Published

- 02:00 am

Temenos (SIX: TEMN), the banking software company, today launches a front-to-back banking software as a service designed uniquely for the US market – with pre-integrated U.S. banking products and services designed to deliver an outstanding customer experience. Leveraging the power of its Temenos Infinity and Temenos Transact banking products built on its modern cloud-native, cloud-agnostic and API-first technology, Temenos has developed the next-generation SaaS product, enabling new digital banks to launch in the US within 90 days, and grow their business rapidly.

According to a recent Economist Intelligence Unit study, challenger banks - whether domestic startups or overseas brands that are now expanding their footprint - are making their presence felt in North America. The study also found that the number of banks choosing to develop new greenfield initiatives in the region has increased from 13% in 2018 to 29% in 2019, coming closer to the worldwide average of 36%. Temenos U.S. SaaS product is ideal for neo and digital banks in the US seeking to dramatically reduce their time to market, operational complexity and cost.

The Temenos U.S. SaaS offering provides new digital banks with a superior omnichannel front-to-back solution that delivers fully configured banking products and services, including support for conversational interfaces, artificial intelligence, augmented reality, and wearable technologies. This gives an exceptional customer experience that allows digital banks to open new accounts seamlessly through all digital channels. Temenos US SaaS product allows new digital banks to come to market quickly, acquire customers fast, reduce customer onboarding time, and grow share of wallet and revenues fast. Onboarding new customers is seamless and frictionless – and can be completed in a matter of minutes.

The solution is highly parameterized, allowing banks to rapidly configure and launch innovative products and services. In a market where a differentiated user experience is critical to success, banks can choose to customize Temenos’ customer-facing applications based on its class-leading multi-experience platform or build their own by connecting to Temenos’ extensive catalogue of functionally rich open APIs.

Additionally, Temenos’ U.S. SaaS platform provides access to pre-integrated and packaged fintechs on Temenos MarketPlace, ranging from ID verification and e-signature, to live chat and Personal Financial Management (PFM) services, allowing new digital banks to create innovative offerings at speed.

The Temenos product has built-in U.S. regulatory compliance and is fully integrated with the U.S. banking landscape via its catalogue of third-party interfaces and connectors. Temenos SaaS cloud deployment provides cost and scalability benefits with high security and availability measures. Accessing the solution through a pay-as-you-go subscription model, banks will pay only for what they use with the price scaling as business grows. The solution is continuously deployed 24 X 7 X365 days, per year, underpinned by a microservices architecture delivering highly efficient elastic scaling capability, automatically provisioning resources to perfectly match demand upwards or downwards. All providing a seamless service experience that delivers constant innovation, releasing banks from the relentless and costly cycle of software upgrades. Temenos cloud-agnostic technology and deep commitment to continual R&D ensures that, for years to come, Temenos will remain at the forefront of banking’s digital transformation, taking advantage of the best cloud innovation available while delivering the lowest cost option.

Max Chuard, Chief Executive Officer, Temenos, said: “With our new U.S. front-to-back SaaS product for digital banks, we will revolutionize the software banking landscape in the U.S., which is a highly strategic market for us. We are pioneers in cloud software and have global banking expertise in delivering high-profile and hugely successful SaaS-based retail digital banks and neobanks in regulated environments, from Varo Money and Grasshopper in the U.S., to Volt Bank and Judo Bank in Australia, and Leumi’s Pepper in Israel. These are exciting times as we continue to offer banks the most advanced SaaS digital banking product based on modern, cloud-native technology, giving them the freedom to dramatically reduce their time to market, cost, operational complexity and deliver outstanding digital customer experiences.”

Temenos has over 1,300 customers in North America and over 700 employees. The company boasts a list of clients ranging from top-tier global financial institutions such as Commerce Bank to challenger banks such as Grasshopper Bank, Varo Money, and credit unions such as Partners Federal Credit Union. .

Jeffery Kendall, Executive Vice President, North America Sales and Distribution, Temenos, said: “Banks and credit unions in the U.S. have shifted their investment focus to strategies that allow them to quickly grow consumer and small business deposits at a lower cost of acquisition. This trend has created the need for a turn-key digital banking service focused on speed to market with scalable cost as launching a digital bank has historically been an expensive and difficult endeavor. Temenos is powering the critical growth of our customers by providing a front-to-back, SaaS based, digital banking solution that will allow neobanks to compete in this dynamic market.“

Related News

- 03:00 am

Digital banking software provider, Backbase, has today announced the launch of its new regional headquarters in Singapore. Off the back of strong growth in the past few years, the regional centre in Singapore will strengthen its regional footprint to ensure greater proximity to clients and provide high-quality services and expertise to businesses in Asia Pacific (APAC).

