Published

- 05:00 am

Wealthify, the multi-award-winning digital investment platform, today announces the appointment of David Semmens as Chief Investment Officer (CIO). Head of Investment Strategy since 2018, Semmens has been acting as Interim CIO since June 2020.

Michelle Pearce-Burke, co-founder of the business and Chief Operating Officer (COO), had been the CIO until now. Supporting the firm’s ambitious growth plans, Michelle will focus solely as COO, working alongside CEO Andy Russell whilst retaining her position on the Investment Committee.

As CIO, David will sit on the Senior Leadership Team and he will continue to lead Wealthify’s investment strategy across the platform’s broad portfolio of investment options, from ISAs to SIPPs to general investment plans, all designed to make investing easy, accessible, and affordable for anyone. David is a Chartered Financial Analyst Charterholder with more than fifteen years of experience behind him. He has worked in several global financial institutions including HSBC and Standard Chartered.

The news follows a period of strong gains in 2020 across all Wealthify investment plans1, including risk levels from cautious to adventurous, and a fast-growing range of Ethical Plans. Since their inception, eight out of ten portfolios have beaten their benchmark. David’s priority will be continuing to successfully navigate the market risks and opportunities that lie ahead for all customers, as markets begin to recover from the Covid-19 pandemic and in the aftermath of Brexit.

Andy Russell, CEO commented: “We are thrilled that David is taking on the CIO role permanently. He did a fantastic job last year, maintaining strong performance through an unpredictable and fast-changing period. The results of his investment strategies speak for themselves, and these give our customers confidence over their future performance under his stewardship.

“We are also delighted that Michelle has chosen to concentrate fully on her COO role given our emphasis on growth in 2021 and beyond. Michelle’s entrepreneurial spirit is behind much of Wealthify’s success to date and she brings with this an acute understanding of the world of investing. I am really looking forward to continuing our work together into the next phase of our growth so that we can deliver a truly great service for our customers and future customers.”

David Semmens, CIO said: “I am absolutely delighted to now be leading the talented investment team at Wealthify on a permanent basis. Despite the challenges of 2020, we have produced superb results for our customers, and I am looking forward to building on that success in the years ahead.”

Michelle Pearce-Burke, co-founder and COO, added: “Wealthify has come a long way since our humble beginnings almost five years ago. Our investment performance to date has been strong – we have weathered some hard times, not least during our launch just weeks before the Brexit vote in 2016 and navigating the painful market crash last year due to Covid. The Ethical Plans we launched a couple of years ago have also seen exceptional growth, smashing their benchmarks and winning multiple awards.

“David’s expertise and knowledge has been an integral part of making this happen. So, I am pleased to hand over the CIO reigns to him knowing our customers’ Plans are in safe hands. And I am really looking forward to focusing on driving significant growth to meet our ambitious targets. As we enter this next exciting phase, customers can expect more from our existing products, as well as new product development and partnerships, all underpinned by the excellent, award-winning customer service we have become known for.”

1 https://www.wealthify.com/blog/2020-performance-update-positive-returns-in-a-difficult-year

Related News

- 08:00 am

SG NewTech, a Kenya-based tech services company and subsidiary of Software Group, has won an award for ‘Best in MEA’ at Finastra’s Global Hackathon “Hack the Future” for its latest project, Banking4U, designed to provide quick and easy access to bank loans.

Created by SG NewTech employees, Faith Kangichu and Yonah Ochieng, the winning Banking4U App uses customers’ mobile money transaction data to determine loan eligibility. The App rates and scores potential loan applicants using simple, easy to use scoring models to determine the amount they can qualify for borrowing. If the system certifies the customer's eligibility for a loan, he/she is provided with fast and easy access to financial services without requiring a bank account.

‘Hack to the Future’ is Finastra’s second annual global hackathon. This year’s virtual event saw over 4,500 registrations from 100+ countries around the world. Over 230 ideas, POCs, and apps were submitted from a range of different companies and educational institutions around the themes of reducing systemic inequality, hacking through COVID-19, and embracing technology-enabled change.

