Published

- 02:00 am

Billhop (https://billhop.com/fi/) has announced a partnership with Visa Finland and OmaSäästöpankkiOyj (OmaSp) to help Finnish businesses improve their cash flow and close their liquidity gap.

As part of the collaboration, OmaSp has released a new Visa business credit card product, the first of its kind in Finland, giving OmaSp customers access to a variety of benefits, including access to Billhop’s service at a preferential rate when paying with an OmaSp card.

Following the launch of OmaSp’s commercial card, and the first of its kind in Finland, in November 2020, its cardholders are now able to improve their working capital by paying their suppliers via Billhop. When paying through Billhop, the actual cash flow effect does not occur until the payment of the card statement is due, thereby significantly strengthening the liquidity cushion of the company. This has not previously been possible for Finnish businesses and can be especially important in today’s business climate.

This announcement follows Billhop’s collaboration with Visa in Ireland earlier this year and a period of significant growth in the commercial space. In the midst of the pandemic, commercial card issuers have seen a drastic decline in transaction volumes due to the absence of travel and entertainment spend which traditionally make up the bulk of transactions on commercial cards.

Billhop, which has already launched in several European markets, is the payment service which enables businesses and individuals to pay invoices with credit cards regardless if the end beneficiary accepts card payments or not. No onboarding of the end beneficiary is required, allowing Billhop to enable 100% of supplier payments on card instantaneously. In practical terms, this means that Finnish businesses from now on can pay virtually all invoices using their existing credit card.

RiikkaSalminen, Country Manager for Visa Finland, Sweden and the Baltics, is pleased with the long-term cooperation with Billhop. Riikka adds: “I am pleased to launch our cooperation with Billhop with the help of OmaSäästöpankki. This launch is of a special significance to us, as the new OmaSp Visa Business Credit card is the very first of its kind in Finland.”

Billhop's CEO Sebastian Andreescu said: "The cooperation with OmaSp marks an important step in commercial issuer cooperation. We see the interest for Billhop’s service increase among issuers as they are experiencing significant reduction in overall travel and entertainment volumes as a consequence of Covid-19. The foremost obstacle in the B2B space is low card acceptance and Billhop instantly removes this hurdle and makes all supplier payments card-accessible."

Billhop's CFO IngemarSjögren is enthusiastic about working with OmaSäästöpankki and launching the product in Finland: "Billhop’s service will be available to OmaSäästöpankki's customers at a much lower price, which will help thousands of Finnish companies improve their cash flow and close their liquidity gap. Billhop already has more than 50,000 satisfied customers across Europe."

Related News

- 01:00 am

Maintaining high levels of ATM uptime is critical, and even more so for deployers that are rationalising their fleets. The right software solutions can make the world of difference.

Almost all ATMs are monitored remotely

RBR’s Global ATM Market and Forecasts to 2025 shows that at the end of 2019, the vast majority of ATMs were monitored remotely, with a high proportion also covered by cash management software.