There is a rising demand for fintech solutions in the region underpinned by the rapid adoption of technology, as well as a segment of consumers and small- and medium-sized enterprises (SMEs) underserved by traditional banking solutions.1 These factors, coupled with the economic potential of the region, sets a strong foundation for financial institutions to adopt a digital-first approach in providing customised services.

Backbase has proved that it is an industry expert and trusted partner with state-of-the-art technology through its work with global banks such as Citibank, HSBC, Barclays, Goldman Sachs and more.

The APAC office puts Backbase in the heart of a tightly-knit community of like-minded fintech companies. It will provide Backbase with the access to specialised workers, shared innovation, and proximity to related professional services in the fintech industry.

CEO for Backbase, Jouk Pleiter said, “We’re excited to join the fintech ecosystem in APAC, building momentum for the exciting work we’re doing. But most importantly, our new APAC office brings us so much closer with our customers in the region. We already have a dozen very strategic customers in the APAC region, and together with them we are rapidly expanding our regional development centers - recruiting and onboarding digital talent to help us execute multiple strategic digital transformation projects in the region.”

With the launch of the new APAC headquarters, Backbase has recently announced its next generation Backbase-as-a-Service, a managed cloud platform service that covers Backbase’s entire portfolio of banking products. The platform is available worldwide to support banks and neo-banks in keeping pace, helping businesses to innovate with speed whilst reducing their costly operational hurdles.

“Digital disruption is occurring at every level in the banking industry. Banks and neo-banks must now think in new and innovative ways, or risk becoming a mere back-office utility. The launch of the new Backbase-as-a-Service and APAC office reiterates our commitment to work closely with companies to address digital disruption and implement digital transformation that enables them to be relevant at all times, with consistent and fulfilling customer experiences in both the digital and physical spaces”, said Jouk Pleiter.

Related News

- 04:00 am

In a Sunday opinion column in The Financial Times (FT), Google and Alphabet chief executive officer (CEO) Sundar Pichai wrote about the importance of having government oversight regarding artificial technology (AI).

“Growing up in India, I was fascinated by technology. Each new invention changed my family’s life in meaningful ways,” he wrote.

Now that he is in the position to frame new tech advances, he said he believes that international cooperation for oversight is vital in order to impose workable global standards.

“Now there is no question in my mind that artificial intelligence needs to be regulated. It is too important not to. The only question is how to approach it,” he wrote, pointing to historical examples that “technology’s virtues aren’t guaranteed.”

He said people “need to be clear-eyed” about the many possible negative consequences of technology, particularly when it comes to AI.

The market should not dictate how technology is used, and big tech firms like Google have a responsibility to make sure “technology is harnessed for good and available to everyone,” he wrote.

In 2018, Google created its own AI policies to provide guidance as well as open-source tools and code for the ethical development of AI that also avoids bias and ensures privacy. The policy also outlined Google’s opposition to mass surveillance and the infringement of human rights.

“We believe that any company developing new AI tools should also adopt guiding principles and rigorous review processes,” he said in the article. “Government regulation will also play an important role.”

He pointed to Europe’s General Data Protection Regulation (GDPR) as being a good start for a “strong foundation.”

Google wants to partner with regulators to extend its own expertise and tools and “navigate these issues together.”

Earlier this month the Trump administration submitted new rules governing any future federal regulation of AI. Any new rules will not impact how federal agencies like law enforcement utilize “facial recognition and other forms of AI.”

AI watchdogs point to the current lack of accountability as more computer infrastructure and software systems replace human workers in multiple professional environments.

Related News

- 08:00 am

Yolt, the smart thinking money app, has announced that one of its newest features, Yolt Pay, is now available to Monzo account holders.

Within the Yolt app, users can view all of their incoming and outgoing transactions across multiple accounts, in one central place – the latest feature, Yolt Pay, now allows users to make quick payments to their friends and family and also to transfer money between different bank accounts connected within the app. Yolt Pay also takes away the hassle of remembering account numbers and sort codes since any contact a user has previously saved across their banking apps will now appear, pre-populated within the Yolt app.

Yolt was built upon the promise of Open Banking, a UK initiative implemented to increase competition and provide more choice in the financial products and services available for consumers. Yolt Pay and Yolt’s aggregation features rely on Open Banking APIs and despite it only being just over two years since the launch of Open Banking, Yolt has already enabled over one million registered users across Europe to feel the benefits of open banking.