Faith and Yonah's project was selected based on three criteria: a submission’s ability to solve a real and pressing need, its feasibility and use of technology, and its commercial potential. In addition to winning the ‘Best in MEA’ prize, Banking4U was also recognized as a finalist in the ‘Best Fintech’ category.

“We were inspired to develop a solution that will provide users with a convenient way to borrow money and get loans without having to go into a physical bank, and for people without a bank account. The idea behind Banking4U is simple but very effective, and even more relevant during the COVID times we live in, as virtual banking is becoming more and more popular for consumers. Congratulations to Faith and Yonah for the deserved recognition, for going the extra mile to turn this project into reality, and, most importantly securing their win over hundreds of other ideas, and thousands of participants from around the world," commented Tunde Oladele, CEO of SG NewTech.

Chirine BenZaied, Head of Innovation at Finastra, said: “Finastra was delighted to host our second global, virtual event this year, and see the quality and range of submissions, all focused on hacking for good. Congratulations to all the winners and our thanks to organizations such as SG NewTech, whose excellent presentation helped us to create such an incredible and impactful event.”

Related News

- 09:00 am

Link Fund Solutions, part of Link Group (ASX: LNK), a leading global provider of financial administration services, and Confluence Technologies, Inc. (“Confluence”) have partnered to launch a portfolio compliance solution across 283 funds in the UK and Europe.

Link Fund Solutions is the UK’S largest independent Authorised Corporate Director (ACD). It is also one of Europe’s largest third-party management companies (ManCo) and supports clients in Ireland and Luxembourg. Confluence is a global technology solutions provider, delivering innovative products to the worldwide money management industry.

Link Fund Solutions utilises a data warehouse it built in-house to capture essential valuation and custody data. The warehouse supports a range of regulatory monitoring and reporting requirements for European funds, where Link Fund Solutions acts as either an ACD, Authorised Fund Manager, or ManCo, delivering an authenticated dataset and streamlined processes. Link Fund Solutions continuously seeks to invest in ways to enhance its risk management framework, while adapting and evolving to future-proof its systems and services.

Link Fund Solutions has further harnessed the data held in its warehouse by utilising Confluence’s portfolio compliance solution. It provides automated daily monitoring of Link Fund Solutions’ funds’ compliance with Investment and Borrowing Power rules, as set out by the regulators in the UK, Ireland, and Luxembourg.

Confluence’s solution supports the full lifecycle of compliance and incorporates a sophisticated breach management workflow, creating a sustainable culture of compliance monitoring. The solution is adaptable to future requirements and provides Link Fund Solutions with full control over its compliance data and rules. In an ever-changing regulatory environment, this system can flex and evolve to meet future requirements and respond to increasing complexity and change.

By using Confluence’s solution, Link Fund Solutions’ portfolio monitoring teams are more efficient and better able to assign time and resources to ensuring data integrity and oversight, as opposed to time-consuming base tasks such as portfolio position calculations.

Confluence’s solution is now the primary production platform for Link Fund Solutions’ 45 funds in Ireland and Luxembourg, with the 238 UK funds also now live as 2021 commences.

Karl Midl, Managing Director, Link Fund Solutions, said: “As the UK’s largest independent ACD, we strive to lead the market in the use of technology and data solutions. That’s why we have chosen to work alongside Confluence, a global leader in data-driven investment management solutions. Our data warehouse continues to evolve and deliver a streamlined process for our funds to embrace market evolution. We share the same values as Confluence: we are committed to continuously evolving our governance and empowering our clients’ knowledge in order to drive market solutions with efficiency through an automated control framework.”

Todd Moyer, President and Chief Operating Officer of Confluence Technologies, said: “We are delighted to partner with Link Fund Solutions, part of a global, technology-led financial organization. Confluence operates in more than 40 countries worldwide, and we share with Link Fund Solutions a drive to help clients globally and across Europe. Our solution will give Link Fund Solutions clients the confidence in their compliance data and we look forward to working together with them in a long-term, mutually beneficial relationship.”

Related News

- 03:00 am

Previse, the AI fintech that gets suppliers paid instantly, has made two new hires to its London team.

Niv Subramaniam joins Previse as Commercial Lead and Steve Dempsey as Sales Director.

