Published

- 01:00 am

Tata Consultancy Services (TCS) (BSE: 532540, NSE: TCS), a leading global IT services, consulting and business solutions organization, announced that Bahrain Development Bank (BDB), a development finance institution established by the government of Bahrain, focusing on financing and development of small and medium businesses, to encourage and support entrepreneurship in the Kingdom of Bahrain, has selected the TCS BaNCS™ Global Banking Platform for its core banking transformation.

BDB offers conventional and Islamic business finance services, venture capital and investment advisory to small and medium enterprises across multiple industries in the Kingdom of Bahrain. Through focused, innovative products, services, and a redefined operating model, BDB has been stimulating and driving entrepreneurial activity in the country. The bank was looking for a modern, digital banking solution that would help it transform customer engagement through the delivery of contextual experiences. Furthering the government’s vision of moving operations and infrastructure to the cloud, BDB wanted to host the entire core banking platform on a public cloud.

The bank selected the front-to-back digital offering, TCS BaNCS Global Banking Platform, enabled with APIs and cognitive tools such as AI and analytics. The platform will help BDB meet the unique needs of the small and medium business segment spanning digital banking channels, origination, core banking, trade finance, treasury and supporting services like AML and reconciliations. It will interface with technology offerings from TCS’ partners for CRM, sales, risk management and other enterprise functions.

TCS BaNCS will enable BDB to launch new innovative products faster. Further, it can leverage TCS’ fintech partner ecosystem to accelerate innovation and create superior and contextual experiences for its customers. The deployment of TCS BaNCS on AWS brings together the transformative power of a modern, future-proof digital core with the scalability, security, availability and cost-efficiency of a trusted global public cloud platform.

Khalid Al Rumaihi, Chairman, Bahrain Development Bank, said: “BDB plays a key role in the Kingdom of Bahrain’s growth by supporting SMEs and entrepreneurs to build, operate, and grow their businesses with confidence. With the selection of the comprehensive suite of offerings from the TCS BaNCS Global Banking Platform, which will be deployed on AWS, we are undertaking the core banking transformation and cloud migration of a three-decade-old platform, making it one of the first of its kind in the world. We will now be able to provide our clientele with an omni-channel digital financial services and a launch pad for their businesses to grow and flourish.”

Sanjeev Paul, Group CEO, Bahrain Development Bank, said: “BDB’s digital transformation program is a key pillar of delivering on the Bank’s vision to build BDB as a sustainable, industry leader and trusted partner for entrepreneurs in Bahrain, helping them to grow their businesses into successful and regionally competitive enterprises. With the full solution stack being implemented by TCS, BDB will be able to transform our clients’ experience delivering new channels, and innovative products. With this visionary project Bahrain is once again leading the way in adopting full digital core banking on cloud, delivered using a SaaS model thereby assuring that the Bank is always at the cutting edge of technology.”

“We are pleased to be partnering with a bank that has a social and economic purpose which goes beyond conventional business objectives. Designed on the Digital First, Cloud First™ philosophy, TCS BaNCS will help BDB enhance agility, drive superior customer experiences and transform itself to meet the needs of an ever-evolving banking environment,” said Venkateshwaran Srinivasan, Head, TCS Financial Solutions.

The TCS BaNCS Global Banking Platform embodies the Digital First, Cloud First philosophy on which all its components are designed, enabling financial institutions to offer products and services to customers throughout their lifecycle and across all touch points. Anticipating their requirements even before they begin looking for solutions, the platform comprises innovative, adaptive digital apps and a high performing processing engine. It can support a wide range of products and services covering assets and liabilities, cash and securities, and has been deployed at more than 400 financial institutions, with an assured 24x7x365 availability. With functionally granular and extendable APIs, the solution enables financial institutions with choice while also empowering them to leverage larger ecosystems and create new revenue models.