Yolt’s rapid growth means that they have now completed over 390 million API calls, making them responsible for over 30% of all API traffic in the market. As the number of API calls continues to increase, more and more consumers are feeling the benefits of the Open Banking initiative.

Pauline van Brakel, Chief Product Officer at Yolt said:

“It’s great Yolt users with a Monzo account will now be able to access all of the benefits of Yolt Pay, enabling them to not only manage and interpret their day to day spending across all of their accounts but also with the added benefit of being able to transfer money to and from their Monzo account, along with quickly and easily pay friends & family.

“The Open Banking initiative has undoubtably cemented it’s mark in the future of our financial landscape and it’s fantastic to see certain sectors such as the payments industry really being transformed in light of legislation such as Open Banking and PSD2.”

Yolt, the smart thinking money app, has announced that one of its newest features, Yolt Pay, is now available to Monzo account holders.

Within the Yolt app, users can view all of their incoming and outgoing transactions across multiple accounts, in one central place – the latest feature, Yolt Pay, now allows users to make quick payments to their friends and family and also to transfer money between different bank accounts connected within the app. Yolt Pay also takes away the hassle of remembering account numbers and sort codes since any contact a user has previously saved across their banking apps will now appear, pre-populated within the Yolt app.

Yolt was built upon the promise of Open Banking, a UK initiative implemented to increase competition and provide more choice in the financial products and services available for consumers. Yolt Pay and Yolt’s aggregation features rely on Open Banking APIs and despite it only being just over two years since the launch of Open Banking, Yolt has already enabled over one million registered users across Europe to feel the benefits of open banking.

Yolt’s rapid growth means that they have now completed over 390 million API calls, making them responsible for over 30% of all API traffic in the market. As the number of API calls continues to increase, more and more consumers are feeling the benefits of the Open Banking initiative.

Pauline van Brakel, Chief Product Officer at Yolt said:

“It’s great Yolt users with a Monzo account will now be able to access all of the benefits of Yolt Pay, enabling them to not only manage and interpret their day to day spending across all of their accounts but also with the added benefit of being able to transfer money to and from their Monzo account, along with quickly and easily pay friends & family.

“The Open Banking initiative has undoubtably cemented it’s mark in the future of our financial landscape and it’s fantastic to see certain sectors such as the payments industry really being transformed in light of legislation such as Open Banking and PSD2.”

Related News

- 01:00 am

Royal Bank of Scotland has appointed Vanessa Bailey as chief risk officer (CRO) of its ring-fenced bank, it said in an announcement. She will be based in London. Vanessa Bailey Bailey was formerly interim chief risk officer, NatWest Markets, and assumed her new position on August 20. She will report to group chief risk officer Bruce Fletcher, and Ross McEwan, the chief executive of NatWest Holdings. The new role will also see her joining the NatWest Holdings executive committee and chairing the NatWest Holdings risk executive committee.

Jeremy Arnold has been hired as CRO for NatWest Markets and will report to Fletcher and the division’s chief executive Chris Marks. Arnold is joining from Nomura, where he is currently CRO for Emea, and has more than 25 years’ trading and risk experience. He is due to start his new role on September 3 and will also be based in London.

Related News

- 03:00 am

Red Deer, the financial technology company dedicated to enhancing the performance of active investment managers, and Cappitech, a leading provider of regulatory reporting and intelligence solutions for the financial services industry, today announced a partnership to deliver a combined MiFID II and MAR compliance solution for investment managers.

Red Deer’s Holistic Surveillance solution helps compliance teams mitigate risk and increase confidence in their approach to solving for market abuse regulations by leveraging data and analytics for best practice, while Cappitech’s MiFID II solution includes MiFID II Transaction Reporting, Best Execution Monitoring, RTS 27/8 Reporting, RTS 28 Market Intelligence and Trade Reconciliation. Under the partnership, the two businesses will offer the other’s services to their respective client bases, with a view to providing a seamless integrated solution that helps compliance teams manage the complexities of the regulation.

Red Deer’s Holistic Surveillance solution covers multi-asset class trade and communications surveillance, embedding compliance and control functions within front, middle and back-office workflows that offer full operational transparency, quick retrieval of data, and full trade reconstruction to ensure timely and accurate disclosures. The outcome of this approach is confidence in the firm’s compliance with regulations and demonstrable efficiency gains from alert investigations and case management, through to reporting, infrastructure maintenance and front-office interactions.