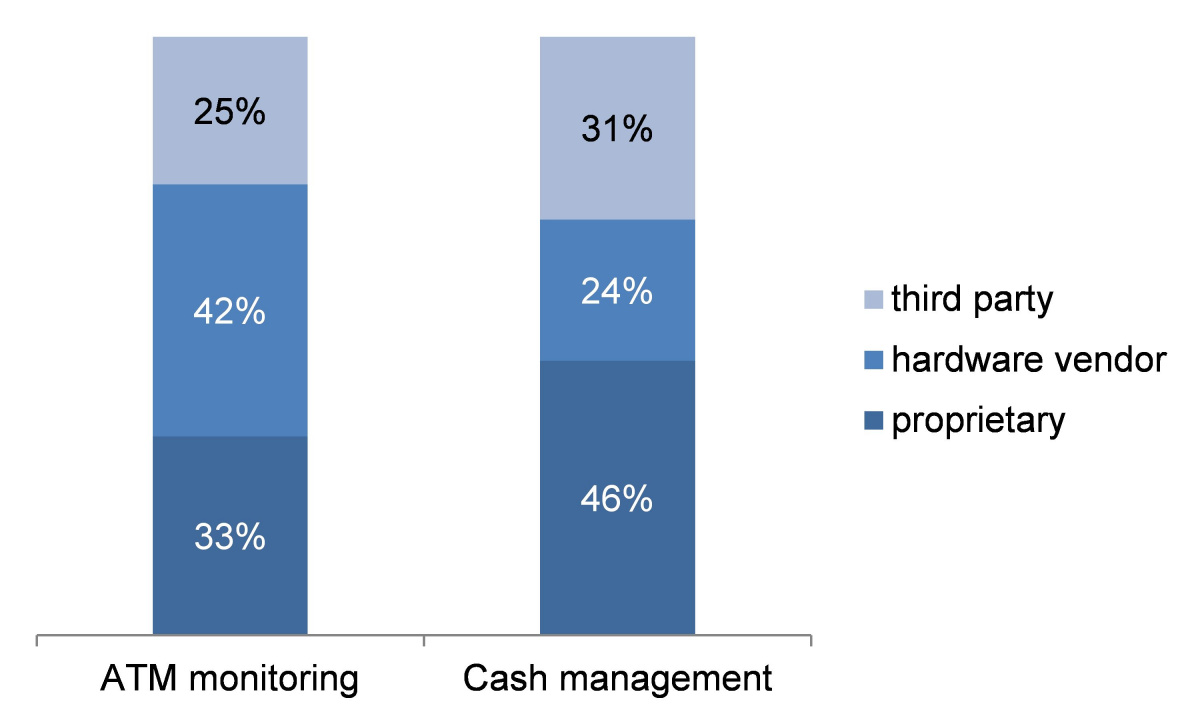

The number of ATMs installed worldwide has been falling since 2018, and is set to continue decreasing, making a high quality of service at the remaining machines crucial. To optimise fleet performance, operators use remote monitoring software to track status and quickly identify problems. Banks and independent ATM deployers (IADs) tend to purchase this softwarefrom either the ATM hardware manufacturer or a third-party supplier, although some deployers, mainly banks, have developed proprietary, in-house, monitoring solutions.

Most of the largest Chinese banks have developed their own ATM monitoring solutions

Two countries that demonstrate alternative approaches to this issue are Malaysia and China. In Malaysia, virtually all ATMs use vendor-supplied monitoring software – most deployers have mixed fleets of hardware, but then use a single software supplier for the whole estate. By contrast, over 90% of Chinese ATMs are monitored by proprietary solutions.

Cash management software helps banks avoid ATMs running out of cash

As well as maintaining their ATMs, it is of course important that deployers avoid them running out of cash. Withdrawals have dropped in 2020 as COVID-19 has hit ATM availability and consumer use of cash, but RBR forecasts that usage will pick up again over the next few years. Customers still require cash, and will expect quick and convenient access to the money in their accounts. The research shows that two thirds of ATMs are covered by cash management software, enabling operators to proactively plan when they will need refilling. Both banks and IADs most commonly use proprietary cash management solutions. The share of proprietary cash management software is highest in Spain at 89%, while in Sweden it is just 19% as all but one deployer use the same third-party solution.

Rowan Berridge, who led RBR’s Global ATM Market and Forecasts to 2025 research, commented: “Ensuring access to cash and other services,in the face of declining ATM and branch numbers in many countries,poses a major conundrum for the financial industry right now. While customers only see the outside of the ATM, what is inside is arguably much more important, and software will play a vital role in meeting the challenges that lie ahead.”

Related News

- 06:00 am

Together with another 11 international companies and organisations, CaixaBank has initiated a new benchmark project focusing on the protection of privacy and personal data as outlined within the framework of the Horizon 2020 programme, funded by the European Union. Together with Tenforce, Deutsche Telekom, Technische Universität Berlín, Athens Technology Center, Ipsos, Kaspersky, Vlaamse overheid, Cini, ULD, Institute Mihailo Pupin and E seniors, CaixaBank has launched the research consortium TRAPEZE (Transparency, Privacy and Security for European Citizens), with the goal of developing new tools that facilitate the administration and protection of citizens' data security and privacy.

More specifically, TRAPEZE will work to create a platform to register user consent for the use of their data and adjust user policies in real time, and in a fully transparent way for the end user, in response to changing circumstances.

For CaixaBank, its customers' security and protection is paramount. The entity has a team of professionals specialised in cybersecurity, working to combat threats from cyber attackers. The company seeks to protect the operations and financial transactions of customers and shareholders to ensure that they take place in the most secure environment possible, preventing external threats that can jeopardise confidentiality and privacy.