Related News

- 13.10.2020 -- 02:01 pm

Other Videos

- 03:00 am

Dell Technologies’ third biennial Digital Transformation Index details how organisations are accelerating digital transformation projects amidst unprecedented uncertainty; 4,300 business leaders in 18 countries weigh in

Story Highlights

· Digital transformation seen as critical business driver for recovery

· 72 percent of organisations in the UK have fast-tracked some digital transformation programs this year. This is compared to 75 percent of organisations across Europe and 80 percent globally

· Data privacy and cybersecurity concerns, limited resources and difficulty extracting insights from data identified as barriers to Digital Transformation

· Complete results can be found at: https://DellTechnologies.com/DTIndex

Full story

Dell Technologies today released results from a global study that shows organisations are shifting their digital transformation programmes into high gear and are on the path to accomplish in a few months what would normally havetaken them years. The findings, updated biennially in the Dell Technologies’ Digital Transformation Index (DT Index), indicate organisations are accelerating transformational technology programs during the global COVID-19 pandemic.

In one of the first global studies to measure business behaviour because of the pandemic, Dell’s 2020 Index found that seven in 10 organisations (72 percent) in the UK have fast-tracked some digital transformation programs this year. This is compared to 80 percent globally and 75 percent across Europe. In addition, 72 percent of UK organisations are re-inventing their business model.

The DT Index is a global benchmark indicating organisations’ status of digital transformation and their performance across the globe. The survey included 4,300 business leaders (C-suite to Director) from mid-size to enterprise companies across 18 countries.

A new digital transformation curve

This year’s results sets the number of UK Digital Leaders (the most digitally mature organisation) to five percent. Digital Adopters (the second most digitally mature group) has grown from 22 percent in 2018 to 32 percent in 2020 – a 10-percentage point increase.

The DT Index also records a modest drop since 2018 in the number of Digital Laggards (the least digitally mature group) by one percentage point, and a steep fall in the second to last group, Digital Followers, by 17-percentage points. These organisations are moving up, into the Digital Adopter and Digital Evaluator groups, which have expanded in tandem.

“We’ve been given a glimpse of the future, and the organisations that are accelerating their digital transformation now will be poised for success in the Data Era that is unfolding before our eyes”, says Michael Dell, Chairman and CEO, Dell Technologies.

Using a curve visual, the DT Index plots digital transformation progress, from one wave of the DT Index to the next.

Barriers to transformation

The pandemic may have catalysed digital transformation across the globe, but continuous transformation is challenging: 94 percent of organisations in the UK are facing entrenched barriers to transformation. According to the 2020 DT Index, the following are the top-3 barriers to digital transformation success in the UK:

· Lack of budget and resources (#1 in 2016, #1 in 2018)

· Data privacy and cybersecurity concerns (up from #4 in 2016, #2 in 2018)

· Unable to extract insights from data and data overload (up from #11 in 2016, #3 in 2018)

Responding in an uncertain world

Prior to the pandemic, business investments were strongly focused on foundational technologies, rather than emerging technologies. The vast majority in the UK, 89 percent, recognise that as a result of disruption this year, they need a more agile/scalable IT infrastructure to allow for contingencies. The DT Index shows the top technology investments for the next one to three years in the UK:

· Cybersecurity

· Data management tools

· Hybrid-Cloud environment

· Privacy software

· Software: containers and serverless

And recognising the importance of emerging technologies, 78 percent of UK respondents envision increased usage of Augmented Reality to learn how to do or fix things in an instant; 81 percent foresee organisations using Artificial Intelligence and data models to predict potential disruptions, and 70 percent predict distributed ledgers - such as Blockchain - will make the gig economy fairer (by cutting out the intermediary). Despite these findings, only 10 percent are planning to invest in Virtual/Augmented Reality, just 28 percent intend to invest in Artificial Intelligence and a mere 11 percent plan to invest in distributed ledgers in the next one to three years.

Research methodology

During July and August of 2020,Dell Technologies partnered with independent research companyVanson Bourne who surveyed 4,300 business leaders from mid-size to enterprise organisations across 18 countries, to create a global benchmark indicating businesses’ status of transformation. Vanson Bourneclassified businesses' digital business efforts by examining their IT strategy, workforce transformation initiatives and perceived performance against a core set of digital business attributes. This is the third instalment of the DT Index (the inaugural study in 2016 was followed by the second DT Index in 2018).

