointment follows the news that Delta Capita has acquired distributed ledger technology from SETL to build the next-generation capital markets ecosystem, with Montis Group announced as the anchor client.

Joe Channer, CEO of Delta Capita commented: “We are delighted to welcome Alan as our Chief Product Officer. His extensive market knowledge and decades of experience working in financial services will be highly valuable as we continue to build new and exciting technology offerings for our clients, including Distributed Ledger Services, and support us on our mission to reinvent the financial services value chain.”

Alan Philpot, Chief Product Officer at Delta Capita adds: “I’m pleased to be joining at such an exciting time, both for Delta Capita and the wider industry. The next chapter of capital markets and technology innovation is here, and I’m looking forward to bringing to market fresh new solutions that will transform the way that our clients work and how they service their customers.”

Related News

- 06:00 am

Archie – an innovative new fintech acceleration partner – launches with a mission to scale the next generation of fintech disruptors that will define and lead the category.

With the belief that fintech founders need much more than financial backing to turn their ambitions into reality, Archie will identify and partner with a select portfolio of early-stage fintechs globally, working alongside founders to help supercharge their growth.

By investing intellectual capital and growth expertise into Series A & B firms at the most critical stage of their go-to-market strategy, Archie will improve the odds of high-potential fintechs breaking through and evolving from start-ups into sustained high-growth businesses.

Archie will initially focus on partnering with fintechs in Australia, the UK and the fast-expanding Middle East fintech market, where the team’s expertise, experience and networks are deepest and where they can help founders access global markets.

Led by one of fintech’s best-known serial entrepreneurs, Anthony Thomson (co-founder and former chair of Atom Bank, digital bank 86 400, and Metro Bank) with global tech and fintech leader Steve Brennen as founder CEO (Uber, PayPal, eBay & Zip), Archie brings together one of fintech’s strongest scale-up teams with deep expertise in delivering hyper-growth.

Archie will work side-by-side with fintech founders, deploying its team of experts to help supercharge partners’ growth, de-risk go-to-market strategies and maximise their chances of success.

Archie’s innovative new model will enable fintechs to superscale by offering:

experience, expertise & toolkits to lever them into hyper-growth;

operational support, developing and implementing Go-To-Market plans, leveraging Archie’s deep global fintech, banking and tech experience in strategy, marketing and sales in highly regulated markets;

access to senior board advisors – including experienced Chairs & CEOs Anthony Thomson and Paul Pester – to strengthen governance and strategy; and

access to the ARCHIE NETWORK to build partnerships, support capital requirements and recruit talent.

Offering a new partner model to accelerate fintech growth , Archie will invest its intellectual capital, go-to-market and growth expertise, along with the highly-prized ARCHIE NETWORK in exchange for equity.

This ‘equity first’ model is a key differentiator within the fintech ecosystem, designed specifically to ensure a true partnership with fintech founders, aligning all interests and focussing efforts on driving success.

Over the past twenty years, Archie’s team has been at the forefront of founding and scaling some of the world’s biggest brands and fintechs, including Uber, eBay, Paypal, Atom Bank and 86 400.

Archie’s senior team also includes fellow Co-Founders Tommy Mermelshtayn (global scaler and strategy, Zip and Equifax) and Richard McCandless (brand and performance optimisation, FCB and Publicis Groupe). While banking and tech veterans Fawaz Zu’bi (founder and CEO of global venture capital firm Silicon Badia) and Paul Pester (Chair of Tandem Bank, former CEO of TSB and Virgin Money globally, and founder of Loop) also provide expertise acting as Non-Executive Directors.

Archie launches at a critical time for the global fintech market.

Global fintech funding totalled $75bn in 2022 taking total funding to over $350bn since 2018 and the global fintech market is forecast to be valued at (US) $1.5 trillion by 2030, driven by the huge potential for new technologies and innovation to disrupt large areas of financial services.