CaixaBank, the most active European bank in R&D linked to Horizon 2020

CaixaBank has formed part of a total of five international research consortia in the framework of Horizon 2020, the European Union's largest research and innovation programme, with almost €80 billion of available funding over seven years (2014-2020).

The bank, chaired by Jordi Gual and led by Gonzalo Gortázar, has received the most funding among European banks within the H2020 European Commission programme for research and innovation, being assigned a total of €1.5 million.

Besides TRAPEZE, CaixaBank is currently participating in the consortia ENSURESEC, CONCORDIA and I-BiDaaS and it was part of EU-SEC, which was completed last year. All of these projects share the philosophy of bringing research and innovation closer to the business environment in a framework of international collaboration featuring different organisations from European countries.

The goal of the ENSURESEC project is to develop a solution to protect e-commerce transactions against physical and cyber threats. CaixaBank is participating in this project together with another 21 international companies and organisations. This programme, launched in 2020, is expected to last for two years. During this period, the member companies will design different tools to guarantee e-commerce security, protect transactions and enable constant monitoring and a real-time response.

CaixaBank is also part of the CONCORDIA consortium, which tackles the current fragmentation with regards to cybersecurity at the European level, through the creation of a pan-European cybersecurity centre grouping various benchmarking entities in this area. This project was launched in January 2019 and is planned to be completed in December 2022.

Furthermore, in 2018 I-BiDaaS was launched, a project which will be completed by 2020 and which is focused on the development of a platform to facilitate the use of big data technologies by end users, reducing costs and preserving the security and privacy of in-cloud data. CaixaBank, in addition to other companies, is carrying out a pilot project to demonstrate the platform's benefits, which makes use of the advanced computer science expertise of the project's members, such as Barcelona Supercomputing Center and IBM Research Haifa.

Lastly, together with eight European institutions and companies, the entity has developed the EU-SEC (European Security Certification Framework). The project focused on creating a European framework for the ongoing certification of security in cloud environments.

CaixaBank, a benchmark in the financial sector

CaixaBank's participation in these projects establishes the position of the company as a leader in R&D for the financial sector, especially focusing on information security. The bank's 2019-2021 Strategic Plan sets an ambitious target of accelerating the digital transformation so as to help the Group become more customer oriented and adapt better to new customer habits and behaviours.

Furthermore, being part of these international consortia provides the entity with greater coordination in the ongoing improvement of its cybersecurity environment and of the financial sector in general.

Technology and digitalisation are key in CaixaBank's business model, which has the largest base of digital customers in Spain (7 million). In addition, CaixaBank has developed landmark technology projects in the sector, such as the creation of the first ATMs that allow users to withdraw cash through facial recognition and without having to enter their PIN – a project chosen as one of the Technological Projects of the Year at the Tech Project Awards 2019 by The Banker magazine.

Thanks to its digital transformation strategy, CaixaBank has become one of the highest rated banks in the world for the quality of its digital products and services, with accolades such as being named World's Best Consumer Bank 2020 and Best Bank in Spain 2020 by the US magazine Global Finance. These awards are in addition to those obtained in the digital banking sphere, such as Best digital bank in consumer banking in Spain 2020, and in the private banking sphere, in which CaixaBank has been named Best Private Bank in Europe for its digital culture and vision 2020.

Related News

- 07:00 am

TietoEVRY and the Eika Alliance, one of Norway`s largest banks and insurance companies, have entered into a comprehensive strategic agreement for the delivery of next-generation core banking and payment solutions, including card services and digital channels. With these deliverables TietoEVRY will ensure that the Eika banks gain high-quality digital solutions that attend to compliance and security at the same time as innovative and future-oriented banking solutions.

The more than 50 local banks in the Eika Alliance provide a broad spectrum of banking and insurance products to approximately 700,000 customers in the Norwegian market. Eika’s vision is to strengthen local banks by being Norway’s most attractive partner for independent banks. Its strategic collaboration with TietoEVRY will ensure that the Eika banks have competitive and modern solutions in line with this vision.