Cappitech’s regulatory service platform uses state-of-the-art technology to provide a unified experience for multi-jurisdiction regulatory reporting, along with an industry-leading analytics dashboard to monitor and extract value from compliance data. It provides access to instant insights based on trading data so that decision-makers can make informed data-driven decisions and monitor best execution practices. It easily connects with trade reports from trading platforms, such as EMS and OMS, to enable a seamless MiFID II compliance for clients who are regulated by the likes of FCA, CySEC, CBOI and MFSA, among others.

Alistair Downes, Vice President of Product at Red Deer, commented: “Our Holistic Surveillance solution delivers value from intelligently surfaced, relevant and correlated data, enabling investment management firms to confidently manage their regulatory obligations with maximum efficiency.

“The partnership with Cappitech now enables us to help our clients seamlessly meet the requirements of transaction reporting and best execution under the regulations, without affecting their investment or operational workflow.”

Ronen Kertis, CEO at Cappitech, added: “This partnership provides multiple benefits for investment managers who are all demanding seamless, integrated regulatory solutions across multiple jurisdictions. Our goal is to provide efficient, cost-effective solutions that also drive added value, and the addition of Red Deer’s Holistic Surveillance solution to our offering supports this. We are also looking forward to supporting Red Deer’s clients, as they look to integrate our regulatory reporting solutions into their existing services.”

Related News

- 02:00 am

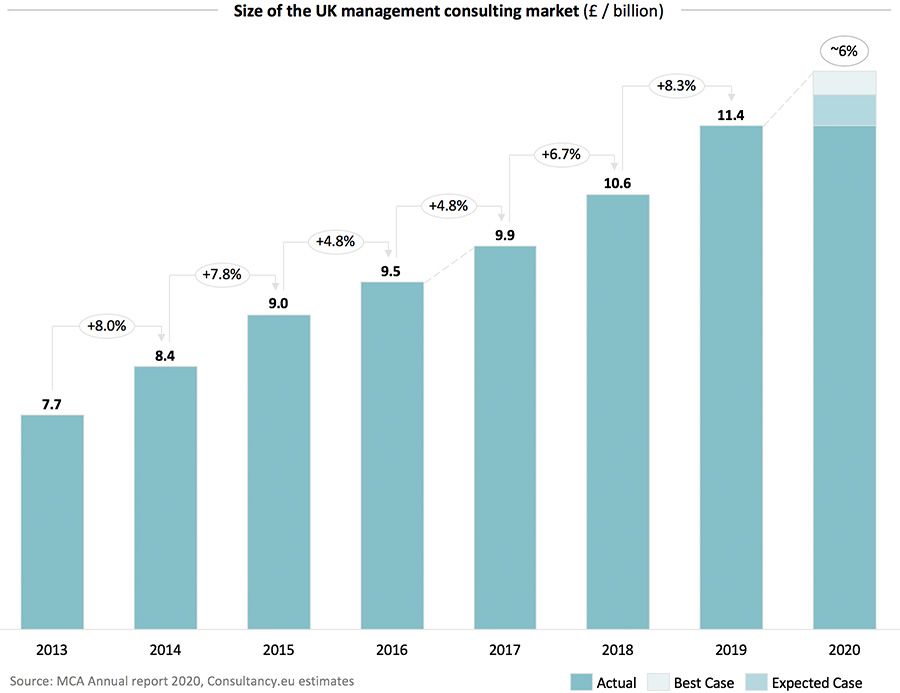

The United Kingdom’s management consulting industry has grown by 8.3% last year, its second fastest rate of growth since the financial crisis. Although less optimistic than a year ago, three out of four UK consulting firms expect demand for management consulting services to increase in the next 12-24 months.

The vast majority of consulting firms in the UK (86%) said that consultancy activity had met or exceeded expectations in the past 12 months, according to data release by the Management Consultancies Association (MCA). The association for the UK’s consulting industry surveyed some 500 consultants for its analysis, including managing directors, partners and heads of consulting at generalist companies.

Over a third of consultancies (34%) ended the year exceeding their initial growth expectations, despite the political and economic turmoil of last year felt by the Brits. Tamzen Isacsson, chief executive of the MCA, said on the development, “The consulting industry continued to experience strong growth and meet the increasing demands from public and private sector clients.”

With 8% growth, UK’s consulting market roughly matches the growth of Germany’s consulting industry in 2019, but sees the French outpace its performance by nearly 3%. According to Syntec Conseil – the MCA’s counterpart for France – the French consulting market enjoyed a 11% boom in revenue to reach a total market value of just over €8 billion.