While fintech’s early stages have been successfully powered by large pools of investment, Archie’s analysis shows that only a tiny proportion of start-up innovation realises its full market potential – with founders noting they need support beyond financial backing alone. And with market conditions hardening, now is the time for high-impact plans, with the correct deployment of capital and little room for second chances.

Co-founder and Chair of Archie, Anthony Thomson says,

“Fintechs are a force of good – for years they’ve disrupted the financial services industry, providing better products, services and experiences for customers. But despite many great ideas, too many have fallen short, having not had the support they need.

“Archie will change that. Our team is perfectly positioned to offer the real hands-on, senior support they need. And crucially, provide it now, with it being more important than ever for fintechs to use resources in the right way.

“The Archie model means our years’ of global expertise are embedded and our interests aligned – creating partners out of practitioners and ensuring founders and their fintechs reach the heights they should.”

Co-Founder and Archie CEO, Steve Brennen says,

“Realising your dream and building a fintech isn’t easy. But truly scaling one is even harder. The Archie team has been there and done it, got the scars and the t-shirt.

“We have the know-how, expertise and experience of scaling global businesses. We’ll be able to parachute in and help founders develop and implement Go-To-Market strategies, avoiding the pitfalls and levering Archie’s deep experience in strategy, marketing, sales & governance across tech and fintech, as well as accessing the ARCHIE NETWORK to ensure access to the right talent, partners and finance.

“We know there’s an appetite for support just like this and I’m excited to help the next generation of fintech disruptors reach their potential – and help founders have the best journeys in doing so.”

Related News

- 03:00 am

Limassol, located on the southern coast of Cyprus, will receive in September one of the most significant events in the financial and B2B sectors. The iFX EXPO will take place on September 19-21, 2023, and is set to host more than 4,000 participants and 100 speakers. The event will bring together professionals in online trading, fintech, and financial services across Europe, Asia, and the Middle East.

The sponsored content platform PRNEWS.IO has a guaranteed spot at iFX EXPO and will be showcasing its on-demand service content marketplace. The startup, established in Estonia in 2018, is today the leader in the field and paid out $1.815 million to media outlets in 2022 for brand-related content.

“We're thrilled to be exhibiting one more time at iFX EXPO and showcasing our platform alongside some of the biggest names in the B2B industry”, says Alexander Storozhuk, a member of the Forbes Business Council and founder of the PRNEWS.IO platform. “This conference provides an excellent opportunity for us to connect with investors and businesses from around the world and to showcase our cutting-edge technologies. We hope to demonstrate the valuable contributions we are making to the global marketing and PR communications landscape”.

Media exposure without borders

European, Asian, and Middle Eastern companies have shown a growing interest in the fast-changing field of digital PR communications, recognizing the importance of effective and strategic communication to reach a wider audience and gain media exposure. PRNEWS.IO has emerged as a leader in the field, providing a global content marketing platform that facilitates the way for companies to share their news and stories with journalists, bloggers, and media around the world. In other words: clients no longer need to communicate with each media outlet separately.

Mikhail Karkhalev, CEO of PR agency BitBullMedia, corroborates the above, by sharing his positive experience utilizing the PRNEWS.IO platform: “Thanks to PRNEWS.IO we can solve a variety of tasks for our clients: PR reputation, publication of press releases, interviews, native publications, advertising articles, link building, brand awareness. A huge choice of media platforms, from the smallest to the largest in the world, allows us to solve these problems with maximum flexibility. If necessary, we can choose one or several suitable publications, or dozens of them at once. The ‘all in one window’ principle saves a lot of time, which is no less valuable resource for business than money. There is no need to storm the mail of each individual publication, some of which may take weeks to respond to”.

The next level of sponsored content

PRNEWS.IO’s exhibition at iFX EXPO will highlight what makes the platform different from other PR platforms: the on-demand service content marketplace, with no hiring process and no long-term commitment. The company's team will also be available to provide expert advice and answer questions about digital PR communications and media coverage, sharing their knowledge and insights with attendees.

