Published

- 04:00 am

EY releases Global Banking Outlook 2021: 'Can banks turn today's disruption into tomorrow's transformation?' which discusses the once-in-a-generation opportunity caused by the pandemic for banks to accelerate transformation in order to grow, cut costs, connect with customers and drive a more sustainable future.

Some key highlights from the report include:

- Creating opportunities from uncertainty: As banks look ahead, the trajectory of the world's recovery will remain critical to their profitability. Subsequent waves of the virus and accompanying lockdowns would require more provisions and a further squeeze on lending books' scenarios which banks should prepare for now. But while COVID has created challenges, this disruption has led to new opportunities; therefore, 2021 must be about seizing the opportunity to transform by accelerating investments in technology and embedding agile and scalable business models.

- Building a more resilient enterprise: Banks can build greater strength across the enterprise by expanding testing for scenarios around cyber, third parties, technology, operations and regulations, and develop new performance metrics. The pandemic has shown that you cannot predict all risks, but that building resilience means building an organization that can respond with agility and flexibility when they occur. Furthermore, banks can expect to be under more intense pressure to prioritize and disclose ESG factors: they will need to identify not just risks, but new opportunities presented by ESG, notably in sustainable finance.

- Rethinking cost management as a foundation of profitability: Banks that consider the crisis as an opportunity for holistic cost reduction across three areas such as operational, structural, and strategic can find strategic ways to align resources to maximize potential. Even in weaker conditions, investment in transformation remains critical.

- Greater customer-centricity through data: Banks must build new revenue streams, find ways to give customers the products and services they want in a post-pandemic world, and deliver these in the ways they demand. This requires financial institutions to consider how to leverage data to hyper-personalize the value they offer to retail, wealth and business customers, embrace the potential of platforms and become more attuned to the changing needs of customers.

To download the report, follow this link.

Related News

- 05:00 am

In a year marked by an unprecedented pandemic and many economic uncertainties, e-commerce in Latin America is expected to grow 8.49% and reach USD 200 billion in market value, becoming one of the fastest-growing markets in the world, according to the study Beyond Borders 2020/2021, released today by the fintech company EBANX.

Based on data from the main players in the sector in a partnership with AMI (Americas Market Intelligence), in addition to consumer surveys and internal EBANX data, Beyond Borders 2020/2021 was dedicated to understanding the impacts of COVID-19 on online purchases in the region and in four Latin American countries: Brazil, Mexico, Colombia, and Chile.

"There is a new Latin America that emerges from the pandemic. Despite the tragic effects on public health and in the countries' economies, millions of consumers were able to access digital goods and services and were financially included with the surge of new products. Beyond Borders outlines this new digital outlook, that can become a path for the economic recovery in the region and for the inclusion of thousands of Latin Americans," says João Del Valle, co-founder and COO of EBANX.

As stated by the study, 52 million people in Latin America will buy online for the first time during the pandemic, increasing the number of online consumers by up to 30% in some countries – a jump that, under normal conditions, would only be achieved by 2022.

"The pandemic has more than doubled the estimate of new online consumers in Latin America," says Juliana Etcheverry, director of Expansion LatAm and Strategic Partnerships at EBANX. Social isolation measures adopted throughout the year, in addition to emergency aids paid by local governments through digital accounts, helped to boost the online market.

New payment methods such as digital wallets and debit cards in Brazil have advanced in the region's e-commerce, reaching up to a 32% growth rate in some countries, as occurred with e-wallets in Chile, according to AMI data.

Nevertheless, cash vouchers, like boleto bancário in Brazil and OXXO in Mexico, represented up to 20% of online purchases in LatAm during the pandemic. These traditional and widespread local payment methods also grew in international e-commerce: in Brazil, for example, 68% of consumers mentioned boleto as their preferred payment method for cross-border purchases, according to the survey conducted with 3,280 consumers by Beyond Borders 2020/2021.

Cross-border

When it comes to international purchases, price has become even more decisive for Latin American consumers, who have been facing an economic crisis with record unemployment. Paying cheaper is now the main driver for buying on international websites, according to consumers consulted by Beyond Borders 2020/2021.

Even with the devaluation of local currencies against the dollar, which negatively impacted international retailers along 2020, Latin Americans increased the consumption of digital products and subscription services offered by global companies – which grew up to 63%.

