Published

- 03:00 am

China is pushing for technical innovation. The world’s second-largest economy is currently transitioning towards a “New Economy” where innovation and digital transformation are the key driving forces. Swiss bank UBS pooled the vast opportunities of this development in a dedicated ETF, the UBS Solactive China Technology UCITS ETF. The Exchange Traded Fund will be launched on March 19th, 2021, and it tracks the Solactive China Technology Index. This release marks a new engagement between UBS and Solactive after the successful launches of previous ETFs and Index Certificates1.

The Chinese tech industry is emerging as a high-profile opportunity for investors globally, and the pandemic has considerably accelerated this process. Record high internet, app, and mobile payment usage confirm this trend, and many companies in this industry are benefiting from both this growing demand as well as from supportive political initiatives. Above all, China is shaping up to be a tech leader beyond the IT industry. It has become the largest Electric Vehicle market globally2, is bound to challenge the US’ dominance in the biotech industry3, and is a creative hub from many technologically oriented sectors.

The Solactive China Technology Index captures this trend by including the 100 largest technology-driven companies headquartered or incorporated in China. They derive the majority of their revenues from various innovative business activities, including nine sub-themes of technological innovation: Future Cars, Healthcare Innovation, Genomics, Social Media, Digital Entertainment, Blockchain, Cyber Security, Cloud Computing, and Robotics & Automation.

Timo Pfeiffer, Chief Markets Officer at Solactive, comments: “China’s innovation potential is driven by the country’s ambition to become the number one in virtually any discipline. This aspiration bears immense growth potential, which investors can now easily access through UBS Asset Management’s new China Technology ETF. UBS AM recognized investors’ demand in this space, and we are very happy to contribute with our index to this promising fund release.”

Clemens Reuter, Global Head of ETF & Index Fund Client Coverage at UBS Asset Management, said: “We have had a presence in China for several decades and have built deep expertise in the country. This new ETF is part of UBS AM’s strategic focus to provide investors with innovative exposure to one of the world’s fastest growing markets. The fund incorporates stocks beyond ‘traditional tech’, including exposure to areas such as social media, future mobility or medical technologies companies, and shows our strength to create products that align client interest and China’s long-term economic trends.”

The UBS Solactive China Technology UCITS ETF starts trading on the SIX Swiss Exchange, XETRA and Borsa Italiana on March 19th, 2021.

Related News

- 02:00 am

Delta Capita is pleased to announce that inSPire Due Diligence, its mutualised industry service for ‘Know Your Distributor’ due diligence, has launched in both the Americas and Asia Pacific, to complement the existing service across Europe.

Inspire Due Diligence is the first global utility service that centralises and standardises ‘Know Your Distributor’ Due Diligence for the mutual benefit of Structured Product issuers and distributors alike. So far, issuers’ have requested inSPire’s standardised Due Diligence Questionnaire on over 500 distributors globally, covering distribution in 75+ countries.

Issuers and distributors have long expressed frustrations at a repetitive, inefficient due diligence process. By standardising the Due Diligence Questionnaire and centralising the data gathering, chasing and report production - inSPire Due Diligence has simplified and streamlined the process, delivering time and cost savings while at the same time reducing operational and regulatory risk for issuers and distributors.

The addition of coverage in the Americas and Asia Pacific means - for the first time - structured products issuers can engage with new distributors who are based in any of the main financial centres across the globe and benefit from the same, best in class, peer reviewed inSPire Due Diligence Questionnaires for new distributor relationships and refreshing existing distributor due diligence.

Mark Aldous, CEO of Structured Products at Delta Capita commented “For too long, the industry has grappled with slow distributor onboarding processes and inefficient due diligence duplication. inSPire Due Diligence transforms this process and reduces the overhead for everyone involved whilst ensuring consistent cross-regional standards/”

Delta Capita’s services cover distributor screening, DDQ production and remediation as well as support across the full client onboarding process, including a centralised outreach for KYC documentation, KYD documentation and distribution agreements.

Related News

- 07:00 am

Major digital lending platform IndiaLends has raised US$5.1 million in a financing led by existing investors ACP Partners and DSG Consumer Partners. The Delhi NCR based firm will use the funds to expand its technology platform, increase its market footprint and amplify its product offerings to meet the pent-up demand in a post-COVID economic recovery.