“Our customers have ever-greater expectations of our digital solutions and services. We are therefore pleased to be able to announce that we have entered into a strategic partnership with TietoEVRY. The agreement will strengthen the Eika banks’ long-term competitiveness through significant cost efficiencies, stronger development capabilities, and greater strategic flexibility. This will strengthen our opportunities in terms of continuing to be a positive driving force for growth and progress for our customers, employees and local communities,” comments Hans Kristian Glesne, the Chair of the Board of Eika and the CEO of Skue Sparebank.

“The fact that the local banks in the Eika Alliance haven chosen TietoEVRY as their strategic partner for next-generation digital banking services represents a significant vote of confidence in our company. The agreement shows that our solutions are adapted to the requirements of the digital bank of the future and the associated need for extensive user friendliness and quality delivered both securely and efficiently. The agreement provides us with a good basis for further growth in the years ahead,” comments Christian Pedersen, Managing Partner for TietoEVRY Norway.

Prior to signing this agreement, the parties completed a thorough preliminary study based on an efficient framework that will provide the banks with a controlled migration to a new platform. 53 alliance banks that took part in the project have signed up to the new agreement. The transition to the new solution will take place step-by-step, with all the Eika banks due to be operating on the new platform by mid-2023.

“This agreement will help strengthen the Eika Alliance’s competitiveness, and its local banks will gain customer-centric solutions that will make them even closer and more relevant to their customers. Our ambition as a leading provider in the Nordic market is to help the Eika banks to make the most of the opportunities associated with open, modular and scalable banking software, with services and connected ecosystems,” comments Christian Segersven, Head of Financial Services Solutions at TietoEVRY.

Related News

- 04:00 am

The fourth round of Raiffeisen Bank International’s (RBI) Partnership Program Elevator Lab took place virtually in the second half of 2020. Elevator Lab, selected as one of the “Best Financial Innovation Labs in 2020” by the renowned magazine Global Finance and nominated for the “Best Accelerator or Incubator Program 2020” award by the Central European Startup Awards, aims at finding innovative fintech solutions and building mutually beneficial partnerships between RBI and fintechs.

This year, RBI’s subsidiary banks played an even more active role, setting the search topics, conducting the scouting and choosing the most promising solutions to be tested locally, aligned with the head office in Vienna. On top of that, some subsidiary banks continued to organize Elevator Lab Challenges for later-stage fintechs and Elevator Lab Bootcamps for early-stage startups in their home markets.

Three tracks of the global Elevator Lab Programs were organized in 2020, with four selected winners. These fintechs, together with mentors and experts from RBI’s subsidiary banks and head office, are working on developing Proofs of Concepts (PoC). In the second quarter of 2021, all of the fintech solutions tested in the PoC phase, will be presented at a Demo Day and subsequently evaluated for a potential partnership.

Advanced Analytics and Loyalty Solutions

Co-hosted by Raiffeisen Bank in Romania and Raiffeisenbank in Bulgaria, the “Advanced Analytics and Loyalty Solutions” track ended with two winners: The jury from the Romanian subsidiary bank selected iFactor (https://ifactor-online.com), a fintech which is developing an engine used for monitoring abnormal behavior and fraud detection during the factoring process. This technology will enable lenders to get a better understanding of both default and fraud credit risk of the applicant sellers and debtors and thus minimize risks in factoring.

The Bulgarian subsidiary bank chose Synerise (https://synerise.com), which focuses on online customer experience and growth development in e-commerce. The aim of this cooperation will be to generate specific predictive sales signals for corporate customers and to analyze anonymous customer behavior.

Value added Services for Large Corporates

Within the "Value added Services for Large Corporates" track, RBI´s head office searched for innovative fintech solutions to expand its offerings to business customers through new value-added services in the fields of cash, treasury, expense and risk management. The jury chose FinLync (https://www.finlync.com) which strives to develop white-label applications for real-time cash management, trade finance reporting and exchange rates integration, directly embedded in the corporate’s Enterprise Resource Planning (ERP) environment, thus enabling RBI to communicate end-to-end with corporate customers.

Bank as a Platform

The goal of RBI’s Slovakian subsidiary Tatra Banka’s “Bank as a Platform” track was to find a solution for building a digital platform that will connect Tatra Banka’s clients with third-party solutions. The selected fintech Zentity (https://zentity.com) offers a platform and products which allow customers to use multiple services of third-party merchants without downloading separate apps, with the goal of creating a unified experience in one app.