The internationalization of e-commerce in Latin America is also reflected in some of the most trusted brands by consumers. Netflix, SHEIN, Amazon, AliExpress, and Spotify are some of the most mentioned by those interviewed by Beyond Borders 2020/2021.

When considering online visitor traffic, the main players in e-commerce in Latin America are Mercado Libre, Americanas, OLX and Amazon, followed by Brazilians Magazine Luiza and Casas Bahia.

Brazil

The largest market in Latin America, Brazil saw a 25% jump in the number of online consumers in 2020, according to figures collected by Beyond Borders 2020/2021. As a result, the e-commerce market in the country is expected to grow 8.3% this year, and accelerate 19% in 2021, reaching a total value of USD 134 billion.

When it comes to payment methods, the use of debit cards in e-commerce grew 16% during the pandemic, driven by a new authentication protocol and the use of emergency aid for online purchases. Digital services such as streaming and online games have increased by 42%, and mobile shopping has reached record levels: 85% of consumers surveyed by Beyond Borders 2020/2021 said they have already purchased on smartphones.

Mercado Livre, Americanas and OLX are the main e-commerce players in Brazil according to online traffic data; the American e-commerce titan Amazon appears in fourth place, followed by Magazine Luiza and Casas Bahia.

Mexico

A market where mobile purchases overpassed the desktop ones, Mexico is expected to finish 2020 with 31% more online consumers, the largest increase in the region. The Mexican e-commerce market should grow 12% this year and jump to 25% in 2021. One of the main drivers is the consumption of digital products and services, which grew by 37%.

International purchases account for almost 20% of the market, mainly due to the proximity to the United States. International websites have the preference of 51% of consumers interviewed by Beyond Borders 2020/2021, dividing the attention with national brands. This is also demonstrated by online traffic: Mercado Libre, Amazon and Coppel are the main players in e-commerce in Mexico in terms of online visitors.

As for the form of payment, the OXXO voucher stands out, being the third most used method in the country, just behind credit and debit cards.

Colombia

One of the fastest-growing e-commerce markets in Latin America, Colombia saw e-wallet payments jump 20% this year, according to AMI data. Mobile purchases match those made by the desktop, and the e-commerce market is expected to double in size by 2023.

The penetration of streaming services is noteworthy: 80% of consumers consulted by Beyond Borders 2020/2021 in the country had subscriptions, a much higher percentage than in other markets. The consumption of digital products and services in Colombia grew 63% during the pandemic, according to AMI data.

Mercado Libre, Amazon and Falabella appear as the main e-commerce players in the country, according to online traffic data.

Chile

Despite being the smallest market among the surveyed countries, Chile is expected to see the volume of online purchases double in size by 2023. The country's population is more banked than in the rest of Latin America, and cards represent around 85% of payments in online commerce.

At the same time, mobile shopping, although still less significant than in other countries, has shown very high adherence in recent months: more than 80% of Chileans interviewed by Beyond Borders 2020/2021 used some app to make purchases during the pandemic.

Chilean Falabella, followed by Mercado Libre and Yapo, appears as the main e-commerce player in the country, according to online traffic data.

Related News

- 03:00 am

The European Women Payments Network (EWPN) has launched a new online community portal to enhance the communications for and between its members with messaging, forums and interest groups. Supporting collaboration between members, the new portal also features an events calendar, access to EWPN programmes and learning opportunities, and will include posts for job listings in the near future.

EWPN launched in 2015 to champion diversity and inclusion in fintech & payments and now reaches over 350,000 individuals and organisations. As the first and only pan-European organisation for women in FinTech & Payments, EWPN also runs many workshops and networking events throughout the year, as well as a mentorship scheme.

The new portal allows members to connect digitally with any other EWPN member, find and be a source of support for other women in FinTech and Payments and actively participate in the diversity, equity and inclusion (DEI) movement to help change the industry today and for future generations.

Martha Mghendi-Fisher, Founder of EWPN, commented: “EWPN is dedicated to building a community for women in the FinTech and Payments industry across Europe. Our membership is growing rapidly as more people recognise the significant institutionalised problems within the industry – not just gender discrimination, but discrimination based on age, race, sexuality, ethnicity, disability, religion and political beliefs as well.