IndiaLends has already won the trust and confidence of over 8 million customers and disbursed more than INR 2,000 crores in personal loans since its launch via its technology platform and API-based lending solutions that it offers to other B2C companies. The company aims to emerge as the leading financial marketplace in India and double the disbursements in the next 18-24 months with a focused outreach towards retail consumers living across tier I-II cities and tier III towns. IndiaLends also intends to extend its outreach to the underserved customers, people who are worthy of getting access to credit but are unfortunately left out owing to the lack of reliable credit history.

IndiaLends Founder and CEO Gaurav Chopra said, “This fresh round of financing comes at a critical point in our business, enabling us to build our services and offer innovative products to our customers, as we usher into the next phase of growth. The use of new-age technologies and the government’s pro-active efforts to push digitisation is helping this high-potential space to grow and drive greater financial inclusion across the country. Although the pandemic had a severe impact on the sector, it has also led to the belief that digital lending is now the new normal. This investment is a testament to the fact that the sector is going to witness an upward curve in the days to come. We are very excited to have received this funding from our current investors ACP Partners and DSG Consumer Partners who have shown their trust and confidence in the business all along.”

"DSGCP first invested in Indialends in 2015. Since then, we have witnessed strong market traction as Indialends leverages relationships with leading NBFCs and banks to make credit accessible to a broad set of consumers. We were particularly impressed by how Gaurav and his team at IndiaLends navigated the challenges posed by the COVID-19 pandemic. We are excited to back Indialends as it enters its next phase of growth", said Deepak Shahdadpuri, Managing Director, DSG Consumer Partners.

"IndiaLends is helping customers make educated and better borrowing decisions by giving them curated loan offers from over 50 lenders with transparent product terms, enabling them access to credit. We are excited to support this growth and offer these services to millions of Indians through our “lending as a service” partnerships", said Alok Oberoi, ACP Partners.

Started in March 2015 by Gaurav Chopra and Mayank Kachhwaha, IndiaLends uses its transparent and highly advanced automated processing system to offer unsecured credit products to a customer-base of over 8 million through its 50-plus bank and NBFC partners across the country.

In addition, IndiaLends is now able to serve over a 100 million consumers via its B2B API solutions where it offers other consumer platforms a “Lending as a Service product” whereby these platforms can offer personal credit products to their user base via lending products available from a wide range of Banks and NBFCs.

Apart from traditional Banks and NBFCs, IndiaLends is now also offering pre-qualified loans from all major Fintech and P2P lenders to its customers – improving both eligibility and process.

About IndiaLends

IndiaLends is an online marketplace for credit products that include personal loans, credit cards, gold loans. It also offers its users free credit reports and other financial education tools. IndiaLends recently launched Digital Lending 2.0 — a range of touchless and contactless products that include loans, cards and a line of credit. Available on both the web and mobile, IndiaLends offers instant loans to its customers with most products being fully digital. IndiaLends also provides technology, data and credit analytics solutions along with a loan management platform to financial institutions. IndiaLends is run by a team of credit risk professionals and data scientists with multiple years of experience in consumer credit. IndiaLends has a customer base of 8M. For further information, please visit www.indialends.com.

About ACP Partners

Founded in 2001, ACP Partners is a private equity and debt special situations investor. ACP sources and structures exclusive investment opportunities for its clients and partners, seeking risk-adjusted return profile opportunities in debt, equity and hybrid transactions. ACP has deployed and committed over US$1 billion across c. 50 independent global transactions, ranging from US$5 million to US$100 million in size.

About DSG Consumer Partners

DSG Consumer Partners (DSGCP) is an early stage venture capital fund focused on investing exclusively in consumer brands and businesses in India and South East Asia. Since its inception in 2013, DSGCP has backed over 40 start-ups and helped build some of the leading insurgent brands including OYO Rooms (sold to Softbank), Zipdial (sold to Twitter), Redmart (sold to Lazada), Veeba, Epigamia, Chai Point, Eazydiner, SaladStop!, Chope, GOQii, Mswipe, The Moms Co, Sleepy Owl Coffee, Simplee Aloe, Piccolo, YouVit, Pip & Nut, Sleepy Cat, Vista Rooms, Super Bottoms, Brewlander and others. DSGCP currently manages US$200 million of committed capital and has investment professionals and advisors in Mauritius, Singapore and Mumbai.