“We are delighted to welcome PRNEWS.IO as an exhibitor at iFX EXPO International. Our goal is to connect service providers with their audience, and PRNEWS.IO definitely has a lot to offer. We look forward to their participation and learning more about their services”, says Ultimate Fintech, organizers of iFX EXPO events.

For more information on iFX EXPO: cyprus2023.ifxexpo.com/

Related News

- 04:00 am

Today PayU GPO, the leading online payment service provider operating in over 30 emerging markets, announces a strategic partnership with 4fund.com as its official payment operator, delivering enhanced benefits to users across the European Union. The 4fund.com platform is now available to users throughout the EU who can either donate or create their own fundraisers. It allows both individuals and organisations to raise funds for charity, business projects, and major or challenging life events.

4fund.com, the newest player on the crowdfunding map in Europe, is a part of Zrzutka.pl, a pioneer in Polish crowdfunding with over a decade of excellence under its belt. Zrzutka.pl is a licensed payment processor, allowing 4fund.com to oversee all financial operations independently, including Anti-Money Laundering (AML) and Know Your Customers (KYC) protocols, eliminating the need to involve third parties. In addition, the use of the platform is 100% free for both the online collection’s organisers and donors. Payment and withdrawal security is guaranteed by PayU GPO, which offers the highest security standards including 3DS authentication and PCI DSS Level 1 compliance.

Under the payment institution license, withdrawals can be seamlessly processed immediately upon the conclusion of a fundraiser. In addition, with the integration of the PayU GPO payment platform, 4fund.com has made donations and withdrawals as easy and secure as possible for all users. With the lead time decreasing to minutes, users no longer need to wait for days for withdrawn funds to be settled.

The integration also means that transfers of funds to a Mastercard or Visa card can be requested at any time and the funds will be available within minutes, including on weekends.

Joanna Pieńkowska-Olczak, CEO of PayU GPO CEE, comments: “In five years of fruitful collaboration with Zrzutka.pl in Poland, we have seen the platform's remarkable evolution and the trust that it has gained among millions of users. We are thrilled to be a part of their next chapter. This, combined with the growing popularity of crowdfunding platforms in Europe, makes us confident that 4fund.com will have a significant impact in this market. The cross-border payments capabilities of PayU GPO will undoubtedly play a pivotal role in this exciting development.”

4fund.com offers a variety of payment methods including Apple Pay, Google Pay and card payments. Donations can be made also from abroad, regardless of the currency, and will be automatically converted by the bank and will go to the fundraiser in Euros.

“We follow the crowdfunding business all over the world and have always been astonished by one simple fact - the "players" in this sector, including the most recognizable ones, charge high commissions (from 5% to 15%), and in addition, the Organiser of the fundraiser can wait up to 14 days to withdraw the funds raised. Astonishing as it is, it has a simple explanation - all these portals, as far as we know, are not payment processors and use the support of payment service providers or financial institutions to manage all financial issues and KYC/AML. This makes the process of delivering payments to collection Organisers on these platforms long, costly, and inefficient in terms of time. This is why we are going out to all collectors in the European Union with our model, which has worked so well in Poland” - says Krzysztof Ilnicki, CTO and Vice President of 4fund.com.

Related News

- 05:00 am

BC Payments, the licensed subsidiary of EQT-backed innovative tech-led payments business, Banking Circle Group, has launched in Australia. It will provide Australian FinTechs, payments businesses and banks with global payment solutions, facilitating both onshore and offshore growth.

The parent company, Banking Circle S.A., already serves over 250 financial institutions globally and is settling more than 10% of Europe’s B2C e-commerce flow. The latest data shows that in 2022, it processed enough payments to imply €332bn in total annual run-rate payment volumes.

BC Payments has appointed Piers Cracknell as Head of Australia. He joins from his previous role as Director, Strategic Initiatives at National Australia Bank (NAB), bringing over 20 years of payments experience.