“It is our hope, and the objective of EWPN, that in bringing these issues to the fore, we can raise awareness and begin to make real change for the sake of future generations. This portal is an important step in that journey. It should help us to all get involved, spread the word, and get even more people taking an active role in creating a stronger, more diverse, inclusive, creative, innovative and valuable financial services industry.”

Click here to find out more, and to register for an EWPN portal account and help bring about change.

Related News

- 08:00 am

Finzly, a fintech provider of modern banking applications for foreign exchange, trade finance, payments and digital account opening, announces today that Texas First Bank has selected Finzly’s contactless digital account opening (DAO) solution. The fully automated solution will equip Texas First with greater flexibility and faster integration to enhance back-office account opening processes, positioning the bank to offer a more seamless, modern experience to customers.

Through this partnership, Finzly will enable Texas First to fully automate the account opening process, while eliminating manual processing and driving operational savings. Because it uses core-agnostic open APIs, Finzly’s DAO solution integrates with existing solutions quickly, providing the bank with greater levels of customer-facing flexibility to help reduce application abandonment rates. Not only will Texas First have continuous access to the best, most up-to-date offerings available on the market, but Finzly also supports the bank in combatting the latest fraud threats using AI-enabled customer ID verification and “selfie” validation, paired with out-of-wallet questions when warranted.

“Finzly’s DAO solution will help us stay true to our mission of ‘Helping Texans Build Texas’ by providing individuals and businesses with a fully online process to open their accounts,” said Chris Doyle, president, Texas First Bank. “By meeting customers where they are, with a solution that’s quick, secure, and seamless, we look forward to making banking with us even easier so our customers can focus on the things they do every day that help our local communities flourish.”

“Texas First has built its reputation on dedication to providing the best solutions and quality of service to its customers,” said Booshan Rengachari, founder and CEO, Finzly. “With the DAO solution in place, Texas First will be able to leverage Finzly’s open APIs, pre-integrated partners, and natively-developed apps to simplify the account opening process, drawing on more flexibility, easy implementation and full automation capabilities, without compromising security or compliance.”

Related News

- 01:00 am

Marlowe, the UK leader in specialist services, which assure safety and compliance, have taken strategic steps towards a digitally enhanced future by collaborating with HAYNE Solutions, a leading consultancy, to implement CCH Tagetik, a leading CPM solution, into their business.

Marlowe’s existing challenge is to automate their consolidation process and reduce the time taken during forecasting and planning cycles. In addition, a need for a solution to quickly integrate acquisitions led to their search for a digital solution which would help move their business forward. They knew that by investing in the right CPM solution, they would be able to meet their acquisition integration and automation challenges and more, setting up their business for the digital future whilst continuing their rapid growth.

CCH Tagetik’s finance transformation platform was the obvious choice for Marlowe, due to the way it will allow them to give freedom to their different divisions to create their own detailed operational planning and reporting processes, each combined into a harmonised suite of group reports. This gives them a more detailed and accurate consolidation, reporting and insight into their business, in a faster way with greater agility to forecast and scenario plan as required.

“We are delighted to welcome Marlowe Plc as a HAYNE customer,” said Neil Whitmore, CEO, HAYNE Solutions.

James McEntee, managing director at CCH Tagetik UK, commented: “We are pleased to see a fast-growing, forward-looking business such as Marlowe Plc selecting CCH Tagetik and HAYNE Solutions to underpin their financial performance management. Like many acquisitive organisations, Marlowe’s increasing financial complexity is a perfect match for the flexibility of the CCH Tagetik Platform.”

The final part of the puzzle was choosing the right consultancy and implementation partner, enter HAYNE Solutions. HAYNE, as a leading UK consultancy that deliver best-in-class performance management and business intelligence solutions, were the perfect partner for Marlowe.

“Upon meeting HAYNE, we immediately felt the team understood our organisation and our objectives. Neil and his team have invested in what we are aiming to achieve, we aren’t just another customer, and this isn’t just another project for them,” said Matthew Allen, group financial controller at Marlowe.

HAYNE Solutions are a leading UK financial performance management consultancy with over 50 years’ experience of delivering consolidation and reporting solutions to all types and sizes of organisation. They provide the very best services and solutions to all their clients, ensuring that projects are run on-time, within budget and which deliver ROI.