Related News

- 01:00 am

Landbay, one of the UK’s leading mortgage lending platforms, has launched a new five-year funding partnership worth £200m of originations per annum.

Landbay has partnered with Allica Bank to fund its buy-to-let mortgages over the next five years. Allica Bank, the leading challenger bank for established small and medium-sized enterprises (SMEs), will fund a range of residential buy-to-let mortgages originated by Landbay.

Allica Bank was awarded its banking licence in September 2019 and has grown rapidly since. The bank recently announced it had lent over £70m to SMEs in its first year of lending with £120m of committed lending offers in the process of completion.

Landbay’s new deal with Allica Bank comes in addition to a number of funding deals secured over the past 12 months. In November last year Landbay secured a £1billion funding deal from an asset manager. Prior to that it secured a £200million bank funding deal in July and another £1billion of funding in mid-2019.

The Allica Bank partnership complements Landbay’s wide-spread institutional funding arrangements via its marketplace model that includes banks, funds and securitisation programmes.

Landbay is growing so rapidly that just last week it was announced as the twelfth-fastest growing company in Europe. It was listed at number 12 in the FT 1000 of the European companies that have achieved the highest compound annual growth between 2016 and 2019.

John Goodall, CEO at Landbay, said: “This partnership with Allica Bank reinforces the growing reputation that Landbay has for originating high quality buy-to-let mortgages for our institutional partners via our platform. It will also ensure that we can continue to provide some of the most competitively priced, buy-to-let mortgages in the market. We are really pleased to be working with Allica who have similar values to Landbay and also have a real customer focus.”

Richard Davies, CEO at Allica Bank, said: “We are delighted to partner with Landbay, extending our strong commercial lending expertise into the residential sector, enabling us to support even more people who are seeking access to finance. The Landbay team share our ambition to support and encourage customers through the combination and optimisation of great customer service and modern technology."

“This partnership is an important step forward in accelerating Allica’s impressive growth potential, leveraging our unique skills and expertise in lending underpinned by the robust and solid foundations we have built.“

Related News

- 02:00 am

Mercuryo, a global cryptocurrency payments network, is teaming up with Sumsub, an identity verification platform that provides a unified solution for automating KYC/KYB/KYT processes. Sumsub is set to speed-up onboarding for up to 350,000 users in the Mercuryo ecosystem. In addition, Sumsub will be helping Mercuryo tackle compliance in an ever changing regulatory landscape.

Mercuryo is a payments service that helps users store and make transactions with cryptocurrency—while also enabling businesses to profit off of these transactions. In the last six months, Mercuryo’s global payment gateway has experienced 20x growth in volume, with over 150 crypto projects already in their portfolio. Mercuryo partners with industry leaders like Binance, Trust Wallet, and Exmo.

Persistent fraud concerns in the crypto industry have pushed Mercuryo to enhance their security measures. Sumsub has been able to help Mercuryo by incorporating AML data screening and ongoing monitoring across international watchlists, sanctions, and PEP lists. What’s more, Sumsub has provided graphic editor detection and metadata analysis, further consolidating Mercuryo’s protection against forgery and scams.

To support Mercuryo’s regional expansion, Sumsub automated the company’s global compliance and reporting processes through an easy-to-navigate dashboard. This made identity checks swift and user-friendly, allowing Mercuryo to keep conversion rates high and reduce verification time to just a couple of minutes.

Sumsub’s reusable KYC feature was especially valuable for Mercuryo. Now, Mercuryo’s partners can share their applicants’ KYC data with one another, eliminating the need to ask clients to go through verification multiple times.

“When your business is all about handling multiple payments, especially the ones that involve cryptocurrency, it is not that easy to keep up with all the requirements from regulators in different jurisdictions. That’s why we are so thrilled to work with Sumsub, a company with deep expertise in local and global regulations. Automation of the KYC and AML procedures affects our performance tremendously by cutting the costs and accelerating verification checkups. We also believe it will help us improve relationships with our partners and clients by delivering an excellent service and allowing them to rely on us entirely,”—says Greg Waisman, Co-Founder & COO, Mercuryo.