Related News

- 09:00 am

Invoice financing and transaction company Crowdz, has today announced it will introduce fraud-detection application Invoice Check, by Trade Finance Market (TFM) as part of its SuRF Score product. Crowdz is working to create the market’s most accurate risk assessment technology for investors.

TFM will join a variety of inputs that comprise the Crowdz SuRF Score, specifically to pinpoint and combat invoice fraud, which is at an all-time high during COVID-19.

This collaboration will increase transparency and security for funders, and provide liquidity for hundreds of small businesses, many of whom have struggled to secure bank financing to bounce back from the COVID-19 crash.

Since the beginning of the pandemic, Crowdz has experienced 5,000 percent growth in business users accelerated by a surge in demand to improve cash flow during the toughest economic downturn in decades. This growth has resulted in a $2.2 million Series A+ reinvestment led by BOLD Capital Partners despite the pandemic.

CEO and Co-founder of Crowdz, Payson Johnston, said the rapid increase in demand for financing meant the company would also need bolster its ability to create value and reduce risk for funders on the platform.

“In regular market conditions, let alone the current COVID-19 crisis, investors want to ensure invoice finance fraud, such as double-financing or defaulting, is not an issue.

“By introducing Invoice Check, to our SuRF Score risk assessment product, Crowdz can better protect its customers with secure, tamper-proof blockchain technology. We’re able to ensure the validity of invoices, encrypt transaction data, and mitigate double-financing. This feature comes at a crucial time when fraud is rampant, businesses are vulnerable,” he said.

Executive Director of Trade Finance Market, Raj Uttamchandani, sees the collaboration with Crowdz as a demonstration of how fintechs are taking the lead in making it easier for businesses to access liquidity – much needed at this challenging time.

“Due to potential fraud, the inability to validate invoices is an obstacle for companies in obtaining finance quickly.

“Invoice Check provides a solution which utilizes blockchain in a way that has never been done before - providing funders with security and ensuring finance reaches the many small businesses which really need it, thereby protecting countless jobs and livelihoods,” he said.

Crowdz is overhauling the accounts receivables space by creating an alternative financing solution for small businesses that often struggle to obtain traditional bank financing. Its technology, which enables small businesses to sell invoices for financing, reduces cash flow bottlenecks and gives small businesses capital to survive and thrive.

Related News

- 04:00 am

Integral (www.integral.com), a leading FX technology provider, announced today that Mr. Kevin Wilson, a former Citi executive, has joined the firm as Managing Director - Business Development.

Wilson has spent much of his career at Citi and brings extensive experience in the foreign exchange market, most notably within senior relationship management roles serving the hedge fund community. In his new role, Kevin will be responsible for managing new business initiatives and senior client relationships.

An accomplished senior executive, his most recent roles at Citi included positions within the Futures, Clearing and FXPB division and as a founding member of the group’s Margin FX Trading business, which he successfully orchestrated the sale of in 2015. Prior to this he held roles within the group’s eCommerce and FX corporate sales divisions.

Commenting on the hire, Harpal Sandhu, CEO of Integral, said: “We are extremely pleased to welcome Kevin Wilson as a new member of the Integral team. Kevin has a strong track record in strategic business development and excellent industry experience supporting hedge fund and buy-side clients grow their FX business. We have seen a significant uptick of interest from this segment of the market and Kevin’s appointment demonstrates our strong commitment to invest in our resources and deliver exceptional service to the hedge fund community.”

Kevin Wilson, Managing Director at Integral, said: “I am delighted to be joining Integral during an exciting period as they expand their technology and trading offerings for the hedge fund community. The timing is ideal as the hedge fund industry is rapidly evolving and is seeking innovative solutions from the fintech sector. Integral has built its reputation on the delivery of award-winning FX trading, connectivity, and workflow management tools and I believe we have tremendous opportunity to expand on our existing services from which more hedge funds around the globe could benefit.”