Related News

- 09:00 am

Avelacom, the high-performance global connectivity and IT infrastructure provider for the financial services industry, is adding the Brazilian Stock Exchange (B3)’s real-time market data to its service portfolio. This will provide investment banks and low latency trading firms with B3’s native market data feeds to markets in North America, EMEA and APAC via Avelacom’s 80+ global points of presence (PoPs). Firms will be able to improve price discovery and arbitrage strategies across all derivatives, as well as access B3 markets for trial purposes.

This initiative reflects the strengthening demand to trade new markets, with Brazil ranked third (after China and India) among the most attractive markets that firms intend to engage with over the next year (according to the Acuiti’s survey commissioned by Avelacom).

“Expanding B3’s global reach is definitely a top priority,” said Alexandre Jahnecke, Superintendent of Technology Services at B3. “The combined services of B3 and Avelacom’s infrastructure will surely leverage B3’s internationalization plans, creating a better quality experience for our clients across key markets for market data, DMA and other trading and, eventually, post trade services.”

“Brazil is one of the most commonly cited countries in which financial institutions are interested in starting operations over the next 12 months. Adding low latency access to the B3’s data centre for all key financial markets, combined with the existing hosting capabilities we provide in Sao Paulo, and the most direct fiber-optic routes between global exchanges all support the integration of Brazil’s markets for global traders,” said Aleksey Larichev, CEO of Avelacom.

Related News

- 09:00 am

Global analytics software provider FICO today released its analysis of UK card trends for October 2020, which may ring some alarm bells for lenders ahead of the traditional festive spending season.

“Our new data paints quite a complex picture of consumer spending and financial management,” explained Stacey West, principal consultant for FICO® Advisors. “Certainly, card spend was down compared to September, which may be a reflection of the regional tier system that came into place during the month. But overall spend was only 4.5 percent lower than October 2019. That seems to suggest that consumers may have been starting to gain financial confidence, perhaps relying on payment holidays and furlough payments to fund their purchases.

“In the run up to Christmas it is going to be a difficult juggling act for credit card issuers to provide their customers with a means to spend while trying to prevent their balance building to unsustainable levels. The recent increase in balances and consumers missing payments remains a concern because of the vast amount of credit available to many consumers who may not be able to afford to repay it if used.”

Average credit card limits continued to fall by a further £22 to £5,382 and as issuers start to open their doors to new credit applications, this limit may continue to drop. The highest proportion of accounts, 28.9 percent, remain in the limit range of £5,001 to £10,000, with an average balance of only £1,250. However, with the percentage of the card limit utilised on active accounts reaching another over two-year low, down 10.2 percent annually, this leaves 72.4 percent of available credit unused, which may be a cause for concern.

“With more than £90 billion in unused credit, there is scope for high spending, with the added potential of longer opening hours to compensate for the second lockdown,” commented West. “For those consumers currently relying on payment holidays or furlough payments, extra spending may not really be affordable. Will some be able to resist the combination of the pressure of Christmas and the available credit?

“With an increasing percentage of workers being furloughed in November (although below the June 2020 levels) and higher unemployment expected next year, combined with Christmas spending, it is anticipated that debt levels will increase with a proportion unsustainable. Issuers need to ensure that sufficient checks are in place to help reduce unaffordable balance build for those impacted by COVID-19 or displaying signs of financial stress. They should also be proactively contacting their customers to discuss their financial position ahead of missing payments, and expanding the range of treatments available for customers who fall behind in their payments. Consumers can also, of course, proactively reach out to their card providers informing them of any existing or anticipated future issues.”

Spend on UK cards only 4.5 per cent lower than October 2019

Tracking the pattern of spending through 2020, average spending on UK credit cards fell by £21 in October to £619. Average spend is now only 4.5 percent lower than a year ago.

Monthly payments continue to increase

The percentage of payments to balance continued to increase, although the growth rate is slowing; it is now 5.5 percent above October 2019 and is higher than it has been for at least two years. This is influenced by accounts that have been opened for over a year. The percentage of cardholders paying the full balance increased and is now 9.1 percent higher than a year ago.