“We see increasing demand for reusable KYC coming from services like Mercuryo and other rapidly growing projects partnered with multiple payments services. Reusable KYC enables partnered services to share KYC data with each other, which means that users only get verified once—and for all. Integrating reusable KYC also cuts additional costs and boosts conversion, while eliminating the need for users to upload documents again and again within the same ecosystem. We are happy to be working with Mercuryo to help them and their partners achieve a truly effortless onboarding routine.”—Jacob Sever, Co-founder of Sumsub.

Related News

- 07:00 am

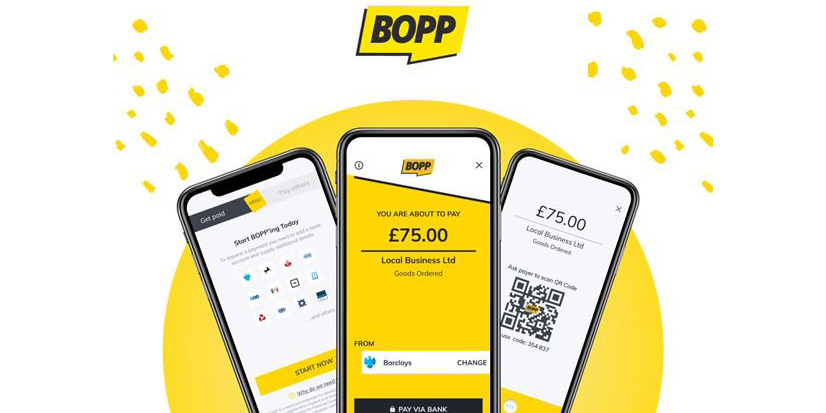

Today marks the launch of BOPP, a brand-new payment platform that removes the need for cards, and uses Open Banking to facilitate immediate, secure payments directly from one bank account to another.

A payment request can be sent in the form of a pay link via SMS, WhatsApp, email or QR code. The payment request link takes the user to the secure BOPP site, connects to the recipient’s online banking app and provides all the payee and transaction details – the payer only needs to authorise and confirm the payment with their bank. The money is transferred securely in real-time, without the need for credit or debit cards.

“We all know that paying with cash is becoming a thing of the past, and with the amazing progress in the world of payments, businesses have an opportunity to re-think how they get paid,” comments Ian Gass, CEO of Agitate, the company behind BOPP. “Every time a merchant uses BOPP, they save money, reduce fraud, and get cash in the bank immediately.”

In 2019, over £1bn was lost in card fraud, with card not present fraud at a staggering £470m. Generating a payment link from BOPP eliminates this. The technology wipes the slate clean as every bank account that requests payments is verified by BOPP directly from their business bank. All payments made using the platform are consented to by the payee using their biometrics and online bank app security.

Businesses accepting card payments pay up to 3% in transaction fees and may have to wait 3-5 days before actually receiving their funds (and this ignores other drawbacks such as card fraud and chargeback costs). BOPP simplifies electronic payments by making it much easier for customers to pay businesses directly bank-to-bank, cutting out all the middlemen. BOPP is completely free for personal use, and businesses pay just £10 per month all-in. Zero transaction fees, and funds received in seconds.

“In 2019, £829 billion was spent using debit and credit cards in the UK alone from 22 billion transactions. If you take an average card processors fees of 1.5%, this means UK businesses spent over £11bn in fees,” added Gass. “If BOPP was used, the fees would save over £9bn a year. UK businesses work hard to get customers and make money, but every time someone pays using a card, they pay ridiculously high fees. It’s important to us to support UK businesses by enabling them to make more from each sale, have a stable cashflow, and have the tools they need to bounce back and ultimately thrive in these difficult times.”

With the ability for UK consumers to easily click or scan to pay, with zero transaction fees for organisations, means that the charity sector in particular is seeing the potential in BOPP. NHS Charities Together is already signed up as a launch customer to make donating simpler and more secure.

Justine Davy, Head of Fundraising for NHS Charities Together; the national charity raising funds to support NHS staff, patients and volunteers said: “We are excited to work with the team at BOPP to showcase the ease of donations using QR codes but also the wider use of BOPP as a donation method. Providing a new and easy way to donate securely and safely without the need for donors to enter card details, is something we are keen to offer.”

Related News

- 03:00 am

Envestnet | Yodlee (NYSE: ENV), a leading data aggregation and data analytics platform powering dynamic, cloud-based innovation for digital financial services, today announced the appointment of William Napier as Product Director, Open Banking for Europe, the Middle East, and Africa (EMEA).