Related News

- 03:00 am

SEON, the fraud fighters, has today announced its partnership with DevCode Identity, a leading identity platform, which will be utilising SEON’s unique and innovative fraud prevention solution to help iGaming companies prevent fraudsters from signing up during the customer onboarding process.

By integrating SEON’s tool via an API or Chrome extension, SEON offers a seamless integration experience, cutting down on the typically long implementation times most other fraud prevention tools are known for, and via an API or Chrome extension, the DevCode Identity platform will have near-immediate access to SEON’s services

Additionally, DevCode Identity will have access to rich data taken from the email, phone number or IP addresses it gathers from customers, while also collecting all accessible data points about customers’ digital footprints from social media profiles, available via open sources in the public domain. This allows DevCode Identity to ensure that its merchants can wean out any fraudulent accounts during the onboarding process.

Having launched in 2017, DevCode Identity is a gateway for Know Your Customer (KYC), anti-money laundering (AML) and fraud services. With a core focus on iGaming, the DevCode Identity Platform allows merchants to verify customers in real time, wherever they are, with a single API. As a Software-as-a-Service (SAAS) platform, it enables merchants to outsource all authentication, on-boarding and KYC processes safely, with the knowledge that its customers’ identities are correct and there are no fraudsters trying to open accounts or access existing ones. At the same time, customers can rest assured that no one is able to access their accounts.

iGaming merchants using the DevCode Identity Platform, will be able to use the SEON tool to catch fraudsters by defining rules and actions, such as on withdrawals to determine if accounts have been involved in any fraudulent activities. Based on the rich data provided by SEON, the merchant will then be able to block the transaction and action the suspicious behaviour. This ultimately protects both them and their customers from online fraudulent activity. It also prevents the merchants involved from incurring any costly regulatory sanctions that can have a devastating effect on both the company’s reputation and finances.

Magnus Frost, CEO at DevCode Identity, said: “When it came to partnering with a fraud prevention solution to give our merchants extra security and protection, we didn’t have to look far. SEON has a very good reputation in the sector and we really liked the entrepreneurial spirit at the company. It is clear from the success they’ve achieved in such a short space of time that they are working hard to be the best solution out there.”

Tamas Kadar, CEO and Founder at SEON, commented: “Our vision at SEON has always been focused on fighting fraud differently using existing technologies. DevCode Identity recognised this and we’re thrilled to have partnered with them in what is one of our key sectors. The collaboration has been very smooth, both from a technical and business standpoint and we look forward to growing our relationship even more, to help protect merchants across the iGaming sector.”

Related News

- 04:00 am

Avaloq, a leader in digital banking solutions, has launched the Engage app, a solution that allows wealth managers and advisers to engage with clients through social messaging channels such as WhatsApp and WeChat in a secure and compliant manner.

Avaloq Engage has been developed to help financial institutions capitalize on the growth of new sales and service channels and comes at a time when “conversational banking” has become a major trend in wealth advisory and the wider financial services sector. The rollout of Avaloq Engage follows the recent launch of Avaloq Wealth and forms part of a new stand-alone, core-agnostic suite of digital wealth management platforms.

The Engage app allows relationship managers to service clients who use social messaging services in a responsive and timely manner and engage in meaningful conversations in real time through chat, notification and video calls. It also offers news and content provision, semantic language processing and smart “client intent” detection to deliver a higher level of service. For clients, it allows them to interact with their relationship manager using their preferred channels and perform banking transactions in a secure and compliant manner.

Use of digital channels and the demand for new ways of client interaction have accelerated during the COVID-19 pandemic, with engagement levels likely to escalate further as social messaging services become mainstream platforms. WhatsApp usage increased by 51% during COVID-19 lockdown, for instance, and many banks and wealth managers have found it difficult to maintain the high levels of availability and responsiveness required to deliver tailored advice at the time when clients need it most.