BC Payments will help local FinTechs face barriers to non-domestic growth. At the centre of these barriers is the current de-risking in the B2B payments space by local incumbents. High-growth, compliant FinTechs have been caught in the crossfire, unable to find a clearing, settlement and cross-border payments partner.

Free from the inflexible legacy systems of incumbents, BC Payments will focus on innovation; building new, market-leading solutions that meet the needs of local FinTechs. By reducing the cost and increasing the speed of non-domestic payments, Australian FinTechs will be able to extend their geographic reach and customer propositions efficiently and cost-effectively.

Piers Cracknell, Head of Australia at BC Payments comments: “Having witnessed first-hand the frustration of Australian FinTechs losing access to global payment solutions, I’m excited to now be part of the solution. BC Payments’ offering will be delivered utilising the scale and infrastructure of the broader Banking Circle Group, which is already meeting the needs of some of the world’s largest payments businesses and banks.

“For Australia’s banks, we can help reduce the correspondent banking fees they have to absorb and provide more payment rail options with which to process their customers’ international payments. For marketplaces, we can enable overseas collections and payments for local merchants. And as private and government stakeholders push to grow the size of the FinTech market here in Australia, there has never been a more important time to get these companies to market and keep them growing. For those FinTechs looking for a global payments provider to expand into the EU and UK markets, we have the expertise to help.”

Mishal Ruparel, Chief Revenue Officer of Banking Circle added: “Led by our tech-first approach, Banking Circle is driving the evolution of global payments infrastructure, which goes to the heart of financial inclusion. We believe this is a great fit for the growing Australian FinTech space.

“We're excited that Piers will be heading BC Payments. His experience and strong network, coupled with our international track record, will be invaluable in helping Australian firms harness the benefits of our payment capabilities.”

Related News

- 07:00 am

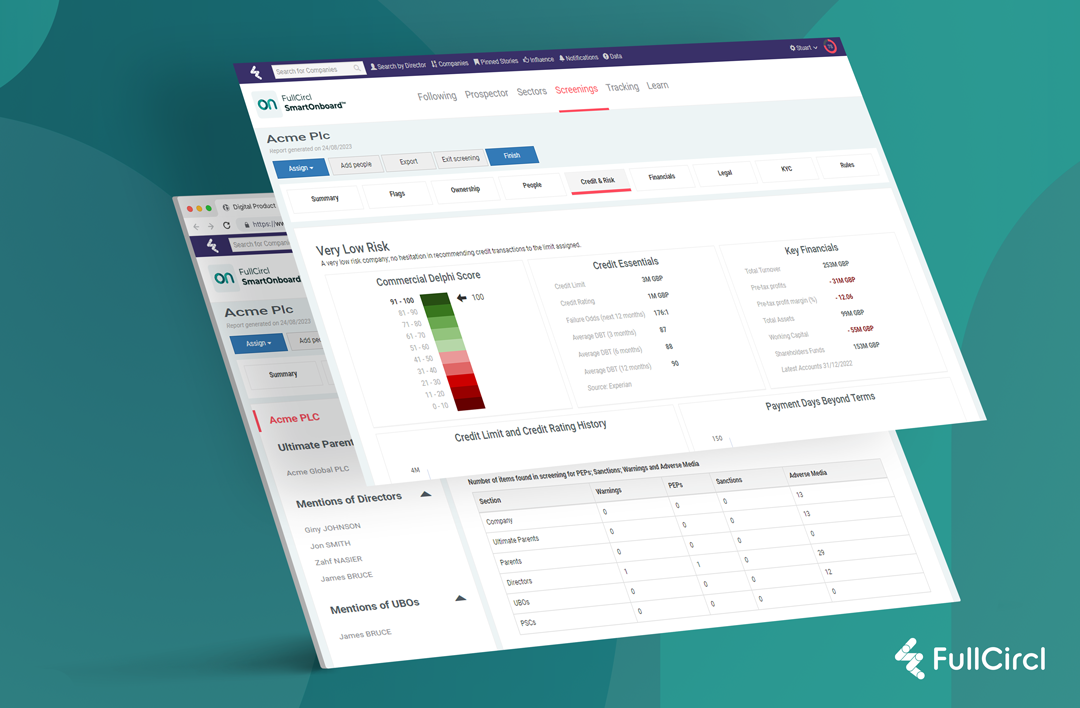

- ComplyAdvantage PEPs and sanctions API integration - effective screening and monitoring of individuals and entities against global watch