A focus for Mr. Napier will be to continue the expansion of Envestnet | Yodlee's open banking solution and commitment to the development of open finance to firms across the EMEA. This effort will help to extend Envestnet | Yodlee's support for FinTechs to drive innovation and empowerment of financial institutions to expand their global capabilities through its open banking products.

Open banking provides consumers and businesses a secure and transparent way to link accounts, transactions and other financial data to third-party financial wellness experiences via application programming interfaces (APIs). Through Envestnet | Yodlee’s trusted open banking ecosystem, its APIs support financial service companies and FinTech innovators, and are designed to support PSD2 and Open Banking regulations.

Mr. Napier joins Envestnet | Yodlee’s London office most notably from Experian where he was product lead and responsible for several offerings within the direct-to-consumer marketplace that use open banking. Prior to this, he worked at companies including 118118 Money and Iglu.com, where he held positions developing new products and driving growth with existing products.

Jason O'Shaughnessy, Head of International Business at Envestnet | Yodlee, said: “William is an excellent hire with a proven history of expanding established products in market while also helping develop new solutions. His experience in open banking will be invaluable to driving our expansion in EMEA markets.”

Related News

- 03:00 am

FinTech Breakthrough, an independent market intelligence organization that recognizes the top companies, technologies and products in the global FinTech market, today announced that LexisNexis® Risk Solutions, a leading data, analytics and technology provider, has been selected as winner of the “Best Fraud Prevention Company” award in the fifth annual FinTech Breakthrough Awards program.

By combining physical and digital identities, the LexisNexis Risk Solutions suite of fraud management solutions lets customers apply the appropriate level of friction for every interaction across the customer lifecycle to prevent fraud before it happens. The combination also allows companies to protect and personalize the consumer experience at every touch point.

“In today’s hyper connected and quickly evolving digital world, organizations must rapidly evolve their strategies to effectively combat fraud,” said Kim Sutherland, vice president of fraud and identity, LexisNexis Risk Solutions. “We design our best-of-class fraud solutions to help customers manage fraud risks in a continually evolving environment. It is an honor to receive this recognition from FinTech Breakthrough for our ongoing efforts in helping our customers reduce both fraud and associated costs to their business.”

The FinTech Breakthrough Awards was founded to recognize the FinTech innovators, leaders and visionaries from around the world in a range of categories, including Digital Banking, Personal Finance, Lending, Payments, Investments, RegTech, InsurTech and many more. The 2021 FinTech Breakthrough Awards program attracted more than 3,850 nominations from across the globe.

“While fraud prevention technology has made enormous strides in recent years, each day brings new complex fraud schemes that combine with an accelerating digital economy to create an extremely challenging business environment,” said James Johnson, Managing Director, FinTech Breakthrough. “LexisNexis Risk Solutions is at the forefront of staying one step ahead of this challenging landscape, delivering breakthrough solutions that help businesses confidently discern between trusted customers and risky or fraudulent activity. We are thrilled to name LexisNexis Risk Solutions our ‘Best Fraud Prevention Company’ in the 2021 FinTech Breakthrough Awards program.”

In 2020, LexisNexis Risk Solutions took bold steps to ensure broader fraud prevention throughout the customer journey, completing several key acquisitions such as ID Analytics, a leader in leveraging physical identity insights from consumer application activity that helps companies grow while balancing ever-present risk factors, and Emailage®, a renowned expert in global email intelligence.

LexisNexis Risk Solutions also offers LexisNexis® ThreatMetrix to customers, an enterprise solution for global digital identity intelligence and authentication powered by insights from billions of transactions, embedded machine learning and an orchestration and decision platform.

Additionally, LexisNexis Risk Solutions recently added another layer of defense to LexisNexis® ThreatMetrix® with LexisNexis® Behavioral Biometrics. Behavioral Biometrics integrates the way a user interacts with their device with information relating to the trustworthiness, integrity and authenticity of that device to improve the detection of high-risk fraudulent scenarios.

Related News

- 01:00 am

Dreams (www.getdreams.com), the financial wellbeing platform which empowers millennials to pay off debt, save, invest and feel better about their money, today announces the appointment of Lucia Hegenbartova as its new Chief Commercial Officer.