In a recent white paper, Rise of Conversational Banking – Transforming Mobile Client Advice, Avaloq outlined the significant opportunities open to financial institutions that cater to the increase in new channels and digital engagement. While servicing clients on their preferred channels, conversational banking still fulfils the expectation of strict compliance and security and allows relationship managers to move from a sporadic exchange with their clients to ongoing interaction. A set of artificial intelligence-based analytic tools and semantic language processing capabilities helps the relationship manager to detect client intentions and answer client questions.

Fabian Grande, Avaloq Group Product Manager, Engage Platform, said: “Avaloq Engage has been launched to allow wealth managers to benefit from socio-behavioural changes as digital channels have become an integral part of the customer journey. Face-to-face advice will remain a central part of wealth advisory but social channels have risen in importance in much the same way as telephone banking did decades ago. Keeping ahead of this fragmented environment, and turning it into a competitive advantage, is at the heart of Avaloq Engage.”

Martin Greweldinger, Avaloq Group Chief Product Officer, said: “The wealth management sector is evolving, and it is evolving fast. Aspects of the market will remain the same, such as offering high levels of client service and competitive products. But digitalization is creating new challenges and opportunities. There are new market entrants, a focus on the new generation of wealth owners, including digital natives, and competition is fierce. Companies need to adapt to remain relevant, outcompete and succeed.”

Launched in July this year, Avaloq Wealth enables banks and wealth managers to provide highly personalized investment advice and bespoke services to their clients while reducing the time spent on preparing and analysing investment proposals. Besides Wealth and Engage, Avaloq is also planning to launch another stand-alone platform, Insight, in the coming months. The new, highly innovative platforms are designed to provide cost-efficient end-to-end digital solutions at a level of simplicity that will pave the way for the democratization of wealth management.

Related News

- 06:00 am

OpenPayd, the API-led Banking-as-a-Service provider, today announced the launch of a new partnership with leading open banking infrastructure provider, Token.io LTD to bring Open Banking to OpenPayd’s customers.

The multi-phase collaboration is part of OpenPayd’s ambition to become the one-stop-shop for its corporate customers’ banking and payments needs, and will in time see the launch of a new Open Banking API from OpenPayd - enabling OpenPayd’s customers to offer Open Banking services to their own customers.

Through the integration with Token’s API platform, OpenPayd’s customers will gain the ability to bring together business and corporate bank accounts from multiple institutions into a single dashboard, where they can manage their balances and seamlessly initiate payouts to beneficiaries. This new feature will cement OpenPayd’s position at the core of its customers’ banking and payments infrastructure.

In the second phase, OpenPayd will introduce its simple and secure Open Banking API, enabling its customers- crypto, financial institutions, remittance companies, lenders, and online marketplaces - to offer banking, payments and Open Banking services directly to their own customers.

End users will be able to initiate payments from any of their bank accounts and transact without ever leaving their familiar provider’s app or web interface whilst ensuring PSD2 compliance at all times. For example, OpenPayd’s crypto exchange clients will be able to offer seamless fiat wallet top-ups, embedding Open Banking payment flows within their apps and allowing users to transfer funds without having to open their online banking service.

OpenPayd is also amongst the first providers to offer SEPA Instant functionality in addition to the already ubiquitous Faster Payments, giving clients and end-users the same instant and integrated experience for both European and UK payments. Instant payments through SEPA Instant and Faster Payments are especially important for Open Banking which requires real-time payment initiation to ensure a frictionless user experience and drive adoption.

OpenPayd Chief Product Officer Adam Bialy said: “Open Banking continues to be the most significant development in fintech. Our partnership with Token marks our commitment to furthering the potential of Open Banking in the B2B space by making its benefits available to corporate customers through a simple and elegant integration. We look forward to launching new enterprise tools and workflows that will make the most of the promise and potential of Open Banking and will maximise its value for our customers and their customers in turn. This is just the first phase of our partnership so stay tuned for more soon”

Todd Clyde, CEO of Token, added: “As open banking use-cases become mainstream, banking and payment platform providers realise they must offer open banking data aggregation and payment capabilities as part of their platform. Token aims to be the platform inside the platform. Specifically, to provide the simplest and fastest way for banking-as-a-service platforms, PSPs, and acquirers to launch open banking propositions which can be white-labeled from Token and delivered through their platforms. We are thrilled to be partnering with OpenPayd and to be playing a part in their overall API-led, Banking-as-a-Service strategy.”