- Experian Delphi Score upgrade – latest credit scoring advancements for more accurate lending decisions.

- Experian Credit data API integration – seamlessly pull real time credit check data into systems, applications, and workflows.

- Improved customer monitoring – new credit and risk-based triggers for proactive identification and mitigation of potential risks.

Related News

- 09:00 am

Finnovating, the world's first AI-powered global deal-matching platform that connects corporations, investors, and over 100,000 technology startups and scaleups (Fintech, Insurtech, Proptech, etc.), has been named as one of the top 25 Digital Business Solutions companies in the world by CNBC and Statista.

The list, which is based on a comprehensive analysis by CNBC and Statista of global financial technology companies, recognises Finnovating for its innovative approach to match companies and facilitate business. Finnovating's platform uses artificial intelligence to match companies based on their needs and goals, helping them find the right partners and collaborators to grow their businesses.

“We are honoured to be recognized by CNBC and Statista as one of the leading Digital Business Solutions companies in the world,” said Finnovating CEO, Rodrigo García de la Cruz. “This recognition is a testament to our team's hard work and dedication to building a AI based platform that helps companies connect and grow. We are committed to continuing to lead global B2B connections as well as the development of digital business solutions for companies, governments and ecosystem builders”, concludes.

In addition to being named as one of the top 25 Digital Business Solutions companies, Finnovating is also recognized as one of the top 200 Fintech companies worldwide. This recognition is based on a number of factors, including the company's size, growth, innovation, and impact on the financial technology industry.

Finnovating has been rapidly growing in recent years, and currently connects over 20,000 companies from 130 countries. The company's platform has facilitated over 20 million interactions between companies, resulting in over $300 million in business.

In May of this year, Finnovating launched MatchGPT®, its most significant disruption to date. MatchGPT® is the first language-based GPT (Generative Pre-Trained Transformer) AI for matching companies and enabling business in the Fintech industry globally.

MatchGPT® has already resulted in over 10 million interactions between companies and is helping to accelerate the growth of the Fintech industry.

“We are excited to continue to innovate and lead the way in the development of digital business solutions,” said García de la Cruz. “We believe that our platform has the potential to revolutionise the way companies connect and grow, and we are committed to making it the go-to platform for technology businesses of all sizes”.

Study Methodology

Statista analysed over 1,500 companies across nine different market segments, evaluating each against a set of key performance indicators, including revenue, user count, and total funding raised.

To identify the top 200 Fintech companies globally, Statista conducted a quantitative analysis of the global market across nine categories: neobanks, digital payments, digital assets, digital financial planning, digital wealth management, alternative financing, alternative lending, digital banking solutions, and digital business solutions.

The final list includes some of the sector's largest companies (Ant Group, Tencent, PayPal, Stripe, Klarna, and Revolut), as well as several emerging companies striving to be relevant in the future of financial services.

Specifically, over 10,000 data points were evaluated, including annual reports, company websites, and news articles in media outlets.

Scoring Model

Statista developed a scoring model for companies by calculating aggregate scores based on their performance relative to their respective KPIs (e.g., revenue and revenue per employee), alongside a separate score for their performance relative to specific KPIs within their respective market segments.

This process led to the selection of between 5 and 40 companies for each individual market segment. To decide which companies made the cut, Statista divided the scoring model into a 40% weighting for general KPIs and a 60% weighting for segment-specific KPIs.