Lucia will be responsible for building Dreams’ new B2B business unit dedicated to the acquisition and development of B2B partnerships with some of the largest banks and financial institutions across the globe. In her new role as Chief Commercial Officer, Lucia will play an integral part in developing and executing the B2B go-to-market strategy, overseeing all revenue-generating functions across the Sales, Marketing and Customer Success departments, and carrying out Dreams’ international expansion strategy.

Lucia joined Dreams in April 2020, having occupied two other roles within the company, as Country Manager for Germany, and Head of Customer Success B2B. In joining Dreams’ executive management team, Lucia brings with her over a decade experience of building Enterprise SaaS companies, having been instrumental in the market launch of three other technology start-ups in a number of senior roles including Chief Operating Officer at data infrastructure provider Contiamo, VP Marketing at Customer Data Platform CrossEngage, and VP Marketing at eCommerce technology provider commercetools. Lucia studied business administration at the Ludwig-Maximilians University and computer science at the Technical University in Munich.

Dreams’ financial wellbeing platform is currently live as a consumer app in the Nordics, where it has achieved a 16% market share of all 20-39 year olds across Sweden and Norway, having helped more than 460,000 users build healthier financial habits by effectively operationalising the latest insights from cognitive and behavioral science.

In 2020, Dreams announced two strategic partnerships with banking software provider Silverlake Symmetri, and Ukrainian commercial bank UKRSIBBANK (part of BNP Paribas Group), marking an expansion of the company’s business model into the B2B space, as it evolves its services as a provider of effective engagement banking solutions for financial institutions.

Through its dedicated team of in-house scientists, Dreams leverages cognitive and behavioural science principles and insights to drive product innovation and equip users of the platform with the necessary tools and skills to be better at paying off debt, saving and investing money, and ultimately, enabling them to live a more fulfilled life.

Dreams’ methodology – which is deep-rooted in behavioural economics and cognitive science – has enabled the company to gain an unrivalled understanding of the specific needs and wants of the modern consumer, which is what allows Dreams to excel in terms of its marketing capabilities, build highly personalised and engaging services and deliver a first-class digital user experience. Ultimately, with such an approach, Dreams is establishing itself as the ideal partner for banks looking to engage critical new audiences, boost customer loyalty and stay relevant in the era of the challenger bank.

Lucia Hegenbartova, Chief Commercial Officer at Dreams comments: “From day one I’ve been fully on board with the company’s vision of empowering people to feel better about their money, and I’ve been really impressed with how Dreams has already flawlessly delivered on this mission by significantly, and measurably, improving the financial wellbeing of thousands of customers.

Through the success of our B2C product in the Nordics, we’ve been able to showcase the tangible business value that caring about customers’ wellbeing can bring to banks and other financial institutions in generating emotional engagement and attracting younger audiences. With the ESG trend rapidly building more and more momentum, the need for banks to ensure their values are aligned with those of their customers is greater than ever, and I’m confident that our unique expertise and proven track record in the realms of engagement banking, sustainability and social responsibility will prove vital in helping banks future proof their digital banking offering.

These are now really exciting times for Dreams, as the company looks to consolidate its international expansion and growth strategy, and further transform the entire industry. I’m thrilled to be able to bring this bold vision to life, and I look forward to working with some of the world’s most visionary banking partners and help them prevail at the forefront of the emerging financial wellbeing movement.”

Henrik Rosvall, CEO & co-founder of Dreams, adds: “We’re really pleased to welcome Lucia as part of our executive management team, where she’ll play such an important role in our B2B strategy moving forward. Her track record of efficiently managing teams and her wealth of experience in successfully delivering go-to-market strategies for emerging B2B product categories will prove invaluable to the sustained growth of our company.

Having already achieved critical success in Scandinavia, where we have managed to turn the idea of saving into an effortless, fun and social activity for over 460,000 Dreams users, we’re confident that we can replicate this success in other markets. There’s no doubt that Lucia will play a vital role in expanding our global footprint and achieving our mission of helping people make better financial choices at an even greater scale.”

About Dreams

Dreams was created to improve the financial wellbeing of an entire generation. While major banks continue to offer complex, impersonal savings and investments, the arrival of a new wave of easy, one-click credit has left a generation living from paycheck to paycheck.