Previse is growing its team in response to increased demand for its InstantPay technology, which has been spurred on by the need for SMEs to receive faster payments to be able to survive the Covid-19 storm.

The UK’s small business community are owed approximately £50 billion in late payments.

Last year, Previse was awarded a £2.5 million grant by the Banking Competition Remedies’ Capability and Innovation Fund. The money is being used to fund further development of Previse’s industry leading InstantPay solution, making it accessible to more SMEs.

Niv has run functional teams across global organisations including HSBC, where she served as MD, Head of Global Lending Product; and Barclays, as Director of Global Debt Product. She has built banking solutions from the ground up for startups as part of the senior exec team at Oaknorth Bank, and as Customer Solutions lead at TSB Business Banking.

Steve joins Previse from Tungsten Network, where he served as Enterprise Sales Manager. He brings over 20 years’ experience helping global enterprises transform the way they do business by harnessing new technology and solutions.

Niv and Steve will help Previse accelerate rollout of its InstantPay solution.

Niv Subramaniam, Chief Commercial Officer at Previse, said: “Previse has seen a growing demand for its InstantPay product in the past year, as a direct response to the worsening slow payments problem brought about by Covid. No other solution exists to get suppliers paid as quickly, or easily. I am looking forward to helping Previse meet its mission of getting every supplier paid on day-1”.

Steve Dempsey, Sales Director at Previse, said: “I am excited to be part of Previse’s mission to pay suppliers quickly and easily – same day, instantly and will continue to build on a strong sales career and look forward to educating the market in “Trade Finance 2.0”, enabling corporates to harness their data to drive growth for companies large and small.”

Related News

- 03:00 am

To help businesses meet customer needs and provide greater support for the financially vulnerable, PayPoint is stepping up the benefits for its digital solution, PayByLink.

Through PayByLink, companies collecting bill payments – whether on credit or prepaid – can already send tailored, personalised payment reminders by email or SMS, allowing customers to pay quickly and easily. Now, with the latest enhancements to PayByLink Recurring Payments, businesses can enable customers to decide whether to make a single, one-off payment, or set up a recurring payment.

PayByLink sits within PayPoint’s multi-channel digital payment solution, MultiPay, and gives customers options on how best to manage their payments and repayments. Payments are transparent and instant, improving the customer experience and engagement. This also minimises unnecessary payment chasing, the burden on call centres, whilst reducing arrears and improving cashflow.

Danny Vant, Client Services Director of PayPoint, commented: “Payment flexibility has never been more important than it is today, with the financial uncertainty many are facing. Our latest digital payment solution is a valuable tool to help companies deliver vital support for their customers in such challenging times.”

Delivering true customer-focused flexibility, the customer will also receive a barcode for making an in-store payment, if that is their preferred method, as well as the option to request a call back so they can pay over the phone. By having contact options, customers will be more engaged and both parties will benefit from a positive conversation.

Danny Vant concludes: “PayPoint is dedicated to providing solutions that genuinely empower people to manage their finances and reduce arrears. Our solutions aim to increase customer confidence in the businesses they use, and in how their personal and financial details are managed. At PayPoint we are constantly enhancing our range of digital offerings to bring solutions that benefit businesses and consumer alike, helping them to work together to manage payments and arrears effectively and efficiently.”

PayByLink benefits for late payment collection:

- Integrates with client’s system to send automated SMS customer reminders

- Enhances customer engagement

- Offers user-friendly payment optionality

- Increases collection of small arrears and creates the opportunity for customers to begin the journey to making larger or full payment

- Easily integrates into your own CRM system

- Increases efficiency with bulk payment options

- Reduces spend on collections and write offs

- Enhances cash flow management

- Fully PCI compliant and can be used effectively in a call centre environment

Related News

- 02:00 am

The Bitcoin price nears $50,000 and will continue to reach new highs in this first quarter of 2021 – but investors should also expect volatility due to increasing regulatory scrutiny.

This is the warning from Nigel Green, CEO and founder of deVere Group, one of the world’s largest independent financial advisory and fintech organizations.

It comes after the cryptocurrency hit more than $49,700 for the first time in history on Sunday.