“The possible use cases we have discussed so far with the selected fintechs from this year’s Elevator Lab Program are very promising and make me look forward to the PoCs on which we are now working together. Furthermore, it was very encouraging to see the active participation of our subsidiary banks in this program, especially in the face of the challenging circumstances in 2020. I am very pleased that 10 out of 13 subsidiary banks organized initiatives to foster the fintech ecosystems and advance innovation in CEE,“ says Christian Wolf, Head of Strategic Partnerships & Ecosystems at RBI.

More details can be found under www.elevator-lab.com.

Related News

- 04:00 am

The withdrawal of major banks from trade finance and especially in the SME space is creating extraordinary challenges and opportunities, according to Finverity, the UK cross-border supply chain finance platform. Finverity today announced a step change collaboration with the Financial Services Regulatory Authority of Abu Dhabi Global Market (ADGM) - Abu Dhabi’s international financial centre. The collaboration will develop a proof-of-concept to improve the transparency and trustworthiness of UAE SMEs’ credit profiles to enable faster access and on better credit terms to working capital finance.

The SME sector is key to the growth and diversification of the UAE economy. Although local SMEs represent 95% of companies in the country and 86% of the private sector’s workforce, they account for only 5% of total bank lending in the UAE. While UAE SMEs’ share of domestic credit leads other countries in the region, it is still well below the levels in developed markets. [1]

UAE SMEs face two key challenges when seeking trade and working capital financing. Firstly, banks face high on-boarding and processing costs when handling a loan applications, making lending to larger firms relatively more profitable. Secondly, banks lack sufficient data on SMEs to efficiently evaluate their credit risk. As a result, banks either refrain from lending or charge higher rates of interest to compensate for the perceived risk. These challenges sharply reduce access to finance for SMEs and even for mid-caps, when compared to global multinationals or national leaders.

The collaboration has grown out of the selection of Finverity as a finalist in the FinTech Abu Dhabi Innovation Challenge 2020, which was announced during the 4th FinTech Abu Dhabi Festival, co-hosted by the Central Bank of the United Arab Emirates. Finverity was selected as the finalist for problem statement number 6, which sought solutions to address the “creation and validation of financial information, robust future cash flow predictions and sustainable business model strategies for small and medium enterprises (SMEs), so that we can help build trusted and transparent credit profiles that provide the banks and other financiers a greater level of confidence of their credit-worthiness”.

“3 clicks” to access supply chain finance and get invoices paid upfront

The collaboration addresses the above challenges via a programme designed to collect real-time financial data from the accounting packages of SMEs on the Finverity platform and build comprehensive credit profiles. Real-time financial data will boost visibility into the financial position of participating SMEs, supplementing KYC, trade and invoice data already captured by the Finverity platform. By participating, SMEs will gain access to Finverity’s “3 clicks” supply chain finance facility, whereby SMEs will receive upfront payment with a discount from a funder for invoices due later from some of the larger local buyers. The buyer then pays the invoice at maturity to the respective funder. This enables SMEs fast access to working capital that is otherwise trapped in payment terms, while data is being gathered and their credit profiles become comprehensive enough for direct lending.

This collaboration will make supply chain financing (SCF) available to even the smallest of UAE SMEs in a tech-enabled, easy access format. Finverity’s highly automated process for rolling out SCF facilities and its fully guided and KYC-enabled digital onboarding screens for suppliers were key decision-making factors in launching the collaboration.

The UAE’s SME sector has in the past found it harder to engage with SCF programmes as it was economically unviable for banks to engage with smaller suppliers and midcap buyers due to high onboarding and operational costs relative to profit. The Finverity platform enables funders to fund smaller SCF programmes at scale, thanks to a high level of automation that leads to significantly lower operational costs and better risk mitigation.

Slava Oganezov, CEO of Finverity, commented: “The SME sector is the backbone and engine of sustained economic growth in many countries and a key player in global trade, but it is also the sector most in need of accessing financing and releasing working capital trapped in supply chains. We are seeing very strong interest among UAE companies in the US$50m – 1,000m revenue bracket who want to access supply chain finance and are actively engaged in matching them to funders on our platform.”

Slave Oganezov, CEO of Finverity, added: “The UAE government’s active push towards greater data transparency and a stronger regulatory regime make it highly attractive for funders on the Finverity platform seeking to fund supply chain finance offering a good risk/return ratio. We are delighted to be endorsed by ADGM and the UAE Central Bank as the UAE is one of the leading trade finance and fintech hubs in developed emerging markets with strong growth potential.”