Dreams is a unique platform, designed to give millennials a simple way to achieve their goals and ambitions, and improve their financial wellbeing. Rooted in cognitive science and behavioural economics, Dreams is as much a science company as a tech company. In addition to directly serving 460,000 users in Sweden and Norway, Dreams B2B offering allows banks and financial institutions worldwide to license the award-winning financial wellbeing platform to increase their digital engagement and retention, attract new audiences, build a lasting emotional connection with their users and take a future-proof stance on sustainability and social responsibility.

Dreams was set up in 2014, and currently employs a diverse team of 80 employees from 15 different countries, in its Stockholm HQ and offices in Oslo and Berlin. In 2020, Dreams was recognised by CB Insights as one of the best fintech startups in the world. For more information about Dreams, please visit: https://getdreams.com/en/b2b/

Related News

- 03:00 am

LAVEGO AG – part of Unzer - is an expert in its craft. For over 25 years, the German girocard network provider has been enabling retailers and SMEs to accept card-based payments and benefit from a host of other value-added services. With a tech-led business model, LAVEGO pioneered a Linux-based solution and defined its own host-software and host-protocol back in 1997, before specializing in supporting the complex and unique requirements of the petrol and unattended POS (point-of-sale) market back in 2003, where it maintains strong market share to this day.

But for this tech-savvy service provider, it was the prohibitive marketplace and complexity of interoperability – both in its native Germany and across the continent - that put a blocker on its innovation and agility.

This case study is an exploration of how specifications and protocols developed by nexo standards are empowering LAVEGO to realize new efficiencies both at home and internationally, and how it is channelling new resource into an open-source, innovation-led strategy that’s bringing huge benefits to its customers.

Read on for an insight into:

- The payments acceptance challenges facing LAVEGO

- Why nexo standards?

- A note on ISO 20022

- What’s next for LAVEGO

The challenges facing LAVEGO

Domestic pain, international ambitions

The challenges of LAVEGO can largely be considered two-fold – domestic and international. In its native Germany, it was faced with a unique market – only one proprietary host was commercially available on the market that was able to connect to the girocard domestic scheme. As a result, in 1997, LAVEGO decided to craft its own.

The reasons behind LAVEGO’s decision were simple – this dominance of a single proprietary system can create a less competitive marketplace, with a limited number of terminal manufacturers providing compatible hardware, leading to challenges of vendor lock-in. This can make it difficult for payment acceptance vendors to compete on a level playing field.

Crucially, as part of its ambitions, LAVEGO wanted to address what it describes as the ‘post-industrial’ payments market. Industrialization has happened, producing high volumes of the same product – in this case, transactions. But while now a commodity and standardized to a degree, the resulting infrastructure is very difficult to modify. LAVEGO recognized a need for, and aimed to deliver, more tailored solutions for its customers that could bring innovation to this post-industrial market.

In parallel, its business ambitions were increasingly international. But in its neighbouring markets, LAVEGO faced the same challenges to implement unique protocols to enable acceptance of comparative per-country schemes. So, not only faced with the integration of girocard in its native Germany, LAVEGO also had to contend with the numerous national debit schemes present across Europe.

After 20 years running its debut solution, in 2017, the decision was made to invest in a new platform, PaySphere. The goals were clear: the best possible security, self-service for cardholders, merchants and partners, always-online, scalable, i18n compatible, built with the principles of the reactive manifesto – and, if possible, with a protocol that is used internationally.

Why nexo standards?

A standardized payment acceptance solution

LAVEGO has long been a champion of standardization. By 1996, Linux was its preferred OS to other proprietary Unix-systems, at a time when nobody could have imagined how this then brand-new operating system would evolve. Today, LAVEGO is still a fan of open source; the new PaySphere-platform was built with cloud-native projects, is totally open source and was developed with a strong community.

Active in the European market, LAVEGO had seen the evolution of SEPA (Single Euro Payments Area), the creation of EPASorg, and finally in 2014, the combination of initiatives to form nexo standards. The resulting association, nexo standards, had not just a regional but a truly international agenda.