Mr Green says: “Last week was a massive one for Bitcoin, reaching new all-time highs amid soaring interest from institutional investors.

“Morgan Stanley, the investment giant is reported to be considering investing in Bitcoin through its $150 billion investment arm; Elon Musk’s Tesla announced it had invested $1.5 billion in the digital currency and was getting ready to accept it as payment; BNY Mellon confirmed that it had created a digital assets unit to build a custody and admin platform for crypto assets; and Mastercard said it would give its merchants the option to accept cryptocurrencies later this year.

“In addition, Miami confirms it is considering paying workers and collecting taxes in cryptocurrency and the mayor of the city wants to hold Bitcoin in the city’s treasury.

“This all follows the likes of PayPal’s decision last year to allow customers to buy, sell and hold Bitcoin and as Wall Street giants like Goldman Sachs and JP Morgan issue RFIs (request for information) to explore Bitcoin and crypto asset custody.”

He continues: “There is a clear direction of travel: institutional investors are taking Bitcoin more and more seriously as a financial asset and a medium of exchange. They are increasing their exposure to it at a faster rate than ever before.

“This is pushing cryptocurrencies ever more into the mainstream financial system and, subsequently, driving the price skywards.”

The deVere chief goes on to say: “With the growing institutional demand combined with ultra-low interest rates, we can expect Bitcoin – which has already given a 55% return so far year to date after the 300% gain in 2020 - to reach new highs in this first quarter of 2021.

“However, with increasing dominance and value, comes increasing regulatory scrutiny.

“Bitcoin and other cryptocurrencies will come under the spotlight from watchdogs like never before and this can be expected to create volatility in the market.”

His warning comes as central banks and governments around the world ramp up their focus on digital currencies.

In the U.S. in recent days, Treasury Secretary Janet Yellen raised again the prospect of future cryptocurrency regulation and as the Securities and Exchange Commission (SEC) could reportedly investigate Elon Musk over Tesla’s $1.5 billion Bitcoin purchase.

Nigel Green concludes: “Institutional investors are increasingly appreciating that in this tech-driven, ultra low interest rate, low growth world, and where there is diminishing trust in traditional currencies, digital and borderless cryptocurrencies may be becoming a better fit.

“We can expect the price of Bitcoin to surge to fresh highs as a result. But investors must be aware that regulatory pressures will cause price turbulence.”

Related News

- 09:00 am

The World Federation of Exchanges (WFE), the global industry group for exchanges and CCPs, has responded to the EU’s proposals for a Digital Operational Resilience Act (DORA) for Financial Sectors.

The WFE welcomes the ambitions of the EU Commission in seeking to improve and harmonise operational resilience requirements across the financial ecosystem – especially those purely operating in digital-based environments.

The global pandemic will, naturally, further increase regulatory scrutiny of resilience measures, as society’s dependency on ICT providers is greater than ever before. However, to ensure that these measures are effective, and can inter-relate smoothly across jurisdictions, they need to be carefully crafted. Prescriptive, tick-boxing rules that do not evolve are to be avoided and, instead, it is risk-based and outcomes-focused guiding principles that are key to enabling the delivering of future resilience against the next threat. In this regard, the WFE also welcomes the EU’s desire to achieve a principles, more risk-based, approach but would encourage the Commission to consider how it can go further in embedding that concept across its proposals.

The WFE recognises the Commission’s desire to ensure accountability and to have appropriate oversight capabilities of important ICT service providers. However, meeting that objective does not need to be at the cost of having disproportionate requirements levelled against firms which do not have the accompanying risk profile to warrant them, thereby potentially creating needless barriers to access the most resilient and effective ICT service provision globally available.

Straying from the principle of proportionality could unfairly and unnecessarily promote market fragmentation; with improving the efficiency of markets, reducing risk and consumer choice affected by the proposals. Getting that approach right is integral to encouraging cross-border trade and promoting the EU as a business-friendly environment with safe and efficient markets.