The main drivers of UK growth were not surprisingly digital and technology consulting work, amid a rapidly digitising business environment. Digital demand was strong across functions and industries, with digital strategy, IT programme management, robotics process automation, customer experience digitisation and applications development among the offerings that saw growth.

Work in sustainability services also saw a notable jump in 2019, with consulting firms increasingly being asked by businesses to advise them on environmental and sustainability issues. Top in-demand propositions in this space include reviewing business models for sustainability, identifying evolving customer sustainability expectations, detecting risks with climate change and implementing the sustainable development goals of the United Nations.

Heightened spending of the government on external consultants (as it did in the Netherlands a well last year) was another growth driver, as the public sector pushed through a number of major reforms and projects in areas such as infrastructure, tax and public services. Consultancy related to Brexit readiness jumped, however, this work was channelled to a handful of larger firms including McKinsey & Company, Boston Consulting Group and the Big Four.

Not all UK consultancies managed to ride on the growth wave. According to the MCA, the performances between the top performing consulting firms and lagging peers has become widened. Compared to the year previous, a slightly larger proportion of firms stated that consulting activity had failed to meet expectations – a 3% increase for SMEs and 5% increase for larger players.

2020: The road ahead?

In its forecast for 2020, the MCA paints a picture of optimism – 76% of the UK consulting firms surveyed expects activity to increase in the next one to two years, albeit a slight decline from the previous year (86%). Sectors expecting to see particularly high growth are the government & public sector followed by infrastructure, health & life sciences and energy & resources. Digital consulting will remain the fastest growing service area.

Challenges identified by UK’s consulting leaders include finding and keeping talent on board and motivated, innovating business models to adapt to changing client demands and, in the case of the larger firms, fending off fee pressure challenges from the growing army of independent consultants and niche consultancies.

Related News

- 03:00 am

Finastra announced today that TONIK, the first licensed digital-only bank in Southeast Asia, has selected Fusion Essence in the cloud to power its end-to-end core banking capabilities. The move will support TONIK as it launches its retail deposit and customer loans services in the Philippines, giving it agility and the ability to scale quickly.

Greg Krasnov, Founder & CEO at TONIK, said, “The banking sector in the Philippines is ripe for digital disruption. The country has high internet usage, the majority of Filipinos are unbanked and research shows half of the people who do have bank accounts would be interested in switching to a neobank.

“We want to create a hyper-compelling consumer proposition that will revolutionize the way money works in the region. Finastra’s Fusion Essence Cloud - powered by Microsoft Azure - will give us the agility to get these services to market quickly and efficiently. We are also impressed by the modern, open and scalable capabilities of the solution, particularly the in-built analytics, which will help us to better understand our customers’ smart digital banking needs.”

The key proposition for digital banks is providing a customer experience that traditional banks struggle to offer. This requires modern, cloud-native technology that facilitates innovation whilst future-proofing investment. For TONIK, Fusion Essence Cloud will be deployed out of the Microsoft Azure Southeast Asia Region (Singapore Data Center), which will allow for both low latency and data residency. TONIK will benefit from a low cost of entry into the market, ease and speed of deployment, and the ability to increase business volumes and diversify its product set cost-effectively. It will also benefit from ongoing software updates and, in time, access to further innovation via FusionFabric.cloud, Finastra’s platform for open innovation and the development of applications.

European neobanks, including revverbank and Gravity, are already being powered by Fusion Essence Cloud, and this deployment in Southeast Asia will help bring the benefits of innovative digital banking to the Philippines.

Anand Subbaraman, General Manager, Retail Banking at Finastra, said, “TONIK is well positioned to replicate the disruption that has taken place in Europe, where digital banks have quickly attracted millions of customers and billions of dollars in investor funding. Using digital technologies and a lower-cost operating model, TONIK will be able to offer customers the products and services they need, delivered in a convenient way, as well as increasing opportunities for financial inclusion in Asia. Fusion Essence Cloud is ideally suited to help TONIK achieve these goals, as well as see a fast return on its investment. We are extremely proud to be TONIK’s partner in bringing digital banking to the Philippines for the first time.”

Related News

- 03:00 am

Stratis, an enterprise blockchain technology company, announces the winners of its latest hackathon, the Stratis Smart Contracts Challenge. Attracting nearly 200 participants and 13 high-quality submissions, the online hackathon produced a range of smart contract applications spanning finance, law, identity, trade, supply chain, charity, healthcare and gaming.