But what was nexo standards all about? And how could it help LAVEGO?

nexo standards develops messaging specifications and protocols which adhere to ISO 20022 standards to enable fast, interoperable, and borderless payments acceptance by standardizing the exchange of payment acceptance messages and data between payment stakeholders. It champions a truly collaborative approach. By welcoming all payment stakeholders to its membership and working groups, nexo exists to remove fragmentation in the industry by defining and agreeing upon a single standardized approach for its payments acceptance specifications and protocols, while ensuring the needs of all players are addressed. Its membership categories include acceptors, card schemes, payment processors, PSPs and vendors.

nexo standards and its full stack of specifications and protocols provided LAVEGO with the answer to its major challenges and ambitions. Utilizing the nexo FAST (Financial Application Specification for Terminals) Specification, nexo TMS and the nexo Retailer Protocols, LAVEGO has defined a truly universal payments acceptance platform that can easily be adjusted to customer needs and operate seamlessly in a number of environments and with any nexo-host.

Here’s some of the key benefits LAVEGO has been able to realize:

· Control of the complete value chain. For LAVEGO to tailor solutions fit for the ‘post-industrial’ age of payments, it needed control of the complete value chain – from PoS-device to the host, and beyond. The nexo FAST Specification enabled LAVEGO to realize this control. It opens up market choice of EMV®-based components and hardware, while offering tailorable software on devices. All built on a foundation of an internationally accepted protocol stack, nexo gave power, choice and flexibility back to LAVEGO.

· Unified terminal management. Most terminals come with software from a third-party supplier (either from the manufacturer or specialized companies), while every vendor runs its own Terminal Management System (TMS). With the nexo TMS Protocol, LAVEGO can maintain all upcoming nexo products with the same interoperable solution. Integrating the nexo TMS into its PaySphere platform can be done seamlessly via APIs.

· Simplified integration of multiple payment schemes. nexo’s common criteria approach enables native acceptance of local requirements, as well as support for international networks, by incorporating them into an interoperable, international, ISO-based standardized approach. Thanks to the support of nexo’s German membership, acceptance of girocard requirements is now incorporated into its specifications and LAVEGO’s nexo-based solution is now certified by the payment scheme. Longer term, integration and processing of other payment schemes across Europe (and beyond!) is dramatically simplified.

· Ease of development. Unlike the legacy protocols it had been grappling with, LAVEGO was able to benefit from nexo’s ecosystem of comprehensive, well-crafted and documented stack of protocols and implementation guidelines. nexo is XML-based, meaning it is human readable and far simpler to develop with. Another major advantage was the nexo TMS support for remote key injection, removing the need for human intervention and dramatically simplifying this crucial security element. All saving significant time and money, while reducing complexity.

· Innovation. With internal resource freed from the ‘firefighting’ of completing testing and certification requirements, LAVEGO can release resource back into investment into new, value-added services. By utilizing nexo’s more advanced, modern protocols, its capacity to create these value-added services from one system is also expanded significantly. Its PaySphere solution delivers master data management, automated online-reporting, accounting support and a host of other information such as invoice notes, VAT information, total sums, and product information to help its customers gain new insights and simplify existing processes. PaySphere is easy to integrate with other platforms such as eCommerce, to offer a true omnichannel experience.

· An open business model. Crucially for LAVEGO, investment in nexo is enabling it to take its open standards-led business model to the next level and achieve the independence it craves. With the same software extended to all devices, it is free to work with numerous hardware manufacturers and partners that best suit its commercial and technical needs. This complements its PaySphere solution, which can be implemented with nexo FAST across a range of different Android devices based on customer requirements, such as mobile, unattended devices and vending machine solution.

A note on ISO 20022…

nexo standards protocols and specifications are all based on ISO 20022. Rebuilt for the modern world’s messaging capacity and communication speeds, ISO 20022 defines a whole host of transactions in both payments and financial services more broadly. It is live in over 70 countries already, forming the basis of several innovation initiatives such as faster payments models. In 2009, Europe championed use of ISO 20022 for retail payments and created SEPA, while the specifications are already in place for instant debit and credit transfers in the region too.

In short, ISO 20022 offers a real opportunity to promote greater efficiency and interoperability for functions and processes across the industry and is leading the migration away from the mesh of incompatible and proprietary systems in place today. With ISO 20022 already so widely accepted by major banks and PSPs across the globe, it is a compelling option for stakeholders to maximize investment and champion use of the standards across other functions, such as card payment acceptance. This is where nexo sits, with its mission to avoid repeated fragmentation by agreeing a consistent mode of implementation and testing among payments acceptance actors.