The WFE has a particular concern that, alongside issues such as data localisation developing from rules around location requirements for ICT service providers, aspects of market-data service provision may also be inappropriately captured and subject to prohibitive requirements under DORA. The current definitions employed by the Commission to determine what constitutes an ICT service provider, and also what is deemed to be a ‘critical’ one, appear ambiguous and could lead to confusion in implementation. Better understanding of how market-data service provision would be classified is required – especially if derived from a provider operating from a third-country. Additional clarity, with appropriate regulatory application, that accurately reflects the risk profile of such service provision, would be greatly welcomed by the WFE.

Nandini Sukumar, Chief Executive Officer of the WFE, said: “We strongly support the Commission’s ambitions for improving operational resilience across all sectors of the financial services industry. Ensuring that the measures used in achieving those ambitions are fair and proportionate is integral to their success in the long run. As a global organisation we would also emphasise the importance of observing international guiding rules when considering new requirements and for further consideration to be given to how the regulatory approaches of third-countries can be recognised by the EU, to avoid ICT service provision being unnecessarily inhibited.”

Please click here to read in full.

Related News

- 04:00 am

Post Office is expanding its presence in the identity services market with the roll-out of a suite of online and in-branch products in a new partnership with digital identity company Yoti. The rollout includes a free-to use app that will combine customers’ personal data and biometrics to create a secure, reusable ID on their phone, and in-branch services for those customers who do not have access to a smartphone or who prefer face-to-face contact when asked to confirm their identity.

The partnership will also connect Post Office customers with online businesses, by enabling companies to use Post Office and Yoti identity verification services for fraud detection, E-signatures and customer authentication services, using secure biometric face matching and liveness detection.

The partnership combines Post Office’s existing experience in identity services and its extensive branch network with Yoti’s leading identity technology to help drive the UK’s digital transformation. Post Office continues to embrace new technology and this further expansion into the identity services market is part of its efforts to adapt and remain relevant in the digital age, whilst ensuring it continues to offer customers choice as to how they transact.

The UK’s digital identity market is currently worth an estimated £2 - 4 billion per annum and growing at 5% each year* as regulation and digitisation grows. As UK companies, Government departments and public sector organisations continue to embrace digital transformation, difficulties with asserting identity in a digital world can fuel uncertainty and lack of trust that limits the full range of services offered online.

Nick Read, Chief Executive at Post Office, said: “Post Office is embracing new technologies and this partnership will enhance our reputation as the trusted go-to destination for identity solutions. Whether it’s proving your identity on a smartphone or face-to-face with a Postmaster, we will make transactions faster and simpler than ever before.”

“I am delighted that Post Office and Yoti are joining forces to expand our identity services. We have an ambitious strategy to deliver a unique offer to the market that integrates digital and physical identity verification at scale benefitting both individuals and businesses.”

Robin Tombs, CEO at Yoti, said: “I’m proud to announce Yoti’s partnership with the Post Office, together we’ll make it simpler and safer to prove who you are and know who you’re dealing with, anywhere in the UK. Seven years ago, Yoti set out to fix the broken identity system. Trust is critical in the emerging digital ID space and our plan has always been to partner with the Post Office, which I believe is one of the most trusted brands in the UK.

“We have already invested over £85m creating a world-leading ID platform that removes the friction from outdated ID processes, puts individuals in control of their identity, preserves privacy and helps reduce identity fraud. Together with the Post Office, we will help drive the UK’s digital transformation, making life simpler and safer for individuals and businesses online, in-branch and on the high street.”

Post Office and Yoti have ambitions to be the UK market leader in identity services, providing solutions that will enable individuals and businesses to be able to trust that others are who they claim to be in every online and face-to-face transaction.

Post Office Digital Identity App

A new free-to-use Post Office digital identity App will launch in the Spring. It will combine a person’s personal data and biometrics to create a secure, reusable ID on their device.

Customers have the choice as to what information they share. The creation of their own digital identity means they don’t need to carry documents such as a driver’s licence or passport to prove their identity. Customers will be able to use the Post Office digital identity app for a range of online and in person transactions such as one-click bank account applications, job applications, mortgage applications, proof of age for the purchase of restricted goods such as cigarettes, picking up parcels and for travel purposes.

Customer products and services in-branch

Post Office is the market leader for enabling people to verify their identity online and access Gov.UK Verify Services such as tax self-assessment, Universal Credit and basic Disclosure and Barring Service (DBS) checks. Almost four million UK citizens hold a Post Office Gov.UK Verify account.