Wai Lum Kwok, Senior Executive Director, FSRA, Abu Dhabi Global Market, commented: “SMEs are core contributors to the UAE’s economy and will play an important role in the economy’s future growth and diversification. We welcome scalable solutions that improve financing conditions for SMEs, including those that reduce the processing costs of financing through automation. The availability of high quality credit risk data on UAE SMEs will help attract a substantially larger pool of funding capital and remove obstacles to their growth.”

Related News

- 07:00 am

Leading Dutch subscription app Dyme has partnered with Tink for open banking technology, to take its money saving service across Europe. Live in the Netherlands since November 2019, Dyme is now launching in the UK and Germany, to help people take greater control of their finances.

The partnership will see Dyme use Tink’s account aggregation technology in the UK and Germany, to connect people’s bank accounts within the app. This enables Dyme to calculate which subscriptions or recurring costs users have, such as energy, mobile, insurance, or streaming services. Users can then decide whether they want to save money by letting Dyme re-negotiate or switch their service to a better deal or cancel their subscription in one click.

People in the Netherlands have 14 subscriptions on average according to Dyme, who has already saved its Dutch users €3 million collectively.

Joran Iedema, founder of Dyme, said: “Many people have a blind spot when it comes to knowing exactly where their money goes every month, due to such rapid growth in the subscription economy. We want to change that by doing the tedious financial tasks that people don't want to do themselves. Our partnership with Tink allows us to take what we have built successfully in the Netherlands, and seamlessly roll it out in the UK and Germany, in a timeframe that would have been impossible otherwise. This is the first step in our expansion across Europe, with more markets to follow.”

Jerome Albus, regional director France & Benelux at Tink, added: “Subscriptions and recurring costs take up what seems like an ever-increasing part of people’s expenditure. Dyme has proven the service it offers to its users is valued, and we look forward to helping them take this to many more people across Europe.”

Related News

- 01:00 am

Path Solutions successfully completes the annual AAOIFI compliance requirements of iMAL. The recertification process of iMAL demonstrates Path Solutions’ ongoing efforts to maintain compliance with existing and newly issued AAOIFI Sharia and financial accounting standards.

AAOIFI certification renewal also assures the public that the Islamic core banking system provider remains committed to adhering to the Sharia law, by staying current and abreast of changing industry regulations and environments.

iMAL Islamic Core Banking Platform facilitates and automates Sharia-compliant banking operations with multiple deployment models, including pure-play Islamic, Islamic windows, and coexisting Islamic and conventional banking. This comprehensive suite covers a wide range of Sharia-compliant Islamic financial modes including Murabaha, Mudaraba, Ijarah, Wa’ad, Musharaka, Wakala, Tawarruq, Qard-ul-Hassan, Jualah, Sukuk, Salam and Istisna’a.

“We are glad to complete the annual recertification of iMAL for the year 2021. iMAL from Path Solutions leverages both technology and Sharia compliance features for increased transparency and improved performance. The system’s Islamic business processes, contracts, lifecycle proceedings and related accounting entries have been assessed to be in compliance with AAOIFI’s Sharia and financial accounting standards,” commented Omar Mustafa Ansari, Secretary General of AAOIFI.

The powerful features of iMAL enable Islamic banks to extensively configure the lifecycle processing of financing transactions based on specific requirements. Given the strict prohibition of interest in Islamic finance, Islamic banks need to construct innovative financial products in order to comply with the Sharia law and follow Islamic financing principles.

“In a fast-paced, rapidly changing world, the most successful and sustainable source of competitive advantage is through uniqueness and innovation. Collaboration is key to unlocking continuous improvement and business elevation in a forward-thinking financial ecosystem. Our close collaboration with a global body for Islamic finance such as AAOIFI signifies that we are staying current with Sharia, Islamic accounting and auditing standards, and the unified industry practices as to the new iMAL platform during the last twelve months. Our flagship solution is fully compliant with Sharia principles and regulatory requirements such as Basel Committee standards and Anti-Money Laundering regulations, allowing Islamic banks to ensure corporate governance and reduce risks. We appreciate AAOIFI’s role in strengthening the Islamic finance sector and re-emphasize the value and significance of AAOIFI’s annual review and certification of our system,” said Mohammed Kateeb, Path Solutions’ Group Chairman & CEO.

iMAL is the leading AAOIFI-certified suite, confirming its compliance with AAOIFI’s Sharia and financial accounting standards. It has been architected out of years of experience and offers several powerful and differentiating features making it one of the most comprehensive, flexible and scalable Islamic solutions available in the market.