Related News

- 04:00 am

Uncapped, Europe’s first revenue-based finance provider, joined hands with Salt Edge, leader in offering open banking solutions, to verify data from client’s bank accounts at the touch of a button and to shift the funding process into the highest gear.

Uncapped helps entrepreneurs raise crucial growth capital without giving up control of their businesses. Uncapped offers a unique service for the European market by offering start-ups and other companies financial resources with 0% interest. Salt Edge Partner Program helps Uncapped to accelerate the eligibility checks, providing instant access to the required data aggregated from banks. Now the company will be able to speed up the time it takes to verify the applicant’s business performance and boost a lending decision from several days to a few hours. Salt Edge’s global coverage grants Uncapped instant international reach and borderless business availability.

Uncapped has leveraged open banking technology to pot automatisation in their funding processes in Europe. Uncapped clients range from companies in the e-commerce, SaaS, direct-to-consumer, gaming to app development sectors and company’s service takes only 3 minutes to apply. Driven by Salt Edge’s open banking and data enrichment solutions, Uncapped eliminates red-tape and bureaucratic obstacles which businesses usually meet trying to qualify for additional funding. Via data enrichment solution, Uncapped obtains the bank data of their clients in a categorised and normalised format that saves a great deal of time, thus digitalising and speeding-up the verification process.

Piotr Pisarz, CEO and Co-founder at Uncapped, said: "Uncapped provides businesses the possibility to raise significant growth capital without casting off control of their business. Collaborating with Salt Edge, we are able to speed-up the eligibility checks for funding and granting resources to the companies looking for financial boost. We feel special responsibility and honor to support and even bolster companies’ development by providing additional funding via modern technology."

Vasile Valcov, VP at Salt Edge, added: "Open banking brings so many different applications and we are excited to find new ways of helping companies grow. Salt Edge’s ready-to-use solutions help Uncapped simplify and accelerate the processes of business eligibility verification, thus offering the possibility for faster funding to enterprises in Europe. Collaborating with Uncapped we are truly proud to promote open banking solutions and be a part of something so important nowadays."