Post Office also provides a number of identity transactions such as passport and driving licence renewals as well as DBS and documentation certification checks from its branches. In 2020, despite Covid-19 related lockdown restrictions, seven million identity-related transactions were carried out at Post Office branches.

As part of this partnership with Yoti in July, a pilot, initially at around 750 Post Offices, will offer these new in-branch services. This will enable those people without a smartphone, secure internet access, or photo ID to complete their identity verification at a Post Office. Those who simply prefer face-to-face transactions will also be able to have their identity verified by a Postmaster in-branch.

Business to Business products and services

Post Office and Yoti will bring a range of reusable and transactional identity services to businesses. These include identity verification services which can be used as part of fraud detection measures, age verification services, E-signature services and customer authentication services which provide customers with a secure way of accessing a company’s services using secure biometric face matching and liveness detection.

Elinor Hull, Identity Services Director at Post Office, said: “Access to products and services are increasingly moving online, whether it’s opening a bank account, applying for a job, accessing medical services or buying goods. We’re responding to this shift with a free-to-use App that will allow customers to build their own secure digital identity on their smartphone, enabling them to easily control and prove who they are to whichever business they want to interact with. For businesses, we are providing a suite of transactional and reusable identity verification services that will enable them to serve their customers with ease, trust and at low cost.”

John Abbott, Chief Business Officer at Yoti, said: “We’re excited to see Yoti’s secure technology and operations combined with the Post Office identity services and network. Privacy, security and simplicity are at the heart of our solutions, designed to put individuals in control of their data and make it easy for businesses to join our trusted network.

“Together, our unique partnership will provide a suite of services including identity verification, esigning and authentication that leverage privacy-preserving AI and advanced encryption to protect people’s important personal data. We’ll remove the barriers between the online world and high street with our shared values of inclusivity and accessibility.”

Yoti has 2 million consumer app downloads in the UK (9m worldwide) and provides identity solutions to businesses including Virgin Atlantic, NCR, the Co-Op, NSPCC and the NHS and Government of Jersey.

Related News

Victor Fredung

CEO at Shufti Pro

As of today, more than 106 million coronavirus cases have been reported until now across the world. see more

- 05:00 am

57.18 million of us now make digitally-enabled transactions, bringing the total value of digitally enabled payments annually to a staggering $188.3 billion, this is an increase of 19.7% when compared to 2019. These are the findings from Digital 2021 UK, the annual country-specific report from Hootsuite, the global leader in social media management and We Are Social, the socially-led creative agency which analyses the UK’s use of social media and digital trends.

Other key stats from the report include:

The total value of the ecommerce goods market in the UK = $97.03 billion

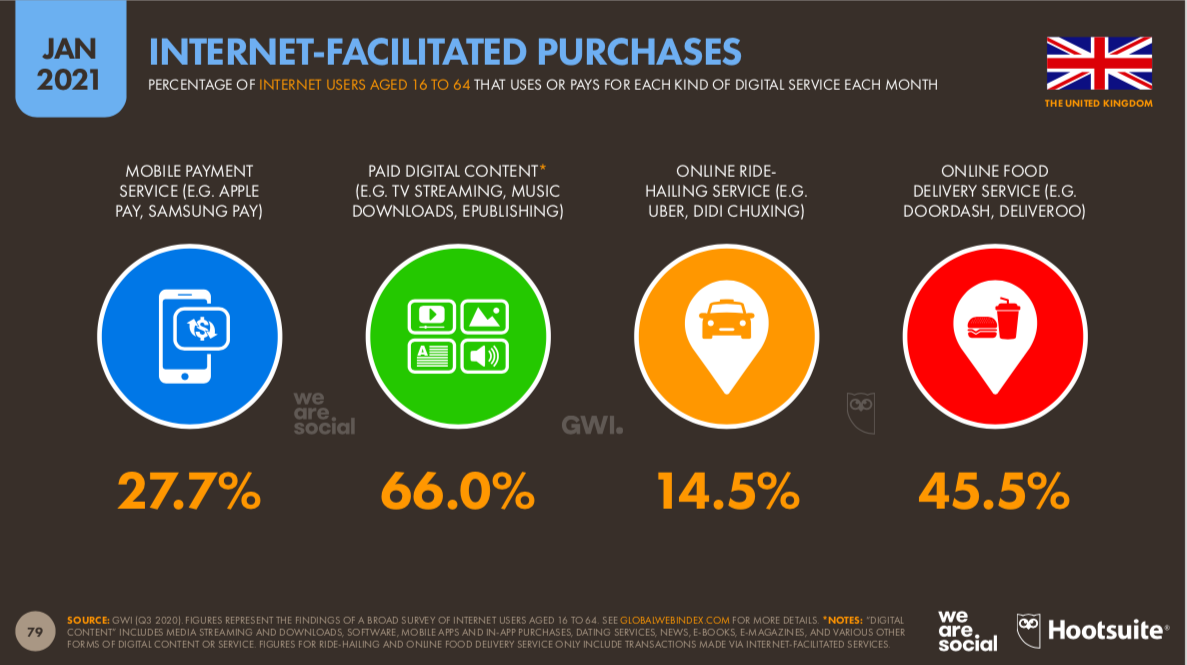

27.7% of us pay for a mobile payment service, such as Apple Pay, 66% of us pay for digital content, 14.5% of us pay for online ride-hailing services

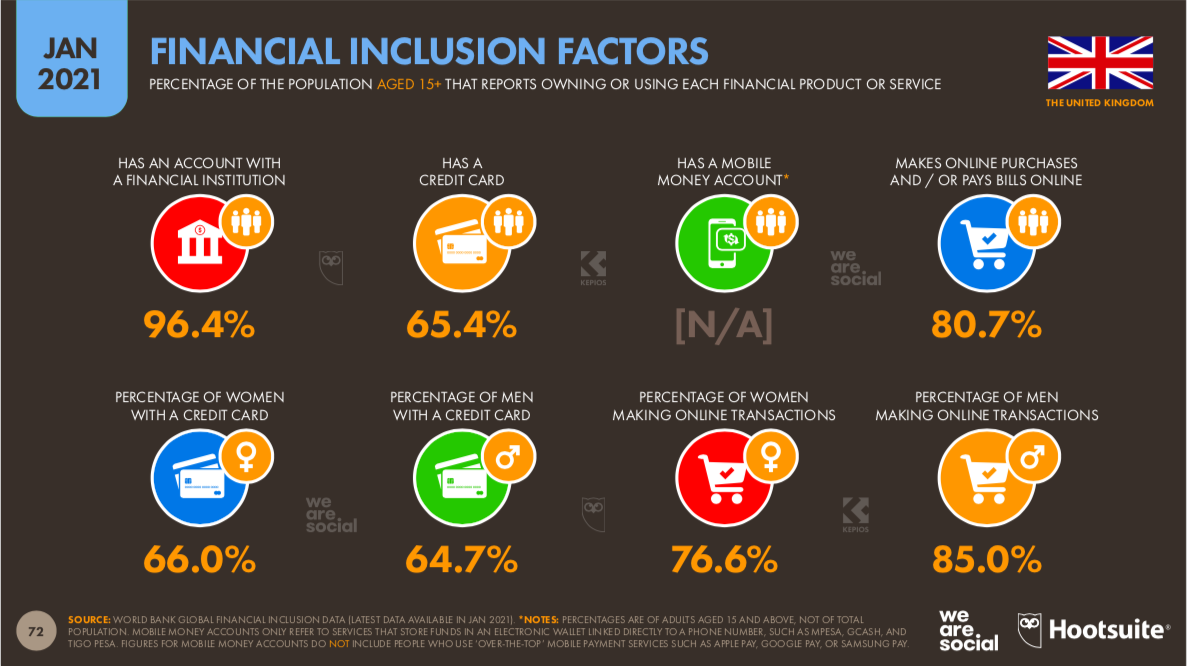

65.4% of the UK now have a credit card

76.6% of females make online transactions, this increases to 85% for men

When looking at consumer spend on apps, we spent the most money on Tinder in 2020, followed by Disney+ and YouTube

You can view the report via this link.