Related News

- 08:00 am

PCI Pal®, the global provider of cloud-based secure payment solutions, has today announced it is hosting a virtual conference that invites attendees from around the globe to discuss and learn about the future of payment security and customer experience.

The "Payments: The Future of Security and CX" virtual conference, which takes place on 24th February 2021, is designed to provide insights, best practice and guidance to organisations that handle sensitive customer data in their contact centres.

A number of industry experts will explore the future of payments, compliance, security, and customer experience within the contact centre and wider business communications environments.

Speakers include Neira Jones, who is internationally renowned across the payments, fintech, and cyber security industries having held senior positions at Barclaycard. She will be joined by Ciske van Oosten, Head of Global Business Intelligence and Lead Author of Verizon’s 2020 Payment Security Report, in addition to James Barham, CEO and Geoff Forsyth, CISO of PCI Pal.

More confirmed partners and speakers will be announced in January 2021.

Jane Goodayle, SVP Global Marketing, PCI Pal, said: “We are passionate about payment security, safeguarding organisations’ reputations, and building consumer trust. This event is therefore a great opportunity for us all to discuss upcoming trends in the market, share best practice, showcase innovative solutions, and provide insights into the future of payment security, compliance and CX in 2021 and beyond.”

To register for PCI Pal’s free "Payments: The Future of Security and CX" virtual conference, visit: https://www.pcipal.com/us/knowledge-centre/events/payments-the-future-of-security-cx/.

For more information on PCI Pal visit www.pcipal.com, call +44 207 030 3770 to arrange a demonstration or follow PCI Pal on Twitter.

Related News

- 06:00 am

VibePay, which powers account to account payments between consumers, friends and businesses, today announces the integration with content creator tools and services provider StreamElements to transform the way the gaming community makes and receives tips.

Integrating VibePay with the fastest growing production platforms for livestreaming, means gamers can instantly send and receive money from viewers and subscribers, directly from account to account for free. Gamers will no longer be burnt by unfair payment fees and have to waste time sharing bank details through unsafe methods, instead they can now focus on what they love doing the most and receive 100% of their tips.

VibePay is disrupting payments within the gaming industry, benefitting gamers, streamers and their audiences. Partnering with StreamElements and other platforms in the space accelerates VibePay’s mission to make account to account payments the default way to pay and get paid.

Luke Massie, CEO of VibePay, said: “Gaming is one of the most creative and rapidly growing industries in the world, yet the community is still making and receiving tips through dated payment methods. As streaming is the main source of income for many people, they shouldn’t have to pay unfair fees and wait days, or even weeks, to receive tips which they rely on to live. Payments should be instant and seamlessly integrated into the streaming experience with no fees. Through our new partnerships, we want to make content creators’ lives easier and also help others who want to make the streaming dream a reality.”

Shay Ben Yacov, Product Manager at StreamElements, said: “StreamElements provides content creators with the platform to turn their passions and talents into a business. With streaming becoming the main profession for many users on our platform, VibePay will help these creators get paid easily through tips while being able to keep 100% of what they are given. This is just the start of the journey with the team at VibePay and we can’t wait to see what 2021 has in store.”

Rewarding streamers for views

To mark the new partnerships with StreamElements, VibePay is also launching its affiliate programme, which rewards streamers for connecting their viewers to VibePay. This includes referral rewards, sponsored giveaways and competitions.

Through the programme, VibePay will be targeting the biggest names in the streaming world to continue to grow its community, which includes award-winning grime artist, JME, who actively takes part in #VibePayFriday and recently promoted the testing of the product on Twitter.

Massie concluded: “We are on a mission to power the workforce of the future, and the gaming industry is at the heart of this. By integrating with the world’s largest production platform for livestreaming, we will bring our forward-thinking, innovative approach to the gaming community to make VibePay the go-to way to pay and get paid in the streaming world.”

To find out how to set up VibePay on StreamElements visit: www.vibepay.com.