“The higher proportion of payments to balance remains a positive sign,” added West. “Lower average balances (down 7.9 percent year on year) are contributing and some consumers may be continuing with payments because of the government financial support.

“Another heartening factor is the percentage of accounts with a direct debit, which has been increasing for three months, with accounts open 1 to 5 years reaching over a two-year high. However, accounts up to 1 year open have seen the percentage steadily dropping since April, down 15 percent. This suggests there are opportunities to promote direct debit at the account opening stage, which will help prevent ‘lazy payers’ being faced with late payment fees if at least the minimum payment is covered automatically each month.”

Increase in missed payments

The one missed payment rates started to increase again in October — both the number of accounts with one missed payment and the percentage of 1 missed balance to total balance, the latter with a higher rate. However, both remain lower than a year ago, although the average balance on accounts missing one payment is only £21 lower than October 2019.

Accounts booked up to 1 year ago had the highest average balance seen for over two years. The percentage of accounts and balance with two missed payments remained stable month on month. However, the average balance is £202 higher than a year ago. For three missed payments the annual increase rise is £401.

West added: “Whilst the growth in accounts missing payments is only marginally increasing and the percentage of delinquent balances is growing more noticeably, they are still much lower than we saw in October 2019. It is the average balance of accounts that are missing payments that is a concern, as they exceed what we saw this time last year.

“Collection teams could ensure that higher-balance accounts are worked as a priority and acquisition teams should make sure that adequate checks are in place to ensure appropriate initial limits are set. Nine months of account performance data during the pandemic is now available to help shape future strategic approaches and decisions. There is, however, still uncertainty regarding how much the government support is propping up some consumers’ ability to pay and what the impact of Christmas will be on finances in general.”

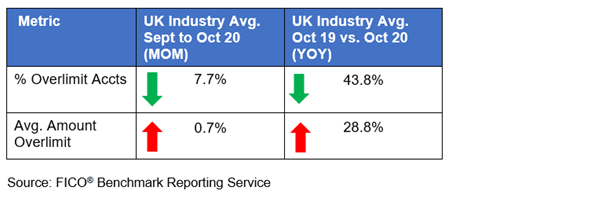

Accounts over their limit decrease, with the average growing

The proportion of accounts exceeding their limit continued to decrease in October and is now 44.8 percent lower year-on-year. The average amount over limit increased marginally month on month and is still 28.8 percent higher than October 2019.

“Issuers that stopped unsolicited card limit increases earlier in the year because of COVID-19 are starting to reintroduce this service,” West adds. “However, consumers may find it more difficult to qualify, and if they do qualify the extra offered credit is lower than pre-pandemic, as issuers show more caution in these uncertain times.”

Drop in spend impacts cash as it starts to decrease again

The drop in overall spend has result in the percentage of consumers using credit cards to get cash starting to decrease again, and levels are 53.9 percent lower than a year ago. This has resulted in a 2.1 percent decrease in cash as a percentage of total spend. It is anticipated that cash usage may not reach the levels seen pre COVID-19 as consumers get used to using less cash.

These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service. The data sample comes from client reports generated by the FICO® TRIAD® Customer Manager solution in use by some 80 percent of UK card issuers. Issuers wishing to subscribe to this service can contact staceywest@fico.com.

Related News

- 08:00 am

Cognizant (Nasdaq: CTSH) today announced that Ursula Morgenstern has joined the company as its president of Global Growth Markets (GGM) and a member of Cognizant’s Executive Committee effective December 14, 2020. She is based in London.

Morgenstern joins Cognizant from Atos, where she previously served as head of Central Europe. Her career at Atos spanned more than 16 years, where she held several roles, including CEO of Germany and UK/Ireland, as well as leading the Business & Platform Solutions global technology divisions.

At Cognizant, Morgenstern will focus on diversifying the company’s revenue mix across Europe and Asia Pacific by accelerating digital within Cognizant’s priority areas of digital engineering, AI and analytics, cloud, and IoT. She will also focus on investing in strong local leadership and talent, while extending the delivery footprint to access the best talent globally to meet client demand.

“In the knowledge-based business, investing for growth starts with attracting, developing, and retaining outstanding talent,” said Brian Humphries, CEO, Cognizant. “We are hiring the best, ensuring that Cognizant is operating with a harmonious, high-performing team of deeply experienced, client-centric leaders who share my commitment to getting Cognizant back on a growth trajectory. I am delighted to welcome Ursula, another exceptional leader, as our new head of Global Growth Markets.”