US$10,000 First Place: Cirrus Swap

Tyler Pena took the first-place prize of US$10,000 for his Cirrus Swap decentralised exchange application which allows users to hold their own tokens and settle trades on Stratis’ Cirrus Sidechain.

Cirrus Swap is a set of four contracts – BuyOrder, SellOrder, Orders, and JsonConfig – working together with a User Interface (UI) to create a clean user experience for trading SRC-20 for CRS tokens. It means that users only need to open the Cirrus Swap UI and Cirrus Core wallet to immediately begin trading.

As more SRC-20 tokens join the Cirrus Sidechain, for example MEDI, the application will make it easier for users to exchange tokens on chain in a decentralised manner, as opposed to utilising traditional methods like cryptocurrency exchanges. This added functionality will improve liquidity on the Cirrus Sidechain and help the token economy to thrive.

Cirrus Swap demonstrated a proven use case that provides millions in daily value right now. Cirrus Swap's UI not only works but is aesthetic and intuitive. The contract code is clean, well-tested, and integrates with existing Cirrus contract standards. The project has even put effort into branding – Cirrus Swap could feasibly be a real product with a full team behind it.

US$5,000 Second Place: Wheelgame

This gambling web application was designed by Sergey Ankarenko. Based on a standard multi-player bidding game, players log in with a decentralised, arbitrary private key to make it impossible for participants to cheat or gain an illegal advantage. The ultimate vision behind the application is that it could be extended across the gaming sector, including online casinos.

US$3,000 Third Place: Stratis Signature

This web application for digital signatures was created by Divyang Desai. It allows multiple users to securely create, sign and verify documents. This enhances integrity and transparency, making it perfect for use by enterprises in law, invoicing, resource management, operations and finance.

The judges also commended other notable submissions including the Sale Deed Registry, Passport Agency Office (passport application/renewal), and TrustEvent (decentralised event ticketing system).

Chris Trew, CEO and Founder of Stratis, said: “We would like to congratulate all of the entries in our Smart Contracts Challenge, especially the top three winners. The number of high-quality submissions was extremely impressive and highlights the functionality possible on the Stratis Platform as well as the enterprise and government applications that can be built using Stratis Smart Contracts.

“It was also encouraging to see just how many new developers submitted entries. We pride ourselves on making blockchain easy and this was evidence of how we can encourage smart contract adoption by attracting developers already familiar with C# programming.

“We will now look to take forward the best use-cases in order to add utility to the STRAT token and boost our credentials for enterprise adoption. Following the success of this hackathon, we hope that there will be many more in the future.”

The hackathon ran from 1 November to 16 December 2019 and was open to submissions from individuals and teams from around the globe. Developing on the Stratis Platform, participants were encouraged to build smart contract applications that are useful, easy to use, innovative and impactful. The judging panel consisted of sector experts, including developers, blockchain gurus and Microsoft MVPs judged the submissions on their utility, usability, creativity, functionality, and design and documentation.

Related News

- 01:00 am

JCB International, Co., Ltd., the international operations subsidiary of JCB Co., Ltd., and Nordic-based payment service provider Nets Group, today announce the wider enablement of JCB payment acceptance by Nets merchants in Finland.

This latest strategic expansion initially enables over 18,000 businesses across Finland to accept JCB payments through the Nets Merchant Services platform. This will provide JCB’s growing Russian and Japanese cardmember base with the opportunity to shop with ease and peace of mind whilst they visit the country.

JCB and Nets Merchant Services will continue, during 2020, to enable well known consumer brands in Finland to further increase JCB acceptance across the country.

This ongoing partnership strengthens JCB’s coverage across the Nordics, and further enhances the payment brand’s goal to expand its network of 33 million merchant partners and provide a unique and seamless shopping experience to its 136 million global cardmembers.

Mr. Tsuyoshi Notani, Managing Director, JCB International (Europe) Ltd., said: “The growth of JCB acceptance in Finland further aids our intent to expand even further afield by working with more partners in markets where our cardmembers demand it. This includes our growing base of cardmembers in Russia, so they can pay for goods and services.”

Petri Carpén, Head of Large Accounts at Nets in Finland said: "Finland is an important gateway for JCB’s Asian cardmembers visiting Europe. According to Visit Finland 2017 data, the number of trips made by Chinese visitors to the country rose 63 percent, with spend averaging 1,263 euros per person per trip, outspending visitors from all other countries. This initial phase of JCB acceptance will enable our merchants across Finland to tap into this increasingly important tourism channel.”