Related News

- 02:00 am

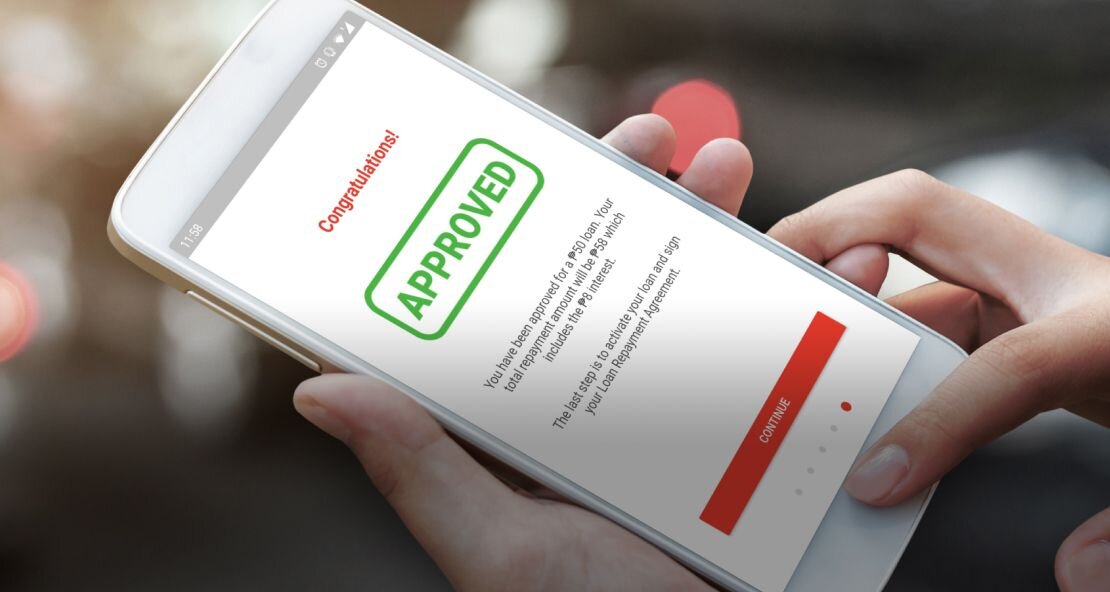

Venio, the mobile application providing "nano-credit" facilities to unbanked consumers in emerging markets accessed via a smartphone, today announces its launch in Mexico. Venio Aplicaciones de Mexico, the Company’s Mexican business arm, has been established to support Venio’s expansion across the high growth emerging market.

Venio’s international rollout has been expedited on the back of an oversubscribed and successful debut in the Philippines. The Venio app has now been translated into Spanish and will be available to consumers across Mexico with a strong foothold in Mexico City, Guadalajara, and Monterrey.

Venio’s aim is to lift a generation of unbanked people into the financial system, help them to achieve financial discipline and a credit footprint in order to open up fair and equal access to useful financial services that wouldn’t otherwise be available to them. The need for these services has become more acute as COVID-19 has caused unprecedented impacts, increasing hardships and difficulties in accessing basic necessities.

The Mexican market is well placed to benefit from Venio’s “nano credit” loan facilities due to underlying demographic trends and high mobile penetration alongside the unmet demand for fintech payments in the population, where rates of financial exclusion remain high. According to the latest report from the World Bank Group, as many as 1.7bn adults are unbanked globally, a figure approaching one fourth of the global population, the majority of these cases are in emerging markets. In Mexico a high proportion of the population is unbanked with 63% of its 126 million inhabitants without access to a bank account [1].

Venio offers its customers responsible loans without the need for upfront collateral, this will revolutionize Mexico’s existing credit culture and improve people’s ability to access financial support with ease. At launch, loans with a value of US$1.20 - US$7.00 (MXP25.00 - MXP150.00) will be available to Venio customers. In Mexico 25.00 Pesos can cover the cost of a meal, basic medicine or transportation to and from work.

Venio’s highly scalable app is easily transferable to the Mexican market as the country’s retail landscape is highly developed and therefore similar to what can be found in the Philippines, where Venio proved its model following a launch earlier this year. Venio will leverage Mexico’s extensive network of local Changarro stores that are akin to the Philippines’ ‘mom-and-pop’ Sari-Sari convenience stores, again placing accessible local community retail at the core of Venio’s redemption network model.

Strategic partnerships for billing and fulfillment have been developed to enable Venio to accept payments and to cement the Company in the Mexican retail marketplace with national retail partners bolstering Venio’s presence. The app’s credit facilities will be redeemable with partners across retail, transportation, and healthcare.

Venio’s local team which is already operational is highly experienced, featuring senior leadership from Venio’s core management team alongside local expertise. Due to Venio’s strong emerging market focus the Company’s strategy is to deepen relationships across Latin America. The company is poised to establish itself as a leading provider of nano credit across multiple emerging markets tackling endemic financial exclusion.

In the post-COVID era financial inclusion must be ensured for the economic development of communities impacted by the pandemic. In its wake there has been an increased demand for both credit facilities and for digital financial solutions that allow for services to be accessed remotely and for contactless transactions. Credit can help users meet needs for emergency cash flow shortages, food, transportation, communication and home expenses.

Warren Platt, Founder & CEO at Venio, commented: “Mexico is a dynamic market where we have established key contacts and excellent partnerships and we now look forward to capitalizing on this to build Venio’s growth and achieve our targets for the Mexican market . Venio’s arrival in Mexico will have an immediate impact on the country’s underbanked where there is growing demand among customers for new products that meet their needs. Venio wants to change how people access financial services by making access to responsible loans easier and fairer, this will offer a whole segment of the population the chance to build a credit profile and take the first step on the journey to financial inclusion. Access to financial products and services opens economic opportunities for individuals and entire communities.”

____________________________