“I am extremely honoured to be joining Cognizant at such an exciting time,” said Morgenstern. “Global growth markets will be the powerhouse behind the next stage in Cognizant’s trajectory. The team is extremely driven and totally committed to helping clients on their digital journeys, engineering modern businesses that improve everyday life. I am also very keen to embrace diversity and inclusion in the workplace and mentor women at Cognizant to fulfill their potential.”

Morgenstern is a passionate supporter of bridging the digital skills gap and assisting women to grow their careers in the technology sector.

Related News

- 06:00 am

Horizon Software, leading provider of electronic trading solutions and algorithmic technology for the global capital markets, today announces that it has successfully completed its System and Organization Controls (SOC) for Services Organizations (SOC 2®)Type 1 examination as of 15 November 2020 for their Managed Services with trusted third-party security and compliance firm, A-LIGN ASSURANCE (A-LIGN).

Following the launch of its managed services offer, Horizon immediately began exploring a SOC 2 examination, designed by the American Institute of Certified Public Accountants. Financial institutions are increasingly concerned with the operational risks of outsourced hosting and data services, especially with the added risks of working from home. The success of this examination demonstrates that Horizon Software has designed their controls to provide reasonable assurance to customers that its services commitments and systems requirements were achieved throughout their entire workflows, acknowledging them as a reliable and trusted partner.

This marks the first in two examinations. Now Horizon Software has secured Type 1, it has set its eyes on achieving Type 2 by June 2021, for which A-LIGN will review the design and operating effectiveness of Horizon Software’s controls around infrastructure, software, people, data, processes and procedures.

Francis Leclerc, Head of Managed Services at Horizon Software, said: “This is a key milestone in our roadmap. While operating managed services, we take the full responsibility of directly handling the data of our clients. SOC 2 was the obvious approach to reach and comply with the highest standards of quality and security. And it has greater recognition in some of our key growth markets, such as APAC and the US.”

Sylvain Thieullent, CEO of Horizon Software, added: “Security has always been something we take very seriously. Our company is made of 75% technology professionals, so it’s always had a lot of importance placed on it internally, but we wanted to show that ongoing dedication to the market as quickly as possible. The team has proactively taken the steps to secure this report and now we can look to achieve Type 2.”

Huw Pegler, VP of EMEA and Asia Pacific at A-LIGN, said: “SOC 2 is a challenging audit for many software providers. Its increasing recognition means it is an ever more popular standard in Europe, particularly for firms seeking to grow their business in the US. As a trusted third-party security and compliance firm, A-LIGN scrutinises client data processes and procedures, governance on internal controls and security posture. The success of Horizon Software’s SOC 2 Type 1 examination reiterates its commitment to their customers in international information security management standards to mitigate cybersecurity risks.”

Related News

- 04:00 am

Trulioo, the leading global identity verification provider, today announced a partnership with True Medical, a UK-based digital healthcare provider committed to offering patients easily accessible quality healthcare combined with outstanding customer service and ongoing support, to deliver real-time identity verification during customer onboarding as well as meet regulatory requirements in the UK. With access to the world’s largest marketplace of independent data sources through Trulioo GlobalGateway, True Medical can now verify and offer quick and convenient digital onboarding to its UK users while ensuring it is compliant with local health regulations.

Trulioo enables True Medical to take a risk-based approach, which means that depending on the information that the user provides during sign-up, True Medical will determine whether they need more details or if what is provided at first will suffice. Trulioo GlobalGateway helps customers meet requirements related to the countries’ regulations around KYC/AML compliance.

“We are very excited to partner with True Medical and provide our innovative solution to help this startup scale and offer a seamless and convenient onboarding process for those in need of medical services in the UK. As we have witnessed, this pandemic changed the way we do business and, above all, the way we live our lives, so now more than ever, services like True Medical are essential for the population,” said Steve Munford, CEO of Trulioo.

Through its marketplace of global data sources, Trulioo GlobalGateway will allow True Medical to run independent checks of any customer when they’re onboarding in a way that meets any local regulation while providing a seamless, fast, and simple onboarding process.